Release Notes - CCH iFirm Cantax T2 2019 v.2.3 (2019.50.v27)

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Cantax

Welcome to CCH iFirm Cantax, the first cloud-based professional tax software in Canada.

CCH iFirm Cantax runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Cantax is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Cantax version, consult the Technical Release Notes.

About CCH iFirm Cantax T2

With CCH iFirm Cantax T2, you have the most comprehensive collection of corporate tax forms available, as well as tools designed to address complex T2 preparation requirements. CCH iFirm Cantax T2 also provides you with:

- the possibility of attaching supporting documents to electronically transmitted returns;

- GIFI data transfers.

Modifications Made to Version 2.3 (2019.50.v27)

Corporate Identification and Other Information

The e-mail address and the fax number indicated in the Certification section of the Identification form are no longer synchronized with the information in the Contacts module. As a result, you can now enter data separately.

Modifications Made to Version 2.2 (2019.50.v26.02)

The modifications made to version 2.2 correct problems that were identified in version 2.1 (2019.50.v26.01):

- CO-1029.8.33.TE – Boxes 33 and 34 in Part 4 are selected even if employees turned 60 or 65 after January 1 of the calendar year

- Revenu Québec is not able to decode the bar codes printed with the CO-17 or CO-17.SP return, which causes a delay in processing the return

Modifications Made to Version 2.1 (2019.50.v26.01)

The modifications made to version 2.1 correct problems that were identified in version 2.0 (2019.50.v26):

- AT1 Schedule 21 – When Alberta Schedule 21 is applicable, the AT1 return (Net File) is rejected with error code 10030, and data is missing from the RSI printing in Alberta Schedule 21

- Capital Cost Allowance (CCA) Workchart – Incorrect amount calculated on the line Capital cost of qualified property that became available for use in the current taxation year before July 1, 2019

- Forms T2054 and CO-502 - Incorrect calculation of the number of months in Part 4

- T1134, Letter LW and Client Letter, Filing Instructions - Filing deadline for T1134 in diagnostic F93 as well as in letters LW and Client Letter, Filing Instructions is incorrect when the taxation year straddles January 1, 2020

Overview - Version 2.0 (2019.50.v26)

CCH iFirm Cantax T2 2019 v.2.0 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

Electronic filing of the amended Québec income tax return

You can now electronically transmit an amended Québec income tax return. For more information, consult the note relating to this subject.

AT1 – Alberta Corporate Income Tax Return

The form has been modified to include the basic tax rate that will decreased from 11% to 10% on January 1, 2020. For more information, consult the note relating to this subject.

New Forms

The following forms have been added to the program:

- CO-771.1.3.AJ, Adjusted Business Limit;

- CO-1029.8.33.TE, Tax Credit to Foster the Retention of Experienced Workers – SMB; and

- CO-1029.8.33.TF, Agreement Respecting the Tax Credit to Foster the Retention of Experienced Workers – SMB.

Improve Your Productivity

Federal

Federal

Schedule 3 – Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation

In Part 1, the line used to enter deductible dividends under paragaph 113(1)c has been split into two to make the difference between dividends received from a foreign affiliate considered a connected corporation and those of a foreign affiliate not considered a connected corporation. Therefore, the custom line Dividends deductible from taxable income under paragraph 113(1)(c) ITA (this amount is included on line 320 of the T2 return) has been renamed Other dividends deductible from taxable income under paragraph 113(1)(c) ITA which are not included on the above line and the line Dividends deductible from taxable income under paragraph 113(1)(c) ITA received from a foreign affiliate which is considered a connected corporation under subsection 186(4) ITA has been added under column 275 in Part 1.

This makes it possible to include the dividend received from a foreign affiliated corporation on line 730, in Part 2 of Schedule 7 when this corporation would be a connected corporation under subsection 186(4) ITA, if this subsection applied. The amount shown on this new line will also be included on line 320 of Schedule 200, on the line Taxable dividends deductible under sections 112 and 113 in Part 6 of Schedule 21, on the line Taxable dividends deducted per Schedule 3 in the Foreign column of the Net taxable dividends section of Schedule 7, on the line Dividends deductible from taxable income under subsection 746(c) TA (this amount is included on line 256 of the CO-17 return) in Part 1 of Form CO-17S.3 and on custom line Dividends deductible from taxable income under paragraph 113(1)(c) ITA in Part 2 of Schedule 510.

Note that the amounts entered on those two custom lines do not have to be reported to the CRA, because paragraph 113(1) (c) ITA does not apply to Schedule 3. However, they allow the program to correctly perform the calculation of certain items relating to the return. In addition, completing these lines does not make Schedule 3 applicable.

Verify if all or part of the amount on line Other dividends deductible from taxable income under paragraph 113(1)(c) ITA which are not included on the above line comes from a foreign affiliated corporation that would be a corporation connected under subsection 186(4) ITA, if this subsection applied. If this is the case, enter this amount on the new custom line Dividends deductible from taxable income under paragraph 113(1)(c) ITA received from a foreign affiliate which is considered a connected corporation under subsection 186(4) ITA and adjust the amount on the line Other dividends deductible from taxable income under paragraph 113(1)(c) ITA which are not included on the above line accordingly.

Québec

Québec

Transmission of amended CO-17 returns

The amended tax return can now be transmitted electronically. The program will transmit a complete amended CO-17 return with the desired changes, and not Form CO-17.R.

The process to prepare an amended CO-17 return is similar to the process already in place for the automatic preparation of an adjustment request. We recommend that you use a copy of the original tax return when you prepare an amended tax return. Answer Yes to the question Is this an amended Québec tax return? in Form Identification and make the amendments in the Québec return.

When you answer Yes to the question Is this an amended Québec tax return? in Form Identification, a copy of Form CO-17.R will be created and the EFILE CO-17 status will no longer be Accepted, so that you will then be able to amend the return to make the desired changes.

Once the transmission is accepted by Revenu Québec, the confirmation number and the date the transmission is accepted will be saved in Form CO-17.R.

At the top of the CO-17.R form, the custom question Do you want to electronically retransmit the amended CO-17 return instead of mailing a CO-17.R form? has been added. The answer to this question will be Yes when you answer Yes to both questions Is this an amended Québec tax return? in Form Identification and Do you want to electronically file this tax return with Revenu Québec? in Form RSI-EFILE-Bar codes in the Québec (Internet Filing) section.

Note that a CO-17.SP return cannot be transmitted electronically and EFILE exclusions that apply to the transmission of original CO-17 returns also apply to the transmission of amended returns.

If you would still like the amendments made to the return to display in Form CO-17.R.

If you want to prepare a summary of amendments made in the return, select the check box Select this check box to prepare an automatic CO-17.R form in Form CO-17.R before amending the return. The lines on which data was modified since this box was selected will then display in Form CO-17.R, as well as the expected change to the balance due or refund. You can print Form CO-17.R for reference purposes or to provide it to the client. However, the authorized representative is not required to sign the form.

For more information, consult the Question used to specify whether it consists of an adjustment request concerning a Québec tax return section of the Corporate Identification and Other Information topic.

Filing of a copy of Schedule 200 and Schedule 7 with the Québec return

As per Revenu Québec requirements, a copy of Schedule 200 must be filed with the Québec return when a corporation assigns a portion of the business limit to another CCPC under subsection 125(3.2) ITA. Previously, diagnostic F106 was prompting you to file a copy of Schedule 200 in this situation. Now, when the corporation has a permanent establishment in Québec and an amount is indicated on line K in the “Small business deduction” section of Schedule 200:

- A copy of this schedule is automatically attached to the Québec return when this return is electronically filed;

- A copy of this schedule is printed for the Québec return with the “Client Copy,” “Government copy,” and “Office copy” print formats.

In addition, a copy of Schedule 7 must be filed with the Québec return in the following situations:

- Another CCPC assigns a portion of the business limit to the corporation under subsection 125(3.2) ITA;

- The corporation assigns a portion of the specified partnership business limit to a designated member of a partnership under subsection 125(8) ITA;

- A member of a partnership assigns a portion of the specified partnership business limit to the corporation under subsection 125(8) ITA.

Before, diagnostics F127, F128 and F129 were prompting you to file a copy of Schedule 7 in each of these situations. Now, when the corporation has a permanent establishment in Québec and an amount is indicated on line 335, 336 or CC of Schedule 7:

- A copy of this schedule is automatically attached to the Québec return when this return is electronically filed;

- A copy of this schedule is printed for the Québec return with the “Client Copy,” “Government copy,” and “Office copy” print formats.

Note: The jump codes used for the print templates are QT2 and QS7).

New Forms

Québec

Québec

CO-771.1.3.AJ – Adjusted Business Limit

Multiple copies can be created for Part 2, which is used to calculate the adjusted aggregate investment income (AAII) of the filing corporation and its associated corporation for taxation years ended in the previous calendar year. For the filing corporation, the first copy of Section 2.2 is automatically completed with the amounts entered in the Québec CO-771.1.3.AJ – Adjusted business limit section in Schedule 9 WORKCHART of the filing corporation. For associated corporations, a copy of Part 2 is automatically created and data on lines 06 to 09 in Section 2.1, as well as amounts on lines 11, 12, 14 to 18, 21 and 23 in Section 2.2 are calculated from the relevant data entered in the Québec CO-17 – Corporation income tax return and Québec CO-771.1.3.AJ – Adjusted business limit sections of Schedule 9 WORKCHART.

Automatically created copies relate only to the last taxation year ending in the previous calendar year of the corporation. When a corporation (filing or associated) has more than one taxation year ending in the previous calendar year, a copy must be manually created using the Add button, selecting the name of the corporation from the drop-down menu on line 08 and completing the relevant lines manually. For more information, consult the note relating to Schedule 9 WORKCHART.

Parts 3 and 4 are used to calculate the business limit reduction for taxation years starting after 2018. When an amount is calculated on line 28 and the amount of paid-up capital on line 56 of Form CO-771 is less than $15 million, the amount on line 38 is updated to line 94a of Form CO-771.

CO-1029.8.33.TE – Tax Credit to Foster the Retention of Experienced Workers – SMB

This multiple copy form is for any corporation that has an establishment in Québec where it carries on a business, has a specified paid-up capital for the previous taxation year, including that of the members of an associated group, of less than $15 million and whose number of remunerated hours of its employees, calculated for the taxation year, is greater than 5,000 (provided it is not a corporation in the primary or manufacturing sector).

The refundable tax credit is calculated on the employer’s contributions paid by the corporation with respect to an employee. The rate of the refundable tax credit will vary based, firstly, on the individual's age and, secondly, the corporation's total payroll. Thus, in respect of an employee aged at least 60 but no older than 64, the tax credit that can be claimed by a qualified corporation with a total payroll of $1 million or less, on the employer contributions paid in respect of such an employee, will be calculated at a rate of 50% and can total as much as $1,250 annually. In respect of an employee aged at least 65, the tax credit such a corporation can claim on employer contributions paid in respect of such an employee will be calculated at a rate of 75% and can total as much as $1,875 annually.

If the corporation claims the tax credit as both a qualified corporation and a qualified member of a partnership, complete a copy of the form for each of these claims.

The “Identification” custom part has been added on screen only. The answers to the questions Is the paid-up capital determined for the preceding taxation year, including that of members of an associated group, less than $15 million? and Does the number of remunerated hours of its employees, calculated for the taxation year, exceed 5,000 or is the corporation in the primary or manufacturing sector? will be defined when the qualified or specified expenditure is incurred by the corporation.

The answer to the question Is the paid-up capital determined for the preceding taxation year, including that of members of an associated group, less than $15 million? will be “Yes” when the amount on the line Paid-up capital of the previous taxation year used for the calculations of Form CO-1029.8.33.TE of the filing corporation plus the total of the amounts on the lines Paid-up capital of the previous taxation year (adjusted) of the associated corporations entered in Schedule 9 WORKCHART is less than $15 million.

The answer to the question Does the number of remunerated hours of its employees, calculated for the taxation year, exceed 5,000 or is the corporation in the primary or manufacturing sector? will be “Yes” when the number of hours on line 07a or 07b of Form CO-771 is greater than 5,000 or if the proportion of activities in the primary sector or the manufacturing sector indicated on line 187c of Form CO-771 is greater than 25%.

For each eligible employee, complete Part 4 on a separate copy. Custom check box Select this box if you want to roll forward information about the employee has been added above Section 4.1 of the form, on screen only, to allow you to roll forward or not data in Part 4. This box is selected by default. When rolling forward a return, if this box is selected, the data entered in fields 30 to 32 in the subsection concerning the employee as well as the answer to the question Is the qualified corporation or qualified partnership associated with at least one other qualified corporation in the calendar year in question and have they paid salary and wages or other remuneration to this employee? will be retained.

The table in Part 5 will be completed from the information entered in Part 4.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount was entered on line 107 of Form QC L440P-Y, it will be retained as an overridden amount. Complete the sections of Form CO-1029.8.33.TE relating to this credit and cancel the override on line 107 of Form QC L440P-Y for the credit calculated in Form CO-1029.8.33.TE to be updated in Form QC L440P-Y.

CO-1029.8.33.TF – Agreement Respecting the Tax Credit to Foster the Retention of Experienced Workers – SMB

This multiple copy form allows you to allocate the qualified or specified expenditure when the corporation is associated with at least one other qualified corporation and they paid salary and wages or other remuneration to an employee. The “Identification” custom part has been added at the top of the form to identify which type of entity incurred qualified or specified expenditures. To complete Part 3, you must have answered “Yes” to custom question Is the qualified corporation or qualified partnership associated with at least one other qualified corporation in the calendar year in question and have they paid salary and wages or other remuneration to this employee? in Part 4 of Form CO-1029.8.33.TE. A copy of Form CO-1029.8.33.TF PART 3 is then automatically created under the entity that incurred the expenditure. If you want to delete a copy, access Form CO-1029.8.33.TE and answer “No” to the question.

Column A in Part 4 is completed based on the identification numbers or the names entered in the Part 4 completed for all employees.

Deleted Forms

Federal

Federal

RC366 – Direct Deposit Request for Businesses

This form has not been available since July 5, 2019, on the CRA Web site. Therefore, it was removed from our program. For information on how you can sign up for direct deposit or to update information, go to Direct deposit – Canada Revenue Agency.

Québec

Québec

CO-1029.8.36.HE – Tax Credit for the Modernization of a Tourist Accommodation Establishment

CO-1029.8.36.HF – Agreement Concerning the Annual Limit of the Tax Credit for the Modernization of a Tourist Accommodation Establishment

CO-1029.8.36.MA – Tax Credit for the Diversification of Markets of a Québec Manufacturing Company

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Federal

Schedule 200 – T2 Corporation Income Tax Return*

In the June 17, 2019, Notice of Ways and Means Motion to amend the Income Tax Act, paragraph 110(1)(e) ITA has been added to allow a corporation to deduct, in calculating its taxable income, the amount of the benefit deemed by subsection 7(1) ITA to have been received by the taxpayer in respect of a non-qualified security under an employee stock options agreement. For more information, consult the June 17, 2019, Notice of Ways and Means Motion to amend the Income Tax Act.

To that end, custom line a, Employer deduction for non-qualified securities under an employee stock options agreement, has been added under line 350 in the Taxable income section.

Schedule 1 – Net Income (Loss) for Income Tax Purposes*

The calculation of the amount on line 101 has been updated to include the amount from line 7010 of Schedule G9998.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, make sure to verify whether any adjustments are required on lines 239 and/or 347 resulting from the change to the calculation on line 101.

Schedule 2 – Charitable Donations and Gifts*

Schedule 4 – Corporation Loss Continuity and Application

In the June 17, 2019, Notice of Ways and Means Motion to amend the Income Tax Act, paragraph b) of the description of E in the definition non-capital loss in subsection 111(8) ITA has been modified to take into account the new amount of an employer for non-qualified securities under an employee stock options agreement that is added to the Taxable income section of Schedule 200. As a result, line 1d, Amount of an employer for non-qualified securities under an employee stock options agreement deductible under paragraph 110(1)(e), has been added to Part 1.

Schedule 5 – Tax Calculation Supplementary – Corporations*

The following lines have been added:

- line 562, Nova Scotia innovation equity tax credit;

- line 563, Nova Scotia venture capital tax credit;

- line 699, Yukon business carbon price rebate.

Schedule 8 WORKCHART – Capital Cost Allowance (CCA) Workchart

As a result of the tabling of Bill 42, on November 7, 2019, by the Government of Québec, the following modifications have been made to the calculation of the amount on line E in subsection Qualified property that was acquired after November 20, 2018, and before December 4, 2018 of Section Additional capital cost allowance (CCA) for Québec to be compliant with section 156.7.5 TA, as proposed in section 37 of Bill 42:

- the following four lines have been removed:

- Capital cost of qualified property that became available for use in the current taxation year before December 4, 2018 that is not accelerated investment incentive property;

- Capital cost of qualified property that became available for use in the current taxation year before December 4, 2018 that is accelerated investment incentive property;

- Capital cost of qualified property acquired after December 3, 2018 but before July 1, 2019 that became available for use in the current taxation year and that is not accelerated investment incentive property; and

- Capital cost of qualified property acquired after December 3, 2018 but before July 1, 2019, that became available for use in the current taxation year and that is accelerated investment incentive property;

- the line Capital cost of qualified property that became available for use in the current taxation year before July 1, 2019 has been added to replace the removed lines;

- the field Amount added to UCC attributable to all qualified properties in the class has been renamed Half of the capital cost of qualified property that became available for use in the current taxation year and is equal to half of the amount entered on the new line Capital cost of qualified property that became available for use in the current taxation year before July 1, 2019.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, the total of the amounts entered on the four removed lines will be entered on the line Capital cost of qualified property that became available for use in the current taxation year before July 1, 2019.

When rolling forward a return saved in a prior version of CCH iFirm Cantax T2, the amount rolled forward to the two lines Amount of line E from the first year will take into account the adjustments made to the calculation performed on line E.

EFILING the return of a corporation that acquired classes 43.1 and 43.2 property in the taxation year

As a result of a CRA request, corporation income tax returns (T2) can no longer be EFILED when one of diagnostics R0080200 or R0080300 concerning missing information relating to classes 43.1 and 43.2 displays in the diagnostics pane.

Schedule 8 WORKCHART ADD – Additions and Dispositions Workchart

Changes have been made to the “Information relating to zero-emission vehicles” section, which displays for a CCA class 54 property. The calculation of the cost and the calculation of the capital cost of a zero-emission passenger vehicle have been modified to ensure conformity with subparagraph 13(7)(i)(i) and subsection 13(7.1) ITA. Any government assistance is now deducted in the calculation of the field “Original capital cost” after the application of the $55,000 capital cost limit, while the amount in the field “Eligible cost of addition” only consists of the purchase cost and the applicable sales tax. To reflect these changes, the layout of the fields in this section has been modified and the field “Deemed capital cost under subparagraph 13(7)(i)(i) (the lesser of the cost of addition and the capital cost limit)” has been added to the “Addition of a zero-emission passenger vehicle” subsection.

In addition, the fields “Cost of the vehicle” and “Government assistance received or repaid” have been added to the “Disposition of a zero-emission passenger vehicle” subsection. These fields are used to calculate the amount in the field “Proceeds of disposition” of the “Disposition” section for a zero-emission passenger vehicle when the corporation deals at arm’s-length with the purchaser. The field “Government assistance received or repaid” is used to enter any government assistance received or repaid regarding the vehicle, according to the changes announced in section 52 of the Legislative Proposals Relating to Income Tax and Other Legislation published on July 30, 2019.

When opening a return prepared with a prior version of CCH iFirm Cantax T2 and when rolling forward a return, the amounts that will be indicated in the “Information relating to zero-emission vehicles,” “Addition” and “Disposition” sections will take into account all the modifications to the calculations described above.

Schedule 9 WORKCHART – Related and Associated Corporations Workchart

Part Québec CO-771.1.3.AJ – Adjusted business limit has been added to record data from the last taxation year ending in the previous calendar year. This data is used to calculate the adjusted aggregate investment income to compute the Québec income tax. When an amount is entered on at least one of the lines under the title Data related to the last taxation year that ended in the preceding calendar year and the resulting amount of adjusted aggregate investment income (AAII) is greater than “0,” a copy of Part 2 in Form CO-771.1.3.AJ is automatically created and the amounts are updated to the corresponding lines for the filing corporation and its associated corporations (other than corporations for which association code “5” is selected). For more information, consult the note relating to Form CO-771.1.3.AJ.

In a taxation year beginning in 2019, these lines will be calculated from amounts 2A to 2L and line 741 in Part 2 of Schedule 7, when line 744 has a positive amount.

Otherwise, when rolling forward a return with a taxation year starting in the previous calendar year, the amounts on lines 705 to 741 in Part 2 of Schedule 7, will be updated to the corresponding lines in this section of the filing corporation’s copy.

The line Total adjusted aggregate investment income for prior taxation years that ended in the preceding calendar year has been moved from Part “Québec CO-771.1.3 - Associated corporation’s agreement respecting the allocation of the business limit” to Part “Québec CO-771.1.3.AJ – Adjusted business limit.” The amount on this line represents the total of the amounts on line 24 in the copies of Part 2 of Form CO-771.1.3.AJ in which the name of the corporation corresponds to the name of the corporation entered at the top of Schedule 9 WORKCHART.

As a result of the removal of Form CO-1029.8.36.HF, the “Québec CO-1029.8.36.HF – Agreement respecting the annual tax credit limit for the modernization of a tourist accommodation establishment” section has been removed because this credit can only be claimed for a taxation year that ended before 2017.

The Section “Québec CO-1029.8.33.TE - Tax credit to foster the retention of experienced workers – SMB” has been added to calculate the paid-up capital of the previous taxation year of the filing corporation and enter the paid-up capital used to determine the applicability of Form CO-1029.8.33.TE.

Schedule 23 – Agreement Among Associated Canadian-Controlled Private Corporations to Allocate the Business Limit*

Schedule 27 – Calculation of Canadian Manufacturing and Processing Profits Deduction*

T661 – Scientific Research and Experimental Development (SR&ED) Expenditures Claim

The year’s maximum pensionable earnings amount for purposes of the Canada pension plan has been updated for the 2020 calendar year (and is now $58,700). This amount is used to determine the specified employees’ salary or wages when the proxy method is selected to calculate the SR&ED expenditures.

Schedule 49 – Agreement Among Associated Canadian-Controlled Private Corporations to Allocate the Expenditure Limit*

Schedule 50 – Shareholder Information*

Schedule 53 – General Rate Income Pool (GRIP) Calculation*

Schedule 71 – Income Inclusion for Corporations that are Members of Single-Tier Partnerships

Schedule 72 – Income Inclusion for Corporations that are Members of Multi-Tier Partnerships

The question Did the partnership elect to change its fiscal period-end? and the fields relating to the tax year start and end dates for the old fiscal period have been removed from Part 1. When opening a return prepared with a prior version of CCH iFirm Cantax T2, the values entered in these fields will not be retained.

Schedule 73 – Income Inclusion Summary for Corporations that are Members of Partnerships

The column in the table of Part 1 for line 120 has been removed. When opening a return prepared with a prior version of CCH iFirm Cantax T2, the value on this line will not be retained.

T1044 – Non-Profit Organization (NPO) Information Return*

T1134 – Information Return Relating to Controlled and Not-Controlled Foreign Affiliates

The filing deadline for Form T1134 has been shortened. Form T1134 should be filed within the following deadlines depending on the taxation year end:

- 15 months for years ending before January 1, 2020;

- 12 months for years ending in 2020; and

- 10 months for years ending after December 31, 2020.

The diagnostics as well as the filing deadline shown in the Client Letter Worksheet used in the paragraph relating to Form T1134 in the Client Letter Filing Instructions have been modified in accordance with these changes.

Client Letter Worksheet

As a result of the removal of Form CO-1029.8.36.HF, the CO-1029.8.36.HF check box has been removed from the CO-17-Paper format and CO-17 – Internet filing sections because this credit can only be claimed for a taxation year that ended before 2017. In addition, the paragraph relating to Form CO 1029.8.36.HF has been removed in the letter Filing Instructions.

The CO-1029.8.33.TF check box has been added to the “CO-17-Paper format:” and “CO-17 – Internet filing” sections. When this box is selected in one of these sections, the paragraph relating to Form CO-1029.8.33.TF is included in the letter Filing Instructions. Note that this box is automatically selected in the relevant section when Form CO-1029.8.33.TF is applicable.

AgriStability and AgriInvest Additional Information and Adjustment Request*

The column Line code has been added to the table of Part 2.

AgriStability and AgriInvest Programs – Ontario*

AgriStability and AgriInvest Programs – Harmonized Provinces* and British Columbia*

AgriStability and AgriInvest – Programs – Alberta*

Several changes have been made to the statement A. Here are the main ones:

- The “Name and Address” section has been split into two sections; “Participant Information” and “Authorized Representative – AgriInvest Only.”

- The following modifications have been made to the “Participant Information” section:

- The line Telephone Number (Evenings) has been removed.

- The lines Fax Number, E-mail Address and AFSC ID Number, and the check box AgriInvest Only have been added.

- The lines AGRIS/CAIS Participant Identification Number, Business Number, Trust Number, Province of main residence as of December 31, 2018 have been moved from the “Participant Profile” section to the “Participant Information” section.

- In the “Authorized Representative – AgriInvest Only” section, the line E-mail Address has been added.

- The “Participant Profile” section has been deleted, but the information from this section has been moved to the “Participant Information” and “Identification” sections. Note that the lines Language of preference, Number of years the entity has farmed, Was 2018 your last year of farming? and If the corporation has been dissolved, provide the date of dissolution have been removed.

- The following modifications have been made to the “Identification” section:

- The check boxes a corporation, a co-operative and a member of a partnership have been moved from the “Participant Profile” section to the “Identification” section. However, the check box a communal organization has been removed. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if the check box a communal organization has been selected, the check box Other entity will be selected and “Communal organization” will be entered on the description field.

- The check boxes Single farm and Partnership have been removed.

- The question Was your farming operation involved in any of the following and the check boxes crop share (landlord) and crop share (tenant) have been removed.

- In the “Other farming income” subsection, the line 9617, Custom feeding income has been removed.

- In the “Commodity purchases and repayment of program benefits” subsection, the line 575, Point of sale adjustments, has been added.

- In the « Allowable expenses » subsection, the lines 9830, Prepared Feed and 9831, Custom Feeding, have been removed. In addition, the line 9953, Private premiums for allowable commodities, has been added.

- In the “Non-allowable expenses” subsection, the line 9935, Allowance on eligible capital property, has been removed.

- The following modifications have been made to the “Shareholder Information” section:

- The lines 865, Number of members in co-operative, and 854, Total number of outstanding common shares (voting and non-voting), have been removed. In addition, the columns Social Insurance Number, and 854, Number of Common Shares Per Shareholder, have been removed.

- The column AgriStability and AgriInvest Participant Identification Number (PIN) or AFSC ID Number (if applicable) has been added.

- The following modifications have been made to the “Partnership Information” section:

- The columns Your Name, Social insurance Number, Business Number (if a corporation), and Business Number (if a partner is a corporation) have been removed.

- The column PIN or AFSC ID Number has been added.

AgriStability and AgriInvest – Programs – Saskatchewan*

Ontario

Ontario

Schedule 500 – Ontario Corporation Tax Calculation*

The lines in the schedule have been renumbered. In addition, the amount on line 2C is calculated from the amount on line 427 of the T2 return only when the tax year starts before 2019. Lines 2D to 2H have been added to calculate the Ontario business limit reduction for a tax year that starts after 2018. Data on lines 2D, 2E and 2G are calculated from the equivalent lines in the T2 return. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if the amount on former line 3 was overridden and the tax year starts after 2018, it will be retained as an overridden amount on line 2H.

In accordance with provisions of Bill 138, which was tabled on November 6, 2019, by the Government of Ontario, the small business deduction rate increases from 8% to 8.3% on January 1, 2020. When the corporation’s taxation year straddles January 1, 2020, this rate is prorated based on the number of days in the taxation year that are after December 31, 2019. As a result, line 2N.3 has been added to Part 2.

Schedule 504 – Ontario Resource Tax Credit*

Former Parts 1, 2, 4 and 5 have been removed from the schedule because they are obsolete. In addition, all lines that were used to calculate the current-year resource tax credit for tax years that begin before April 24, 2015, as well as former line I have been removed from former Part 3, which now corresponds to Part 1. Therefore, this schedule should now be used only to claim an unused resource tax credit. When opening a return prepared with a prior version of CCH iFirm Cantax T2, the data indicated on the removed lines will not be retained.

Québec

Québec

CO-17 – Corporation Income Tax Return*

Line 19a, Does the corporation have any income from commercial activities on the Internet?, has been added to Part 2, and the wording on line 28a has been updated to include any payment from which income tax was withheld.

Line 27 is now an input field. When opening a return prepared with a prior version of CCH iFirm Cantax T2 or when rolling forward a return, the answer entered by the program or using an override will be retained.

In addition, on lines 42a and 43b, only the first 10 digits of the identification numbers should be entered. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if a number was entered on one of those lines, only the first 10 digits will be retained.

Note that the following special tax codes can now be selected on lines 425ai and 425bi:

- 95, SMBs to foster the retention of experienced workers;

- 96, To support print media companies.

The registration fees that are indicated on line 441b will be indexed on January 1, 2020. The amount for cooperatives will increase from $41 to $42, the amount for non-profit legal persons (incorporated association), a syndicate of co-ownership and fraternal benefit societies, from $35 to $36, and the amount for corporations, mutual insurance corporations and other entities, from $90 to $92.

QC L440P-Y – Additional Québec Credits

The following credit codes have been removed from the form:

- 060, Tax credit for the short-term rental of specialized facilities - BDC (CO-1029.8.36.AL);

- 073, Tax credit for job creation in Gaspésie and certain maritime regions of Québec - marine biotechnology, mariculture and processing of marine products (CO-1029.8.36.RM, 2013, 2014 or 2015 calendar years);

- 093, Tax credit for the diversification of markets of Québec manufacturing companies (CO-1029.8.36.MA);

- 094, Tax credit for the modernization of a tourist accommodation establishment (CO-1029.8.36.HE);

- 098, Tax credit relating to building used in the course of manufacturing or processing activities - Manufacturing SMB (CO-1029.8.36.BT).

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount had been entered on one of these code lines, it will not be retained.

In addition, on October 2, 2019, the Government of Québec announced in the Information Bulletin 2019-9, that it would implement a new refundable tax credit to support print media companies. As a result, the following credit code has been added to the form:

- 108, Tax credit to support print media companies.

CO-17.A.1 – Net Income for Income Tax Purposes

Code 06, Additional capital cost allowance of 30% in respect of certain property has been added to the code list for lines 129ai to 129ki. Therefore, lines 129ei and 129e are now reserved for code 06, and the additional capital cost allowance of 30% is no longer taken into account in the calculation of the field Total deductions located in the Deduct subsection of the Additional list section. When opening a return prepared with a prior version CCH iFirm Cantax T2, if a code is entered on line 129ei and an amount is entered on line 129e, these values will be transferred to the first empty line of lines 129fi to 129ki and 129f to 129k that will be empty. The corresponding values in the Prior year column will also be transferred in the same manner.

Q1 L70A – Taxable Tax Credits and Q1 L140A – Non-Taxable Tax Credits

The following credit codes have been removed from both forms

- 060, Tax credit for the short-term rental of specialized facilities - BDC;

- 073, Tax credit for job creation in Gaspésie and certain maritime regions of Québec - marine biotechnology and mariculture;

- 093, Tax credit for the diversification of markets of Québec manufacturing companies;

- 094, Tax credit for the modernization of a tourist accommodation establishment;

- 096, Tax credit relating to the costs of issuing shares – Stock Savings Plan II (SSP II);

- 098, Tax credit relating to building used in the course of manufacturing or processing activities - Manufacturing SMB.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount had been entered on one of these code lines, it will not be retained.

In addition, on October 2, 2019, the Government of Québec announced in the Information Bulletin 2019-9, that it would implement a new refundable tax credit to support print media companies. As a result, the following credit code has been added to the form:

- 108, Tax credit to support print media companies.

CO-17.B.1 – Amount to be Included in the Income of a Corporation that is a Member of a Single-Tier Partnership

CO-17.B.2 – Amount to be Included in the Income of a Corporation that is a Member of a Multi-Tier Partnership

Following the update of Schedule 71 and Schedule 72, lines 08, 09 and 10 became input fields. When opening a return prepared with a prior version of CCH iFirm Cantax T2, the value calculated on each of these lines will be retained.

CO-130.A – Capital Cost Allowance*

To take the acquisitions of accelerated investment incentive property (AIIP) and their UCC adjustment into account, the following column have been added:

- Column C.1, Capital cost of AIIP acquired in the taxation year (amount included in column C);

- Column F.1, Proceeds of dispositions available to reduce the capital cost of AIIP acquired in the taxation year;

- Column F.2, Net capital cost of AIIP acquired during the taxation year; and

- Column F.3, UCC adjustment for AIIP acquired during the taxation year.

The following columns have been renamed to better represent the new calculation for CCA:

- Column F, UCC after acquisitions and dispositions;

- Column G, UCC adjustment for non-AIIP acquired during the taxation year;

- Column H, Base amount available for the CCA calculation.

CO-737.SI – Deduction for Innovative Manufacturing Corporations*

For each qualified patented feature incorporated in the qualified property and for which the corporation is claiming the deduction, complete a separate copy of Form CO-737.SI PART 5. To complete Part 5 for each qualified patented feature, access Form CO-737.SI PART 5 from Part 5. When opening a return prepared with a prior version of CCH iFirm Cantax T2, for each qualified patented feature entered in Part 5, a separate copy of Form CO-737.SI PART 5 will be created.

Column B, Patent number, has been added to the table in Section 5.1. Section 5.2 has been added to provide a short description of the valuation method that was used to determine the increase in value that the qualified patented feature adds to the qualified property. Furthermore, a table has been added to the new Section 5.3 to enter the qualified R&D expenditures that were paid by the corporation and the associated corporations for the 5-year period preceding the taxation year covered and for which these corporations qualified for an R&D tax credit. When rolling forward a return, data from columns F to C will be retained in columns E to B, and column F should be completed, if applicable.

CO-771 − Calculation of the Income Tax of a Corporation*

Line 06a has been added to Part 1 to indicate whether the corporation or a corporation with which it is associated in the taxation year has an adjusted aggregate investment income calculated on Form CO-771.1.3.AJ.

In Section 8.1, custom lines JA and JB, which were used to calculate the business limit reduction, have been removed following the addition of Form CO-771.1.3.AJ. When the amount of paid-up capital on line 56 of Form CO-771 is less than $15 million and Form CO-771.1.3.AJ is applicable, the amount on line 94a will be calculated using data entered on this form. Otherwise, the calculation of line 94a remains unchanged.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, the overridden amounts on lines JA, Adjusted aggregate investment income, JB and Business limit reduction (amount JA or JB, whichever is the greater)” will be retained, respectively, on lines 34, 28, 33 and 38 of Form CO-771.1.3.AJ.

CO-771.2.1.2 – Income of a Corporation That Is a Member or Designated Member of a Partnership From an Eligible Business Carried On in Canada by the Corporation*

CO-771.R.3 – Breakdown of Business Carried On in Québec and Elsewhere*

The section “Indicate to which line(s) you will carry the percentage shown in box H” has been removed.

In addition, four selectable lines have been added to the form:

- 06a - The corporation must calculate its proportion of business carried on in Québec using the salaries and wages paid by the corporation and the corporation’s gross revenue as a basis of calculation.

- 06b - The corporation must calculate its proportion of business carried on in Québec using a basis of calculation other than the salaries and wages paid by the corporation and the corporation’s gross revenue.

- 07a - The corporation has gross revenue in the taxation year, but has not paid salaries and wages to its employees.

- 07b - The corporation has no gross revenue in the taxation year, but has paid salaries and wages to its employees.

CO-1029.8.33.13 – Tax Credit for the Reporting of Tips*

This form has been updated in order to integrate the various applicable rates for 2020. In compliance with Revenu Québec requirements, the calculation of the health and services fund rates on lines 22, 60b, 60e and 60h is now performed with two decimals.

COZ-1179 – Logging Operations Return*

MR-69 – Authorization to Communicate Information or Power of Attorney*

As per Revenu Québec requirements, the 2D bar code is no longer generated when some minimal validations are not met. Diagnostics have been updated to advise the preparer that the bar code will not be generated when printing the form as long as the adjustments are not made. Please note that the absence of a 2D bar code may cause processing delays from Revenu Québec.

RD-1029.8.9.03 – Tax Credit for Fees and Dues Paid to a Research Consortium*

As a result of the update of the form, the following modifications were made:

- Former Section 2.1 becomes Part 2.

- Part 3 has been added to keep track of the balance of cumulative fees or dues paid to the research consortium. Note that the expenditures incurred by the consortium, whether or not they are related to R&D activities covered on lines 116b, 116c, 116g and 116h, must reduce the fees or dues paid to the consortium according to the first in, first out method.

- In the past, if the eligible dues or fees originated from more than one taxation year and the percentage on line 135 was not the same for all those years, you had to perform the calculations covered on lines 139 to 141 for each year and override the total of these amounts on line 141 in former Section 2.5. From here on, use the table that was added to Section 4.1 to keep track of eligible fees or dues relating to prior taxation years (line 116c) according to the taxpayer’s percentage interest for those prior taxation years.

- The information indicated in Section 4.2 includes information entered in former Section 2.5 relating to the taxpayer who became a member of the research consortium in the fiscal year of the latter and whose fiscal year in question ended in the taxation year covered.

- Former Section 2.4 becomes Section 4.2.1.

- Section 4.2.2 includes the same calculation of the eligible fees or dues relating to the taxation year covered. Therefore, lines 136 to 138 were kept as in the previous version. The description of line 136 was modified, because it now refers to line 116h in Part 3.

- Section 4.3 performs the addition of eligible fees or dues from prior years (line 138b) and the year covered (line 138a). In addition, lines 142 to 151 were kept as in the previous version.

- Former Parts 3 to 7 become Parts 5 to 9.

- Former Sections 2.2, 2.3 and 2.6 as well as lines 139 to 141 in former Section 2.5 were removed from the form.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if amounts were entered on lines 139 and 140, they will be retained in the first occurrence of columns B and C, respectively, of line 120 in Section 4.1. In addition, if an amount had been overridden on line 141, it will be retained as an overridden amount in the first occurrence of column D on line 120 in Section 4.1. If this is your situation, it means that the percentage on line 135 was not the same for all prior taxation years. Therefore, enter the information concerning the taxation years in the table of Section 4.1 for each prior taxation year. If an amount was entered on line 153d, it will be kept as an overridden amount on line 116k. A diagnostic will prompt you to complete Part 3 and to remove the override. Finally, the amount on line 136 will be updated to line 116h in Part 3.

When rolling forward a return, information on line 112f in Part 2 as well as on line 135 in Section 4.2.1 will be updated to columns A and C of a new occurrence of line 120 in Section 4.1. In addition, the information relating to the other prior taxation years in Section 4.1 will also be retained if the amount on line 116e was greater than 0.

CO-1029.8.36.FO – Employee Training Tax Credit for Small and Medium-sized Businesses

Based on new Revenu Québec requirements, you can now enter cents on line 23 of the form.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount had been entered or overridden on this line, it will be retained.

TP-1029.9 – Tax Credit for Taxi Drivers or Taxi Owners*

The permit number to be entered on line 20 of Section 2, Column A of Section 3.1, and Section 3.2 is now 12 characters long (without hyphen or space).

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if a permit number longer than 12 characters (excluding hyphens and spaces) was entered in one of the fields above-mentioned, the number will not be retained.

In addition, for section 3.2 to be completed in accordance with the requirements of the Revenu Québec form, you must now complete a separate copy of Form TP-1029.9 PART 3.2 for each permit issued to more than one taxpayer if these taxpayers have chosen to designate the corporation as the sole holder to claim the tax credit. You can access Form TP-1029.9. PART 3.2 from Part 3, Subsection 3.2 “Designation of the holder of a taxi owner's permit” of Form TP-1029.9.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, a separate copy of the form will be created for each entity that completes section 3.2. The data in section 3.2 regarding the designation of the holder of a taxi owner's permit will be transferred on a first copy of Form TP-1029.9 PART 3.2 related to the applicable entity. Please check if any adjustments are necessary.

The base amount on line 53 will indicate the amount for the 2019 taxation year, i.e. $584, when the taxation year ends after December 30, 2019. The base amount for the 2020 taxation year, i.e. $594 applies to a taxation year that ends after December 30, 2020.

British Columbia

British Columbia

Schedule 421 – British Columbia Mining Exploration Tax Credit*

Schedule 427 – British Columbia Corporation Tax Calculation*

Former lines 4, 5 and F, which were used to calculate the amount eligible for the credit unions deduction taking into account the 80% reduction rate of the deduction that was applicable in 2016, have been removed from the schedule because they are obsolete. When opening a return prepared with a prior version of CCH iFirm Cantax T2, the amounts that were indicated in the fields of these lines will not be retained.

Schedule 428 – British Columbia Training Tax Credit*

Alberta

Alberta

AT1 – Alberta Corporate Income Tax Return*

The basic tax rate will be decreased from 11% to 10% on January 1, 2020. Therefore, the rate used for calculating the amount on line 068 has been modified. When the corporation’s taxation year straddles January 1, 2020, this rate is prorated based on the number of days in the taxation year that are after December 31, 2019. In addition, the small business deduction rate for the province has been modified. For more information on this topic, consult the note relating to Form AT1 Schedule 1 below.

AT1 Schedule 1 – Alberta Small Business Deduction*

The small business deduction rate for the province will be decreased from 9% to 8% on January 1, 2020. The table Calculation of the Alberta Small Business Deduction has been modified to reflect this change. Lines of the table that were used for the periods after March 31, 2007, and before April 1, 2008, as well as after March 31, 2008, and before April 1, 2009, have been removed. In addition, in the “AREA B – Determination of the Value for Line 015” section, the presentation of the calculation of the passive income business limit reduction has been reviewed. Therefore, the Passive Income Limit Reduction subsection has been added.

AT1 Schedule 9 – Alberta Scientific Research & Experimental Development (SR & ED) Tax Credit and AT1 Schedule 9 – Listing of SR & ED Projects Claimed in Alberta

In its budget tabled on October 24, 2019, the Alberta Government announced that the credit for SR&ED will be eliminated starting in 2020 and that expenses incurred after December 31, 2019, will no longer be eligible for this credit. The amounts entered in columns 105, 109 and 111 of Form A9 LISTING must relate to expenses incurred before January 1, 2020. If no eligible expense was incurred before January, 2020, answer No, where applicable, to the questions Were part or all of the SR&ED expenditures of the third party incurred in Alberta before January 1, 2020? of Form T1263, Third-party Payments for SR&ED and Were part or all of the SR&ED expenditures for this project were incurred in Alberta before January 1, 2020? of Form T661, Part 2 - Project Information. Diagnostics have been added to facilitate data entry about this measure.

AT1 Schedule 12 – Alberta Income/Loss Reconciliation

As a result of the addition of the employer deduction for non-qualified securities under an employee stock options agreement in the Taxable income section of Schedule 200, the line Employer deduction for non-qualified securities under an employee stock options agreement, has been added to the Federal and Alberta columns of the AREA B – TAXABLE INCOME FOR ALBERTA section.

AT1 Schedule 18 – Alberta Dispositions of Capital Property*

The numbering, description and layout of the lines have been modified.

AT1 Schedule 21 – Alberta Calculation of Current Year Loss and Continuity of Losses

As a result of the addition of the employer deduction for non-qualified securities under an employee stock options agreement in the Taxable income section of Schedule 200, line A, Amount of an employer for non-qualified securities under an employee stock options agreement deductible, has been added to the CALCULATION OF CURRENT YEAR NON-CAPITAL LOSS section.

AT100 – Preparing and Filing the Alberta Corporate Income Tax Return*

Former check box 4, It is not claiming the Alberta Royalty Tax Credit nor has it received Royalty Tax Credit instalments for the taxation year, has been removed, affecting the order of the exemption criteria of the following check boxes.

The former exemption criteria for check box 9, It is not claiming the Alberta Scientific Research & Experimental Development (SR&ED) Tax Credit, a recapture of SR&ED, the Alberta Interactive Digital Media Tax Credit, an Alberta Capital Gains Refund nor any other credits (line 087 of the AT1 return), now applies to check box 7 with respect to the Alberta Scientific Research and Experimental Development Tax Credit and the recapture of SR&ED.

The former exemption criteria for check box 5, It has no amounts to report on Schedule 3, Alberta Other Tax Deductions and Credits, or on Schedule 5, Royalty Tax Deduction, now applies to check box 9 with respect to the Alberta Investor Tax Credit, the Capital Investment Tax Credit, Interactive Digital Media Tax Credit and the Alberta Capital Gains Refund.

Check box 8 is now used for the Alberta Qualifying Environmental Trust Tax Credit and any other credits (line 087 of the AT1 return).

Because of the change in the order of the exemption criteria, When opening a return prepared with a prior version of CCH iFirm Cantax T2, if former check boxes 5 or 9 were overridden, verify if adjustments are required.

Saskatchewan

Saskatchewan

Schedule 404 – Saskatchewan Manufacturing and Processing Profits Tax Reduction

A validation has been added to line B in Part 1 so that no negative amount can be entered on that line. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if a negative amount was entered on this line, it will not be retained.

Schedule 411 – Saskatchewan Corporation Tax Calculation*

Manitoba

Manitoba

Schedule 381 – Manitoba Manufacturing Investment Tax Credit*

Custom lines 1a and 1b were replaced by lines 109 and 112. Custom lines used for the calculation of line 121 were replaced by lines 121 and 123. In addition, custom lines used for the calculation of line 148 were replaced by lines 148 and 149.

Schedule 383 – Manitoba Corporation Tax Calculation*

The field on line 1A, Taxable income for Manitoba, is now used for the period prior to January 1, 2019, and for the period after December 31, 2018. As a result, the field on former line A2, Taxable income for Manitoba, has been removed from Part 1 for the period after December 31, 2018.

In addition, in Part 1 for the period prior to January 1, 2019, the section relating to credit unions has been retained because it is required to calculate the additional deduction for credit unions when the tax year ends before 2019. Therefore, if the tax year ends before 2019, the amount on line 1F is calculated using the amount on line 4. Otherwise, it is calculated using the amount on line 1E.

Also, in Part 1 for the period after December 31, 2018, the section relating to the deduction for credit unions has been removed as it is now included in Part 4 of Schedule 17.

Finally, line 3D has been added to Part 3 to calculate Manitoba tax before the additional deduction for credit unions and the tax credits. Line 3E has been added to calculate the additional deduction for credit unions for a taxation year ending after 2018. This calculation comes from line 652 in Part 4 of Schedule 17.

Note that line numbering in the form has been modified.

Schedule 384 – Manitoba Paid Work Experience Tax Credit*

Schedule 387 – Manitoba Small Business Venture Capital Tax Credit

The field Portion of the credit on line 102 from eligible investments issued to the corporation in the taxation year after June 11, 2014 has been removed from Part 1 because it is obsolete. Therefore, all calculations related to investments made in the year by the corporation after June 11, 2014, are now performed directly using the amount on line 102. When opening a return prepared with a prior version of CCH iFirm Cantax T2, the amount that was entered in the removed field will not be retained.

Schedule 389 – Manitoba Book Publishing Tax Credit*

The duration of the eligibility criteria for the credit has been extended for five years. The modifications are the following:

- the publication date for the book must be prior to 2025;

- the book publishing labour costs must be paid prior to 2025;

- the printing costs must be paid prior to 2026.

The diagnostics relating to these topics have been modified accordingly.

Nunavut

Nunavut

Schedule 481 – Nunavut Corporation Tax Calculation*

Northwest Territories

Northwest Territories

Schedule 461 – Northwest Territories Corporation Tax Calculation*

Yukon

Yukon

Schedule 443 – Yukon Corporation Tax Calculation*

New Brunswick

New Brunswick

Schedule 366 – New Brunswick Corporation Tax Calculation*

The lines in the schedule have been renumbered. In addition, the amount on line 1D is calculated from the amount on line 427 of the T2 return only when the tax year starts before 2019. Lines 1E to 1I have been added to calculate the New Brunswick business limit reduction for a tax year that starts after 2018. Data on lines 1E, 1F and 1H are calculated from the equivalent lines in the T2 return. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if the amount on former line D was overridden and the tax year starts after 2018, it will be retained as an overridden amount on line 1I.

Nova Scotia

Nova Scotia

Schedule 341 – Nova Scotia Corporate Tax Reduction for New Small Businesses*

Schedule 346 – Nova Scotia Corporation Tax Calculation*

The lines relating to the period prior to January 1, 2017, have been removed from the form as a taxation year starting before January 1, 2017, cannot be entered in this version of the program. In addition, former Part 2, which related to the calculation of income from active business when there is partnership income, has also been removed because the Nova Scotia business limit is the same as the federal government business limit for taxation years starting after 2016.

Prince Edward Island

Prince Edward Island

Schedule 322 – Prince Edward Island Corporation Tax Calculation*

Lines E1 and E2 have been removed from Part 1. In addition, the lower tax rate will be decreased from 3.5% to 3% on January 1, 2020. As a result, line 2C has been added to Part 2.

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

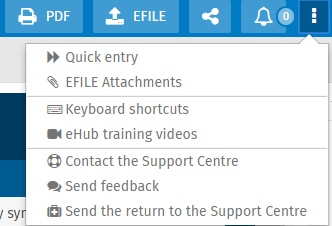

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Cantax T2 e-Bulletin notifies you each time an updated or new form is made available in a program update.

How to Reach Us

Technical and Tax support Hours

Monday to Friday: 8:30 a.m. to 8:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com