CCH iFirm Cantax Forms 2020 v.5.0 (2021.20.31) Release Notes

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Cantax

Welcome to CCH iFirm Cantax, the first cloud-based professional tax software in Canada.

CCH iFirm Cantax runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Cantax is bilingual and provides you with:

- Most robust tax calculations of the industry, powered by Taxprep software programs, built and enhanced over many years

- Comprehensive diagnostics with audit trail of user‑reviewed diagnostics

- Ability to navigate through cells with data entered in the year

- Intuitive user interface

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Cantax version, consult the Technical Release Notes.

Forms and Slips Coverage

The slips, RL slips and summaries included in CCH iFirm Cantax Forms 2020 normally apply to the 2020 taxation year. You can nonetheless use them if you need to file a slip for the 2021 taxation year before the 2021 versions of the slips are made available by government authorities.

Individual forms can be used until they are updated by the CRA or RQ. Note that the CCH iFirm Cantax Forms e-Bulletin notifies you each time an updated or new form is made available in an application update.

Rolling Files Forward

CCH iFirm Cantax Forms allows you to roll forward client files that were saved with the 2019 version of Taxprep Forms or Cantax FormMaster, which have the .T19 extension, as well as client files saved with Taxprep Forms 2020 or Cantax FormMaster 2020 that have the .T20 and .T21 extension.

In addition, CCH iFirm Cantax Forms allows you to roll forward files saved with Intuit’s ProFile FX application that have a .19X extension.

If you want to roll forward the files saved with the AvanTax eForms application that have a .T19N extension, please contact the Support Centre.

Electronic Filing

CCH iFirm Cantax Forms enables you to electronically transmit data from the T5013 return and the following slips and RL slips:

|

Slips |

||

|---|---|---|

|

NR4 |

T5013 |

RL-8 |

|

T4 |

T5018 |

RL-11 |

|

T4A |

RL-1 T4 |

RL-15 |

|

T4A-NR |

RL-1 T4A |

RL-18 |

|

T4RIF |

RL-1 T4ANR |

RL-24 |

|

T4RSP |

RL-2 RIF |

RL-25 |

|

T5 |

RL-2 RSP |

RL-31 |

|

T2202 |

RL-2 T4A |

|

|

T5008 |

RL-3 |

|

Government requirements

At the federal level and in Québec, any filer filing more than 50 information slips of a same type must file the data electronically by Internet. Below that threshold, paper filing is accepted.

Taxation years covered

Revenu Québec only accepts electronic transmissions of the RL slips for the 2020 and 2021 taxation years. The CRA does not impose restrictions about the taxation year that can be processed.

Important dates for Internet transmission

CCH iFirm Cantax Forms 2020 complies with the latest Internet transmission requirements issued by government agencies. Files generated with CCH iFirm Cantax Forms 2020 can therefore be electronically transmitted:

- To the CRA, starting on January 11, 2021, (date on which the CRA reopens its Internet transmission service, which will be closed on December 22, 2020, for update purposes);

- To Revenu Québec, without any delay (as Revenu Québec’s Internet transmission service has been updated on November 9, 2020).

CRA’s Web Access Code

If you already have a Web access code, you can use it to file your information returns for 2020 and subsequent years.

Version 5.0 Content

Updates and Additions

To review the updates and additions contained in version 5.0 of CCH iFirm Cantax Forms 2020, consult the Updates and Additions table.

Comments and Details

RC4616, Election or Revocation of an Election for Closely Related Corporations and/or Canadian Partnerships to Treat Certain Taxable Supplies as Having Been Made for Nil Consideration for GST/HST Purposes

The form underwent significant changes at the time it was updated. The effective date of the revocation must be presented separately from the date of election. Therefore, Part C, Revocation of the election, has been added to the form and Part B has been renamed Election. If you had entered a revocation date, it will be moved to Part C. The Certification by the first specified member subsection has also been moved to the end of the form and became Part D, Certification.

T4A/RL-1, Pension and Other Income

Starting with the 2020 taxation year, fees and other amounts paid for maintenance work carried out inside or outside a public building must be included in box O (code RD) of the RL-1 slip even if no Quebec tax was withheld on these amounts. Therefore, an option has been added to indicate that the amount in box 048 should be carried over to box RL-1 RD.

T2060, Election for Disposition of Property Upon Cessation of Partnership

The Due date and Filing date boxes have been added to calculate the sum of months or parts of months used to calculate the late filing penalty.

Version 4.0 Content

Updates and Additions

To review the updates and additions contained in version 4.0 of CCH iFirm Cantax Forms 2020, consult the Updates and Additions table.

Comments and Details

User-defined cells for reporting purposes

Fields have been added to the User-defined cells for reporting purposes section in the General information tab of the preparer profile. Data in these new fields is updated to the corresponding section of Form Identification. This is information is for the sole purpose of following up on your returns; it is not required to calculate the income tax return and will not be EFILED.

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates

A new version of Form T1134 for taxation years starting after 2020 has been integrated into the program and only displays when the taxation year covered by the return starts on January 1, 2021, or after. For taxation years starting prior to this date, the previous version of the form must be used.

The new version of the form provides the ability, for a group of reporting entities that are related to each other, to file as a group. The information related to individuals, corporations, trusts and partnerships that are part of this related group must be indicated in new subsections A and B in Section 3 of Part I. Note that the taxation year-end date or fiscal year-end date must be the same for all entities in the group. In addition, if an election to use functional currency was made, individuals and trusts cannot be part of the group.

In the new subsection C in Section 3 of Part I (which corresponds to former Section 3 of Part 1), the question Is the reporting entity submitting a group organizational chart for the required information noted in C. (i) through (iv)? will allow you to submit an organizational chart if it contains the required information.

Several tables have been added to the form to allow for the filing of the return by a group of related entities. Therefore, entities in the group that are indicated in subsection A of Section 3 in Part I will be used to form a list from which you will be able to select the relevant entities in the tables of the T1134 Supplement section.

The layout of the form has also been revised and a lot of information that was already requested in the previous version of the form has been incorporated into the new tables. When opening a return prepared with a prior version of CCH iFirm Cantax Forms in which the taxation year starts after 2020 or when rolling forward a client file in which the taxation year after roll forward is the first year starting after 2020, data entered in the previous version of the form will be retained in the corresponding fields of the new version of the form, where applicable.

Finally, if you completed Form T1134 for a year beginning after 2020 with a prior version of CCH iFirm Cantax Forms:

- The amounts that were entered in the table in Section 2 of Part III will be rounded to the nearest thousand, then retained on the corresponding line in the column Total gross revenues (all sources) in the table of Section 2 in Part III. Currency codes will also be retained on the corresponding lines.

- If an amount was entered on one of lines (i) to (viii) in Section 3 of Part III, it will be retained on the corresponding line among lines in table (iv) of Section 3 in Part III, in column FAPI if it is positive or in columns FAPL or FACL as an absolute value if it is negative.

We strongly suggest that you review the entire form before filing it.

T2042, Statement of Farming Activities

T2121, Statement of Fishing Activities

T2125, Statement of Business or Professional Activities

Line 9, Electricity for zero-emission vehicles, has been added to Chart A.

T3010, Registered Charity Information Return

Commencing on May 15, 2021, you will no longer be able to file Form RC232 with the charity's annual Form T3010. For more information, consult Ontario Business Registry.

Version 3.0 Content

Updates and Additions

To review the updates and additions contained in version 3.0 of CCH iFirm Cantax Forms 2020, consult the Updates and Additions table.

Comments and Details

CO-359.10, Flow-Through Shares Information Return

As a result of the latest update of the CO-359.10 form, the option on line 28, Cheque or money order enclosed in Part 5 has been deleted. In addition, former Part 7, Expenses that may be renounced, has been removed and replaced by the new Part 7, Amount payable to calculate the amount payable and enclose this amount with the CO-359.10 return.

CPT1, Request for a CPP/EI Ruling – Employee or Self-Employed?

As result of an update, Form CPT1 has been completely redesigned. For example, among the many changes, taxpayers are now required to answer the new question Why do you want a ruling? in Part A – Request. Therefore, we strongly suggest that you review the entire form before submitting it.

RC199, Voluntary Disclosures Program (VDP) Application

Following the update of this form, Part E – For disclosures identifying shares of non-resident corporations (other than foreign affiliates) was removed from Section 6.

Version 2.0 Content

Updates and Additions

To review the updates and additions contained in version 2.0 of CCH iFirm Cantax Forms 2020, consult the Updates and Additions table.

Comments and Details

PD27, 10% Temporary Wage Subsidy Self-identification Form for Employers

Form PD27, which allows you to identify the amount of temporary wage subsidy (TWS) of 10% of the remuneration paid from March 18 to June 19, 2020, has been added to the program. Diagnostics have also been added to make sure that the amount of TWS claimed does not exceed the following limits: $25,000 per employer; $1 375 per eligible employee and 10% of the remuneration paid per pay period. In addition, custom Section Reconciliation of the T4 Summary and PD27 form has been added to the T4 Summary to adjust the overpayment or balance due in the customer letter when the difference is explained by an amount of TWS applied as a reduction of the 2020 payroll remittances. This section has no impact on the information transmitted to the government.

RL-1 Summary, Summary of Source Deductions and Employer Contributions

LE-34.1.12, Reduction of the Contribution to the Health Services Fund: Creation of Specialized Jobs

The measure relating to the reduction of the contribution to the health services fund for the creation of specialized jobs was applicable until 2020. Therefore, Form LE-34.1.12 should not be completed for 2021. In addition, lines 37a to 37c have been removed from the temporary RL-1 Summary.

T2058, Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation

The Eligible capital property subsection in the Information on the property disposed of and consideration received section has been removed.

T2059, Election on Disposition of Property by a Taxpayer to a Canadian Partnership

The Eligible capital property subsection in the Information on the property disposed of and consideration received section has been removed.

T3010, Registered Charity Information Return

Some of the fields that were used when filing the T3010 return have been removed for the 2020 and 2021 taxation years as they were obsolete. Indeed, the field of statement C5, Public policy dialogue and development activities, in Section C, Programs and general information has been removed. In addition, the field used to describe the charity's public policy dialogue and development activities in the Public policy dialogue and development activities – Schedule 7 section has also been removed.

TP-614, Transfer of Property to a Canadian Partnership

As a result of a significant number of changes made to the form, the calculation of the fair market value in column D of Section 3.1 had to be deleted, because this amount does not necessarily correspond to the amount in column Fair market value of total consideration of the Information on the property disposed of and consideration received section of Form T2059. Therefore, the cells in column D are now input cells.

Version 1.1 Content

Updates and Additions

To review the updates and additions contained in version 1.1 of CCH iFirm Cantax Forms 2020, consult the Updates and Additions table.

Comments and Details

T4RIF/RL-2 Data entry screen, Income from an RRIF

T4RIF slip, Statement of Income from a Registered Retirement Income Fund

T4RIF Summary, T4RIF Summary

Box 37, Advanced life deferred annuity purchase has been added for the filing of the T4RIF Summary and slip for the 2020 and subsequent taxation years.

T4RSP/RL-2 Data entry screen, Income from an RRSP

T4RSP slip, Statement of Income from a Registered Retirement Saving Plan

T4RSP Summary, T4RSP Summary

Box 37, Advanced life deferred annuity purchase has been added for the filing of the T4RSP Summary and slip for the 2020 and subsequent taxation years.

T2200, Declaration of Conditions of Employment and T2200S, Declaration of Conditions of Employment for Working at Home Due to COVID-19

This year, two versions of the form are available, i.e. the long version (T2200), and the short version (T2200S). When opening the T2200 form, the two versions of the form will be presented one after the other. However, two options have been added at the top of the form to allow you to display only the desired version. Note that the short version should only be used for employees who worked from home in 2020 due to COVID 19.

T5013 Schedule 12, Resource-Related Deductions

As a result of another update, Part 5 - Recapture of earned depletion has been added again.

Version 1.0 Content

Updates and Additions

To review the updates and additions contained in version 1.0 of CCH iFirm Cantax Forms 2020, consult the Updates and Additions table.

Comments and Details

E-Signature

The E-signature functionality was added to forms that can be electronically signed in CCH iFirm Cantax Forms. For the complete list of forms that can be electronically signed, consult the article Digital Signature – Supported Forms.

Preparer profile

The option Do not allow e-mail address entry in any of the forms in the return has been added to Section B. Options – Forms in the PROFILE tab of the preparer profile. When this option is selected, a diagnostic will display in the return to prevent you from entering or editing information in the e-mail address fields. This option is set to No by default. Note that when converting the preparer profile, this option selection will be retained. The roll forward for the e-mail address is not impacted by this addition. Therefore, any e-mail address entered will be rolled forward.

Prior period Preparer Profile

When a new taxation year or fiscal period is added to the application, remember that the prior period Preparer Profile must be imported. For more information, please consult the following FAQ: https://support.cch.com/canada/solution/000118906/FAQ-Why-is-my-current-Preparer-Profile-empty-since-the-latest-deployment-of-CCH-iFirm-Tax?language=en.

Client letter – Client Letter Worksheet

The Partner field has been added to the LW form so that it could be used in a custom letter.

LE-34.1.12-V, Reduction of the Contribution to the Health Services Fund: Creation of Specialized Jobs

Line 11, Portion of the salary or wages entered on line 10 that was used to calculate the health services fund contribution for an employee on paid leave due to the COVID-19 pandemic, has been added to Part 2, Eligible salaries or wages of this form.

NR4, Amounts Paid to Non-residents

According to the EFILE requirements of this form, the amounts in boxes 16 and 26, Gross income as well as boxes 17 and 27, Non-resident tax withheld, cannot exceed 11 numeric characters, i.e., $999,999,999.99. Therefore, an EFILE diagnostic has been added to this form to remind you to break down this amount between more than one slip.

In addition, the CRA has added an income code that can be selected in boxes 14 and 24, i.e., code 85, Dividend compensation payments made under a Securities Lending Arrangement (SLA).

T4/RL-1, Employment Income

As result of an update, four new codes have been added to the drop-down lists of lines Other information in the Information to report – Other section:

- 57, Employment Income – March 15 to May 9;

- 58, Employment Income – May 10 to July 4;

- 59, Employment Income – July 5 to August 29;

- 60, Employment Income – August 30 to September 26.

These codes should be used to report employment income and retroactive payments made during pay periods that were concurrent with COVID-19 benefits. The amounts that will be reported using these codes are also included in the amount on line 14, Total employment income. This will allow the CRA to validate payments for the Canada Emergence Wage Subsidy (CEWS), the Canada Emergency Response Benefit (CERB) and the Canada Emergency Student Benefit (CESB).

T4A, Pension and Other Income

Box 037, Advanced life deferred annuity purchase has been added to the form. In addition, boxes 142, Indian (exempt income) - Eligible retirement allowances and 143, Indian (exempt income) – Non-eligible retirement allowances have been removed.

TP-64.3, General Employment Conditions

Section 3.6 has been added to Form TP-64.3 to enter expenses related to remote work. This section must be completed for employees who incurred expenses solely for remote work performed in the context of the COVID-19-related crisis.

T2058, Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation

TP-529, Transfer of a Property by a Partnership to a Taxable Canadian Corporation

As a result of an update, Form TP-529 underwent many changes. Several sections of the form have been renumbered. A table has been added to Section 2.2, Rollover application, to enter the class number and the undepreciated capital cost (UCC) of the transferred property. The following changes have been made in the table of Section 3.1, Assets transferred and agreed amount: the Incorporeal capital property subsection has been removed and the Other than shares and Name and class of shares lines located under former line E, Consideration received have been removed. In addition, columns A, Line number in section 3.1 associated with the property, B, Consideration other than shares, Short description, and E, Total FMV of the consideration received, have been added to the table of Section 3.2, Consideration received section.

Some changes have been made to Section 1, Identification, to present the civic and suite numbers as well as the province separately from the street name and the city name on lines 03 and 12. Therefore, the Number, Suite, and Province cells have been added to Form T2058 to make the transfer of that information more easily.

If you completed this form using a prior version of CCH iFirm Cantax Forms, we strongly suggest that you review the entire form before submitting it.

T5013/RL-15, Partnership Income

The following amounts and information codes have been deleted as they are no longer required to file T5013 slips for the 2020 taxation year:

- Code 177, Recapture of earned depletion;

- Code 208, Eligible amount of medical gifts.

In addition, the following amounts and information codes have been added to file T5013 slips for the 2020 taxation year:

- Code 226, Repaid assistance (for Canadian exploration expenses);

- Code 227, Repaid assistance (for Canadian development expenses);

- Code 228, Repaid assistance (for Canadian oil and gas property expenses);

- Code 229, Amount receivable for CEE property or CEE unitized oil and gas field;

- Code 230, Amount receivable for CDE property or CDE unitized oil and gas field;

- Code 231, Amount receivable for CCOGPE unitized oil and gas field;

- Code 232, Proceeds of disposition (for Canadian development expenses);

- Code 233, Proceeds of disposition (for Canadian oil and gas property expenses);

- Code 234, Accelerated Canadian development expenses;

- Code 235, Accelerated Canadian oil and gas property expenses;

- Code 236 Canadian Journalism Labour Tax Credit.

T5013 Schedule 8, Partnership’s capital cost allowance schedule

T776, Statement of Real Estate Rentals

T2042, Statement of Farming Activities

T2121, Statement of Fishing Activities

T2125, Statement of Business or Professional Activities

TP-80, Business or Professional Income and Expenses

TP-128, Income and Expenses Respecting the Rental of Immovable Property

The new CCA class 56 has been added for properties acquired after March 1, 2020, and available for use before 2028, that are zero-emission automotive equipment and vehicles that currently do not benefit from the accelerated rate provided by classes 54 and 55. Like these two CCA classes, class 56 benefits from a temporary enhanced first-year CCA rate of 100% for eligible property available for use before 2023.

T1134, Information Return Relating to Controlled and Not-Controlled Foreign Affiliates

The Canada Revenue Agency (CRA) published a new version of Form T1134, which must be used for taxation years starting after 2020. Therefore, the previous version of the form must be used for T1134 forms prepared for taxation years starting prior to 2021.

Note that only the previous version of Form T1134 will be available in version 2020.1.0 of CCH iFirm Cantax Forms. To that end, a note has been added at the top of the form when the taxation year is starting in 2021. The new version of the form will be integrated in a future version of CCH iFirm Cantax Forms.

T2200S, Declaration of Conditions of Employment for Working at Home During COVID-19

Form T2200S had not yet been received at the time this version of the program was released. Therefore, it will be available in the next version, which is scheduled to be released during the first week of February.

Important: T5013, Partnership Information Return and schedules

At the time of release, we still have not received a response from the CRA concerning the paper approval and XML certification for the partnership information return form. As a result, the T5013 return and schedules are up to date, but cannot be used for paper or electronic filing.

The T5013 return and schedules will be available for paper and electronic filing in the next version.

T5013 Schedule 2, Charitable Donations, Gifts, and Political Contributions

As result of an update, Part 6 – Gifts of medicine has been deleted.

T5013 Schedule 12, Resource-Related Deductions

As a result of an update, Form T5013 Schedule 12 underwent some changes, for example, Part 5 Recapture of earned depletion has been deleted. In addition, several lines have been added to Parts 1 to 4, in particular line Repaid assistance, which has been added to all parts.

If this form has been prepared using a prior version of CCH iFirm Cantax Forms, we strongly suggest that you review the entire form before submitting it.

T5013 Schedule 58, Canadian Journalism Labour Tax Credit

This new schedule is used to calculate the refundable labour tax credit at a rate of 25% of qualifying labour expenditures incurred in a taxation year, after December 31, 2018, by a qualifying journalism organization in respect of an eligible newsroom employee. This tax credit is subject to an annual threshold of $55,000 per eligible newsroom employee. The amount on line 140 is allocated to eligible partners of the partnership in box 236 of Form T5013/RL-15, Partnership Income.

TP-518, Transfer of Property by a Taxpayer to a Taxable Canadian Corporation

As a result of an update, Form TP-518 underwent many changes. First, a table has been added to Section 2.2, Rollover application, to enter the class number and the undepreciated capital cost (UCC) of the transferred property. In addition, the following changes have been made in the Assets transferred and consideration received section: the Incorporeal capital property subsection has been removed and the Other than shares and Name and class of shares lines located under former line E, Consideration received have been deleted. Also, column A, Row number of the table in Part 3.1 associated with the asset, column B, Consideration other than shares, and column E, Total FMV of the consideration received, have been added to the table of Section 3.2, Consideration received section.

If you completed this form using a prior version of CCH iFirm Cantax Forms, we strongly suggest that you review the entire form before submitting it.

TP-614, Transfer of Property to a Canadian Partnership

As a result of an update, Form TP-614 underwent many changes. All the form has been renumbered. A table has been add in Part 2.2, Rollover application, to provide the class number and the undepreciated capital cost (UCC) of the transferred property. The following changes have been made in the 3.2, Assets transferred and consideration received section: the Incorporeal capital property subsection and the lines Description of the consideration received have been removed. Also, the table 3.2, Consideration received has been add to the form.

If you completed this form using a prior version of CCH iFirm Cantax Forms, we strongly suggest that you review the entire form before submitting it.

Where to Find Help

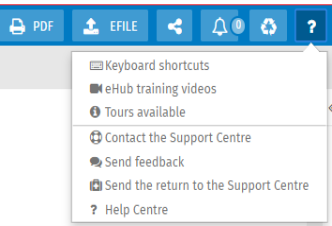

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the Help, click the following icon:

How to Reach Us

Technical and Tax support

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com