To file T5013 slips and RL-15 slips, use the combined data entry screen T5013/RL-15, Partnership Income.

In the appropriate section of the data entry screen, identify the partner for whom you are completing the slip. As well, indicate the partner’s share (%) in the partnership using one of the possible allocation methods in the “Basis for allocation to partners” section of Form T5013 Worksheet B. You can also enter the partner’s share (%) manually using an override. The partner’s share (%) will be applied to the amounts entered in Form T5013 Worksheet B to provide the results shown in the boxes of the T5013 slip and the RL-15 slip.

Calculate the partner’s interest (%) based on the allocation method used on Worksheet B:

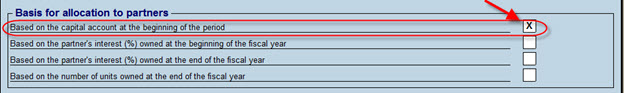

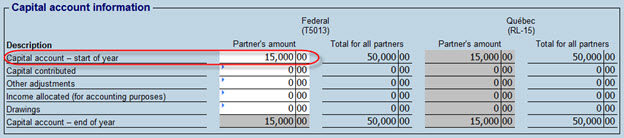

1- Based on the capital account at the beginning of the period:

If this allocation method is chosen in the “Basis for allocation to partners” section of Form T5013 Worksheet B, an amount must be entered on line Capital account – start of year in the “Capital account information” section of Form T5013 Data entry screen for each partner in order for the interest (%) to be calculated correctly for all partners.

T5013 Worksheet B

T5013 Data entry screen

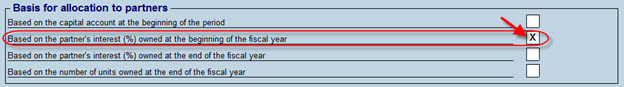

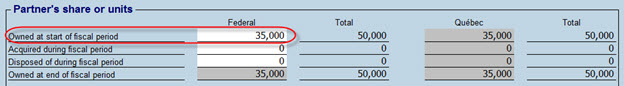

2- Based on the partner’s interest (%) owned at the beginning of the fiscal year:

If this allocation method is chosen in the “Basis for allocation to partners” section of Form T5013 Worksheet B, a value must be entered on the line Owned at start of fiscal period in the “Partner’s share or units” section of Form T5013 Data entry screen for each partner in order for the interest (%) to be calculated correctly for all partners.

T5013 Worksheet B

T5013 Data entry screen

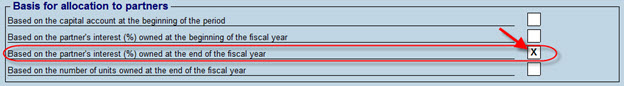

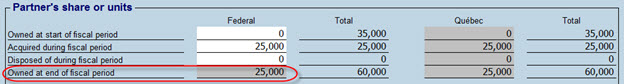

3- Based on the partner’s interest (%) at the end of the fiscal year:

If this allocation method is chosen in the “Basis for allocation to partners” section of Form T5013 Worksheet B, a value must be entered on the line Owned at end of fiscal period in the “Partner’s share or units” section of Form T5013 Data entry screen for each partner in order for the interest (%) to be calculated correctly for all partners.

T5013 Worksheet B

T5013 Data entry screen

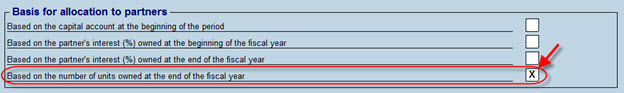

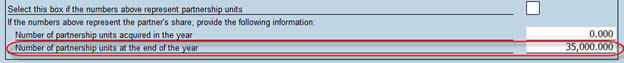

4- Based on the number of units owned at the end of the fiscal year:

If this allocation method is chosen in the “Basis for allocation to partners” section of Form T5013 Worksheet B, a value must be entered on the line Number of partnership units at the end of the year in the “Partner’s share or units” section of Form T5013 Data entry screen for each partner in order for the interest (%) to be calculated correctly for all partners.

T5013 Worksheet B

T5013 Data entry screen

Business income based on partner’s code boxes

|

Rental income |

Business income |

Professional income |

||||

|

Gross |

Net |

Gross |

Net |

Gross |

Net |

|

|

Code "0" – Limited partner |

117 |

107 |

118 |

104 |

121 |

120 |

|

Code "3" – Limited partner’s exempt interest |

117 |

107 |

118 |

104 |

121 |

120 |

|

Code "5" – Partner of an LPP (full shield) |

117 |

107 |

118 |

104 |

121 |

120 |

|

Code "1" – Specified partner (passive partner) |

117 |

110 |

118 |

116 |

121 |

120 |

|

Other partners (codes 2 and 4) |

117 |

110 |

118 |

116 |

121 |

120 |

|

Commission income |

Farming income |

Fishing income |

||||

|

Gross |

Net |

Gross |

Net |

Gross |

Net |

|

|

Code "0" – Limited partner |

123 |

122 |

125 |

101 |

127 |

103 |

|

Code "3" – Limited partner’s exempt interest |

123 |

122 |

125 |

101 |

127 |

103 |

|

Code "5" – Partner of an LPP (full shield) |

123 |

122 |

125 |

101 |

127 |

103 |

|

Code "1" – Specified partner (passive partner) |

123 |

122 |

125 |

124 |

127 |

126 |

|

Other partners (codes 2 and 4) |

123 |

122 |

125 |

124 |

127 |

126 |

Calculations based on the type of partner

|

At-risk amount |

Deemed capital gain |

Eligibility to the ITC |

|

|

Code "0" – Limited partner |

105 + 106 |

Yes |

Not eligible |

|

Code "3" – Limited partner’s exempt interest |

N.A. |

N.A. |

Not eligible |

|

Code "5" – Partner of an LPP (full shield) |

105 + 106 |

Yes |

Not eligible |

|

Code "1" – Specified partner (passive partner) |

N.A. |

Yes |

Not eligible |

|

Other partners (codes 2 and 4) |

N.A. |

N.A. |

Eligible |

Note: In the Québec RL-15 slip, the equivalent of partner’s code “5” is code “0” (limited partner).

Deemed capital gain calculation under subsection 40(3.1):

- If the partnership is a limited partnership and the partner is a limited partner (code “0”) or a specified member (passive partner) (code “1”), the deemed gain amount under subsection 40(3.1) at the end of year is equal to the partner’s ACB absolute value at the end of year when this amount is negative.

- If the partnership is a limited liability partnership (LLP) that confers “full shield” to partners (according to subsections 40(3.14) and 96(2.4)) and the partner is a partner of an LLP (full shield) (code “5”), the deemed gain amount under subsection 40(3.1) at the end of year is equal to the absolute value of the following total when the latter is negative: the partner’s ACB at the end of year plus the partner’s share of the net income (loss) for the year (box 220, T5013 Schedule 50).

|

Note: The deemed gain amount under subsection 40(3.1) indicated in the notes shown at the bottom of the partner’s T5013 slip must be used to report income for this partner in the schedule used to calculate the capital gain. This schedule depends on the type of tax return that is filed:

|

Partner Withdrawal (including partnership dissolutions)

This section provides information required to correctly calculate the ACB of the withdrawn partner as well as the gains and losses, if applicable, arising from the partner’s withdrawal, either because of the sale or the buyout of all of his or her shares, a retirement, a wind-up of the partnership, or any other motive.

To complete this section, proceed as follows:

- Select the box indicating that the partner is withdrawn from the partnership. The value in this box will be rolled forward next year.

- Enter the partner’s withdrawal date.

- Select one of the following values to indicate the partner’s type of interest at the time of withdrawal:

- Withdrawal – Deemed continued (active) interest (ss. 96(1.01) ITA): The partner’s shares are bought out entirely or disposed of these shares in favour of one or more partners of the partnership. This type of withdrawal is also used for wound-up partnerships (save in the case of the exception under ss. 83(6), because the partners are then deemed to dispose of all of their shares at the time of the wind-up.

- Withdrawal – Residual interest (ss. 98.1(1) ITA): The partner ceases to be a partner, but retains interest of the partnership’s property since his or her shares are gradually bought out over several years (paragraph 98.1(1)(a) ITA.)

- Withdrawal – Income interest (ss. 96(1.1) ITA): The partner ceases to be a partner (as a result of the sale of all his or her shares), the main activity of the partnership is carrying on a business in Canada and all other partners agree to allocate part of the income to the ex-partner.

- To calculate whether a capital gain or loss results from the partner's withdrawal, select the box indicating that the withdrawn partner received the last payment during the fiscal year when the type Withdrawal – Residual interest (ss. 98.1(1) ITA) is selected.

Calculation detail:

- If the type Withdrawal – Deemed continued (active) interest (ss. 96(1.01) ITA) is selected:

- the program will calculate the ACB at the end of the fiscal year after the adjustments under subsection 96(1.01) ITA;

- the program will calculate the amount of the gain (as defined in subsection 40(3.1) ITA) or loss (election under subsection 40(3.12) ITA) arising from the sale or the buyout of the interest, if applicable;

- the amount of the gain or loss in accordance with subsection 40(3.1) or 40(3.12) will be displayed in a note at the bottom of the T5013 slip.

- If the type Withdrawal – Residual interest (ss. 98.1(1) ITA) is selected:

- all amounts received by the partner after the withdrawal must be listed as a capital repayment;

- if the ACB of a residual interest becomes negative at the end of the fiscal year, the program will calculate a capital gain equal to the negative balance in accordance with paragraph 98.1(1)c) ITA;

- if the ACB of a residual interest is positive after the last repayment is received, the program will calculate a capital loss equal to the ACB balance in accordance with paragraph 98.1(1)(c) ITA;

- the capital gain or loss in accordance with paragraph 98.1(1)(c) will be displayed in a note at the bottom of the T5013 slip.

- If the type Withdrawal – Income interest (ss. 96(1.1) ITA) is selected:

- the program will calculate the gain or loss under subsection 40(3.1) ITA arising from the disposition of the partner’s shares in the partnership the first year of the partner’s withdrawal;

- only the income and losses of the partnership will be allocated to the partner;

- if the withdrawn partner decides to dispose of this right to income of the partnership, the program will prompt you to enter the consideration amount received;

- the proceeds of disposition of the “income interest” (defined in subsection 96(1.2) ITA) by the withdrawn partner is not capital property and the amount received is 100% taxable (under subsection 96(1.4) ITA).

See Also

T4068, Guide for the Partnership Information Return (T5013 Forms)