The ID form is used to enter identification information about the trust. It also allows you to answer the questions that come from page 2 of the T3 return.

Critical information includes:

- The Canada Revenue Agency account number of the trust (recently created trusts may not have an account number yet and may have to leave this field blank).

- Name and address of the trust and trustee.

- Province of residence.

- Taxation year - To learn about the taxation years covered by your Taxprep for trusts version, access the About Taxprep for Trusts box (Help/About Taxprep for Trusts).

- Type of trust.

- Date of death for testamentary trusts and trust creation date for inter vivos trusts. Note that inter vivos trusts created before 1972 are eligible to pay tax at graduated rates (rather than the top rate) unless the trust is "tainted."

-

If the trust is a resident of Québec, complete the “Information regarding Québec” section as well. Certain types of trusts only exist in Québec. Therefore, ensure to select the type that corresponds to Revenu Québec’s requirements. Consult the TP-646.G guide for more details.

Internal information for the preparer

The fields “Tax Preparer’s Profile used,” “Personalized identification number,” “Client code,” “Partner,” “Preparer,” “Reviewer,” “Date needed,” “Assigned to” and “Delivery method,” at the top of the form, are provided to help you manage tax returns. Note that the name in the “Partner” field is kept at all times when rolling forward data. However, the names in the “Preparer,” “Reviewer” and “Assigned to” fields will not be kept if the check boxes Keep the reviewer’s name, Keep the preparer’s name and Keep the field “Assigned to” have been cleared under Roll Forward/Data Options in the Options and Settings dialog box.

If you are using the staff list from the preparer profile, note that the names will be rolled forward when the preparer profile is converted and this preparer profile must be rolled forward first in order for the names to be rolled forward as well in the client file.

Preparer profile’s users

You may now create a list of the accounting firm staff to make it easier to manage the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields.

|

|

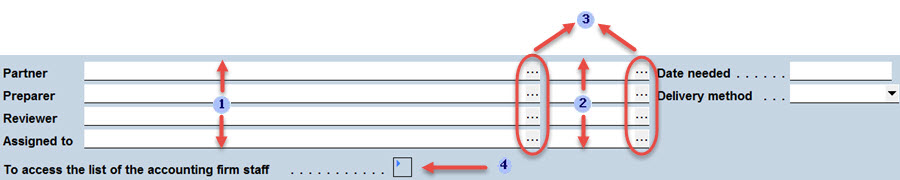

The names of the staff members selected for the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields will display in these fields. |

|

|

The identification numbers of the staff members for the “Partner,” “Preparer,” “Reviewer” and “Assigned to” fields will display in these fields. |

|

|

Click these buttons to access the list of names or identification numbers of staff members who are assigned the roles of “Partner,” “Preparer” and “Reviewer,” as well as the general list accessible using the “Assigned to” field in the preparer profile used and in the customized list described at point four. You may create separate lists for each of the three roles. As for the list of the “Assigned to” field, it contains the first and last names of all persons in the list of the accounting firm staff in the preparer profile and in the customizable list described at point four. |

|

|

Double-clicking this expand box will allow you to access the List of the Accounting Firm Staff form. The names of the accounting firm staff entered in the list in the preparer profile will be displayed, but cannot be modified. However, if the check box Allow customizing the list using Form Trust Identification and Other Information has been selected in the preparer profile used, you may add names to the list. Note that the names of staff members added in that section are only accessible in the active client file and are not added to the master list in the preparer profile. If you entered the names of staff members in the input section of the List of the Accounting Firm Staff form, but you do not want to roll them forward, clear the Retain these values when rolling forward the file check box at the bottom of the form. |

Note: Using the list of the accounting firm staff in this section of the form will not be possible if no preparer profile has been converted or created.

See Also