T1 Planner Returns

The Planner mode is a powerful planning tool that allows you to evaluate the tax situation of your clients for the coming year.

Content

- Create a T1 Planner return by rolling forward the current-year return

- Create a new T1 Planner return

- Identification of T1 Planner returns

- The different functionalities of T1 Planner Returns

- T1 Planner Rates

Create a T1 Planner return by rolling forward the current-year return

To roll forward a return to a Planner return, proceed as follows:

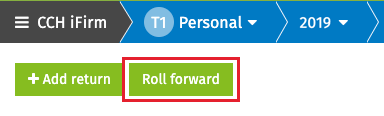

- From the return manager, click Roll forward.

- In the Roll forward from list, select the option [tax year to be rolled forward] to Planner [subsequent year]

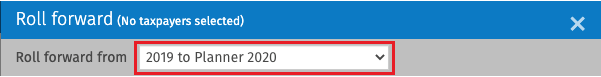

- Under the CCH iFirm Taxprep tab, select the clients whose return you want to roll forward.

- If desired, you can also import data entered in the current-year return to the Planner mode return. To do so, select the Import data entered this year after roll forward check box in the Roll forward dialog box.

- Click Roll forward.

Create a new T1 Planner return

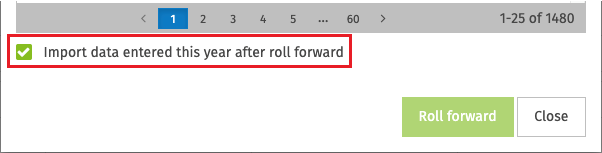

To create a new return in Planner mode, proceed as you normally would for a regular return and select Planner as the taxation year.

Identification of T1 Planner returns

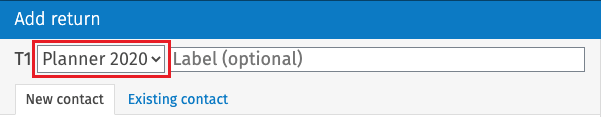

Planner returns are identified as Planner [20XX] in the Info column in the Return Manager of the taxation year preceding the one covered. For example, a 2020 return in Planner mode will appear in the 2019 return manager.

In an open Planner return, the indicators in the breadcrumb menu and in the header of each form will display Planner [20XX] to indicate that the active return is in Planner mode.

The different functionalities of T1 Planner Returns

The following table presents the difference in functionalities for planner files:

|

Functionality |

Description |

|

Print returns and forms |

The Planner watermark is automatically applied when printing Planner returns. |

|

EFILE |

Transmission to one of the electronic services available in the application is not allowed. |

|

Roll forward |

Planner returns cannot be rolled forward. |

T1 Planner Rates

The T1 Planner Rates section allows you to edit the T1 Planner Rates table, which contains rates for taxes, credits and deductions, as well as other important basic data for the coming taxation year.

To edit the Planner rates, proceed as follows:

- On the left-hand menu, click Settings > Taxprep.

- In the Taxprep section, click T1 Planner Rates.

- In the T1 Planner Rates section, edit the desired rates.

- Click Save to save your changes.

Note: The Reset rates to default button will restore all default values for the taxation year selected.