Release Notes - CCH iFirm Taxprep T1 2021 v.5.0 (2022.10.33.01)

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax-related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About

This version contains the forms released by the Canada Revenue Agency (CRA) and Revenu Québec for the 2021 taxation year.

The modifications made to version 5.0 only relate to tax rates and the addition of extra calculations. The 2022 federal and provincial government tax rates which were known at the time of this release have been integrated to help you forecast your clients’ tax situation for the next taxation year (with the Planner mode).

This version is approved for:

- Paper filing;

- EFILE;

- Electronic filing of Form AUTHORIZATION;

- Electronic filing of Form T1135;

- Using the Auto-fill T1 return (AFR) service (TaxprepConnect functionality);

- The ReFILE service;

- The transmission of returns for taxpayers in multiple-jurisdiction situations;

- The PAD (Pre-authorized debit);

- The Express NOA (Notice of Assessment);

- Printing the 2D bar code on the federal and Québec returns;

- Electronic filing via NetFile Québec.

Import or convert preparer profiles, custom letters, print formats and diagnostics

When a new taxation year is added to the application, remember that the prior period Preparer Profile, custom letters, print formats and diagnostics must be imported or converted.

For more information, please consult the following FAQ: https://support.cch.com/canada/solution/000118906/FAQ-Why-is-my-current-Preparer-Profile-empty-since-the-latest-deployment-of-CCH-iFirm-Tax?language=en

Auto-fill T1 return – 2021 Tax Season

Important dates

Federal

February 7, 2022 – Opening of the Auto-fill T1 return service. The CRA tax data can be downloaded from the RETRIEVE tab.

What’s new:

T5013 slips can now be downloaded. However, the CRA only makes the following boxes available:

- box 002 – Partner code;

- box 003 – Country code;

- box 004 – Recipient type;

- box 005 – Partner’s share (%) of partnership;

- box 010 – Total limited partner’s business income (loss);

- box 020 – Total business income (loss);

- box 030 – Total capital gains (losses);

- box 040 – Capital cost allowance.

Unfortunately, this information is not sufficient to correctly complete the taxpayer’s return. Therefore, you have to check for missing information on the hard copy of the T5013 slip.

The CRA increased the quantity of data that can be downloaded with respect to the Home Buyers' Plan (HBP) and the Lifelong Learning Plan (LLP) so that the downloaded information might mirror the presentation found on the My account and Represent a client Web pages.

In addition, the following information can now be downloaded when available:

- the amounts in boxes 201, 205, 210 and 211 of the T4A slip;

- the Canada training credit limit;

- a new indicator for employment insurance for self-employed workers.

Electronic services prior years’ support

Federal

In addition to the current tax year 2021, the CRA also supports prior-year electronic services as indicated below until January 2023:

|

2020 |

2019 |

2018 |

2017 |

2016 |

|

|

T1 EFILE (original returns) |

✓ | ✓ | ✓ | ✓ | |

|

T1 ReFILE (amended returns) |

✓ | ✓ | ✓ | ||

|

T1135 |

✓ | ✓ | ✓ | ✓ | |

|

Auto-fill my return (slips only) |

✓ |

✓ | ✓ | ✓ | ✓ |

|

Express notice of assessment (Express NOA) |

✓ | ✓ | ✓ | ✓ |

* You will have to use the CCH iFirm Taxprep T1 program for the year in question and update your EFILE password to the current year.

Québec

In addition to the current tax year 2021, Revenu Québec also supports prior-year electronic services as indicated below until January 2023:

|

2020 |

2019 |

2018 |

|

|

TP1 Netfile Québec (original returns) |

✓ | ✓ | ✓ |

|

TP1 Netfile Québec (amended returns) |

✓ | ✓ | ✓ |

|

Tax data download |

✓ | ✓ |

* You will have to use the CCH iFirm Taxprep T1 program for the year in question and update your EFILE password to the current year.

Tax Data Download from Revenu Québec – 2021 Tax Season

Important dates

Québec

February 21, 2022 – Opening of the Tax Data Download service.

The Revenu Québec tax data can be downloaded from the RETRIEVE tab.

What’s new:

The amount in the following new boxes can now be downloaded when available:

- boxes RY, O-8, O-9 and O-10 of the RL-1 slip;

- boxes G1, G2, H1, H2, J1 and J2 of the RL-10 slip;

- box H of the RL-19 slip.

Modifications Made to Version 5.0

Updated Forms

Federal

In its 2022 budget, the federal government has announced the following measures. These measures have been integrated in the current version of the program, but are only available in Planner Mode or for returns that are produced early:

- The First-Time Home Buyers’ tax credit amount will be doubled to $10,000, providing a tax credit of up to $1,500 to eligible home buyers.

- The annual expense limit of the Home Accessibility Tax Credit is increased to $20,000 for expenditures incurred during the 2022 and subsequent tax years.

Labour mobility deduction for tradespeople

The 2022 federal budget proposes to introduce a labour mobility deduction for tradespeople to recognize certain travel and relocation expenses for workers in the construction industry. This measure would allow eligible workers to deduct up to a maximum of $4,000 in eligible expenses per year.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Air Quality Improvement Tax Credit

In Bill C-8, introduced on December 14, 2021, the federal government is proposing a new air quality improvement tax credit. This 25% refundable credit is available to eligible entities for expenses incurred between September 1, 2021 and December 31, 2022, primarily for the purpose of improving ventilation systems to increase outdoor air intake or to improve air cleaning. The expenses are subject to a maximum of $10,000 per eligible location and a total of $50,000 for all members of an affiliated group.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Passenger vehicles – Increase of the capital cost ceiling for passenger vehicles in respect of capital cost allowance and maximum monthly deductible leasing costs purposes

On December 23, 2021, the Department of Finance Canada has announced, through a news release, the ceilings governing the deductibility of automobile costs and the rates used to calculate the value of taxable benefits related to the use of an automobile that will be applicable for the year 2022.

Effective January 1, 2022:

- the $55,000 ceiling applicable to zero-emission passenger vehicles (Class 54) will increase to $59,000 when such a vehicle is purchased after 2021;

- the $30,000 ceiling applicable to passenger vehicles (Class 10.1) will increase to $34,000 when such a vehicle is purchased after 2021;

- the ceiling will increase from $800 to $900 a month in respect of eligible deductible leasing costs for leasing contracts entered into after 2021.

The new calculations have not been integrated to this version of the program, but diagnostics have been added asking to modify certain amounts when these new tax rules are applicable.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Immediate expensing – Expanded eligibility to individuals for investments made after December 31, 2021

The 2021 budget included proposals to allow for the temporary immediate expensing of certain assets acquired by a Canadian-controlled private corporation (CCPC).

Eligible assets include long-lived assets subjected to capital cost allowance (CCA) rules other than assets in classes 1 to 6, 14.1, 17, 47, 49 and 51.

This measure was originally meant to be applicable to Canadian-controlled private corporations (CCPC) only.

Later, it was extended to individuals and Canadian partnership whose partners are all individuals. The assets must have been acquired after December 31, 2021, and be ready for use before January 1, 2025.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Ontario

Low-income Individuals and Families Tax Credit (LIFT)

In its 2022 budget, the Government of Ontario has announced the enhancement of the Low-income Individuals and Families Tax Credit (LIFT). Starting in 2022, the enhanced LIFT Credit would correspond to the lesser of the following amounts:

- $875 (up from the current amount of $850);

- 5.05 % of employment income.

This amount would then be reduced by 5% (down from the current percentage of 10%) of the greater of the following amounts:

- the adjusted individual net income in excess of $32,500 (up from the current amount of $30,000);

- the adjusted family net income in excess of $65,000 (up from the current amount of $60,000).

The measures above have been integrated in the current version of the program but are only available in Planner Mode or for returns that are produced early.

Ontario Seniors Care at Home Tax Credit

In its 2022 budget, the Government of Ontario is proposing a new Seniors Care at Home Tax Credit to help seniors who are 70 years old or older with certain eligible medical expenses. Individuals eligible for the new tax credit can receive up to 25% of the medical expenses claimed on their tax return, up to $6,000, for a maximum credit of $1,500.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Ontario Staycation Tax Credit

In its 2022 budget, the Ontario government has announced the Ontario Staycation Tax Credit. In addition to helping the tourism sector, this temporary credit is intended to encourage Ontario families to discover the province. In their 2022 tax return, Ontario residents will be able to claim a refund of 20% of eligible accommodation expenses incurred in the year, up to a maximum amount of $1,000 for an individual or $2,000 for a family, for a maximum credit of $200 or $400 respectively.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

New Brunswick

In Bill 103 tabled on May 10, 2022, the New Brunswick government has announced the following measures, which have been integrated in the current version of the program but are only available in Planner Mode or for returns that are produced early:

- An increase in the spouse partner amount from $9,868 to $11,720;

- An increase in the eligible dependant amount from $9,868 to $11,720.

Nova Scotia

More Opportunities for Skilled Trades (MOST)

The 2022 Nova Scotia budget is introducing More Opportunities for Skilled Trades (MOST), a measure to attract and retain the youth in industries experiencing labour shortages. This measure aims to refund the tax paid on the first $50,000 of income for eligible individuals under the age of 30.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Children’s Sports and Arts Refundable Tax Credit

In its 2022 budget, the Nova Scotia government is introducing a non-refundable tax credit for children’s sports and arts programs. The $500 credit is intended to help pay for registration fees for sports and arts activities for children under the age of 19 years old.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Fertility and Surrogacy Rebate

As part of the 2022 budget, the Nova Scotia government has announced a new refundable tax credit covering 40% of the cost of fertility treatments provided by a licensed Nova Scotia medical officer or a fertility treatment clinic. In addition to being available to all types of families, including same-sex parents-to-be, there is no limit to the number of treatments a person can claim. The total eligible costs are $20,000 for a maximum annual refund of $8,000.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

British Columbia

In its 2022 budget, the British Columbia government has announced that used zero-emission vehicles would be exempt from the provincial sales tax effective February 23, 2022. The exemption applies to sales of all used zero-emission vehicles through car dealerships, and to private sales of used zero-emission vehicles that have been driven at least 6,000 kilometres. The exemption is applicable for five years and will be in effect until February 22, 2027.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Clean Buildings Tax Credit

Effective February 23, 2022, the British Columbia government will be introducing a new temporary tax credit for renovations that improve the energy efficiency of multi-unit residential buildings of four or more dwellings and prescribed types of commercial buildings.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2022.

Manitoba

The Government of Manitoba has announced the following measures, which have been integrated in the current version of the program but are only available in Planner Mode or for returns that are produced early.

- As announced in the 2021 budget, existing education property tax rebates, including the Education Property Tax Credit and Advance, the Seniors School Tax Rebate and the Seniors Education Property Tax Credit, will be proportionately reduced by 37.5% in 2022 from the prior 2020 amount.

Newfoundland-and-Labrador

Newfoundland-and-Labrador Income Supplement and Newfoundland-and-Labrador Seniors’ Benefit

The government of Newfoundland-and-Labrador has announced in its 2022 budget the enhancement of the Newfoundland-and-Labrador Income Supplement and the Newfoundland-and-Labrador Seniors’ Benefit. Starting in July 2022, both, which are paid on a quarterly basis along with the federal GST/HST credit, will increase by 10%.

Electronic Filing

What’s New:

Since February 2022, the CRA allows for Canadian residents and factual residents returns to be EFILED with a non-Canadian mailing address.

EFILING T1 returns with a non-Canadian mailing address

For the 2021 and subsequent tax years, the EFILE service will accept T1 income tax returns with a non-Canadian mailing address for Canadian residents and factual residents. A new section, i.e., EFILE: non-Canadian mailing address, is displayed on the ID form when a foreign country is entered in the mailing address. In this section, indicate whether the taxpayer is a Canadian resident or a factual resident for EFILE purposes. Please note that non-resident returns remain an exclusion from EFILE. Only returns with a Canadian province of residence (taxing province) can be EFILED with a non-Canadian mailing address.

When a non-Canadian mailing address is entered in the return and an amount is entered in box 24, Foreign business income, of the T3 slip, you will be prompted to enter a Canadian postal code if you want to EFILE the return. Enter the taxpayer’s Canadian postal code in the ID form even though the mailing address is outside Canada. In this situation, the postal code will only be used to process the SFD form associated with the T3 slips as required by the CRA—it will not be used in the mailing address.

Information about EFILE

Federal

Important dates

- February 7, 2022 Opening of the system for electronic transmission of authorization requests.

- February 21, 2022 Opening of the EFILE On-Line transmission system.

- January 27, 2023 The CRA will stop accepting electronically filed T1 returns.

Registration and Renewal On-line

To renew your EFILE privileges for this year’s tax season, you must follow the instructions provided on the "Renewal" page on the CRA Web site at http://www.efile.cra.gc.ca/l-rnwl-eng.html.

To register as a new electronic filer, you must register online by completing the EFILE Registration On-Line form on the CRA Web site at http://www.efile.cra.gc.ca/l-rgstr-eng.html.

You will find more information concerning renewals and new applications at http://www.efile.cra.gc.ca/.

In order to be able to electronically file Form AUTHORIZATION, you must meet the following two criteria:

- Have a valid EFILE number and password; and

- Be a registered representative (online access).

A registered representative is a person who is registered with the CRA’s Represent a Client service. To register with the service, go to http://www.cra.gc.ca/representatives

Québec

Important dates

- February 21, 2022 – Opening of the NetFile Québec system.

- February 21, 2022 – Opening of the Refund Info-line system.

- January 27, 2023 – The NetFile Québec system will shut down.

NetFile Québec

- Tax preparers must register for “My Account for professional representatives” (available in French only), a secure space on RQ’s Web site, if they have not already done so in the past.

Note that renewal is automatic for persons who registered for this space in the past. - Consult the page “À qui s'adresse Mon dossier” (available in French only) to see which profile applies to you and what actions you can perform online on behalf of a business or an individual.

Modifications Made to Version 4.0

Updated Forms

Federal

T2043, Return of Fuel Charge Proceeds to Farmers Tax Credit – New version of the form – Calculation changes made to line 8 of Chart B

As a result of recent changes made by the CRA to Form T2043, the calculations of line 8 in Chart B of Form T2043WS have been modified as follows:

- If the total gross income in row 2 of Chart B or the total salaries and wages paid in row 5 of Chart B is zero, the total percentage in row 7 should no longer be multiplied by 50%.

As a result, once Chart B has been completed, the Return of Fuel Charge Proceeds to Farmers Tax Credit increases.

For more information on this topic, please see the T2043 – New update issued by CRA - Changes to calculations in Row 8 of Chart B troubleshooting memo.

Benefit – Climate Action Incentive

This benefit is now calculated based on the 2022 rates.

Québec

Québec budget of March 22, 2022 ¬ Introduction of a one-time tax credit to help deal with the rising cost of living

A new special one-time refundable tax credit has been created to help individuals in Québec deal with the rising cost of living.

It will be paid out to eligible individuals who file an income tax return for 2021 and whose net income for the year is less than $105,000.

If your net income for 2021 was $100,000 or less, you will receive a $500 tax credit. If your net income for 2021 was more than $100,000 but less than $105,000, the $500 will be reduced by 10% of the part of your net income that exceeds $100,000. If your net income for 2021 was $105,000 or more, you will not receive the credit.

Note that under the Tax Administration Act, we can apply this credit to the payment of any amount you may owe the government. This means the amount of the tax credit can be used to pay off or reduce the debt.

How was this credit introduced in this version of the program?

A new section was added, on the screen only, at the bottom of Form TP1 to calculate this new tax credit if the taxpayer meets eligibility requirements. Please note that this section has no impact on any of the calculations in Form TP1. The amount of the refund or the balance due on the return should not be modified to take this tax credit into account. It will be automatically paid by Revenu Québec if the taxpayer is eligible. In addition, no changes related to this tax credit were made to the various comparative summaries since this is a one-time measure.

However, an additional paragraph was added to the client letters to specify the amount of the new tax credit as well as the estimated refund or balance due that takes the new credit into consideration.

Visit this Revenu Québec website to obtain all the details relating to this new tax credit:

https://www.revenuquebec.ca/en/citizens/tax-credits/special-one-time-cost-of-living-tax-credit/

FAQ available on Revenu Québec’s website:

Northwest Territories

Northwest Territories Cost of Living Offset

As a result of its 2022-2023 budget tabled on February 22, 2022, the Northwest Territories government has announced it will be increasing the Northwest Territories cost of living offset to $260 per year per person and $300 per year per child effective July 1, 2022. The calculation of this benefit has been updated in the program as a result of this announcement.

Corrected Calculations

The following problem has been corrected in version 2021 4.0:

Federal

Modifications Made to Version 3.0

Updated Forms

Federal

T1206, Tax on Split Income

As a result of an update, Part 4, Tax on split income for multiple jurisdictions, has been added to the form.

Slip T5013 – Addition of Box 237

As a result of the introduction of the Return of Fuel Charge Proceeds to Farmers tax credit, box 237 has been added to slip T5013. For details on this new addition and how to use this box in the program, see the If the partner receives a T5013 slip in which an amount is shown in box 237 section.

Québec

TP-766.3.4, Income Tax on Split Income

As a result of an update, lines 90 to 100 have been added to present the income tax on split income when the taxpayer is also subject to the alternative minimum tax carry-over.

Modifications Made to Version 2.0

Forms, Schedules, and Workcharts Added to the Program

Federal

Rates, Foreign Exchange Rates

This form has been added to the program so preparers can consult foreign exchange rates. The exchange rates are available as monthly averages as well as annual averages. The exchange rates used in the program are based on the Bank of Canada effective rates.

The rates included in the downloaded documents in the Rate form are now available.

T2043, Return of Fuel Charge Proceeds to Farmers Tax Credit

Beginning in the 2021-2022 year, the Government of Canada introduced a refundable tax credit, i.e., the Return of Fuel Charge Proceeds to Farmers Tax Credit. This credit is intended to return a portion of the fuel charge proceeds from the federal carbon pollution pricing system directly to farming businesses in provinces that do not currently meet the federal stringency requirements.

These designated provinces are Ontario, Manitoba, Saskatchewan, and Alberta. Eligible farming businesses include self-employed farmers, partnerships and partners in farming partnerships that actively engage in either the management or daily activities related to the earning of income from farming and incur total farming expenses of $25,000 or more, which are all or partially allocated to designated provinces.

As a result, Form T2043 has been added to calculate the return of fuel charge proceeds to farmers tax credit. In addition, Form T2043 WS has been added to facilitate calculations in Parts A, B and C. The worksheets will be automatically linked to a statement (T2042, T1163 or T1273). Form T2043 cumulates all worksheets T2043 WS. Note that this refundable tax credit is claimed on line 47556 of the T1 return.

The credit is considered government assistance received during the year and is taxable. It should be included in the return for the taxation year in which it was claimed, not in the year in which it is received.

If the statement of income and expenses (Form T2042, T1163 or T1273) already exists, depending on the type of statements of income and expenses, this refundable tax credit is automatically included in income on:

- line 9600 of Form T2042;

- line 9600 of Form T1163;

- line 9600 of Form T1273.

However, should the taxpayer be a member of a partnership the credit will be prorated on Form T2043 and considered as the partner’s and will be updated to line 5B in Part 5 of Form T2042 or to line E of Form T1163 or T1273.

If the partner receives a T5013 slip in which an amount is shown in box 237:

For partners, the amount of this credit is entered in box 237 of the issued T5013 slip. The amount from this box is automatically transferred to Form T2043 and included as farming income. If the farming income on the T5013 slip is transferred to a statement of farming income for purposes of deducting the partner’s personal expenses, the amount in box 237 will be automatically updated to line 5B of Part 5 in the appropriate copy of Form T2042. If the taxpayer participates in the AgriStability and AgriInvest programs, the amount in box 237 will have to be manually included on line E of Forms T1163 or T1273 respectively.

If the partner receives a letter indicating the amount of the tax credit:

Where the partner received a letter indicating the refundable tax credit amount and where no T5013 slip was filed, manually enter the credit amount on line 67077 in Part 5 of Form T2043. In addition, this amount must be manually entered as personal income on line 5B of Part 5 in the appropriate copy of Form T2042. If the taxpayer participates in the AgriStability and AgriInvest programs, include the amount on line E of Forms T1163 or T1273 respectively.

Updated Forms

Preparer Profiles

EFILE tab

- The box using an electronic signature method on Form RC71 for all or some taxpayers has been added to the preparer profiles in the Discounter default information section.

- New cells have been added to the Revenu Québec section, under the title TP-1000.TE - Online Filing of the Personal Income Tax Return by an Accredited Person, to enter the address of the business if it differs from the firm's address.

Federal

Schedule 3, Summary of Dispositions – Capital Gains (or losses) – Impact of rules relating to the eligible transfer of a family business as the result of Bill C-208.

As a result of the changes made to s. 84.1 of the Income Tax Act by Bill C-208, an eligible disposition of qualified small business corporation shares and shares of the capital stock of a family farm or fishing corporation by an individual to a corporation that is controlled by one or more of the individual’s children or grandchildren who are 18 years of age or older will be deemed to be a non arm’s length transaction for dispositions after June 28, 2021. As a result, the transaction will not be subject to the deemed dividend rules in s. 84.1 and for federal purposes, such a transaction should be treated in the same manner as a disposition of such property to an arm’s length party and entered on Schedule 3 accordingly.

However, for Québec purposes, the transaction will still be treated as non-arm’s length, although a portion of what would otherwise have been a deemed dividend may be deemed to be a capital gain on Form TP-517.5.5. A check box has been added to Part 1 and 2 of Schedule 3 to identify these transactions for Québec purposes and when this check box is selected, a diagnostic will remind the preparer to complete Form TP-517.5.5.

Benefit – Climate Action Incentive

The climate action incentive payment amounts are paid to residents of Ontario, Manitoba, Saskatchewan and Alberta, because these provinces do not have a pollution pricing system of their own. This is part of the federal government backstop, which ensures there is a consistent price on pollution across Canada and that approximately 90 per cent of proceeds go directly to Canadians. Families in rural and small communities receive an extra 10%.

Starting in July 2022, these payments will shift to quarterly amounts paid through the benefit system.

Details on these payments are available in the program, on Form GSTC.

Client letters:

Client letters have been adjusted to include the climate action incentive payment amounts.

Note: This benefit is calculated based on the 2021 rates, as the 2022 rates were not yet available at the time of this version release.

RC71, Statement of Discounting Transaction

Please note that the Canada Revenue Agency will not accept an RC71 form with an electronic signature until legislation is tabled and Royal Assent is received. Error 138 will be returned by the CRA if the electronic signature is used before Royal Assent has been received. The program has been updated in advance to allow you to use the electronic signature as soon as Royal Assent is received.

Electronic signature: Similar to what was introduced last year for Form T183, the CRA added three new EFILE fields, i.e., Electronic signature indicator, Signature date, and Signature time. Data in all of these fields must be transmitted when Form RC71 is electronically signed.

These fields can be found in the new Electronic Signature section, which was added to Form RC71, on screen only. When the answer to the question Are you planning on using an electronic signature method on Form RC71? is Yes and the return is discounted, EFILE diagnostics will prompt you to complete these fields to transmit the return.

When an electronic signature date is indicated, the signature date will automatically update to the existing field 65090. Both the new electronic signature date field and existing field 65090 are electronically transmitted to the CRA.

If you are a discounter and do not plan on using electronic signatures, you can clear the check box using an electronic signature method on Form RC71 for all or some taxpayers in the EFILE tab of the preparer profile in the Discounter default information section.

Doing so will prevent EFILE diagnostics related to the electronic signature on Form RC71 from being displayed.

T777S - Statement of Employment Expenses for Working at Home Due to COVID-19

For the 2021 taxation year, the maximum of home office expenses has increased from $400 to $500 with the temporary flat rate method.

T2222, Northern Residents Deductions

In its 2021 Budget, the federal government proposed to expand access to the travel component of the Northern Residents Deductions for the 2021 taxation year. Under the component, a taxpayer would have the option to claim, in respect of each of the taxpayer and each “eligible family member,” up to:

- the amount of employer-provided travel benefits the taxpayer received in respect of travel by that individual; or

- a $1,200 standard amount that may be allocated across eligible trips taken by that individual.

The same amendments have been made to Form TP-350.1 for the residents of Québec.

Québec

TP1, Line 18 – Addition of code 08, Refugee protection claimant

To identify the status of individuals who are claiming certain credit for which they are not eligible, code 08, Refugee protection claimant, has been added to line 18 of the TP1 return.

This code can be selected in the program from the drop-down list of Form Residence QC.

TP-59S - Statement of Employment Expenses for Working at Home Due to COVID-19

For the 2021 taxation year, the maximum of home office expenses has increased from $400 to $500 with the temporary flat rate method.

Newfoundland and Labrador

NL428, Newfoundland and Labrador Tax

In its 2021 Budget, the Government of Newfoundland and Labrador proposed to add three new 2022 tax brackets for income in excess of $250,000, $500,000, and $1,000,000, for a total of eight brackets. The latter has been integrated to this version of the program but only for the Planner Mode or for early-filed returns.

Corrected Calculations

The following problems have been corrected in version 2021 2.0:

Federal

Modifications Made to Version 1.0

Forms, Schedules, and Workcharts Added to the Program

Ontario

ONS12, Ontario Seniors' Home Safety Tax Credit

A refundable credit, i.e., the Ontario seniors’ home safety tax credit, has been introduced for seniors and individuals who share a home with a senior relative. The refundable credit is equal to 25% of the eligible expenses. The credit amount is limited to $2,500.

Saskatchewan

SKS12, Saskatchewan Home Renovation Tax Credit

A non-refundable Saskatchewan home renovation tax credit has been introduced for 2021 and 2022 for owners of an eligible dwelling and can be allocated between members of a family. However, the total amount claimed cannot exceed the maximum authorized. For the 2021 taxation year, the qualified expenditures must be incurred between October 1, 2020, and December 31, 2021. The total qualified expenditures must be in excess of $1,000 (base amount) but cannot be more than $12,000 (maximum amount of $11,000 for 2021).

SK479, Saskatchewan Credit

This form allows taxpayers to claim the new active families benefit. This refundable tax credit has been introduced for families with children enrolled in sport, recreational and cultural activities. The maximum claimable amount per eligible child is $150. An additional amount of $50 can be claimed if the child is eligible for the disability tax credit.

Newfoundland and Labrador

NL479, Newfoundland and Labrador Credits

This form allows taxpayers to claim the new non-refundable physical activity tax credit, which has been introduced so that families can participate in physical and recreational activities. The maximum amount that can be claimed per family is $2,000.

The form also allows taxpayers to claim the Newfoundland and Labrador research and development tax credit for individuals, which was previously claimed on line 47900 of the T1 return.

Prince Edward Island

PE 58365, Children’s Wellness Tax Credit

This worksheet allows taxpayers to claim this new non-refundable tax credit which has been introduced for all families with children under the age of 18, for eligible activities for the wellness of their children.

Updated Forms

ID, Identification and Other Client Information

Questions relating to Elections Canada and Form T1135 have been added to the Other information section.

Preparer profile

The option Do not allow e-mail address entry in any of the forms in the return has been added in the General Information tab of the preparer profile. When this option is selected, a diagnostic will display in the return to prevent you from entering or editing information in the e-mail address fields. Note that when converting the preparer profile, this option selection will be retained. The roll forward for the e-mail address is not impacted by this addition. Therefore, any e-mail address entered will be rolled forward.

Preparer Profile and Forms T776, T1163, T1273, T2125, T2042, T2121, and T1135

The following changes have been made to the presentation and the processing of information on the contact person or preparer based on the options selected in the General Information tab of the preparer profile:

- The Accounting firm's name and address to print in the financial statements and the Notice to Reader section.

The selection of the Do you have a contact person? option on Forms T1163 and T1273 is now based on the choice made in the preparer profile for the option Use the accounting firm name and address for Forms T776, T2125, T2042, T2121, T1163 and T1273.

The information that displays in Forms T776, T2125, T2042, T2121, T1163 and T1273 is that of the Accounting firm’s address section or that of the new subsection Enter the information if it differs from that of the accounting firm.

- Forms T2125, T2042 and T2121

In Part 1, the Name and address of person or firm preparing this form subsection is now available in the form on screen.

- Section Contact persons

The option Use the accounting firm address for Form T1135 has been added. This option is selected by default for newly-created preparer profiles as well as for converted preparer profiles. The choice made for this option will be retained at the time of conversion starting with version 2022 1.0.

Federal

Schedule 6 – Canada Workers Benefit – New secondary earner exemption

As a result of an update of the form, the secondary earner exemption has been introduced for the 2021 taxation year.

When the taxpayer who completed Schedule 6 to claim the Canada workers benefit has an eligible spouse, the income used to calculate the benefit is based on their combined income.

The secondary earner exemption is a special rule for taxpayers who have an eligible spouse. The spouse or common-law partner with the lowest working income can exclude up to $14,000 from his or her working income when computing the adjusted net income, allowing a greater number of families to have access the Canada workers benefit.

Schedule 14, Climate Action Incentive

The Government of Canada has announced that the Climate Action Incentive (CAI) will now be delivered as a quarterly benefit rather than as a refundable credit on the T1 Income Tax and Benefit Return. Eligible taxpayers will automatically receive CAI payments four times a year, starting in July 2022. To receive the payments, taxpayers must file a tax return even if they did not receive income in the year. For more information, go to canada.ca/child-family-benefits. The CAI consists of a basic amount and a 10% supplement for residents of small and rural communities. Schedule 14 should only be completed by taxpayers residing outside a census metropolitan area (CMA) and who expect to continue to reside outside the same CMA on April 1, 2022. To find out if the taxpayer resides outside a CMA, go to canada.ca/census-metropolitan-areas. As a result of these changes, line 45110 has been removed from the T1-Jacket.

The calculations for this new benefit will be updated in the next version, which is scheduled to be released in February 2022.

T4A slips – Addition of boxes

Box 201

To help taxpayers get through the COVID-19 pandemic, the federal and provincial governments introduced various benefits. However, certain taxpayers had to repay part, or all of the COVID-19-related benefits received in 2020.

These repayments are entered in the T4A slip to which the following box has been added:

- Box 201, Repayment of COVID-19 financial assistance payments.

The repayment of federal benefits in 2021 should be updated to new line 23210, Federal COVID-19 benefits repayment of the T1 return.

The repayment of provincial or territorial benefits in 2021 should be updated to line 23200 of the T1 return.

To correctly identify the type of benefits repaid and, as a result, update the repaid amount to the corresponding line in the T1 return, the following custom boxes have been added to the T4A slip in the program:

- box 2011, Repayment of federal COVID-19 benefits received in 2020; and

- box 2012, Repayment of provincial or territorial COVID-19 benefits received in 2020.

Line 23210 of the T1 return

It is possible for taxpayers to have claimed a deduction for a repayment of federal COVID-19 benefits on their 2020 tax return (if the benefits were received in 2020 and repaid before 2023) prior to receiving their tax slip indicating the amount repaid. To ensure an amount repaid is not claimed as a deduction twice, a diagnostic has been added on line 23210 to make sure that the repayment of federal COVID-19 benefits entered on this line has not already been claimed on line 23200 of the taxpayer’s 2020 return. If this is the case, override the amount on line 23210 so that the amount already claimed is not taken into account.

Note: This diagnostic has been added as per a CRA request.

Box 205

In August 2021, the federal government provided financial support through a one-time taxable payment of $500 to seniors born on or before June 30, 1947, and eligible for Old Age Security in June 2021.

This payment amount is entered in the T4A slip to which the following box has been added:

- Box 205, One-time payment for older seniors.

This amount should be updated to line 13000.

Box 210

In its 2021 Budget, the federal government announced that the postdoctoral fellowship income would be considered income earned for the purposes of the registered retirement savings plan (RRSP).

Postdoctoral fellowship income (box 210 of the T4A slip) is included in earned income for purposes of a registered retirement savings plan (RRSP). This change allows postdoctoral fellows to qualify for supplemental RRSP contributions to make deductible contributions to an RRSP, a pooled registered pension plan (PRPP) or a specified pension plan (SPP). This measure is applicable retroactive to 2011. It is important to verify whether the taxpayer has reported postdoctoral fellowship income after 2010 and before 2021. Where applicable, the taxpayer can send an adjustment request to the CRA to have their RRSP contribution room adjusted.

This income is entered in the T4A slip to which the following box has been added:

- Box 210, Postdoctoral fellowship income earned.

You are not required to report this amount in the income tax return.

Box 211

To help taxpayers deal with the COVID-19 pandemic, the federal and provincial governments have introduced various benefits. The federal government proposes the new Canada Worker Lockdown Benefit. The latter provides an income support of $300 a week to eligible workers who, because of a temporary public health lockdown between October 24, 2021, and May 7, 2022, cannot work.

This benefit amount is entered in the new box 211 of the T4A slip:

- Box 211, Canada Worker Lockdown Benefit.

This amount must be updated to line 13000 of the T1 return.

T4E slip, Canada Emergency Response Benefit (CERB)

Box 30

In response to the COVID-19 pandemic, the federal government introduced various benefits, one of which is the Canada Emergency Response Benefit (CERB). However, certain individuals had to repay part, or all of the CERB benefits received in 2020.

If the CERB was paid by the CRA, the repayment amount is indicated in box 201 of the T4A slip. On the other hand, if the benefit was paid by Service Canada, the repayment must be included with any other repayment in box 30 of the T4E slip. If this is the case, the CERB amount repaid will be indicated in a Service Canada letter sent to the taxpayer.

The 2021 repayment of federal benefits must be updated to line 23210, Repayment of COVID-19 financial assistance of the T1 return.

Finally, any other repayment included in box 30 must be updated to line 23200 of the T1 return.

To correctly identify the type of benefits repaid and, as a result, update the repaid amount to the corresponding line in the T1 return, box 30 has been split in two, and now corresponds to box 301, Repayment of an overpayment (excluding CERB) and box 302, Repayment of COVID-19 financial assistance (CERB). Note that the letter transmitted by Service Canada indicates the amount to enter in box 302.

T4RSP, Statement of RRSP Income – Addition of a box

A box related to box 22 of the T4RSP slip has been added. This new box is used to enter the withdrawal amount of a tax-exempt RRSP for an Indian. The amount in this box will be updated for purposes of the federal return to Form T90 as well as for purposes of the Québec return to Form TP1 Line 293.

T657, Calculation of Capital Gains Deduction

If you disposed of qualified farm or fishing property (QFFP) or qualified small business corporation shares (QSBCS) you may be eligible for the lifetime capital gains exemption (LCGE). Because you only include one half of a capital gain in your income, your cumulative capital gains deduction is one half of the LCGE.

The total of your capital gains deductions on gains arising from dispositions in 2021 of qualifying capital property has increased to $446,109 (i.e., one half of the LCGE increased by indexation to $892,218 for 2021).

For dispositions of QFFP after April 20, 2015, the LCGE is increased to $1,000,000. This additional deduction does not apply to dispositions of QSBCS:

- The limit on gains arising from dispositions in 2020 of qualifying capital property is $441,692 (one half of an LCGE of $883,384)

- The limit on gains arising from dispositions in 2019 of qualifying capital property is $433,456 (one half of an LCGE of $866,912)

- The limit on gains arising from dispositions in 2018 of qualifying capital property is $424,126 (one half of an LCGE of $848,252)

- The limit on gains arising from dispositions in 2017 of qualifying capital property is $417,858 (one half of an LCGE of $835,716)

- The limit on gains arising from dispositions in 2016 of qualifying capital property is $412,088 (one half of an LCGE of $824,176)

- The limit on gains arising from dispositions in 2015 of qualifying capital property is $406,800 (one half of an LCGE of $813,600)

- The limit on gains arising from dispositions in 2014 of qualifying capital property is $400,000 (one half of an LCGE of $800,000)

- The limit on gains arising from the dispositions of qualifying capital property after 2008 and before 2014 is $375,000 (one half of an LCGE of $750,000).

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates

A new version of Form T1134 for taxation years starting after 2020 has been integrated into the program.

The new version of the form provides the ability, for a group of reporting entities that are related to each other, to file as a group. The information related to individuals, corporations, trusts and partnerships that are part of this related group must be indicated in new subsections A and B in Section 3 of Part I. Note that the taxation year-end date or fiscal year-end date must be the same for all entities in the group.

In the new subsection C in Section 3 of Part I (which corresponds to former Section 3 of Part 1), the question Is the reporting entity submitting a group organizational chart for the required information noted in C. (i) through (iv)? will allow you to submit an organizational chart if it contains the required information.

Several tables have been added to the form to allow for the filing of the return by a group of related entities. Therefore, entities in the group that are indicated in subsection A of Section 3 in Part I will be used to form a list from which you will be able to select the relevant entities in the tables of the T1134 Supplement section.

Québec

Tax measures announced in the November 25, 2021, Economic and Financial Update

On November 25, 2021, the Government of Québec introduced a number of tax measures.

Firstly, a one-time tax assistance has been introduced, i.e., the new one-time cost of living credit. Briefly, this assistance, of $200 per adult and an additional amount of $75 for persons living alone, is granted to individuals who are eligible for the refundable solidarity tax credit during the payment period starting on July 1, 2021, and ending on June 30, 2022, and will be paid automatically at the start of 2022.

As the payment will be made in January 2022 and this measure is automatically processed by the government, it will not be reflected in the program.

Secondly, starting with the 2022 taxation year, an individual (other than a trust) who provided childcare in Québec for compensation must now prepare an RL-24 slip and provide a copy to the payer. Therefore, receipts are no longer accepted as proof of payment for purposes of claiming the refundable tax credit for childcare expenses. This change has no impact on the program.

Finally, with regards to the refundable senior assistance tax credit and the refundable tax credit for childcare expenses, a number of rates and limits have been modified, and all required adjustments have been made to the program.

TP1, Income Tax Return – Incentive program to retain essential workers (IPREW)

As a result of an update, line 151 of the TP1 return has been removed and the Incentive program to retain essential workers (IPREW) benefit amounts received will now be updated to Section 02 on the TP1 Line 154 form.

TP1 Line 246, Deduction for a Repayment of Amounts Overpaid to You

To cope with the COVID-19 pandemic, the federal and provincial governments introduced various benefits. However, certain individuals had to repay part, or all benefits received in 2020 2020.

In this regard, Revenu Québec mentioned a repayment of the Québec Incentive program to retain essential workers (IPREW) made in 2021 could be deducted in the 2020 taxation year. However, the Canada Revenue Agency does not share this position.

As no lines have been created for that purpose in the TP1 return, a taxpayer who wants to deduct an IPREW amount received 2021 in the already filed 2020 income tax return, the taxpayer must file a Form TP-1.R only. If the 2020 income tax return has not been filed, the line relating to the IPREW must be overridden in Form TP1 Line 246 in order for the deduction to apply in Québec only. In addition, the taxpayer will have to claim the deduction for 2021 at the federal level only. Therefore, the line relating to the IPREW will need to be overridden in Form TP1 Line 246.

Schedule C, Tax Credit for Childcare Expenses

As a result of an update of the form by Revenu Québec, box 18, receiving Employment Insurance benefits or amounts for the Canada Recovery Benefit (CRB), Canada Recovery Sickness Benefit (CRSB) or Canada Recovery Caregiving Benefit (CRCB), has been added to the schedule.

RL-10 Slip, Decrease in the labour-sponsor tax credit - Fondaction

On June 1, 2021, the provincial labour-sponsor tax credit for investments made in Fondaction decreased to 15%.

The investments made in Fondaction before June 1, 2021, give entitlement to a tax credit corresponding to 20% of the investment made during this period. Therefore, the maximum tax credit for investments made during this period is $1,000, for a maximum investment of $5,000.

The investments made starting on June 1, 2021, give entitlement to a maximum provincial tax credit of $750, for a maximum investment of $5,000.

Boxes have been added to the RL-10 slip to differentiate the periods during which the investments in Fondaction have been made.

RL-26 Slip, Capital régional et coopératif Desjardins

The non-refundable tax credit rate for the acquisition of Class A shares of the Capital régional et coopératif Desjardins capital stock will be reduced from 35% to 30% for any Class A share acquired after February 28, 2021.

The tax credit rate for Class B shares will be maintained at 10%

CCA – Abolishment of the 35% and 60% additional deductions in Québec for property in classes 50 and 53

In the CCA CLASS forms of the T2125/TP80, T2042/Q2042 and T2121/Q2121 forms, the following additional deductions that could be claimed in Québec for property in classes 50 and 53 have been deleted:

- Additional CCA of 35%, for qualified property that was acquired and became available for use after March 28, 2017, and before March 28, 2018; and

- Additional CCA of 60%, for qualified property that was acquired and became available for use after March 27, 2018, and before December 4, 2018.

TP-1029.9, Tax Credit for Taxi Drivers or Taxi Owners

Tax credit for taxi drivers

The refundable tax credit for holders of a taxi driver’s permit will be phased out. Therefore, for 2021, taxpayers will be able to qualify for a credit equal to the lesser of the following amounts:

- 50% of the maximum amount that would otherwise have been applicable for the year, i.e., $301;

- 1% of the total of their gross income for the year arising from their employment as a taxi driver and their gross income for the year arising from their business of transportation services by taxi.

The tax credit will be abolished as of 2022.

Tax credit for taxi owners

The refundable tax credit for holders of a taxi owner’s permit will be abolished for a fiscal year or a taxation year starting after October 9, 2020.

Ontario

ON479, Ontario Credits

A refundable credit, i.e., the Ontario jobs training tax credit, has been introduced for eligible individuals. The credit is limited to $2,000.

A refundable tax credit, i.e., the Ontario seniors’ home safety tax credit, has been introduced.

Finally, the Ontario apprentice training tax credit has been eliminated.

ON479-A, Ontario Childcare Access and Relief from Expenses (CARE) Tax Credit

The credit entitlements for Ontario childcare access and relief from expenses (CARE) tax credit have increased by 20% for 2021 only.

Manitoba

MB428, Manitoba Tax

As a result of an update of the form, the personal income levels used to calculate the Manitoba tax and the basic personal amount have been increased. In addition, the maximum credit amount that can be claimed by an individual for the small business venture capital tax credit has increased from $67,500 to $120,000.

MB479, Manitoba Credits

As a result of an update of the form, changes have been made to the education property tax credit, seniors’ school tax rebate and school tax credit for homeowners. In particular, all three amounts have been reduced by 25% to consider the fact that property owners will now receive a cheque for the new Education Property Tax Rebate in the same month (or earlier) during which municipal property taxes are due. Property owners will not be required to apply for the rebate as the Education Property Tax Rebate will be automatically paid by the province of Manitoba.

In addition, a refundable teaching expense tax credit has been introduced for eligible educators. The credit equals 15% of eligible teaching expenses up to $1,000. The rules to claim this credit are the same as the federal educator school supply tax credit (line 46900) with the exception that supplies must have been used in Manitoba. A box has been added to Form T1 Line 46900 to confirm that expenses entered for federal purposes were for supplies used in Manitoba.

New Brunswick

NB428, New Brunswick Tax and Credits

The Government of New Brunswick announced the following measures, which were integrated to the current version of the program:

- A reduction of the provincial personal income tax rate on the first tax bracket from 9.68 per cent to 9.4 per cent;

- An increase of the Low-Income Tax Reduction (LITR) threshold from $17,630 to $17,840 for the 2021 taxation year.

Newfoundland and Labrador

NL428, Newfoundland and Labrador Tax

Following the tabling of its March 31, 2021 Budget, the Government of Newfoundland and Labrador changed the personal income tax brackets and rates used to calculate the Newfoundland and Labrador income tax.

Note that most non-refundable provincial tax credits as well as the Newfoundland and Labrador income tax reduction for low-income families have also changed.

Prince Edward Island

PE428, Prince Edward Island Tax and Credits

Following its March 12, 2021 Budget, the Government of Prince Edward Island increased the basic personal amount from $10,000 to $10,500. The low-income threshold used to calculate the Prince Edward Island low-income tax reduction has also been increased.

In addition, the Prince Edward Island rate of the tax credit for dividends other that eligible dividends has been decreased from 2.74% to 1.96% on January 1, 2021.

Finally, the children's wellness tax credit has been added.

Forms Removed

Québec

- Schedule O, Tax credit for respite of caregivers

- Relevé 23, Recognition of volunteer respite services

Corrected Calculations

The following problems have been corrected in version 2021 1.0:

Federal

Where to Find Help

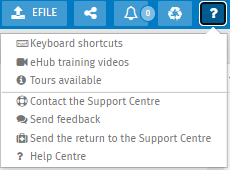

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the help resources, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Tax T1 e-Bulletin notifies you each time an updated or new form is made available in a program update.

How to Reach Us

Technical and Tax Support Hours

Monday to Friday: 8:30 a.m. to 6:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com