This form has been designed to allow you to calculate interest on the balance unpaid, the late-filing penalty as well as the interest on the late-filing penalty for the following two returns: the Trust Income Tax and Information Return (T3) and the Trust Income Tax Return (TP-646).

Preparer Profiles

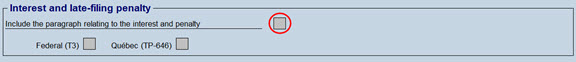

Options with respect to printing the paragraph relating to interest and late-filing penalty

If Form Interest and Late-Filing Penalty is applicable and the check box Include the paragraph relating to interest and penalty is selected at point 1 in the “Client letter information” section of the CLIENT LETTER tab in the selected preparer profile, the paragraph relating to interest and late-filing penalty will be included in the client letter for all your client files.

You are also able, for a particular client file, to not include the paragraph relating to interest and penalty, by clearing the check box Include the paragraph relating to the interest and penalty in the “Interest and late-filing penalty” section of the Client Letter Worksheet (Jump Code: LW).

Display and print detailed calculations of the interest and late-filing penalty

If you want to display on screen and print detailed calculations of the interest on the balance unpaid, the late-filing penalty and the interest on late-filing penalty in the “Federal” and “Québec” sections, select the following box:

Calculating the late-filing penalty in the “Federal” section

Under subsection 162(1) of the Income Tax Act (ITA), if a trust late-files its tax return, it is liable to a penalty of 5% on the unpaid tax, plus 1% of this tax for each complete month that the return is late, up to a maximum of 12 months.

However, under subsection 162(2) of the ITA, if a trust has not filed a return for a taxation year after having received a demand to file under ss. 150(2) and if prior to this failure, a penalty was payable for failure to file an income tax return for any of the three preceding taxation years, the trust is liable to a penalty of 10% of tax payable plus 2% of this tax for each complete month that the return is late, up to a maximum of 20 months. The following question is used to adjust the late-filing penalty rates according to the trust situation, if applicable.

Field “Filing deadline”

The field “Filing deadline” in the “Federal” and “Québec” sections is used to determine the number of complete months that the return is late for purposes of calculating the late-filing penalty and is also used to determine the number of days that the return is late for purposes of calculating the interest on the late-filing penalty.

Field “Expected filing date”

The field “Expected filing date” in the “Federal” and “Québec” sections allows you to enter the date on which the return is filed. It is used to enable the calculations for the late-filing penalty, the interest on the late-filing penalty and the interest on the balance unpaid. When a date is entered in this field and the field “Date balance paid (if different from expected filing date above)” is not completed, the program considers that the total payment has been made, i.e., that the payment enclosed with the return takes into account the balance unpaid and the amounts of interest and penalty estimated in this form.

Field “Date balance paid (if different from expected filing date above)”

When the trust late filed its return and the total payment of its balance due has been made at a date other than the date entered in the field “Expected filing date,” the field “Date balance paid (if different from expected filing date above)” in the “Dates” subsection of the “Federal” and “Québec” sections allows you to enter the date on which the balance due has been paid in full. When a date is entered in this field, the program calculates the interest on the balance due as of this date.

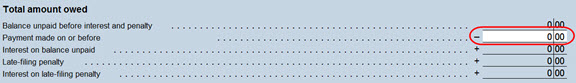

Subsection “Total amount owed”

If the trust paid part of its balance due on or before the balance-due day, you can enter the amount of the payment made in the field below in the “Total amount owed” subsection of the “Federal” and “Québec” sections. The program will then calculate the interest on the balance due, the late-filing penalty and the interest on the late-filing penalty using the difference between the balance due and the payment made.

Field “Balance-due day”

The field “Balance-due day” in the “Federal” and “Québec” sections is used to determine the number of days that the balance due is late for purposes of calculating the interest on the balance unpaid.

Calculations in the “Rates” subsection in the “Federal” and “Québec” sections

The prescribed interest rates are compounded quarterly. A calendar year has four quarters, which correspond to the following four periods: January 1 to March 31, April 1 to June 30, July 1 to September 30 and October 1 to December 31. The prescribed interest rates for each quarter will be displayed based on the expected filing date and the balance-due day in the “Rates” subsection of the “Federal” and “Québec” sections.

Calculations in the “Interest” subsection in the “Federal” and “Québec” sections

Interest on the balance unpaid is calculated per quarter. Therefore, in the “Interest” subsection of the “Federal” and “Québec” sections, a calculation of the interest on the balance unpaid will be performed for each quarter in the “Rates” section. In addition, a calculation of the interest on the late-filing penalty will be performed for each quarter occurring between the expected filing deadline and the filing deadline.

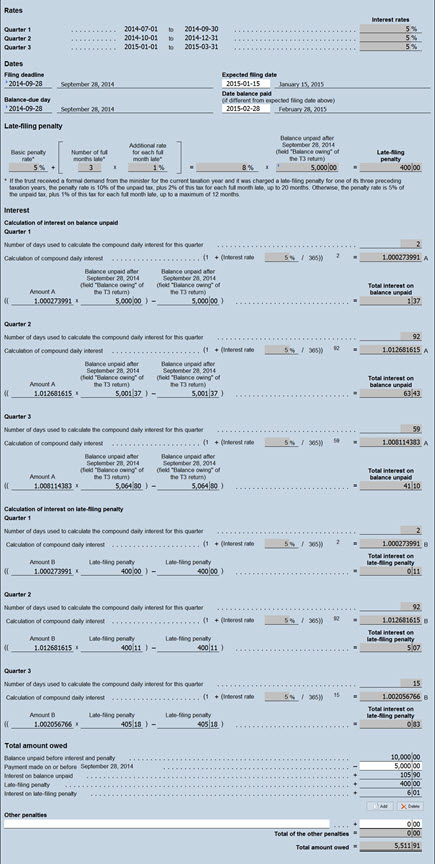

Here is an example illustrating how to use the form:

The trust has a balance due of $10,000 in its Trust Income Tax and Information Return (T3) and it has made a payment of $5,000 before the balance-due day. The filing deadline and the balance-due day are September 28, 2014, the expected filing date is January 15, 2015 and the date the balance is paid is February 28, 2015.

The late-filing penalty as well as the interest on this penalty is applicable starting September 29, 2014, until January 15, 2015.

As for the interest on the balance due, it is calculated for the period of September 29, 2014, to February 28, 2015.

See Also

Guide TP-646.G-V, Guide to Filing the Trust Income Tax Return