Export links and data of linked returns

Corporations’ export allows you to export your copies of the S9 Workchart schedule of the active return to linked returns. It also allows you to synchronize tax data between the copies of the S9 Workchart schedule that are linked to a return. Note that exporting the value of copy 2 and subsequent copies of the S9 Workchart schedule to the source return is only applicable for cells in which a value is allocated among the associated corporations (for example: the percentage of the business limit).

Access to the export functionality

To access the functionality allowing you to export your copies of the S9 Workchart schedule and tax data to their linked returns, you must have at least one corporation linked to your active return. If this is the case, proceed as follows:

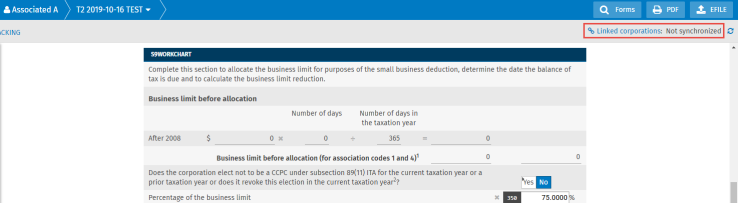

- Click the Linked corporations: Not synchronized button.

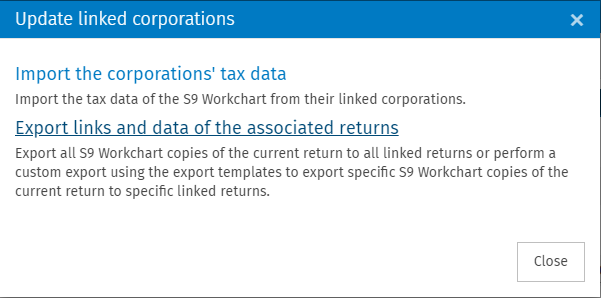

- Click the Export links and data of the associated returns link.

Export all

Choosing to export all allows you to export all copies of the S9 Workchart schedule of your active return to all returns that are linked to it.

To export all, proceed as follows:

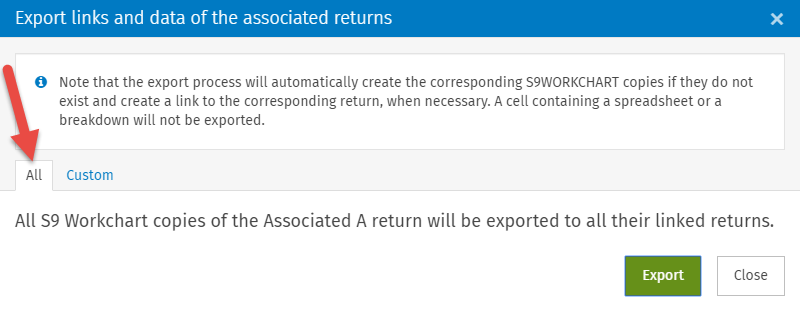

- Access the export of copies of the S9 Workchart schedule.

- Click the All tab.

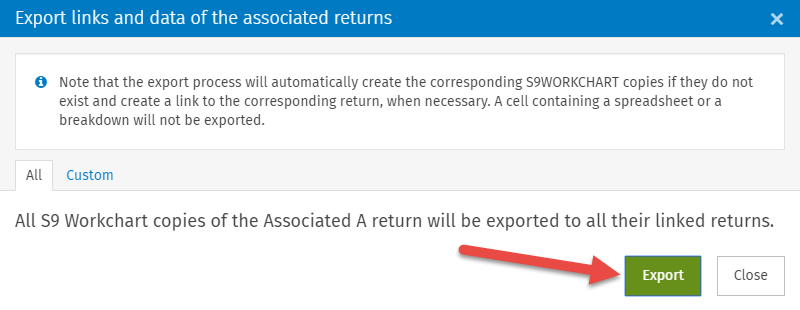

- Click the Export button.

If a copy of the S9 Workchart schedule of the active return does not exist in a linked corporation, it will automatically be created in the linked return during the export process and will contain the same tax data.

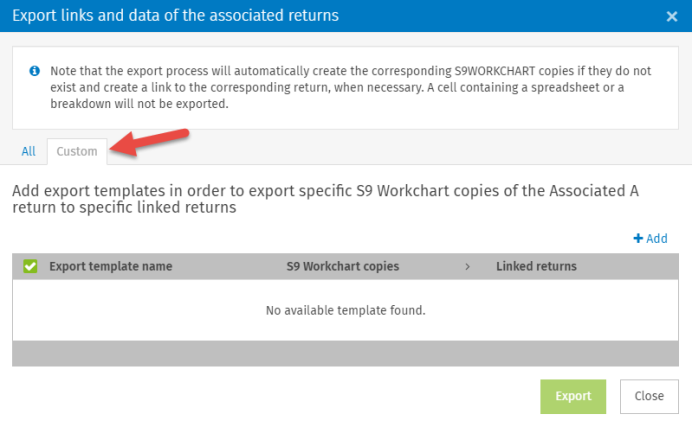

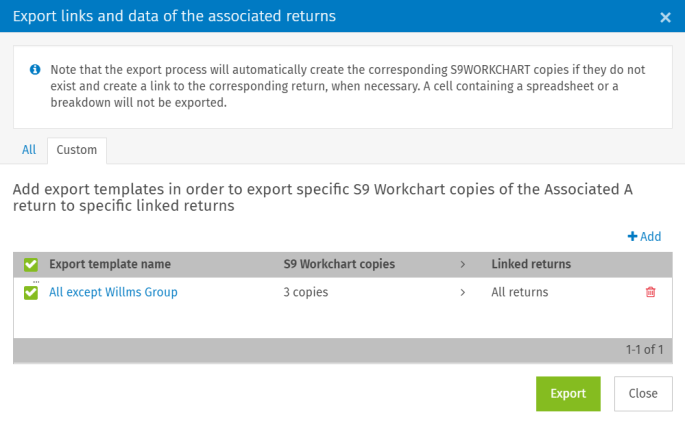

Custom export

The custom export allows you to create export templates. With these templates, you can select specific copies of the S9 Workchart schedule in the active return that you want export to selected linked corporations.

Add an export template

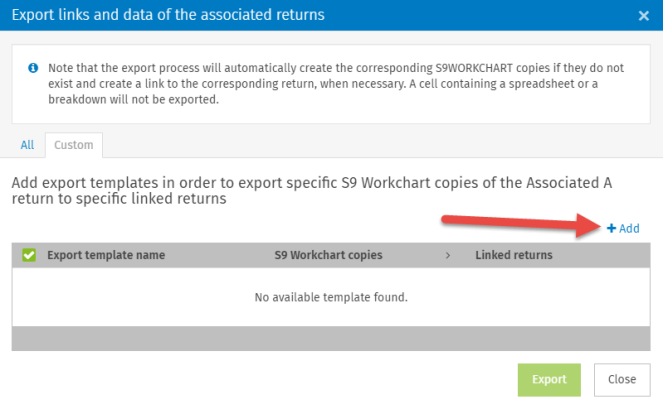

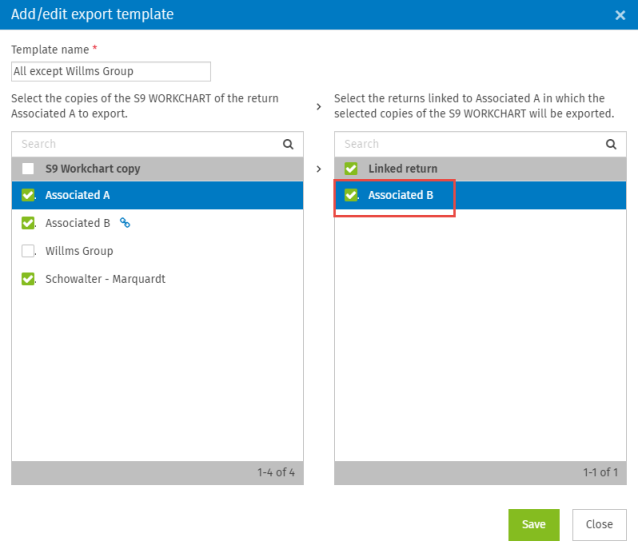

To add a new export template, proceed as follows:

- Access the export of copies of the S9 Workchart schedule.

- Click the Custom tab.

- Click the + Add button.

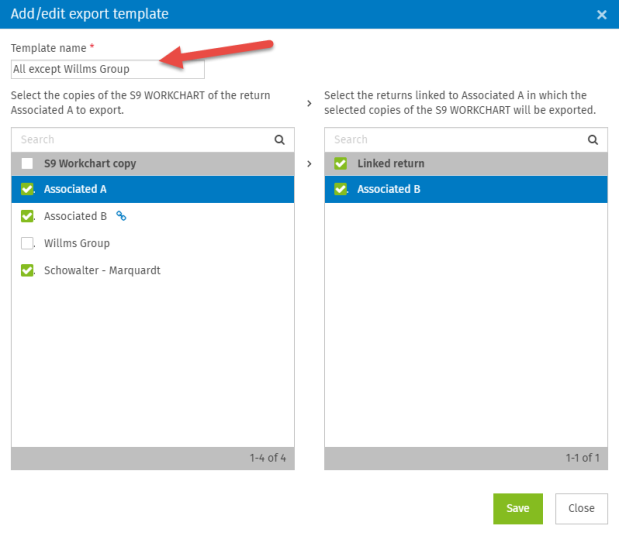

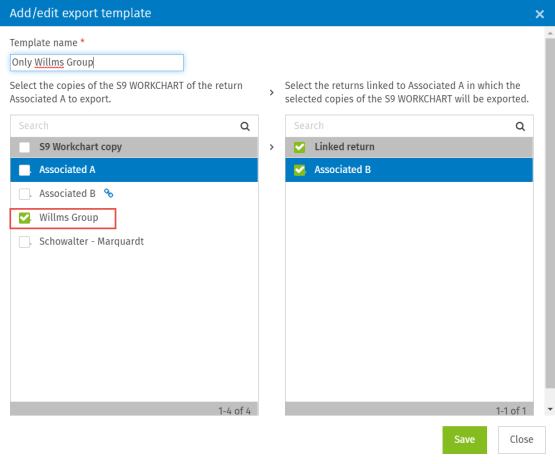

- Enter the name for your export template.

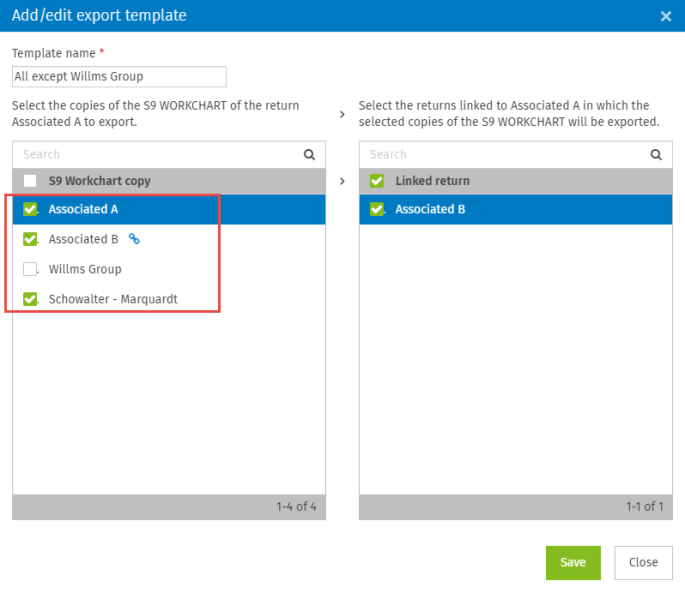

- Select the copies of the S9 Workchart schedule of the active return that you want to export.

- Select the linked return into which the selected copies of the S9 Workchart schedule will be exported.

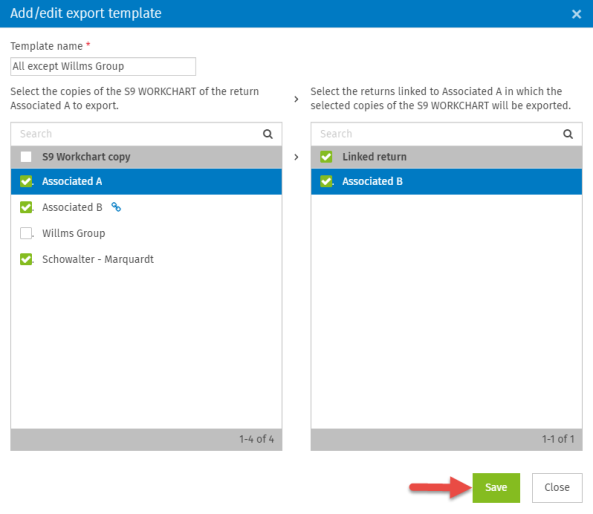

- Click the Save button.

Note that the icon indicates that the copy “Associated B” (in the example) is linked.

icon indicates that the copy “Associated B” (in the example) is linked.

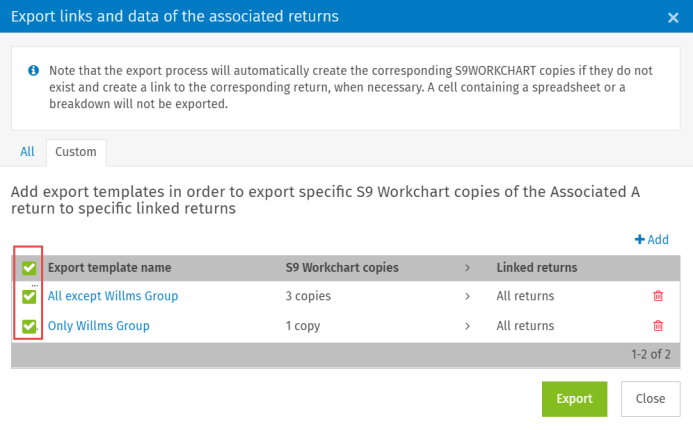

The “All except for Willms Group” export template will be created and displayed in the export templates grid by indicating:

- the number of selected copies of the S9 Workchart schedule;

- the number of selected linked returns.

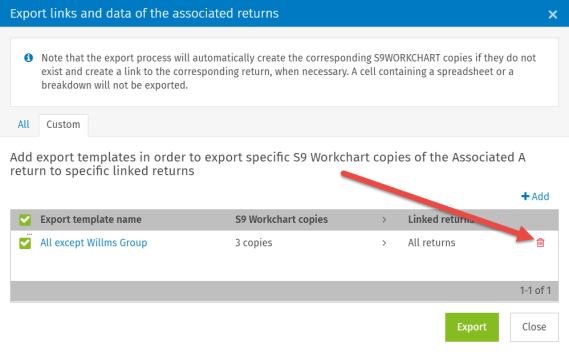

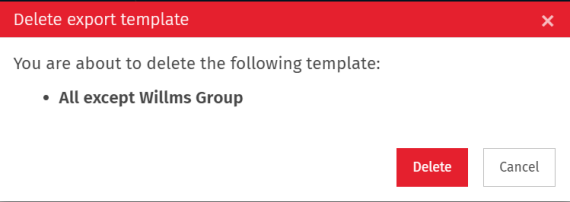

Delete an export template

To delete an export template from the grid containing the export templates, proceed as follows:

- Click the

icon.

icon.

- Confirm deletion by clicking the Delete button.

The export template will be deleted and will no longer display in the export templates grid.

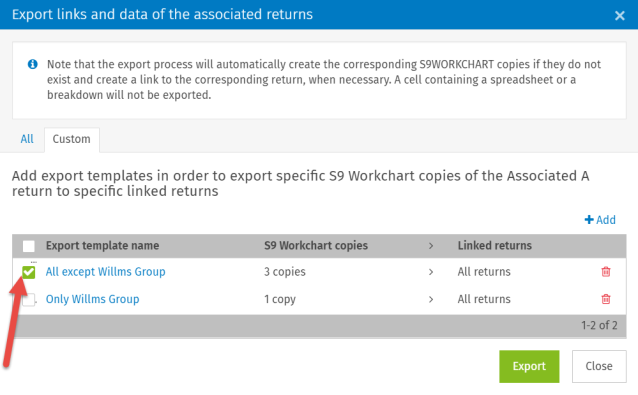

Export copies of the S9 Workchart schedule from an export template

To export the copies of the S9 Workchart schedule in the linked returns from an export template, proceed as follows:

- Select an export template from the export template grid.

- Click the Export button.

This export template (“All except for Willms Group”) will be added, or updated if it exists, to the list of export templates of selected linked returns.

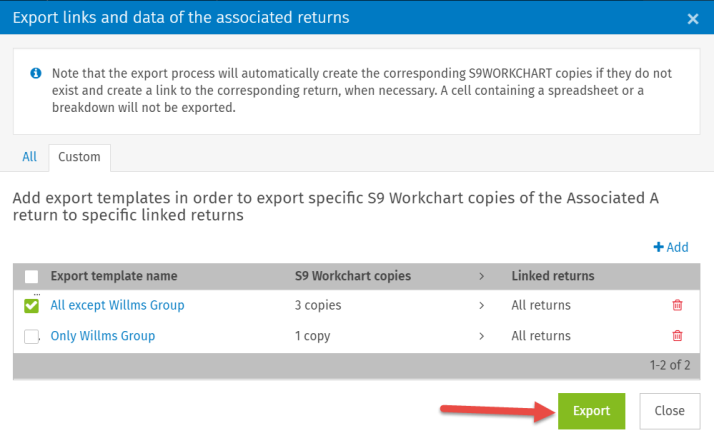

Export copies of the S9 Workchart schedule from one or more export templates

The steps to export from several export templates are the same as the steps to export from a single export template, except that you must select at least two.

In the “Only Willms Group” export template, only the copy of the S9 Workchart schedule “Willms Group” is selected.

When you proceed with the export, all selected copies of the S9 Workchart schedule of the two export templates will be exported to all linked and selected returns in both templates.

Notifications

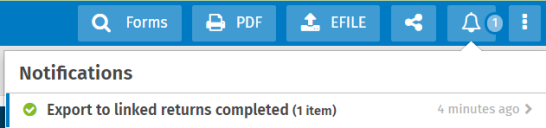

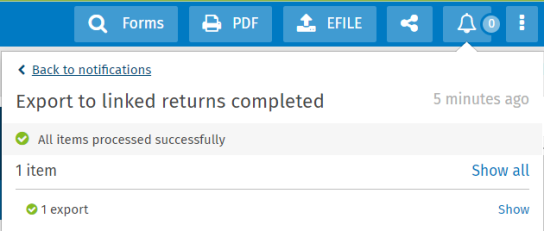

When you click the Export button, a message will display in the bottom right corner of your screen to indicate that the export of your copies of the S9 Workchart schedule of the active return to their linked return is in progress.

You will receive a notification once export is complete.

You can consult the notification by clicking the bold export notification.

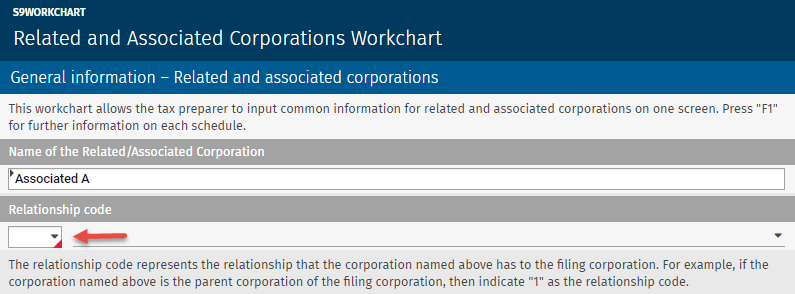

Relationship code

Note that the relationship code in the “General information – Related and associated corporations” section of the S9 Workchart schedule is not exported to the linked returns. Therefore, after having exported links and tax data in the active return to the linked returns, you must enter a relationship code in each copy of the S9 Workchart schedule for all linked returns of the corporate group.

Training Video