CCH iFirm Taxprep Forms 2021 v.5.0 (2022.20.33.02) Release Notes

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, powered by Taxprep software programs, built and enhanced over many years

- Comprehensive diagnostics with audit trail of user‑reviewed diagnostics

- Ability to navigate through cells with data entered in the year

- Intuitive user interface

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Tax version, consult the Technical Release Notes.

Forms and Slips Coverage

The slips, RL slips and summaries included in CCH iFirm Taxprep Forms 2021 normally apply to the 2021 taxation year. You can nonetheless use them if you need to file a slip for the 2022 taxation year before the 2022 versions of the slips are made available by government authorities.

Individual forms can be used until they are updated by the CRA or RQ. Note that the CCH iFirm Taxprep Forms e-Bulletin notifies you each time an updated or new form is made available in an application update.

Rolling Files Forward

CCH iFirm Taxprep Forms allows you to roll forward client files that were saved with the 2020 version of Taxprep Forms or Cantax FormMaster, which have the .T20 extension, as well as client files saved with Taxprep Forms 2021 or Cantax FormMaster 2021 that have the .T21 and .T22 extension.

In addition, CCH iFirm Taxprep Forms allows you to roll forward files saved with Intuit’s ProFile FX application that have a .20X extension.

If you want to roll forward the files saved with the AvanTax eForms application that have a .T20N extension, please contact the Support Centre.

Electronic Filing

CCH iFirm Taxprep Forms enables you to electronically transmit data from the T5013 return and the following slips and RL slips:

|

Slips |

||

|---|---|---|

|

NR4 |

T5018 |

RL-8 |

|

T4 |

RRSP |

RL-11 |

|

T4A |

RL-1 T4 |

RL-15 |

|

T4A-NR |

RL-1 T4A |

RL-18 |

|

T4RIF |

RL-1 T4ANR |

RL-22 |

|

T4RSP |

RL-2 RIF |

RL-24 |

|

T5 |

RL-2 RSP |

RL-25 |

|

T2202 |

RL-2 T4A |

RL-27 |

|

T5008 |

RL-3 |

RL-31 |

|

T5013 |

RL-7 |

|

Government requirements

At the federal level and in Québec, any filer filing more than 50 information slips of a same type must file the data electronically by Internet. Below that threshold, paper filing is accepted.

Taxation years covered

Revenu Québec only accepts electronic transmissions of the RL slips for the 2021 and 2022 taxation years. The CRA does not impose restrictions about the taxation year that can be processed.

Important dates for Internet transmission

CCH iFirm Taxprep Forms 2021 complies with the latest Internet transmission requirements issued by government agencies. Files generated with CCH iFirm Taxprep Forms 2021 can therefore be electronically transmitted:

- To the CRA, starting on January 10, 2022, (date on which the CRA reopens its Internet transmission service, which will be closed on December 22, 2021, for update purposes);

- To Revenu Québec, without any delay (as Revenu Québec’s Internet transmission service has been updated on November 15, 2021).

CRA’s Web Access Code

If you already have a Web access code, you can use it to file your information returns for 2021 and subsequent years.

Version 5.0 Content

Updates and Additions

To review the updates and additions contained in version 5.0 of CCH iFirm Taxprep Forms 2021, consult the Updates and Additions table.

Comments and Details

FP-2189, General GST/HST and QST Rebate Application

Codes 13 and 20 are no longer available on this form for GST/HST purposes; please see the form’s instructions for more details. In part 2 of the form, changes have been made to restrict the selection to one code and to automatically select the QST equivalent, where applicable.

FP-2190.P, GST-QST New Housing Rebate Application: Owner of a new or Substantially Modified Home

The section 2.2.2 that contained the surface area of the renovated or the newly constructed building has been completely removed. Furthermore, section 2.2.1 is now included in section 2.2.

If you completed this form using a previous version of the program, we recommend that you review this section of the form before filing it.

FP-2190.L, GST-QST New Housing Rebate Application: Owner of a Home on Leased Land or a Share in a Housing Co-Op

The table in section 3 that contains information on the surface area of the renovated building before and/or after a major addition or a substantial renovation was completed, has been greatly simplified. Additionally, two sub-questions (88a and 89a) were added to the form as guidance for the tax preparator.

If you completed this form using a previous version of the program, we recommend that you review this section of the form before filing it.

GST20, Election for GST/HST Reporting Period

With the update of this form, the Threshold amount calculation chart that was previously in the General information section has been reclassified to step 3 of Part B.

RC7294, GST/HST and QST Final Return for Selected Listed Financial Institutions

Contact person information has been added to Part A of these forms.

LM-1, Application for Registration

Following the update, this form can no longer be used to obtain a registration number for the tax on insurance premiums and the municipal tax for 9-1-1 service. The information concerning these two taxes has therefore been removed from the form. In addition, the former sections 1, Basic information and 2, Information about the business have been reorganized and renamed 1, Individual in business and 2, Other legal form.

TD1NB, New Brunswick Personal Tax Credits Return

The basic personal amount of $11,720 is based on a budget announcement. Royal assent was received on June 10, 2022, following the government’s update of the form.

TP-930, Elections Respecting the RRSP of a Deceased Annuitant

As a result of an update, significant changes have been made to this form, among others:

- Several lines of the form have been renumbered.

- The information on the legal representative, the surviving spouse or the qualifying survivor and the registered retirement savings plan, which was previously presented in section 1, is now presented in sections 2 to 4.

- The remaining sections have been renamed and renumbered.

If you completed this form using a previous version of the program, we recommend that you review the entire form before filing it.

TP-1016, Application for a Reduction in Source Deductions of Income Tax

Following an update of the form, if the option Amount exempt from income tax under a tax agreement or treaty is selected in Part 3, it is required to enter an amount. In Part 5.1, the line to indicate whether the individual is self-employed or an employee has been replaced with checkboxes. If the form was prepared with a previous version, please update your selection.

TP-1102.1, Notice of Disposition or Proposed Disposition

The trust account number is now required in part 1 when the non-resident vendor is a trust, and the postal code is now reported separately from the rest of the address.

Version 4.0 Content

Updates and Additions

To review the updates and additions contained in version 4.0 of CCH iFirm Taxprep Forms 2021, consult the Updates and Additions table.

Comments and Details

GST111, Financial Institution GST/HST Annual Information Return

As a result of an update, significant changes have been made to this form. The following parts have been removed:

- Part E, Exported supplies;

- Part G, Tax adjustments;

- Part I, Change in use of capital property;

- Part J, Election to deem certain supplies to be financial services; and

- Part K, Income allocation to various jurisdictions.

The remaining parts have been renamed in consequence. Several changes were also made in parts A to D. If you completed this form using a previous version of the program, we recommend that you review the entire form before filing it.

The new version of the form should be used for an exercise ending after December 31, 2021. For an exercise ending before January 1, 2022, please use the form in the previous version of the program.

RC7291, GST/HST and QST Annual Information Return for Selected Listed Financial Institutions

As a result of an update, significant changes have been made to this form. The following parts have been removed:

- Part E, Exported supplies;

- Part G, Tax adjustments;

- Part I, Change in use of capital property;

- Part J, Election to deem certain supplies to be financial services; and

- Part K, Income allocation to various jurisdictions.

The remaining parts have been renamed in consequence. Several changes were also made in parts A to D. If you completed this form using a previous version of the program, we recommend that you review the entire form before filing it.

The new version of the form should be used for an exercise ending after December 31, 2021. For an exercise ending before January 1, 2022, please use the form in the previous version of the program.

T106 Slip

T106 Summary, Information Return of Non-Arm's Length Transactions with Non-Residents

A new version of Form T106 for taxation years starting after 2021 has been integrated into the program and only displays when the taxation year covered by the return starts after 2021. For taxation years starting prior to 2022, the previous version of the form must be used.

In the version of the form that applies for taxation years starting after 2021, new fields have been added in the T106 Slip:

- The field Taxpayer Identification Number (TIN) has been added at the beginning of Part II;

- In Part IV, a line has been added to indicate the information regarding an investment in the reporting entity by the non-resident;

- At the end of Part IV, new fields allow you to indicate if a Pertinent Loan or Indebtedness (PLOI) election was made and, if applicable, the amount of deemed interest related to the election.

In addition, for taxation years starting after 2021, when a reporting person’s total amount of transactions with a non-resident during the taxation year is below $100,000, it is not required to report these transactions in Part III of the T106 Slip. For taxation years starting prior to 2022, the threshold remains at $25,000.

TD1-IN, Determination of Exemption of an Indian’s Employment Income

As a result of an update, significant changes have been made to this form. Several questions to be answered by the employer have been added, and it is now required for the employer to sign the form as well. If you completed this form using a previous version of the program, we recommend that you review the entire form before filing it.

TP-1079.PN, Disclosure of a Nominee Agreement

The trust account number is now required when the entity is a trust in Section 2, Information about the taxpayers or partnerships party to the nominee agreement, and in Section 3, Information about other taxpayers or partnerships with tax consequences arising from the nominee agreement.

TPZ-1179, Logging Operations Return

The trust account number is now required when the taxpayer is a trust.

Rate, Table of Rates and Values Used in the Forms

The Department of Finance Canada announced on December 23, 2021, that the CCA ceiling for passenger vehicles is increasing from $30,000 to $34,000 (before taxes), and the ceiling for zero-emission passenger vehicles is increasing from $55,000 to $59,000 in respect of vehicles acquired after December 31, 2021. However, the CRA informed us that these increased ceilings would only be considered once a bill confirming this increase is tabled. At the date of publication of the program, a bill had still not been tabled.

In the T5013 Schedule 8 – Capital cost allowance (CCA) section of Form Table of Rates and Values Used in the Forms, we have added two lines to allow a different acquisition cost limit to be entered for vehicles acquired after December 31, 2021, versus those acquired before January 1, 2022. When the bill is tabled, these rates will be updated to reflect the new limits.

Note:

The Auditing and Assurance Standards Board (AASB) has issued a new Canadian Standard on Related Services (CSRS) 4200, Compilation Engagements. Under CSRS 4200, the use of disclaimers on any schedule of the tax return may no longer be appropriate, and a notice to reader is no longer considered an appropriate form of communication. Diagnostics have been added to inform you of this situation when you choose to use the disclaimers or the Notice to Reader letter template. These two elements will be removed from version 2022 1.0 of the program, which is scheduled to be released in December 2022.

Version 3.0 Content

Updates and Additions

To review the updates and additions contained in version 3.0 of CCH iFirm Taxprep Forms 2021, consult the Updates and Additions table.

Comments and Details

T777 – Statement of Employment Expenses

The Calculation of the percentage of the home used as a work space for work purposes subsection has been added to the Calculation of work-space-in-the-home expenses section.

When Form T777 was updated, the personal-use portion was removed from the Calculation of work-space-in-the-home expenses section. Please review the calculations in this section.

T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

For the 2021 taxation year, the maximum of home office expenses has increased from $400 to $500 with the temporary flat rate method.

T5013, Partnership Income

In its economic and fiscal update of December 14, 2022, the CRA proposed to add various tax credits. Therefore, boxes 237, Farmer fuel charge tax credit and 238, Ventilation system installation tax credit, have been added to Form T5013 Worksheet B, Summary of amounts to allocate to partners and Form T5013/RL-15, Partnership Income. However, the CRA will not be able to process requests for these appropriations until Bill C-8, An act to implement the economic and fiscal update of 2021, which is currently in second reading, has obtained royal assent. Therefore, if you do not want to delay the processing of your file, it is suggested that you do not fill in these boxes before the adoption of this bill.

Version 2.0 Content

Updates and Additions

To review the updates and additions contained in version 2.0 of CCH iFirm Taxprep Forms 2021, consult the Updates and Additions table.

Comments and Details

Client letters and Client letter, Worksheet

To resolve a display problem with date fields in the paragraphs, we replaced the second date fields which were protected with new protected fields in the following sections of the Client Letter Worksheet form:

- Identification of client

- Other information

- T3/RL-16 – Trust income

- T4/RL-1 – Employment income

- T4A/RL-1/RL-2 – Pension and other income

- T5/RL-3 – Investment income

- NR4 – Statement of amounts paid or credited to non-residents of Canada

- T5008/RL-18 – Statement of securities transactions

- RL-24 – Childcare expenses

- RL-31 – Information on the occupancy of a dwelling

- T3010/TP-985.22 – Registered Charity Information Return

- T5013FIN/TP-600 – Partnership financial return

- Form(s) to sign and send or keep

In addition, we have also replaced all date fields that were used in the Client letter, Instructions for filing slips,RL slips and T3010/TP-985.22 return, Client letter T5013, Filing instructions for the T5013 and TP-600 partnerships returns, Client letter, Additional letter, Client letter, Notice to Reader and Client letter Québec, Notice to Reader. Adjust your customized letters, if necessary.

LE-39.0.2, Calculation of the Contribution Related to Labour Standards

RL-1 Summary, Summary of Source Deduction and Employer Contributions

The Government of Québec recently passed the Act to modernize the occupational health and safety regime. Therefore, effective in 2022, new categories of employers will be required to pay the contribution related to labour standards. Depending on the category, their contribution rate will be the regular 0.06% rate or a reduced rate of 0.02%. The reduced rate will be 0.03% in 2023 and 0.05% in 2024. Beginning in 2025, the rate will be the same for all employers.

As a result, several changes have been made to the Contribution relating to labour standards section of temporary Summary 1. Box 40 has been added to enter the code corresponding to the type of employer for employers subject to the reduced rate. In addition, the calculation of the contribution related to labour standards is now presented in a table in order to apply the correct contribution rate.

Changes have also been made to the LE-39.0.2 form. Box 1a, Employer code, has been added to Section 1. Section 3 has been renamed Remuneration subject to the contribution and Section 4, Contribution relating to labour standards, has been added and includes a table similar to the one in the Summary 1.

Version 1.0 Content

Updates and Additions

To review the updates and additions contained in version 1.0 of CCH iFirm Taxprep Forms 2021, consult the Updates and Additions table.

Comments and Details

Preparer profile

The option Do not allow e-mail address entry in any of the forms in the return has been added to Options – Forms in the General Information tab of the preparer profile. When this option is selected, a diagnostic will display in the return to prevent you from entering or editing information in the e-mail address fields. This option is set to No by default. Note that when converting the preparer profile, this option selection will be retained. The roll forward for the e-mail address is not impacted by this addition. Therefore, any e-mail address entered will be rolled forward.

Mandatory Electronic Filing Threshold

In its April 19, 2021 Budget, the Government of Canada announced its intention to lower the mandatory electronic filing threshold of income tax information returns from 50 to 5 returns. However, note that this measure is not yet in force. For the latest information, refer to the CRA Web site at canada.ca/mandatory-electronic-filing. You can also subscribe to their Electronic Filing of Information Returns e-mail distribution list at canada.ca/cra-email-lists.

FP-2190.AC-V, GST -QST New Housing Rebate Application for a New Home Purchased from a Builder

As a result of the update of the form, the fields GST/HST account and Identification number in subsection 2.1 as well as the entire subsection 2.2.2, Surface area of home, have been removed from the form.

GST191-WS, Construction Summary Worksheet

As a result of an update, the form underwent significant changes. Two fields have been added in Part A. One field is to be used to report the claimant’s legal name and the other is to report the date the construction or substantial renovation became substantially complete. In Part B, the fields to describe how the fair market value was determined and to detail the substantial renovations or the major addition have been replaced with text boxes to facilitate the description entry. In Part C, fields have been added to enter the description of goods and services in the Others subsection.

NR4 Summary, Summary of Amounts Paid or Credited to Non-residents of Canada

The non-resident account number and the payer name will now be updated from the corresponding information in the Client identification - Individual section of the ID form, provided this section is completed.

R102-R, Regulation 102 Waiver Application

A check box has been added to Section I – Applicant Identification to indicate if Form T1261, Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-Residents, has been sent to the Sudbury Tax Centre.

R105, Regulation 105 Waiver Application

A check box has been added to Section I – Applicant Identification to indicate if Form T1261, Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-Residents, has been sent to the Sudbury Tax Centre.

T4/RL-1, Employment Income

As result of an update, the following four code names have been modified in the drop-down lists of lines Other information in Section Information to report – Other:

- 57, Employment Income – March 15 to May 9, 2020;

- 58, Employment Income – May 10 to July 4, 2020;

- 59, Employment Income – July 5 to August 29, 2020;

- 60, Employment Income – August 30 to September 26, 2020.

These codes should be used to report employment income and retroactive payments made during 2020 pay periods only.

T4A, Pension and Other Income

Box 210, Postdoctoral Fellowship Income, has been added to the Information to report – Other section. The amount in this box must be included in box 105. Therefore, this box has been split in two: custom box 1051, Scholarships, bursaries, fellowships, artists' project grants, and prizes (box 210), corresponds to the amount in box 210 and box 1052, Scholarships, bursaries, fellowships, artists' project grants, and prizes (excluding box 210), must exclude postdoctoral fellowships income. The total of the amounts in boxes 1051 and 1052 will be updated to the T4A slip.

If you completed the T4A slip using a prior version of the program and a postdoctoral fellowship income amount is included in box 105, reclassify this amount in box 210.

T2062, Request by a Non-Resident of Canada for a Certificate of Compliance Related to the Disposition of Taxable Canadian Property

A check box has been added to the Vendor (non-resident) section to indicate whether Form T1261, Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-Residents, has been sent to the Sudbury Tax Centre.

TP-518, Transfer of Property by a Taxpayer to a Taxable Canadian Corporation

TP-614, Transfer of Property to a Canadian Partnership

As a result of the update of these forms, box 06, Trust account number, has been added to subsection 1.1.

T5013, Partnership Information Return and schedules

At the time of release, we still have not received a response from the CRA concerning the paper approval and XML certification for the partnership information return form. As a result, the T5013 return and schedules are up to date, but cannot be used for paper or electronic filing.

The T5013 return and schedules will be available for paper and electronic filing in the next version.

Where to Find Help

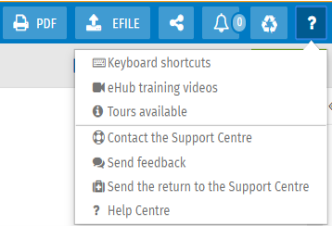

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the Help, click the following icon:

How to Reach Us

Technical and Tax support

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com