Add a return

CCH iFirm Taxprep allows you to add a return from a new or an existing contact in the Contacts module.

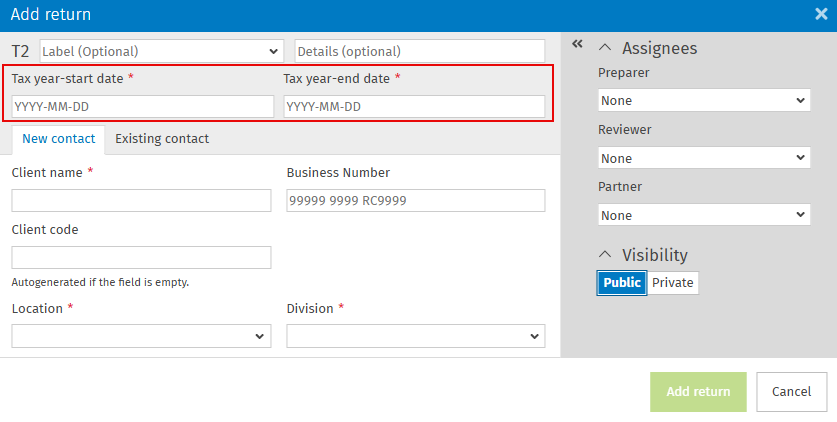

Add a return for a new contact

To add a return for a new contact, proceed as follows:

- Select the type of return .

- Click Add return.

- In the New contact tab, fill in the mandatory fields Title, First name, Last name, Birth date, Group 1 and Group 2 . The field Client code is created automatically when it is empty.

-

Click Add return. The return is then added to the return manager and the contact is added to the Contacts module.

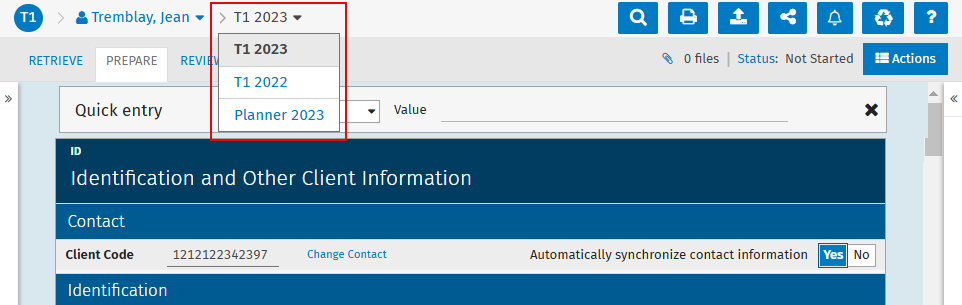

The new return is displayed in the returns menu as well as in the shortcut bar. By clicking the tax year, you can quickly switch from one year to another.

Note: Afterwards, you can add the return of a spouse or add the return of a dependant to the return of your new contact.

Note: Afterwards, you can add the return of a spouse or add the return of a dependant to the return of your new contact.

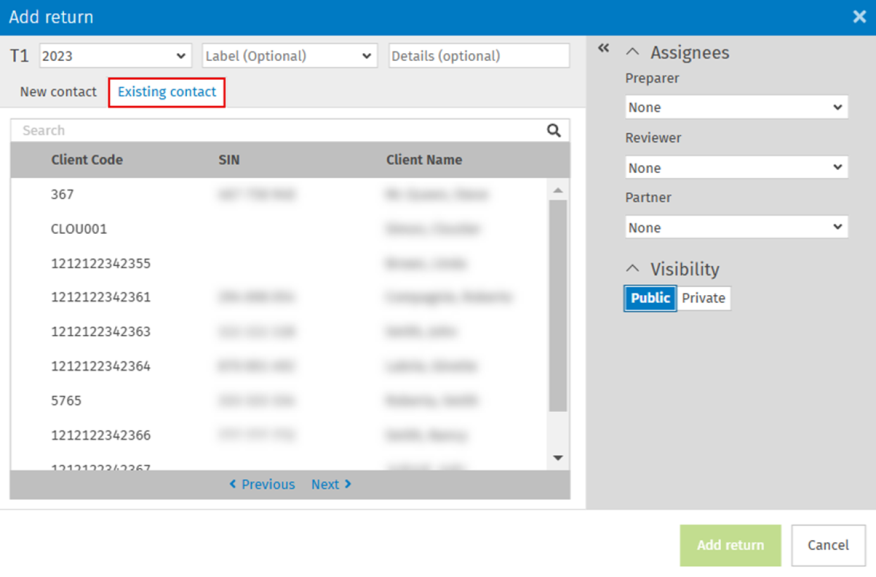

Add a return for an existing contact

To add a return for an existing contact, proceed as follows:

-

Select the type of return .

-

Click Add return.

-

In the Existing contact tab, select the contact for whom you want to add a tax return.

-

Click the Add return button. The return is then added to the return manager and linked with the contact in the Contacts module.

The return is added to the returns menu, to the existing client name, as well as to the shortcut bar. By clicking the tax year, you can quickly access returns of previous years.