Release Notes - CCH iFirm Cantax T2 2020 v.2.1 (2020.40.30)

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Cantax

Welcome to CCH iFirm Cantax, the first cloud-based professional tax software in Canada.

CCH iFirm Cantax runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Cantax is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Cantax version, consult the Technical Release Notes.

About CCH iFirm Cantax T2

With CCH iFirm Cantax T2, you have the most comprehensive collection of corporate tax forms available, as well as tools designed to address complex T2 preparation requirements. CCH iFirm Cantax T2 also provides you with:

- the possibility of attaching supporting documents to electronically transmitted returns;

- GIFI data transfers.

Taxation Years Covered

CCH iFirm Cantax T2 2020 v.2.1 is designed to process corporate tax returns with taxation years beginning on or after January 1, 2018, and ending on or before May 31, 2021.

Overview – Version 2020 2.1

Addition of new Québec forms

The following four new Revenu Québec forms have been added to this version:

- CO-1029.8.33.CS, Tax Credit for SMBs that Employ Persons with a Severely Limited Capacity for Employment.

- CO-1029.8.36.II, Tax Credit for Investment and Innovation;

- CO-1029.8.36.IK, Cumulative Limit Allocation Agreement for the Tax Credit for Investment and Innovation;

- CO-1029.8.36.PS, Tax Credit to Support Print Media Companies; and

For more information, consult the notes on these topics.

Modifications to the Saskatchewan lower tax rate

As a result of changes announced by the Government of Saskatchewan, modifications have been made to the Saskatchewan lower tax rate for corporations that have days in their taxation year that are after September 30, 2020.

For more information, consult the note on this topic.

New Forms – Version 2020 2.1

Québec

CO-1029.8.33.CS, Tax Credit for SMBs That Employ Persons with a Severely Limited Capacity for Employment

This multiple copy form is for any corporation that has an establishment in Québec where it carries on a business, has a specified paid-up capital for the previous taxation year, including that of the members of an associated group, of less than $15 million and whose number of remunerated hours of its employees, calculated for the taxation year, is greater than 5,000 (provided it is not a corporation in the primary or manufacturing sector). The refundable tax credit is calculated on the employer’s contributions paid by the corporation with respect to an employee.

The “Identification” custom section has been added on screen only. The answers to the questions Is the paid-up capital determined for the preceding taxation year, including that of members of an associated group, less than $15 million? and Does the number of remunerated hours of its employees, calculated for the taxation year, exceed 5,000 or is the corporation in the primary or manufacturing sector? will be defined when the qualified or specified expenditure is incurred by the corporation.

The answer to the question Is the paid-up capital determined for the preceding taxation year, including that of members of an associated group, less than $15 million? will be “Yes” when the amount on the line Paid-up capital of the previous taxation year used for the calculations of Form CO-1029.8.33.CS of the filing corporation plus the total of the amounts on the lines Paid-up capital of the previous taxation year (adjusted) of the associated corporations entered in Schedule 9 WORKCHART is less than $15 million.

The answer to the question Does the number of remunerated hours of its employees, calculated for the taxation year, exceed 5,000 or is the corporation in the primary or manufacturing sector? will be “Yes” when the number of hours on line 07a or 07b of Form CO-771 is greater than 5,000 or if the proportion of activities in the primary sector or the manufacturing sector indicated on line 187c of Form CO-771 is greater than 25%.

For each eligible employee, complete Part 2.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount was entered on line 107 of Form QC L440P-Y, it will be retained as an overridden amount. Complete the sections of Form CO-1029.8.33.CS relating to this credit and cancel the override on line 110 of Form QC L440P-Y for the credit calculated in Form CO-1029.8.33.CS to be updated in Form QC L440P-Y.

CO-1029.8.36.II, Tax Credit for Investment and Innovation

This multiple copy form must be completed by any corporation that has a permanent establishment in Québec where it carries on a business, and that incurred specified expenses after March 10, 2020, to acquire specified property that is manufacturing or processing equipment, computer equipment or certain software packages.

A corporation can claim the tax credit as a corporation, a member of a qualified partnership or as a party to a joint venture. An Identification custom section has been added, on screen only, to allow you to identify the qualified entity that incurred the specified expenses.

Parts 2 to 4 should be completed on a separate form for each zone in which the specified property was used as well as when the corporation claims the tax credit as a corporation and as a member of a partnership or as part of a joint venture. Parts 5 to 12 are only completed once and are printed only on the first copy of the form.

The specified expenses incurred in the taxation year to acquire specified property that exceed the cumulative limit of $100 million of dollars are not eligible for the tax credit. The tax credit is calculated on the portion of these specified expenses related to each specified property in excess of $12,500 ($5,000 for computer equipment and qualified software packages). On screen, the table in Section 5.1, Specified expenses for the year after taking the annual limit balance into account has been split into three separate sections, i.e., Section 5.1A, Expenses incurred by the corporation, Section 5.1B, Expenses incurred by the partnership and Section 5.1C, Expenses incurred by the parties to a joint venture. Section 5.1B is displayed and must be completed for each different qualified partnership entered on line 36 of Part 4 in the copies of the form, while a Section 5.1C is displayed and must be completed for each copy of the form for which the selected specified entity in the Identification custom section is a joint venture.

All or part of the tax credit calculated for a taxation year is refundable when the total assets and gross revenue for the previous taxation year of the corporation (including the amounts for the associated corporations) are less than $100 million. The non-refundable portion of the tax credit for a taxation year can be carried back three taxation years (that end after March 10, 2020) and carried forward twenty taxation years. A custom table, Summary and analysis of credit available for carryforward, which is displayed on screen only, has been added at the end of the form to recognize the amounts of the tax credit that can be carried forward.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount is entered on the line corresponding to code 109 of Form QC L440P-Y, it will be retained as an overridden amount.

You will then have to complete Form CO-1029.8.36.II, cancel the override on line 109 of Form QC L440P-Y in order for the credit calculated in Form CO-1029.8.36.II to be updated.

CO-1029.8.36.IK, Cumulative Limit Allocation Agreement for the Tax Credit for Investment and Innovation

This new form is to be completed by a corporation that is claiming the tax credit for investment and innovation and wishes to agree with the corporations associated with it on how to allocate the $100 million cumulative limit used to calculate this tax credit. The form is completed based on the information entered in the new Québec CO-1029.8.36.IK – Cumulative limit allocation agreement for the tax credit for investment and innovation section added in Schedule 9 WORKCHART. For more information, consult the note relating to Schedule 9 WORKCHART.

CO-1029.8.36.PS, Tax Credit to Support Print Media Companies

This multiple copy form is for any corporation that has an establishment in Québec where it carries on a business, that incurred qualified salary or wages after December 31, 2018, for eligible employees or that owns a qualified subsidiary that incurred such salary or wages for work done in the period, included in the corporation’s taxation year, that started after December 31, 2018, and ended before January 1, 2020. The refundable tax credit corresponds to an amount equal to 35% of the qualified salary and wages.

The Identification custom section has been added, on screen only, to allow you to identify the qualified entity that incurred the qualified salaries or wages. If the corporation claims the tax credit both as a qualified corporation and as a member of a qualified partnership, complete a copy of the form for each of these applications.

For each eligible employee, complete Parts 2 and 3 on a separate copy. The table in Part 4 will be completed with the information entered in Parts 2 and 3.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount is entered on line 108 of Form QC L440P-Y, it will be retained as an overridden amount. You will then have to complete the sections of Form CO-1029.8.36.PS relating to this credit and cancel the override on line 108 of Form QC L440P-Y in order for the credits calculated in Form CO-1029.8.36.PS to be updated in Form QC L440P-Y.

Updated Forms – Version 2020 2.1

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Schedule 9 WORKCHART, Related and Associated Corporations Workchart

Section Québec CO-1029.8.36.II – Tax Credit for Investment and Innovation has been added to allow you to enter the gross revenue for the preceding taxation year of the reporting corporation and associated corporations. The total of these amounts is used to calculate the rate of refundability of the tax credit in Section 8.2 of Form CO-1029.8.36.II. For more information, consult the note relating to Form CO-1029.8.36.II.

Section Québec CO-1029.8.36.IK – Cumulative limit allocation agreement for the tax credit for investment and innovation has been added to allow you to complete the new Form CO-1029.8.36.IK. In particular, you must enter in this section, for the reporting corporation and the corporations associated with it, the specified expenses and eligible expenses incurred in taxation years that ended in the 60-month period that preceded the beginning of the taxation year covered by the return. This data allows for the calculation of the cumulative limit balance for the tax credit for investment and innovation, which is afterwards allocated in Form CO-1029.8.36.IK. For more information, consult the note relating to Form CO-1029.8.36.IK.

Finally, for the first copy of Schedule 9 WORKCHART, the calculation of the amount shown in the Eligible expenses incurred in the taxation year concerned field of the Québec CO-1029.8.36.ID – Cumulative limit allocation agreement for the tax credit for investment section has been modified in order to no longer deduct the amount of excluded expenses. As a result of this modification, when rolling forward a return, the rolled forward amount that will be entered in the Eligible expenses incurred in the taxation year that preceded the beginning of the taxation year concerned field of the Québec CO-1029.8.36.ID – Cumulative limit allocation agreement for the tax credit for investment section and included in the amount K in the Québec CO-1029.8.36.IK – Cumulative limit allocation agreement for the tax credit for investment and innovation section will no longer be reduced by the amount of excluded expenses.

Saskatchewan

Schedule 411, Saskatchewan Corporation Tax Calculation

In its Bill 2, tabled on December 7, 2020, the Government of Saskatchewan announced that the lower tax rate of 2% would be decreased to 0% as of October 1, 2020. The calculation on line 3A, which calculated the tax amount at the lower rate of 2%, has been modified to only take into account the number of days in the taxation year that are prior to October 1, 2020.

Corrected Calculations

The following problem has been corrected in version 2020 2.1:

Federal

- Schedule 322 – The rate used to calculate tax at the higher rate is incorrect for taxation years ending after December 31, 2020.

- The N1 diagnostic prevents the electronic filing and printing of the Bar codes and RSI for the T2 and AT1 returns even when no Mandatory modification diagnostics appear

Saskatchewan

Overview - Version 2.0 (2020.40.29)

CCH iFirm Cantax T2 2020 v.2.0 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

New engagement letter

A new Engagement Letter has been added and allows you and your client to sign an agreement with respect to the engagement relating to corporation income tax preparation. For more information, consult the note on this topic.

Form T1134 update

Form T1134 has been updated and the information that must now be entered include important modifications for corporations with a taxation year starting after 2020. For more information, consult the note on this topic.

Addition of new Québec forms in a future version 2.1 2020

We expect to add four Revenu Québec forms in a future version 2.1 2020 which should be available at the end of February 2021. For more information, consult the note on this topic.

Improve Your Productivity

Corporate Identification and Other Information

As per the CRA specifications, the telephone number format has been changed to support international telephone numbers. You can now enter telephone numbers that have between 10 and 15 digits. The numbers will be displayed as follows: 111222333444550. Note that North American telephone numbers will continue to have the traditional format, i.e., (514) 555-2221. This modification has been applied to all forms in the program except for Alberta schedules and Form MR-69. If an international telephone number is entered, it will not update to these forms. In that situation, a diagnostic will prompt you to enter a 10-digit telephone number. In addition, lines 110 and 125, Fax number, of Form T661 have also been modified to support international fax numbers.

ECL, Engagement Letter

The new Engagement Letter allows you and your client to sign an agreement with respect to the engagement relating to corporation income tax preparation. This letter contains the basic terms of the agreement for income tax preparation. Like all letters provided in the program, this letter can be customized according to the firm’s needs.

The new Engagement Letter template has been added. The content and print options have been added to the Client Letter tab of the Preparer Profiles and the Client letter Worksheet. To make these options applicable, select the box(es) corresponding to your needs.

Preparer Profiles

AUTHORIZATION FORMS tab

As a result of the removal of the mention RC59 from the program, the section relating to the representative authorization form is now called AUTHORIZATION – Representative Authorization Request. The Filing subsection is now entitled Electronic filing and the following two options have been added:

- Transmit for clients for whom you do not have the authorization or whose authorization is expired: when selected, the question Do you want to transmit an Authorization request for this business? will default to Yes in all client files in which the expiry date is passed or the answer to the statement The business already authorized you to access the Represent a Client service and your access is still valid is No in the Rolled forward data section;

- Do not transmit: when selected, the answer to the question Do you want to transmit an Authorization request for this business? will default to No in all client files.

EFILE tab

Because authorization and cancellation requests can only be electronically transmitted from the program, options Select Forms RC59 for electronic filing and Select Forms RC59X for electronic filing have been removed from the Canada Revenue Agency section. The answer to the question Do you want to transmit an Authorization request for this business? will now be determined based on which option is selected in the Electronic filing subsection of the AUTHORIZATION – Representative Authorization Request section of the AUTHORIZATION FORMS tab.

Federal

T106 Summary Form, Information Return of Non-Arm's Length Transactions with Non-Residents (T106SUM) and Form T106 Slip (T106)

CCH iFirm Tax now allows you to EFILE Form T106 (summary and slips) for preparers who have an EFILE preparer number (a Web Access Code (WAC) is not enough). For more details, consult the note relating to the transmission of Form T106 in the Technical Changes section.

A section was added to the T106 summary and slips so that they can be electronically transmitted. When a Form T106 should be filed for a corporation and you want to EFILE it, set the answer to the statement Select this form for electronic filing to Yes in the Electronic Filing section of the corporation’s T106 Summary Form. The program sets the answers to the questions Were all diagnostics related to Form T106S corrected in the Filing diagnostics tab?, Were all diagnostics with the “T106S” mention and relating to electronic filing corrected in the General diagnostic tab? and Form T106 applicable based on the information related to the corporation (for example, whether the corporation’s name, Business Number (BN) and address comply with the EFILE requirements) and data entered in Form T106.

To make sure that Form T106 is not mailed to the CRA after it is EFILED, a Duplicate watermark will be printed on the form after it is successfully EFILED.

In addition, to comply with EFILE requirements, in Form T106 Summary, the Type of return field was added, on screen only, to identify the type of return, i.e. New, Unmodified and Amended. Fields were also added to the T106 slip, on screen only, to identify the type of slip, i.e. New, Unmodified and Amended, and allow for the cancellation of a slip. These fields display when the answer to the statement Select this form for electronic filing is set to Yes. For more information, consult the Help.

T1134, Information Return Relating to Controlled and Not-Controlled Foreign Affiliates (T1134)

CCH iFirm Tax now allows you to EFILE Form T1134 for preparers who have an EFILE preparer number (a Web Access Code (WAC) is not enough). For more details, consult the note relating to the transmission of Form T1134 in the Technical Changes section.

A section was added to Form T1134 so that it can be EFILED. When a Form T1134 should be filed for a corporation and you want to EFILE it, set the answer to the statement Select this form for electronic filing to Yes in the Electronic Filing section of the corporation’s Form T1134. The program sets the answers to the questions Were all diagnostics related to Form T1134 corrected in the Filing diagnostic tab? and Were all diagnostics with the “T1134” mention and relating to electronic filing corrected in the General diagnostic tab? and Form T1134 applicable based on the information related to the corporation (for example, whether the corporation’s name, Business Number (BN) and address comply with the EFILE requirements) and data entered in Form T1134.

To make sure that Form T1134 is not mailed to the CRA after it is EFILED, a Duplicate watermark will be printed on the form after it is successfully EFILED.

In addition, to comply with EFILE requirements, in Form T1134 Summary, the Type of return field was added, on screen only, to identify the type of return, i.e. New, Unmodified and Amended. Fields were also added to Form T1134 Supplement, on screen only, to identify the type of supplement, i.e. New, Unmodified and Amended, and allow for the cancellation of a supplement. These fields display when the answer to the statement Select this form for electronic filing is set to Yes. For more information, consult the Help.

Deleted Forms

Federal

- Schedule 46, Part II - Tobacco Manufacturer's Surtax

Ontario

- Schedule 562, Ontario Sound Recording Tax Credit

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Schedule 200, T2 Corporation Income Tax Return*

In the Attachments section, line 272 relating to the applicability of Schedule 58 has been added and line 249 relating to the applicability of Schedule 46 has been removed.

In the Small business deduction (SBD) section, the fields used to calculate the SBD for days in the tax year before January 1, 2018, have been removed. As a result, lines 2 to 4 have been renumbered 1 to 3.

In addition, in accordance with subsection 227(14) ITA, which stipulates that Parts IV, IV.1, VI and VI.1 of the Income Tax Act do not apply to tax-exempt corporations, when either box 1, 2 or 4 is selected on line 085, If the corporations is exempt from tax under section 149, tick one of the following boxes, the amounts on the following lines are no longer calculated:

- line Q, Total Part IV tax payable from Schedule 3, in the Refundable dividend tax on hand (for tax years starting before 2019) section;

- in the Refundable dividend tax on hand (for tax years starting after 2018) section:

- line L, Part IV tax payable on taxable dividends from connected corporations (amount 2G from Schedule 3);

- line M, Part IV tax payable on eligible dividends from non-connected corporations (amount 2J from Schedule 3);

- line R, Part IV tax before deductions (amount 2A from Schedule 3); and

- line T, Part IV tax reduction due to Part IV.1 tax payable (amount 4D of Schedule 43).

- line 604, Refundable tax on CCPC's investment income, in the Part I tax section; and

- in the Summary of tax and credits section:

- line 716, Part IV.1 tax payable from Schedule 43;

- line 720, Part VI tax payable from Schedule 38; and

- line 724, Part VI.1 tax payable from Schedule 43.

Finally, in the Summary of tax and credits section, line 708 relating to the amount of Part II surtax payable from Schedule 46 has been removed.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, data entered on the removed lines will not be retained.

AUTHORIZATION, Representative Authorization Request

The mention RC59 has been removed from the program. As a result, the jump code for the form has been changed from RC59 to AUTHORIZATION.

In addition, the fields Do you want to complete an authorization request for the current year?, Do you have a valid authorization? and You had a valid authorization in the previous year in the Rolled forward data section have also been removed. Finally, the field Access to the CRA's Represent a Client service is enabled has been renamed This business already authorized you to access the Represent a Client service and your access is still valid.

The question Do you want to transmit an authorization request for this business? in the Electronic filing section will determine if the form is to be filed.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, data entered on the removed lines will not be retained.

Cancellation, Request to Cancel Authorization for a Representative

The mention RC59X has been removed from the program. As a result, the jump code for the form had changed from RC59X to CANCELLATION.

Schedule 1, Net Income (Loss) for Income Tax Purposes*

Schedule 2, Charitable Donations and Gifts*

Schedule 3, Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation*

Schedule 5, Tax Calculation Supplementary – Corporations*

Line 883, which relates to the British Columbia small business venture capital tax credit transferred on an amalgamation, has been added. In addition, the following lines have been removed from the schedule because the credits relating to these lines relate to taxation years starting before January 1, 2018:

- Line, 575, New Brunswick political contribution tax credit and line 894 Contribution;

- Line 464, Ontario sound recording tax credit (from Schedule 562);

- Line 603, Manitoba co-op education and apprenticeship tax credit (from Schedule 384);

- Line 612, Manitoba refundable cooperative development tax credit (from Schedule 390); and

- Line 630, Saskatchewan manufacturing and processing investment tax credit (from Schedule 402).

Furthermore, line 472, Ontario Regional Opportunities Investment Tax Credit, has been added under line 470. It allows you to enter the Ontario regional opportunities investment tax credit for the corporation.

Schedule 6, Summary of Dispositions of Capital Property*

Schedule 8 WORKCHART, Capital Cost Allowance (CCA) Workchart

The new CCA class 56 has been added for properties acquired after March 1, 2020, and available for use before 2028, that are zero-emission automotive equipment and vehicles that currently do not benefit from the accelerated rate provided by classes 54 and 55. As for these two CCA classes, class 56 benefits from a temporary enhanced first-year CCA rate of 100% for eligible property available for use before 2024.

For classes 50 and 53, following the adoption of Bill 42 by the National Assembly of Québec on September 24, 2020, the line Capital cost of qualified property acquired in the current taxation year before July 1, 2019 in the Additional CCA of 60% - Qualified property that was acquired after November 20, 2018, and before December 4, 2018 section has been replaced by the following four custom lines:

- Capital cost of qualified properties acquired in the current taxation year before December 4, 2018, that are not AIIP;

- Capital cost of qualified properties acquired in the current taxation year before December 4, 2018, that are AIIP;

- Capital cost of qualified properties acquired in the current taxation year after December 3, 2018, and before July 1, 2019, that are not AIIP; and

- Capital cost of qualified properties acquired in the current taxation year after December 3, 2018, and before July 1, 2019, that are AIIP.

These four lines are used to calculate the amount on the line Amount added to the UCC attributable to qualified property, which replaces the line Half of the capital cost of qualified property that became available for use in the current taxation year in the calculation of the amount on line E.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, the four lines can contain amounts in the following situations:

- When Schedule 8 WORKCHART ADD is used, the four new lines can contain an amount when the amount entered on the line Capital cost of qualified property acquired in the current taxation year before July 1, 2019 is equal to the total of the amounts on the line Adjusted capital cost – Québec for each copy of the form concerning properties acquired in the taxation year after November 20, 2018, and before July 1, 2019, that are identified as not being eligible for the 30% additional CCA. The amount on each line will correspond to the total of the adjusted capital cost amounts in each copy of the workchart corresponding to the attributes mentioned in the description of the lines.

- When Schedule 8 WORKCHART ADD is not used and the amount on the line Additions (property subject to subsection 1100(2) ITR) in the Québec column is equal to the amount entered on the line Capital cost of qualified property acquired in the current taxation year before July 1, 2019, the amounts on the lines Capital cost of qualified properties acquired in the current taxation year after December 3, 2018, and before July 1, 2019, that are not AIIP and Capital cost of qualified properties acquired in the current taxation year after December 3, 2018, and before July 1, 2019, that are AIIP will be calculated when the tax year start is after December 3, 2018.

- In other cases, the amount on the line Capital cost of qualified property acquired in the current taxation year before July 1, 2019 will be retained, depending on the tax year start, on one of lines Capital cost of qualified properties acquired in the current taxation year before December 4, 2018, that are not AIIP or Capital cost of qualified properties acquired in the current taxation year after December 3, 2018, and before July 1, 2019, that are not AIIP. A diagnostic will prompt you to allocate this amount between the four lines.

- In addition, where the amounts on the four lines can be determined and the amount on the line Half of the capital cost of qualified property that became available for use in the current taxation year is not an overridden amount, the amount on the line Amount added to the UCC attributable to qualified property will be recalculated and will be equal to the total of the amounts determined on each line multiplied by the applicable adjustment factor.

When rolling forward a client file, the amount rolled forward to the line UCC of qualified property (giving rise to the additional CCA of 60%) that became available for use in the preceding taxation year will be equal to the difference between the total of the amounts on the four new lines and the result of the CCA claimed multiplied by the ratio between the amount on the line Amount added to the UCC attributable to qualified property and the amount on the line UCC in the class before CCA.

In all cases, verify that the amount updated to the new lines or rolled forward to the lines UCC of qualified property (giving rise to the additional CCA of 60%) that became available for use in the preceding taxation year and Amount of line E from the first year are accurate.

Schedule 21, Federal and Provincial or Territorial Foreign Income Tax Credits and Federal Logging Tax Credit*

The lines Additional deduction for credit unions (line 628) in Parts 7 and 8 were removed from the schedule. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount was entered on these lines it will not be retained.

Schedule 23, Agreement Among Associated Canadian-Controlled Private Corporations to Allocate the Business Limit

The calculation of custom field Percentage required to maximize the SBD now takes into consideration the amount of passive investment income from line 417 of Schedule 200 when this percentage is calculated for taxation years starting after 2018.

Schedule 25, Investment in Foreign Affiliates*

Schedule 27, Calculation of Canadian Manufacturing and Processing Profits Deduction*

Schedule 31, Investment Tax Credit - Corporations*

In Part 1, many specified percentage fields were removed because they related to expenditures incurred before 2016.

In Part 4, custom column Type of investment as well as Note 1 were removed because specifying the type of investment is no longer required because mining property must be acquired before 2017.

In Part 5, the field of line Qualified resource property acquired after December 31, 2013, and before January 1, 2016 (applicable part from amount A1 in Part 4) is now an input field, as it is no longer possible to have qualified mining property acquired before January 1, 2016 for a tax return supported by this version.

Line 360 in Part 8 was removed because capital expenditures have not been qualifying capital expenditures since January 1, 2014.

Part 10 was also modified because, for taxation years ending after March 18, 2019, the taxable income is no longer taken into account in calculating the SR&ED expenditure limit.

In Part 11, the lines relating to current and capital expenditures for a taxation prior to 2014 were removed.

Parts 18 and 20 as well as lines 870, 872, 874, 876, 880, q and H4 of Part 19, were removed as they related to pre-production mining expenditures incurred before 2016. As a result, Parts 19 and 21 to 30 were renumbered Parts 18 to 28.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount was entered on one of the removed lines or in the field of line Qualified resource property acquired after December 31, 2013, and before January 1, 2016 (applicable part from amount A1 in Part 4) of Part 5, it will not be retained.

A calculation has been added on line 103 of Part 3 by the CRA. Prior to the latest update, 80% of the contributions to agricultural organizations for SR&ED had to be entered in Part 8. However, as per a request by the CRA, 100% of the contributions to agricultural organizations for SR&ED must now be entered in Part 8. This amount will then be multiplied by 80% and the result of this calculation will be entered on line 103. In addition to 100% of the contributions to agricultural organizations for SR&ED, 100% of the government assistance, non-government assistance and contract payments related to these contributions must now be entered in Part 8. When opening a return prepared with a prior version of CCH ifirm Cantax T2, make any required adjustments to the amounts entered in order for the amount on line 103 to be calculated correctly.

Schedule 49, Agreement Among Associated Canadian-Controlled Private Corporations to Allocate the Expenditure Limit*

Schedule 50, Shareholder Information*

A new column 200 has been added on screen only to indicate the account number for a partnership. If a partnership shareholder does not have a partnership account number, indicate “NR” (not registered) to indicate that the partnership is not registered.

Note that when printing, only one column 200 will display the business number or the partnership account number, as applicable.

Schedule 53, General Rate Income Pool (GRIP) Calculation*

Schedule 54, Low Rate Income Pool (LRIP) Calculation*

Schedule 55, Part III.1 Tax on Excessive Eligible Dividend Designations*

Schedule 71, Income Inclusion for Corporations that are Members of Single-Tier Partnerships*

The following parts as well as all custom subsections that were used to enter or calculate the amounts relating to each type of income were removed:

- Part 2, Eligible alignment income;

- Part 5, Qualifying transitional income (QTI);

- Part 6, Adjusted amount of qualifying transitional income;

- Part 7, Transitional reserve.

The remaining parts and lines were renumbered accordingly.

As a result, when opening a return prepared with a prior version of CCH ifirm Cantax T2, if amounts were entered in the removed parts or custom subsections, they will not be retained.

Schedule 72, Income Inclusion for Corporations that are Members of Multi-Tier Partnerships*

The following parts and custom subsections that were used to enter or calculate the amounts relating to each type of income were removed:

- Part 2, Eligible alignment income;

- Part 5, Qualifying transitional income (QTI);

- Part 6, Adjusted amount of qualifying transitional income;

- Part 7, Transitional reserve.

In addition, in Part 3, only the former third subsection starting with the following sentence is retained: Complete this section if subparagraphs (b)(i) and (b)(ii) of the definition of “adjusted stub period accrual” in subsection 34.2(1) do not apply [paragraph (a) of the definition of “adjusted stub period accrual” in subsection 34.2(1)].

The remaining parts and lines were renumbered accordingly.

As a result, when opening a return prepared with a prior version of CCH ifirm Cantax T2, if amounts were entered in the removed parts or custom subsections, they will not be retained. If the amount on line T in Part 3 is entered using an override, the amount will be retained as an overridden value on line 2I.

Schedule 73, Income Inclusion Summary for Corporations that are Members of Partnerships*

The following columns were removed from the table in Part 2:

- column 8, Eligible alignment income;

- column 9, Qualifying transitional income (QTI);

- column 10, Adjusted amount of QTI;

- column 11, Current-year transitional reserve;

- column 12, Previous-year transitional reserve.

Column 13 in Part 2 as well as columns 14 and 15 in Part 3 were renumbered.

As a result, when opening a return prepared with a prior version of CCH ifirm Cantax T2, none of the amounts entered in one of the removed columns will be retained.

Schedule 88, Internet Business Activities*

Schedule 89, Request for Capital Dividend Account Balance Verification*

Following the update of the schedule, Part 1, CDA components (except for eligible capital property), is now Part 2 as Part 1, Identification, has been added to the form. As a result, all parts of the form have been renumbered.

In addition, column 2, Amount S from Schedule 10, which was under Section B: CDA components – List of ECP dispositions in former Part 2, has been removed. In new Part 3, the columns Cost of eligible capital property acquired and Proceeds of sale (less outlays and expenses not otherwise deductible) from the disposition of all eligible capital property have been added under Section B: CDA components – List of ECP dispositions. Furthermore, the field of column 4, Non-taxable portion of ECP sales, is now an input field. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount was calculated or overridden in this field, it will be retained.

Schedule 125, Income Statement Information*

T183, Information Return for Corporations Filing Electronically*

T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim*

The following lines, which relate to capital expenditures, were removed from the form, because they refer to a taxation year ended before 2014:

- 350, 355, 390 and 400 in Section B of Part 3; and

- 496, 504, 510, 512, 514b, 514b1, 514b2, 514c, 514d, 514e, 514, 516, 518, 532, 535, 540, 543, 546 and 558 in Part 4.

In part 4, line 528 has been renamed 80% of the amounts paid in respect of an SR&ED contract to a person or partnership that is not a taxable supplier. In addition, line 557 was replaced by line 559.

The rate used to calculate the prescribed proxy amount (PPA) is 55% for a taxation year started after 2013. In that respect, the calculations for obsolete periods in Section B of Part 5 were removed.

In the table in Part 6, column 758, Overhead and other expenditures in the tax year (total of line 360, if applicable), has been added. The fields in this column must be completed if the traditional method is used and the information is mandatory for a taxation year end after 2020 and optional for a taxation year end before 2021. To generate data in this column, data must be entered on line 758 of Form T661 Part 2 for the project involved. Note that the amount on this line will affect the total project cost.

The year’s maximum pensionable earnings amount for purposes of the Canada pension plan has been updated for the 2021 calendar year (and is now $61,600). This amount is used to determine the specified employees’ salary or wages in Part 5 when the proxy method is selected to calculate the SR&ED expenditures.

T661 Part 2, Project Information*

Following the addition of column 758 in Form T661, line 758, Overhead and other expenditures (Portion of the amount on line 360) was added under line 756. Note that the amount on this line will affect the total project cost.

T1044, Non-Profit Organization (NPO) Information Return*

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates*

A new version of Form T1134 for taxation years starting after 2020 has been integrated into the program and only displays when the taxation year covered by the return starts after 2020. For taxation years starting prior to 2021, the previous version of the form must be used.

The new version of the form provides the ability, for a group of reporting entities that are related to each other, to file as a group. The information related to individuals, corporations, trusts and partnerships that are part of this related group must be indicated in new subsections A and B in Section 3 of Part I. Note that the taxation year-end or fiscal year-end date must be the same for all entities in the group. In addition, if an election to use functional currency was made, individuals and trusts cannot be part of the group.

The requirements for new subsection C in Section 3 of Part I (which corresponds to former Section 3 of Part I) can now be met by submitting a group organizational chart that includes the information requested in this subsection. When opening a return prepared with a prior version of CCH ifirm Cantax T2 in which the taxation year starts after 2020 or when rolling forward a client file in which the taxation year after roll forward is the first year starting after 2020, if data was entered in the tables of former Section 3 of Part I, the answer to the question Is the reporting entity submitting a group organizational chart for the required information noted in C. (i) through (iv)? located at the beginning of subsection C in Section 3 of Part I will be No.

Several tables have been added to the form to allow for the filing of the return by a group of related entities. Therefore, entities in the group that are indicated in subsection A of Section 3 in Part I will be used to form a list from which you will be able to select the relevant entities for the tables in Form T1134 Supplement. The layout of the form has also been revised and a lot of information that was already requested in the previous version of the form has been incorporated into the new tables. When opening a return prepared with a prior version of CCH ifirm Cantax T2 in which the taxation year starts after 2020 or when rolling forward a client file in which the taxation year after roll forward is the first year starting after 2020, data entered in the previous version of the form will be retained in the corresponding fields of the new version of the form, when applicable. We strongly suggest that you carefully review the information retained in this situation to ensure it is correct.

Finally, When opening a return prepared with a prior version of CCH ifirm Cantax T2 in which the taxation year covered by the return starts after 2020:

- The amounts that were entered in the table in Section 2 of Part III will be rounded to the nearest thousand, then retained on the corresponding line in the column Total gross revenues (all sources) in the table of Section 2 in Part III. Currency codes will also be retained on the corresponding lines. More specifically, the amounts on line (i) and in field Interest – Other will be added, then retained on line (i) only if the currency is the same for these two amounts. Similarly, the amounts on line (ii) and in field Dividends – Other will be added, then retained on line (ii) only if the currency is the same for both amounts;

- If an amount was entered on one of lines (i) to (vi) in Section 3 of Part III, it will be retained on the corresponding line among lines (a) to (f) in table (iv) of Section 3 in Part III, in column FAPI if it is positive or in column FAPL as an absolute value if it is negative;

- If an amount was entered on line (vii) in Section 3 of Part III, it will be retained in the field shares of table (iv) in Section 3 of Part III, in column FAPI if it is positive or in column FACL as an absolute value if it is negative. Verify if this amount should be retained in the field other than shares of the same table instead;

- If a positive amount was entered line (viii) in Section 3 of Part III, it will be retained on line (i) in table (iv) of Section 3 of Part III. If a negative amount was entered on line (viii) in Section 3 of Part III, it will not be retained.

T1135, Foreign Income Verification Statement*

T1145 (Schedule 61), Agreement to Allocate Assistance for SR&ED Between Persons Not Dealing at Arm's Length*

Lines 015, Current expenditures, and 020, Capital expenditures, have been removed from the form. However, the allocated amount of assistance for SR&ED must be entered on line 010, The transferor and the transferee identified below hereby agree to allocate this amount of assistance for SR&ED to the transferee. When the corporation is the transferee, the amount from line 010 is transferred to line 538 of Form T661. When opening a return prepared with a prior version of CCH ifirm Cantax T2, the amount entered on line 010 will be retained as an input amount.

T1146 (Schedule 62), Agreement to Transfer Qualified Expenditures Incurred in Respect of SR&ED Contracts Between Persons Not Dealing at Arm’s Length*

Lines 015, Current expenditures and 020, Capital expenditures have been removed from the form. However, there no longer is an allocation of the amount on 010, The transferor and the transferee identified below hereby agree to transfer the amount of SR&ED qualified expenditures to the transferee to lines 015 and 020. When the corporation is the transferor, the amount on line 010 is transferred to line 544 of Form T661 and, when the corporation is the transferee, on line 508.

T2054, Election for a Capital Dividend Under Subsection 82(2)*

The field related to the tax services office has been removed from Part 1. In addition, a field for the telephone extension number has been added to this part. If the contact person is the same person as the authorized signing officer, the extension number will be updated from the authorized signing officer information entered in Form Identification. If this is not the case, enter the extension number in the new field.

AgriStability and AgriInvest Programs – Ontario*

AgriStability and AgriInvest Programs – Harmonized Provinces* and British Columbia*

The line Trust business number has been added to the Participant identification section.

AgriStability and AgriInvest – Programs – Alberta*

AgriStability and AgriInvest – Programs – Saskatchewan*

AgriStability and AgriInvest Additional Information and Adjustment Request*

Instalments, Federal Tax Instalments

As a result of the announcement by the CRA that the payment date of September 30, 2020, applies to instalments under other Parts of the Act as well as to instalments under Part I, all the amounts in sections and lines that referred specifically to Part I tax and Parts VI, VI.1 and XIII.1 tax in Sections 1 – 1st Instalment base method, 2 – Combined 1st and 2nd instalment base method and 3 – Estimated tax method, that were calculated when the answer to the question Do you want to calculate the instalments according to the extended payment date (COVID-19)? is Yes, have been removed. In addition, lines L1 to N2 in the Instalment base calculation according to the Parts of the Act subsection of the Instalment base calculation section have also been removed.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if the answer to the question Do you want to calculate the instalments according to the extended payment date (COVID-19)? is Yes and an amount is overridden on one of the removed lines relating to Parts VI, VI.1 and XIII.1 tax in Sections 1 – 1st Instalment base method, 2 – Combined 1st and 2nd instalment base method and 3 – Estimated tax method, this amount is added to the amount on the line relating to Part I tax and the result is retained, as an overridden value, on the line bearing the same general description. For example, if the amount on line 1st Instalment base amount – Parts VI, VI.1 and XIII.1 tax is overridden, this amount is added to the amount on line 1st Instalment base amount – Part I tax and the result is retained, as an overridden value, on line 1st Instalment base amount.

Furthermore, in the Instalment base calculation section, if one of the amounts on lines L1 to N2 is overridden, the total of the amounts on lines N1 and N2 will be retained on line N in the corresponding column.

INTEREST, Interest and Late-filing Penalty

As a result of the announcement by the federal government that the extended balance-due day of September 30, 2020, applies to the balance of tax payable under other Parts of the Act as well as to tax payable under Part I, in the Federal section, the question Do you want to calculate the interest on the balance unpaid for Part I tax and provincial and territorial tax separately from the tax on other Parts of the Act (COVID-19)? as well as all the fields that could be calculated when the answer to this question is Yes have been removed. The targeted fields are:

- The fields in subsections Part I tax and provincial and territorial tax and Tax from other Parts of the Act;

- The fields in the Calculation of interest on balance unpaid – Part I tax and provincial and territorial tax (COVID-19) and Calculation of interest on balance unpaid – Tax from other Parts of the Act (COVID-19) subsections of the Interest section; and

- The fields Payment made after – and on or before, Interest on balance unpaid – Part I tax and provincial and territorial tax (COVID-19) and Interest on balance unpaid – Tax from other Parts of the Act in the Total amount owed subsection.

The field Unpaid tax balance has been added in the Dates subsection.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, when the answer to the question Do you want to calculate the interest on the balance unpaid for Part I tax and provincial and territorial tax separately from the tax on other Parts of the Act (COVID-19)? is Yes, the following calculations are performed:

- If an amount is entered in one of fields Balance payable according to the T2 return – Part I tax and provincial and territorial tax or Balance payable according to the T2 return – Tax from other Parts of the Act, using an override, the total of the amounts entered in both fields will be retained as an overridden value in the new field Unpaid tax balance.

- If an amount is entered in the field Payment made after – and on or before, the total of the amounts entered in that field and the field Payment made on or before will be retained in the latter.

Data entered in the other removed fields will not be retained.

In addition, the CRA announced that it would waive interest on existing tax debts for the 2nd and 3rd quarters of 2020 (from April 1, 2020, to September 30, 2020). In the Rates subsection of the Federal section, when one of the quarters starts on April 1, 2020, or July 1,2020, the corresponding interest rate will be calculated to 0%.

Client Letter, Client Letter Worksheet

As a result of the announcement by the CRA that the extended balance-due day of September 30, 2020, applies to the balance of tax payable under other Parts of the Act as well as to tax payable under Part I, the fields in the COVID-19 – Balances-due dates (extended) subsection have been removed. As a replacement, the question Do you want to use the extended balance-due day (COVID-19)? and the field Extended balance-due day have been added.

When the answer to this question is Yes, the date in the field Extended balance-due day is used in the Client Letter, Filing Instructions as well as in Form Interest and Late-filing Penalty.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if data had been entered in the removed fields, it will not be retained.

Ontario

Schedule 500, Ontario Corporation Tax Calculation*

In Part 2, the line that related to the calculation of the Ontario small business deduction rate for the period before January 1, 2018, (former line 2N.1) was removed.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if a rate was entered on this line, it will not be retained.

As a result of the update of the schedule, several lines have been renumbered, in particular custom lines 2N.2, 2N.3, which have been renumbered 2M and 2N in Part 2. These new lines allow for the Ontario small business deduction to be calculated based on the number of days in the tax year before January 1, 2020, and the number of days in the tax year after December 31, 2019. Previously, lines 2N.2 and 2N.3 were used to calculate the small business deduction rate, which means that the calculation of this deduction has been condensed. Therefore, line 2N.4, which was used to add the rates from lines 2N.1 to 2N.3, has been removed as it was no longer useful. When opening a return prepared with a prior version of CCH ifirm Cantax T2, the values that were indicated on former lines 2N.1, 2N.2, 2N.3 and 2N.4 will not be retained.

In addition, following the modifications in Part 2, lines 4D and 4E have been added to Part 4 to allow for the Ontario credit union tax reduction to be calculated based on the number of days in the tax year before January 1, 2020, and the number of days in the tax year after December 31, 2019.

Schedule 502, Ontario Tax Credit for Manufacturing and Processing*

As a result of the update of the schedule, several lines have been renumbered. The amount on the new line 1C is now calculated according to provisions of the federal legislation. Verify if an adjustment should be made according to provisions of the Ontario legislation and override if required. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount had been entered in former field Notional resource allowance for the year (amount from line 105 of Schedule 504), it will be retained as an overridden amount on the new line 1C.

In addition, former line c in Part 2, which allowed for the calculation of the tax credit for the period before July 1, 2011, has been removed from the schedule because it was obsolete. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount had been entered using an override on former line H, it will be retained as an overridden amount on the new line 2N.

Finally, Part 5 has been added to the schedule to allow for the calculation of the adjusted Crown royalties for the tax year, which is calculated on line 5H and is updated to line 1A. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount had been entered in former field Adjusted Crown royalties for the year (amount from line 100 of Schedule 504, Ontario Resource Tax Credit), it will be retained as an overridden amount on the new line 1A.

Schedule 504, Ontario Resource Tax Credit*

Schedule 508, Ontario Research and Development Tax Credit

Following the removals related to capital expenditures in Form T661, on screen custom lines Current expenditures and Capital expenditures of lines 110 and 115 have been removed. In addition, the column Capital Expenditures has been removed from the Schedule A section. For more details, consult the note on Form T661.

Schedule 566, Ontario Innovation Tax Credit

Following the removals related to capital expenditures in Form T661, custom columns Current Expenditures and Capital Expenditures in Part 7 have been removed. In addition, the column Capital Expenditures has been removed from the Schedule A section. For more details, consult the note on Form T661.

Québec

Addition of new Québec forms in a future version 2.1 2020

We expect to add the following four new Revenu Québec forms in a future version 2.1 2020:

- CO-1029.8.36.II, Tax Credit for Investment and Innovation;

- CO-1029.8.36.IK, Cumulative Limit Allocation Agreement for the Tax Credit for Investment and Innovation;

- CO-1029.8.36.PS, Tax Credit to Support Print Media Companies; and

- CO-1029.8.33.CS, Tax Credit for SMBs that Employ Persons with a Severely Limited Capacity for Employment.

If you need to file these forms with a tax return and you can wait until the end of February 2021, we suggest that you wait for version 2.1 2020, which should be available for download at that time.

CO-17, Corporation Income Tax Return*

The question on line 19b, Did the corporation receive or dispose of (sell, transfer, exchange, gift, etc.) virtual currency? has been added to Part 2. In addition, the question on former line 26, Is the corporation a general partner, or a party to either a contract of mandate or a contract of prête-nom? and the line Where applicable, state the object of the contract of prête-nom have been removed.

Note that the following special tax codes can now be selected on lines 425ai and 425bi:

- 100, Deduction relating to the commercialization of innovations in Québec; and

- 101, Deduction relating to the Ssynergy capital tax credit.

The registration fees on line 441b will be indexed on January 1, 2021. The amount for cooperatives will increase from $42 to $43, the amount for non-profit legal persons (incorporated association), a syndicate of co-ownership and fraternal benefit societies, will remain at $36, and the amount for corporations, mutual insurance corporations and other entities, will increase from $92 to $93.

QC L265-266, Deductions from Taxable Income

The following code has been added to the form:

- 18, Deduction relating to the commercialization of innovations in Québec.

QC L421B-421F, Deduction in the Tax Calculation

The following codes have been added to the form:

- 312, Deduction relating to the synergy capital tax credit – current year

- 313, Deduction relating to the synergy capital tax credit – previous year

- 314, Deduction relating to the synergy capital tax credit – subsequent year

CO-17.B.1, Amount to Be Included in the Income of a Corporation That Is a Member of Single-Tier Partnership

Following the update of federal Schedule 71, when opening a return prepared with a prior version of CCH ifirm Cantax T2, the amounts in Parts 3, 6, 7 and 8, calculated from the corresponding lines in the removed parts in Schedule 71, will be retained as input amounts.

CO-17.B.2, Amount to Be Included in the Income of a Corporation That Is a Member of Multi-Tier Partnership

Following the update of federal Schedule 72, when opening a return prepared with a prior version of CCH ifirm Cantax T2, the amounts in Parts 3, 6, 7 and 8, calculated from the corresponding lines in the removed parts in Schedule 72, will be retained as input amounts.

CO-17.R, Request for an Adjustment to a Corporation Income Tax Return or to an Information and Income Tax Return for Non-Profit Corporations*

CO-771, Calculation of the Income Tax of a Corporation*

Line 05a in Part 1, Information about the corporation as well as lines 180 to 186 in Section 11.1, Proportion of manufacturing and processing activities (taxation year beginning before January 1, 2017) can no longer be accessed as they relate to taxation years starting before January 1, 2018.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if the box on line 05a had been selected and amounts had been entered on lines 180 to 186, the values on these lines will not be retained.

CO-1029.8.33.13, Tax Credit for the Reporting of Tips*

This form has been updated in order to integrate the various applicable rates for 2021.

CO-1029.8.36.DA, Tax Credit for the Development of E-Business*

Parts 2 and 3 have been modified to reflect the calculation as per the “qualified salary or wages” definition of section 1029.8.36.0.3.79 of the Taxation Act.

For each employee with regard to whom the corporation is claiming the tax credit, a separate copy of Form CO-1029.8.36.DA PARTS 2 and 3 must be completed. To complete Part 2 and, if required, Part 3 for each eligible employee, access Form CO-1029.8.36.DA PARTS 2 and 3 from Part 2-3, Qualified salary or wages and percentage of the qualified salary or wages that may give rise to more than one tax credit.

In addition, check box 11 has been added to section 2.1, Identification of the employee, to determine whether the salary or wages incurred for the employee is subject to more than one tax credit.

In subsection 2.2.1, line 21e has been added and replaces line 21a and line 21c has been added to enter the percentage of qualified salary or wages that may give rise to more than one tax credit calculated in Part 3.

Lines 33a and 33b have been added to subsection 2.2.2 to apply the percentage of qualified salary or wages that may give rise to more than one tax credit.

Field 38c has been removed from Part 3 and field 40 is now used to calculate the percentage of qualified salary or wages instead of the reduced qualified salary or wages.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, for each eligible employee listed in Part 2, a separate copy of Form CO-1029.8.36.DA PARTS 2 and 3 will be created. In addition, if an amount had been entered on line 36 and/or 37, check box 11 will be selected. In addition, if no amount had been entered on lines 36 and/or 37, the amount entered on line 21a will be retained on line 21e. Otherwise, recalculate the portion of the amount on line 21d that is attributable to eligible work carried out by the employee and whose ultimate beneficiary is a government entity and enter this amount on line 21e. Finally, if an amount had been overridden on line 40, it will not be retained.

CO-1029.8.36.ES, Tax Credit for the Production of Sound Recordings*

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an answer to the question Was the application for an advance ruling, or the application for a qualification certificate if no application for an advance ruling was previously files, filed with the SODEC after March 10, 2020? was provided n the Information about the qualified property section, the answer will be moved between boxes 12c and 12d, as the case may be.

CO-1029.8.36.IN, Tax Credit for Investment*

The option to calculate the tax credit for eligible expenditures incurred before January 1, 2017, in the Identification section has been removed. When opening a return prepared with a prior version of CCH ifirm Cantax T2, the data for this option will not be retained.

In addition, Section 2.2 has been added to identify property for which an election has been made to consider such property as qualified property for the application of the tax credit for investment instead of specified property for the application of the new tax credit for investments and innovation. When an election is made, this section must be signed. Note that it can be signed electronically.

CO-1159.2, Compensation Tax for Financial Institutions*

Box 06A is now box 06a and still allows you to indicate whether the corporation is an independent loan corporation, an independent trust corporation or an independent corporation trading in securities. However, this box no longer needs to be selected at the same time as box 06. Only one of boxes 06 and 06a must be selected. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if both boxes 06 and 06A were selected, only box 06a will remain selected.

RD-1029.7, Tax Credit for Salaries and Wages (R&D)*

RD-1029.8.6, Tax Credit for University Research or Research Carried Out by a Public Research Centre or a Research Consortium*

When the answer to the custom question Does the taxation year of the corporation that incurred qualified expenditures or the fiscal period of the qualified partnership that incurred qualified expenditures start after March 10, 2020, and was the research and development work carried out after that date? is Yes, no data will be updated to the lines in Sections 4.1, Exclusion threshold and 4.2, Amount of reducible expenditures.

RD-1029.8.9.03, Tax Credit for Fees and Dues Paid to a Research Consortium*

When the answer to the custom question Does the taxation year of the corporation that incurred qualified expenditures or the fiscal period of the qualified partnership that incurred qualified expenditures start after March 10, 2020, and was the research and development work carried out after that date? is Yes, no data will be updated to the lines in Sections 6.1, Exclusion threshold and 6.2, Amount of reducible expenditures.

RD-1029.8.16.1, Tax Credit for Private Partnership Pre-Competitive Research*

When the answer to the custom question Does the taxation year of the corporation that incurred qualified expenditures or the fiscal period of the qualified partnership that incurred qualified expenditures start after March 10, 2020, and was the research and development work carried out after that date? is Yes, no data will be updated to the lines in Sections 4.1, Exclusion threshold and 4.2, Amount of reducible expenditures.

TP-1029.9, Tax Credit for Taxi Drivers or Taxi Owners*

On November 6, 2020, the Government of Québec announced in Information Bulletin 2020-12, that the tax credit for taxi owners will be eliminated for a taxation year or a fiscal period that starts after October 9, 2020. In that situation, no credit will be calculated in Section 3.4.

To claim the tax credit for taxi owners for a taxation year or fiscal period that starts after December 31, 2019, the taxation year or fiscal period must include October 9, 2020, and the income entered on lines 56, 57 and 58 must be attributable to the portion of the taxation year or fiscal period that precedes October 10, 2020.

British Columbia

Schedule 421, British Columbia Mining Exploration Tax Credit*

Schedule 425 (T666), British Columbia Scientific Research and Experimental Development Tax Credit

Following the removals related to capital expenditures in Form T661, the column Capital (before 2014) in the Schedule A section has been removed. For more details, consult the note on Form T661.

Schedule 427, British Columbia Corporation Tax Calculation*

In Part 2, line 2A.1 relating to the lower tax rate for the period prior to April 1, 2017, and line 2B.1 relating to the higher tax rate for the period prior to January 1, 2018, were removed. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount was entered on one of those lines, it will not be retained.

Schedule 428, British Columbia Training Tax Credit*

Schedule 430, British Columbia Shipbuilding and Ship Repair Industry Tax Credit*

Columns E1 and F1 in section 1 and columns E4 and F4 in section 3, that were related to the British Columbia Training Tax Credit, have been removed. As a result, columns G1 and G4 have been renamed E1 and E4, respectively.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount had been entered or overridden in columns E1, F1, E4 and F4, the amount will not be retained.

Alberta

AT1, Alberta Corporate Income Tax Return*

AT1 Schedule 1, Alberta Small Business Deduction*

AT1 Schedule 9, Alberta Scientific Research & Experimental Development (SR&ED) Tax Credit

Following the removals related to capital expenditures in Form T661, the lines Portion of Alberta capital expenditures included in the amount of line 031 in the Eligible Expenditures for Alberta Purposes section, Current expenditures and Capital expenditures in the Maximum Expenditure Limit section and Capital expenditures in the Alberta SR&ED Tax Credit section have been removed. For more details, consult the note on Form T661.

AT100, Preparing and Filing the Alberta Corporate Income Tax Return*

Saskatchewan

Schedule 402, Saskatchewan Manufacturing and Processing Investment Tax Credit*

Former Parts 2, Calculation of the non-refundable credit available for the year and available for carryforward, 4, Analysis of credit available for carryforward by year of origin and Summary and analysis of credit have been removed from the schedule as non-refundable unused credits can no longer be carry-forward.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, or rolling forward a client file, if any amount was entered on the removed lines, it will not be retained.

Schedule 404, Saskatchewan Manufacturing and Processing Profits Tax Reduction*

In Part 1, the section for the period before January 1, 2018, as well as the lines used to calculate the income eligible for the Saskatchewan manufacturing and processing profits tax reduction according to the number of days before 2018 and after 2017 were removed.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if amount W was entered using an override, it will be updated to amount J and retained as an overridden value. However, if any amounts were entered on the other removed lines, they will not be retained.

Schedule 411, Saskatchewan Corporation Tax Calculation*

The sections in respect of the calculations of the income subject to tax in Part 1 and of the Saskatchewan tax for the period before January 1, 2018 have been removed.

Manitoba

Schedule 380, Manitoba Research and Development Tax Credit*

Lines for eligible expenditures incurred in the current tax year before April 12, 2017, and related to credit lines, have been removed from the schedule, i.e., lines 106, 108 and 116 in Section 1, line 121 in Section 2 and lines 205 and 215 in Section 5. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if data was entered on the removed lines, it will not be retained.

Schedule 381, Manitoba Manufacturing Investment Tax Credit*

Lines 108, 120 and 145 relating to qualified property acquired before April 12, 2017, were removed. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount was entered on one of those lines, it will not be retained.

Schedule 383, Manitoba Corporation Tax Calculation*

Schedule 384, Manitoba Paid Work Experience Tax Credit*

Schedule 387, Manitoba Small Business Venture Capital Tax Credit*

Schedule 389, Manitoba Book Publishing Tax Credit*

Northwest Territories

Schedule 461, Northwest Territories Corporation Tax Calculation

As a result of the tabling of Bill 16 on October 30, 2020, which announced a decrease in the lower tax rate to 2% on January 1, 2021, line 2A in Part 2 has been split into two lines to calculate the tax at the lower rate, i.e., one for the number of days in the tax year before January 1, 2021, and one for the number of days after December 31, 2020.

Yukon

Schedule 440, Yukon Manufacturing and Processing Profits Tax Credit*

The lines relating to the number of days in the taxation year before July 1, 2017, have been removed from the schedule. In addition, the small business increment calculation has been modified to reflect the decrease in the increment from 0.5% to 0% as of January 1, 2021.

Schedule 442, Yukon Research and Development Tax Credit*

Schedule 443, Yukon Corporation Tax Calculation*

In Part 2, the lines that related to the calculation of the Yukon tax at the lower rate as well as the tax at the higher rate for the period before July 1, 2017 (former lines H and K) were removed. Note that the lines Total Yukon tax at the lower rate (former line J) and Total Yukon tax at the higher rate (former line M) were also removed.

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount was entered on one of those lines, it will not be retained.

In addition, the 2% tax rate on the income of small businesses will be eliminated as of January 1, 2021.

Newfoundland and Labrador

Schedule 307, Newfoundland and Labrador Corporation Tax Calculation*

In Part 2, the line that related to the calculation of the tax at the higher rate for Newfoundland and Labrador and its offshore area for the period before January 1, 2016, (former line 1) was removed as well as the line Tax at the higher rate for Newfoundland and Labrador and its offshore area (former line I).

When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount was entered on one of these lines, it will not be retained.

Nova Scotia

Schedule 341, Nova Scotia Corporate Tax Reduction for New Small Businesses*

Following the 2020 Nova Scotia Budget, tabled on February 25, 2020, a line has been added to take into account the lower corporate income tax rate, which was decreased from 3% to 2.5% on April 1, 2020.

Schedule 346, Nova Scotia Corporation Tax Calculation*

Following the 2020 Nova Scotia Budget, which was tabled on February 25, 2020, lines were added to Part 2 to take the following new measures into account:

- the reduction in the lower tax rate, which was decreased from 3% to 2.5% on April 1, 2020;

- the reduction in the higher tax rate, which was decreased from 16% to 14% on April 1, 2020.

Schedule 348, Additional Certificate Numbers for the Nova Scotia Digital Animation Tax Credit*

Prince Edward Island

Schedule 322, Prince Edward Island Corporation Tax Calculation*

In Part 2, line 2A.1 relating to the lower tax rate for the period prior to January 1, 2018, was removed. When opening a return prepared with a prior version of CCH ifirm Cantax T2, if an amount was entered on this line, it will not be retained.

In addition, line 2C has been added to Part 2 and is used to calculate the tax at the lower rate for the number of days in the tax year after December 31, 2020.

Corrected Calculations

The following problems have been corrected in version 2020 2.0:

Québec

- General

-

Federal

-

- COVID-19 – Balance-due day applicable to the tax balance of Parts other than Part I of the Act, including instalments payable to the federal government, extended to September 30, 2020

- T2 Return – In the first tax year of a corporation starting after 2018, the calculation of the ERDTOH on line 520 is incorrect for a CCPC that elected under subsection 89(11) ITA not to be a CCPC.

-

Québec

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

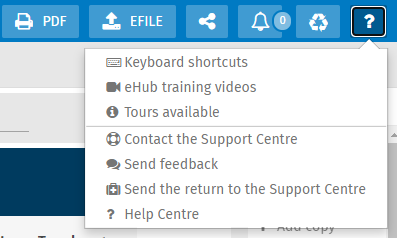

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Cantax T2 e-Bulletin notifies you each time an updated or new form is made available in a program update.

How to Reach Us

Technical and Tax support Hours

Monday to Friday: 8:30 a.m. to 8:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com