CCH iFirm Taxprep Forms 2023 v.5.0 (2024.20.37.02) Release Notes

New: Introducing Wolters Kluwer Support Platform

As part of our commitment to service, Wolters Kluwer is pleased to announce the launch of our new Support Platform.

Register to our Support Platform to submit, modify and track all your support requests in a single location. A chatbot system and a live chat feature powered by our virtual assistant are also included, with access to over 40,000 articles from our knowledge base. Note that since December 1, 2023, the Support Centre no longer offers an email support service, which has been replaced by our new support ticketing system.

If you need help during the registration process, please consult the following article to get all the information you need: How do I register to the new Support Platform?

Register now to our Support Platform and take advantage of all the benefits it has to offer!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Taxprep is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, powered by Taxprep software programs, built and enhanced over many years

- Comprehensive diagnostics with audit trail of user‑reviewed diagnostics

- Ability to navigate through cells with data entered in the year

- Intuitive user interface

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

Forms and Slips Coverage

The slips, RL slips and summaries included in CCH iFirm Taxprep Forms 2023 normally apply to the 2023 taxation year. You can nonetheless use them if you need to file a slip for the 2024 taxation year before the 2024 versions of the slips are made available by government authorities.

Individual forms can be used until they are updated by the CRA or RQ. Note that the CCH iFirm Taxprep Forms e-Bulletin notifies you each time an updated or new form is made available in an application update.

Rolling Files Forward

CCH iFirm Taxprep Forms 2023 allows you to roll forward client files that were saved with the 2022 version of Taxprep Forms or Cantax FormMaster, which have the .T22 extension, as well as client files saved with Taxprep Forms 2023 or Cantax FormMaster 2023 that have the .T23 and .T24 extension.

In addition, CCH iFirm Taxprep Forms allows you to roll forward files saved with Intuit’s ProFile FX application that have a .22X extension.

If you want to roll forward the files saved with the AvanTax eForms application that have a .T22N extension, please contact the Support Centre.

Electronic Filing

CCH iFirm Taxprep Forms enables you to electronically transmit data from the T5013 return and the following slips and RL slips:

|

Slips |

||

|---|---|---|

|

NR4 |

T5018 |

RL-11 |

|

T4 |

RRSP |

RL-15 |

|

T4A |

RL-1 T4 |

RL-18 |

|

T4A-NR |

RL-1 T4A |

RL-22 |

|

T4FHSA |

RL-1 T4ANR |

RL-24 |

|

T4RIF |

RL-2 RIF |

RL-25 |

|

T4RSP |

RL-2 RSP |

RL-27 |

|

T5 |

RL-2 T4A |

RL-31 |

|

T2202 |

RL-3 |

RL-32 |

|

T5008 |

RL-7 |

|

|

T5013 |

RL-8 |

|

Mandatory electronic filing (slips and RL slips)

The threshold for mandatory electronic filing of information returns for a calendar year has been lowered from 50 to 5 for information returns filed after December 31, 2023. For the latest information about the penalty for not filing information returns over the Internet, go to canada.ca/mandatory-electronic-filing.

The threshold for RL-24 remains at 50.

Taxation years covered

Revenu Québec only accepts electronic transmissions of the RL slips for the 2023 and 2024 taxation years. The CRA does not impose restrictions about the taxation year that can be processed.

Important dates for Internet transmission

CCH iFirm Taxprep Forms 2023 complies with the latest Internet transmission requirements issued by government agencies. Files generated with CCH iFirm Taxprep Forms 2023 can therefore be electronically transmitted:

- To the CRA, starting on January 8, 2024;

- To Revenu Québec, without any delay (as Revenu Québec’s Internet transmission service has been updated in November 2023).

CRA’s Web Access Code

If you already have a Web access code, you can use it to file your information returns for 2023 and subsequent years.

Version 5.0 Content

Updates and Additions

To review the updates and additions contained in version 5.0 of CCH iFirm Taxprep Forms 2023, consult the Updates and Additions table.

Comments and Details

AUT-01, Authorize a Representative for Offline Access; and

AUT-01X, Cancel Authorization for a Representative

The program identifier RM, Import/export has been removed. Consequently, if it was used to identify a business number in a previous version of the program, it will not be retained.

FP-505, Special-Purpose Returns;

FP-505.D.A, GST/HST – QST Return Respecting the Purchase of Taxable Immovables or Taxable Carbon Emission Allowances; and

FP-505.D.F, GST/HST – QST Return for a Person That Is Not a GST/HST or QST Registrant

Following an update to Form FP-505, changes have been made to these schedules. Fields have been added to enter an immovable’s address, where applicable. Lines have also been added to provide additional details on rebates used to reduce or offset taxes payable, as required.

Finally, Form FP-505 and its schedules must now be sent to the following address:

Revenu Québec

3800, rue de Marly

Québec (Québec) G1X 4A5

FP-524, New Residential Rental Property GST Rebate Application

Following an update to the form, the following changes have been made:

-

A line for entering the legal description of the property has been added to the Information about the rental property section.

-

Cooperative housing corporation units (builder/landlord as well as purchaser/landlord) are now among the types of claimants that can be selected on the form.

-

The type of property Multiple unit residential complex covered by the GST rebate for purpose-built rental housing (four or more private apartments, or at least ten private rooms or suites) has been added to the form.

NR73, Determination of Residency Status (Leaving Canada)

Several changes have been made to this form, including:

-

The Individual tax number (ITN) and the Temporary tax number (TTN) fields have been added to the Identification section.

-

The Address Information section has been added. The city, province, post office box, postal code and country are now shown separately.

-

In the Relationship section, additional information with respect to the individual who has left or will be leaving Canada must be entered.

-

In the Employment section, it is now possible to select one or more applicable situations.

-

In the Ties in Canada section, additional information must be entered when a spouse or a common-law partner remains in Canada, when children or dependants are left in Canada or when landed immigrant status is retained.

-

Finally, in the Ties in another country section, additional information may be required in certain situations.

If you have completed this form with a previous version of the program, we strongly suggest that you review the entire form before filing it.

NR74, Determination of Residency Status (Entering Canada)

Several changes have been made to this form, including:

-

The Individual tax number (ITN) and the Temporary tax number (TTN) fields have been added to the Identification section.

-

The Address Information section has been added. The city, province, post office box, postal code and country are now shown separately.

-

In the Length of your stay in Canada section, the answer to the question When will you be leaving Canada? must now be a date presented in the YYYY-MM-DD format. Since the format was different in the previous version of the form, this information will not be retained and you will have to enter it again.

-

In the Living outside Canada section, you can now select more than one option to explain the reasons for living outside Canada.

-

In the Why you are in Canada section, you must select only one option, whichever best describes the reason for you being in Canada. If more than one option is selected, the first option selected will be retained by default.

If you have completed this form with a previous version of the program, we strongly suggest that you review the entire form before filing it.

RC1, Request for a Business Number and Certain Program Accounts

As of May 13, 2024, the CRA no longer registers nor maintains import and export RM program accounts. These services are now provided by the Canada Border Services Agency (CBSA). However, the CRA remains responsible for issuing Business Numbers (BN). As a result, Part F, Registering for an import-export program account (RM), has been removed from Form RC1, and Parts G and H have been renamed Part F and Part G respectively.

T101B, Adjustment to Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs) previously renounced

A field has been added for Ontario to the column Provincial – CEE Critical mineral exploration tax credit of the table in Step 5 of Part 2. If you select the box Complete T101 slips based on information in form T101B, box 155 of the T101 slip will be calculated with the information from this new field.

Version 4.0 Content

Updates and Additions

To review the updates and additions contained in version 4.0 of CCH iFirm Taxprep Forms 2023, consult the Updates and Additions table.

Comments and Details

GST44, GST/HST Election Concerning the Acquisition of a Business or Part of a Business

When the GST/HST return is filed electronically, Form GST44 must now be sent to the Sudbury Tax Centre to the following address, regardless of your tax centre:

1050 Notre Dame Avenue

Sudbury ON P3A 5C2

However, if the GST/HST return is not filed electronically, Form GST44 can be attached to it.

GST111, Financial Institution GST/HST Annual Information Return

Following an update to the form, options have been added to question 6 in Part A to indicate the first two digits of your NAICS code.

LM-1, Application for Registration

It is now possible to request a municipal tax registration number for 9-1-1 as well as for the tax on insurance premiums from Revenu Québec. If the business is making this request, additional boxes in section 5.2 must be filled.

In addition, the following question related to activities involving specific tax characteristics has been added to section 4.2: Does the business hold a brewer’s permit, a beer distributor’s permit, a cider or wine maker’s permit, a distiller’s permit, an artisan producer’s permit for alcoholic beverages other than beer or a small-scale beer producer’s permit?.

T4RIF, Income from an RRIF; and

T4RSP, Income from an RRSP

Box 38, Fair market value (FMV) of the RRIF at the end of the year, is mandatory for the 2023 and subsequent taxation years. It is transmitted to the CRA when the T4RIF or T4RSP information return is filed electronically only and is not displayed on paper slips. For cases where the FMV is equal to zero at year-end, a custom box has been added below box 38 for the preparer to confirm that the FMV is nil. If this is not the case, the preparer must enter an amount in box 38.

T776, Statement of Real Estate Rentals;

T2042, Statement of Farming Activities;

T2121, Statement of Fishing Activities; and

T2125, Statement of Business or Professional Activities

Important changes have been made with respect to the update of the UCC adjustment factors for AIIPs and ZEVs used to calculate UCC adjustments for 2024 and 2025. The table of rates has been updated and now includes the adjustment factors that have been announced for the multiple CCA categories that are impacted. By default, the program uses 2024 and 2025 rates if no day in the fiscal year falls in 2023. If part of the fiscal year is in 2023, a diagnostic will remind the preparer to check that the correct adjustment factors have been used.

T400A, Notice of Objection – Income Tax Act

Notices of objection must now be sent to the following address:

Appeals Intake Centre

1050 Notre Dame Avenue

Sudbury ON P3A 5C1

T1223, Clergy Residence Deduction

Following an update to the form, every applicable option to questions 1 and 3 in Part B must now be selected.

T5013 Schedule 8, Capital Cost Allowance (CCA);

T5013 CCA General, General CCA Classes;

T5013 Vehicle CCA, CCA Class 10.1 (Passenger Vehicles); and

T5013 Leasehold CCA, CCA Class 13 (Leasehold Improvements)

Numerous changes have been made to these forms.

Immediate expensing

For a Canadian partnership, the immediate expensing measure ends on December 31, 2024, if all the partners are individuals (other than trusts) throughout the fiscal period. If one of the partners is a CCPC, the immediate expensing measure ends on December 31, 2023.

To process this measure correctly, you now have to answer the following new custom questions on Form T5013 Schedule 8:

Is the partnership a Canadian partnership (all of the members of which were, throughout the period, CCPCs, individuals (other than trusts) residing in Canada, or a combination thereof)? and

If yes, are all the members of the partnership individuals throughout the fiscal period?.

The answers to these questions will be used, among other things, to calculate the answer to the custom question Is the partnership eligible for immediate expensing for the current fiscal period?.

Accelerated investment incentive property (AIIP) and zero-emission vehicles (ZEV)

With regard to the measure for AIIP and ZEV, the adjustment factors and percentages used to calculate UCC adjustments are reduced for property acquired and available for use after 2023 and before 2028. Various changes have been made to Forms T5013CCAR, T5013CCAPV and T5013CCALI to identify the period during which the property is available for use. The appropriate factor can then be used to calculate the UCC adjustment for AIIP and ZEV.

For class 10.1, the UCC adjustment factor is determined based on the acquisition date.

For class 13, the lines Available for use before 2024 and Available for use after 2023 and before 2028 have been added to the Acquisitions subsection.

For classes other than 10.1 and 13, the lines Available for use before 2024, Available for use in 2024 or 2025 and Available for use in 2026 or 2027 have been added to the Acquisitions subsection.

These lines are calculated according to the start and end dates of the fiscal period. When the fiscal period overlaps two periods, a diagnostic will remind you to enter the acquisition amount for one of the periods. The acquisition amount for the other period will be the difference between the total AIIP acquisitions and the amount entered for the first period.

For classes other than 10.1 and 13, changes have also been made in the Classes 14, 14.1, 44 and 50 only subsection for property eligible for special accelerated depreciation rules in Québec. The line If “Yes”, enter the capital cost of this property has been renamed Available for use before 2024, and the lines Available for use in 2024 or 2025 and Available for use in 2026 or 2027 have been added.

Modifications for class 10.1 passenger vehicles

The Acquisition and Disposition subsections have been added to Form T5013 CCAPV.

The line Government assistance received or entitled to be received has been added to the Acquisition subsection. The amount entered on this line will be deducted from the acquisition cost of the vehicle after the application of the acquisition cost limit for class 10.1 passenger vehicles.

The section Proceeds of disposition of a passenger vehicle (DIEP in a prior fiscal period only) has been added to correctly calculate the proceeds of disposition when the vehicle was disposed of in the year and the answer to the question Was the property a DIEP in a previous fiscal period? is Yes. The following lines have been added to this new section:

Proceeds of disposition

Cost of the passenger vehicle

Original capital cost (line 3b in the fiscal period of the acquisition)

Government assistance received or repaid

Does the partnership not deal at arm's length with the purchaser?

Applicable proceeds of disposition

The amount on line Proceeds of disposition (DIEP in a prior fiscal period only) corresponds to the amount calculated on line Applicable proceeds of disposition when that amount exceeds the UCC available to calculate the recapture of a passenger vehicle that is a DIEP under subsection 13(2) of the ITA. In all other cases, line Applicable proceeds of disposition is calculated at zero.

If you completed the form with a previous version of the program and the answer to the question Was the property a DIEP in a prior fiscal period? is Yes, the amount entered on the line Proceeds of disposition (total) will be transferred to the line Proceeds of disposition in the new section.

In addition, the amount on the line Cost of acquisitions of DIEP (included on line 3a) will be transferred to the line Original capital cost (line 3b in the fiscal period of acquisition) when rolled forward. This amount is then retained until the vehicle is disposed of.

Several general diagnostics have been added to help you complete these forms. If you completed the T5013 return with a previous version of the program, we strongly recommend that you review these forms and the diagnostics before filing the return.

UHT-2900, Underused Housing Tax Return and Election Form

Following an update to the form, the fields in which the address of the owner, the contact person and the residential property is entered have been expanded to indicate the city, the province and the postal code, where necessary.

A question has been added to Part 1 to specify the capacity in which the owner is filing the return if he or she is an owner in multiple capacities. In addition, an exemption (box 685) has been added to Part 6.

For 2023 and subsequent calendar years, modified definitions have been added for the terms Excluded owner, Specified Canadian partnership and Specified Canadian trust. See the instructions of the form for more details.

Version 4.0 – Corrected Calculations

The following problems have been corrected in this version:

Federal

Version 3.0 Content

Updates and Additions

To review the updates and additions contained in version 3.0 of CCH iFirm Taxprep Forms 2023, consult the Updates and Additions table.

Comments and Details

PD24, Application for a Refund of Overdeducted CPP contributions or EI Premiums

The section Second additional CPP contribution (CPP2) has been added to the table in Part B.

RL-1 Summary, Summary of Source Deductions and Employer Contributions; and

RL-1, Employment and Other Income

Version 2024-01 is now available for the forms mentioned in the title. For more information on the changes made to these forms for 2024, please refer to the release notes relative to the RL-1 summary and the RL-1 slip of the T4 slip in the Version 2.0 – Comments and Details section of the release notes.

T1159, Income Tax Return for Electing under Section 216

Line 3, FHSA deduction, has been added to this form.

T2125, Statement of Business or Professional Activities

The custom lines Light, heating and water and Telephone and utilities have been added to break down the amount of line 9220, Utilities.

If you completed this form with a previous version of the program and an amount was entered on line 9220, this amount will be transferred to the house line Telephone and utilities.

T5013 Schedule 8, Capital Cost Allowance (CCA)

Column 4, Relevant source of income from line 165, has been added to the screen only in the table of Part 2, Income earned from the source in which the DIEP is used, in order to limit the income to the DIEP used per source when there is more than one source of income. As a result, the total in column 4 will now be carried forward to the cell in line B of the Federal column in the custom subsection Immediate expensing limit before the UCC limit of the DIEP of Part 1. If you completed the form with a previous version of the program and an override was made in this cell, the override will be removed if the amount corresponds to the total of the new column 4.

In addition, if the income before CCA from at least one of the sources of income is less than the amount of DIEP used for this source, a new diagnostic will remind you to limit the immediate expensing for these properties.

TP-80, Business or Professional Income and Expenses

Several changes have been made to this form, including:

-

Line 122, Work in progress at the beginning of the fiscal period, has been removed. The amount entered on line 3N, WIP at the start of the year, of Form T2125 will be added to line 110, Sales, commissions or professional fees, of Form TP-80.

-

Line 239, Electricity, heating and water, has been added.

Version 2.0 Content

Updates and Additions

To review the updates and additions contained in version 2.0 of CCH iFirm Taxprep Forms 2023, consult the Updates and Additions table.

Comments and Details

DISBQUOTA, Worksheet – Disbursement Quota

In the section Calculating whether the registered charity met its disbursement quota requirement, the line Total amount of grants made to non-qualified donees (line 5045) has been added so that charities can subtract the grants made to non-qualified donees from the disbursement quota.

For fiscal years ending after December 30, 2023, this worksheet is available for consultation purposes only and will be removed in a future version of the program. Please complete Schedule 8 of the T3010 return if it applies to your situation.

RL-1, Employment and Other Income

The RL-1's appearance has changed significantly in 2024. Boxes B.A and B.B have been added to the slip. Box B.A is replacing former box B and is used to enter the first QPP contribution. Box B.B, located next to it, indicates the amount reserved for second QPP contributions. The modified RL-1 design is only visible when such slips are produced in 2024, as specified by Revenu Québec. Also, box U-Progressive Retirement has become code G-3 in the statement's additional information.

RL-1 Summary, Summary of Source Deductions and Employer Contributions

Significant changes have been made to the temporary RL-1 Summary:

-

The form has been renumbered and sections have been added.

-

The table in section 2, Statement of duties paid or payable (formerly section 1), has been modified. Several columns have been added to break down the duties paid or payable according to their nature, such as columns B, QPP contributions, C, QPIP premiums, D, Québec income tax, and E, Contribution to the health services fund. The total of each column will be transferred respectively on lines 44 to 46 of section 3, Source deductions of Québec income tax, QPP contributions and QPIP premiums, and line 56 of section 4, Contribution to the health services fund. If you had completed the RL-1 Summary for a 2024 fiscal year using a previous version of the program, the information in the Month and Duties paid or payable columns of the old table will be transferred respectively to columns A, Remittance period, and F, Total for the remittance period, of the new table.

-

Line 23, Additional employee contributions (RL-1.T [temporary RL-1 slip], box B.B), and line 24, Additional employer contribution, have been added to subsection 3.1, QPP contributions.

-

Line 49 of section 3, Source deductions of Québec income tax, QPP contributions and QPIP premiums, and line 83 of section 7, Refund or balance due, have been added to explain the reasons for an overpayment.

-

Boxes 90 to 94 have been removed from the remittance slip template. As a result, box 95, Remittance, is now calculated from line 82, Balance due. In addition, the Payment code box has been added to the remittance slip.

In view of these major changes, Revenu Québec will not accept a RL-1 Summary for a fiscal year ending in 2024 filed with version RLZ-1.S-V (2023-10) of the form. You will have to use version RLZ-1.ST (2024-01).

If you have completed the summary for a fiscal year ending in 2024 using a previous version of the program, it is advisable to review it before filing it.

RL-1 Summary, Summary of Source Deductions and Employer Contributions; and

RL-1, Employment and Other Income

Revenu Québec has made major changes to the RL-1 summary and the RL-1 slip for the year 2024. As a result, for 2024, forms produced with version 2023-10 are not accepted by Revenu Québec; therefore, you must wait for version 2024-01, which is not available in CCH iFirm Taxprep Forms version 2023 v.2.0 for the forms mentioned in the title. It will only be available in version 2023 v.3.0.

RL-24 Summary, Childcare Expenses

Boxes Québec enterprise number (NEQ) or social insurance number and Facility number (“numéro d’installation”) or identification number (“numéro de fiche”) assigned by the Ministère de la Famille or the school code assigned by the Ministère de l’Éducation (where applicable) have been removed from the RL-24 summary. The following boxes have been added:

-

10, Québec enterprise number (NEQ)

-

11, Social insurance number (SIN)

-

12, Identification number ("numéro de fiche") assigned by the Ministère de la Famille

-

13, Facility number ("numéro d’installation") assigned by the Ministère de la Famille

-

14, School code assigned by the Ministère de l’Éducation

As a result, the custom section Type of issuer has been moved to Section 1, Information about the childcare provider, to automatically fill in the new boxes. If you had overridden the value in one of the two deleted boxes, or if more than one number was entered in the custom section, please ensure that the number that applies to your situation is the same as the one that is shown in box H of the RL-24 slips you filed with Revenu Québec. Also, it is now required to specify the name of the signee in section 4, Certification.

If you have completed the summary with a previous version of the program, it is recommended that you review the entire summary before filing it.

T4, Statement of Remuneration Paid

Calculations for second CPP and QPP contributions have been added to the data entry screen and to the slips. They can therefore be used for the transmission and printing of the slips. However, as the boxes and calculations related to second contributions will only be required for the production of T4 slips in 2024, they will be visible and functional only if the year-end date is set in 2024.

T2200, Declaration of Conditions of Employment

Following updates to the form, major changes took place within it. We recommend that you check all the data entered before filing the form to ensure it is properly completed. Please note that Form T2200S, Declaration of Conditions of Employment for Working at Home Due to COVID-19, is no longer available.

T3010, Registered Charity Information Return

Important changes have been made to this return for fiscal periods ending on or after December 31, 2023:

-

In Section C, Programs and general information, questions C17 and C18 have been added.

-

In Section D, Financial information, line 4505, Total amount of 10 year gifts received, has been removed.

-

In Schedule 1, Foundations, lines 111 and 112 have been added.

-

In Schedule 6, Detailed financial information, you must now specify the amount of cash, bank accounts, and short-term investments, the portion of land and buildings in Canada used for charitable programs or administration and the portion used for other purposes, impact investments, as well as the total interest and investmentincome from impact investments and the total interest and investment income from persons not at arm's length.

-

In Schedule 6, lines 4180, 10 year gifts, and 4505, Total amount of 10 year gifts received, have been deleted.

- Schedule 8, Disbursement quota, has been added to the return and replaces the custom form Worksheet – Disbursement Quota. It must be completed if, in the 24 months preceding the beginning of the fiscal period, the average value of the charity's property not used directly in its charitable activities or administration exceeded $100,000 if the charity is designated as a charitable organization. Schedule 8 must also be complete if the value exceeded $25,000 for a charity that is designated as a public or private foundation.

If you have completed this return using a previous version of the program, it is necessary to review the return before filing it.

TP-64.3, General Employment Conditions

Following updates to the form, section 3.6, Expenses related to working remotely, was removed.

TP-600, Partnership Information Return

Previously, partnerships were required to send their completed return to the address that is closest to the location where the declarant primarily carries on its activities. From now on, these documents must be sent to Revenu Québec at the following address:

Revenu Québec

C.P. 3000, succursale Place-Desjardins

Montréal (Québec) H5B 1A4

TP-985.22, Information Return for Registered Charities and Other Donees

Previously, registered charities and other donees were required to send their completed return to the address that is closest to the location where the declarant primarily carries on its activities. From now on, these documents must be sent to Revenu Québec at the following address:

Revenu Québec

3800, rue de Marly

Québec (Québec) G1X 4A5

Modifications Made to Version 1.1

The modifications made to version 1.1 correct the following problem:

Version 1.0 Content

Updates and Additions

To review the updates and additions contained in version 1.0 of CCH iFirm Taxprep Forms 2023, consult the Updates and Additions table.

Comments and Details

Government requirements

As of January 1, 2024, payments or remittances to the Receiver General for Canada should be made as an electronic payment if the amount is more than $10,000. Payers may face a penalty unless they cannot reasonably remit or pay the amount electronically. For more information, go to canada.ca/payments.

First Home Savings Account (FHSA)

In Budget 2022, the government proposed the introduction of the tax-free First Home Savings Account (FHSA). This new registered plan would give prospective first-time home buyers the ability to save $40,000 on a tax-free basis. The FHSA was enacted by Bill C-32, which received Royal Assent on December 15, 2022. As a result, the new T4FHSA slip and RL-32 slip have been published by the CRA and Revenu Québec respectively and can be produced with CCH iFirm Taxprep Forms in the same way as the other slips and RL slips.

The following forms have therefore been added to the program:

T4FHSA/RL-32 Data Entry Screen, First Home Savings Account

It is important to note that there are significant differences between the content of the T4FHSA paper slip and the content of the XML file transmitted electronically to the CRA. The paper slip includes only the information that is required on the recipient's tax return. The XML file must include certain information for which no box is provided on the paper slip, in addition to providing details of all transactions in the FHSA account. This additional information will eventually be available in My Account on the CRA website.

The Recipient’s identification section allows you to enter the recipient's general information (name, address, social insurance number, etc.).

The Additional Information on the FHSA section allows you to enter the FHSA contract number and its fair market value at the end of the calendar year. It also includes the sub-sections Closing of FHSA, Death of the holder and Transfer received from a FHSA following the death of another person.

The Transaction information section allows you to enter transactions. A sorting function has been added to ensure that transactions are presented in chronological order. For each transaction, the type of transaction must be selected from a predefined list. The transaction date also needs to be inputted. The transaction will be transmitted only if the appropriate box is selected.

For each slip, the amounts of transactions of the same type will be added together and the total will be reported in the Information to report section. This section includes the sub-section Other information (for electronic transmission only), which shows information not on the paper slip.

The Filing details section allows you, among other things, to change the type of slip (original, amended or cancelled). It also contains the T4FHSA unique slip number. This number is only used for electronic transmission. It will be generated automatically after the slip has been transmitted once and must be retained if the slip is transmitted again. The following information must be completed to generate the unique slip number:

Issuer account number

FHSA identification number

Social insurance number of the recipient for an individual or the business or trust account number if the recipient is anyone other than an individual

FHSA contract number of the recipient or the FHSA contract number of the deceased if the recipient is a beneficiary of a FHSA following the death of another person

The Notes section allows you to enter a comment that will be added to the T4FHSA or RL-32 slips to provide additional information that may be useful in preparing the recipient's tax return.

T4FHSA Slip, First Home Savings Account Statement

This form allows you to view the T4FHSA slips. It therefore contains only the information that must be included in the recipient's tax return.

T4FHSA Summary, Summary of First Home Savings Account

This form provides information about the FHSA issuer and the contact person, the number of slips filed and the totals from the T4FHSA slips. It is also on this form that you will find the question Do you want to file the data on electronic media?. This choice applies to both T4FHSA and RL-32 slips.

Since this is a custom form, Form T4FHSA Summary should never be sent to the CRA.

RL-32 Slip, First Home Savings Account (FHSA)

This form allows you to view the RL-32 slips. It therefore contains only the information that must be included in the recipient's tax return.

RL-32 SUM, Summary of RL-32 slips

This form presents the FHSA issuer's information and the total of every box D, Québec income tax withheld at source, shown on the RL-32 slips. This amount is reported in box 11 of Summary 1, Summary of Source Deductions and Employer Contributions.

Since this is a custom form, the summary of the RL-32 slips must never be sent to Revenu Québec.

Several general and EFILE diagnostics have been added in order to help complete the T4FHSA and RL-32 slips. The EFILE diagnostics relate to mandatory information so that the file transmitted complies with the XML schema. However, it is strongly recommended that you consult the general diagnostics before filing your T4FHSA and RL-32 slips.

FP-505.D.G, Return Respecting the Specific Duty on New Tires for a Purchaser or Leaser of Tires

In its March 21, 2023, budget, Revenu Québec has announced that after June 30, 2023, the $3 specific duty on tires would be increased as follows:

-

$4.50 per new tire with a rim diameter of no more than 62.23 cm (24.5 inches) and an overall diameter of no more than 83.82 cm (33 inches);

-

$6.00 per new tire with a rim diameter of no more than 62.23 cm (24.5 inches) and an overall diameter greater than 83.82 cm (33 inches), but no more than 123.19 cm (48.5 inches).

The new version of Form FP-505.D.G (2023-7), which takes these rates into account, must therefore be used for tires purchased or leased in Québec or brought into Québec after June 30, 2023. For tires purchased or leased in Québec or brought into Québec before July 1, 2023, please use version 2015-04 of the form, available in CCH iFirm Taxprep Forms 2022.

NR4, Amounts Paid to Non-Residents

The list of income codes has been updated, and several changes have been made. Codes 74 to 76 have been added for transactions on a FHSA account and code 25, Registered home ownership savings plan, has been deleted. It is recommended to verify the income codes before filing the slip.

NR5, Application by a Non-Resident of Canada for a Reduction in the Amount of Non-Resident Tax Required to be Withheld

From now on, it will be possible to enter the information of more than one dependent in section 7.

RC1, Request for a Business Number and Certain Program Accounts

Various changes have been made to this form. A table has been added to Part A2, Owners information, to provide information on the corporations controlling the business if the business is itself a corporation. Other tables have also been added to Part A2 to provide information on the partners (other partnerships, corporations or other legal entities) who control the business if it is a partnership. Furthermore, additional questions concerning, among other things, e-commerce and accommodation platforms have been added to Part A5, GST/HST information. It is advisable to review the form before filing.

RRSP, Contributions Made to an RRSP

The authorized official will now be able to sign the RRSP slip electronically.

RL-11.S, Renunciation of Expenses or Allocation of Assistance by a Corporation

As a follow-up to last year's summary update, we have reworked the boxes at the top of the form that indicate the source of the data it uses. Firstly, the instructions near the boxes were rewritten to guide the preparer through the summary. It is now clearer that the various sections need only to be completed in certain situations, such as when we want to renounce to resource expenses or correct a past renunciation, for example.

In addition, the transfer boxes for the data on Forms T101A, T101B and T101D are now calculated by default, and Form RL-11.S will use the information entered on the federal forms by default, where applicable. The preparer can renounce this calculation at any time by unchecking the data transfer boxes.

T4, Statement of Remuneration Paid

Box 45, Employer-offered dental benefits, has been added to the T4 slip. This new box is used to indicate whether the recipient or any of his or her family members had access to any dental care insurance or coverage of dental services on December 31. Furthermore, boxes 16A and 17A, Employee’s second CPP contributions and Employee’s second QPP contributions, have been added to the slip. Starting January 1, 2024, employers will have to deduct the second additional CPP and QPP contributions on earnings above the maximum annual pensionable earnings. For this reason, the complete calculations of CPP and QPP will only be added to version 2023 2.0.

T4A, Pension and Other Income

Box 015, Payer-offered dental benefits, has been added to the T4A slip. This new box is used to indicate whether the recipient or any of his or her family members had access to any dental care insurance or coverage of dental services on December 31. This box is mandatory if an amount appears in box 016, Pension or superannuation.

T4PS/RL-25, Payment from an EPSP

Following an update of the XML specifications of RL-25, section Identification of the 2nd recipient (joint account) and the field for the type of beneficiary have been removed.

T4RIF, Income from an RRIF

Box 38, Fair market value (FMV) of the RRIF at the end of the year, has been added to the T4RIF data entry screen. This new box is used to indicate the total fair market value of properties held by the fund at the end of the year. The box will be applicable to the 2023 and subsequent taxation years. Please note that the information will be transmitted to the CRA when the T4RIF information return is filed electronically only. The new box will not appear on paper slips.

T4RSP, Income from an RRSP

Box 38, Fair market value (FMV) of the RRSP at the end of the year, has been added to the T4RSP data entry screen. This new box is used to indicate the total fair market value of properties held by the fund at the end of the year. The box will be applicable to the 2023 and subsequent taxation years. Please note that the information will be transmitted to the CRA when the T4RSP information return is filed electronically only. The new box will not appear on paper slips.

T101 Slip, Statement of Resource Expenses;

T101A, Claim for Renouncing Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs); and

T101B, Adjustment to Canadian Exploration Expenditures (CEEs) and Canadian Development Expenditures (CDEs) previously renounced

Following the update of Form T101A, a box has been added to the Step 4 table for the Ontario critical mineral exploration tax credit.

If you select the check box Complete T101 slips based on information in Form T101A found in Form T101A, line 155 of the T101 slip will now be calculated using the value entered in the new box in Form T101A. If you select the check box Complete T101 slips based on information in form T101B found in Form T101B, line 155 of the T101 slip will be an input line.

T1213, Request to Reduce Tax Deductions at Source

Following updates to the form, the total of the amounts justifying the request for reduced tax deductions at source is no longer calculated.

T1236, Qualified donees worksheet/Amounts provided to other organizations

A field has been added to the space below the Amount of non-cash gifts field for each gift made to a qualified donee or other organization. Notably, you can use this field to have the donor charity report a designated gift. In this case, write “designated gift” and the amount of the gift in question. Please refer to the anti-avoidance rules and designated gifts section of the CRA website.

T1296, Election, or Revocation of an Election, to Report in a Functional Currency

Following updates to the form, Japan’s currency is now available as a choice of functional currency.

T1441, Qualifying Disbursements: Grants to Non-Qualified Donees (Grantees)

When grant-related activities are carried on outside Canada, you must now list each country code and the country where the activities were carried on. Thus, eight slots have been added for each grant. In addition, the country list has been updated so that the country code is displayed as required by the CRA.

T3010, Registered Charity Information Return

At the moment, our program can only generate registered charity information returns for fiscal periods ending on or before December 30, 2023. For fiscal periods ending on or after December 31, 2023, the T3010 information return will be available in version 2.0 to be released in February 2024.

In Section B, Directors/trustees and like officials, the box linked to Form T1235 has been protected and the information will not be retained when the program is updated. In Part C3 of Section C, Programs and general information, the box linked to Form T1236 has been protected and the information will not be retained when the program is updated. However, please note that no information was transmitted to the CRA via these boxes. On a similar note, a protected box has been added to Part C16 of Section C for a more convenient access to Form T1441. Please note that no information will be transmitted to the CRA via this box.

In Part C7 of Section C, it is now possible to choose several methods of payment to the fundraiser.

If you have completed this return using a previous version of the program, it is recommended to review the return before filing it.

T5013 Schedule 8, Capital Cost Allowance (CCA)

Part 2, Income earned from the source in which the designated immediate expensing property (DIEP) is used, has been added to the form. The information in this part replaces column 12, Income earned from the business or property in which the DIEP is used, of the CCA calculation table. Therefore, line Income earned from the business or property in which the DIEP is used has been removed from Forms T5013 General CCA, T5013 Vehicle CCA and T5013 Leasehold CCA, and the total of the former column 12 will be transferred to line 156 in Part 2. Various diagnostics have been added to help complete the new section.

If you have completed this form using a previous version of the program, it is recommended to review the form before filing it.

T5013 Schedule 52, Summary Information for Partnerships that Allocated Renounced Resource Expenses to their Members

The summary of qualified expenses for provincial tax credit purposes has been updated to reflect the division between the mineral exploration tax credit and the critical mineral exploration tax credit for each province. Thus, columns 403, British Columbia CMETC, 405, Saskatchewan CMETC, 407, Manitoba CMETC, and 409, Ontario CMETC, have been added. Boxes 151, 153, 154 and 155 have been added in order to enter the total of each column. In addition, corresponding boxes 241 to 244, Expenses qualifying for a provincial tax credit (CMETC), have been added to Forms T5013, Worksheet B, Summary of amounts to allocate to partners, and T5013/RL-15, Partnership income.

If you completed this schedule using a prior version of the program, it is highly recommended to review the schedule before filing it.

T5013 Schedule 141, General Index of Financial Information (GIFI) – Additional Information

The name of Schedule 141 has been changed from Financial Statement Notes Checklist to General Index of Financial Information (GIFI) – Additional Information. In addition, significant changes have been made to this schedule. The main changes are as follows:

-

In Part 1, Information on the person primarily involved with the financial information, question 111, Can you identify the person specified in the heading of Part 1?, has been added.

-

In Part 2, Type of involvement, it is now possible to choose one or more options. In addition, the options Provided accounting services, Provided bookkeeping services and Other have been added to the list.

-

In Part 4, Other information, question 110 has been removed. However, the information should automatically transfer to the new Part 5, Information on the person who prepared the partnership information return. In addition, questions 104, 105, 106 and 107 are now mandatory at all times.

-

As mentioned above, Part 5 has been added to the Schedule. Please complete this section if the person who prepared the partnership information return has a professional designation in accounting but is not the person identified in Part 1.

If you have completed Schedule 141 using a previous version of the program, it is expected that most of the information will be transferred automatically. However, you should review the entire schedule before producing it, as new questions have been added.

TP-600, Partnership Information Return

In Part 2, Information about the partnership, line 10, Province, territory or country code if the partnership carries on its principal activity outside Québec, and line 23, The partnership’s securities are listed on a stock exchange., have been removed. However, line 15a, The partnership's securities are listed on the stock exchange., has been added. Thus, the information on line 23 will be carried forward to the new line 15a.

If you completed this return using a previous version of the program, we recommend that you review the return before filing.

TP-600.F, Schedule F – Net Income for Income Tax Purposes

As a result of the update, changes have been made to lines 46 and 47. Line 46, Other amounts to be added, has been removed. Line 47, Per additional list, has been renumbered 46.

If you completed this form with a previous version of the program, the information entered on the old line 46 will be added to line 45, Other amounts to be added. It is recommended that you review the content before filing it.

TP-985.22, Information Return for Registered Charities and Other Donees

In Part 2.2, Expenditures (formerly Expenditures and gifts made to qualified donees), line 38a, Total eligible disbursements made to grantee organizations (complete this line only for a registered charity), has been added. It is calculated based on line 5843 of the T3010 return and Form T1441. Also, in Part 5, Other information, line 64 has been added.

If you have completed this return using a previous version of the program, it is recommended that you review the entire return before filing it.

TP-985.22 Schedule A, Disbursement Quota for the Taxation Year, Registered Charity; and

TP-985.22 Schedule B, Disbursement Quota for the Taxation Year, Registered Museum, Registered Cultural or Communications Organization or Recognized Political Education Organization

Following an update to Schedules A and B of Form TP-985.22, section 1.2 for calculating the disbursement quota has been added. This section is to be used when the taxation year begins on or after January 1, 2023. Essentially, the section continues the previous basic disbursement quota calculations of section 1.1 but using an applicable rate of 5% on the amount exceeding the basic amount of $1,000,000. Line 111a was added to Schedule A, and this line is calculated automatically based on line 38a of Form TP-985.22. Finally, section 3 was added to Schedule B to allow the entry of donations between organizations not dealing at arm’s length, if applicable.

If you have completed these forms using a previous version of the program, it is recommended to review these forms before filing them.

TP-1086.R.23.12, Costs Incurred for Work on an Immovable

Following the update of the form, section 1, Information on the payer, has been modified. Furthermore, the Province field has been added to section 2, address of the immovable.

Forms under review

The following forms are presently under review. They are labelled “Under Review” on screen and “Do not submit” watermark when printing:

-

Forms relating to the T5013 return, Partnership income, its schedules, T5013 slip and T5013 Summary, as well as the electronic transmission of the T5013 return and slip.

-

Forms relating to the TP-600, Partnership Information return, and its schedules.

-

Forms relating to the TP-985.22 return, Information Return for Registered Charities and Other Donees, and its schedules.

-

Forms T2200, Declaration of Conditions of Employment, and TP-64.3, General Employments Conditions.

-

Form RL-24 Summary, Childcare Expenses.

Where to Find Help

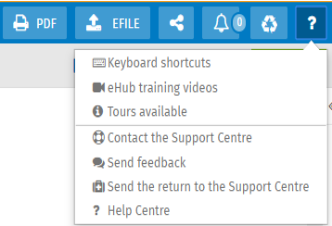

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the Help, click the following icon: