Form T1135 will be applicable and data can be transmitted, if:

- the answer to the question Did the taxpayer own or hold foreign property at any time in 2024 with a total cost amount of more than CAN$100,000? is “Yes”:

- the check box Your firm has not been engaged to prepare and/or transmit Form T1135 is not selected; and

- the check box Form T1135 will be transmitted or paper-filed at a later date (no later than the filing deadline for the income tax return) is not selected.

OR

- The check box If this is an amended return check this box. is selected

The date the form was submitted or paper filed to the CRA displays automatically if the form is selected for electronic transmission. Otherwise the field “Date submitted or paper filed to the CRA” will remain an input field.

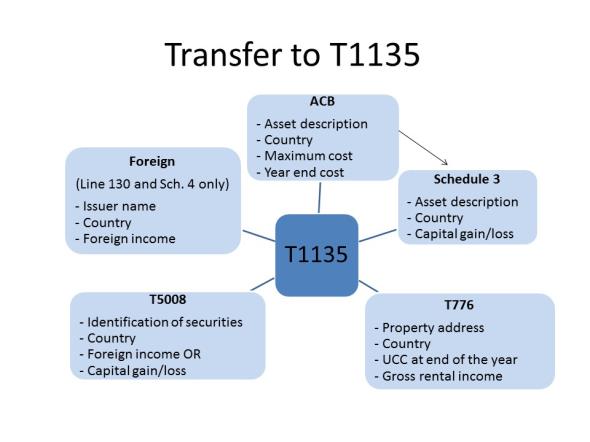

Here is a diagram summarizing the different transfers that can be made to Form T1135:

Note that no data is transferred if Part A, “Simplified reporting method,” has been completed in Form T1135.

A transfer of data from the ACB form into the T1135 form can be made when property held entered in the ACB form is specified foreign property that is part of the following classes:

- Publicly traded shares, mutual funds units, deferral of eligible small business corporation shares, and other shares

- Bonds, debentures, promissory notes, and other similar properties

- Real estate, depreciable property, and other properties

In order for Taxprep to transfer the data, answer the question If this is a specified property, select the section of the Form T1135 into which this property should be transferred.

Based on the section of Form T1135 selected for the transfer, the data transferred is the description, country code, maximum funds held during the year/maximum cost amount during the year/ and funds held at year end/cost amount at year end.

If the property is part of the “Real estate, depreciable property, and other properties” class in the ACB form and the box It consists of depreciable property is selected, only the description and the country code are transferred to Form T1135.

If the data relating to the property is also transferred to Schedule 3, Taxprep transfers the income (loss)/gain (loss) on disposition, as applicable.

Note that no data is transferred if Part A, “Simplified reporting method,” has been completed in Form T1135.

A transfer of data from Schedule 3 into Form T1135 can be made when the property subject of a disposition is specified foreign property that is part of the following classes:

- Publicly traded shares, mutual funds units, deferral of eligible small business corporation shares, and other shares

- Bonds, debentures, promissory notes, and other similar properties

- Real estate, depreciable property, and other properties

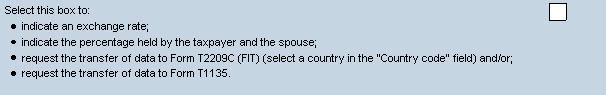

In order for Taxprep to transfer the data, select the following box:

Then, in the Transfer to T1135 list, select the section of Form T1135 into which the income should be transferred.

Based on the section of Form T1135 selected for the transfer, the data transferred is the description, country code and the income (loss)/gain (loss) on disposition.

Note that no data is transferred if Part A, “Simplified reporting method,” has been completed in Form T1135.

A transfer of data from the T776 form into the T1135 form can be made when the rental property is located outside Canada.

In order for Taxprep to transfer the data, select the box Select this box to indicate that the rental property is located outside Canada in the “Foreign income” section. Then, select the box If this is a specified foreign property, select this box to transfer data relating to the property into Form T1135.

The undepreciated capital cost at the end of the year of all categories linked to Form T776 and the adjusted cost base of the land, the address and the gross income are transferred to Section 5, “Real property outside Canada (other than personal use and real estate used in an active business).”

When the rental property is operated by a partnership, Taxprep transfers the undepreciated capital cost at the end of the year of all CCA classes linked to Form T776 and the adjusted cost base of the land based on the taxpayer’s share in the partnership.

When the rental property is held through co-ownership, Taxprep does not transfer the undepreciated capital cost at the end of the year of all CCA classes linked to Form T776 and the adjusted cost base of the land based on the taxpayer’s share, because these amounts should already correspond to the taxpayer’s share.

Note that no data is transferred if Part A, “Simplified reporting method,” has been completed in Form T1135.

A transfer of data from the T5008 slip into Form T1135 can be made when the property subject to a disposition or the property that generated investment income is specified foreign property.

In order for Taxprep to transfer the data, select the appropriate section of Form T1135 from the Transfer to T1135 list.

Based on the section of Form T1135 selected for the transfer, the data transferred is the identification of securities, country code and/or income (loss)/gain (loss) on disposition.

Note that no data is transferred if Part A, “Simplified reporting method,” has been completed in Form T1135.

A transfer of data from the Foreign Income Summary into Form T1135 can be made when the income is generated from specified foreign property.

This transfer is possible only when the type of income selected is 130, Other foreign income, or 121, Investments - Section II – Interest, other investment income, and income from foreign sources.

In order for Taxprep to transfer the data, select the appropriate section of Form T1135 from the Transfer to T1135 list.

Based on the section of Form T1135 selected for the transfer, the data transferred is the issuer, country code and income (loss).

A check box is included at the top of each section of Part B to allow for splitting property between the taxpayer and the spouse. By selecting this box, you will have access to each property entered, a field in which you can enter the percentage held by the taxpayer and the spouse.

Note that when the property comes from Form ACB, T5008, T776 or Foreign, or Schedule 3, you cannot indicate a value different from 100% for the percentage held by the taxpayer. The split between the taxpayer and the spouse must be made in the form where data comes from.

The T1135 form is transmitted separately from the T1 return. However, the electronic filing of the T1135 form has been implemented in Personal Taxprep so that you can transmit both the T1 return (and TP1 return, if applicable) and the T1135 form at the same time.

Alternatively, you can transmit the T1 return without the T1135 form or the T1135 form without the T1 return.

Taxprep defines the status of the check boxes None of the CRA’s exclusion criteria are applicable to this form, None of the CRA’s error conditions are applicable to this form and Form T1135 applicable, based on the taxpayer’s information (e.g. the name, address and SIN comply with EFILE requirements) and the data entered in the T1135 form.

If you selected the T1135 form for electronic transmission and one of the above mentioned boxes is not selected, it is important that you verify the diagnostics to make the required corrections.

Provided the T1135 form is selected for EFILE and there are no problems with the data on the form, the T1135 form will have a status of “Eligible” if:

- the answer to the question Did the taxpayer own or hold foreign property at any time in 2024 with a total cost amount of more than CAN$100,000? is “Yes”:

- the check box Your firm has not been engaged to prepare and/or transmit Form T1135 is not selected; and

- the check box Form T1135 will be transmitted or paper-filed at a later date is not selected.

OR

- the check box If this is an amended return check this box. is selected.

The information on the transmission status of the T1135 form is also available using the File/Properties command (F11).

You can also transmit an amended T1135 form. You must indicate that the T1135 form is amended using the check box provided at the top of the form.

If the T1135 form has already been transmitted and has a T1135 EFILE status of “Accepted,” override the T1135 EFILE status in the File/Properties (F11) dialog box and change the status to “Eligible” in order to transmit the form.

The following instructions are taken from the current version of Form T1135.

All legislative references on this form refer to the Income Tax Act (the Act).

If the reporting taxpayer is a partnership, references to year or taxation year should be read as fiscal period and references to taxpayer should be read as partnership.

All Canadian resident taxpayers (including non-resident trusts deemed resident in Canada by section 94 of the Act) are required to file the Form T1135, Foreign Income Verification Statement if at any time in the year the total cost amount of all specified foreign property to the taxpayer was more than $100,000 (Canadian).

An individual (other than a trust) does not have to file Form T1135 for the year in which the individual first becomes a resident of Canada (section 233.7 of the Act).

The following entities do not have to file this form:

- a mutual fund corporation or mutual fund trust;

- a non-resident-owned investment corporation;

- a person all of whose taxable income is exempt from Part I tax;

- a registered investment under section 204.4 of the Act;

- a trust described in any of paragraphs (a) to (e.1) of the definition of trust in subsection 108(1) of the Act;

- a trust in which all of the persons beneficially interested are persons described above;

- a partnership in which all the members are persons described above; and

- a partnership where the share of the partnership's income or loss attributable to non-resident members is 90% or more of the income or loss of the partnership.

You are required to report all specified foreign property in accordance with subsection 233.3(1) of the Act which includes:

- funds or intangible property (patents, copyrights, etc.) situated, deposited or held outside Canada;

- tangible property situated outside of Canada;

- a share of the capital stock of a non-resident corporation held by the taxpayer or by an agent on behalf of the taxpayer;

- an interest in a non-resident trust that was acquired for consideration, other than an interest in a non-resident trust that is a foreign affiliate for the purposes of section 233.4 of the Act;

- shares of corporations resident in Canada held by you or for you outside Canada;

- an interest in a partnership that holds a specified foreign property unless the partnership is required to file Form T1135;

- an interest in, or right with respect to, an entity that is a non-resident;

- a property that is convertible into, exchangeable for, or confers a right to acquire a property that is specified foreign property;

- a debt owed by a non-resident, including government and corporate bonds, debentures, mortgages, and notes receivable;

- an interest in a foreign insurance policy; and

- precious metals, gold certificates, and futures contracts held outside Canada.

Specified foreign property does not include:

- a property used or held exclusively in carrying on an active business;

- a share of the capital stock or indebtedness of a foreign affiliate;

- an interest in a trust described in paragraph (a) or (b) of the definition of "exempt trust" in subsection 233.2(1) of the Act;

- a personal-use property as defined in section 54 of the Act; and

- an interest in, or a right to acquire, any of the above-noted excluded foreign property.

For frequently asked questions or examples, see Questions and answers about Form T1135 on the CRA website at canada.ca/en/revenue-agency/services/forms-publications/forms/t1135.html.

If the total cost of all specified foreign property held at any time during the year exceeds $100,000 but was less than $250,000, the form has been designed to provide you with the option of completing either Part A or Part B.

Where a particular specified foreign property has been reported all of the other fields associated with that particular property must also be completed. All nil amounts should be reported by indicating "0" in the corresponding field rather than leaving it blank. Amounts should be rounded to the nearest dollar.

If an election has been made under paragraph 261(3)(b) of the Act to report in a functional currency, state all monetary amounts in that functional currency, otherwise state all monetary amounts in Canadian dollars. The codes for the functional currencies are as follows:

AUD – for Australian dollar

USD – for U.S. dollar

GBP – for U.K. pound

EUR – for Euro

JPY – for Japanese Yen

Check the appropriate box to identify the category of taxpayer filing this form. Provide the taxpayer's name, address, and identification number. Provide the taxation year for which this form is being filed.

For individual code, check:

- If the individual or the individual's spouse (common-law partner) is self-employed.

- If the individual and the individual's spouse (common-law partner) are both not self-employed.

For partnership code, check:

- If end partners are individuals or trusts.

- If end partners are corporations.

- If end partners are a combination of 1 and 2 mentioned above.

An end partner is the final recipient (corporation, trust or individual) that receives an allocation of income from the partnership after the income has flowed through the various levels of a tiered partnership.

This form contains seven tables corresponding to different categories of specified foreign property. Report the detail of each particular property that was held at any time during the year in the appropriate category.

For the list of country codes, see List of country codes or the CRA publication T4061 entitled NR4 – Non-Resident Tax Withholding, Remitting and Reporting Guide, Appendix A .

The country code for each category should identify:

- Category 1 – the country where the funds are located;

- Category 2 – the country of residence of the non-resident corporation;

- Category 3 – the country of residence of the non-resident issuer;

- Category 4 – the country of residence of the trust;

- Category 5 – the country where property is located;

- Category 6 – the country where property is located;

- Category 7 – depending on the type of property, use the instructions above from categories 1 to 6.

If you are uncertain of the appropriate country code for a particular specified foreign property, select "OTH" for "Other".

Cost amount is defined in subsection 248(1) of the Act and generally would be the acquisition cost of the property.

If you immigrate to Canada, the cost amount is the fair market value of the property at the time of immigration. Similarly, if you received specified foreign property as a gift, or inheritance, the cost amount is its fair market value at the time of the gift or inheritance.

The maximum cost amount during the year can be based on the maximum month-end cost amount during the year.

The amounts to be reported on Form T1135 should be determined in the foreign currency then translated into Canadian dollars. Generally, when converting amounts from a foreign currency into Canadian dollars, use the exchange rate in effect at the time of the transaction (i.e. the time the income was received or the property was purchased). If you received income throughout the year, an average rate for the year is acceptable.

The following summarizes how other amounts of the form should be translated:

- Maximum funds held during the year – the average exchange rate for the year.

- Funds held at year end – the exchange rate at the end of the year.

- Maximum fair market value during the year – the average exchange rate for the year.

- Fair market value at year end – the exchange rate at the end of the year.

Tables

Specified foreign property has been divided into seven (7) categories and should be reported in one of the following tables:

Funds held outside Canada include money on deposit in foreign bank accounts, money held with a foreign depository for safekeeping and money held by any other foreign institution at any time during the year. Prepaid debit or credit cards and negotiable instruments, such as cheques and drafts, are also included in this category. Marketable securities should be reported in category 3.

Report all shares of non-resident corporations whether or not they are physically held in Canada.

Do not report shares of a foreign affiliate corporation. Generally, a foreign affiliate is a non-resident corporation (or certain non-resident trusts) of which you hold at least 1% of the shares individually, and, either alone or with related persons, hold 10% or more of the shares. If you have a foreign affiliate, you may have to file Form T1134, Information Return Relating to Controlled and Not Controlled Foreign Affiliates.

Report all amounts owed to you by a non-resident person (other than a foreign affiliate corporation) whether the indebtedness is held inside or outside Canada. Include all promissory notes, bills, bonds, commercial paper, debentures, loans, mortgages, and other indebtedness owed to you by a non-resident person. Marketable securities, such as guaranteed investment certificates, government treasury bills and term deposits issued by a non-resident, should be reported under this category.

Report all interests in non-resident trusts acquired for consideration, other than a non-resident trust that is a foreign affiliate for the purposes of section 233.4 of the Act.

If you contributed to, or received a distribution or loan from, a non-resident trust you may be required to file Form T1141, Information Return in Respect of Contributions to Non-Resident Trusts, Arrangements or Entities or Form T1142, Information Return in Respect of Distributions from and Indebtedness to a Non-Resident Trust.

Report all real property located outside of Canada other than real property used in an active business or used primarily for personal use (such as a vacation property used primarily as a personal residence). Rental property outside Canada should be included in this category.

This category should include any property that does not correspond to any of the other categories.

Other property includes:

- shares of corporations resident in Canada held by you or for you outside Canada;

- an interest in a partnership that holds specified foreign property where the partnership is not required to file the Form T1135;

- foreign insurance policies;

- precious metals or bullion (e.g., gold and silver) situated outside Canada;

- commodity or future contracts, options or derivatives that constitute a right to, a right to acquire, or an interest in, specified foreign property; and

- any other rights to, rights to acquire, or interests in, specified foreign property.

A taxpayer who held specified foreign property with a Canadian registered securities dealer (as defined in subsection 248(1) of the Act) or with a Canadian trust company (as determined under paragraph (b) of the definition of restricted financial institution in subsection 248(1) of the Act) is permitted to report the aggregate amount of all such property in this category.

The table for this category should be completed as follows:

- all of the property held with a particular securities dealer or trust company should be aggregated on a country-by-country basis;

- it is also acceptable to provide aggregate totals for each particular account on a country-by-country basis;

- refer to the "country code" instructions above to determine the appropriate country for each property; and

- the maximum fair market value during the year may be based on the maximum month-end fair market value.

Certification

This area should be completed and signed by:

- the person filing this form in the case of an individual;

- an authorized officer in the case of a corporation;

- the trustee, executor or administrator in the case of a trust; or

- an authorized partner in the case of a partnership.

Due dates for filing this form

Form T1135 must be filed on or before the due date of your income tax return or, in the case of a partnership, the due date of the partnership information return, even if the income tax return (or partnership information return) is not required to be filed.

Filing by internet (EFILE or NETFILE)

Individuals, corporations, partnerships, and trusts can file Form T1135 electronically.

- Individuals can file Form T1135 electronically (EFILE or NETFILE) for the 2017 and subsequent taxation years.

- Corporations can EFILE Form T1135 electronically for the 2014 and subsequent taxation years.

- Partnerships can file Form T1135 electronically (EFILE or NETFILE) for the 2017 and subsequent taxation years.

- Trusts can EFILE Form T1135 electronically for the 2021 and subsequent taxation years.

- EFILE – Your EFILE service provider, including a discounter, can complete and file your Form T1135 for you if he/she uses a tax preparation software PROGRAM certified by the CRA to EFILE Form T1135. For more information, go to EFILE for individuals and EFILE for corporations.

- NETFILE – You can file your Form T1135 by Internet if it is prepared with a tax preparation software program certified by the CRA to EFILE Form T1135. Most individuals are eligible to NETFILE. For more information or to file your Form T1135, go to NETFILE at http://www.canada.ca/netfile.

Filing a paper return

Form T1135 can be attached to your income tax return, or partnership information return, and mailed to your tax centre. Form T1135 can also be mailed separately to the following address:

Winnipeg Taxation Centre

Data Assessment & Evaluation Programs

Validation & Verification Section

Foreign Reporting Returns

66 Stapon Road

Winnipeg MB R3C 3M2

Penalties for non-compliance

There are substantial penalties for failing to complete and file Form T1135 accurately and by the due date. For additional information regarding penalties, see the Table of penalties CRA website at canada.ca/en/revenue-agency/services/forms-publications/forms/t1135.html.

Voluntary disclosures

To promote compliance with Canada's tax laws, we encourage you to correct your tax affairs through the Voluntary Disclosures Program. For more information, see Information Circular IC00-1R6, Voluntary Disclosures Program (VDP) or visit the CRA Web site.

More information

If you need more information visit our website at canada.ca/taxes. Alternatively you can call general enquires at:

- 1-800-959-5525 for businesses, self-employed individuals and partnerships; or

- 1-800-959-8281 for individuals (other than self-employed individuals) and trusts.

You may also contact your local tax services office. Our addresses and fax numbers are listed on our Web site and in the government section of your telephone book.

Privacy notice

Personal information is collected under the authority of section 233.3 of the Act and is used to monitor compliance with the foreign reporting requirements related to offshore investments. Information may also be used for the administration and enforcement of the Act, including audit, enforcement action, collections, and appeals, and may be disclosed under information-sharing agreements in accordance with the Act. Incomplete or inaccurate information may result in various compliance actions, including the assessment of monetary penalties.

Your Social Insurance Number is the authorized number for income tax purposes under section 237 of the Act and is used under certain federal programs.

Information is described in personal information bank CRA PPU 035 in the Canada Revenue Agency (CRA) chapter of the Info Source publication at canada.ca/cra-info-source. Personal information is protected under the Privacy Act and individuals have a right of protection, access to, and correction of their personal information. Further details regarding requests for personal information at the CRA can be found at canada.ca/cra-access-information-privacy.