Release Notes - CCH iFirm Cantax T1 2020 v.6.0 (2021.30.31.01)

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Cantax

Welcome to CCH iFirm Cantax, the first cloud-based professional tax software in Canada.

CCH iFirm Cantax runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Cantax is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Cantax version, consult the Technical Release Notes.

About

This version contains the forms released by the Canada Revenue Agency (CRA) and Revenu Québec for the 2020 taxation year.

This version of CCH iFirm Cantax T1 was updated in order to integrate the most recent tax measures pursuant to the 2020 taxation year.

This version is approved for:

- Paper filing;

- EFILE;

- Electronic filing of Form AUTHORIZATION;

- Electronic filing of Form T1135;

- Using the Auto-fill T1 return (AFR) service (TaxprepConnect functionality);

- The ReFILE service;

- The transmission of returns for taxpayers in multiple-jurisdiction situations;

- The PAD (Pre-authorized debit);

- The Express NOA (Notice of Assessment);

- Printing the 2D bar code on the federal and Québec returns;

- Electronic filing via NetFile Québec.

Import preparer profile

When a new taxation year is added to the application, remember that the prior period Preparer Profile must be imported.

For more information, please consult the following FAQ: https://support.cch.com/canada/solution/000118906/FAQ-Why-is-my-current-Preparer-Profile-empty-since-the-latest-deployment-of-CCH-iFirm-Tax?language=en

Auto-fill T1 return - 2020 Tax Season

Important dates

Federal

February 22, 2021 – The Auto-fill T1 return service opens. The CRA tax data can be downloaded from the RETRIEVE tab. This year, the tax-related information list will be expanded to include:

- The last three characters of the taxpayer’s postal code on record with the CRA;

- The T2202 slip issuer’s name when available.

In addition, the amounts in the following new boxes can be downloaded when available:

- Boxes 57, 58, 59 and 60 of the T4 slip;

- Boxes 37, 197, 198, 199, 200, 202, 203 and 204 of the T4A slip;

- Box 37 of the T4E slip;

- Box 37 of the T4RIF slip;

- Box 37 of the T4RSP slip.

Auto-fill T1 return – Download prior-year data

You can download tax data from the previous four years (2016, 2017, 2018 and 2019). To download data of a given year, you will have to use the CCH iFirm Tax T1 program of the year in question.

Note that only data on slips of prior years will be available; data that does not relate to a specific year, such as carried forward balances, will not be available.

Tax Data Download from Revenu Québec – 2020 Tax Season

Important dates

Québec

February 22, 2021 – The Tax Data Download service opened.

The Revenu Québec tax data can be downloaded with version 6.0 of CCH iFirm Tax T1 2020 from the RETRIEVE tab. This year, the tax-related information list will be expanded to include:

- The amounts in new boxes O-5, O-6 and O-7 of the RL-1 slip, when available.

Tax Data Download of Revenu Québec – Download prior-year data

You can now download prior-year tax data. To do so, you must use the version of CCH iFirm Tax T1 of the year in question and hold a valid MR-69 form with Revenu Québec.

T3 slips reconciliation

Where applicable, the program can now automatically group the downloaded T3 slips and/or RL-16 slips based on the previous-year consolidation.

In addition, when reconciled T3 slips and/or RL-16 slips are imported into the return, the program now automatically selects the Consolidated T3 check box in the T3 form, to help identify, when revising the return, the copies that contain reconciled slips.

Slips/RL slips association – Enhanced automatic association of downloaded tax data

The automatic association of slips/RL slips downloaded from the CRA’s Auto-fill my return service and Revenu Québec’s Tax data download service with data in the return has been enhanced. This association feature is now available for all slips and RL slips and applies to data rolled forward, imported and/or entered in the return.

Prior Year RRSP Contribution History

The total of the RRSP contributions made since 1991 is now calculated and displayed at the top of Form Prior Year RRSP Contribution History.

Modifications Made to Version 6.0

Updated Forms

Federal

Line 23200 – Other Deductions – Repayment of COVID-19 benefits – Addition of supporting line 23210

The measures proposed in the 2021 Federal Budget with respect to claiming a deduction for repayments of COVID-19 benefits were approved under Bill C-30, which received Royal Assent on June 29, 2021.

The approved measures allow taxpayers to claim a deduction for repayments of COVID-19 benefits made before January 1, 2023, on their return for:

- the year in which they received the benefit;

- the year in which they repaid the benefit;

- a combination of a) and b) above as long as the total deduction amount does not exceed the total amount repaid.

To that hand, the federal COVID-19 benefits include the:

- Canada Emergency Response Benefit / Employment Insurance Emergency Response Benefit;

- Canada Emergency Student Benefit;

- Canada Recovery Benefit;

- Canada Recovery Sickness Benefit;

- Canada Recovery Caregiving Benefit.

Therefore, the CRA created a supporting line, i.e., line 23210, which was added to the T1 Line 23200 form, to identify any COVID-19 benefit amount entered on line 23200.

The inclusion of supporting line 23210 in the 2020 software is necessary to reduce post-assessment reviews for taxpayers, questions from CRA to taxpayers in order to validate claims, and to ensure faster processing of returns with such claims.

With this version of the program an individual who makes his or her repayment after having filed his or her 2020 income tax return, is able to request an adjustment using the ReFile service or may apply for a readjustment with the T1-ADJ form. The amendment request can be requested on line using the Change my return service.

The following link will direct you to a CRA Web site which provides some additional helpful information in the form of Questions and Answers relating to the above changes, including some examples:

Tax Treatment of COVID-19 Benefit Amounts - Canada.ca

For Québec residents:

The repayment of COVID-19 benefits must be deducted on line 246 of the Québec income tax return. The amount entered on supporting line 23210 of the federal income tax return will be updated to line 246 of the Québec income tax return. An individual who makes his or her repayment after having filed his or her 2020 income tax return, is able to request an adjustment using the ReFile - Québec service or may apply for a readjustment using the TP-1.R form. However, Revenu Québec requires a valid MR-69 form for the electronic transmission of an amended TP-1 return.

(missing or bad snippet)Modifications Made to Version 5.0

Updated Forms

Federal

Schedule 6 – Canada Workers Benefit

The following measure was announced in the 2021 federal Budget and were integrated to the current version of the program, but only in Planner mode or for early-filed returns for the 2021 taxation year (pre-bankruptcy and deceased returns):

Enhancement of the Canada Workers Benefit starting in 2021. This enhancement would increase:

- the phase-in rate from 26 per cent to 27 per cent for single individuals without dependants as well as families;

- the phase-out thresholds from $13,194 to $22,944 for single individuals without dependants and from $17,522 to $26,177 for families; and

- the phase-out rate from 12 per cent to 15 per cent.

Note that, to the exception of Nunavut, Québec and Alberta, these rates apply in Schedule 6 for all provinces.

Line 23200 – Other deductions – Repayment of a COVID-19 benefit amount

Important: This note is no longer valid. Please refer to the following note: Line 23200 – Other Deductions – Repayment of COVID-19 benefits – Addition of supporting line 23210

Federal Budget 2021 proposed to allow individuals the option to claim a deduction in respect of the repayment of a COVID-19 benefit amount in computing their income for the year in which the benefit amount was received rather than the year in which the repayment was made. This option would be available for benefit amounts repaid at any time before 2023. For these purposes, COVID-19 benefits would include:

- Canada Emergency Response Benefits/Employment Insurance Emergency Response Benefits;

- Canada Emergency Student Benefits;

- Canada Recovery Benefits;

- Canada Recovery Sickness Benefits; and

- Canada Recovery Caregiving Benefits.

Individuals may only deduct benefit amounts once they have been repaid. An individual who makes a repayment, but who has already filed their income tax return for the year in which the benefit was received, would be able to request an adjustment to the return for that year.

In the current version, enter the repaid amount on the empty lines identified as Other deductions.

A specific line for this purpose will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

RRSP Earned Income - Postdoctoral Fellowship Income

Federal Budget 2021 proposes to include postdoctoral fellowship income in “earned income” for RRSP purposes. This would provide postdoctoral fellows with additional RRSP room in order to make deductible RRSP contributions. This measure would apply in respect of postdoctoral fellowship income received in the 2021 and subsequent taxation years. This measure would also apply in respect of postdoctoral fellowship income received in the 2011 to 2020 taxation years, where the taxpayer submits a request in writing to the Canada Revenue Agency for an adjustment to their RRSP room for the relevant years.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

Employee Stock Options

In the November 30, 2020, Fall Economic Statement, the Department of Finance Canada proposes to introduce new tax rules for employee stock options to limit the benefit of the employee stock option deduction for high-income individuals employed at large, long established, mature firms, effective for stock options granted after June 2021. The existing rules would continue to apply to options granted before July 2021 (including qualifying options granted after June 2021 that replace options granted before July 2021). Changes from the previously announced measures include:

- The exclusion for so-called small start-up non-CCPCs from the “specified persons” (paragraphs (b) and (c) of the definition dealing with the $500 million gross revenue threshold) replaces the previous “prescribed conditions”; and

- The “vesting year” paragraph (b), instead of using the reasonably expected to be exercised test, is now replaced by a pro-rata rule, allocating securities to vesting years over the term of the option, to a maximum of five years. For example, if the option agreement was three years, one third of the option in respect of the securities would vest over each of the three years under this rule.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

T2222 – Northern Residents Deductions

Federal Budget 2021 proposes, subject to the other restrictions noted above, that a taxpayer would have the option to claim, in respect of each taxpayer and each “eligible family member,” up to:

- the amount of employer-provided travel benefits the taxpayer received in respect of travel by that individual; or

- a $1,200 standard amount that may be allocated across eligible trips taken by that individual. After application of the 50-per-cent factor for residents of the intermediate zone, the second limit effectively becomes a $600 standard amount. For these purposes, an eligible family member would be an individual living in the taxpayer’s household who is:

- the spouse or common-law partner of the taxpayer;

- a child of the taxpayer (including a child of the taxpayer’s spouse or common-law partner) under the age of 18; or

- another individual who is related to the taxpayer and who is wholly dependent on the taxpayer (and/or on the taxpayer’s spouse or common-law partner) for support, and who is, except in the case of a parent or grandparent of the taxpayer, so dependent by reason of mental or physical infirmity. If any taxpayer claims a deduction in respect of an employer-provided benefit for travel by the taxpayer or an eligible family member of the taxpayer in a year, no other taxpayer would be allowed to also claim all or part of the $1,200 standard amount in respect of travel by that first-mentioned taxpayer or that eligible family member in that year. If any taxpayer claims all or part of the $1,200 standard amount in respect of travel by an individual, the maximum total amount that could be claimed in respect of that individual by all taxpayers would be $1,200.

It also proposes that across all taxpayers in a given individual’s household, a maximum of two trips taken by that individual would be allowed to be claimed in total for non-medical personal travel in a year. A taxpayer would continue to be able to claim any number of trips for medical purposes. In light of the proposed changes described above, claims for a given trip would be limited to the least of:

- the amount of the employer-provided travel benefit received in respect of the trip or the amount allocated to that particular trip by the taxpayer out of the $1,200 standard amount;

- the total travel expenses paid for that trip; and

- the cost of the lowest return airfare to the nearest designated city.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

Québec

Removal of Shedule O, Tax Credit for Respite of Caregivers

The rates and calculations for these credits have been deleted from the current version of the program, but only in Planer mode or for early-filed returns.

- Starting in 2021, the following two credits will be abolished:

- The refundable tax credit for respite expenses, also called the “tax credit for respite of caregivers” (Schedule O).

- The refundable tax credit for persons providing respite to informal caregivers, also called the “tax credit for volunteer respite services.” (RL-23 slip).

- The rate of the non-refundable tax credit for the acquisition class “A” shares of the Capital régional et coopératif Desjardins shared-capital will be decreased from 35% to 30% for any class “A” share acquired after February 28, 2021.

TP-1029.8.33.6, Tax Credit for an On-the-Job Training Period

In its 2021 Budget, the Government of Québec announced modifications for the tax credit for an on-the-job training period:

The tax legislation will be amended as follows:

- the basic rate of the tax credit is increased from 24% to 30% where the eligible taxpayer is a corporation;

- the basic rate of the tax credit is increased from 12% to 15% where the eligible taxpayer is an individual;

- where the eligible trainee is a disabled person, an immigrant, an Aboriginal person or where the on-the-job training takes place in an eligible region:

- the tax credit rate is increased from 32% to 40% where the eligible taxpayer is a corporation,

- the tax credit rate is increased from 16% to 20% where the eligible taxpayer is an individual.

These amendments will apply to qualified expenditures incurred after the day of the budget speech and before May 1, 2022, in respect of a qualified training period beginning after the day of the budget speech.

This modification will be integrated to version 2021 1.0 of CCH iFirm Cantax T1.

TP-1029.9, Tax Credit for Taxi Drivers and Taxi Owners

In its Information Bulletin 2020-12, published on November 6, 2020, the Government of Québec announced the following measure, which has been integrated to current version of the program:

The tax legislation will also be amended so that a taxpayer who satisfies, for the year 2021, all the conditions pertaining to the refundable tax credit for holders of a taxi driver’s permit may benefit from a tax credit equivalent to the lesser of the following amounts:

- an amount representing 50% of the maximum amount that would have otherwise applied for the year;

- an amount representing 1% of the taxpayer’s total gross income for the year from his employment as a taxi driver and his gross revenue for the year from his business of providing transportation by taxi.

The refundable tax credit for holders of a taxi driver’s permit will be eliminated in the fiscal year starting after October 9, 2020, when the permit holder is a partnership et, in the other cases, for a taxation year starting after that date.

This modification will be integrated to version 2021 1.0 of CCH iFirm Cantax T1.

Ontario

In its 2021 Budget, the Government of Ontario announced the following measure, which was integrated to the current version of the program, but only in Planner mode or for early-filed returns:

- The government is proposing a temporary increase in the support provided by the Childcare Access and Relief from Expenses (CARE) tax credit for 2021. This increase would provide a one‐time top‐up for CARE tax credit recipients equal to 20 per cent of their 2021 credit entitlements.

Temporary Seniors’ Home Safety Tax Credit

In its 2021 Budget, the Government of Ontario introduces the Seniors’ Home Safety Tax Credit. This refundable temporary credit would support seniors who stay in their homes by assisting with improvements that make their homes safer and more accessible. It would not depend on income and could be claimed for eligible expenses by senior homeowners, renters, or people who live with relatives who are seniors. The Seniors’ Home Safety Tax Credit would be worth 25% of up to $10,000 in eligible expenses for a senior’s principal residence in Ontario. The maximum credit would be $2,500. The $10,000 maximum could be shared by the people who share a home, including spouses and common-law partners.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

Temporary Ontario Jobs Training Tax Credit

In its 2021 Budget, the Government of Ontario introduces a new temporary Ontario Jobs Training Tax Credit for 2021. This new refundable credit would be calculated as 50% of eligible expenses for 2021. The maximum credit would be $2,000.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

British Columbia

The following measures were announced in the 2021 British Columbia Budget and were integrated to the current version of the program, but only in Planner mode or for early-filed returns:

- Effective July 1, 2021, the climate action tax credit rate remains at $174 per adult and $51 per child due to the delay in the carbon tax rate increases.

Saskatchewan

Home Renovation Tax Credit

On December 3, 2020, the Government of Saskatchewan announced a new non-refundable tax credit, i.e., the home renovation tax credit. Saskatchewan homeowners may save up to $2,100 in provincial income tax by claiming a 10.5 per cent tax credit on up to $20,000 of eligible home renovation expenses. Eligible expenses include the cost of labour and professional services, building materials, fixtures, equipment rentals and permits.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

Active Families Benefit

The 2021 Saskatchewan Budget confirmed that Saskatchewan will reintroduce the Active Families Benefit, as announced in the 2020 Speech from the Throne. Effective January 1, 2021, this refundable income tax credit will assist families with the cost of registering children in cultural, recreational and sports activities. It will be available to families with a combined net income of $60,000 or less and will provide up to $150 per child, with an additional $50 for children with disabilities.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

Manitoba

In its 2021 Budget, the Government of Manitoba announced following measures, which were integrated to the current version of the program, but only in Planner mode or for early-filed returns:

- Existing education property tax offsets including the Education Property Tax Credit and Advance, Seniors School Tax Rebate and Seniors Education Property Tax Credit will be proportionately reduced by 25% in 2021.

- The Small Business Venture Capital Tax Credit will be amended to:

- increase the maximum annual tax credit claim from $67,500 to $120,000; and

- increase an investor’s maximum eligible investment from $450,000 to $500,000

Teaching Expense Tax Credit

The 2021 Manitoba Budget introduces a new tax credit that will apply to purchases of eligible teaching supplies made by educators that are not reimbursed by their employer. The new Manitoba tax credit will be 15% refundable for up to $1,000 in supplies ($150 maximum refund) and will parallel the eligibility criteria of the existing federal Eligible Educator School Supply Tax Credit.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

Nova Scotia

School Supplies Tax Credit

In its Bill 88, tabled on April 6, 2021, the Government of Nova Scotia introduces a new School Supplies Tax Credit. This credit would allow parents and teachers to claim a 50% tax credit for school supplies up to $200.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

PROV BEN – Provincial Benefits - Nova Scotia Poverty Reduction Credit

As announced in the November 27, 2019 press release, and following its 2021-2022 Budget, the Government of Nova Scotia will be allocating funds to increase the income threshold for the Poverty Reduction Credit from $12,000 to $16,000 in 2021. As a result, the income threshold has been updated in the program.

New Brunswick

In its Bill 48, tabled on May 11, 2021, the Government of New Brunswick announced the following measures, which were integrated to the current version of the program, but only in Planner mode or for early-filed returns:

- A reduction of the provincial personal income tax rate on the first tax bracket from 9.68 per cent to 9.4 per cent;

- An increase of the Low-Income Tax Reduction (LITR) threshold from $17,630 to $17,840 for the 2021 taxation year.

Prince Edward Island

In its 2020-2021 Budget, the Government of Prince Edward Island announced the following measures, which were integrated to the current version of the program, but only in Planner mode or for early-filed returns:

- The basic personal amount will increase from $10,000 to $10,500, effective January 1, 2021.

- The income threshold for the low-income tax reduction will increase from $18,000 to $19,000, effective January 1, 2021.

Children’s Wellness Tax Credit

Effective January 1, 2021, the Government of Prince Edward Island will introduce a non refundable children’s wellness tax credit. The $500 credit is designed to help families pay for activities related to the well-being of children under the age of 18.

This modification will be integrated in CCH iFirm Cantax T1 2021 v.1.0.

Electronic Filing

In the past, tax returns with more than 6 SFD (selected financial data) records were not eligible for EFILE. For the 2020 and subsequent taxation years, tax returns can now be EFILED with up to 12 SFD records. As a reminder, a separate SFD record is automatically completed for each source of self-employment income (including self-employment income from a T5013 slip), rental income (T776), employment expenses (T777), meals or lodging expenses (TL2) and for each property designated as a principal residence (T2091 or T1255).

Information about EFILE

Federal

Important dates

- February 8, 2021 The system for electronic transmission of authorization requests opened.

- February 22, 2021 The EFILE On-Line transmission system opened.

- January 21, 2022 The CRA will stop accepting electronically filed T1 returns.

Registration and Renewal On-line

To renew your EFILE privileges for this year’s tax season, you must follow the instructions provided on the "Renewal" page on the CRA Web site at http://www.efile.cra.gc.ca/l-rnwl-eng.html.

To register as a new electronic filer, you must register online by completing the EFILE Registration On-Line form on the CRA Web site at http://www.efile.cra.gc.ca/l-rgstr-eng.html.

You will find more information concerning renewals and new applications at http://www.efile.cra.gc.ca/.

In order to be able to electronically file Form AUTHORIZATION, you must meet the following two criteria:

- Have a valid EFILE number and password; and

- Be a registered representative (online access).

A registered representative is a person who is registered with the CRA’s Represent a Client service. To register with the service, go to http://www.cra.gc.ca/representatives

Québec

Important dates

- February 22, 2021 – The NetFile Québec system opened.

- February 22, 2021 – The Refund Info-line system opened.

- January 21, 2022 – The NetFile Québec system will shut down.

NetFile Québec

- Tax preparers must register for “My Account for professional representatives” (available in French only), a secure space on RQ’s Web site, if they have not already done so in the past.

Note that renewal is automatic for persons who registered for this space in the past. - Consult the page “À qui s'adresse Mon dossier” (available in French only) to see which profile applies to you and what actions you can perform online on behalf of a business or an individual.

Modifications Made to Version 4.0

Updated Forms

Québec

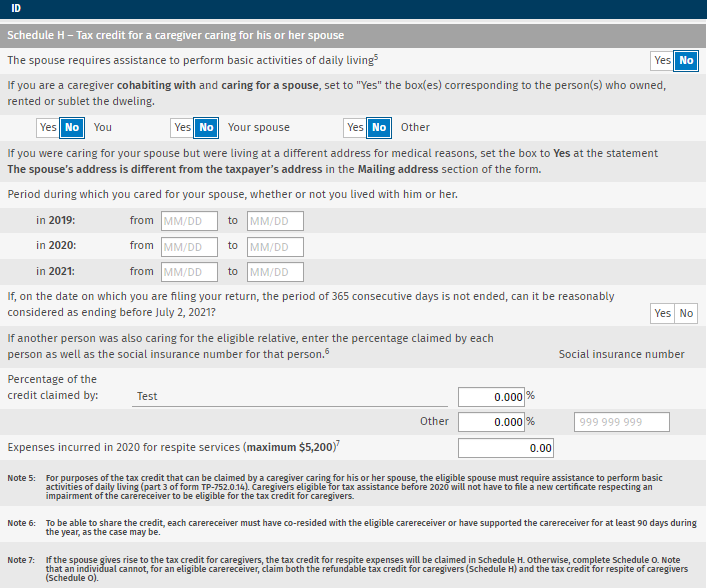

Schedule H, Tax Credit for Caregivers

The calculations in Schedule H have been adjusted to better manage involuntary separation situations when the taxpayer is eligible for the tax credit for caregivers for their spouse and:

- the taxpayer and the spouse ceased living together in 2020 for medical reasons (involuntary separation);

- the number of days during which the taxpayer and the spouse lived together is greater than 182 days; and

- the taxpayer cared for and lived with the spouse for at least 365 consecutive days (counting the days in the previous year).

The field Date of the involuntary separation if it occurred in the year has been added to subsection Schedule H of the ID form to manage this particular situation and calculate the tax credit in the correct section of Schedule H, i.e. in Part B instead of Part C.

For the calculation to be performed in the correct section of Schedule H, indicate the date of the involuntary separation in the new field:

If, in 2020 the taxpayer and spouse lived together for more than 182 days and the 365 consecutive days rule is complied with, the credit will be calculated in Part B of Schedule H.

If, in 2020 the taxpayer and spouse lived together for 182 days or less and the taxpayer continued caring for but not living with the spouse, the credit will be calculated in Part C.

TP-358.0.1, Disability Supports Deduction

This form has been updated by Revenu Québec following the announcement made by the Ministère des Finances du Québec on February 26, 2021, with respect to the Harmonization with the January 19, 2021, Department of Finance Canada’s news release to temporarily modify rules for the refundable tax credit for childcare expenses or the disability supports deduction. As a result, line 6.1, Employment Insurance benefits, including benefits related to a birth or adoption, and Québec parental insurance plan benefits (if you are claiming the deduction for the 2020 or 2021 taxation year), has been added to Section 2, which is used to aggregate certain income to determine earned income for the purposes of this deduction and include employment insurance benefits (including benefits related to a birth or an adoption) and Québec Parental Insurance Plan benefits.

Modifications Made to Version 3.0

Forms, Schedules, and Workcharts Added to the Program

CFSUM/QCFSUM – Federal and Québec Summary of carryforward balances

These summaries have been added to the application to allow preparers to quickly review the return’s opening and closing balances.

Updated Forms

Federal

T183, Information Return for Electronic Filing of an Individual’s Income Tax Benefit Return

If you are using the electronic signature feature in CCH iFirm Portal, the fields in the Electronic signature section of Form T183 will now be automatically completed when the signature is entered on the portal.

In addition, the EFILE diagnostic E648 “Indicate whether Form T183 was electronically signed by the taxpayer” has been modified so that it no longer affects the T1 EFILE status eligibility. This diagnostic will continue to be displayed as a reminder, but you will no longer be required to answer the question Did the taxpayer electronically sign Form T183? on Form T183 to set the return eligible for EFILE. If you do not answer this question or if your answer is “No,” the same value will be transmitted to the CRA. Note that if you answer “Yes” to this question, you must enter the date and time of the electronic signature.

We have confirmed with the CRA that the method to e-mail a PDF copy of Form T183 to the taxpayer so that they can print, sign and scan it to then return it to the preparer is accepted, but does not constitute an electronic signature. Therefore, you are not required to complete the electronic signature fields on Form T183 in that situation.

T5013, Statement of Partnership Income

Boxes 226 to 235 have been added to the T5013 slip. These new boxes are used to calculate the allowable deduction for CEE, CDE or COGPE accounts on Form T1229. More specifically:

- box 226, Amount repaid pursuant to a legal obligation (for Canadian exploration expenses);

- box 227, Amount repaid pursuant to a legal obligation (for Canadian development expenses);

- box 228, Amount repaid pursuant to a legal obligation (for Canadian oil and gas property expenses);

- box 229, Amount receivable (for Canadian exploration expenses);

- box 230, Amount receivable (for Canadian development expenses);

- box 231, Amount receivable (for Canadian oil and gas property expenses);

- box 232, Proceeds of disposition (for Canadian development expenses);

- box 233, Proceeds of disposition (for Canadian oil and gas property expenses);

- box 234, Accelerated Canadian development expenses;

- box 235, Accelerated Canadian oil and gas property expenses.

in addition, the Canadian journalism labour tax credit (CJLTC) from box 236 of the T5013 slip is now added by the program to the partner’s net business income, in addition to being claimed as a refundable tax credit on line 47555 of the T1 return.

The CJLTC allocated by a partnership to a partner is taxable income to the partner in the year it is received. It must be included in the partner’s net business income under paragraph 12(1)x of the Income Tax Act and does not affect the calculation of the partnership’s net business income or loss as computed by the partnership (T5013 slip, box 116).

Client letter, Client Letter Worksheet

As announced by the CRA and Revenu Québec, taxpayers whose income is $75,000 or less and who received COVID-19-related income support benefits such as CERB, CESB, CRB, CRCB, CRSB, employment insurance benefits and similar provincial emergency benefits can qualify for an interest relief until April 30, 2022.

The question Does the taxpayer qualify for the interest relief for the 2020 taxation year? has been added to the Taxation year and filing date section of the Client Letter Worksheet, to allow for the update of the balance-due day that applies in this situation.

If an amount is entered on line 13000 of the T1 return (boxes 197, 198, 199, 200, 202, 203 or 204 of the T4A slip), the answer to the question Does the taxpayer qualify for the interest relief for the 2020 taxation year? will be Yes. However, if the taxpayer received one of these benefits via a T4E slip, you will have to manually define the answer to this question.

The client letter will also display a reference to advise the taxpayer that they qualify for interest relief.

Québec

Schedule C and Form TP-358.0.1 – Harmonization with the January 19, 2021, Department of Finance Canada’s news release to temporarily modify rules for the refundable tax credit for childcare expenses or the disability supports deduction

On January 19, 2021, the Department of Finance Canada announced that the Income Tax Act would be modified to temporarily allow Canadians receiving Employment Insurance (EI) and Québec Parental Insurance Plan benefits (QPIP) to make the same claims for the Child Care Expense Deduction and Disability Supports Deduction as COVID 19 income support recipients.

On February 26, the Ministère des Finances du Québec announced that it would harmonize with this federal measure. As a result, and only for the 2020 and 2021 taxation years, when individuals received, in the course of the year, EI benefits, parental insurance benefits or government assistance amounts, they can claim the refundable tax credit for childcare expenses (using Schedule C) or the disability supports deduction (using Form TP-358.0.1), if applicable.

The calculation of Schedule C and Form TP-358.0.1 has been adjusted accordingly.

Alberta

Child Care – Alberta Working Parents Benefit

To support working parents who need and have paid for child care so they can continue working during the pandemic, the Government of Alberta is providing the Working Parents Benefit, a one-time payment of $561 per child. Families can apply for the Working Parents Benefit online starting March 1, 2021, based on where they live. Applications close March 31, 2021.

You may be eligible to apply if:

- you had a household income of $100,000 or less in the 2020 tax year

- you are a Canadian citizen or a permanent resident living in Alberta

- you are the parent or legal guardian of a child who was born on or after February 29, 2008

- you paid $561 or more for 3 months of child care between April 1, 2020 and December 31, 2020 (receipts required)

- the child care you paid for was provided by a licensed daycare, a licensed out-of-school care program, a licensed preschool, a licensed group family child care program, an approved family day home, a private day home, a nanny or a relative, or any another child care provider (receipts required)

- you required the child care above because you were working or attending school

The benefit is not taxable. However, if the taxpayer or their spouse claim the child care expense deduction on their tax return, they are required to deduct the Working Parents Benefit they received from the child care expenses they are claiming in their 2020 income tax return. This is done by subtracting the benefit received from the Government of Alberta from the total child care expense reported per child in Part A of page 3 on the T778 form. If the taxpayer has already filed their 2020 income tax return, they must request an adjustment to their her income tax return to reduce line 67950 by the total amount of the benefit, and line 67954 by the total amount of the benefit received for children 6 years of age or younger at the end of the year (if applicable).

A check box has been added to the FAM form to allow you to confirm that an amount of working parents benefit has been received for a child. As a result, in Form T778, the child care expenses for this child will be reduced by the benefit amount received.

Corrected Calculations

The following problems have been corrected in version 2020 3.0:

Québec

Modifications Made to Version 2.0

Updated Forms

Preparer Profiles

EFILE tab

- Subsection T185 – Electronic filing of a Pre-authorized Debit Agreement has been added. This subsection allows for granting the authorization to file a preauthorized debit (PAD) agreement for all taxpayers who completed a Form T185.

- The box using an electronic signature method on Form T183 for all or some taxpayers has been added to the preparer profiles.

Federal

T183, Information Return for Electronic Filing of an Individual’s Income Tax Benefit Return

The pre-authorized debit (PAD) agreement section has been removed from this form. To complete a PAD agreement, you must now use Form T185.

The information from the Authorization for the electronic filer to represent the taxpayer section has been moved to the top of the EFILE form. When transmitting T1 returns, the communication indicator informs the CRA whether to contact the electronic filer directly should supporting documents be requested during a pre- or post-assessment review.

The CRA specified that this check box can now only be used for the purposes of these reviews. Previously, selecting this check box would grant you authorization to contact the CRA to ask questions about the client by phone or mail for the taxation year covered by the transmission. This is no longer the case. To obtain the authorization to access information with respect to the taxpayer, transmit Form AUTHORIZATION (authorize online access) or file Form AUT-01 (authorize offline access).

Electronic signature: The CRA will continue to accept an electronic signature on Form T183 for the 2021 tax filing season. The CRA added three new EFILE fields (electronic signature indicator, signature date, and signature time), which must all be transmitted when Form T183 is electronically signed.

These fields can be found in the new Electronic Signature section, which was added to Form T183, on screen only. When the answer to the question Are you planning on using an electronic signature method on Form T183? is Yes, EFILE diagnostics will prompt you to complete these fields to transmit the return. In addition, the date of signature in Part F will no longer be automatically updated. Instead, you will have to manually enter the date of signature in the Electronic signature section. The date that must be transmitted to the CRA is the date of signature and not the print date.

The answer to the question relating to the electronic signature will default to Yes. However, if you elect not to use electronic signatures, the answer to this question can be defaulted to No by clearing the check box using an electronic signature method on Form T183 for all or some taxpayers in the EFILE tab of the preparer profile.

Doing so will prevent EFILE diagnostics related to the electronic signature feature from being displayed and the date of signature in Part F will be automatically updated as in prior years.

Important: Starting with the next version, which is scheduled to be released in mid-March, three new EFILE fields (electronic signature indicator, date of signature and time of signature) will be completed by the program once the taxpayer signed if you are using the electronic signature feature in the CCH iFirm Portal.

CCB, Canada Child Benefit Worksheet

In its Fall Economic Statement 2020, the Government of Canada announced that it would provide temporary support for families who have young children and who are entitled to the Canada Child Benefit (CCB) for 2021. This will provide CCB-entitled families four additional CCB payments, i.e. for the months of January, April, July and October 2021.

The CCB worksheet takes the additional payments into account for the months of July and October 2021 and are determined as follows:

- $300 per child under the age of six to families entitled to the CCB with a family net income equal to or less than $120,000; and

- $150 per child under the age of six to families entitled to the CCB with a family net income above $120,000.

Note that if a family's adjusted net income is too high to receive the CCB in that month, they would not receive a quarterly amount. For the amounts that would be payable in the first quarter of 2021 and April, a family's adjusted net income is based on the family's net income in 2019. For the months of July and October, a family's adjusted net income is based on the family's net income in 2020.

Deceased, Income Tax returns for Deceased Persons

Where the primary beneficiary of an alter ego trust, spousal or common-law partner trust, or the last surviving beneficiary of a joint spousal or common-law partner trust dies, there is a deemed year-end of the trust on the date of death of the beneficiary. The income that is recognized by the trust upon the death of the beneficiary must be included in the return of the trust. However, subsection 104(13.4) ITA allows the trust and the deceased beneficiary’s graduated rate estate to elect to include this income in the final return of the beneficiary, rather than the return of the trust. The income will be shown on a T3 slip issued to the beneficiary.

A field has been added to the Deceased form to enter the income amount in respect of which the election was made. Starting in 2020, this amount must be included in the data transmitted when EFILING the final return of the deceased.

Statement of Discounting Transaction

The preparation of personal income tax returns (including discounted returns) is now exempt from the Manitoba retail sales tax (RST). As a result, Form RC71 has been modified by the CRA to remove RST references in Section D because, effective October 1, 2020, only GST should be charged on Manitoba discounting transactions.

Capital Cost Allowance – New Class 56

The new CCA class 56 has been added for properties acquired after March 1, 2020, and available for use before 2028, that are zero-emission automotive equipment and vehicles that currently do not benefit from the accelerated rate provided by classes 54 and 55. Like these two CCA classes, class 56 benefits from a temporary enhanced first-year CCA rate of 100% for eligible property available for use before 2023.

Modifications have been made to correctly calculate the class 56 CCA in Area A of all self employment income statements.

Invoice

The preparation of personal income tax returns (including discounted returns) is now exempt from the Manitoba retail sales tax (RST). As a result, the invoice has been modified to no longer apply the RST to the returns of Manitoba residents when the box Calculate taxes based on the rate in effect in the client’s province of residence is selected on the BILL tab of the preparer profile.

Income earned for the purposes of the Child Care Expense Deduction, Disability Supports Deduction, New Brunswick Child Tax Benefit and Nunavut Child Benefit

Under the current tax rules, Employment Insurance (EI), Québec Parental Insurance Plan (QPIP) benefits and CERB income are treated differently when determining tax relief under the Child Care Expense Deduction and the Disability Supports Deduction. The recipients of EI and QPIP benefits are not able to deduct eligible expenses against their EI and QPIP income, whereas CERB and other COVID-19 emergency income recipients can.

On January 19, 2021, the Department of Finance Canada announced that the Income Tax Act will be modified to temporarily allow Canadians receiving EI and QPIP benefits to make the same claims for the Child Care Expense Deduction and Disability Supports Deduction as COVID 19 income support recipients. As a result, EI and QPIP income will be included in earned income on Form T778. This change applies to income for 2020 and 2021.

Please note that this change also affects income earned for the purposes of the New Brunswick Child Tax Benefit and the Nunavut Child Benefit.

T777, Percentage of the home used as a work space and maintenance expenses

Starting with the 2020 taxation year, the percentage of the home used as a work space for work purposes must be calculated based on the percentage of the space used for work purposes rather than based on the percentage of the space used for personal purposes.

Note that a distinction should be made between the work performed in a designated room and the work performed in a common area.

A question has been added to the work-space-in-the-home expenses section of Form T777 to determine whether the space is a designated room or a common area.

In addition, if the work is performed in a common area, the number of hours of work per week must be indicated and will be used to calculate the percentage of the home used as a work space for work purposes.

Maintenance expenses

The method for calculating the deductible portion of maintenance expenses as well as the method to determine the percentage of the home used as a work space for work purposes have been modified for the 2020 taxation year. Maintenance expenses paid solely for the work space are now 100% deductible (if the work at home is performed in a designated room) or solely based on the number of hours of work per week (if the work at home is performed in a common area).

An input line has been added to Form T777 to indicate whether the maintenance expenses are paid solely for the work space.

Québec

TP-1033.17 – Election to Defer the Payment of Income Tax Resulting from the Deemed Disposition of Certain Shares Held at the Time of Death

As of the 2020 taxation year, Form TP-1033.17, replaces Form TP-436.C, Election to Defer the Payment of Income Tax Attributable to the Deemed Disposition of an Interest in a Qualified Public Corporation Held at the Time of Death.

Form TP-1033.17 is to be used by the legal representative of a deceased person to elect to defer, over a 20-year maximum period, the payment of income tax by this person resulting from the deemed disposition, immediately before death, of the person’s interest in a qualified public corporation.

Nova Scotia

Nova Scotia child benefit – Provincial or Territorial Benefit Worksheet

In July 2020, the Government of Nova Scotia announced an increase of the Nova Scotia Child Benefit.

Families with incomes below $34,000 will now be eligible. Previously, only those earning $26,000 or less qualified.

Rates:

Corrected Calculations

The following problems have been corrected in version 2020 2.0:

Federal

Modifications Made to Version 1.0

Forms, Schedules, and Workcharts Added to the Program

Federal

T1 Line 31350, Digital News Subscription Expenses

A calculation workchart has been created for purposes of computing the tax credit for digital news subscription expenses.

Starting in 2020, this amount is updated to line 31350 of the T1 return.

T185, Electronic Filing of a Pre-authorized Debit Agreement

The CRA introduced Form T185 which replaces former Part C of Form T183. As a result, starting this year, to electronically transmit a pre-authorized debit (PAD) agreement using the program, Form T185 must be completed and signed by the taxpayer prior to the transmission.

T777S, Statement of Employment Expenses for Working at Home Due to COVID-19

Form T777S is accessible via Form T777. To complete Form T777S, the answer to the question Do you want to complete Form T777S (Statement of employment expenses for working at home due to COVID-19)? must be Yes. Otherwise, the standard Form T777 will be displayed.

In Form T777S the Canada Revenue Agency has introduced a temporary flat rate method to calculate the home office expenses for 2020 for employees who worked from home in 2020 due to COVID-19. If the employee uses this method, their employer is not required to complete Form T2200S, Declaration of Conditions of Employment for Working at Home Due to COVID-19, and the employee is not required to keep documents to support their claim.

If the employee does not use this method, their employer must complete Form T2200S so the employee may use the detailed method of Form T777S and the employee must keep their supporting documents.

The detailed method only applies to taxpayers who are claiming expenses incurred to earn salary or commission income. Form T777S can be completed by taxpayers who have home office expenses related to working at home in 2020 due to COVID-19 and meet all the following conditions:

- The employee worked more than 50% of the time from home for a period of at least a month (four consecutive weeks) in 2020. The period may exceed a month.

- The employee’s employer completed and signed Form T2200S, Declaration of Conditions of Employment for Working at Home Due to COVID-19.

- The employee kept all their supporting documents.

Form T777S does not apply to taxpayers who are claiming employed tradesperson’s and apprentice mechanic’s tools expenses, employees working in forestry operations expenses and employed artists. It does not apply either to taxpayers who are claiming motor vehicle expenses or any capital cost allowance (CCA).

The following list includes common home office expenses. For additional home office expenses that taxpayers can claim, go to canada.ca/cra-home-workspace-expenses.

- rent paid for a house or apartment where the taxpayer lives

- electricity, water, heat or the utilities portion of condominium fees

- maintenance (minor repairs, cleaning supplies, light bulbs, paint, etc.)

- home Internet access fees

- supplies (stationery items, pens, folders, sticky notes, postage, toner, ink cartridge, etc.)

- employment use of a basic cell phone service plan

- long distance calls for employment purposes

Employees who earn commission income can also claim the following:

- property taxes

- home insurance

- lease of a cell phone, computer, laptop, tablet, fax machine, etc. that reasonably relate to earning commission income

T2200S, Declaration of Conditions of Employment for Working at Home Due to COVID-19

There now exists a second version of Form T2200, i.e. Form T2200S. The form is available from Form T2200. To access it, the box Declaration of conditions of employment for working at home during COVID-19 must be selected. Otherwise, the standard Form T2200 will be displayed.

This version of the form is destined to employees who were required to work from their home during COVID-19. The employer must complete and sign this form if the employee chooses to use the detailed method of Form T777S to calculate their home office expenses (work-space-in-the-home and supplies). If the employee is required to pay for expenses other than home office expenses, do not use this form. Instead, complete Form T2200, Declaration of Conditions of Employment.

T1 Line 47555, Canadian journalism labour tax credit

The Canadian journalism labour tax credit (CJLTC) is allocated by a partnership and is shown in box 236 of the T5013 slip. This credit is granted to a member of a qualifying journalism organization that is a partnership. It is available for qualifying labour expenditures incurred for eligible newsroom employees, minus any amount of assistance received by the partnership.

If the individual is a member of a partnership that incurred a qualifying expenditure for 2019, a reassessment can be requested for the 2019 income tax return to claim the CJLTC. The amount claimable will be indicated on a letter given by the partnership. To request a reassessment, you must make an adjustment request using the Represent a client service or Changing a return service in My Account, on the Canada Revenue Agency Web site, or paper file a T1-ADJ form, accompanied by the letter given by the partnership.

Québec

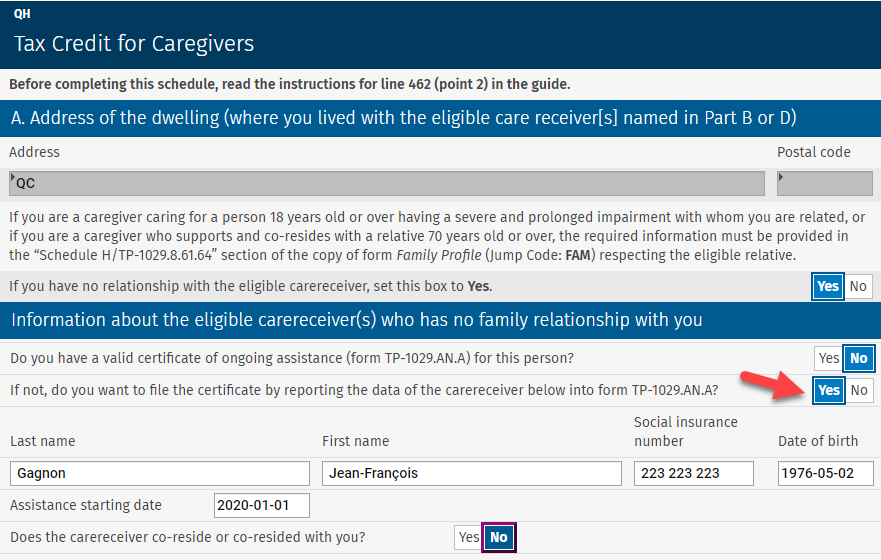

TP-1029.AN.A – Certificate of Ongoing Assistance

Form TP-1029.AN.A has been added to allow preparers to complete and print this certificate for clients concerned. This new certificate must be filed with Revenu Québec if the taxpayer is eligible for the tax credit for caregivers (Schedule H) for an eligible carereceiver with whom he or she is not related. There are two ways to create a form for each eligible carereceiver:

- In Schedule H, select the box If you have no relationship with the eligible carereceiver, select the following check box: and enter the information about the eligible carereceiver who has no relationship with the caregiver to complete the certificate for this person:

- Access and complete the new Form TP-1029.AN.A.

Updated Forms

Federal

Preparer Profiles, T1-ADJ

The fields RepID and EFILE# have been added to the T1-ADJ form.

The EFILE number will be updated to the EFILE# field if that information is entered in the Electronic Services Identification section, which can be accessed from the Settings/Tax menu.

The RepID will be updated to the RepID field if you selected Representative information in the T1-ADJ/Information to enter in the “Authorization” drop-down list in the General Information tab of the form.

Note that when this option is selected, the representative information will be that of the AUTORIZATION form for an authorization request transmitted and accepted in the current year. If this is an authorization request accepted in a prior year, the representative information will be that of the AUTHORIZATION FORMS tab of the Preparer Profile.

AUTHORIZATION FORMS tab

The options Transmit for deceased clients and Transmit for clients with regards to which access to the CRA’s Represent a client service has already been given to you have been removed from the AUTHORIZATION – Authorizing a representative section.

Note that for deaths occurring after February 9, 2020, you are no longer required to submit a new authorization request provided you were the authorized representative of the deceased prior to their death.

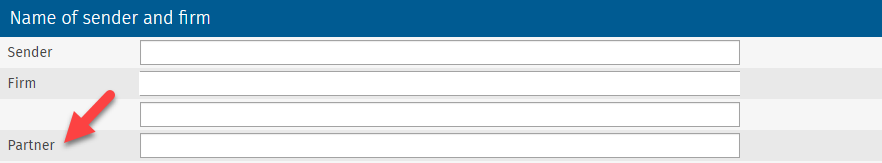

Client letter – Client Letter Worksheet

The Partner field has been added to the LW form so that it could be used in a custom letter.

Federal

ID, Identification and Other Client Information

When a new e-mail address is entered in the client file and the option Already registered is selected in the CRA online mail section, the user will be prompted to confirm whether the e-mail address should be replaced in the CRA files. This will prevent the e-mail address from being updated by mistake in the CRA files.

Virtual currency

A question has been added to report virtual currency transactions other than those giving rise to a capital gain or loss that must be entered in Section 5 of Schedule 3.

You must answer this question if the taxpayer received or disposed of virtual currency (by selling, transferring, exchanging, giving, etc.) for transactions other than those giving rise to a capital gain or loss.

Canada Emergency Response Benefit (CERB), Canada Recovery Benefit (CRB) and Provincial/Territorial COVID-19 financial assistance payments

To face the COVID-19 pandemic, the different federal and provincial governments paid various benefits to Canadian taxpayers to compensate for the decrease in income as a result of job losses or reductions in income caused by the pandemic.

These benefits are indicated in the T4A slip in which new boxes have been added:

- Box 197, Canada Emergency Response Benefit (CERB);

- Box 198, Canada Emergency Student Benefit (CESB);

- Box 199, Canada Emergency Student Benefit (CESB) for eligible students with; disabilities or those with children or other dependents;

- Box 200, Provincial/Territorial COVID-19 financial assistance payments;

- Box 202, Canada Recovery Benefit (CRB);

- Box 203, Canada Recovery Sickness Benefit (CRSB);

- Box 204, Canada Recovery Caregiving Benefit (CRCB)

For Québec residents, these benefits are shown in the following boxes of the RL-1 slip:

- The amounts received as part of the Incentive program to retain essential workers (IPREW) are shown in box O-5 of the RL-1.

- CERB-related benefits are shown in box O-6 of the RL-1.

- CRB-related benefits are shown in box O-7 of the RL-1.

These benefits are updated to the following lines of the T1 and TP1 returns:

T1 return

All COVID-19-related benefits must be reported on line 13000, Other income.

TP1 return

All CERB- and CRB-related benefits must be reported on line 154, Other income. Code 16 has been added to Form TP1 Line 154 to identify CERB and CRB benefits.

In addition, line 169, CERB, CESB, CRB, CRSB or CRCB, has been added to the TP1 return to compute the different benefits received by the taxpayer.

The amount in box O-5 of the RL-1 slip must be reported on the new line 151, Incentive program to retain essential workers.

T1 lines – Worksheet for the return – Line 30000

A worksheet has been added to calculate the basic personal amount updated to line 30000 of the return. The modifications to the basic personal amount were announced in the Economic and Fiscal Update 2019, published by the Department of Finance Canada on December 16, 2019.

This amount increases to $13,229 in 2020 for taxpayers with a net income equal to or less than $150,473. It is phased out to $12,298 for taxpayers with a net income greater than $150,473 and less than $214,368. For taxpayers with a net income equal to or greater than $214,368, this amount is established at $12,298.

The taxpayer’s basic personal amount is also used to calculate the spouse or common-law amount and the amount for eligible dependant.

Canada Training Credit limit

The Canada training credit is a refundable tax credit designed to provide financial assistance to cover up to half of the tuition and other eligible expenses associated with training.

The amount that can be claimed for a taxation year is equal to the lesser of:

- half of the tuition fees and other eligible expenses paid for the taxation year; and

- the Canada training credit limit of the taxpayer for the taxation year. This limit amount is communicated to the taxpayer each year in his or her Notice of Assessment. If the client file is rolled forward from the previous year and the taxpayer was eligible for the accumulation of this limit (calculated in Form Canada Training Credit Limit for the previous year), it will be rolled forward to the line for this purpose, which is located at the top of Schedule 11. If this is a new client file, this limit can be entered on the same line for this purpose.

The amount of the credit is calculated in the Canada Training Credit section of Schedule 11 and is updated to line 45350 of the income tax return.

At the federal level and for all provinces, except for Yukon, this credit amount then reduces the tuition amount available for the purposes of the credit for tuition, education and textbook amounts.

Canada Training Credit

This form is used to determine the Canada training credit limit for the next tax year.

This limit is the lesser of:

- the result of the following calculation: the limit for the previous year plus $250 (if the taxpayer satisfies the conditions listed below) minus the amount of the Canada training credit claimed in the year on line 45350 of the income tax return; and

- the result of the following calculation: $5,000 minus the cumulative Canada training credit claimed in previous years (because taxpayers can accumulate up to a maximum of $5,000 during their lifetime).

To accumulate the amount of $250 corresponding to the Canada training credit limit, a taxpayer:

- file a tax return for the year;

- be at least 26 years of age and under 66 years of age at the end of the year;

- be resident in Canada throughout the year;

- have a total of $10,000 or more of income, including income in the year from:

- an office or employment

- self-employment income

- maternity and parental employment insurance benefits or benefits paid under the Act respecting parental insurance,

- the taxable part of scholarship income, and

- the tax-exempt part of earnings of status Indians and emergency service volunteers

- have individual net income for the year that does not exceed the top of the third tax bracket in the year ($150,473 in 2020).

Taxpayers’ Canada training credit limit is communicated to them each year in their Notice of Assessment and will be available through the Canada Revenue Agency’s My Account portal.

Schedule 9, Donations and Gifts

The calculations in Schedule 9 have been simplified for most individuals. In addition, for the 2020 and subsequent taxation years, a non-refundable tax credit for donations to registered journalism organizations can be claimed.

Donations to registered journalism organizations can also be claimed in Québec.

T90, Income Exempt From Tax Under the Indian Act

A line has been added to Form T90 to report benefits paid in the year by a government in Canada for income lost due to the COVID-19 pandemic, if the benefits were calculated based on tax-exempt employment or self-employment income.

To identify these benefits, a custom box has been added to the T4A slip to enter benefits calculated based on tax-exempt employment income. In addition, a data entry line has been added to Form T90 to enter the benefits calculated based on tax-exempt self-employment income.

T657, Calculation of Capital Gains Deduction

Capital gains arising from the disposition of property made after 2008 and before 2014 qualify for a $375,000 cumulative deduction, which represents half of a lifetime exemption of $750,000.

Capital gains arising from the disposition of property in 2014 give rise to a $400,000 cumulative deduction, which represents half of the $800,000 lifetime exemption. The amount of this cumulative deduction has been indexed from 2015 to 2019 and will continue being indexed each year, until it reaches $500,000, which represents half of a lifetime exemption of $1,000,000.

As a result, for the gains arising from the dispositions of property in 2015, the cumulative deduction is $406,800, which represents half of a lifetime exemption of $813,600.

For gains arising from the disposition of property in 2016, the cumulative deduction is $412,088, which represents half of a lifetime exemption of $824,176.

For gains arising from the disposition of property in 2017, the cumulative deduction is $417,858, which represents half of a lifetime exemption of $835,716.

For gains arising from the disposition of property in 2018, the cumulative deduction is $424,126, which represents half of a lifetime exemption of $848,252.

For gains arising from the disposition of property in 2019, the cumulative deduction is $433,456, which represents half of a lifetime exemption of $866,912.

For gains arising from the disposition of property in 2020, the cumulative deduction is $441,692, which represents half of a lifetime exemption of $883,384.

In addition, for dispositions of qualified farm property or qualified fishing property made after April 20, 2015, the cumulative deduction is $500,000, which represents half of the $1,000,000 lifetime exemption. The dispositions of small business corporation shares do not give rise to this additional deduction.

T1134, Information Return Relating to Controlled and Not-Controlled Foreign Affiliates

The Canada Revenue Agency (CRA) published a new version of Form T1134 which must be used for taxation years starting after 2020. For T1134 forms prepared for taxation years prior to 2021, the previous version of Form T1134 must be used.

For the 2020 tax season, only the previous version of Form T1134 will be available in CCH iFirm Cantax T1 2020. To that end, the following note has been added at the top of the form:

If you are preparing a 2021 early-filed return (deceased or pre-bankruptcy) with a 2020 version of the program, you must use the new version of the form available with the CRA and complete it manually. The new version of Form T1134 will be integrated in the 2021 version of CCH iFirm Cantax T1.

Meal expenses under the simplified method

Starting in the 2020 taxation year, the amount of deductible meal expenses under the simplified method increases from $17 to $23, for a total of $69 per day.

The simplified calculation method can be used to claim meal expenses without having to keep receipts. This method is used for the purposes of the following calculations:

- Moving expenses deduction (Form T1M);

- Claim for meals and lodging expenses (Form TL2);

- Northern residents deduction (Form T2222);

- Expenses for medical services not available in the taxpayer’s area when the distance travelled is at least 80 kilometres of their home (Form MED).

This also applies for equivalent calculations for the purposes of the Québec return.

Québec

Schedule G, Capital Gains and Losses

A section has been added to Part A of the schedule to enter the gain or loss arising from the disposition of virtual currency transactions.

To enter virtual currency transactions giving rise to a capital gain or loss in Section 5 of Schedule 3, select type 2, Virtual currency transactions - Qc, in the Type column in order for data to be transferred to the Virtual currency transactions section of Schedule G. You must also enter the number of units and the method of disposition in Section 5.

Schedule H, Tax Credit for Caregivers

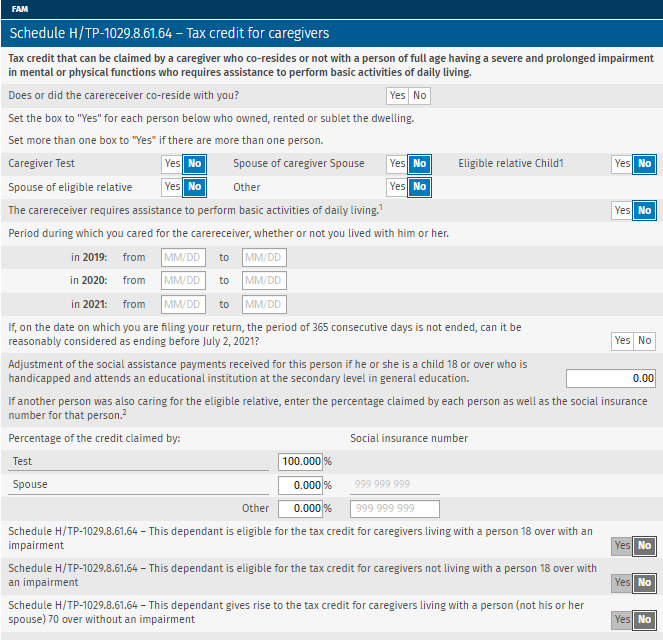

Starting in 2020, the four existing components of the tax credit for informal caregivers of persons of full age will be replaced by the new refundable tax credit, called the “tax credit for caregivers,” comprising the following two components:

- component 1: universal basic tax assistance of $1,250 (no co-residency requirement) for a caregiver providing care to a person aged 18 or older who has a severe and prolonged impairment and needs assistance in carrying out a basic activity of daily living;

- component 2: universal tax assistance of $1,250 for a caregiver who supports and co-resides with a relative aged 70 or older.

Under component 1 of the new tax credit, the caregiver of an eligible carereceiver aged 18 or older who has a severe and prolonged impairment in mental or physical functions and who, according to a certification by a health professional, needs assistance in carrying out a basic activity of daily living will receive additional assistance of up to $1,250 for the year, thereby raising the potential assistance under component 1 to $2,500 if the caregiver co-resides with the eligible carereceiver.

However, if the caregiver does not co-reside with the eligible carereceiver, the only assistance to which the caregiver is entitled will be a reducible amount of up to $1,250 under component 1 of the tax credit.

The $1,250 amount will be reduced in the same way as before, according to a rate of 16% for each dollar of the eligible carereceiver’s income that exceeds the reduction threshold applicable for the year. For 2020, the reduction threshold is $22,180. The tax credit can be claimed for an eligible carereceiver with whom the taxpayer has a relationship or not.

For the application of component 1 of the new tax credit:

- the eligible carereceiver must be a person who has a severe and prolonged impairment who, according to the certificate provided by a health professional (Form TP-752.0.14), needs ongoing assistance to carry out a basic activity of daily living;

- the following adults can also be considered eligible carereceivers under component 1: the spouse as well as the child, grandchild, nephew, niece, brother and sister of the caregiver;

- the eligible carereceiver may have no relationship with the caregiver if a duly completed certificate for ongoing assistance (Form TP-1029.AN.A) is attached to the caregiver’s income tax return.

For the application of component 2 of the new tax credit, the eligible carereceiver must be a person aged 70 or over who is not the caregiver’s spouse.

A section has been added to Schedule H to allow the preparer to enter the information required to perform the calculation of the tax credit for an eligible carereceiver with no relationship with the caregiver. To access this section, the preparer must select the box If you have no relationship with the eligible carereceiver, select the following check box.

The information required to perform the calculation of the tax credit for a spouse who is an eligible carereceiver must be entered in subsection Schedule H – Tax credit for caregivers in Form Identification of the caregiver.

The information relating to a carereceiver who has a relationship with the caregiver must be entered in the Schedule H/TP-1029.8.61.64 – Tax credit for caregivers section of the FAM form.

TP-64.3, General Employment Conditions

Section 3.6 has been added to Form TP-64.3 to enter expenses related to remote work. This section must be completed for employees who incurred expenses solely for remote work performed in the context of the COVID-19-related crisis.

TP-752.PC, Tax Credit for Career Extension

Form TP-752.PC replaces Form TP1 Line 391. Despite this replacement, the calculation of the tax credit for career extension remains unchanged.

TP-1029.9, Tax Credit for Taxi Drivers or Taxi Owners

Tax Credit for Taxi Drivers

The refundable tax credit for holders of a taxi driver’s permit will be eliminated gradually. A taxpayer will then be able to benefit, for 2020, from the refundable tax credit for holders of a taxi driver’s permit, subject to the modifications made to consider the new legal framework governing remunerated passenger transportation by automobile. The level of assistance will be reduced by 50% for 2021 and the tax credit will be eliminated starting in 2022.

For 2020 the condition that the taxpayer is not the holder of a taxi owner’s permit on December 31 in this year is replaced by the condition that the taxpayer is not the holder of a taxi owner’s permit on October 9, 2020.

Tax Credit for Taxi Owners

For the 2020 taxation year, the condition that the taxpayer must be the holder of a taxi driver’s permit in force on December 31 of the taxation year will be replaced by the condition that the taxpayer is the holder of a taxi owner’s permit on October 9, 2020. The other conditions to be satisfied to benefit from the tax credit remain the same.

In addition, to calculate the refundable tax credit, in the situation where the taxation year starts after December 31, 2019, the income taken into account is income earned prior to October 10, 2020.

The refundable tax credit for holders of a taxi driver’s permit will be abolished for a fiscal period or a taxation year that starts after October 9, 2020.

Ontario

ON428 – Ontario Tax

As of January 1, 2020, the rate for the Ontario dividend tax credit for dividends other than eligible dividends has been decreased from 3.2863% to 2.9863%.

In addition, the Ontario apprenticeship training tax credit has been eliminated as of November 14, 2020. As a result, the only expenditures that can be included in the credit calculation are those incurred prior to November 14, 2020, by apprentices who began an apprenticeship program after December 31, 2016, and before November 15, 2017.

British Columbia

BC428, British Columbia Tax

A new 20.5% tax bracket for income over $220,000 has been added for a total of seven brackets.

The British Columbia Charitable Donations Tax Credit has been increased to 20.5% where the taxpayer’s taxable income is over $220,000. The new rate applies to the lesser of the following amounts: the portion of donations in excess of $200 and the portion of taxable income in excess of $220,000. Therefore, a new section has been added to Worksheet BC428.

Alberta

Schedule AB(S11), Provincial Tuition and Education Amounts

Starting in the 2020 tax year, the Alberta tuition and education amounts have been discontinued. Students can continue to claim any unused amounts carried forward from previous years.

AB428 – Alberta tax and credits

The Alberta investors tax credit has been eliminated but unused carry forward amounts can still be claimed.

Manitoba

MB479, Manitoba Credit

A new one-time refundable Manitoba credit, i.e. the Seniors Economic Recovery Credit has been introduced for eligible seniors. This credit can only be claimed in the returns of eligible seniors who have not yet received the May or June 2020 advance payments.

Saskatchewan

SK428, Saskatchewan Tax and Credits

Three new non-refundable tax credits are available for eligible volunteers as of January 1, 2020. These credits are:

- the Volunteer firefighters’ amount;

- the Search and rescue volunteers’ amount; and

- the Volunteer emergency medical first responders' amount.

The tax credits on line 58315, Volunteer firefighters’ amount and line 58316, Search and rescue volunteers’ amount are equal to the federal credits. As for the amount on line 58317, Volunteer emergency medical first responders' amount it is specific to Saskatchewan.

To claim this credit specifically for that province, volunteers must have completed at least 200 hours of eligible volunteer emergency medical services in the year. Recognized volunteers’ services are:

- be on duty and answer corresponding emergency calls;

- assist to meetings organized by the provincial health authority;

- participate in the mandatory training on emergency medical first responders' services.

Yukon

YT428, Yukon Tax

The calculation of the Yukon basic personal amount, the spouse or common-law partner amount and the amount for an eligible dependant has been modified to match the same amounts at the federal level.

YT479, Yukon Credits

The small business investment tax credit has been renamed to business investment tax credit.

The labour-sponsored venture capital corporation tax credit has been discontinued.

Schedule YT 14, Yukon Government Carbon Price Rebate

The undepreciated capital cost (UCC) relating to classes 54 and 55 have been added to the UCC of the classes already eligible for purposes of calculating the Yukon Business Carbon Price Rebate.

The rate for the Yukon Business Carbon Price Rebate increased from 0.345% to 0.69%.

Newfoundland and Labrador

NL428, Newfoundland and Labrador Tax and Credits

Starting in 2020, the eligibility conditions for the volunteer firefighters’ tax credit, the search and rescue volunteers’ tax credit, and the child care tax credit have been modified. Only Newfoundland and Labrador residents are now eligible for these amounts. If you were not a resident of this province on December 31 of the year covered, you cannot claim any of these tax credits.

In addition, the temporary deficit reduction levy has been abolished on December 31, 2019.

Forms Removed

Québec

- TP-1029.RV, RénoVert Tax Credit

- Q1029.RV TPFZ, Keying summary

- QEFILE RV, QC EFILE - Summary of EFILE data fields (TP-1029.RV)

Corrected Calculations

The following problems have been corrected in version 2020 1.0:

Federal

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the help resources, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Tax T1 e-Bulletin notifies you each time an updated or new form is made available in a program update.

How to Reach Us

Technical and Tax Support Hours

Monday to Friday: 8:30 a.m. to 6:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com