CCH iFirm Cantax Forms 2019 v.5.0 (2020.20.28.02) Release Notes

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Cantax

Welcome to CCH iFirm Cantax, the first cloud-based professional tax software in Canada.

CCH iFirm Cantax runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Cantax is bilingual and provides you with:

- Most robust tax calculations of the industry, powered by Taxprep software programs, built and enhanced over many years

- Comprehensive diagnostics with audit trail of user‑reviewed diagnostics

- Ability to navigate through cells with data entered in the year

- Intuitive user interface

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Cantax version, consult the Technical Release Notes.

Forms and Slips Coverage

The slips, RL slips and summaries included in CCH iFirm Cantax Forms 2019 normally apply to the 2019 taxation year. You can nonetheless use them if you need to file a slip for the 2020 taxation year before the 2020 versions of the slips are made available by government authorities.

Individual forms can be used until they are updated by the CRA or RQ. Note that the CCH iFirm Cantax Forms e-Bulletin notifies you each time an updated or new form is made available in an application update.

Rolling Files Forward

CCH iFirm Cantax Forms allows you to roll forward client files that were saved with the 2018 version of Taxprep Forms or Cantax FormMaster, which have the .T18 extension, as well as client files saved with Taxprep Forms Classic 2019 or Cantax FormMaster 2019 that have the .T19 and .T20 extension.

In addition, CCH iFirm Cantax Forms allows you to roll forward files saved with Intuit’s ProFile FX application that have a .18X extension.

If you want to roll forward the files saved with the AvanTax eForms application that have a .T18N extension, please contact the Support Centre.

Electronic Filing

CCH iFirm Cantax Forms enables you to electronically transmit data from the T5013 return and the following slips and RL slips:

|

Slips |

||

|---|---|---|

|

NR4 |

T5013 |

RL-8 |

|

T4 |

T5018 |

RL-11 |

|

T4A |

RL-1 T4 |

RL-15 |

|

T4A-NR |

RL-1 T4A |

RL-18 |

|

T4RIF |

RL-1 T4ANR |

RL-24 |

|

T4RSP |

RL-2 RIF |

RL-25 |

|

T5 |

RL-2 RSP |

RL-31 |

|

T2202 |

RL-2 T4A |

|

|

T5008 |

RL-3 |

|

Government requirements

At the federal level and in Québec, any filer filing more than 50 information slips of a same type must file the data electronically by Internet. Below that threshold, paper filing is accepted.

Taxation years covered

Revenu Québec only accepts electronic transmissions of the RL slips for the 2019 and 2020 taxation years. The CRA does not impose restrictions about the taxation year that can be processed.

Important dates for Internet transmission

CCH iFirm Cantax Forms 2019 complies with the latest Internet transmission requirements issued by government agencies. Files generated with CCH iFirm Cantax Forms 2019 can therefore be electronically transmitted:

- To the CRA, starting on January 6, 2020, (date on which the CRA reopens its Internet transmission service, which will be closed on December 22, 2019, for update purposes);

- To Revenu Québec, without any delay (as Revenu Québec’s Internet transmission service has been updated on November 5, 2019).

CRA’s Web Access Code

If you already have a Web access code, you can use it to file your information returns for 2019 and subsequent years.

Version 5.0 Content

Updates and Additions

To review the updates and additions contained in version 5.0 of CCH iFirm Cantax Forms 2019, consult the Updates and Additions table.

Comments and Details

T4, Employment Income

RL-1 Summary, Summary of Source Deductions and Employer Contributions

LE-34.1.12, Reduction of the Contribution to the Health Services Fund: Creation of Specialized Jobs

In Information Bulletins 2020-7 and 2020-8, published on April 30, 2020 and May 29, 2020, respectively, Finances Québec announced the establishment of a credit on employers contribution to the Health Services Fund in respect of employees on paid leave.

As a result, the following forms were updated as per Revenu Québec’s request:

RL-1 Summary, Summary of Source Deductions and Employer Contributions:

Two items were added to the drop-down list of box 31:

- 00: Amount including both an amount for large investment project exemptions (number 06) and an amount eligible for the credit for contributions to the Health Services Fund (number 19).

- 19: COVID-19 - Amount eligible for the credit for contributions to the Health Services Fund

Note: These items can only be selected for the 2020 taxation year.

If the employer applies for a credit for contributions to the Health and Services Fund, they must:

- select item 00 or 19, as the case may be, from the drop-down list of box 31;

- enter, on line 32, the portion of the salary and wages subject to the contribution entered on line 30 that was paid, for a week falling within a qualifying period, to an employee who was on paid leave, provided this employee had no remuneration for at least 14 consecutive days during that period.

T4, Employment Income

A note has been added to subsection Information in respect to Form LE-34.1.12 in Section Additional details in respect to the employee of the form.

If the employer applies for a credit for contributions to the Health Services Fund, they should then deduct the portion of an employee’s salary and wages used to calculate the contribution to the Health and Services Fund from the amount of eligible salary and wages.

Note: This note will only display for the 2020 taxation year.

LE-39.0.2, Calculation of the Contribution Related to Labour Standards

The program now supports two versions of the LE-39.0.2 form, i.e. versions 2019-01 and 2020-01. This allows you to calculate the contribution relating to labour standards for 2019 and 2020 respectively. A significant number of changes have been made to version 2020-01 of this form. For example, Section 2, Remuneration paid for the year has been added and the amounts on the following new lines are calculated using data from Form T4, Employment Income:

- Line 1, Total of the amounts from box A of the RL-1 slips;

- Line 2, Total of the amounts entered after “R-1” on the RL-1 slips;

- Line 6, Total of the amounts from box Q of the RL-1 slips;

- Line 8, Total of the amounts entered after “A-1” on the RL-1 slips;

- Line 9, Total of the amounts entered after “A-2” on the RL-1 slips.

In addition, remuneration paid to employees governed by a parity committee or by the Commission de la construction du Québec, is presented on line 11 in the 2019-01 version of the form but is split between lines 21 and 22 in the 2020-01 version of the form. If Form LE-39.0.2 was completed for the 2020 taxation year using a previous version of the program, we recommend that you review its content.

T5013 Financial, Partnership Financial Return

TP-600, Partnership Information Return

On May 25, 2020, both the Canada Revenue Agency and Revenu Québec has extended filing deadlines for partnerships to help taxpayers in the wake of the coronavirus (COVID-19). Therefore:

- The deadline for filing partnership returns (T5013 FIN and TP-600) whose initial filing deadline was between April 1 and May 30, 2020, has been postponed to June 1, 2020;

- The deadline for filing partnership returns (T5013 FIN and TP-600) whose initial filing deadline was between May 31 and August 31, 2020, has been postponed to September 1, 2020;

- The deadline for filing the T5013 slip and summary and the RL-15 slip whose initial filing deadline was between April 1 and May 30, 2020, has been postponed to June 1, 2020;

- The deadline for filing the T5013 slip and summary and the RL-15 slip whose initial filing deadline was between May 31 and August 31, 2020, has been postponed to September 1, 2020.

Therefore, the filing deadlines for these returns and their balance due have been modified in the T5013FIN/TP-600 – Partnership information return section of the LW form and the T5013 Client Letter.

LM-15, Voluntary Disclosure

As a result of an update, Form LM-15 underwent many changes. The form was for the most part redesigned, i.e. sections were renumbered, modified or deleted while others were added. For example, Section 3, Conditions for benefitting from the program, which is entirely new. Therefore, we strongly suggest that you review the entire form before submitting it.

Version 4.0 Content

Updates and Additions

To review the updates and additions contained in version 4.0 of CCH iFirm Cantax Forms 2019, consult the Updates and Additions table.

Comments and Details

Electronic Signature

As a result of the measures taken by the governments because of the COVID-19 pandemic, in CCH iFirm Cantax Forms, the digital signature functionality was added on additional forms. Because the needs relating to electronic signature are constantly evolving, we were proactive and added several forms to facilitate the digital signature in the future. For more information on the complete list of forms that can be electronically signed, consult the article Electronic Signature – Supported Forms.

NR4 Summary, Summary of Amounts Paid or Credited to Non-Residents of Canada

NR4 slip, Amounts Paid to Non-Residents

On March 30, 2020, both the Canada Revenue Agency and Revenu Québec announced a series of flexibility measures to help taxpayers in the wake of the coronavirus (COVID-19). Therefore, the deadline for filing the NR4 slip and NR4 summary has been postponed to May 1, 2020. In addition, the filing deadline for these forms has been modified in the NR4 – Statement of amounts paid or credited to non-residents of Canada section of the LW form.

T3010, Registered Charity Information Return; and

TP-985.22-V, Information Return for Registered Charities and Other Donees

On March 27, 2020, both the Canada Revenue Agency and Revenu Québec announced a series of flexibility measures to help taxpayers in the wake of the coronavirus (COVID-19):

- The CRA extends the filing deadline for Form T3010 to December 31, 2020, for all charities that must file this form between March 18, 2020, and December 30, 2020.

- Revenu Québec extends the filing deadline for Form TP-985.22 to December 31, 2020, for all charities that must file this form between March 17, 2020, and December 30, 2020.

Therefore, the filing deadline for these forms has been modified in the T3010/TP-985.22 – Registered Charity Information Return section of the LW form.

T5013 Financial, Partnership Financial Return; and

TP-600, Partnership Information Return

On March 30, 2020, both the Canada Revenue Agency and Revenu Québec announced a series of flexibility measures to help taxpayers in the wake of the coronavirus (COVID-19). Therefore:

- The deadline for filing the income tax returns of partnerships (T5013 FIN) whose initial filing deadline was between March 18 and March 31, 2020, has been postponed to May 1, 2020;

- The deadline for filing the income tax returns of partnerships (TP-600) whose initial filing deadline was between March 17 and March 31, 2020, has been postponed to May 1, 2020;

- The deadline for filing the T5013 slip and summary whose initial filing deadline was between March 18 and March 31, 2020, has been postponed to May 1, 2020;

- The deadline for filing the RL-15 slip whose initial filing deadline was between March 17 and March 31, 2020, has been postponed to May 1, 2020;

- The deadline for the balance-due day of partnership returns payable between March 18, 2020, and August 31, 2020, has been postponed to September 1, 2020.

Therefore, the filing deadlines for these returns and their balance due have been modified in the T5013FIN/TP-600 – Partnership information return section of the LW form and the Client Letter T5013.

AUT-01, Authorize a Representative for Access by Phone and Mail

AUT-01X, Cancel authorization for a representative

Significant changes have been made to the authorization process for representatives with the CRA. The CRA has not been accepting requests to authorize or cancel a representative using the T1013, NR95, RC59 and RC59X forms since February 10, 2020, as these forms were removed. They have been replaced by Form AUT-01, which allows you to communicate with the CRA by telephone or in writing, and Form AUT-01X, which allows you to cancel an authorization. If you completed an authorization or a cancellation request using one of the removed forms in a prior version of the program, only a portion of the information will be transferred to the new AUT-01 and AUT-01X forms. Therefore, we strongly recommend that you review the content of these forms before filing them.

In addition, in the AUTHORIZATION FORMS tab of the preparer profile, the NR95 – Authorizing or cancelling a representative for a non-resident tax account and RC59 – Business Consent for Offline Access sections have been deleted and the T1013 – Authorizing or cancelling a representative section has been renamed AUT-01 – Authorize a Representative for Access by Phone and Mail. The level of authorization drop-down list has been replaced by the options on the line Type of access in a new section entitled Other options. In this section you must also select the access level to business accounts. This choice replaces the All program accounts option in the former RC59 section. You must now choose between a representative that is an individual or a firm by selecting the option provided for this purpose.

T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim

The following lines, which relate to capital expenditures, were removed from the form, because they refer to a taxation year ended before 2014:

- 350, 355, 390 and 400 in Section B of Part 3; and

- 496, 504, 514b, 514b1, 514b2, 514c, 514d, 514e, 514, 516, 518, 532, 535, 540, 543, 546 and 558 in Part 4.

In Part 4, the amount on line 528 is subtracted from the calculation of the amount on line 529. As a result, the amount calculated on line 529 is now 20% of the total of the amounts on lines 340 and 370 minus the amount on line 528. In addition, line 557 was replaced by line 559.

The rate used to calculate the prescribed proxy amount (PPA) is 55% for a taxation year started after 2013. In that respect, the calculations for obsolete periods in Section B of Part 5 were removed.

In the table in Part 6, column 758, Overhead and other expenditures in the tax year (total of line 360, if applicable), has been added. The fields in this column must be completed if the traditional method is used and the information is mandatory for a taxation year end after 2019 and optional for a taxation year end before 2020. To generate data in this column, data must be entered on line 758 of Form T661 Part 2 for the project involved. Note that the amount on this line will affect the total project cost.

T661 Part 2, Project Information

Following the addition of column 758 in Form T661, line 758, Overhead and other expenditures (Portion of the amount on line 360) was added under line 756. Note that the amount on this line will affect the total project cost.

TP-128, Income and Expenses Respecting the Rental of Immovable Property

At the time this form was updated, changes were made to the table in Part 4, Capital cost allowance. Custom column 3a, Cost of acquisitions of column 3 that are AIIP has been renumbered 3.1 and will now print. Columns 5.1, Proceeds of dispositions that can reduce AIIP acquisitions and 5.2, UCC adjustment based on AIIP acquired in the year, were also added.

Version 3.0 Content

Updates and Additions

To review the updates and additions contained in version 3.0 of CCH iFirm Cantax Forms 2019, consult the Updates and Additions table.

Comments and Details

Return Manager – Account Number of a Sole Proprietor

When the contact type is Sole Proprietor in the return manager view, only the social insurance number will now be used as the account number for a return.

PD24, Application for a Refund of Overdeducted CPP Contributions or EI premiums

At the time this form was updated, boxes CPP ruling and EI ruling were added to Part A - Tick the box(es) below that show the reason(s) for this application. In addition, the List the officers of the corporation subsection was deleted and the column Title (If an officer of the company) was added to the List of the officers of the corporation and the distribution of the voting shares subsection. If you completed this form using a previous version of the program, we recommend that you review the content of this subsection before filing the form.

Version 2.0 Content

Updates and Additions

To review the updates and additions contained in version 2.0 of CCH iFirm Cantax Forms 2019, consult the Updates and Additions table.

Version 1.0 Content

Updates and Additions

To review the updates and additions contained in version 1.0 of CCH iFirm Cantax Forms 2019, consult the Updates and Additions table.

Comments and Details

T4/RL-1 Data entry screen – Employment income

A diagnostic has been added in the “Information to report – Other” section with respect to security option deductions under section 725.2 or 725.3 of the Taxation Act (boxes L-9 or L-10), to warn you that the amount of the security option deduction may be deemed nil in certain circumstances. For more information, please consult the Help of the form.

T4 Slip – Statement of Remuneration Paid

The following boxes have been deleted as they are no longer useful for filing a T4 slip for the 2019 taxation year:

- box 68, Status Indian (exempt income) - Eligible retiring allowances;

- box 70, Municipal officer's expense allowance.

T4PS/RL-25 Data entry screen – Payment from an EPSP

Boxes A11, Actual amount of eligible dividends (January 1 to March 27, 2018) (included in box A1), A12, Actual amount of eligible dividends (March 28 to December 31, 2018) (included in box A1), A21, Actual amount of other than eligible dividends (January 1 to March 27, 2018) (included in box A2) and A22, Actual amount of other than eligible dividends (March 28 to December 31, 2018) (included in box A2) have been deleted.

T5/RL-3 Data entry screen – Investment

Before 2018, the tax on split income (TOSI) only applied to individuals under the age of 18. Under the new rules that came into effect in 2018, the tax on split income now applies to individuals age 18 or older.

In general terms, these rules can apply to dividends, interest or capital gains received either directly or indirectly through a partnership or a trust (other than a mutual fund trust). The rules may vary depending on whether the individual is under the age of 18, between 18 and 24 or more than 24. For more information on this topic, consult the Help of the T3 slip.

Although the CRA has not added any boxes to the T5 slip to indicate income subject to the tax on split income, custom boxes have been added to enter the income split amount when preparing slips. If you use the Print Slips (Ctrl + L) command, this information is printed below the “Recipient’s name (last name first) and address – Nom, prénom et adresse du bénéficiaire” box.

In addition, boxes A11, Actual amount of eligible dividends (January 1 to March 27, 2018) (included in box A1), A12, Actual amount of eligible dividends (March 28 to December 31, 2018) (included in box A1), A21, Actual amount of other than eligible dividends (January 1 to March 27, 2018) (included in box A2) and A22, Actual amount of other than eligible dividends (March 28 to December 31, 2018) (included in box A2) have been deleted.

In addition, when the beneficiary is not an individual, the identification number in box 22 of the form must now include the account number (i.e.: RC0001) in addition to the business number. If you open a file prepared with a prior version of the program, the value will be retained, and a diagnostic will prompt you to add the account number.

T101/RL-11 – Resource Expenses

Boxes D-1, Québec exploration expenses that give entitlement to an additional deduction of 10%, D-2 Québec exploration expenses that give entitlement to an additional deduction of 25%, E-1, Québec surface mining exploration expenses or oil and gas exploration expenses that give entitlement to an additional deduction of 10% and E-2, Québec surface mining exploration expenses or oil and gas exploration expenses that give entitlement to an additional deduction of 25%, have been deleted. Box B-2, Accelerated Canadian development expenses, has been added. For more information on the calculation of the deduction, contact Revenu Québec.

T2202 – Tuition and Enrolment Certificate

Form T2202A, Tuition and Enrolment Certificate, has been renumbered T2202. This new form must be used for 2019 and subsequent years registration months and must be filed electronically with the CRA. Flying schools and clubs will now report information on Form T2202 all of the information that was previously reported on Form TL11B, which has been eliminated. Form T2202 contains, for the most part, the same information as Form T2202A in addition to the following information to be completed in the “Educational Institution” section of Form T2202/RL8, Issuer’s Identification, i.e., the school type, the filer’s account number as well as the authorized officer’s telephone and extension number. In the case of a flying school or club, the type of course must also be indicated in the "Filing detail" section of the data entry screen. EFILE diagnostics were also added to help you complete all information required for EFILING.

T5008 / RL-18 – Data Entry Screen - Statement of Securities Transactions

When the beneficiary is not an individual, the identification number in box 12 of the form must now include the account number (i.e.: RC0001) in addition to the business number. If you open a file prepared with a prior version of the program, the value will be retained, and a diagnostic will prompt you to add the account number.

T2091(IND) – Designation of a Property as a Principal Residence by an Individual (Other than a Personal Trust)

This form is for an individual (other than a personal trust) who wants to designate a property as a principal residence. This form is also used to calculate the capital gain resulting from the disposition of the principal residence.

T2091(IND)-WS – Principal Residence Worksheet

This worksheet must be completed together with Form T2091(IND), Designation of a Property as a Principal Residence by an Individual (Other than a Personal Trust), or Form T1255, Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual, to calculate the reduction as a result of the capital gains election for the 1994 tax year.

T5013/RL-15 – Data Entry Screen – Partnership Income

The following additional information codes have been deleted as they are no longer useful for filing an RL-15 slip for the 2019 taxation year:

- box 6a1, Actual amount of eligible dividends (January 1 to March 27, 2018);

- box 6a2, Actual amount of eligible dividends (March 28 to December 31, 2018);

- box 6b1, Actual amount of ordinary dividends (January 1 to March 27, 2018);

- box 6b2, Actual amount of ordinary dividends (March 28 to December 31, 2018);

- box 11-2, Reserve related to qualified farm property;

- box 32-1, Québec exploration expenses that qualify for the additional deduction of 10%;

- box 32-2, Québec exploration expenses that qualify for the additional deduction of 25%;

- box 33-1, Québec surface mining and oil and gas exploration expenses that qualify for the additional deduction of 10%;

- box 33-2, Québec surface mining and oil and gas exploration expenses that qualify for the additional deduction of 25%;

- box 62-1, Québec exploration expenses that qualify for the additional deduction of 10%;

- box 62-2, Québec exploration expenses that qualify for the additional deduction of 25%;

- box 63-1, Québec surface mining and oil and gas exploration expenses that qualify for the additional deduction of 10%;

- box 63-2, Québec surface mining and oil and gas exploration expenses that qualify for the additional deduction of 25%.

The additional information fields related to code 11-1, Reserve related to qualified farm property, and code 11-2, Reserve related to qualified fishing property, have been merged and replaced by code 11-1, Reserve related to qualified farm or fishing property.

The following additional information codes have been added for filing an RL-15 slip for the 2019 taxation year:

- box 3-4, Split income - Net Canadian and foreign rental income;

- box 4-5, Split income - Net foreign rental income;

- box 7-2, Split income - Interest and other investment income from Canadian sources;

- box 12-9, Split income - Other capital gain;

- box 29-2, Accelerated Canadian development expenses;

- box 30-1, Accelerated Canadian oil and gas property expenses;

- box 61-2, Accelerated Canadian development expenses.

T3010 – Registered Charity Information Return

The following elements have been deleted:

- Lines 5030, 5031 and 5032 in Section C;

- Line 5030 in Schedule 6;

- Parts 2 and 3 in Schedule 7.

TP-985.22 – Information Return for Registered Charities and Other Donees

Lines 37.4, 58.1, 59 and 59.1 have been deleted.

T5013 Schedule 8 – Partnership’s Capital Cost Allowance Schedule

TP-600 Schedule B – Capital Cost Allowance

A number of changes have been made to these forms to present the CCA calculation under the rules for Accelerated Investment Incentive Properties (AIIP) and Zero-emission Vehicles (ZVEs).

The following columns have been added to Form T5013 Schedule 8:

- column 4, Cost of acquisitions from column 3 that are accelerated investment incentive property (AIIP) or zero-emission vehicles (ZEV);

- column 6, Amount from column 5 that is assistance received or receivable during the fiscal period for a property, subsequent to its disposition;

- column 7, Amount from column 5 that is repaid during the fiscal period for a property, subsequent to its disposition;

- column 10, Proceeds of disposition available to reduce the UCC of AIIP and ZEV;

- column 11, Net capital cost additions of AIIP and ZEV acquired during the fiscal period;

- column 12, UCC adjustment for AIIP and ZEV acquired during the fiscal period.

In addition, former column 7, 50% rule, of this form has been renamed UCC adjustment for property acquired during the fiscal period other than AIIP and ZEV.

The following columns have been added to Form TP-600 Schedule B:

- column C.1, Cost of AIIP acquired in the taxation year;

- column F.1, Proceeds of dispositions available to reduce the capital cost of AIIP acquired in the taxation year;

- column F.2, Net capital cost of AIIP acquired during the taxation year;

- column F.2.1, Multiplier;

- column F.3, UCC adjustment for AIIP acquired during the taxation year.

In addition, former column G, Reduction, of this form has been renamed UCC adjustment for non-AIIP acquired during the taxation year.

As a result of these changes, the lines Assistance received during the year for property after it is disposed of and Amount repaid during the year for property after it is disposed of, have been added to Forms T5013 General CCA, T5013 Leasehold CCA, CCA class 13 (leasehold improvements) and T5013 Vehicle CCA, CCA class 10.1 (passenger vehicles).

In addition, the lines Proceeds of disposition available to reduce AIIP or ZEV additions, Net capital cost additions of AIIP or ZEVs acquired during the year and UCC adjustment for AIIP or ZEVs acquired during the year have been added to Forms T5013 General CCA. Line ½ of net additions minus the adjustment for additions of the accelerated investment incentive property has been renamed UCC Adjustment for property (other than AIIP or ZEVs) acquired during the year.

T5013 General CCA – General CCA classes

The amount on line Additional CCA of 30% calculated on acquisitions of the current fiscal year claimable in the next fiscal year in the Classes 14, 14.1, 43.1, 43.2, 44, 50 and 53 only section of this form is now calculated.

RC1 – Request for a Business Number and Certain Program Accounts

As a result of the update of Form RC1 by the CRA, Section “Part G, Requesting a charity program account (RR)” has been added.

TP-274-V – Designation of Property as Principal Residence

This form is for an individual (other than a personal trust) who wants to designate a property as a principal residence. This form is also used to calculate the capital gain resulting from the disposition of the principal residence.

TP-274.S-V – Reduction of the Capital Gain Deemed to Have Been Realized on a Principal Residence

This form must be completed if a capital gain deemed to have been realized on the disposition of a principal residence on February 22, 1994, has been claimed. Form TP-274-V, Designation of Property as Principal Residence, must be completed first and attached to Form TP-274.S-V.

Client Letter – Worksheet

A paragraph has been added to the « RL-1 Slip » section of the Filing (Slips and RL slips) letter in order to indicate the payment or refund on Form Summary 1, RL-1 Summary – Summary of Source Deductions and Employer Contributions.

Changes to the mailing addresses of certain forms

The mailing address for the following forms has been changed:

- CPT16, Application to Exempt Self-Employed Earnings from the Canada Pension Plan for Religious Reasons

- T1261, Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non Residents

Refer to the forms for the exact mailing address for each form.

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

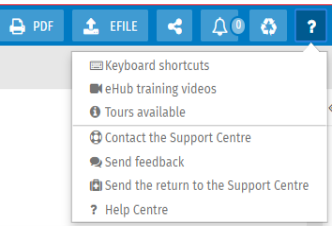

To access the Help, click the following icon:

How to Reach Us

Technical and Tax support Hours

Monday to Friday: 8:30 a.m. to 8:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com