EFILE Statuses

The EFILE status indicates where the return is at in the transmission process and allows CCH iFirm Taxprep to filter the returns that can be transmitted. The EFILE status is diffrent from the return status. Therefore, the status of a return might be In progress and the EFILE status might be Eligible.».

The EFILE status is automatically allocated by CCH iFirm Taxprep following the calculations and transmission operations.

Content

Track electronic transmissions from the return manager

To track electronic transmission for all of the returns, proceed as follows:

-

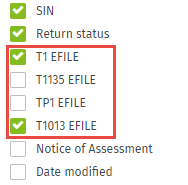

- In the header, click

, then select the transmissions that you want to track.

, then select the transmissions that you want to track.

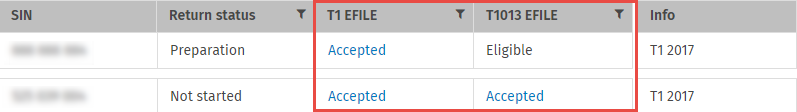

- The columns relating to the selected electronic transmissions as well as the EFILE status of these transmissions are now displayed in the return manager.

- Click one of the links to display the Transmission history.

Track electronic transmissions for a return

To track an electronically transmitted return, proceed as follows:

-

- Click the name of the taxpayer whose electronic transmissions you want to track.

- In the menu bar, click the TRACKING tab to display the list of electronic transmissions as well as their statuses.Tip: Use the Ctrl+4 shortcut to quickly access the TRACKING tab.

- Click the Details option of the transmission for which you want to display the Transmission history.Note: To track the transmission of supporting documents associated with a T2 return, click Details, then select the Attachments tab.

Possible value of EFILE statuses (CCH iFirm Taxprep T1)

Here is a table listing the different possible values of EFILE T1 statuses:

|

Value |

When this review is allocated, it means that ... |

|---|---|

|

|

The return or the form has not been selected for data transmission. |

|

|

CCH iFirm Taxprep estimates that the return or the form does not meet the eligibility criteria. Verify the information provided in the return. |

|

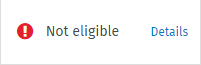

According to the Canada Revenue Agency (CRA), the return is not eligible for electronic transmission. Click Details for more information. |

|

|

CCH iFirm Taxprep estimates that the return or form meets the eligibility criteria for electronic data transmission. However, this does not mean that preparation of the form is finished. |

|

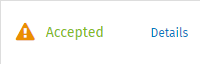

The tax authorities accepted the transmitted return, but a condition has been issued. The condition must be complied with in order for the tax authorities to process the return. A confirmation has been received. |

|

|

The tax authorities accepted the transmitted return or form and will process it. A confirmation number has been received. |

|

|

The tax authorities rejected the transmitted return or form. By referring to the error codes transmitted by the tax authorities, correct the situation to be able to transmit the return or form again. |

Possible values of the EFILE T1135 and EFILE TP1 statuses

Here is a table listing the different possible values of EFILE T1135 and EFILE TP1 statuses:

|

Value |

When this review is allocated, it means that ... |

|---|---|

|

|

The return or form has not been selected for data transmission. |

|

|

CCH iFirm Taxprep estimates that the return or form does not meet the eligibility criteria for electronic transmission. Verify the information provided in the return. |

|

|

CCH iFirm Taxprep estimates that the return or form meets the eligibility criteria for electronic data transmission. However, this status does not mean that preparation of the return or form is finished. |

|

|

The tax authorities accepted the transmitted return or form and will process it. A confirmation number has been received. |

|

|

The tax authorities rejected the transmitted return or form. By referring to the error codes transmitted by the tax authorities, correct the situation to be able to transmit the return or form again. |

Possible values of EFILE statuses (CCH iFirm Taxprep T2)

Here is a table listing the different possible values of EFILE T2, Authorization EFILE and Cancellation EFILE statuses:

|

Value |

When this review is allocated, it means that ... |

|---|---|

|

|

The return or form has not been selected for data transmission. |

|

|

CCH iFirm Taxprep estimates that the return or form does not meet the eligibility criteria. Verify the information provided in the return or form. |

|

|

CCH iFirm Taxprep estimates that the return or form meets the eligibility criteria for the electronic data transmission. However, this status does not mean that preparation of the return or form is finished. |

|

|

The tax authorities accepted the transmitted return or form and will process it. A confirmation number has been issued. |

|

|

The tax authorities rejected the transmitted return or form. By referring to the error codes transmitted by the tax authorities, correct the situation to be able to transmit the return or form again. |

Here is a table listing the different possible values of EFILE T1135, EFILE CO-17 and Net File (Alberta) statuses:

|

Value |

When this review is allocated, it means that ... |

|---|---|

|

|

The return or form has not been selected for electronic data transmission. |

|

|

CCH iFirm Taxprep estimates that the return does not meet the eligibility criteria. Verify the information provided in the return or form. |

|

|

CCH iFirm Taxprep estimates that the return meets the eligibility criteria for the electronic data transmission. However, this status does not mean that preparation of the return or form is finished. |

|

|

The tax authorities accepted the transmitted return or form and will process it. A confirmation number has been received. |

|

|

The tax authorities rejected the transmitted return or form. By referring to the error codes transmitted by the tax authorities, correct the situation to be able to transmit the return or form again. |