Auto-fill a tax return

When you auto-fill a tax return, the tax data is retrieved directly from the Canada Revenue Agency (CRA), optimizing the preparation of tax returns.

Pre-existing information and slips can be imported using CCH iFirm Taxprep to complete T1 – Personal and T2 – Corporate returns.

Content

Auto-fill a T1 tax return

Tax – T1 – Returns – Import CRA/RQ Data

To auto-fill a T1 – Personal return for the current year, proceed as follows:

-

Select the individual concerned by the return in the return manager.

-

Click the RETRIEVE tab, then click Download in the CRA Auto-fill my return service section.

-

Select the family members for which you want to auto-fill the return, then click Download.

-

You will be redirected to the CRA website. Log in with your username and password, and follow the steps displayed to confirm that the data has been prepopulated.

-

Back in CCH iFirm Taxprep, check that all the data has been downloaded.

-

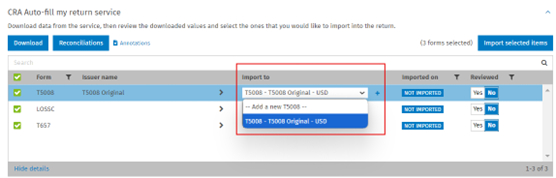

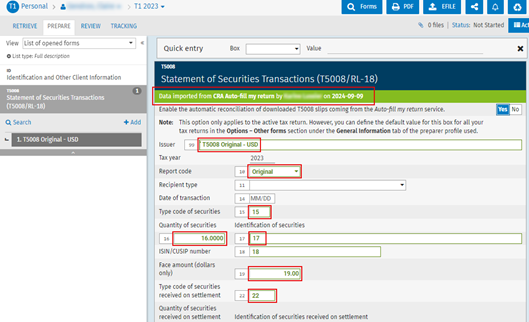

Select the items that you want to import, such as slips and tax instalments, then click Import selected items. To select all the forms, select the box at the top left.

Note: You can link a slip from the new taxation year to a slip from the previous year. Select the corresponding slip, and in the Import to drop-down list, choose the relevant slip. Repeat this step for each slip concerned.

Note: For each family member that was previously selected, click Import selected items in the return of the individual.

-

Once all the items have been imported, click the PREPARE tab to see the information. Click the

button to access the forms. The fields that have been modified due to the import will be displayed in green in the forms.

button to access the forms. The fields that have been modified due to the import will be displayed in green in the forms.

T1 tax information slips

The following information may be available for download to auto-fill your return

|

Feuillets |

Description |

|

T3 |

Statement of Trust Income Allocations and Designations |

|

T4 |

Statement of Remuneration Paid |

|

T4A |

Statement of Pension, Retirement, Annuity, and Other Income |

|

T4A(OAS) |

Statement of Old Age Security |

|

T4A(P) |

Statement of Canada Pension Plan Benefits |

|

T4E |

Statement of Employment Insurance and Other Benefits |

|

T4RIF |

Statement of Income from a Registered Retirement Income Fund |

|

T4RSP |

Statement of Registered Retirement Savings Plan Income |

|

T5 |

Statement of Investment Income |

|

T5007 |

Statement of Benefits |

|

T5008 |

Statement of Securities Transactions |

|

RC62 |

Universal Child Care Benefits Statement |

|

RC210 |

Advanced Canada workers benefits statement |

|

RRSP |

Registered Retirement Savings Plan contribution receipt |

|

PRPP |

Pooled Registered Pension Plan contribution receipt |

|

T2202 |

Tuition and Enrolment Certificate |

|

T1204 |

Government Service Contract Payments |

|

|

RENT ASSIST |

|

T5013 |

Statement of Partnership income |

|

T4FHSA |

First Home Savings Account Statement |

For more information, consult Auto-fill my return on the Government of Canada website.

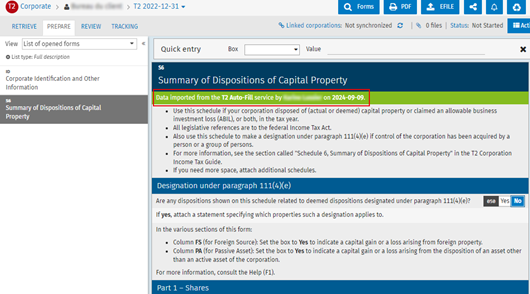

Auto-fill a T2 tax return

Tax – T2 – Returns – Import CRA Data

To auto-fill a T2 – Corporate return for the current year, proceed as follows:

-

Select the corporation concerned by the return in the return manager.

-

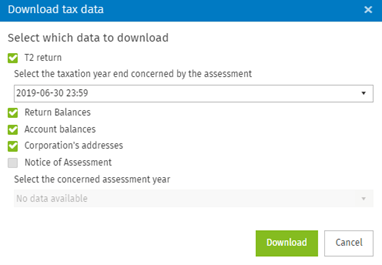

Click the RETRIEVE tab, then click Download in the CRA’s T2 Auto-fill service section.

-

You will be redirected to the CRA website. Log in with your username and password, and follow the steps displayed to confirm that the data has been prepopulated.

-

Back in CCH iFirm Taxprep, choose the taxation year end concerned by the assessment and select all the data to download.

-

Select the items that you want to import, then click Import selected items. To select all the forms, select the box at the top left.

-

Once all the items have been imported, click the PREPARE tab to see the information. Click the

button to access the forms. The fields that have been modified due to the import will be displayed in green in the forms.

button to access the forms. The fields that have been modified due to the import will be displayed in green in the forms.