Prepare family returns

For your T1 – Personal returns, you can group together and prepare returns for the taxpayer, a spouse and dependants. The returns prepared this way are coupled. It is also possible to uncouple the returns to prepare them individually.

Content

Add the return of a spouse

To add the return of a spouse, proceed as follows:

-

From the Taxprep module, click T1 – Personal.

-

Click the name of the taxpayer for whom you want to add the return of a spouse.

-

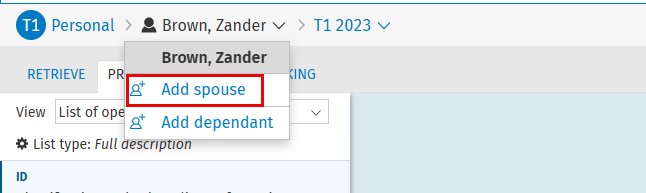

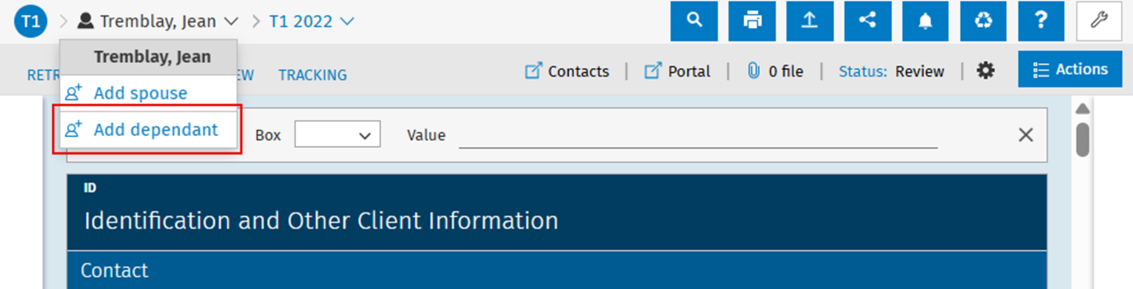

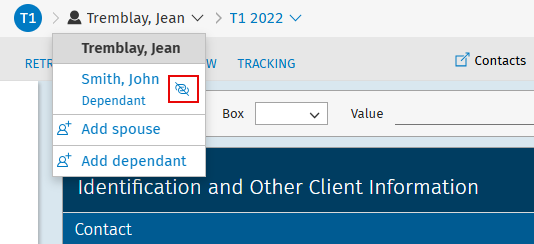

In the shortcut bar, click the name of the taxpayer, then Add spouse.

-

To add the return of a new contact, click the New contact tab and enter the information required to create the tax return.

To add the return of an existing contact, click the Existing contact tab and select the contact for whom you want to add a tax return.

-

Click Add spouse. The return is then added to the return manager and linked to the contact in the Contacts module.

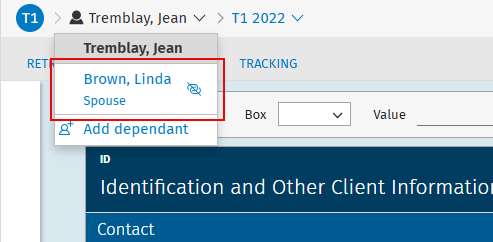

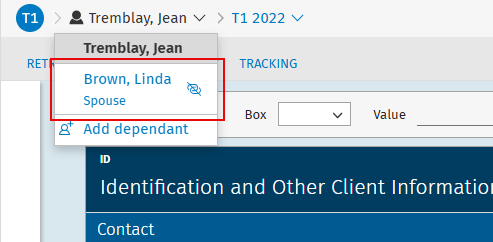

Now, when clicking the taxpayer’s name in the shortcut bar, the spouse’s name appears below the taxpayer’s name.

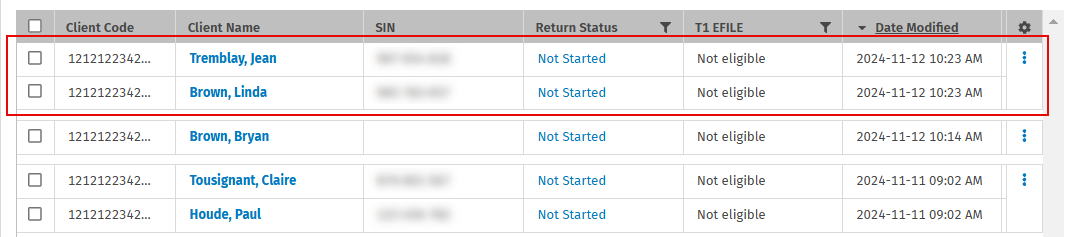

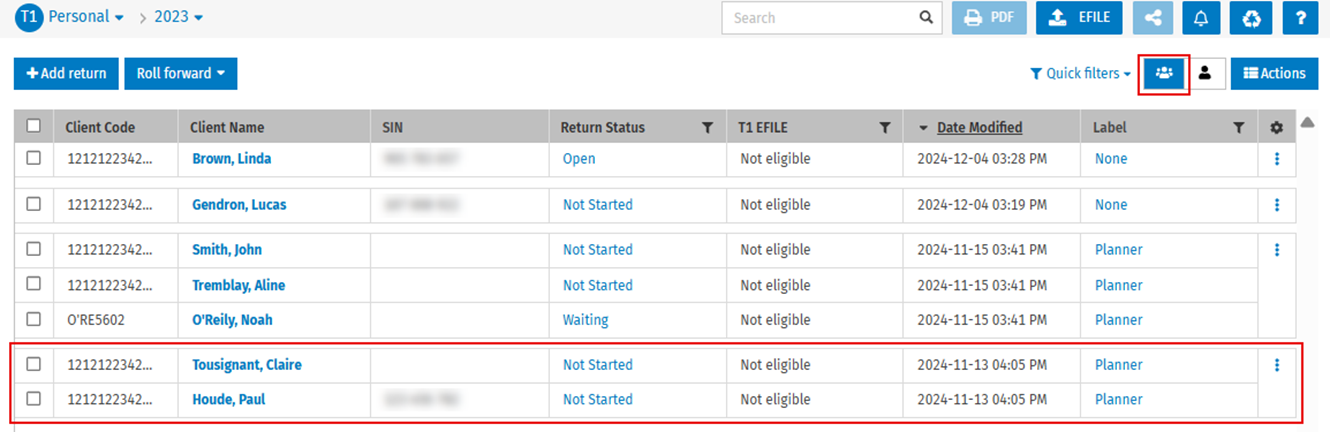

In addition, the taxpayer and the spouse are now grouped together in the return manager if the Group list by family view is selected.

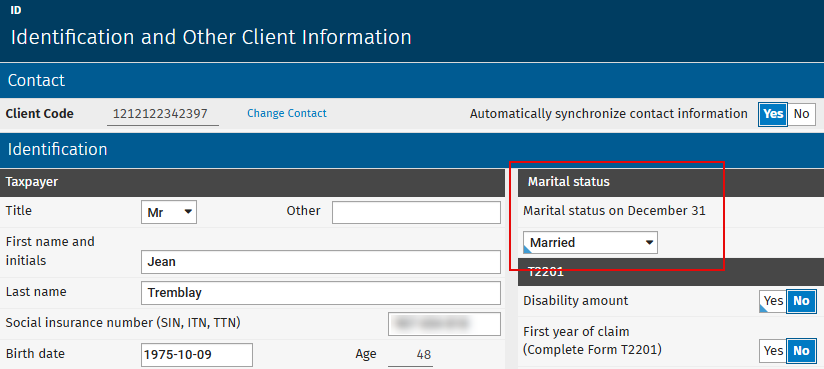

Finally, the Married value is automatically allocated to the Marital status on December 31 field of Form Identification and Other Client Information (ID) in the taxpayer's return.

Add the return of a dependant

To add the return of a dependant, proceed as follows:

-

From the Taxprep module, click T1 – Personal.

-

Click the name of the taxpayer for whom you want to add the return of a dependant.

-

In the shortcut bar, click the name of the taxpayer, then Add dependant.

-

To add the return of a new contact, click the New contact tab and enter the information required to create the tax return.

To add the return of an existing contact, click the Existing contact tab and select the contact for whom you want to add a tax return.

-

Click Add dependant. The return is then added to the return manager and linked to the contact in the Contacts module.

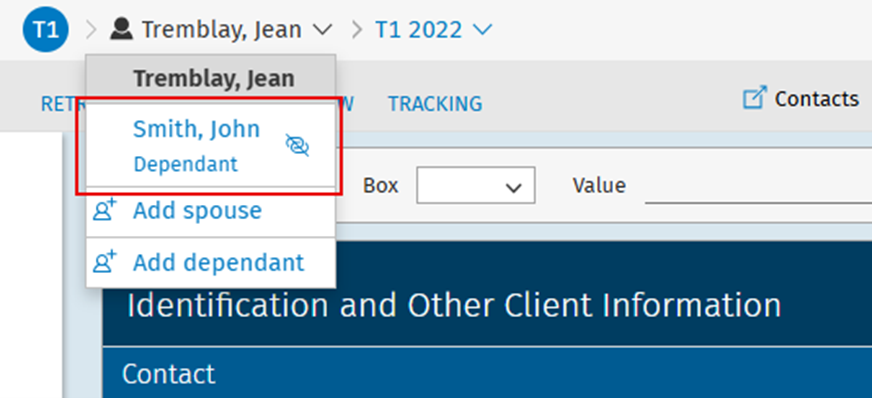

Now, when clicking the taxpayer’s name in the shortcut bar, the dependant’s name appears below the taxpayer’s name.

In addition, the spouse and the dependant are now grouped together in the return manager if the Group list by family view is selected.

Uncouple the return of a spouse

To uncouple the return of a spouse, proceed as follows:

-

From the Taxprep module, click T1 – Personal.

-

Click the name of the taxpayer for whom you want to uncouple the return of a spouse.

-

In the shortcut bar, click the name of the taxpayer, then click the Uncouple taxpayer

icon.

icon. -

Click Uncouple to confirm. The returns are no longer coupled or grouped together in the return manager.

Uncouple the return of a dependant

To uncouple the return of a dependant, proceed as follows:

-

From the Taxprep module, click T1 – Personal.

-

Click the name of the taxpayer for whom you want to uncouple the return of a dependant.

-

In the shortcut bar, click the name of the taxpayer, then click the Uncouple taxpayer

icon.

icon.

-

Click Uncouple. The returns are no longer coupled or grouped together in the return manager.

Note: The contact for whom the return is uncoupled is not deleted from the Contacts module.