Learn about CCH iFirm Taxprep module security roles

When the CCH iFirm Taxprep Pro module becomes active you can assign tax security roles for the Taxprep application to user accounts. The following information outlines what each of the tax security roles allows users to do in the Taxprep application of CCH iFirm Taxprep.

- Tax Product Access

- General Settings

- Environments

- Client Letters

- Print Formats

- Preparer Profile

- Diagnostics and Custom Filters

- Tax Returns Actions

- Custom Return Status

- Labels

- Audit Trail

- EFILE

- Publish to Portal

- Export / Import Return

- Recycle Bin

- Web API

- Custom Filters

Tax Product Access

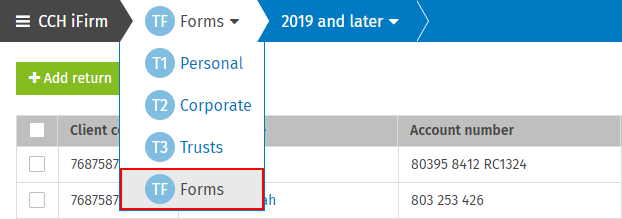

Tax – Access Forms Product

With this security role, users can access the Forms product and all related Taxprep settings. Note that users must have the appropriate license for the Forms product in the Licenses tab of their users settings. Without this security role, users will not have access to the Forms product in CCH iFirm Taxprep or in related Taxprep settings.

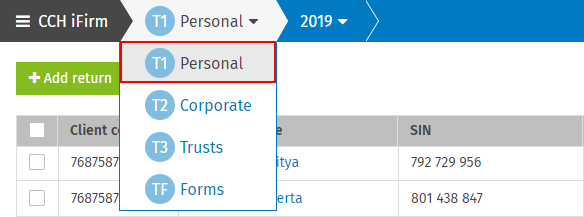

Tax – Access T1 Product

With this security role, users can access the T1 product and all related Taxprep settings. Note that users must have the appropriate license for the T1 product in the Licenses tab of their users settings. Without this security role, users will not have access to the T1 product in CCH iFirm Taxprep or in related Taxprep settings.

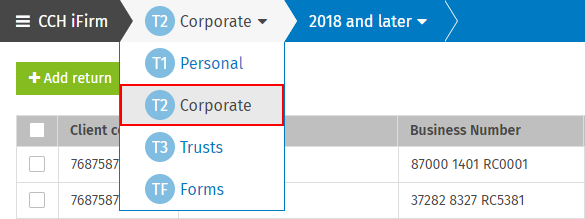

Tax – Access T2 Product

With this security role, users can access the T2 product and all related Taxprep settings. Note that users must have the appropriate license for the T2 product in the Licenses tab of their users settings. Without this security role, users will not have access to the T2 product in CCH iFirm Taxprep or in related Taxprep settings.

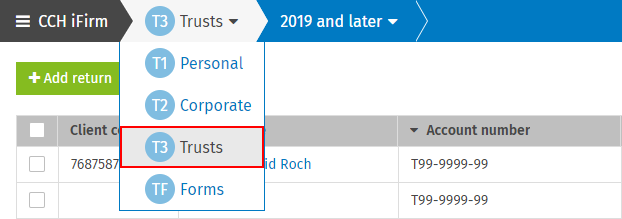

Tax – Access T3 Product

With this security role, users can access the T3 product and all related Taxprep settings. Note that users must have the appropriate license for the T3 product in the Licenses tab of their users settings. Without this security role, users will not have access to the T3 product in CCH iFirm Taxprep or in related Taxprep settings.

General Settings

Tax – Settings – General – Access

With this security role, users can access the general settings. Without this security role, the General page under Taxprep settings will be hidden.

Environments

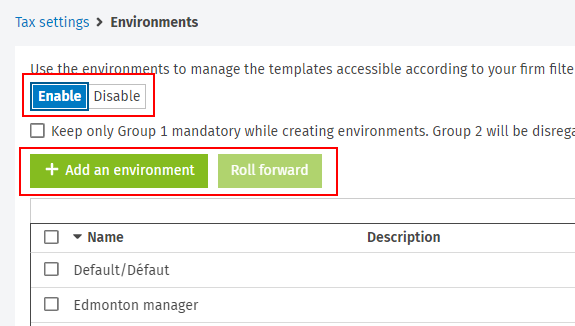

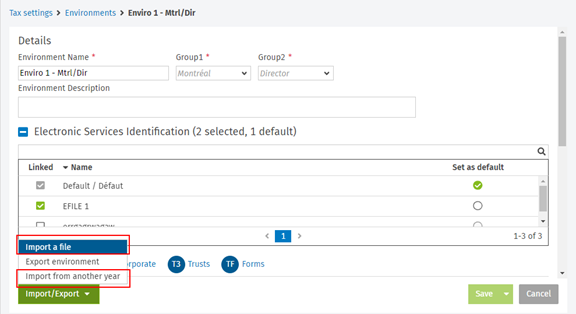

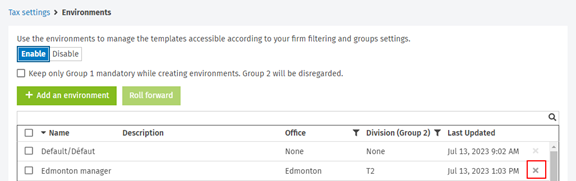

Tax – Settings – Environment – Add, Edit

With this security role, users can create new environments, edit existing ones and import data into existing ones. Without this role, the toggle to activate the Environments feature for your site will be hidden, and it won’t be possible to Add an environment or to Roll-forward an environment. Without this security role, users can still export the data from existing environments.

Tax – Settings – Environment – Delete

With this security role, users can delete existing environments. Without this role, users won’t be able to delete environments.

Client Letters

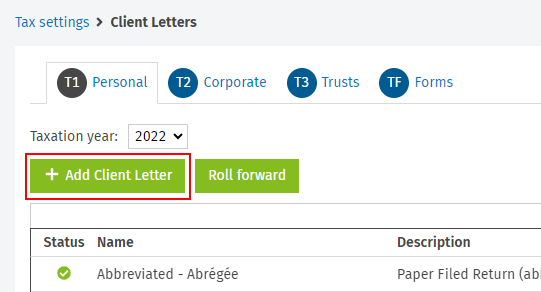

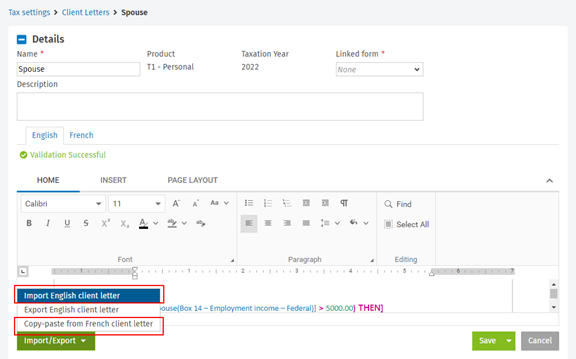

Tax – Settings – Client Letters – Add, Edit

With this security role, users can create new client letters, edit existing ones, import data into existing ones and copy-paste into the other language. Without this security role, the Add client letter button is hidden in the Client Letters manager and all editable fields in an existing client letter cannot be edited. Without this security role, users can still export the data from existing client letters.

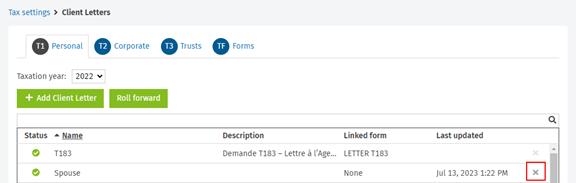

Tax – Settings – Client Letters – Delete

With this security role, users can delete client letters. Without this security role, the Delete button is hidden in the Client Letters manager.

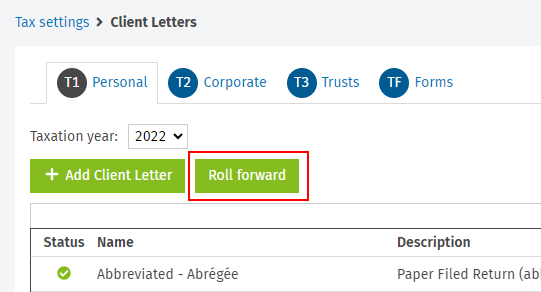

Tax – Settings – Client Letters – Roll Forward

With this security role, users can roll forward existing client letters. Without this security role, the Roll forward button is hidden in the Client Letters manager.

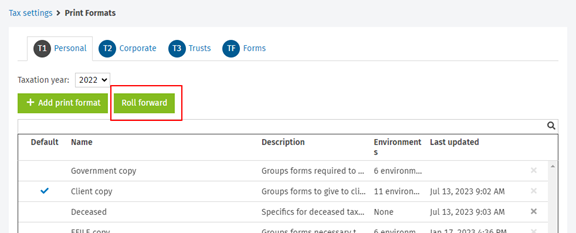

Print Formats

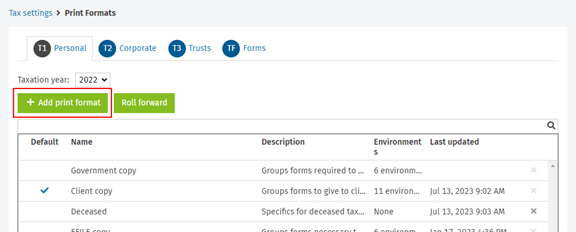

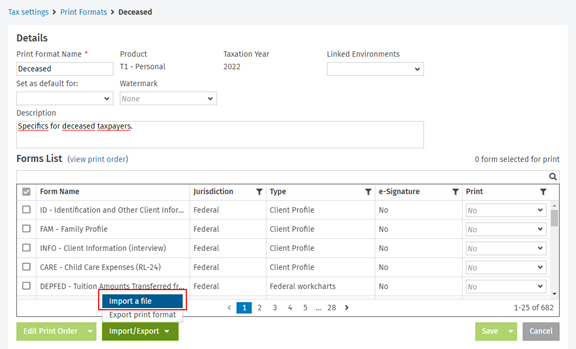

Tax – Settings – Print Formats – Add, Edit

With this security role, users can create new print formats, edit existing ones and import data into existing ones. Without this security role, the Add print format button is hidden in the Print formats manager and all editable fields in an existing print format cannot be edited. Without this security role, users can still export the data from existing print formats.

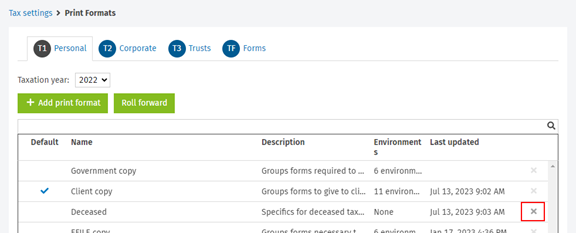

Tax – Settings – Print formats – Delete

With this security role, users can delete print formats. Without this security role, the Delete button is hidden in the Print formats manager.

Tax – Settings – Print formats – Roll forward

With this security role, users can roll forward existing print formats. Without this security role, the Roll Forward button is hidden in the Print formats manager.

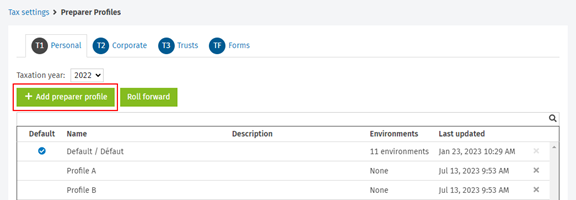

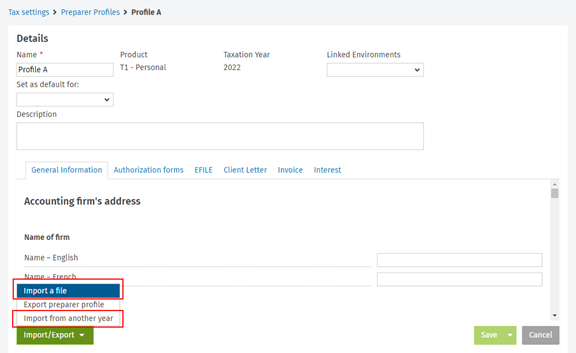

Preparer Profile

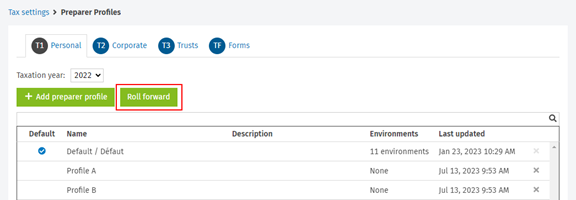

Tax – Settings – Preparer Profile – Add and Edit Preparer Profile

With this security role, users can create new preparer profiles, edit existing ones and import data into existing ones. Without this security role, the Add preparer profile button is hidden in the Preparer profile manager and all editable fields in an existing preparer profile cannot be edited. Without this security role, users can still export the data from existing preparer profiles.

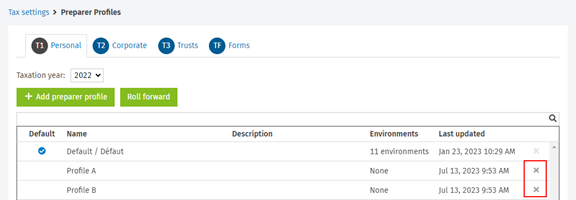

Tax – Settings – Preparer Profile – Delete

With this security role, users can delete preparer profiles. Without this security role, the Delete button is hidden in the Preparer profile manager.

Tax – Settings – Preparer Profile – Roll Forward

With this security role, users can roll forward existing preparer profiles. Without this security role, the Roll Forward button is hidden in the Preparer profile manager.

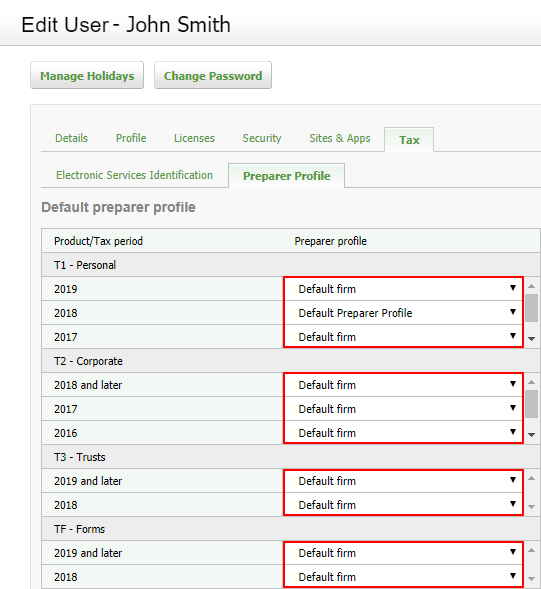

Tax – Settings – User – Preparer Profile

With this security role, users can change the default preparer profile (i.e. per tax product or taxation period) to override the default preparer profile of the firm. Without this security role, all editable fields under the Preparer Profile tab of the user settings cannot be edited.

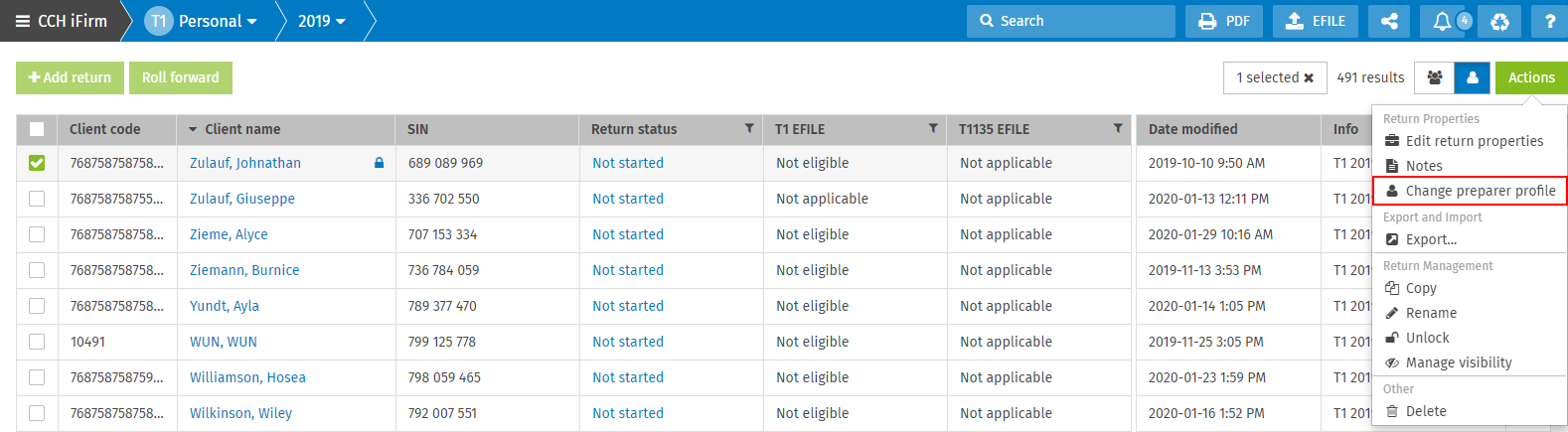

Tax – Returns – Change Preparer Profile

With this security role, users can change the default preparer profile for a specific tax return. Without this security role, the option Change preparer profile on the drop-down menu of the Actions button is hidden in the Return manager or an opened return.

Diagnostics and Custom Filters

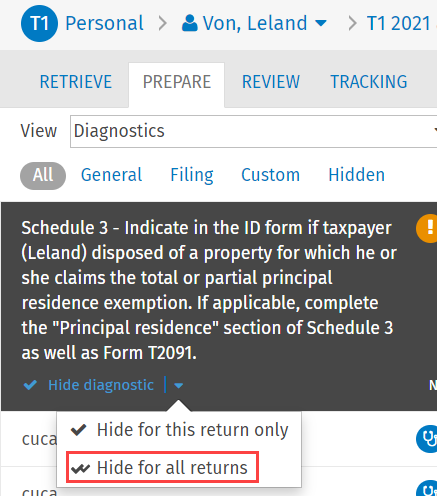

Tax – Returns – Diagnostics – Hide diagnostics for all returns

With this security role, users can hide any diagnostics for all returns. Hidden diagnostics for all returns will be hidden for all taxation years and for all users. Without this security role, the users will only be able to hide selected diagnostics for one return at a time.

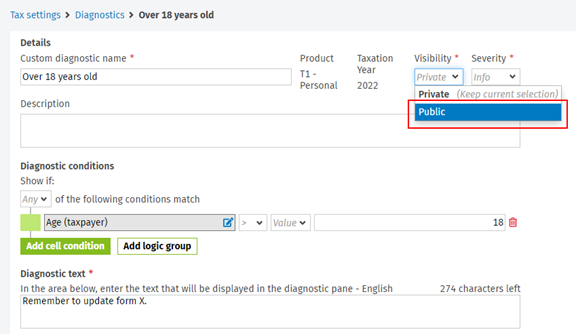

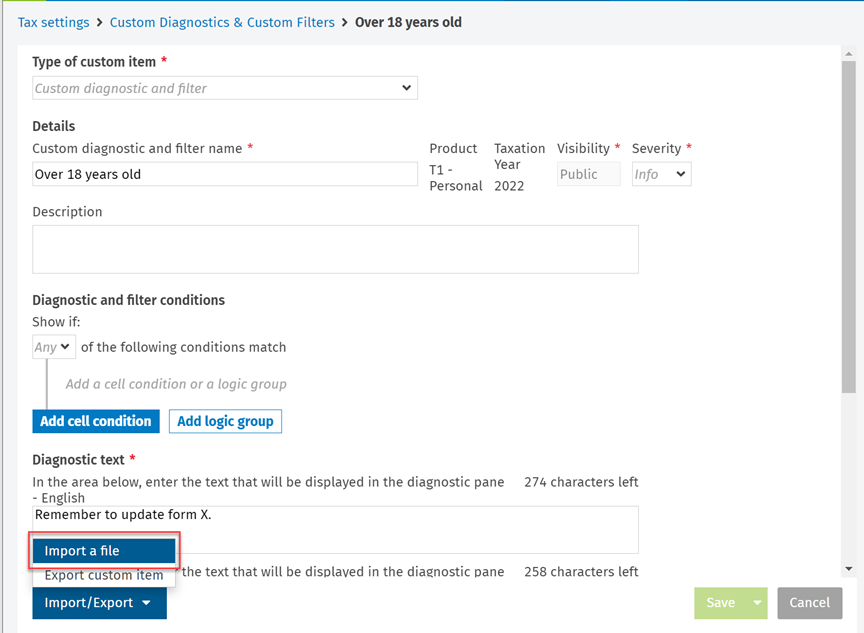

Tax – Settings – Public Custom Diagnostics and Custom Filters – Add, Edit

With this security role, users can create new public custom diagnostics, edit existing ones and import data into existing ones. No security role is required to create private custom diagnostics or edit existing ones. Without this security role, users will not be able to select the Public visibility for a new or existing custom diagnostic. Without this security role, users can still export the data from existing public custom diagnostics.

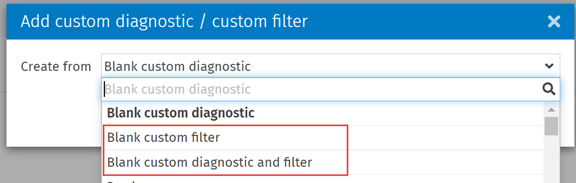

This security role is also required to create, edit and import data into custom filters, as well as custom diagnostics and filters. Without this security role, users will not have access to the options allowing them to create new custom filters or new custom diagnostics and filters. They will be able to view and export data from existing ones, but they will not be able to modify them.

Users must have the Tax – Return Manager – Custom Filters – Apply security role assigned in order to use custom filters to filter the list of returns in the Return Manager.

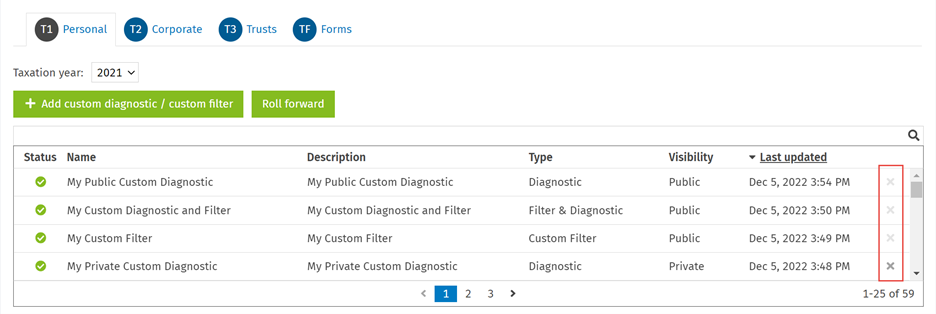

Tax – Settings – Public Custom Diagnostics and Custom Filters – Delete

With this security role, users can delete public custom diagnostics, custom filters, and custom diagnostics and filters. No security role is required to delete private custom diagnostics. Without this security role, users will not be able to delete public custom diagnostics, custom filters, and custom diagnostics and filters.

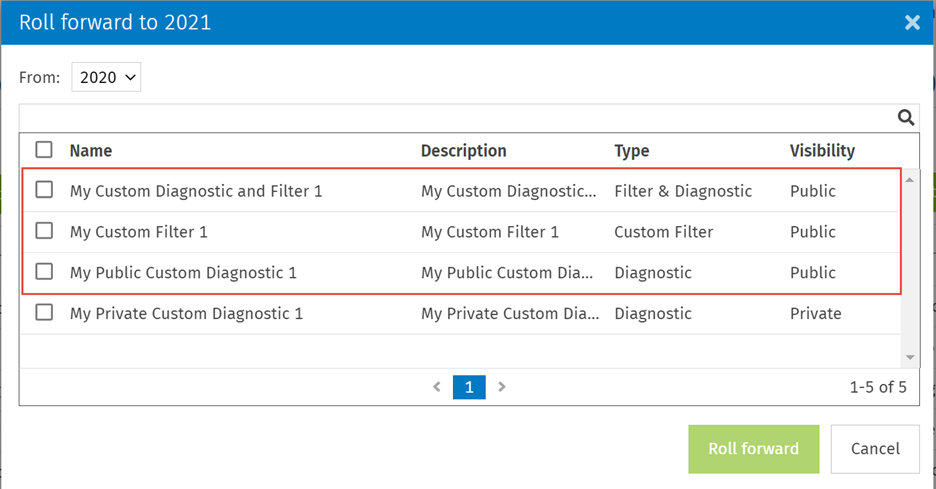

Tax – Settings – Public Custom Diagnostics and Custom Filters – Roll forward

With this security role, users can roll forward public custom diagnostics, custom filters, and custom diagnostics and filters. No security role is required to roll forward private custom diagnostics. Without this security role, users will not see Public custom diagnostics, custom filters, and custom diagnostics and filters in the roll forward confirmation screen.

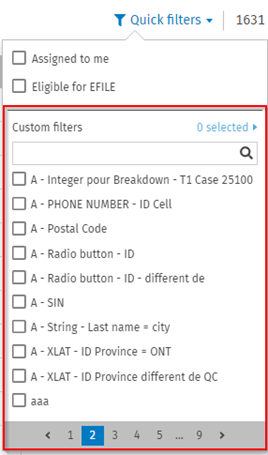

Tax – Return Manager – Custom Filters – Apply

With this security role, users can select and apply custom filters in the Quick filters drop-down menu of the Return Manager, to filter the list of returns based on the conditions defined in the selected custom filter. Without this security role, users will not see the Custom filters section.

This role has no effect on the use of custom diagnostics.

Tax Returns Actions

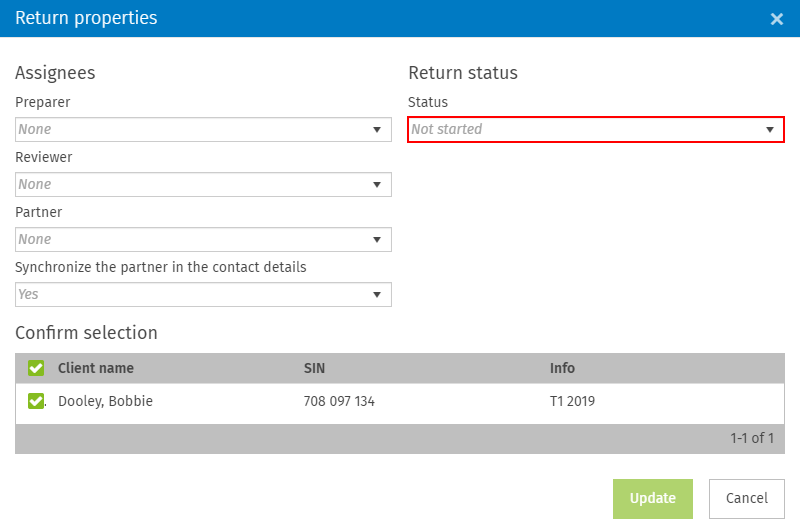

Tax – Returns – Return status

With this security role, users can change a tax return status. In T1, users can also modify the selection of the checkbox which applies the change of the return status to all family members. Without this security role users will see the return status section. However, it will be disabled so it cannot be edited.

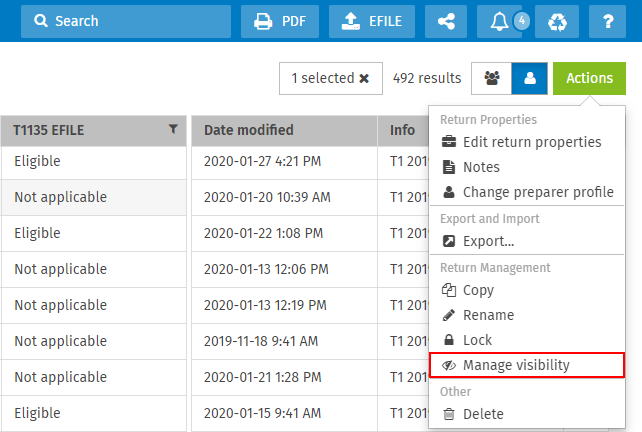

Tax – Returns – Manage Visibility

With this security role, users can make tax returns visible only for a subset of CCH iFirm Taxprep users. Without this security role, the Manage visibility option will be hidden on the drop-down menus of the Actions button and the vertical ellipsis of each return listed in the Return manager. In addition, the Manage visibility option will not be displayed when creating a return.

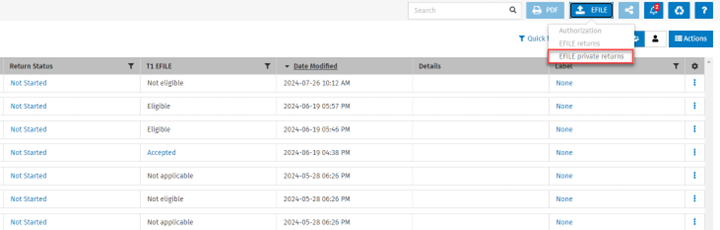

Tax – Returns – Manage Visibility – EFILE

With this security role, users can EFILE T1 and T2 private returns that they do not have access to without being exposed to any private data. Contact security is maintained; therefore, if the user does not have access to a certain contact, the related tax document cannot be EFILED by that user. Without this security role, the EFILE private returns option will be hidden in the EFILE menu.

Note that the user must also have the Tax – T1 – Returns – EFILE and/or Tax – T2 – Returns – EFILE security role(s) to be able to electronically transmit tax returns.

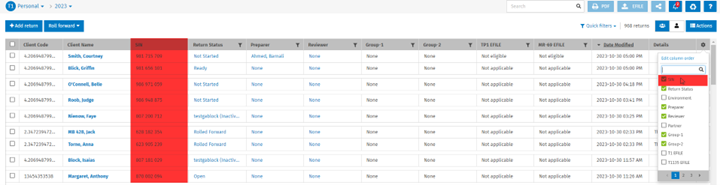

Tax – T1 - Return Manager – View SIN Column

With this security role, users can view the columns where a list of SINs is displayed in Taxprep T1. The SIN column is hidden in the following views and modals when the user does not have the security role:

-

In the Return Manager. In addition, the ability to select/unselect the column in the Manage columns (

) menu will be hidden, and it will not be visible in the Edit column order modal.

) menu will be hidden, and it will not be visible in the Edit column order modal.

-

In the Existing contact tab inside the Add return/Add spouse/Add dependant modal.

-

In the Roll forward report and the Import report modals.

-

In the Select a return modal accessed from the Retrieve tab.

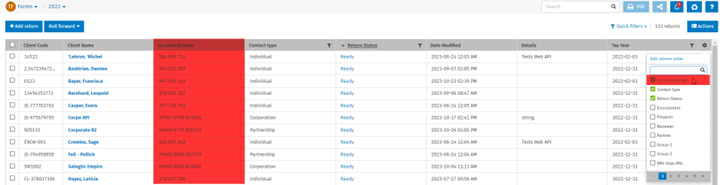

Tax – TF - Return Manager – View Account Number Column

With this security role, users can view the columns where there is a list of account numbers on Taxprep Forms. The Account Number column is hidden in the following views and modals when the user does not have the security role:

-

In the Return Manager. In addition, the ability to select/unselect the column in the Manage columns (

) menu will be hidden, and it will not be visible in the Edit column order modal.

) menu will be hidden, and it will not be visible in the Edit column order modal.

-

In the Existing contact tab inside the Add return modal

-

In the Roll forward report and the Import report modals

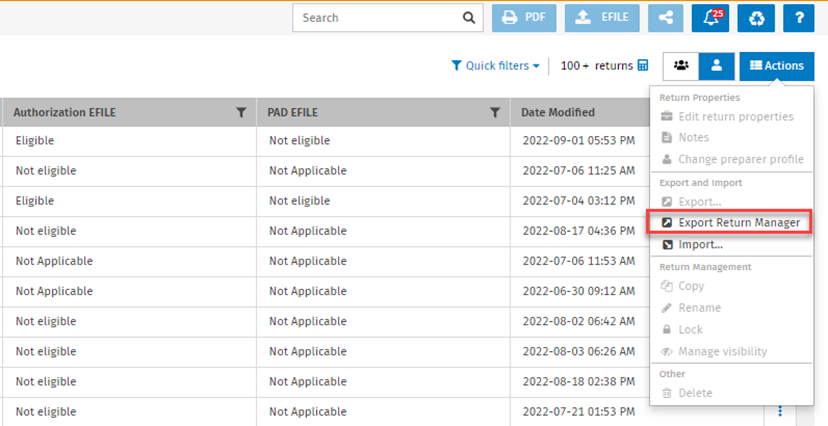

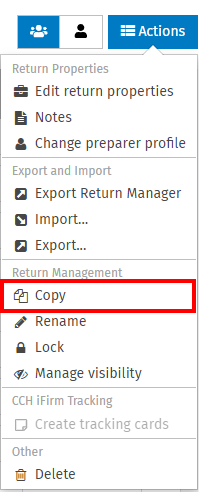

Tax – Returns – Export Return Manager

With this security role, users can export the content of their Return Manager to a CSV file. Without this security role, the Export Return Manager option will be hidden in the drop-down menus of the Actions button.

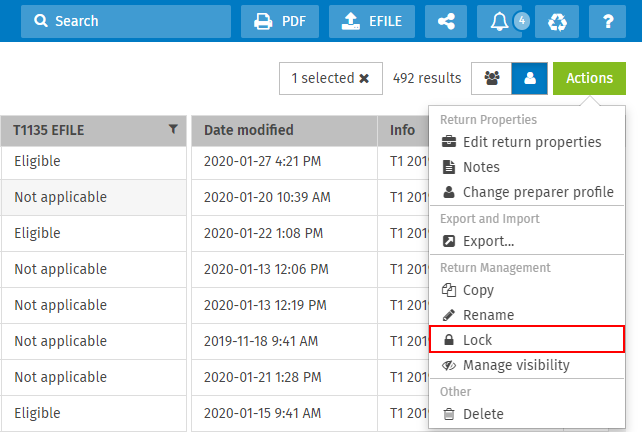

Tax – Returns – Lock and Unlock

With this security role, users can lock or unlock a tax return. Without this security role, the Lock/Unlock option will be hidden on the drop-down menus of the Actions button and the vertical ellipsis of each return listed in the Return manager.

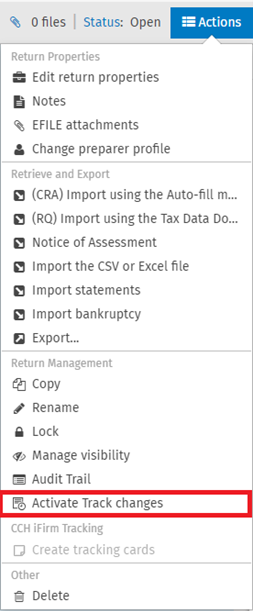

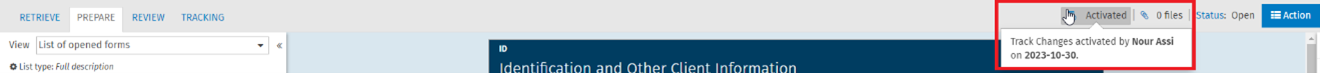

Tax – Returns – Activate and deactivate track changes

With this security role, users can activate or deactivate track changes on a tax return. Without this security role, the Track changes option will be hidden in the drop-down menus of the Actions button inside the opened return. The ability to deactivate track changes from the badge will also be blocked if this security role was not granted.

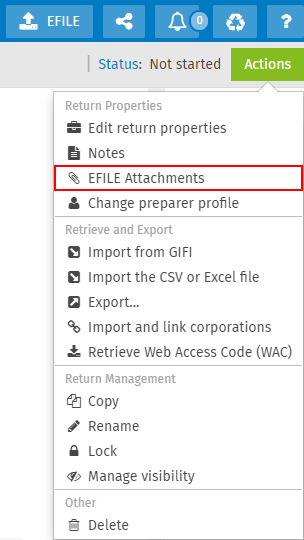

Tax – Returns – EFILE Attachments

With this security role, users can add attachments to a personal or a corporate tax return. Without this security role, the EFILE attachments option will be hidden on the drop-down menu of the Actions button in an opened return. Users will not be allowed to add attachments when EFILING a tax return nor will they be able to consult attachments in the TRACKING tab in a return.

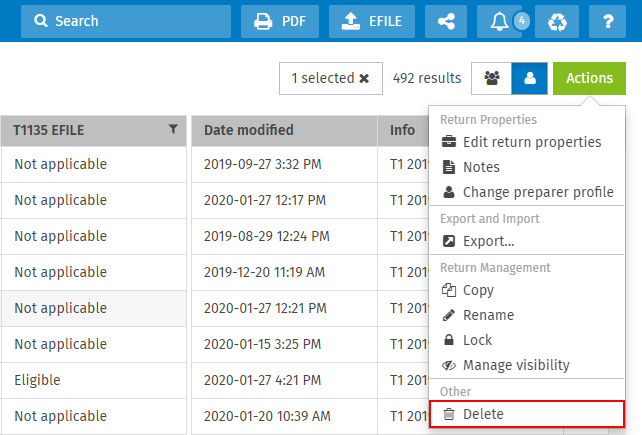

Tax – Returns – Delete

With this security role, users can delete a tax return and send it to the recycle bin. Without this security role, the Delete option will be hidden on the drop-down menus of the Actions button and the vertical ellipsis of each return listed in the Return manager.

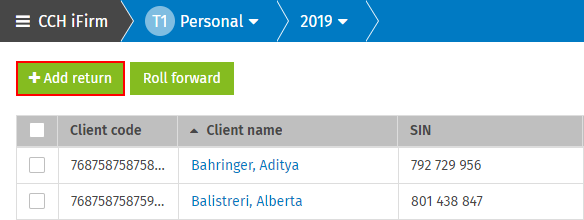

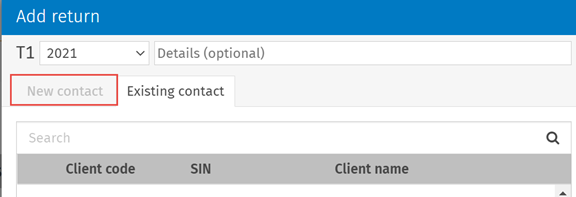

Tax – Returns – Add

With this security role, users can create a tax return. Without this security role, the Add return option located in the Return manager will be hidden.

To create a return for a new contact, the Contacts – View, Add and Edit Contacts security role is required. Without this security role, the New contact section will not be available in the Add return dialog box. It will be possible to create returns for existing contacts, but not for new contacts.

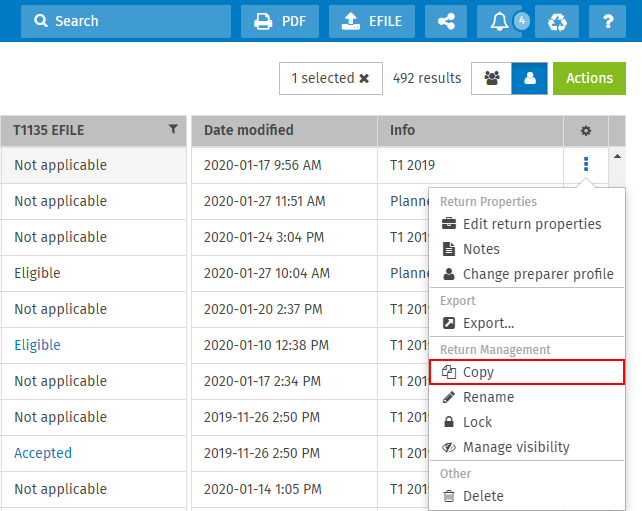

Tax – Returns – Copy

With this security role, users can copy a tax return. Without this security role, the Copy option will be hidden from the drop down menus of the Actions button and the vertical ellipsis of each return listed in the Return manager.

Tax - Returns - Create Tracking card

With this security role, users can create a Tracking card associated with a return. They can do so when they:

-

Create a return;

-

Copy a document;

-

Select Create Tracking cards from the Actions menu;

-

Roll forward a document.

Without this security role, users will not be able to create Tracking cards.

Note: Users must also have the appropriate license for the Tracking product in the Licenses tab of their user settings.

![]()

![]()

Custom Return Status

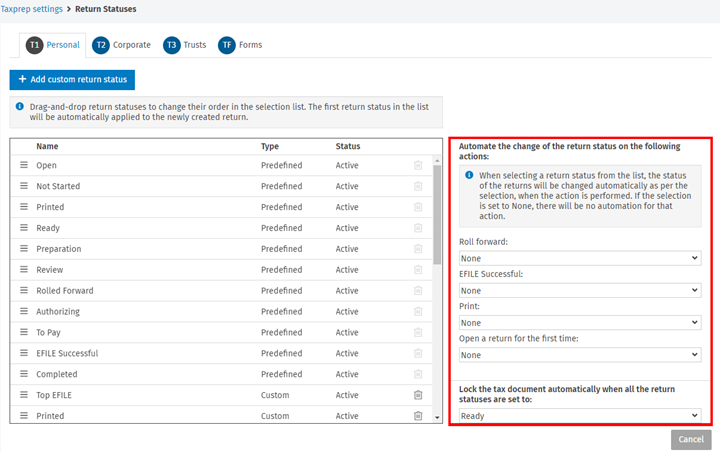

Tax – Settings – Custom return statuses – Add, edit

With this security role, users can create new return statuses and edit existing ones. Without this security role, the Add custom return status button will be hidden in the Return Statuses manager and users will not be able to change the order of the return statuses nor will they be able to edit any of the editable fields in an existing return status. In addition, the following sections in the right panel will be disabled:

-

Activation of automated return statuses

-

Deactivation of automated return statuses

-

Actions based on the return status

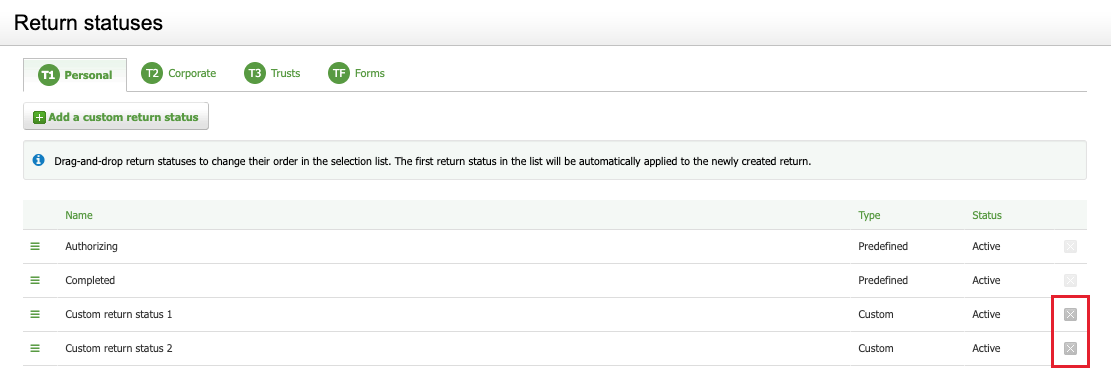

Tax – Settings – Custom return statuses – Delete

With this security role, users can delete custom return statuses. Without this security role, the Delete button will be hidden in the Return Statuses manager.

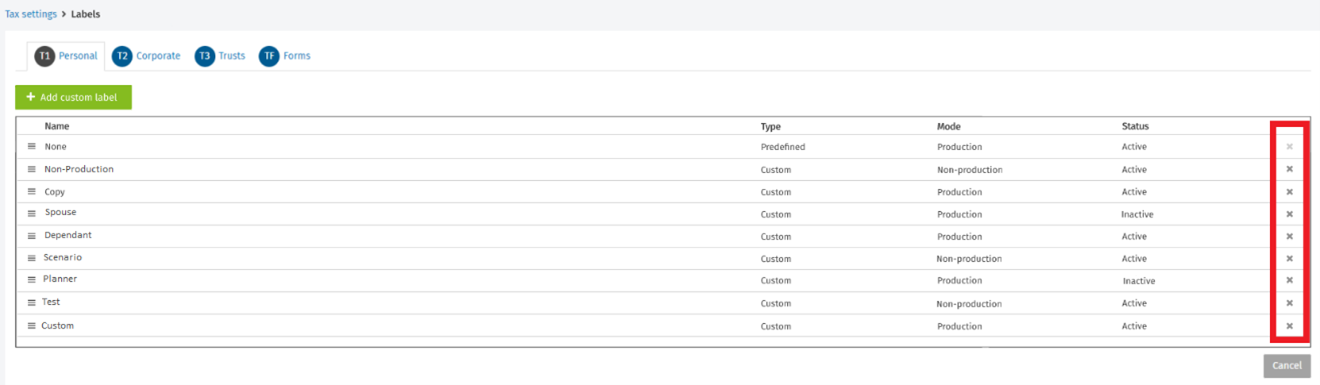

Labels

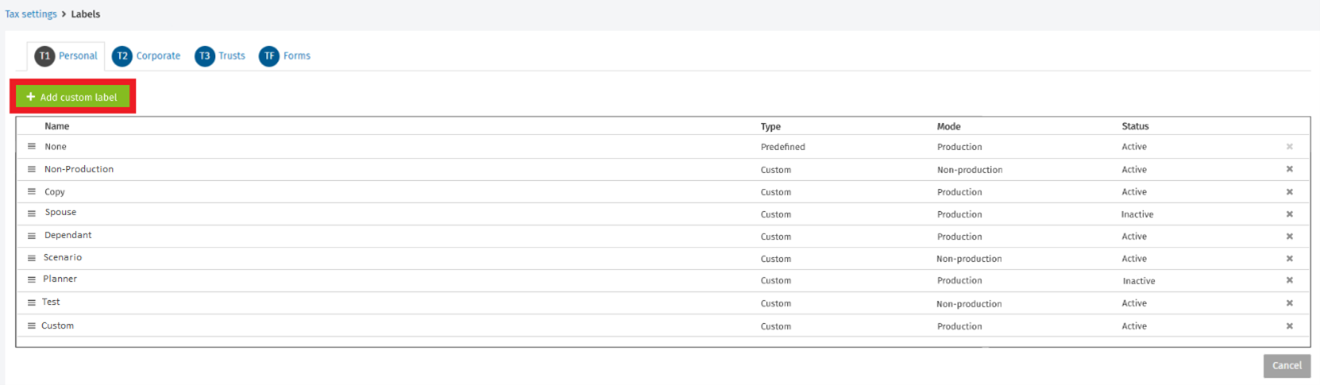

Tax – Settings – Labels – Add, Edit

With this security role, users can create new labels and edit existing ones. Without this security role, the Add custom label button will be hidden in the Labels manager and users will not be able to change the order of the labels nor will they be able to edit any of the editable fields in an existing label.

Tax – Settings – Labels – Delete

With this security role, users can delete custom labels. Without this security role, the Delete button will be hidden in the Labels manager.

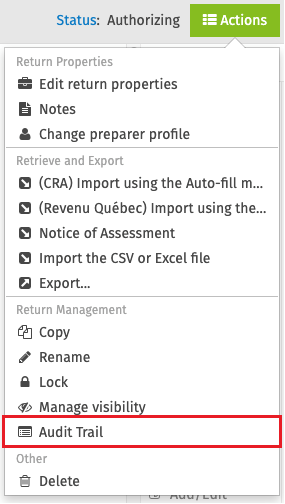

Audit Trail

Tax – Returns - Audit trail – Access

With this security role, users can access the audit trail. Without this security role, the option Audit trail on the drop down menu of the Actions button will be hidden in an opened return.

Tax – Returns – Audit trail – Rollback

With this security role, users can perform a rollback on certain actions. Users must have the Tax – Returns – Audit trail – Access security role assigned in order to have access to the Audit Trail.

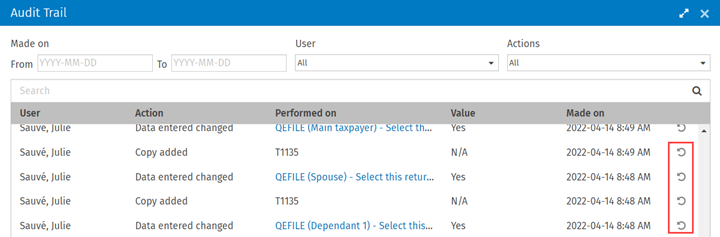

EFILE

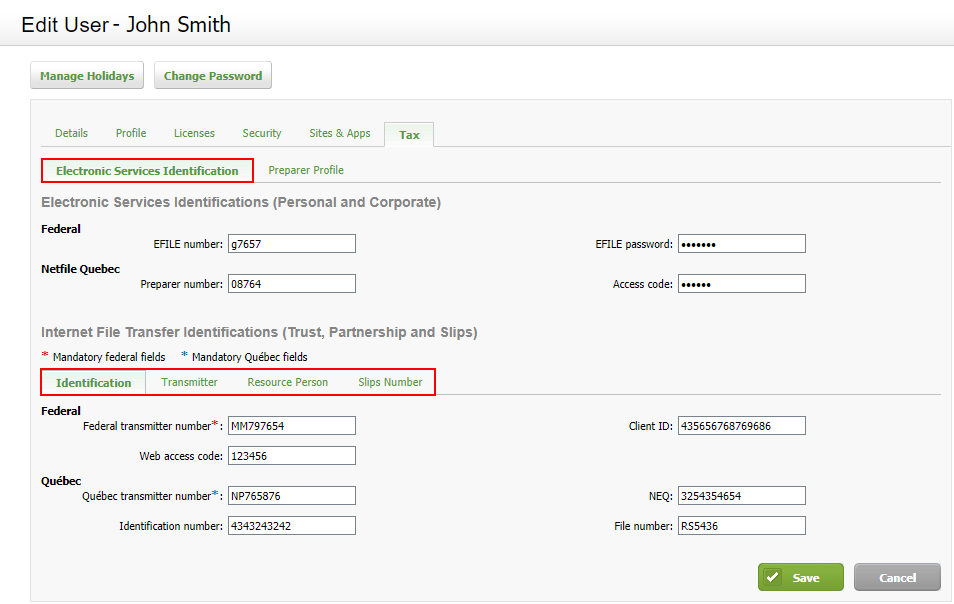

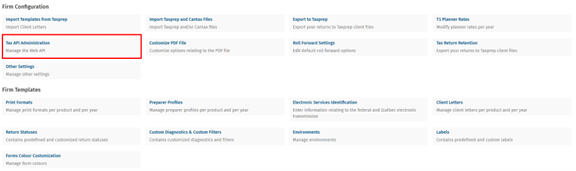

Tax - Settings – Access Firm EFILE information

With this security role, users can access the Electronic Services Identification manager in the Taxprep settings. Without this role, the Electronic Services Identification manager will not be visible; thus, the user will not be able to manage the firm’s electronic services identification information.

Tax – Settings – Edit EFILE information

With this security role, users can edit the EFILE information contained in the users Electronic Services Identification tab (in the Taxprep tab of users’ settings). Without the security role, users cannot see the Electronic Services Identification tab in the Taxprep tab of users’ settings.

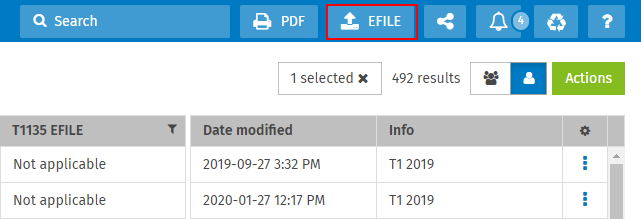

Tax – T1 – Returns – EFILE

Tax – T2 – Returns – EFILE

Tax – T3 – Returns – EFILE

Tax – TF – Returns – EFILE

The EFILE transmission can be accessible or not for each product, according to the security roles assigned to the user. With these security roles, users can EFILE from the return manager and from an opened return for all products. Without these security roles, users are not able to see the EFILE button in the top menu.

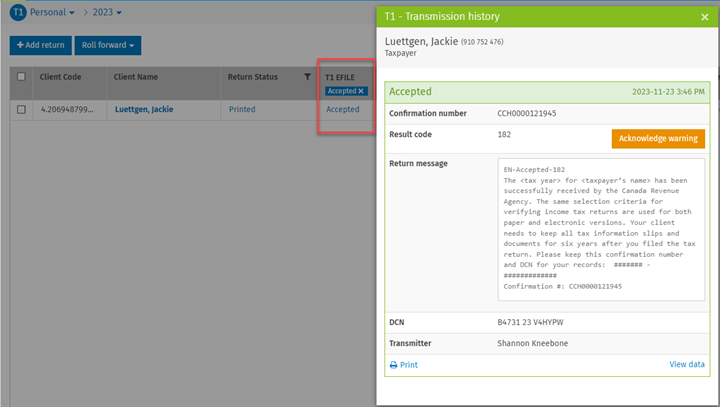

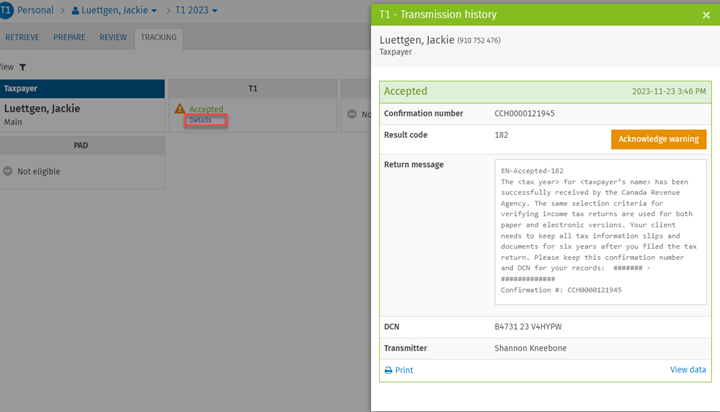

Tax – T1 – Returns – Access transmission history

Tax – T2 – Returns – Access transmission history

Tax – T3 – Returns – Access transmission history

Tax – TF – Returns – Access transmission history

The EFILE transmission history can be accessible or not for each product, according to the security roles assigned to the user. With these security roles, users can consult the transmission history specific to the product. Without these security roles, users are not able to click on the EFILE statuses displayed in the return manager nor on the Details link in the tracking view to visualize the transmission history information.

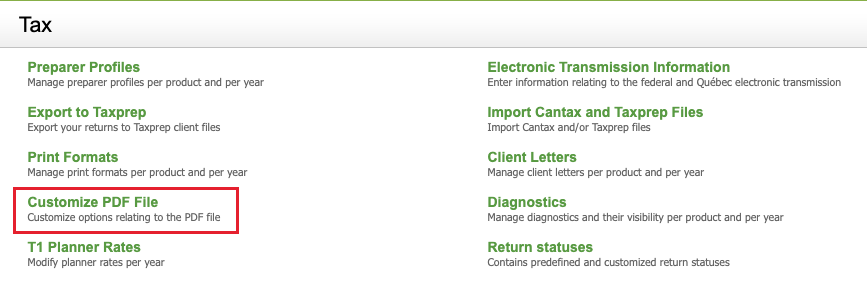

Tax – Settings – Customize PDF File

With this security role, users can access the Customize PDF File section of the Taxprep settings. Without this security role, users will not be able to see the Customize PDF File in the Taxprep settings.

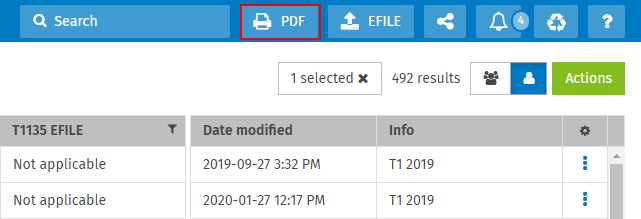

Tax – Print to PDF

With this security role, users can Print PDF returns, Notices of Assessment, forms and slips. Without this security role, users will not be able to see the PDF button in the top menu.

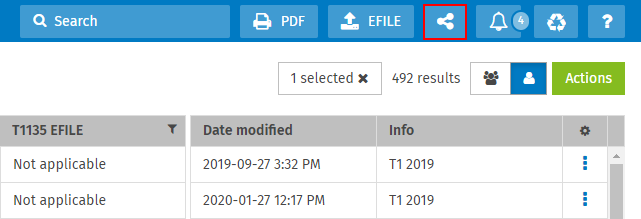

Publish to Portal

Tax – Publish to Portal

With this security role, users can publish returns to Portal, Notices of Assessment, forms and slips. Without this security role, users will not be able to see the Publish button in the top menu.

Export / Import Return

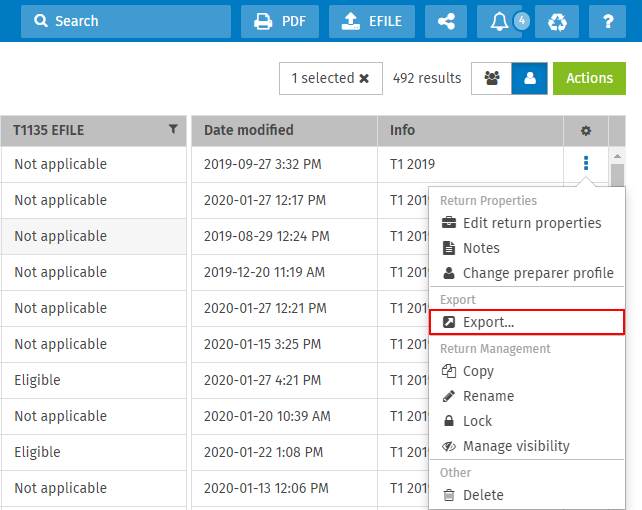

Tax – Returns – Export

With this security role, users can export a single return to a CSV, Microsoft Excel or Taxprep file or multiple returns to CSV or Microsoft Excel. Without the security role, users will not see the Export option on the drop-down menus of the Actions button and the vertical ellipsis of each return listed in the Return manager.

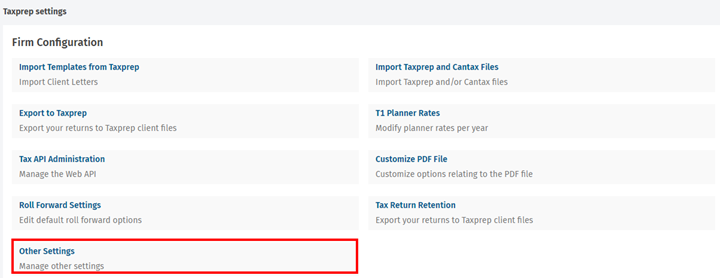

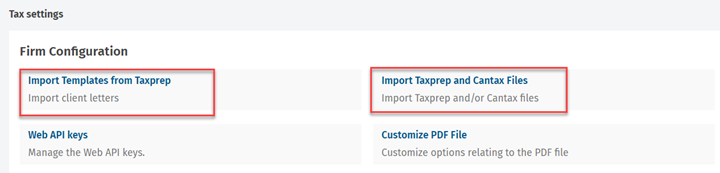

Tax – Settings – Import from Taxprep

With this security role, users can import Taxprep and Cantax files, as well as import templates from Taxprep, in CCH iFirm Taxprep. Without this security role, users will not be able to see the Import Taxprep and Cantax Files and Import Templates from Taxprep sections in the Taxprep settings. Users must have the Tax – Import and Roll Forward Password-Protected Taxprep and Cantax Files security role assigned in order to be able to import password protected Taxprep and Cantax files. Note that during the import of Taxprep and Cantax files, new contacts are created automatically when no match with an existing contact is found in CCH iFirm.

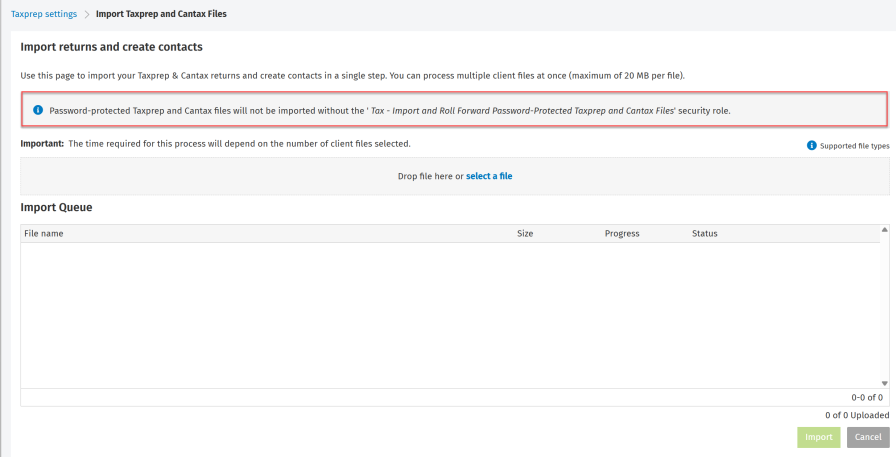

Tax - Import and Roll Forward Password-Protected Taxprep and Cantax Files

With this security role, users can import and roll forward password-protected Taxprep and Cantax files in CCH iFirm Taxprep. Note that the password will be removed and the files will be imported or rolled forward as per the selection. Without this security role, users will not be able to import or roll forward password-protected Taxprep or Cantax files in CCH iFirm Taxprep.

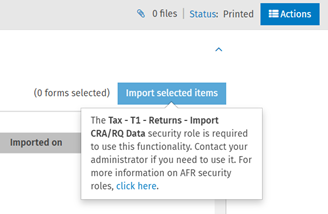

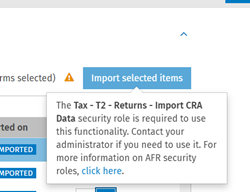

Tax – T1 – Returns – Import CRA/RQ Data

With this security role, users can import into a T1 tax return data that has been downloaded using the CRA's Auto-fill my return service and Revenu Québec Tax Data Download service. Without this security role, the import button will be disabled.

Tax – T2 – Returns – Import CRA Data

With this security role, users can import into a T2 tax return data that has been downloaded using the CRA's T2 Auto-fill service. Without this security role, the import button will be disabled.

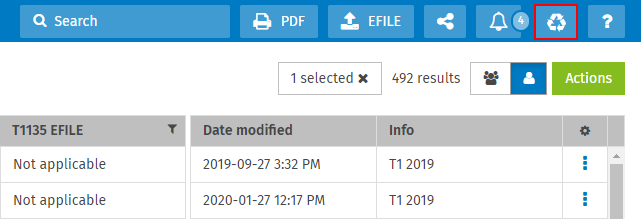

Recycle Bin

Tax – Recycle Bin – Access

With this security role, users can access the recycle bin and restore or permanently delete tax returns. Without this security role, users will not be able to see the Recycle Bin button in the top menu.

Web API

Tax - Settings - Taxprep API Administration - Access

With this security role, users can access the Taxprep API Administration page under the Taxprep settings. From this page, they can access Swagger and manage the API keys when the API Keys authentication method is activated. Without this security role, users will not be able to see the Taxprep API Administration section in the Taxprep settings.

Contact Synchronization

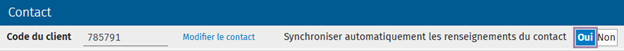

Tax - Returns – Change contact

With this security role, users can modify the contact linked to a return.

Without this security role, users will not be able to change the contact linked to the return. Therefore, if users click the Change Contact link, an error message will be displayed.

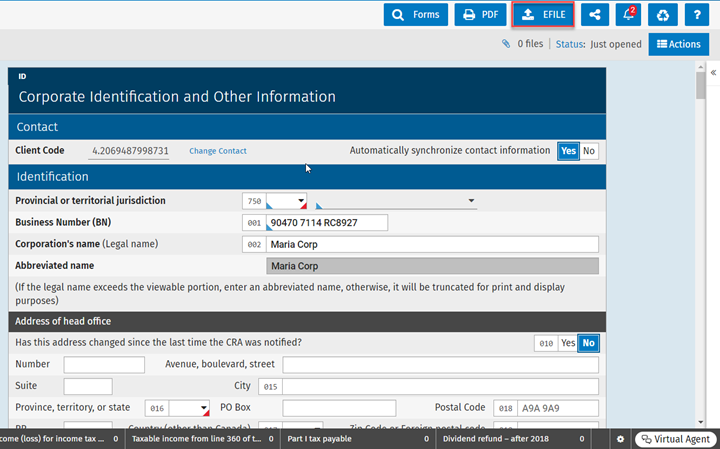

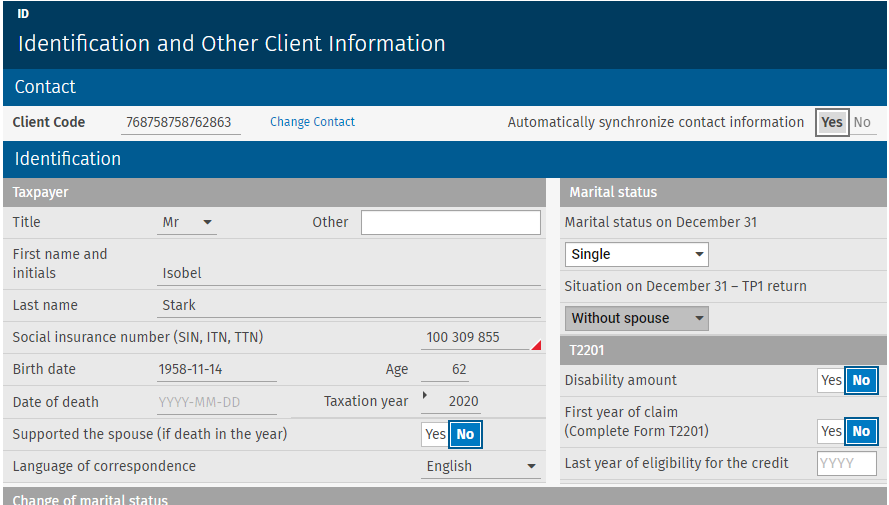

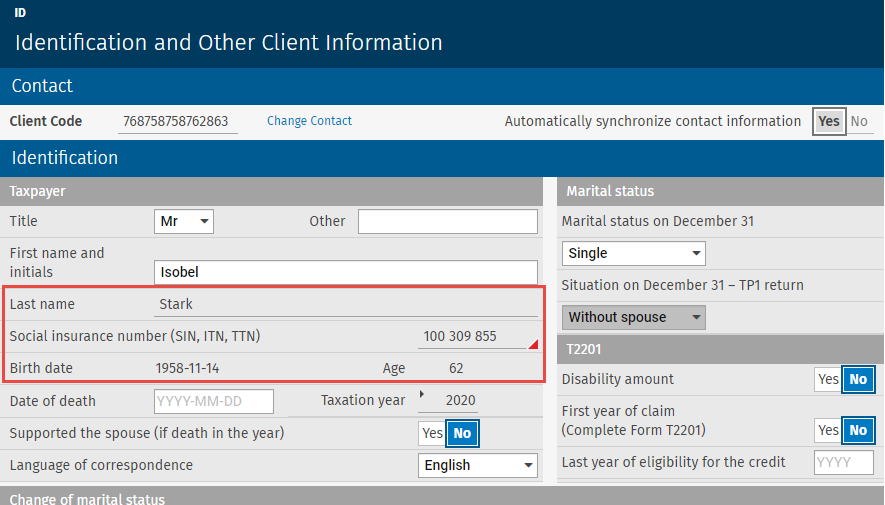

Tax - Returns - Edit all cells of the contact

With this security role, users can edit and synchronize all cells (in the ID form) that can be synchronized with the contact linked to the return.

Without this security role and without the Tax - Returns - Edit specific cells of the contacts security role, users will not be able to edit and synchronize any of the cells that can be synchronized with the contact linked to the return.

Tax - Returns - Edit specific cells of the contact

With this security role but without the Tax - Returns - Edit all cells of the contact security role, users can edit and synchronize only a subset of cells (in the ID form) that can be synchronized with the contact linked to the return. It will not be possible to modify the following cells:

|

Product |

Cells |

|

T1 |

Client code, Last name, SIN, Birth date |

|

T2 |

Client code, Corporation name, Business number |

|

T3 |

Client code, Name of trust, Account number |

|

Forms |

Client code, SIN, Last name, Birth date, Business number, Corporation name, Client name, Account number |

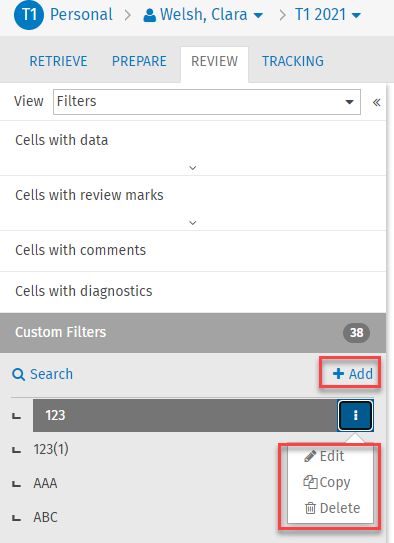

Custom Filters

Tax – Returns – Review – Custom Filters – Add, Edit, Delete

With this security role, users will be able to create, modify and delete custom filters in the Review tab of a return. Without this role, users will only be able to search, view and apply existing custom filters.

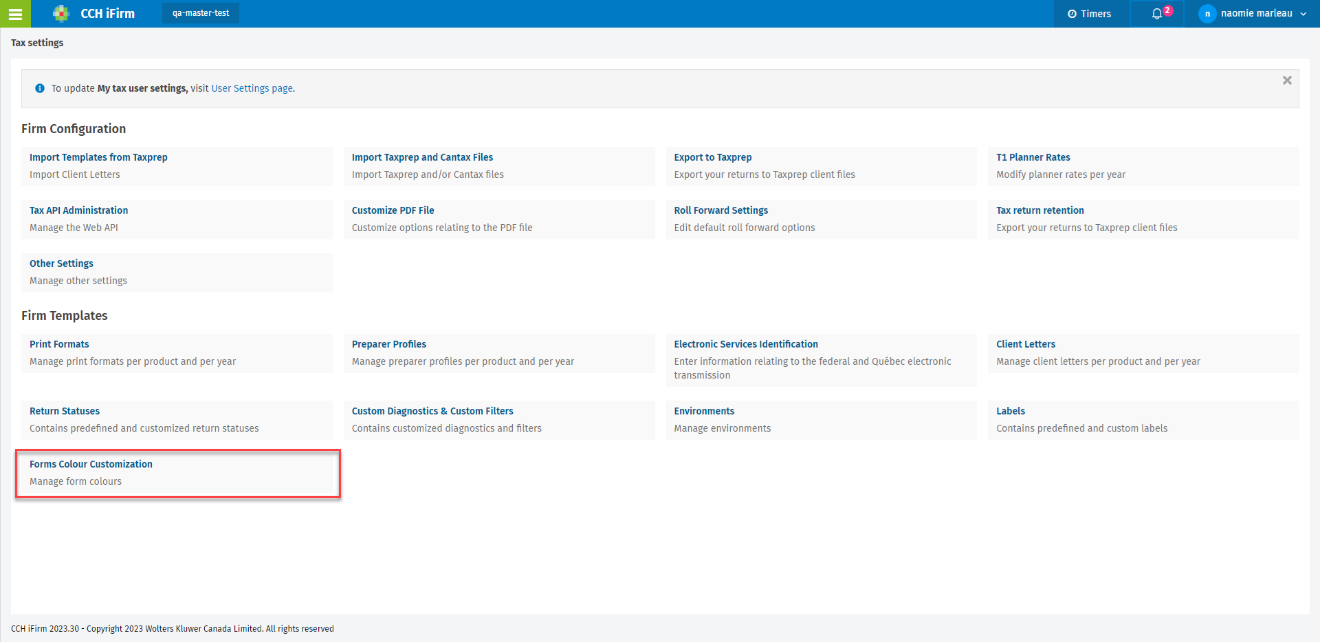

Forms Colour Customization

Tax - Settings - Forms colour customization

With this security role, users can manage and edit the forms’ colour themes. Without this security role, users will not be able to see the Forms Colour Customization section in the Taxprep settings.

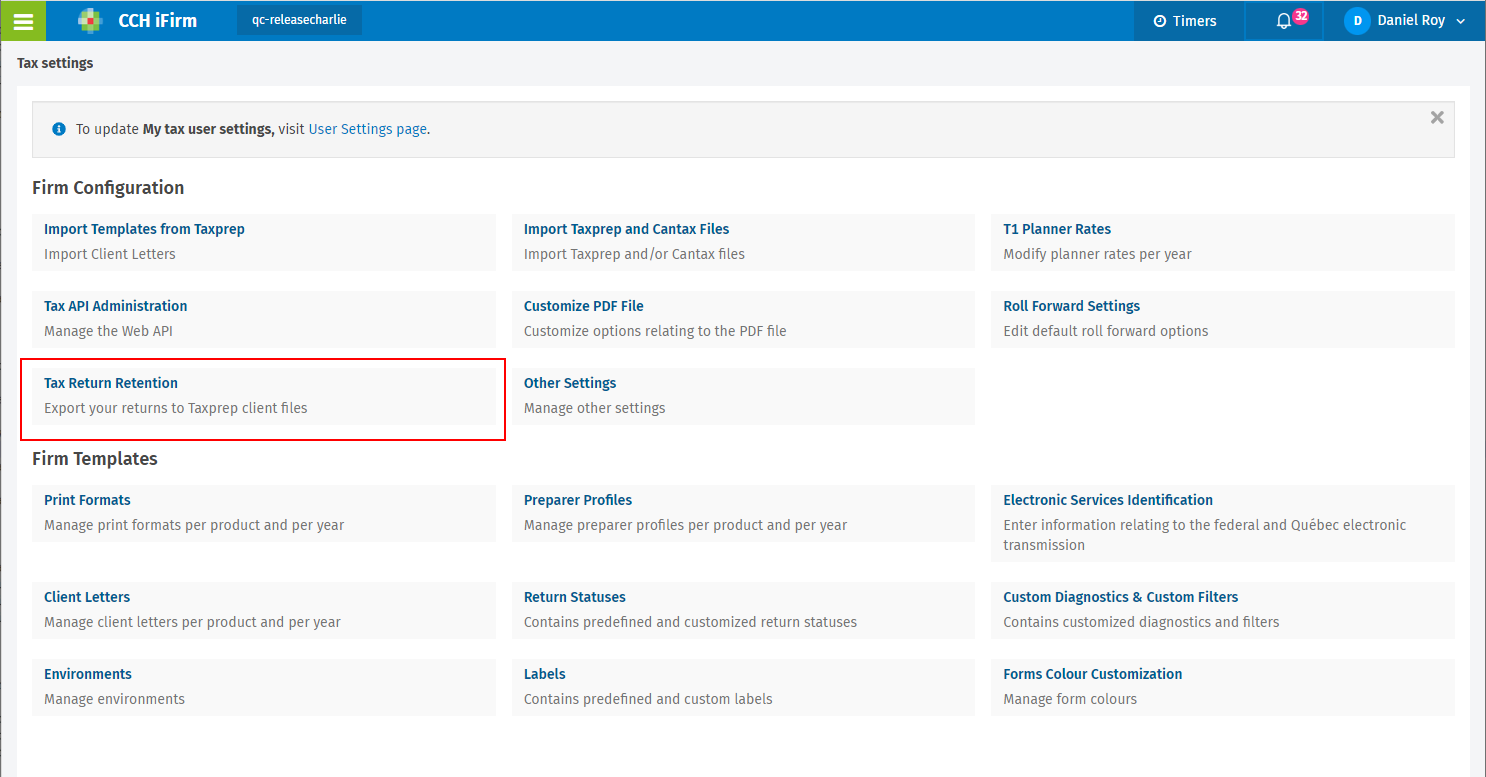

Tax Return Retention

Tax – Settings – Tax Return Retention

With this security role, users can access the Tax Return Retention section in the Taxprep settings. Without this security role, the Tax Return Retention section will not be visible; thus, users will not be able to export to Taxprep files the outdated firm’s returns and then download them.

CCH Axcess Workflow Integration

Tax – Settings – CCH Axcess Workflow Integration

With this security role, users can access the CCH Axcess Workflow Integration section in the Taxprep settings. Without this security role, the CCH Axcess Workflow Integration section will not be visible; therefore, users will not be able to generate a key used to link CCH Axcess Workflow to CCH iFirm Taxprep.

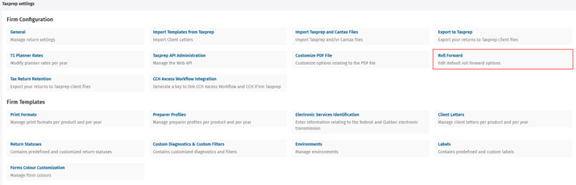

Roll Forward

Tax – Settings – Roll forward

With this security role, users can access the Roll forward section in the Taxprep settings. Without this security role, the Roll forward section will not be visible.

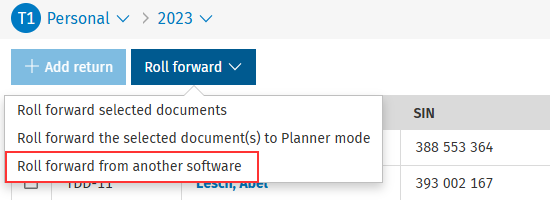

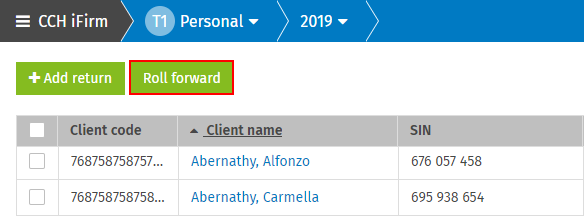

Tax – Returns – Roll forward iFirm Taxprep

With this security role, users can roll forward CCH iFirm Taxprep documents. Without this security role, users will not be able to roll forward CCH iFirm Taxprep documents.

Tax – Returns – Roll forward from Other Software

With this security role, users can roll forward returns that were prepared with another tax software program. Users must have the Tax – Import and Roll Forward Password-Protected Taxprep and Cantax Files security role assigned in order to be able to roll forward password-protected Taxprep and Cantax files. Note that during a roll forward from other software, new contacts are created automatically when no match with an existing contact is found in CCH iFirm.