Adding Parent and Subsidiary Entities in a Multi-Tier Consolidated Engagement

A multi-tier consolidation is where you can setup multiple subsidiary trial balances and define the parent entities they each roll up to. You can create up to 100 subsidiaries and an unlimited number of parents.

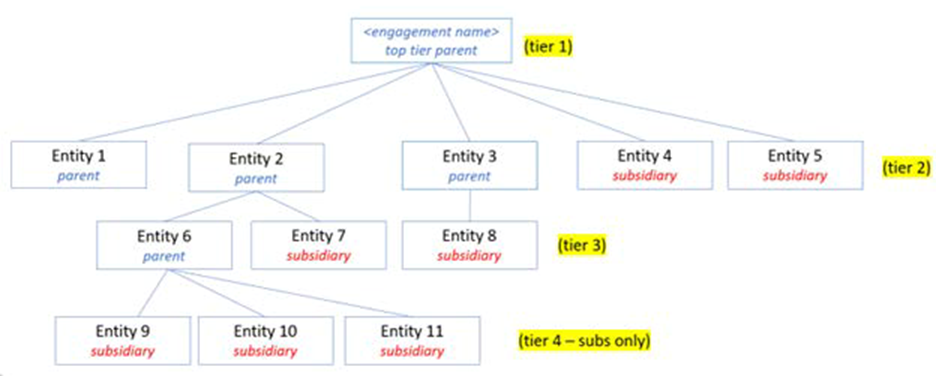

In the Consolidation Setup grid, you define the hierarchy of subsidiaries and parents. The engagement name displays in the 1st row of the grid. This is the 1st tier of the consolidated engagement. Next, you add a mix of parent and/or subsidiary entities below the 1st tier. You continue by adding additional entities below the 2nd and 3rd tier parents as needed. You can create up to 4 tiers, with the 4th tier consisting of subsidiary entities only. The balances in the parent entity are the sum of the entity balances that are rolling up to the parent. Parent entities do not have their own trial balance. Subsidiary entities have their own trial balances and share the same financial and tax groups and sub-groups. This ensures consistency across the subsidiaries and saves time when customizing the grouping list.

Tip: If you want a separate trial balance for a holding company, then add a subsidiary entity below the parent for those accounts and balances.

Example of a 4-tier consolidated engagement:

To add entities in the Consolidation Setup grid:

-

Click the plus sign

in the ADD ENTITY column. The Add Entity pane will open.

in the ADD ENTITY column. The Add Entity pane will open. -

Select the entity type: Parent or Subsidiary.

Enter Entity name. Name can be up to 75 characters. All characters are valid.

Enter Entity short name. Short name can be up to 30 characters. These special characters are not allowed ‘ | : “ , ( ) The short name is displayed in column headers of the trial balance, leadsheets, and other reports. Short name is also used in the formulas created with Trial Balance Links (TB Links) in Microsoft Word and Microsoft Excel.

Note: Changing the entity short name after creating TB Links will break the TB Link formulas. You can use the Find/Replace in Microsoft Excel and Microsoft Word to update the entity short name in the formulas.

-

Click Add to save the entity to the grid.

-

Optionally, for tax consolidations, enter the subsidiary’s CLIENT ID.SUB ID. This is a look up list to the client’s setup in Client manager in CCH iFirm Taxprep. The CLIENT ID.SUB ID will be used to link tax balances to a CCH iFirm Taxprep return. If you do not plan to link to a tax return, you can leave this field blank and the engagement’s CLIENT ID.SUB ID will be automatically added.

Note: Changing the CLIENT ID.SUB ID after linking to a tax return will break the link to the tax return.

-

Optionally, enter a percentage of the subsidiary owned by the parent in the % Owned column. This is for informational purposes only. It is not used in the application.

-

Grid functions you can perform now, or later:

Edit entity names and short names by typing in the grid and click out of the cell to save.

Reorder the entities within a tier, or reorder the subsidiaries under the same parent. Click on the handle on the left side of the row and release when the entity is in the desired location.

Delete an entity by clicking on the

on the right side of the row.

Note: If you delete a parent entity, any subsidiaries under that parent will be moved to the parent above the deleted parent.

-

Click Create to create the multi-tier consolidated engagement. You will be navigated to the home page and the new engagement will be at the top of engagement list.

-

Click on the engagement name to open. The Consolidation Setup page will display.

-

Do either of the following:

-

Click

in the TRIAL BALANCE column to import a subsidiary's trial balance. Repeat for each subsidiary. See Importing Trial Balance Data for information about importing a trial balance.

in the TRIAL BALANCE column to import a subsidiary's trial balance. Repeat for each subsidiary. See Importing Trial Balance Data for information about importing a trial balance.Note: Once you have imported a trial balance, the Import option changes to

. Click View to go directly to the trial balance page for that subsidiary.

. Click View to go directly to the trial balance page for that subsidiary. -

Click Engagement View to go to the Engagement View page for the consolidated engagement. You can upload workpapers, or setup folders and subfolders.

-