CCH iFirm Taxprep Forms 2022 v.5.0 (2023.20.35.01) Release Notes

Our Support Centres are Going Digital: Emails are Now Our First Priority

As part of our transformation to digital support centres, we are pleased to announce that email inquiries will now be given first priority. This digital shift will allow us to process your requests even faster, and better meet your needs.

From now on, use emails instead of telephone to contact Customer Service and the Support Centre by including your account number and the name of your product in the subject line as well as detailed information in your email (form/line/diagnostic number, print screens, etc.) to get accelerated service!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Tax is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, powered by Taxprep software programs, built and enhanced over many years

- Comprehensive diagnostics with audit trail of user‑reviewed diagnostics

- Ability to navigate through cells with data entered in the year

- Intuitive user interface

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Tax version, consult the Technical Release Notes.

Forms and Slips Coverage

The slips, RL slips and summaries included in CCH iFirm Taxprep Forms 2022 normally apply to the 2022 taxation year. You can nonetheless use them if you need to file a slip for the 2023 taxation year before the 2023 versions of the slips are made available by government authorities.

Individual forms can be used until they are updated by the CRA or RQ. Note that the CCH iFirm Taxprep Forms e-Bulletin notifies you each time an updated or new form is made available in an application update.

Rolling Files Forward

CCH iFirm Taxprep Forms allows you to roll forward client files that were saved with the 2021 version of Taxprep Forms or Cantax FormMaster, which have the .T21 extension, as well as client files saved with Taxprep Forms 2022 or Cantax FormMaster 2022 that have the .T22 and .T23 extension.

In addition, CCH iFirm Taxprep Forms allows you to roll forward files saved with Intuit’s ProFile FX application that have a .21X extension.

If you want to roll forward the files saved with the AvanTax eForms application that have a .T21N extension, please contact the Support Centre.

Electronic Filing

CCH iFirm Taxprep Forms enables you to electronically transmit data from the T5013 return and the following slips and RL slips:

|

Slips |

||

|---|---|---|

|

NR4 |

T5018 |

RL-8 |

|

T4 |

RRSP |

RL-11 |

|

T4A |

RL-1 T4 |

RL-15 |

|

T4A-NR |

RL-1 T4A |

RL-18 |

|

T4RIF |

RL-1 T4ANR |

RL-22 |

|

T4RSP |

RL-2 RIF |

RL-24 |

|

T5 |

RL-2 RSP |

RL-25 |

|

T2202 |

RL-2 T4A |

RL-27 |

|

T5008 |

RL-3 |

RL-31 |

|

T5013 |

RL-7 |

|

Government requirements

At the federal level and in Québec, any filer filing more than 50 information slips of a same type must file the data electronically by Internet. Below that threshold, paper filing is accepted.

Budget 2021 announced that the threshold for mandatory electronic filing of income tax information returns for a calendar year would be lowered from 50 to 5 information returns.

The legislation for this measure was not finalized at the time of publication. For the latest information about the penalty for not filing information returns over the Internet, go to Penalty for failure to file information returns over the Internet.

Taxation years covered

Revenu Québec only accepts electronic transmissions of the RL slips for the 2022 and 2023 taxation years. The CRA does not impose restrictions about the taxation year that can be processed.

Important dates for Internet transmission

CCH iFirm Taxprep Forms 2022 complies with the latest Internet transmission requirements issued by government agencies. Files generated with CCH iFirm Taxprep Forms 2022 can therefore be electronically transmitted:

- To the CRA, starting on January 9, 2023;

- To Revenu Québec, without any delay (as Revenu Québec’s Internet transmission service has been updated in November 2022).

CRA’s Web Access Code

If you already have a Web access code, you can use it to file your information returns for 2022 and subsequent years.

Version 5.0 Content

Updates and Additions

To review the updates and additions contained in version 5.0 of CCH iFirm Taxprep Forms 2022, consult the Updates and Additions table.

Comments and Details

AUT-01, Authorize a Representative for Offline Access and

AUT-01X, Cancel Authorization for a Representative

New boxes have been added to Step 1, Account information, to enter another CRA identifier and type if you identified a non-resident account number. The list of program identifiers for business numbers has also been updated to include new identifiers such as LT for the luxury tax and RU for the underused housing tax. Changes have been made to the options for the signee in Step Certification. Validate that the appropriate option has been selected before having the form signed. Finally, if you are making a request for a non-resident account, the forms will now have to be sent to the Sudbury Tax Centre regardless of the province of residence or the language used to file the forms.

Client Identification and Other Information

A validation has been added to the tax year to prevent a year end prior to the period covered by the table of rates from being entered. CCH iFirm Taxprep Forms 2022 covers year ends ending between January 1, 2022, and December 31, 2023.

FP-505.D.F, GST/HST – QST Return for a Person That Is Not a GST/HST or QST Registrant

Lines 4 and 9 as well as lines 5 and 10 have been added to section 3, Taxes payable or rebate, so that the calculation considers the refunds used to reduce or offset taxes payable, if applicable. In addition, the format of the filing deadline has been modified so that only the year and month are visible.

GST10, Application or Revocation of the Authorization to File Separate GST/HST Returns and Rebate Applications for Branches or Divisions

A validation step for the business number has been added to Part A to reject incomplete entries from the Identification form. A previously entered number that was incomplete will not be retained when the program is updated.

The Physical business location subsection has been added to Part A, Identification – Head office, and to Part C, Application or revocation. The custom question The mailing address is the same as the physical business location has been added to Part C to facilitate the filing of the form. If the Yes box is checked, the business location will be reproduced in the mailing address.

Part C, Application or revocation, and Part C, Application or revocation (continued), have been merged in the updated form. Part C, Application or revocation, is now Part C, Application or revocation – 1. Part C, Application or revocation (continued), is now found in Part C, Application or revocation – 2 and in the following occurrences of that part.

In Part C, it is now possible to choose a separate request for authorization or revocation for each branch or division. Similarly, it is now possible to enter a separate effective date of application or revocation for each branch or division.

If you completed this form using a prior version of the program, it is recommended that you review the form before filing it.

T4A/RL-1/RL-2 Data Entry Screen – Pension and Other Income

The following changes have been made to the form to facilitate the transfer of information from box 28, Other income – Amounts not reported anywhere else on the T4A slip, to codes RS, Financial assistance, and RO, Benefits received by a shareholder, of the RL-1 slip:

-

Custom box 281, Employment support allowance, has been created and box RL-1 RS, Financial assistance, has been moved and will now be calculated from box 281.

-

Customs boxes 282 and RL-1 RO1, Benefits granted to a shareholder, including a motor vehicle benefit, have been created. Box RL-1 RO1 will be calculated from box 282.

-

Former box 28 has been renumbered 283.

-

Former box RL-1 RO, Loan benefits, has been renumbered RL-1 RO2.

If you completed this form with a previous version of the program, we suggest that you validate the information in these boxes before filing your T4A and RL-1 slips.

T777, Statement of Employment Expenses

The labour mobility deduction has been added to the available employment expenses. An eligible tradesperson can claim up to $4,000 of eligible temporary relocation expenses. A chart has been added to the form to calculate the new deduction amount.

Version 4.0 Content

Updates and Additions

To review the updates and additions contained in version 4.0 of CCH iFirm Taxprep Forms 2022, consult the Updates and Additions table.

Comments and Details

T1441, Qualifying Disbursements: Grants to Non-Qualified Donees (Grantees)

The new Form T1441 must be completed by registered charities that have made qualifying disbursements by way of grants totalling more than $5,000 to non-qualified donees (grantees) that meet accountability requirements of the Income Tax Act. The addition of the form is also related to the new C16 question of Form T3010.

DISBQUOTA, Worksheet – Disbursement Quota

The Disbursement Quota Worksheet for registered charity has been updated due to a change in the Income Tax Act that was announced in the 2022 federal budget. The question Is the registered charity a charitable organization? has been added at the top of the form. In addition, a bracket in sections Calculating the disbursement quota requirement for the fiscal period covered by the return and Estimating the disbursement quota requirement for the next fiscal period has been added to reflect the new 5% rate on investment assets exceeding $1,000,000 for a charity’s fiscal period beginning on or after January 1, 2023. Please note that if a charity's fiscal year began before January 1, 2023, the 3.5% rate will be applied to investment assets exceeding $1,000,000. The presentation of the prorated number of days in the fiscal year has also been changed in these same sections. Finally, the tax year of the next fiscal period has been added in section Estimating the disbursement quota requirement for the next fiscal period.

If you have completed this form using a previous version of the program, it is recommended that you review the form.

FP-2190.AC, GST-QST New Housing Rebate Application for a New Home Purchased from a Builder

This form has been updated to version 2022-11 and should be used if the purchase agreement was entered into with the builder after April 19, 2021. If the agreement was entered into on or before this date, please use version 2021-10 of the form instead, available in versions 2021.5.0 to 2022.3.0 of CCH iFirm Taxprep Forms.

In addition, the questions on lines 41 and 42 have been amended to reflect the fact that the home may be used not only by the person completing the form or one of his or her relations, but also by one of the co-owners or one of his or her relations.

FP-2190.L, GST-QST New Housing Rebate Application Owner of a Home on Leased Land or a Share in a Housing Co-Op

This form has been updated to version 2022-11 and should be used if the agreement with the builder or under which you purchased a share of the capital stock of a housing co-op was entered into after April 19, 2021. If the agreement was entered into on or before this date, please use version 2021-10 of the form instead, available in versions 2021.5.0 to 2022.3.0 of CCH iFirm Taxprep Forms.

In addition, the questions on lines 41 and 42 have been amended to reflect the fact that the home may be used not only by the person completing the form or one of his or her relations, but also by one of the co-owners or one of his or her relations.

FP-2190.P, GST-QST New Housing Rebate Application: Owner of a New or Substantially Modified Home

This form has been updated to version 2022-11 and should be used only if the construction or substantial modification of the home was substantially completed after April 19, 2021. If the construction or substantial modification of the home was completed on or before this date, please use version 2021-10 of the form instead, available in versions 2021.5.0 to 2022.3.0 of CCH iFirm Taxprep Forms.

In addition, the questions on lines 41 and 42 have been amended to reflect the fact that the home may be used not only by the person completing the form or one of his or her relations, but also by one of the co-owners or one of his or her relations.

GST191, GST/HST New Housing Rebate Application for Owner-Built Houses;

GST524, GST/HST New Residential Rental Property Rebate Application; and

LM1, Application for Registration

The list of banking institution numbers has been updated and several changes have been made. If a withdrawn code has been entered in Part F of Form GST191, in Part G of Form GST524 or in Part 7 of Form LM1, it will be deleted. In all circumstances, it is advisable to validate the banking information before filing one of these forms.

RL-1 T4 Slip, Employment and Other Income;

RL-1 T4A Slip, Employment and Other Income; and

RL-1 T4A-NR Slip, Employment and Other Income

Diagnostics have been added to block the electronic transmission of these slips if the identification number for source withholdings (RS) is missing. Indeed, this information is mandatory according to the tax specifications of the RL-1 slip.

T101B, Adjustment to Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs) previously renounced

Columns Federal – CEE Critical mineral exploration tax credit and Provincial – CEE Critical mineral exploration tax credit have been added to the table in Step 5 of Part 2, Adjustments to amounts previously renounced. If you check the box Complete T101 slips based on information in Form T101B, boxes 122, 151, 153 and 154 of the slip will be calculated with the information in these new columns from now on.

T776, Statement of Real Estate Rentals;

T2042, Statement of Farming Activities;

T2125, Statement of Business or Professional Activities; and

T2121, Statement of Fishing Activities

Area A – Calculation of capital cost allowance (CCA) claim has been updated in the Statement of Business forms. While columns and their relevant instructions have been added to the CCA charts and can be printed, they do not contain any new calculations, as they are used exclusively for immediate expensing. Immediate expensing is not supported in the current version of these forms, nor will it be in future versions. Furthermore, Area G – Agreement between associated eligible persons or partnerships (EPOPs) has been added to print only; as a result, it cannot be filled in the program.

T2057, Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation

Significant changes have been made to this form. The main changes are as follows:

-

Numbering has been added to boxes and sections.

-

In Part 1, Identification, a table has been added so that the name and social insurance number of all co-owners can be indicated.

-

In Part 3, Information required, a table has been added so that more than one corporation can be listed when shares of the capital stock of a private corporation are included in the property disposed of.

-

In the table in Part 4, Description of shares received, the column 251 has been added to indicate whether these shares received are common shares. In addition, the column Class of shares has been renamed Class of shares other than Common. The information about common shares can therefore be removed from this column.

-

The section Information on the property disposed of and consideration received has been moved to the end of the form in Schedule A. In the tables in this schedule, two columns have been added to separate fair market value (FMV) of the consideration received for share, from consideration received for property other than shares.

-

In Schedule A, the table Capital property excluding depreciable property has been renamed Capital property (other than shares and depreciable property) and the table Capital property (shares only) has been added. The information will all be kept in the first table. If applicable, shares will have to be manually moved to the second table.

-

In Schedule A, the table Eligible capital property has also been deleted.

If you have completed the form with a previous version of the program, it is expected that most of the information will be transferred automatically. However, it is strongly suggested to review the entire form before filing it. If you are also required to file Form TP-518, Transfer of Property by a Taxpayer to a Taxable Canadian Corporation, it is also suggested to review the form before filing it, as much of the information it contains is taken from Form T2057.

T2058, Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation

Significant changes have been made to this form. The main changes are as follows:

-

Numbering has been added to boxes and sections.

-

In Part 3, Information required, a table has been added so that more than one corporation can be listed when shares of the capital stock of a private corporation are included in the property disposed of.

-

In the table in Part 4, Description of shares received, the column 251 has been added to indicate whether these shares received are common shares. In addition, the column Class of shares has been renamed Class of shares other than Common. The information about common shares can therefore be removed from this column.

-

In Part 5, Election and certification, a table has been added so that information about all partners in the partnership can be indicated. The question 300 has also been added to validate whether an authorizing agreement is in place. If not, all partners will be required to sign the form in column 345 of this table.

-

The section Information on the property disposed of and consideration received has been moved to the end of the form in Schedule A. In the tables in this schedule, two columns have been added to separate fair market value (FMV) of the consideration received for share, from consideration received for property other than shares.

-

In Schedule A, the table Capital property excluding depreciable property has been renamed Capital property (other than shares and depreciable property) and the table Capital property (shares only) has been added. The information will all be kept in the first table. If applicable, the shares will have to be manually moved to the second table.

If you have completed the form with a previous version of the program, it is expected that most of the information will be transferred automatically. However, it is strongly suggested to review the entire form before filing it. If you are also required to file Form TP-529, Transfer of Property by a Partnership to a Taxable Canadian Corporation, it is also suggested to review the form before filing it, as much of the information it contains is taken from Form T2058.

T2059, Election on Disposition of Property by a Taxpayer to a Canadian Partnership

Important changes have been made to this form. Here are the main changes:

-

Numbering has been added to boxes and sections.

-

In Part 3, Information required, a chart has been added so that more than one corporation can be listed when shares of the capital stock of a private corporation are included in the property disposed of.

-

In Part 4, Election and certification, charts have been added so that information about all partners of the transferor partnership, if applicable, and of the transferee partnership can be indicated. A question has also been added in each section to validate whether an authorizing agreement is in place. If not, all partners will have to sign the form.

-

The section Information on the property disposed of and consideration received is now in Schedule A. In the charts of this schedule, columns have been added to separate consideration received as partnership interest, from consideration received as non-partnership interest.

-

In Schedule A, the chart Capital property excluding depreciable property has been renamed Capital property (other than shares and depreciable property) and the chart Capital property – shares only has been added. The information will be kept in the first chart. If applicable, shares will have to be manually moved to the second chart.

-

In Schedule A, the chart Inventory has been renamed Inventory excluding real property and the chart Inventory – real property has been added. The information will be kept in the first chart. If applicable, real property will have to be manually moved to the second chart.

If you prepared the form with a previous version of the program, it is expected that most of the information will be transferred automatically, despite changes to the layout. However, it is highly recommended to review the entire form before filing it. If you are also required to file Form TP-614, Transfer of Property to a Canadian Partnership, it is also recommended to review that form before filing it, as much of the information it contains is transferred from Form T2059.

T3010, Registered Charity Information Return

In section C, Programs and general information, Part C16 has been added to the return. There are four new questions regarding qualifying disbursements by way of grants to non-qualified donees (grantees). In addition, line 5045 in Section D, Financial Information, and line 5045 in Schedule 6, Detailed Financial Information, have been added.

Also, since grants to non-qualified donees totalling more than $5,000 require the filing of Form T1441, Qualifying Disbursements: Grants to Non-Qualified Donees (Grantees), this form has been added to the Checklist section of the T3010 return.

Finally, please note that the term “gifts to qualified donees” has been replaced by “qualifying disbursements”.

UHT-2900, Underused Housing Tax Return and Election Form; and

List of UHT-2900 Returns

Part 1, Information about the owner, has been modified to allow overrides and direct data entry. As well, since fields 002 to 105 of Part 1 are common to all UHT-2900 returns that are prepared in the same file, they are now displayed only on the first slip.

Form List of UHT-2900 Returns has been added to track all UHT-2900 returns that have been prepared.

Version 3.0 Content

Updates and Additions

To review the updates and additions contained in version 3.0 of CCH iFirm Taxprep Forms 2022, consult the Updates and Additions table.

Comments and Details

T100A, Flow-through Share Information – Application for a Selling Instrument T100 Identification Number (SITIN)

As a result of the update of this form, new critical mineral options have been added to Section C of Part 2, Exploration and Development Sector Information. In addition, item 7 has been added to the checklist to validate that Form T100A-CERT, Certificate of Qualified Professional Engineer or Professional Geoscientist, is attached to the application, if applicable.

T101A, Claim for Renouncing Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures

Several changes have been made to this form following its update. First, new critical mineral options have been added to Section C of Part 2, Exploration and Development Sector Information. Second, the columns Federal – CEE Critical mineral exploration tax credit and Provincial – CEE Critical mineral exploration tax credit have been added to the table in Step 4 of Part 3, Renunciation of eligible resource expenditures. If you select the option Complete T101 slips based on information in Form T101A, boxes 122, 151, 153 and 154 of the slip will be calculated with the information in these new columns from now on.

UHT-2900, Underused Housing Tax Return and Election Form

In its budget of April 7, 2022, the Canada Revenue Agency announced the introduction of a tax for underused housing. This 1% tax took effect on January 1, 2022. The tax applies to non-resident and non-Canadian owners of residential real estate in Canada, and to certain Canadian owners in some situations. As a result, the CRA issued the new UHT-2900 form to pay this tax or to claim an exemption from it. This return must be filed for a calendar year by April 30 of the following calendar year. It should be noted that a significant penalty for failing to file the return on time may apply. Affected owners who are individuals are in fact subject to a minimum penalty of $5,000 and those that are corporations are subject to a minimum penalty of $10,000, even if the tax payment is sent in the timeframe expected.

You can refer to FAQ FTF2022-002 for more information on how to file this return.

Version 2.0 Content

Updates and Additions

To review the updates and additions contained in version 2.0 of CCH iFirm Taxprep Forms 2022, consult the Updates and Additions table.

Comments and Details

NAICS codes

The CRA has released an update to the NAICS. The codes have been converted in the program when applicable. Please verify that the NAICS codes on the various forms and returns are still accurate.

T101 Slip, Statement of Resource Expenses

On December 15, 2022, Bill C-32 received Royal Assent. This bill includes a new 30% critical mineral exploration tax credit for specified mineral exploration expenses (CMETC) incurred in Canada that are renounced to flow-through share investors. As a result, boxes 122, Expenses qualifying for an ITC – CMETC, and 123, Portion subject to an interest-free period – CMETC, have been added to the T101 slip for federal tax credit purposes. In the section Expenses qualifying for a provincial tax credit, boxes 151, British Columbia, 153, Saskatchewan, and 154, Manitoba, have been added to the new CMETC column, while box 143, Saskatchewan, has been added to the METC column.

Note that boxes 122, 151, 153 and 154 cannot be calculated at this time. Forms T101A, Claim for Renouncing Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs), and T101B, Adjustment to Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDE) previously renounced, are expected to be updated and will include the missing calculations.

T1159, Income Tax Return for Electing under Section 216

Line 21, Air quality improvement tax credit, has been added to this form.

T2054, Election for a Capital Dividend Under Subsection 83(2)

Several changes have been added to Form T2054. You must now use this version of the form when electing for a capital dividend under subsection 83(2) of the Income Tax Act. First, the instructions at the beginning of the form have been modified. As such, Schedule 89 must be attached to Form T2054 when either of the following situations apply:

-

You have never filed Form T2054 or Schedule 89 before.

-

You disagree with either the amount shown in your CDA balance that is indicated on the My Business Account website or with your recently received CDA balance from the Canada Revenue Agency.

Also, in Part 1, Identification, the name of the firm is now asked while the mailing address of the contact person has been removed. In addition, the question Has there been an acquisition of control since the date of the last election? has been added in Part 2, Required information. Also, the question regarding a capital dividend received from another corporation or distributed by a trust has been moved from Part 3, Capital dividends received from other corporations, to Part 2. The following parts have been added:

-

Part 4 – Capital dividends distributed to the corporation from a trust

-

Part 5 – Capital gain or loss during the current tax year

-

Part 6 – Shareholder information

-

Part 7 – Additional information – Life insurance

Furthermore, the line's numbers have been added to the form to reflect the official CRA form. If you have completed this form using a previous version of the program, it is recommended that you review the entire form before filing.

T5013 Schedule 52, Summary Information for Partnerships that Allocated Renounced Resource Expenses to their Members

Following the new 30% critical mineral exploration tax credit for specified mineral exploration expenses incurred in Canada that are renounced to flow-through share investors, changes have been made in Part 1 of Schedule 52. As a result, we added columns 310 and 312 in Part 1 to write the expenses allocated to the partners. Box 239, Critical mineral exploration tax credit (CMETC), and box 240, Portion subject to an interest-free period – CMETC, have also been added on T5013, Worksheet B, Summary of amounts to allocate to partners, and T5013/RL-15, Partnership income.

T5013 CCA, General CCA Classes

On December 12, 2022, the Government of Québec released Bill 6. According to this bill, an accelerated investment incentive property that is an eligible intellectual property or that is included in class 50 is also excluded from designated immediate expensing property. As a result, the calculation of the line Cost of acquisitions of DIEP in the Québec column has been adjusted for classes 44 and 50.

TP-80, Business or Professional Income and Expenses

If you are an accountant, a dentist, a lawyer, a notary, a physician, a veterinarian or a chiropractor, the value of the work in progress at the end of the year must be included in your income for the year. If you had elected, for the federal income tax return, to exclude the value of the work in progress at the end of the year from your income and the election was still valid during the last tax year that started before March 22, 2017, a transitional measure stating that the full value of this work would be included in your income for the year as of the fifth tax year beginning after March 21, 2017, was applicable. This transitional measure is no longer in effect. Moreover, for the tax years ending in 2022 and the following tax years, the entire value of the work in progress at the end of the fiscal period must be included in your income.

Version 1.0 Content

Updates and Additions

To review the updates and additions contained in version 1.0 of CCH iFirm Taxprep Forms 2022, consult the Updates and Additions table.

Comments and Details

Immediate Expensing

This measure provides that the capital cost of eligible depreciable property may be deducted entirely, up to a limit of $1.5 million per year. CCH iFirm Taxprep Forms allows this measure to be processed for partnerships only. Therefore, the following changes have been made in the program:

T5013 Schedule 8, Capital Cost Allowance (CCA)

Several changes have been made to this form. First, the custom question Is the partnership eligible for immediate expensing in the current fiscal period? has been added to the form. Immediate expensing will be calculated only if you answer Yes to this question.

Part 1, Agreement between associated eligible persons or partnerships (EPOPs), has been added to the form. If the answer to the new question, Are you associated in the fiscal period with one or more EPOPs with which you have entered into an agreement under subsection 1104(3.3) of the Regulations? is Yes, you will need to complete the table in this section. This table allows you to indicate the percentage of the immediate expensing limit assigned under the agreement to each corporation, individual and partnership of an associated group.

We have also added the custom section Immediate expensing limit before the UCC limit of the DIEP to present the limit used to calculate immediate expensing.

New columns have also been added to the table in Section 2, CCA Calculation, for the calculation of immediate expensing:

-

Column 4, Cost of acquisitions from column 3 that are designated immediate expensing property (DIEP)

-

Column 9, Proceeds of dispositions of the DIEP

-

Column 11, UCC of the DIEP

-

Column 12, Income earned from the business or property in which the DIEP is used

-

Column 13, Immediate expensing

-

Column 14, Cost of acquisitions on remainder of Class

-

Column 15, Cost of acquisitions from column 14 that are accelerated investment incentive properties (AIIP) or properties included in Classes 54 to 56

-

Column 16, Remaining UCC

T5013 General CCA, General CCA Classes

T5013 Vehicle CCA, CCA Class 10.1

T5013 Leasehold CCA, CCA Class 13

New lines corresponding to the new columns in the CCA table on Form T5013 Schedule 8 have been added to these forms. We have also added the question Is the property a designated immediate expensing property (DIEP) for the fiscal period? for class 10.1 and the question Are all assets acquired in the current year DIEP? for class 13 and the general classes. The answer to these questions will be taken into account in the calculation of line Cost of acquisitions of DIEP.

TP-130.EN, Immediate Expensing Limit Agreement

This form is used to allocate the $1.5 million immediate expensing limit among the associated eligible persons or partnerships in Québec. Much of the information is taken from the table in Part 1 of Form T5013 Schedule 8.

In addition, in the instructions at the top of the form, Revenu Québec asks that the federal immediate expense limit agreement be attached to Form TP-600, Partnership Information Return.

TP-600.B, Schedule B – Capital Cost Allowance

Some column headings have been changed to take into account the new measures concerning immediate expensing. However, the calculation of this measure is based on the new Form CO-130.AD.

CO-130.AD, Capital Cost Allowance for Immediate Expensing Property

This Québec form allows you to enter the information regarding the designated immediate expensing property (Part 2) and calculate the immediate expensing amount deducted (Part 3) for the fiscal period.

ID, Client Identification and Other Information

A validation message has been added to the Trust Account Number fields. If an incorrect trust account number is entered, a pop-up message will prompt you to enter a valid one.

RL-18 slip, Securities Transactions

Revenu Québec now allows tax preparers to add a second recipient represented by a business name when the slip’s recipient type is a holder of a joint account. You can do so using the new section Business name of the 2nd recipient (joint account) of T5008’s data entry screen. However, the second recipient can only be an individual when it comes to completing and efiling the T5008. For this reason, the new section is only available when recipients are in Québec. If the new section isn’t completed, the program considers the second recipient is an individual when completing the T5008 and the RL18, exactly like it used to.

RL-24 slip, Childcare Expenses

As stipulated in the Information Bulletin 2021-8 and in the Instructions for completing RL-24 slips, any person who provides childcare services in Québec for remuneration will be subject to the obligation to file a RL-24 slip and send a copy to the payers so they can claim the refundable tax credit for childcare expenses. For greater clarity, the tax legislation will be amended so that the issuance of one or more receipts will no longer be accepted as proof of payment of qualified childcare expenses. These changes will apply in respect of childcare expenses paid for services rendered as of the 2022 taxation year.

RC232, Corporations Information Act Annual Return

Following the announcement on April 30, 2021, by the Canada Revenue Agency, Form RC232 is no longer available for download on the canada.ca website and will no longer be processed by the Agency. Because Ontario’s information returns are now only filed directly through the Ontario Business Registry (online), Form RC232 has been removed from version 2022.1.0 of the program.

T4 slip – Statement of remuneration paid (T4SUPP ), RL-1 T4 slip – Employment and other income (RL1 T4), T5 slip – Statement of investment income (T5SUPP), RL-3 slip – Investment income (RL3), T5013 slip – Statement of partnership income (T5013SUPP) and RL-15 slip – Amounts allocated to the members of a partnership (RL15SUPP)

The slips in screen review format (SUPP) were added for T4, T5 and T5013 slips, and for RL-1, RL-3 and RL-15 slips.

T5013 Schedule 6, Summary of Dispositions of Capital Property

Part 12 has been added to Form T5013 Schedule 6 for the disposition of an interest in a partnership that is subject to a 100% inclusion rate under subsection 100(1).

T5013 Schedule 63, Return of Fuel Charge Proceeds to Farmers Tax Credit

This new schedule is used to calculate the refundable tax credit for the return of fuel charge proceeds to farmers after December 31, 2020. A minimum of $25,000 in gross eligible farming expenses is required to qualify for this tax credit. The applicable payment rate depends on the fiscal period and the province in which the entity operates. The amount of the tax credit for each designated province is allocated to partners on lines 530 to 560 and is carried over to box 237 of Form T5013/RL-15, Partnership Income. Where the entity operates in more than one designated province, the amounts will carry over to the generic boxes of Form T5013/RL-15.

T5013 Schedule 65, Air Quality Improvement Tax Credit

This new schedule is used to calculate the refundable tax credit at a rate of 25% of qualifying ventilation expenditures incurred by an eligible entity during the qualifying period starting on September 1, 2021, and ending on December 31, 2022. This tax credit is subject to a maximum of $50,000 in qualifying expenditures across all qualifying locations and a maximum of $10,000 in qualifying expenditures per qualifying location. Eligible entities that are affiliated must share these limits. The amount on line 510 is allocated to eligible partners of the partnership in box 238 of Form T5013/RL-15, Partnership Income.

Notice to reader removed

As a result of the coming into force of the new Canadian Standard on Related Services (CSRS) 4200, Compilation Engagements, published by the Auditing and Assurance Standards Board, the software introduces changes to the Notice to Reader.

CSRS 4200 addresses compilation engagements, also referred to as “Notice to Reader” in practice and contains new conducting and reporting requirements. Therefore, to align with key changes, including scope and reporting standards, the Notice to Reader is taken from the software.

The removal of the Notice to Reader is showcased in the following locations in the software:

-

removal of the Notice to Reader letter (Federal and Québec)

-

removal of options in Preparer profile section related to Notice to Reader and disclaimers

-

changes in Form ID and Letter C.

The following is retained:

-

the Custom mention option in preparer profile

-

the Engagement letter.

If you were using your own text in the Customized note section of the preparer profile, we recommend checking whether the text is still appropriate in light of the changes that have been made to the Canadian Standard on Related Services (CSRS) 4200.

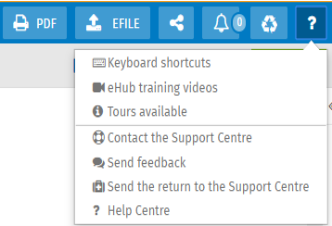

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the Help, click the following icon:

How to Reach Us

Technical and Tax support

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com