CCH iFirm Taxprep Release Notes

Benefit from our Advanced Virtual Agent 24/7!

Since January 1, 2025, the customer support teams offer their high-quality service exclusively through digital channels, and no longer offer incoming phone support.

Register for our Support platform and log in to our virtual agent to find answers, submit a support ticket or chat with a live agent.

For more details about the web ticketing system and best practices, watch the following “How to” videos:

Register now for our Support Platform and take advantage of all the benefits it has to offer!

To consult our customer service schedule and learn more about how to contact us, please visit our corporate Web site.

CCH iFirm Taxprep packages

Three CCH iFirm Taxprep packages are available. To find out which package you have, consult this article: CCH iFirm Taxprep packages.

Contents

-

Taxprep Home – A new landing page created to streamline how users locate, view and open tax returns

-

The date and user associated with the last Auto-fill my return download are displayed

-

The second review mark displays in a different colour than the first review mark

-

The Rolled Forward column is displaying new behaviour in the return manager

-

The Automatically synchronize contact information option is kept during roll forward

-

Decommission of the T1 Notice of assessment Download service

-

Decommission of the CRA’s authorization service in EFILE software for individuals

-

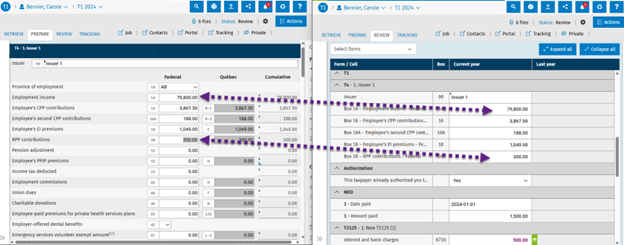

The metadata of the cell is now presented in the enhanced right pane

-

Ability to add hyperlinks in the return’s notes and cell comments

-

The name of multiple copy forms now remains visible at the top of the screen

-

The Notice of assessment (NOA) syntax to customize PDF naming conventions was renamed

-

Support of metadata when importing a Taxprep on-premise file

-

Automatic synchronization of the tax return between two browser windows

-

CCH iFirm Jobs & Billing is now integrated with CCH iFirm Taxprep

-

ESC key now closes the form and brings you to the form that was last opened

-

CCH iFirm Taxprep T3 and CCH iFirm Taxprep Forms support EFILE in bulk

-

Integration with CCH AnswerConnect now allows access to topics from a cell or a form

-

Support of additional metadata when importing a Taxprep on-premise file

-

Warning message advising you that a tax return has already been rolled forward

-

Ability to apply assignees and return statuses to all family members simultaneously

-

The header in the Auto-fill-my return reconciliations modal is always visible

-

The digital signature can be published even when the state of the portal invitation is Pending

What’s New? – December 5, 2025

CCH iFirm Taxprep Essentials, Advanced and Pro

Taxprep Home – A new landing page created to streamline how users locate, view and open tax returns

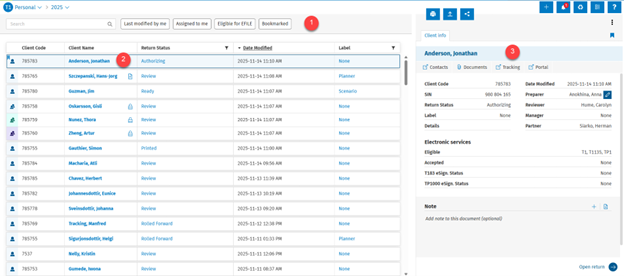

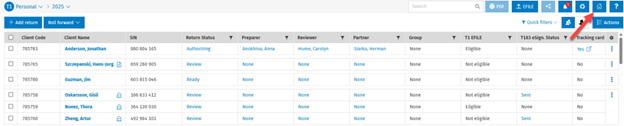

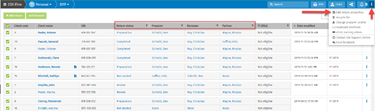

The Taxprep Home functionality provides a streamlined interface that displays pertinent information required for preparing tax returns, allowing users to efficiently access and manage available tax returns.

-

Create the view based on your needs or search for a specific taxpayer.

-

To access a tax return, click the taxpayer's name or any blank area to display the right panel containing the taxpayer’s metadata.

-

The right panel shows the taxpayer’s metadata, which can be viewed or edited, and provides options for actions such as printing, publishing or EFILING. Also, a return can be bookmarked, allowing you to filter based on that metadata.

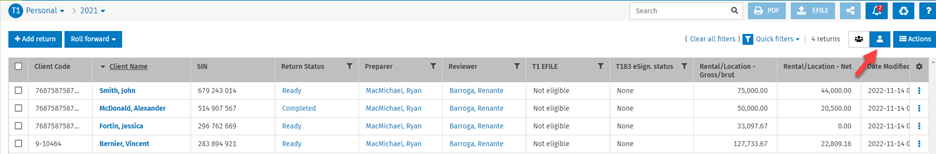

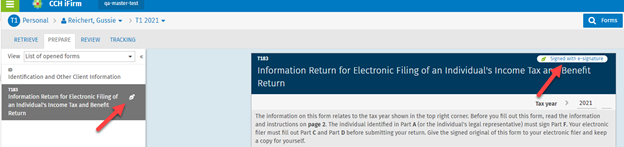

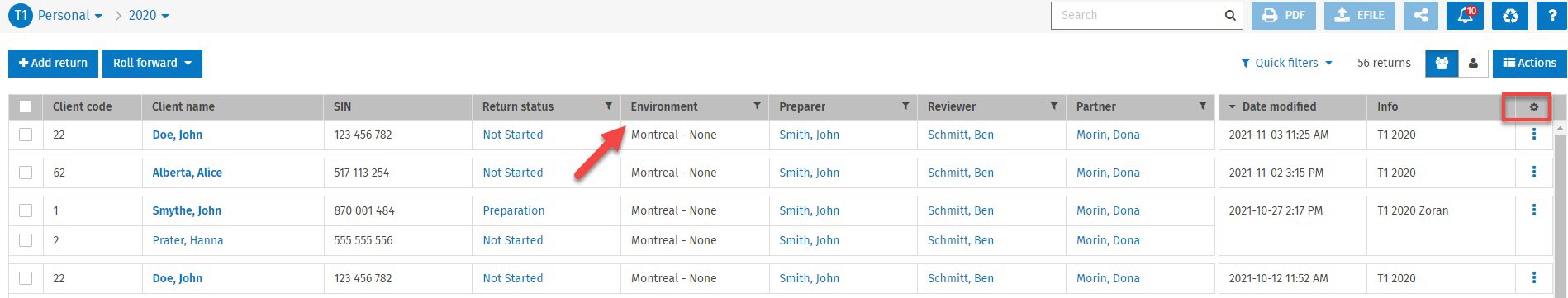

Upon accessing CCH iFirm Taxprep, the user is directed to the return manager by default. To access Taxprep Home, click the Taxprep Home icon from the return manager (see the following image). The next time you open CCH iFirm Taxprep, the application will remember whether your last access was to Taxprep Home or to the return manager.

To go back to the return manager, click the Return manager icon from Taxprep Home.

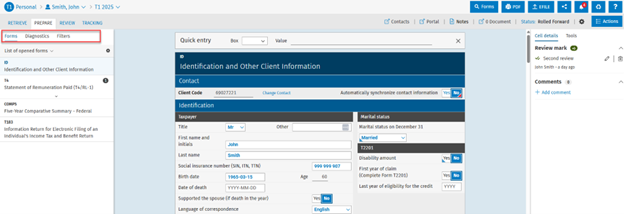

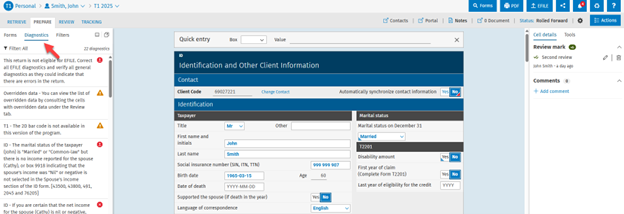

The navigation within the Prepare tab has been updated

Forms, diagnostics and filters from the Prepare tab are now displayed as tabs for easier access between sections.

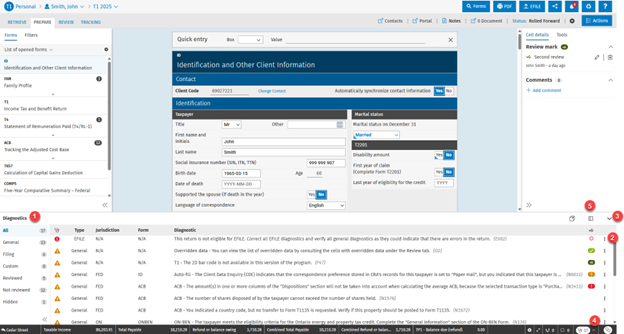

The diagnostics can be opened at the bottom of the screen, in a separate window or from the left pane

Diagnostics can be displayed using the three methods below:

At the bottom of the screen

Diagnostics are now displayed this way by default.

-

Click a filter to display a type of diagnostic.

-

Click the vertical ellipsis to:

Hide diagnostics

Add review marks

-

Click the downward chevron to minimize the Diagnostics pane.

-

Click the upward chevron to open diagnostics.

-

Click the Show diagnostics in the left panel icon to display the diagnostics in the left pane of the Prepare tab.

In the left pane of the Prepare tab

In a separate window

The Diagnostics tab can be opened in a separate window, enabling users to view the Diagnostics tab on one screen and tax forms on another. The values remain synchronized between the Diagnostics tab and the forms, and the cursor moves accordingly between both windows. To open the Diagnostics tab in a separate window, click the Open diagnostics in a new tab icon from the Diagnostics bottom pane.

This can also be done from the Prepare > Diagnostics tabs.

The date and user associated with the last Auto-fill my return download are displayed

When a user downloads data from the T1 or T2 Auto-fill my return service, the download date is shown. In addition, hovering over the date displays the name of the user who performed the most recent download.

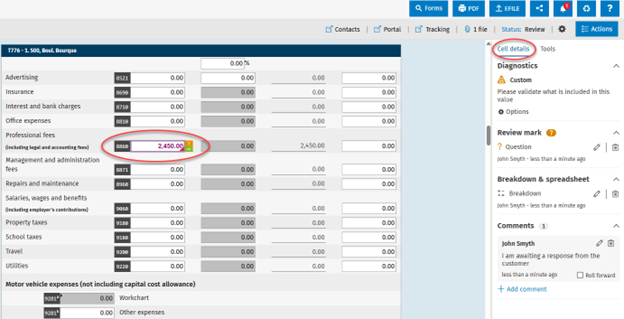

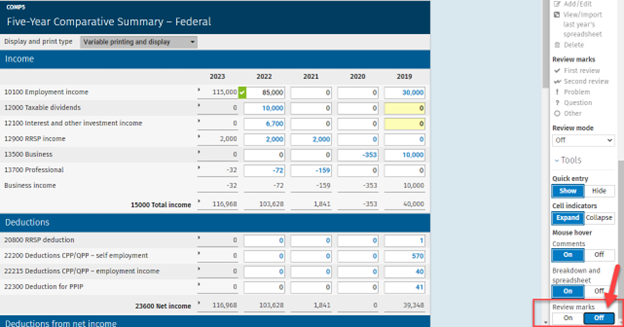

The second review mark displays in a different colour than the first review mark

The colour of the second review mark has been changed to visually distinguish it from the first review mark.

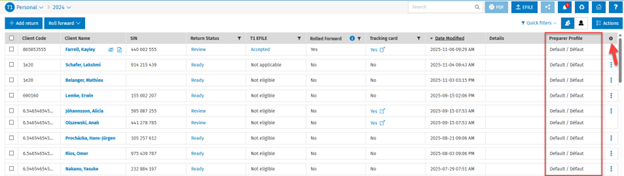

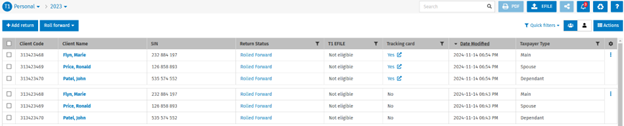

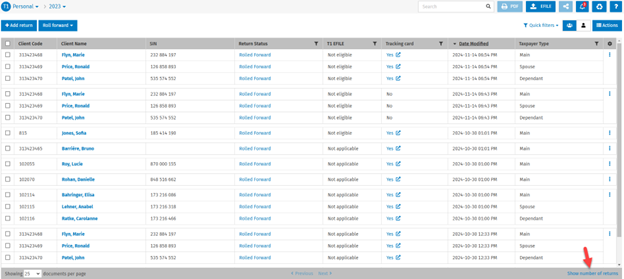

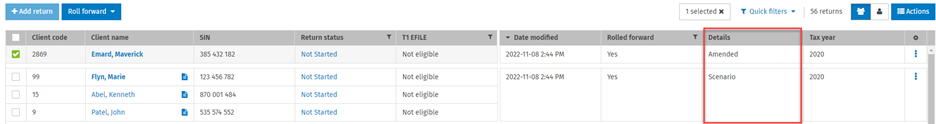

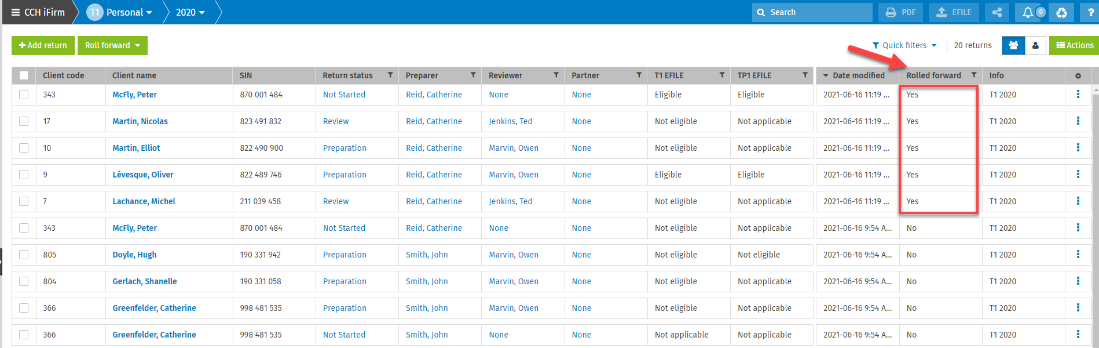

The Rolled Forward column is displaying new behaviour in the return manager

When a return is rolled forward, the Rolled Forward column now shows Yes even if the return was not actually rolled forward to the next year due to tax conditions (e.g., deceased taxpayer). With this enhancement, users can confirm that the file has already been processed for roll forward and no further action is required.

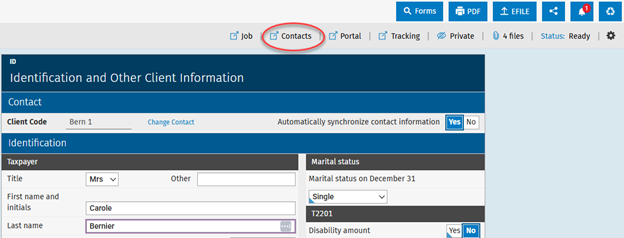

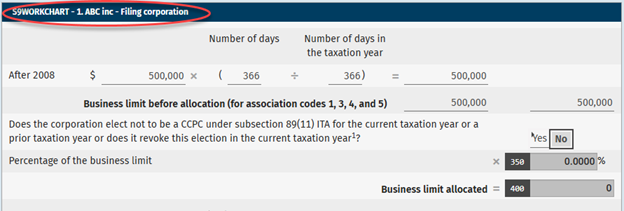

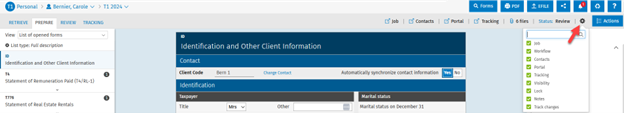

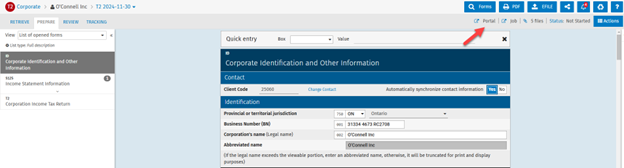

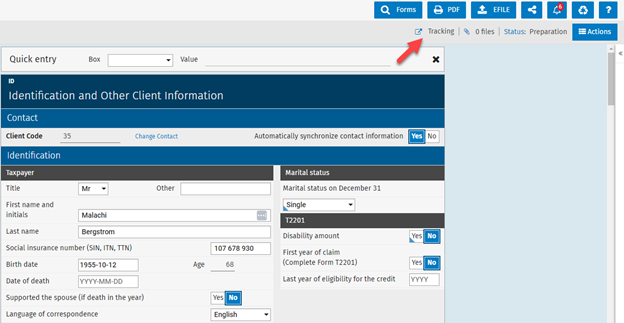

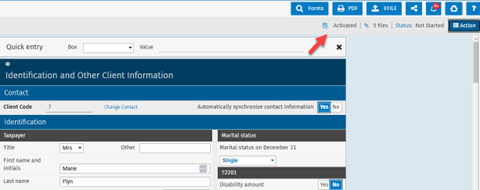

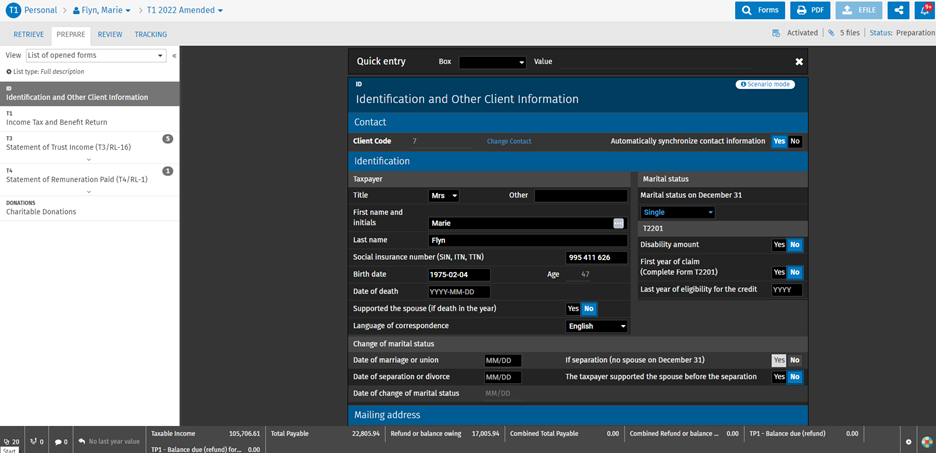

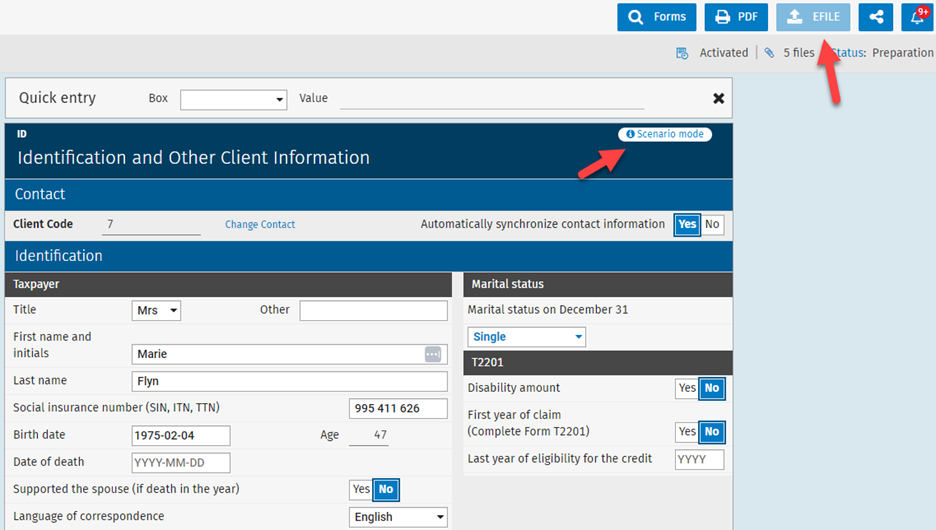

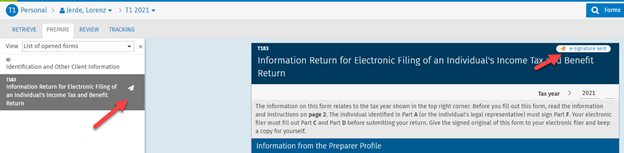

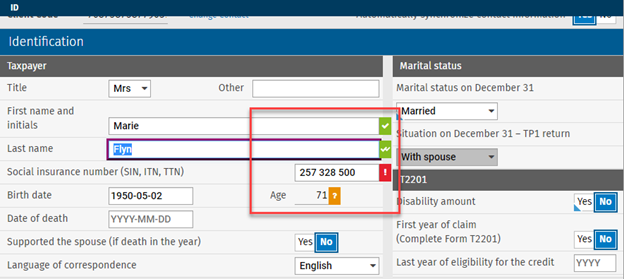

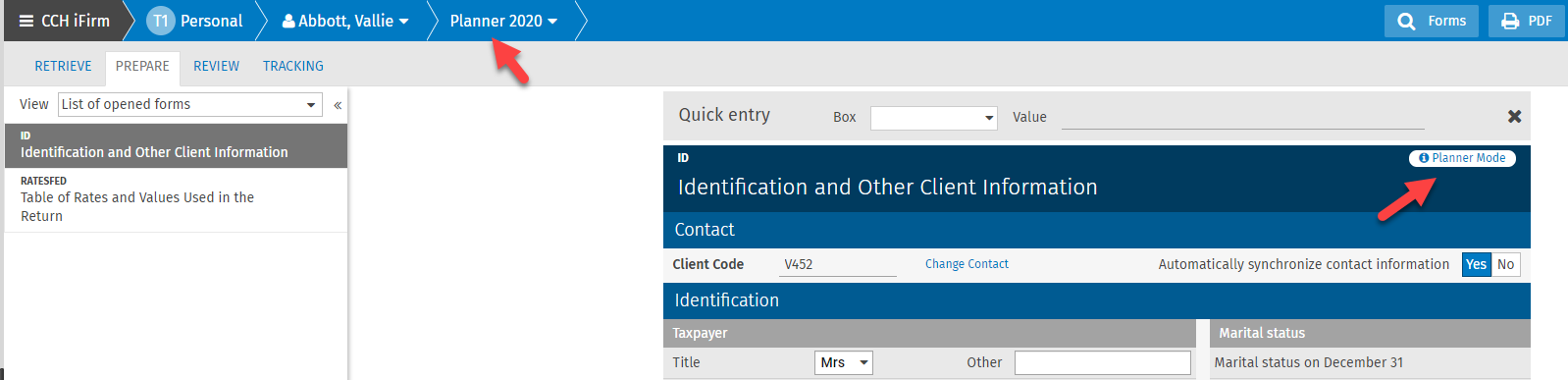

The Automatically synchronize contact information option is kept during roll forward

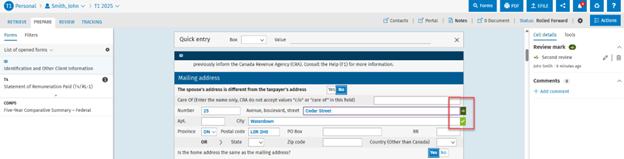

The Automatically synchronize contact selection option in the ID form is now retained when the file is rolled forward.

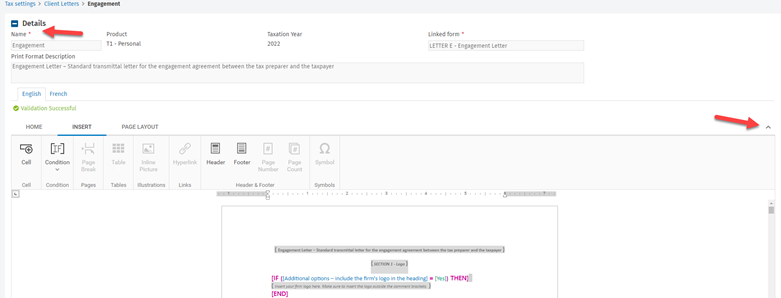

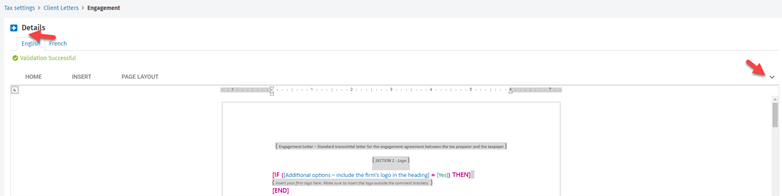

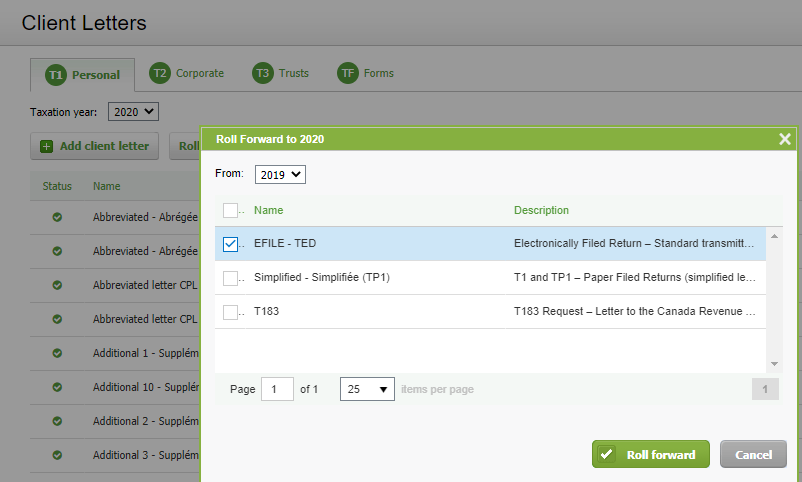

Client letter improvements

-

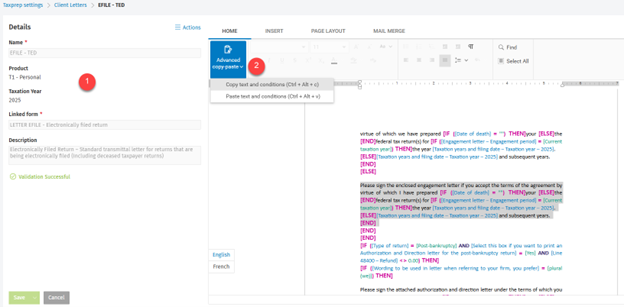

The Details section is now on the left, creating more space for editing the letter.

-

It is now possible to copy and paste the text and conditions of the letter.

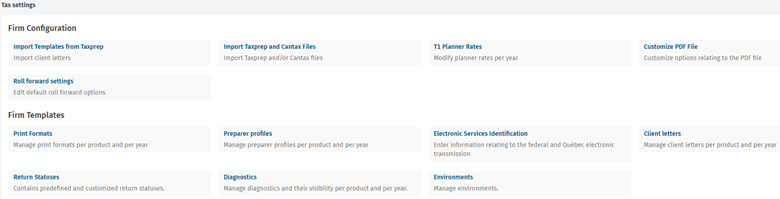

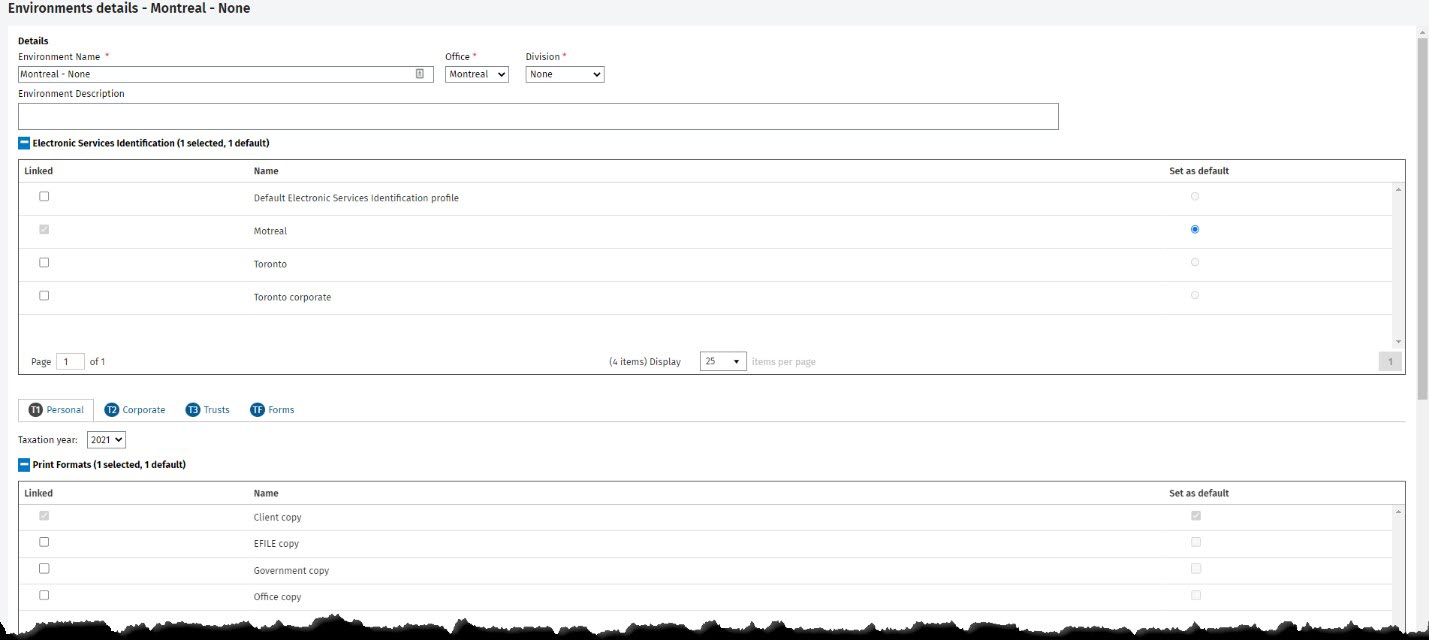

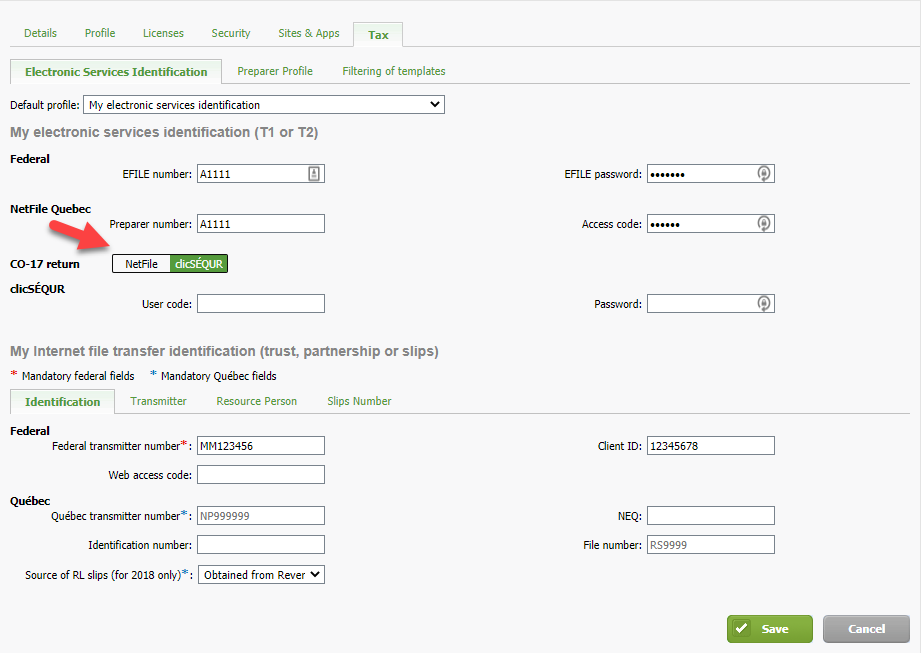

Electronic services identification changes

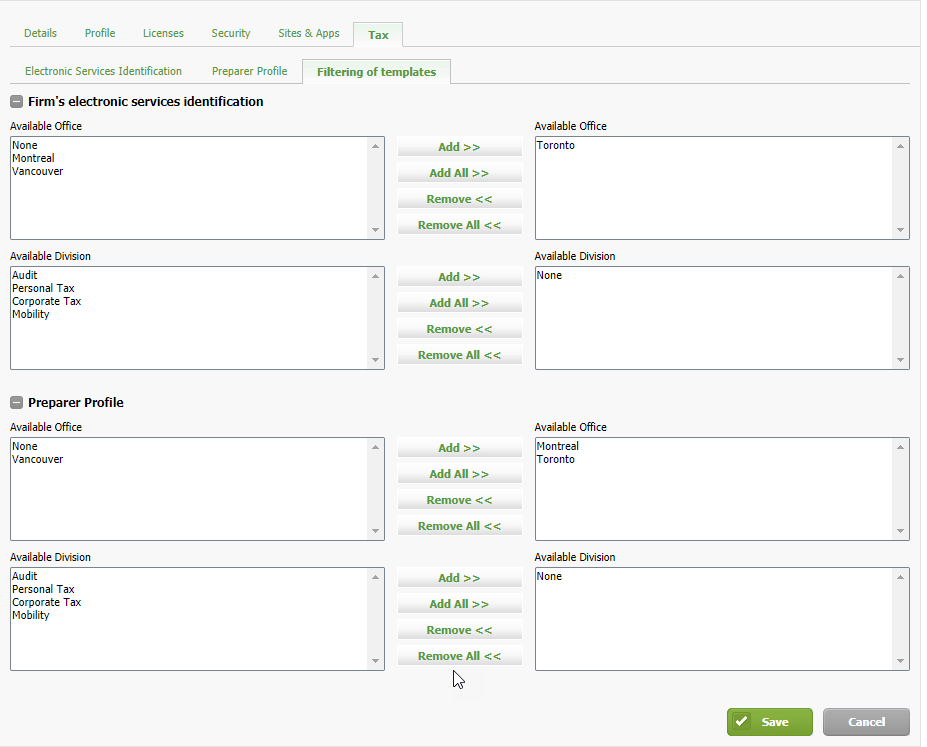

Electronic services identification

-

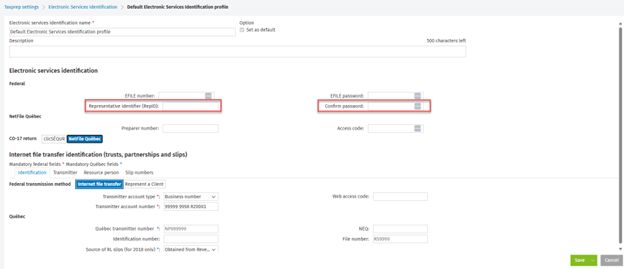

When entering an EFILE password, a confirmation is required, and that password must be re-entered. This is a CRA requirement.

-

The Representative identifier (RepID) field has been added, enabling users to enter the RepID once and the value to be automatically populated in Part C of the T1 and T3 T183 forms and on line 925 of the T2 form. Please note that these values are populated starting with the taxation years below:

T1: 2025 returns

T2: 2023 and subsequent taxation years

T3: 2025 and subsequent taxation years

Internet file transfer identification

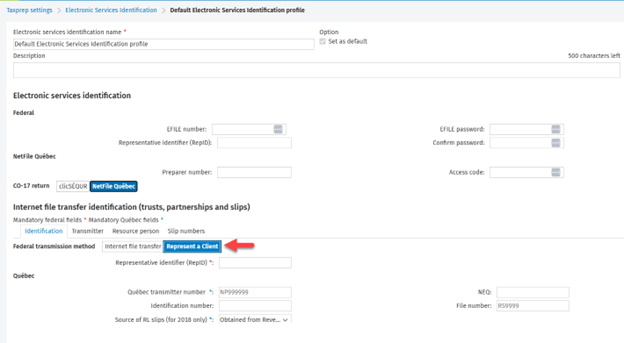

The Represent a Client tab has been added, enabling users to input a Representative identifier (RepID) in the settings. This identifier is then used to generate slips (XML) and upload them to the Represent a Client service (RAC).

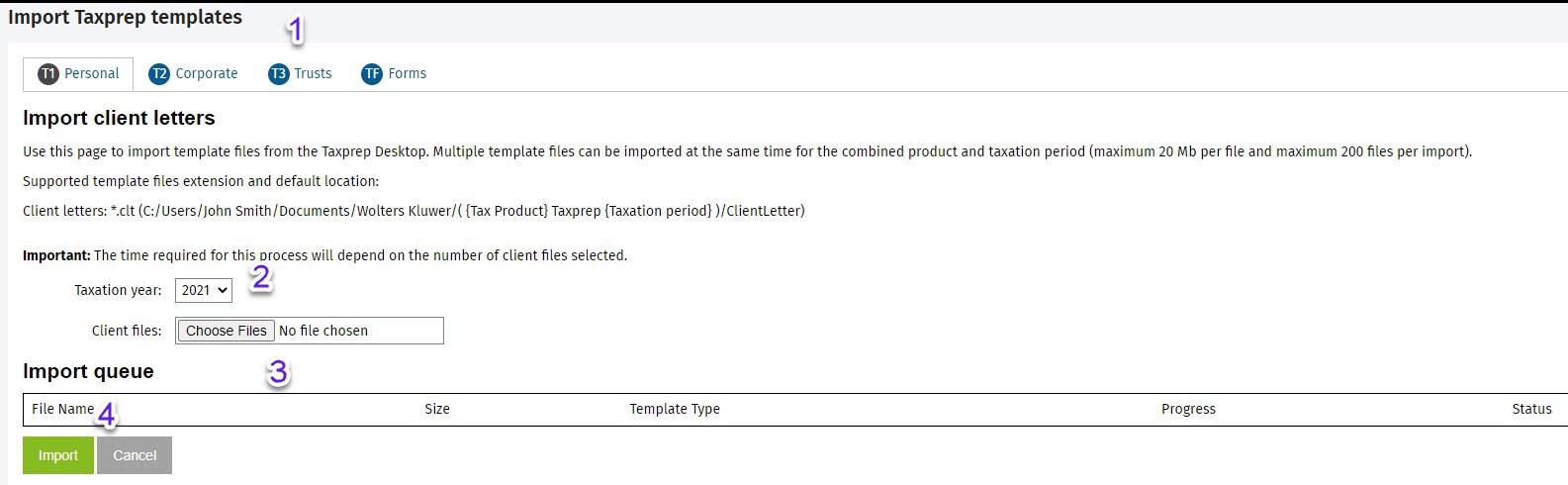

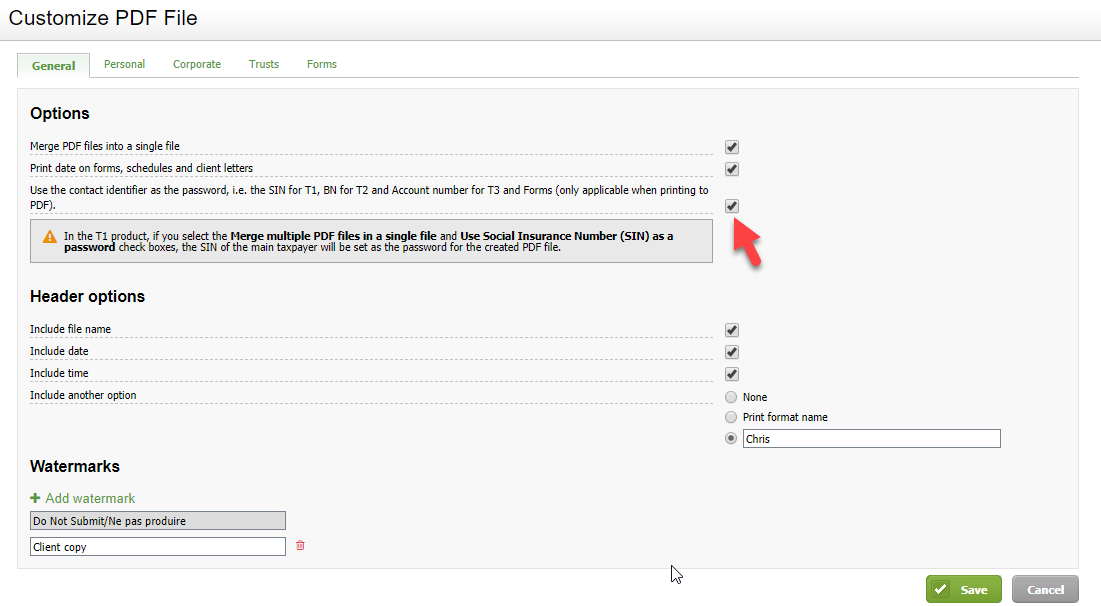

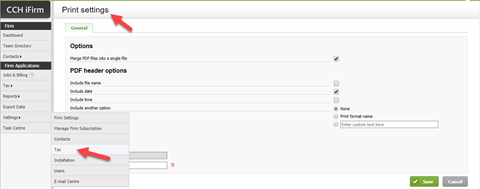

PDF password improvements

The PDF password protection feature is now available for each product individually, enabling the user to select which products (T1, T2, T3 or TF) should have password-protected files.

Additionally, for T2 and TF, you can set the PDF password to the first nine digits of the business or account number. This option is available in Settings > Taxprep > Customize PDF File.

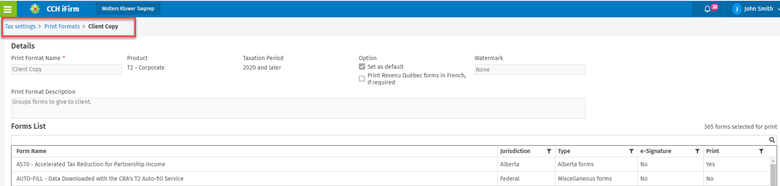

Documents module integration improvements

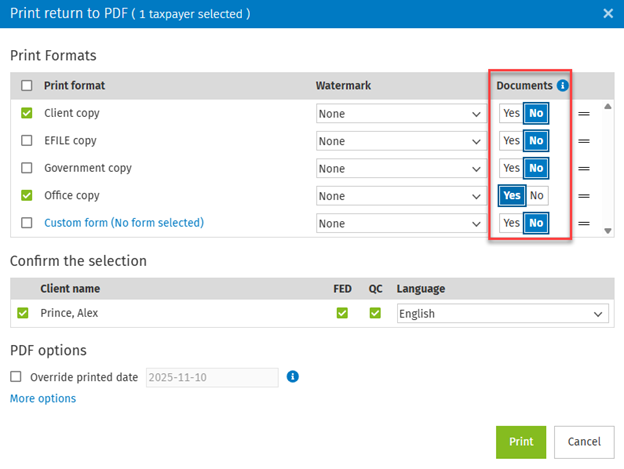

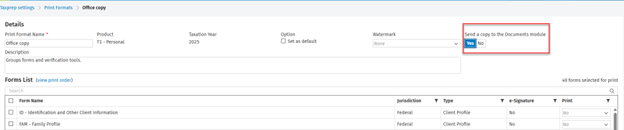

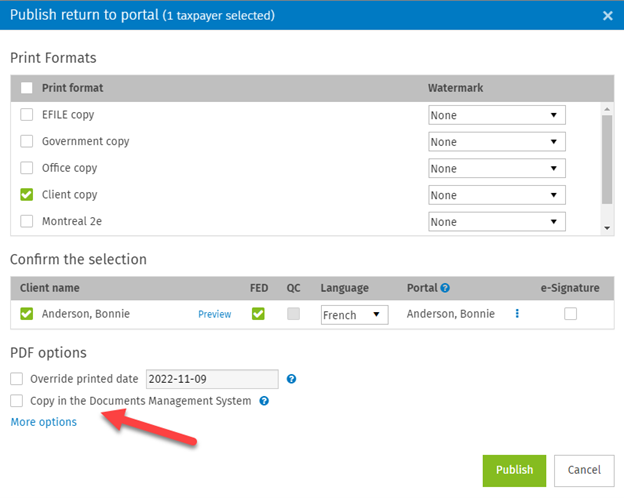

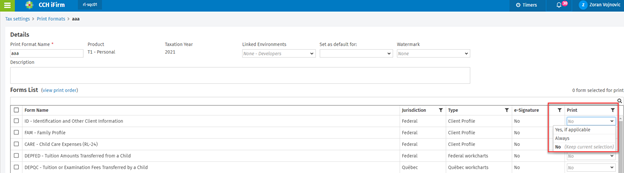

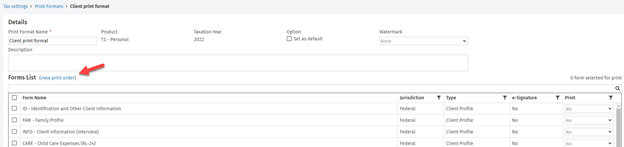

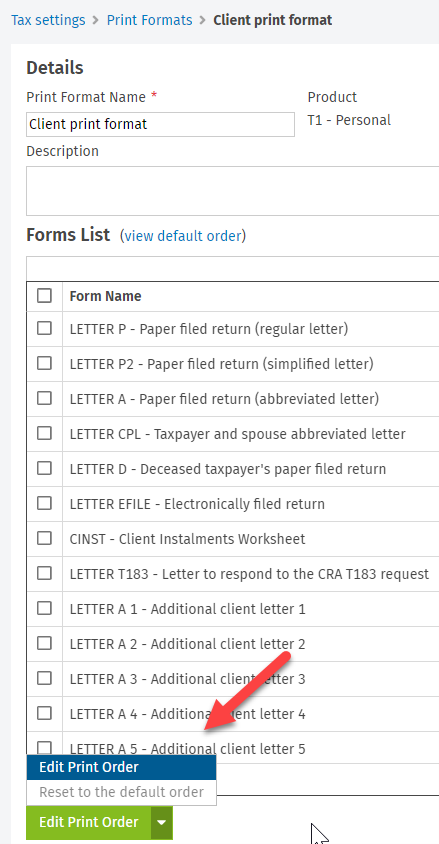

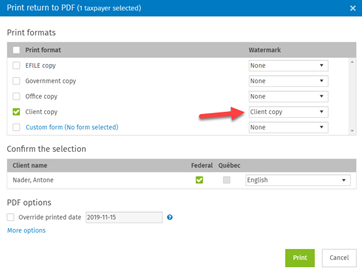

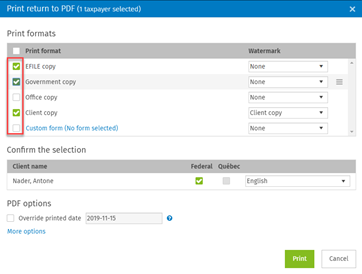

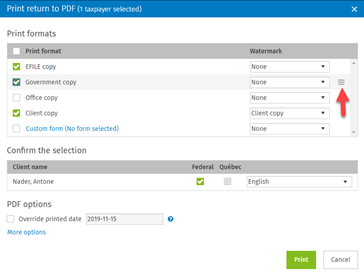

Select print formats when sending returns to the Documents module

When printing or publishing the tax return, the copy can be sent to the Document Management System within the same dialog box. It is now possible to select which print formats, among the ones used for printing or publishing, will be sent to the Documents module.

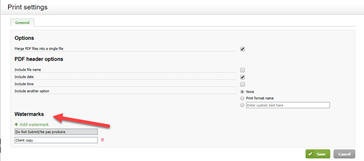

The Send a copy to the Documents Module option has been added to the print formats, allowing a default value for each print format.

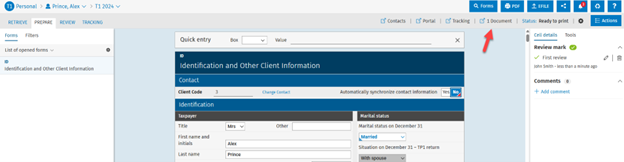

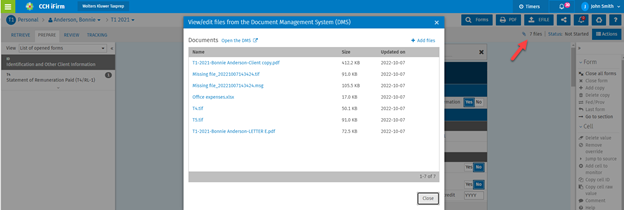

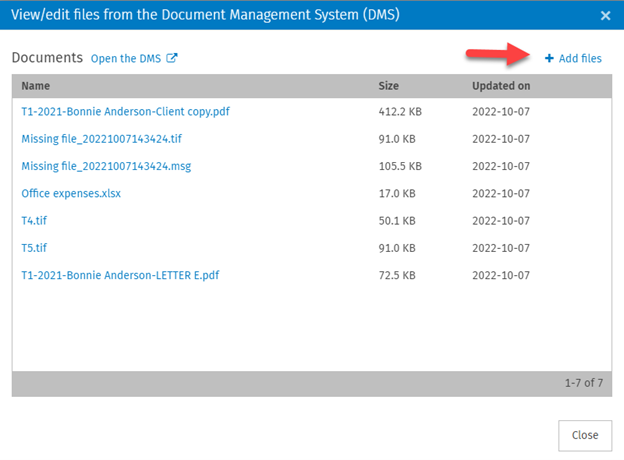

Access the taxpayer’s Documents folder with one click

Supported documents from the Documents module can now be accessed from the breadcrumb of an open tax return in two ways:

-

Opening the Documents folder in a new tab.

-

Opening files from the Documents module directly from the tax return.

These options have been added under Settings > Taxprep > General and can be selected as needed. The taxpayer's Documents folder opens in a new tab by default.

Support of additional metadata when exporting CCH iFirm Taxprep returns to the Taxprep on-premise format

When exporting a CCH iFirm Taxprep return to the Taxprep on-premise format, the following additional metadata is retained:

-

Document notes

-

Return status

-

EFILE status

-

Lock of the return

Decommission of the T1 Notice of assessment Download service

The CRA has decided to decommission the T1 Notice of assessment Download service in tax software for all prior and future tax years, effective February 2026. Therefore, this feature has been removed from the Retrieve tab for 2025 tax returns. For the previous years, the Notice of Assessment feature will continue to exist in order to view notices of assessment that have been already downloaded. However, you will not be able to download them.

In the ID form, the section Notice of assessment or reassessment delivery options for a taxpayer not registered for the CRA’s e-mail notifications has been removed, as it no longer applies.

The CRA has also removed the option to download a notice of assessment in Part E of the T183 form.

Please note that the notices of assessment and reassessment will continue to be available through the My Account or Represent a Client services (for authorized representatives) immediately after the CRA receives and processes a return.

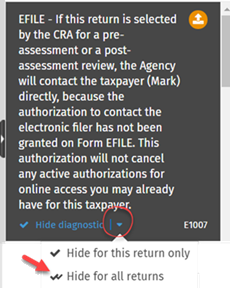

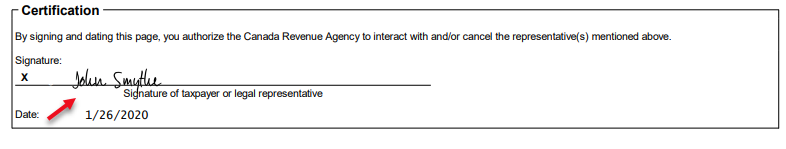

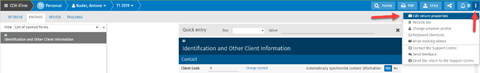

Decommission of the CRA’s authorization service in EFILE software for individuals

On July 15, 2025, the CRA has decommissioned its service used to submit authorization requests for individuals (T1) through EFILE software. Therefore, this feature has been removed. From now on, if you wish to obtain online access for a client, you will need to use the Represent a Client service. Note that we have kept the carried forward data with regard to prior-year authorizations in the program. This information is now visible at the end of the Other information section in the Identification and Other Client Information form.

CCH iFirm Taxprep Advanced and Pro Only

The Review tab can be displayed in a separate window

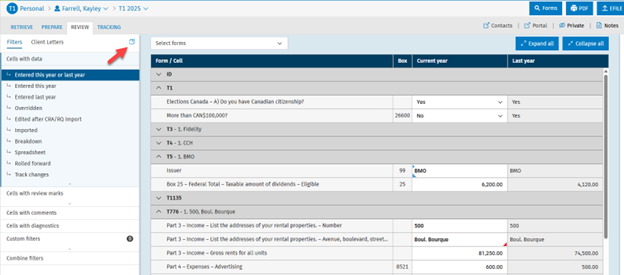

The Review tab can be opened in a separate window, enabling users to view the Review tab on one screen and tax forms on another. The values remain synchronized between the Review tab and the forms, and the cursor moves accordingly between both windows. To open the Review tab in a separate window, go to the Review tab and click the icon next to the Client Letters tab.

The Review tab retains previous user settings

Your expanded or collapsed sections are now saved in the Review tab. As a result, whenever you return to the Review tab, your preferences are automatically retained.

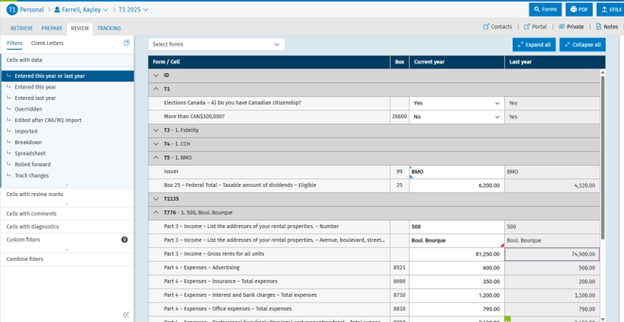

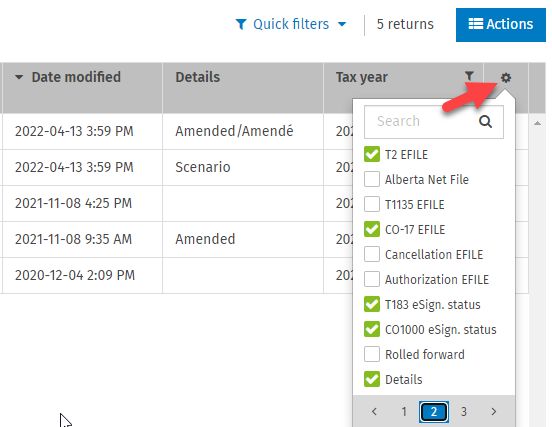

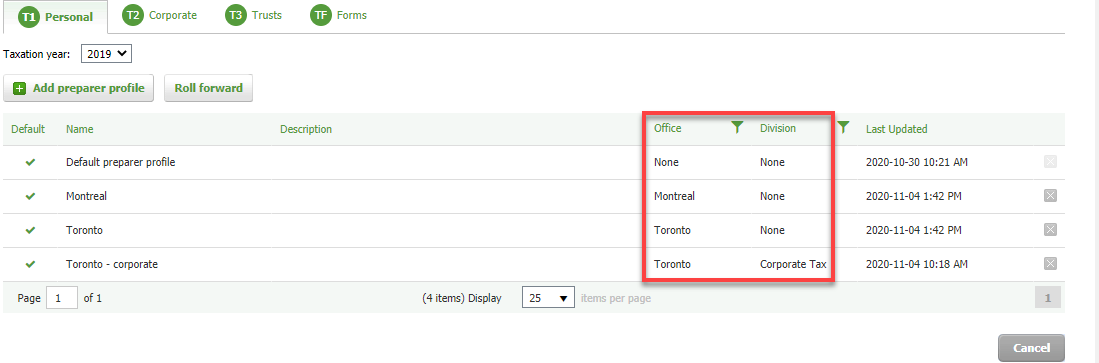

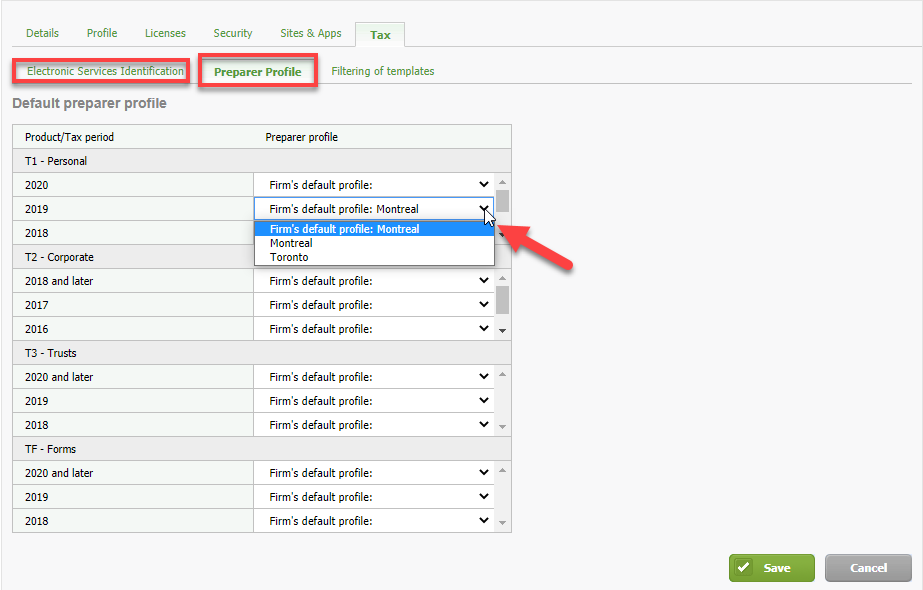

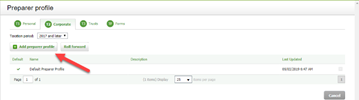

The Preparer Profile column is available in the return manager

The Preparer Profile column can be displayed in the return manager, providing information on which preparer profile is associated with a return.

Note: This column can be added by clicking the gear icon in the top right corner of the return manager and selecting the Preparer Profile column.

CCH iFirm Taxprep Pro Only

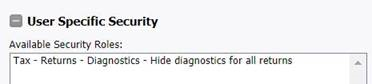

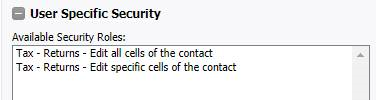

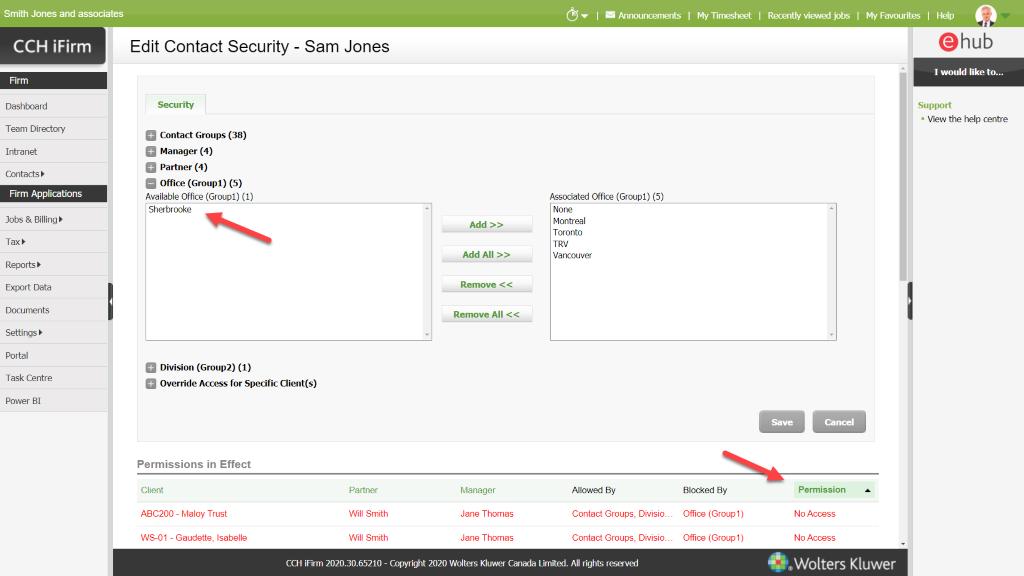

Security roles changes

Change the contact in the ID form

The new Tax – Returns – Change contact security role now controls who can change the contact from the ID form. This was previously managed by the Tax – Returns – Edit all cells of the contact security role.

Note: The users to whom the Tax – Returns – Edit all cells of the contact security role had been assigned will be assigned the Tax – Returns – Change contact security role by default.

Create Tracking cards

The new Tax – Returns – Create Tracking card security role now controls who can create Tracking cards from CCH iFirm Taxprep.

Note: The users to whom the Tracking – Access to Tracking security role had been assigned will be assigned the Tax – Returns – Create Tracking card security role by default.

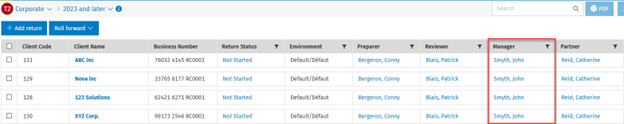

Change the partner and/or manager assignee

The new Contacts – Edit Assignee security role now controls who can modify the assigned partner or manager from the Contacts module and from CCH iFirm Taxprep. Previously, the Tax – Returns – Edit all cells of the contact security role managed who had the rights to modify the assigned partner and manager from CCH iFirm Taxprep.

Note: The users to whom the Tax – Returns – Edit all cells of the contact security role had been assigned will be assigned the Contacts – Edit Assignee security role by default.

Security roles name changes

Tax – Returns – Review – Custom Filters – Add, Edit has been renamed Tax – Returns – Review – Custom Filters – Add, Edit, Delete.

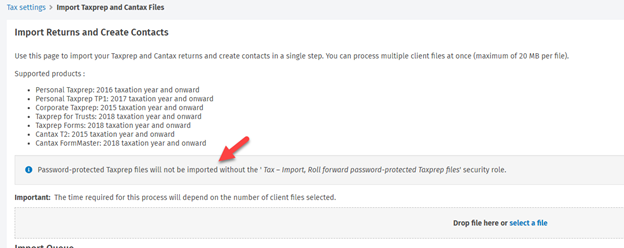

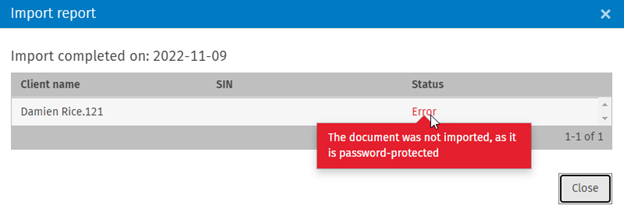

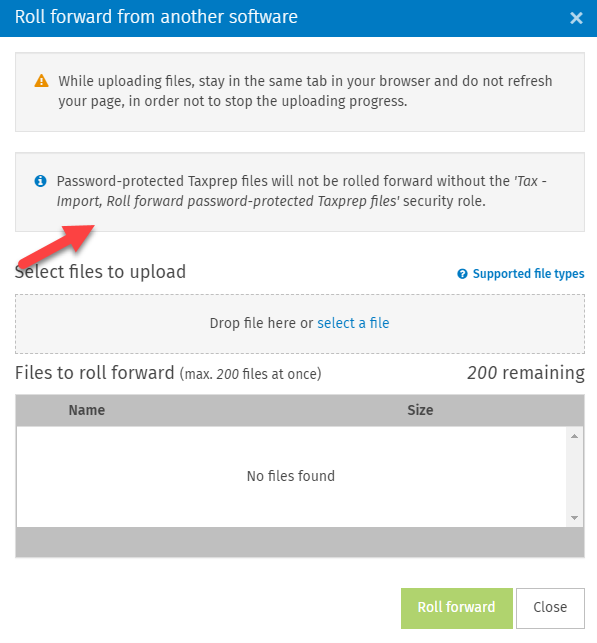

Tax – Import and Roll Forward Password-Protected Taxprep Files has been renamed Tax – Import and Roll Forward Password-Protected Taxprep and Cantax Files.

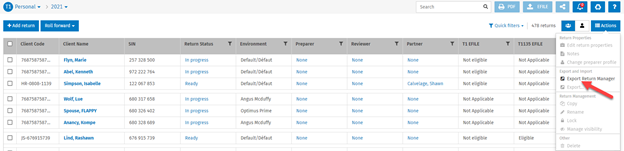

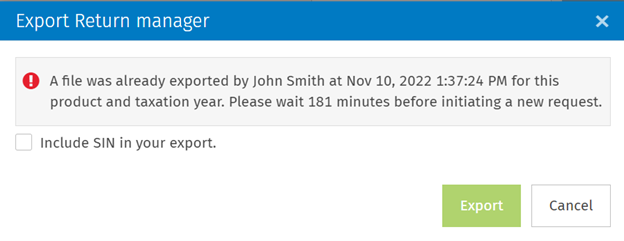

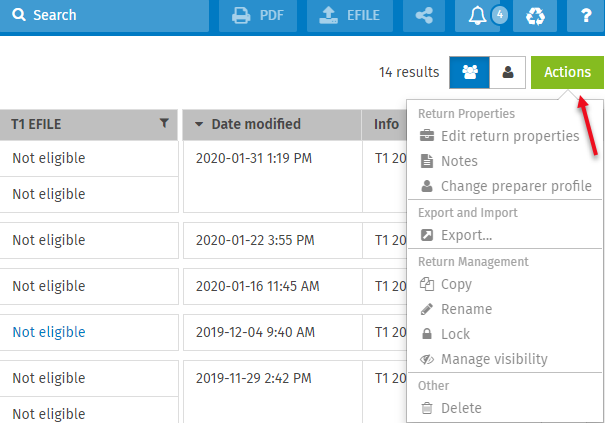

Export return manager functionality improvements

The custom columns shown when a custom filter is applied in the return manager can now be exported. To export, click Actions, followed by Export return manager, and select Export the return manager based on the applied filters.

Web API improvements

Get list of applicable forms

This endpoint returns a list of applicable forms for printing. For more information, see the applicableForms section of the Print Endpoints help topic.

Webhook-based notifications for return status

The Change Return Status event is sent when the return status of a return is changed following a manual or automatic modification.

July 18, 2025 Release

CCH iFirm Taxprep Pro Only

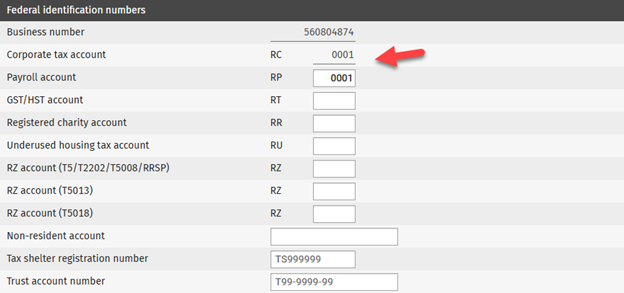

Adjustments related to identification numbers in the Forms product

Users who do not have the Tax – Returns – Edit all cells of the contact security role can now edit identification numbers in the ID form of the Forms product as long as those numbers are not synchronized with the contact. For example, in a corporate entity’s return, only the RC identification number will sync with the contact. As a result, users without this security role will not be able to edit the RC value, but they will be able to modify any other identification number that is not synchronized.

The type of entity associated with the contact determines which identification numbers can be modified.

May 16, 2025 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

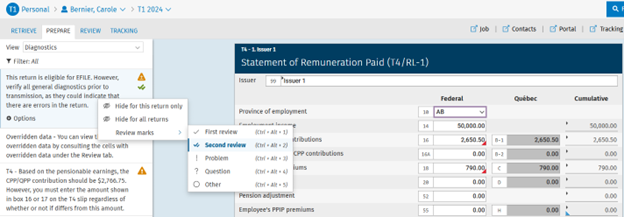

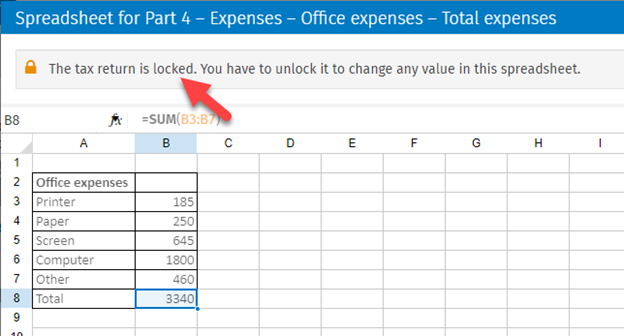

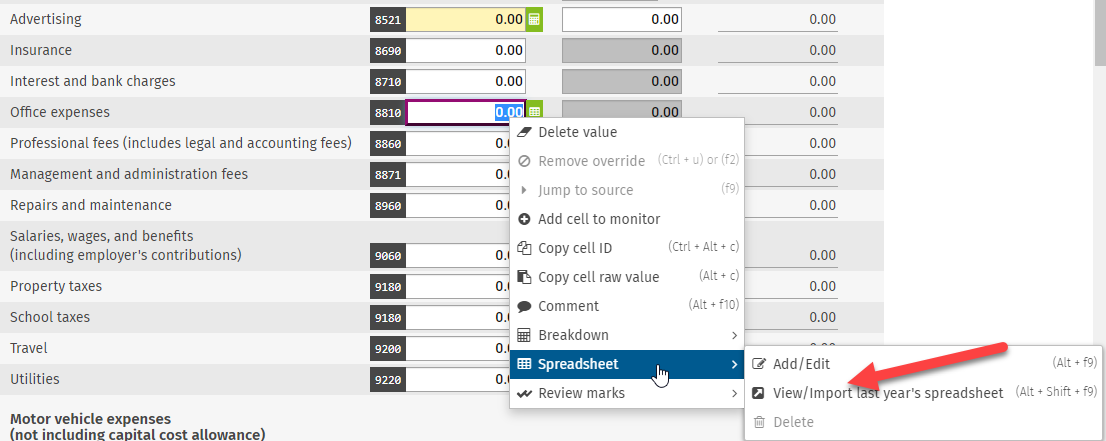

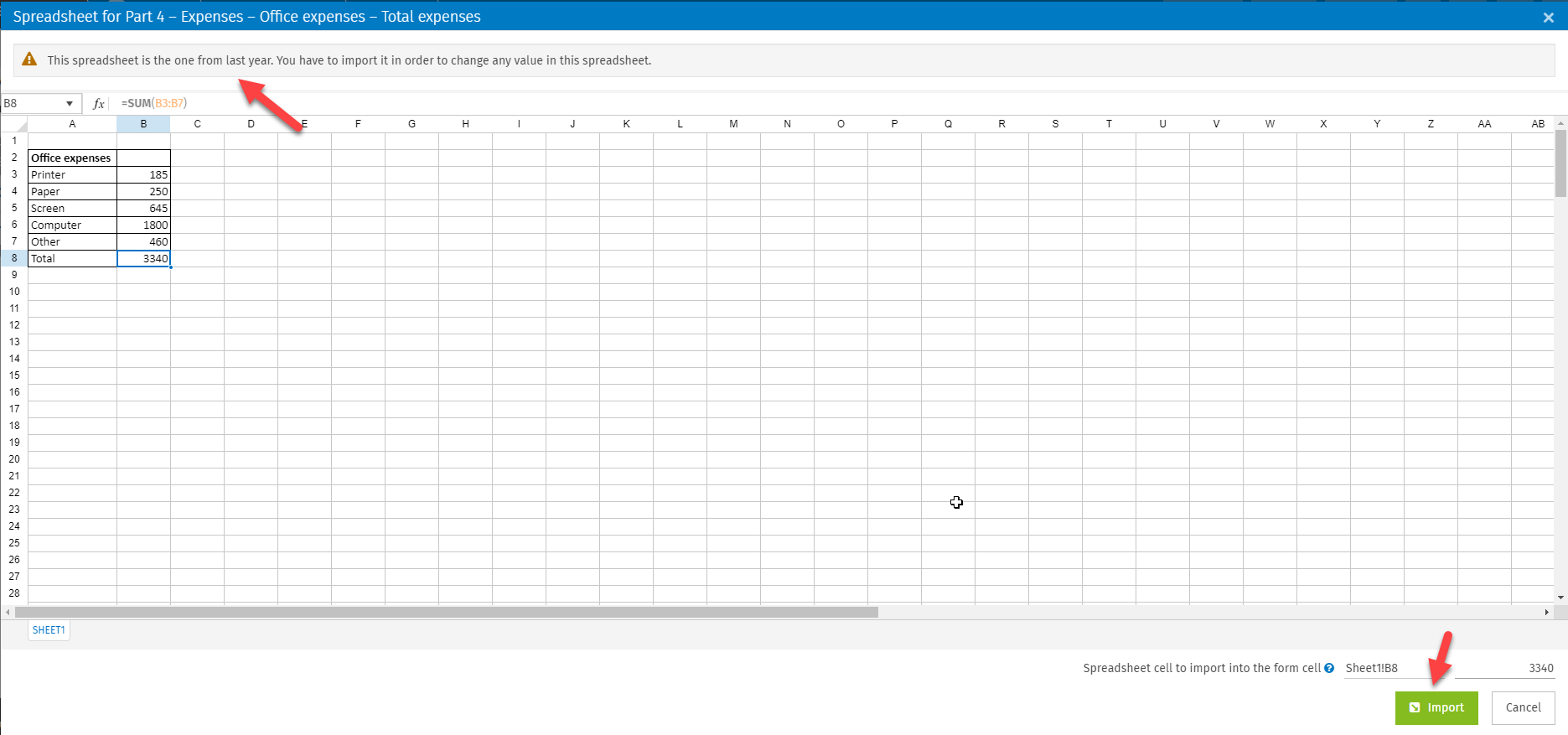

Ability to link multiple cells to a single spreadsheet

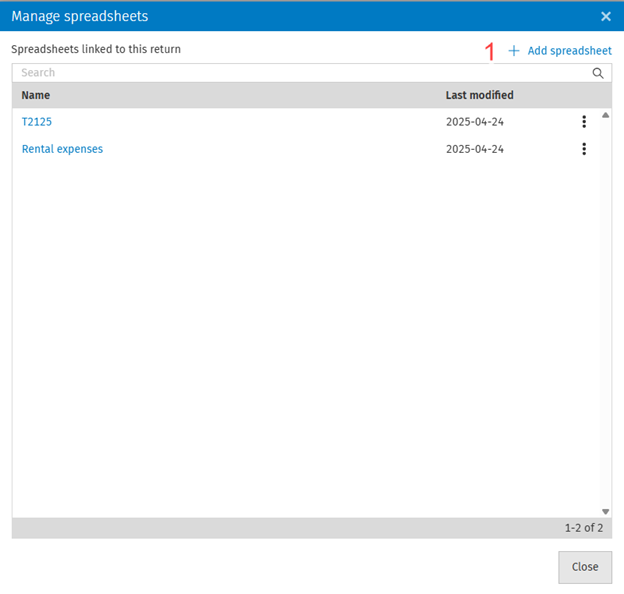

A single spreadsheet can now be linked to multiple cells. To do so, proceed as follows:

-

Add a spreadsheet by using one of the following methods:

Click Actions, followed by Manage spreadsheets and Add spreadsheet, or

Right-click any numeric field, then select Spreadsheet, followed by Link/Edit and Add spreadsheet.

-

Enter the content in the spreadsheet either manually or by importing data from an external spreadsheet by clicking File, then Import.

-

Insert the cells that will be linked to the spreadsheet by clicking Insert cells.

-

Choose the form(s) from which you want to insert cells, then select and insert the desired cells.

-

Map the inserted cells to the spreadsheet values by:

Selecting the inserted cell

Selecting the spreadsheet value

Clicking Select as source

After mapping, the Source cell column in the right pane of the spreadsheet will display the corresponding mapped cell, while the Value column will show the mapped value.

-

Click Add spreadsheet and enter a name. Note that the spreadsheet must be linked to at least one return cell before it can be saved.

The values from the linked spreadsheet will be displayed in the respective fields of the form.

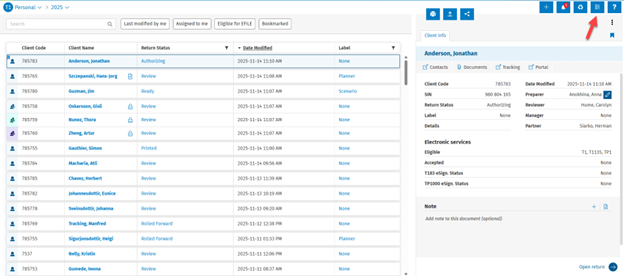

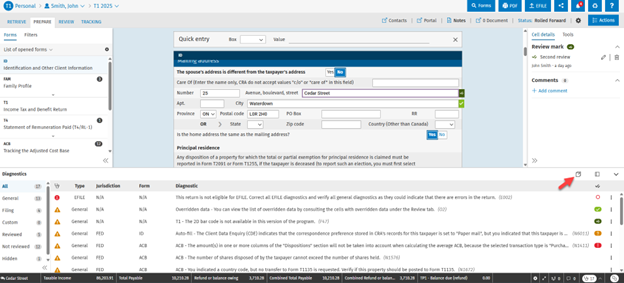

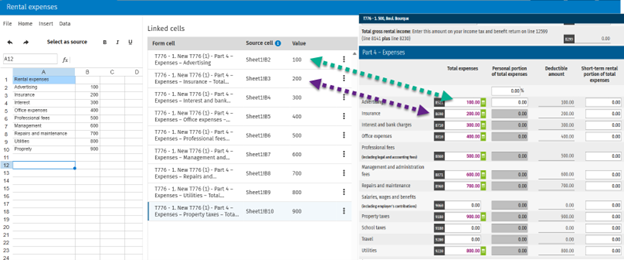

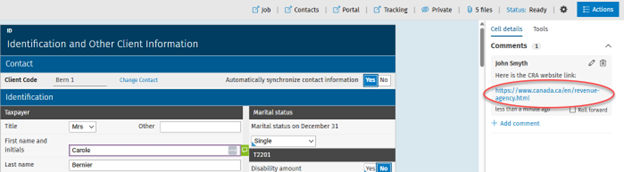

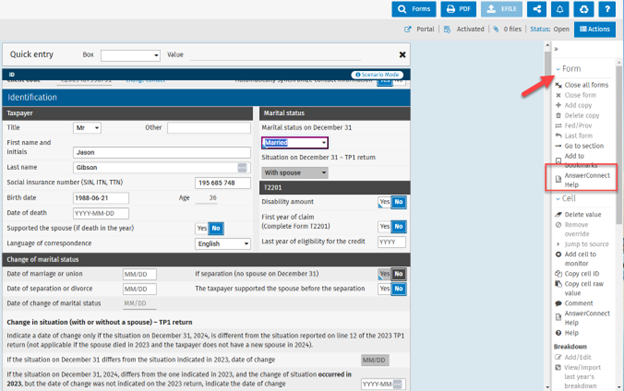

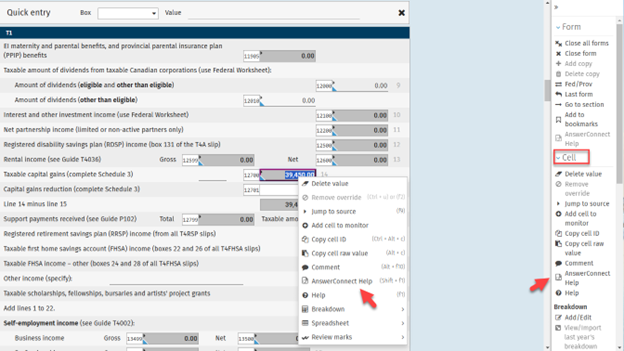

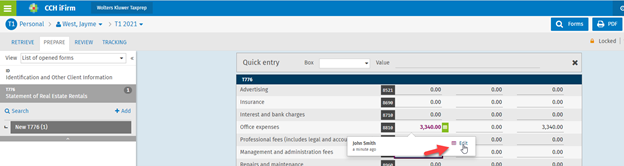

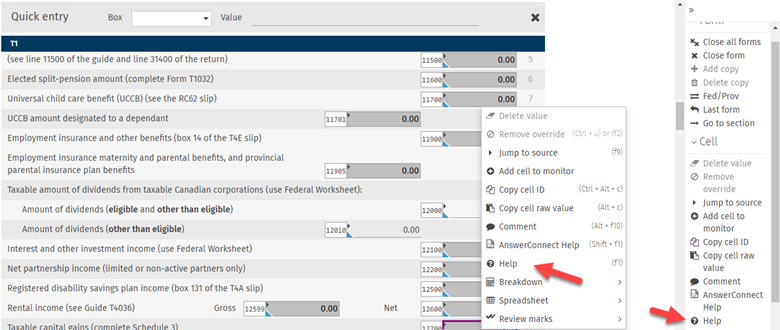

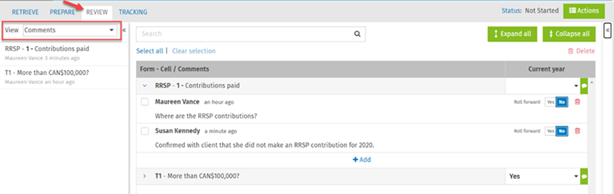

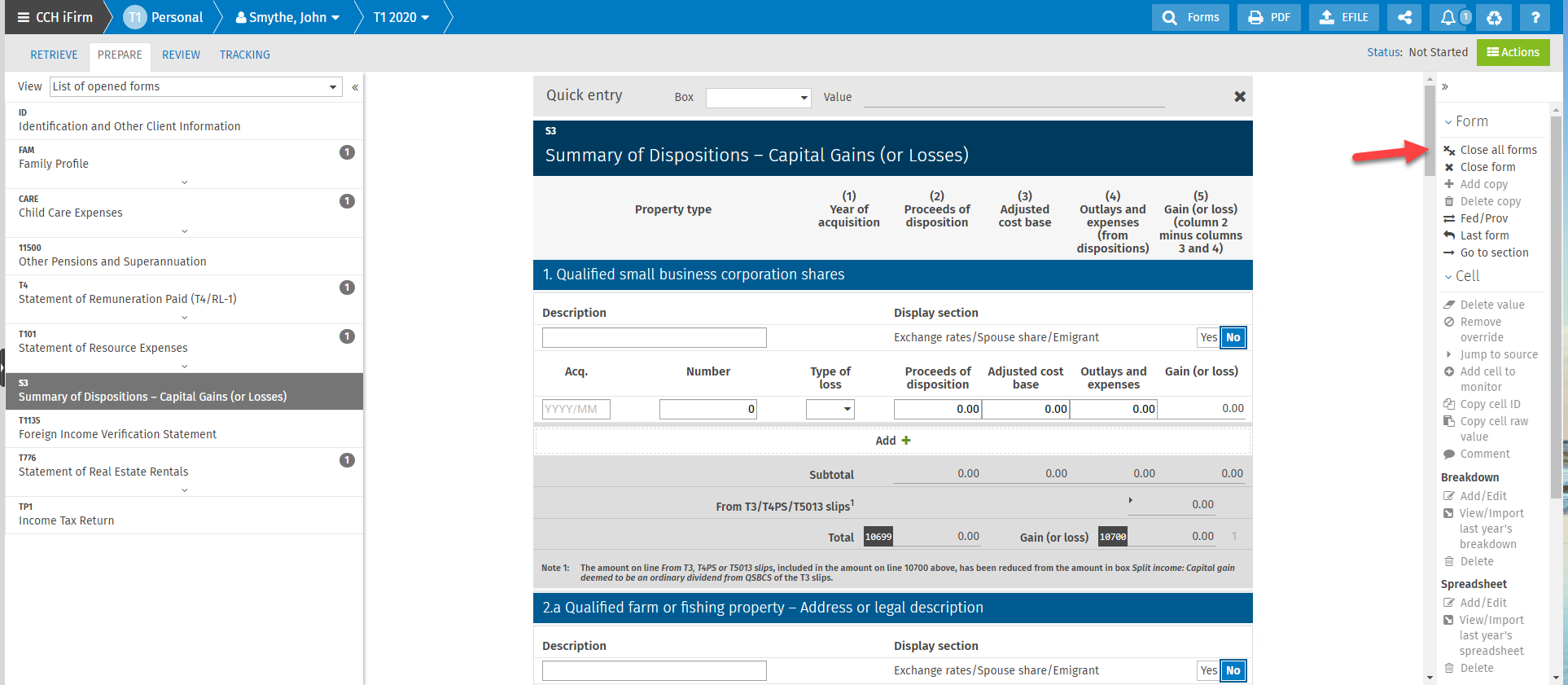

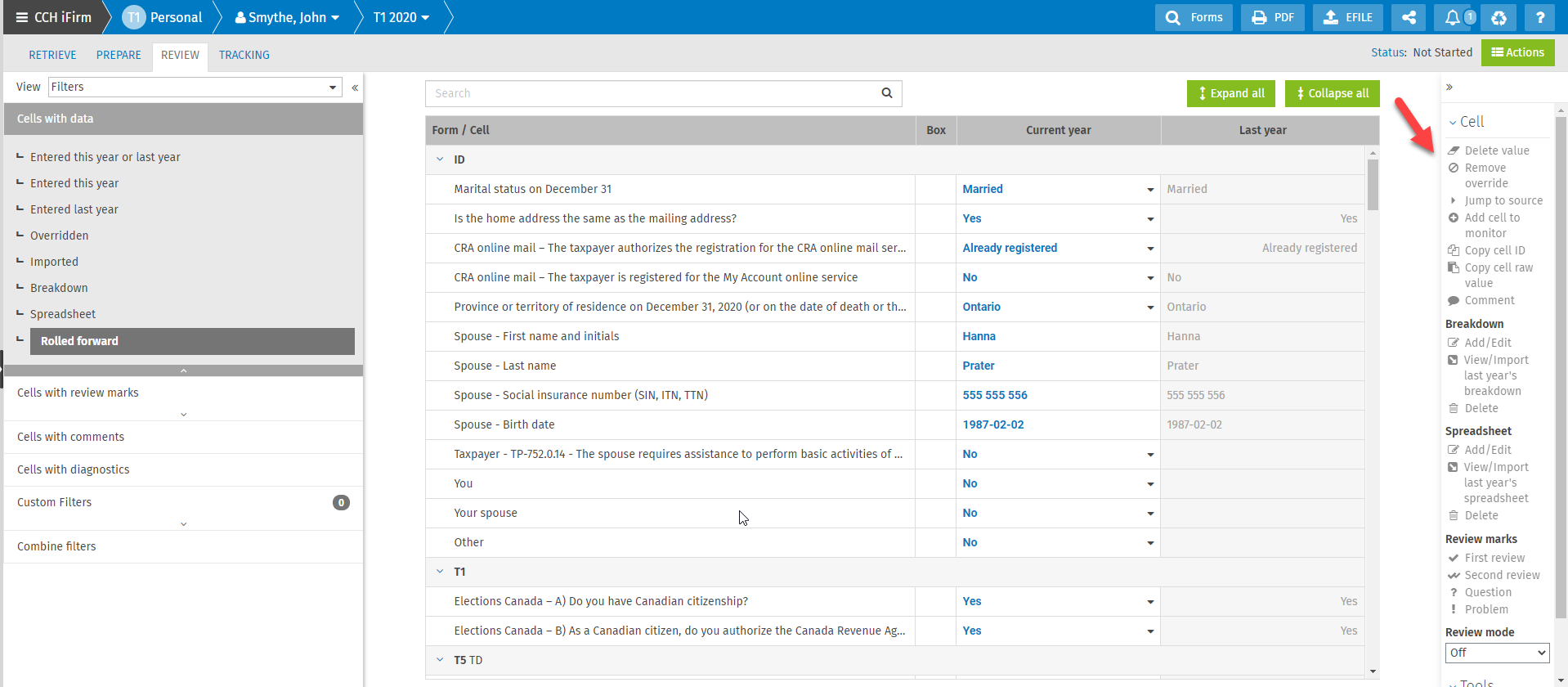

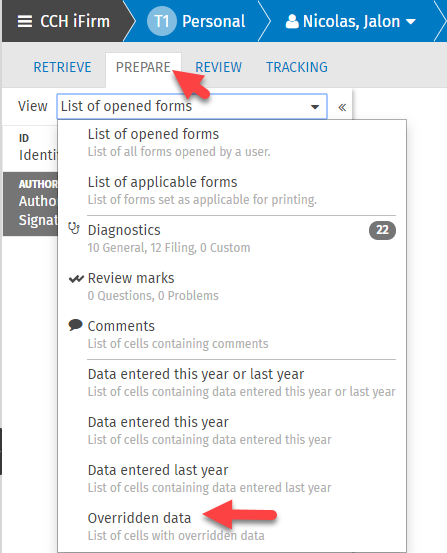

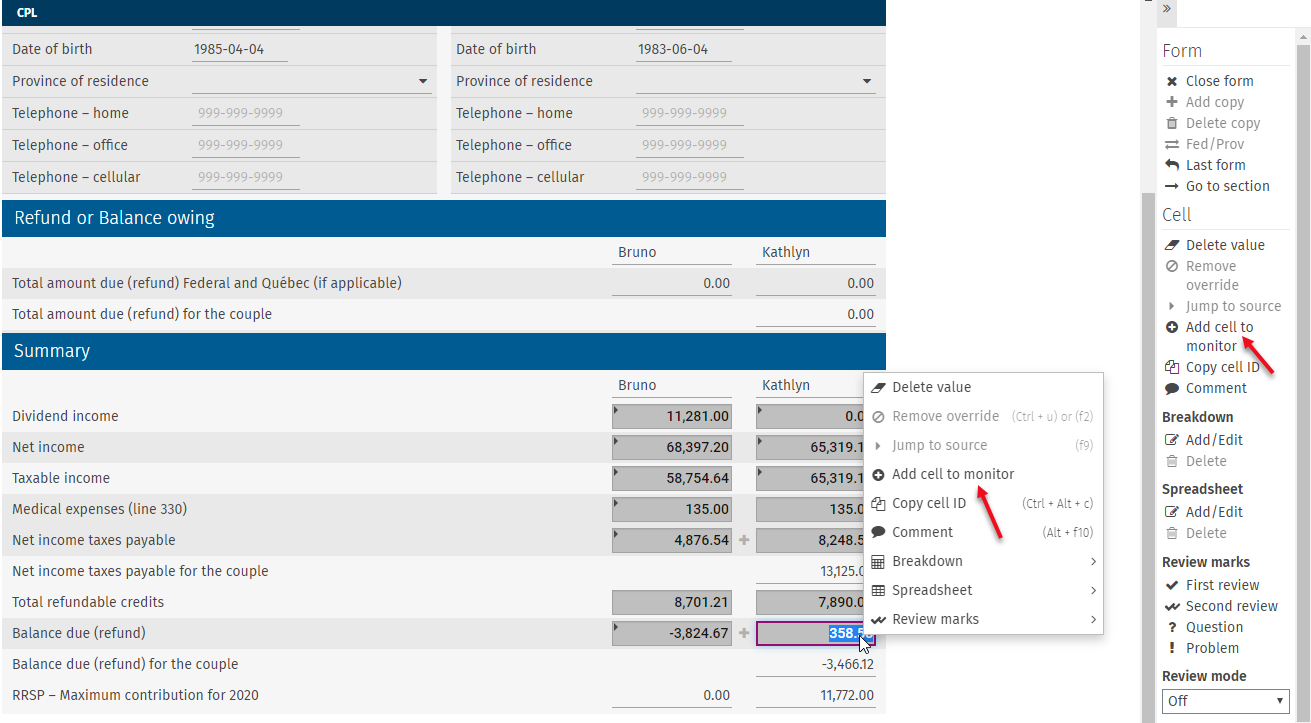

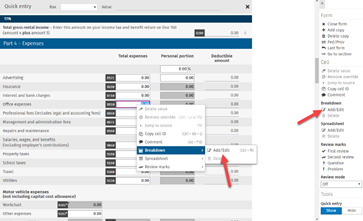

The metadata of the cell is now presented in the enhanced right pane

The right pane in an open tax return has been enhanced. It now includes two tabs:

-

Cell details

-

Tools

Cell details

Upon selecting a cell, this tab will display all its associated metadata. The following metadata can be appended to a cell:

-

Diagnostics

-

Review marks

-

Breakdown

-

Spreadsheet

-

Comments

-

AnswerConnect Help preview

From the right pane, it is possible to apply any available action to given metadata (i.e., add, edit, delete, etc.).

Metadata information will no longer be displayed when hovering on a cell, with the exception of diagnostic text, which will still appear when the cell is hovered over.

Tools

This tab will display all actions that can be applied to:

-

Forms

-

Cells

-

Tools

Ability to add all existing review marks to diagnostics

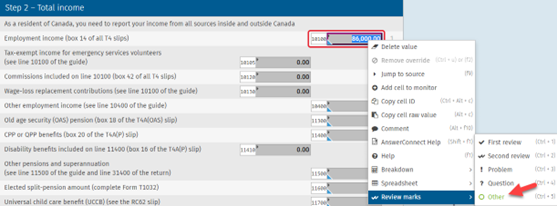

The following review marks can be applied to any diagnostic.

-

First review (Ctrl + Alt + 1)

-

Second review (Ctrl + Alt + 2)

-

Problem (Ctrl + Alt + 3)

-

Question (Ctrl + Alt + 4)

-

Other (Ctrl + Alt + 5)

The review marks can be added to a diagnostic by:

-

Using the shortcuts

-

Right-clicking a diagnostic, clicking Review marks and choosing the desired review mark, or

-

Clicking Options and Review marks in the relevant diagnostic, then choosing the desired review mark

The filters Reviewed and Not Reviewed are available from Diagnostics > Filter to facilitate the reviewing of diagnostics.

Undo previous changes by using a key shortcut (Ctrl + Z)

The Undo feature (Ctrl + Z) lets you roll back recent data input changes made to a tax return.

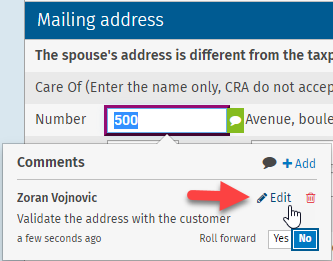

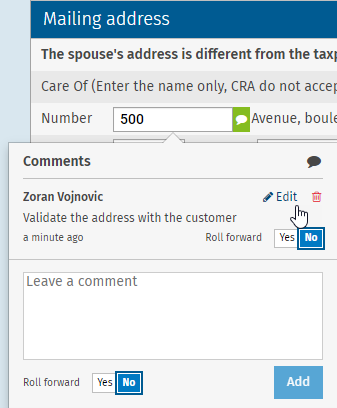

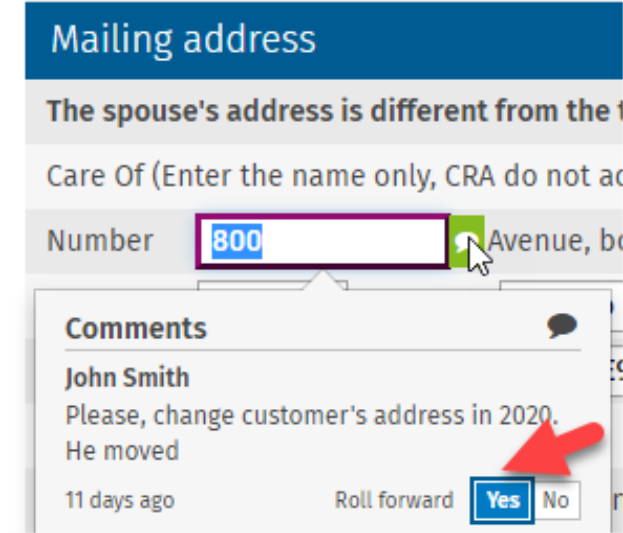

Ability to add hyperlinks in the return’s notes and cell comments

The return’s notes and cell comments can now include a hyperlink, allowing users to click the link and directly access the corresponding Web page.

Note: The hyperlink will be activated once the note is saved.

Open the contact directly from a tax return

From an open tax return, the Contacts icon displays in the toolbar. By clicking it, the taxpayer’s corresponding contact will open in a separate tab.

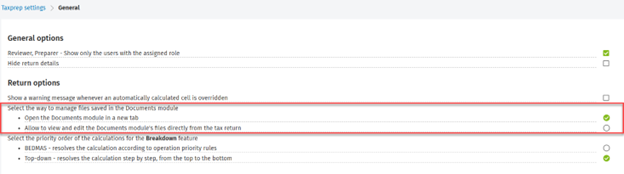

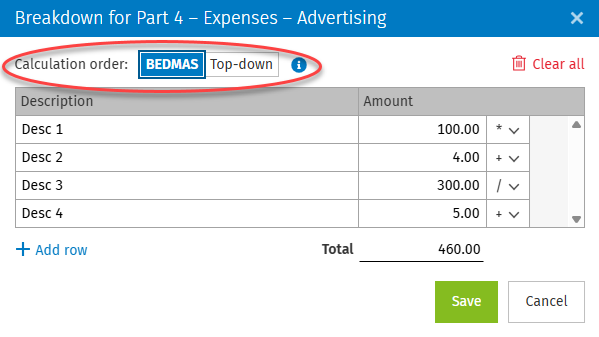

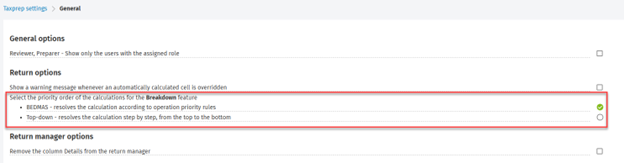

Ability to choose the BEDMAS or top-down calculation order

The Breakdown functionality allows you to choose a calculation order:

-

BEDMAS (resolves the calculation according to operation priority rules (brackets, exponents, divisions, multiplications, additions, subtractions)), or

-

Top-down (resolves the calculation step by step, from the top to the bottom)

The option Select the priority order of the calculations for the Breakdown feature has been added to Settings > Taxprep > General, allowing you to select the default value for any newly added cell breakdown.

The name of multiple copy forms now remains visible at the top of the screen

As you scroll through a multiple copy form, the copy's name stays visible at the top of the screen, helping users easily identify which copy of the form they are working on.

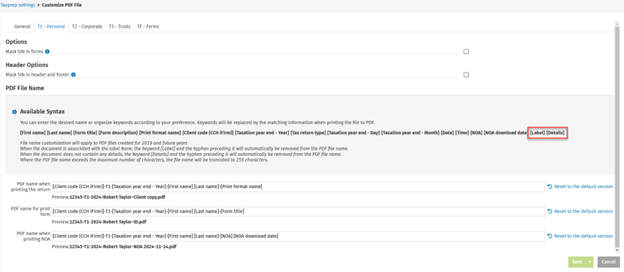

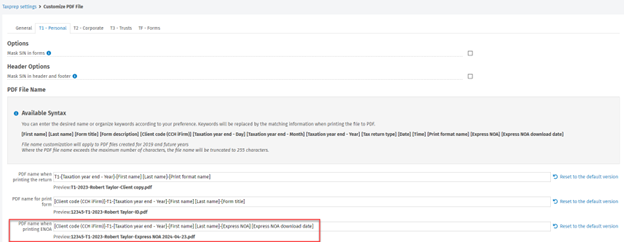

The Notice of assessment (NOA) syntax to customize PDF naming conventions was renamed

Express NOA and Express NOA download date syntaxes have been renamed to the following:

-

NOA

-

NOA download date

Select the information to be displayed in the toolbar

From the gear icon located next to the Actions button, select the direct links and features that you wish to include in the toolbar.

Note that the content displayed when clicking this icon depends on your subscription and purchased modules.

Support of metadata when importing a Taxprep on-premise file

When importing a Taxprep on-premise file into CCH iFirm Taxprep, the following additional metadata is retained:

-

EFILE status (new)

-

Attached schedule (new)

-

Return’s notes (F11)

-

Cells’ comments (attached notes)

-

Predefined return statuses. Please see the Import Taxprep Files help topic to view the list of supported return statuses.

-

Lock of the return

Support of metadata when exporting CCH iFirm Taxprep file

When exporting a CCH iFirm Taxprep file in the Taxprep on-premise format, the following additional metadata is retained:

-

Cells’ comments

Note: You can choose not to export comments by clearing the Export comments option during the export process.

The Other Settings section is now named General

The Other Settings section under Settings > Taxprep has been renamed General.

Note that the Tax – Settings – Other settings – Access security role has been renamed Tax – Settings – General – Access.

Automatic synchronization of the tax return between two browser windows

The data entered is now automatically synchronized when two browser windows or tabs are opened by the same user for the same tax return. For instance, you may open a form on one screen and another form on a second screen, and the information will remain synchronized. Synchronization will also occur between a form and the Review tab.

CCH iFirm Taxprep Advanced and Pro Only

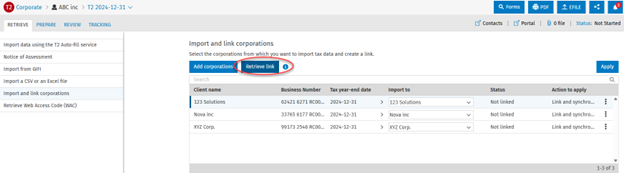

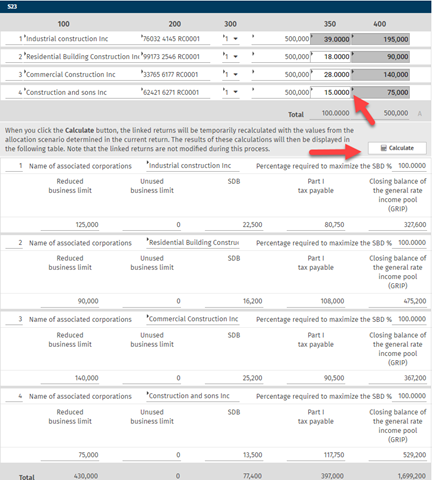

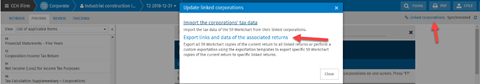

Import and link corporations – The Retrieve link functionality enables the identification of returns to be linked

The Import and link corporations functionality allows you to identify corporate returns that were linked in the previous year. When the T2 return is rolled forward in the current taxation year, click the Retrieve link button to identify all linked returns in the previous taxation year.

Note: All linked returns should be rolled forward in the current taxation year in order to retrieve the links of associated or related corporations.

CCH iFirm Taxprep Pro Only

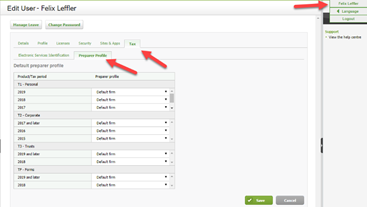

The Manager role can now be assigned to any tax return

The Manager role is now available in the Taxprep module and can be assigned to any tax return, alongside the existing roles of Preparer, Reviewer and Partner.

The following security role is required to assign the Manager role to a tax return: Tax – Returns – Edit all cells of the contact.

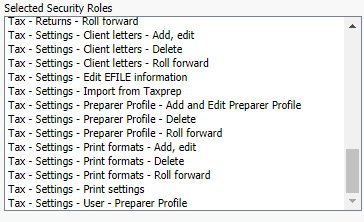

New security role to manage roll forward options from Settings

The Tax – Settings – Roll forward security role has been added to allow you to manage the rights to modify roll forward options from Settings > Taxprep > Roll Forward.

The Tax – Returns – Roll Forward iFirm Taxprep security role now allows you to manage the rights to roll forward CCH iFirm Taxprep returns only.

Web API additional endpoint

Set details

This endpoint allows you to add or update the details of one or a batch of documents. For more information, see the Details Endpoint help topic.

March 11, 2025 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

Ability for trusts to electronically transmit Form T1135, Foreign Income Verification Statement

The electronic transmission of Form T1135 for trusts is now available from CCH iFirm Taxprep T3.

December 20, 2024 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

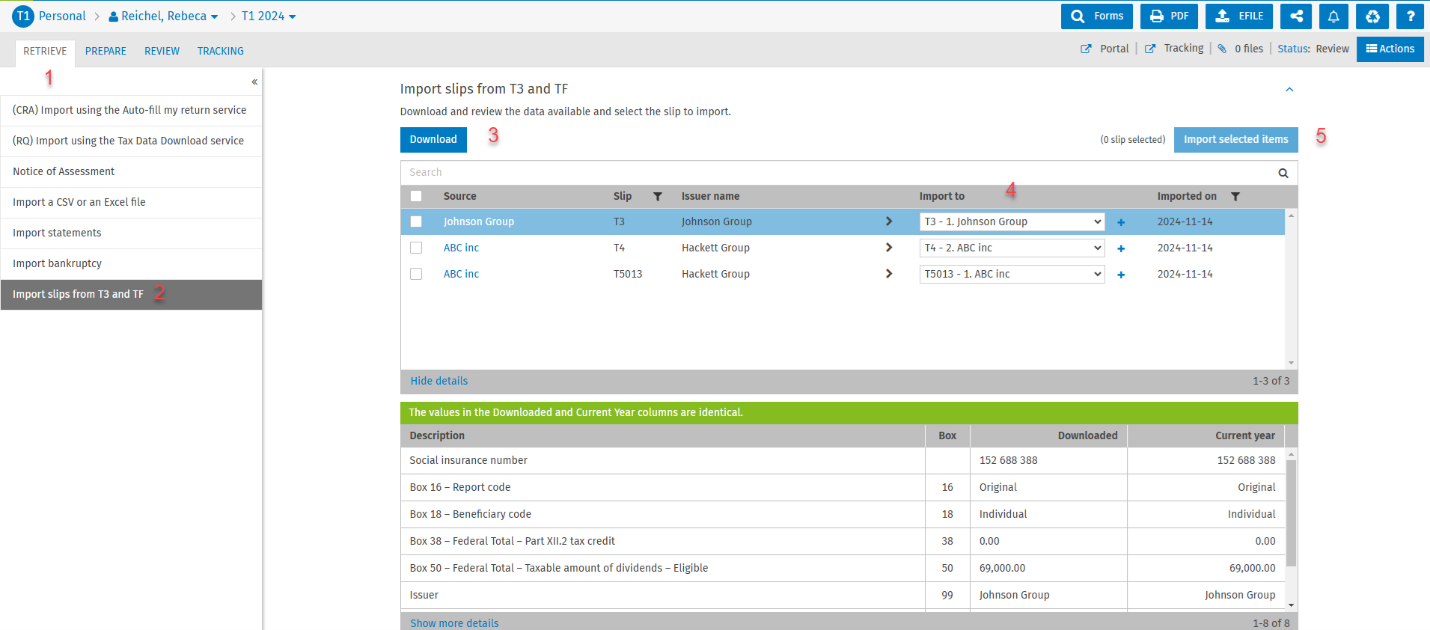

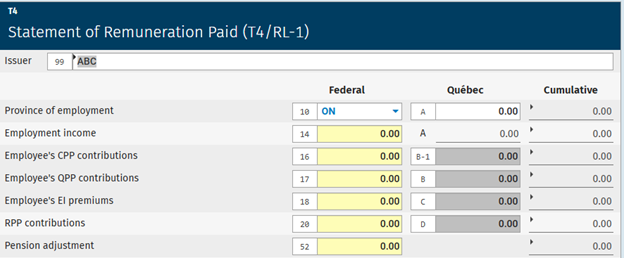

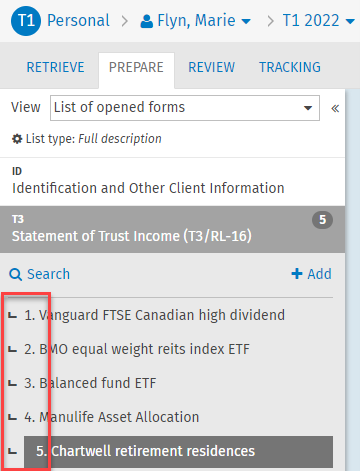

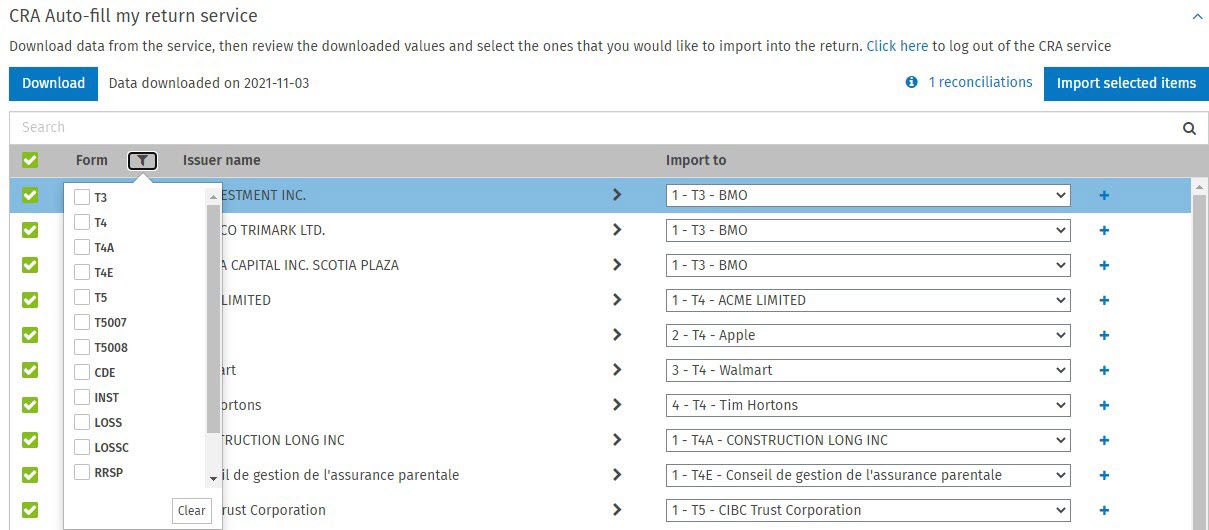

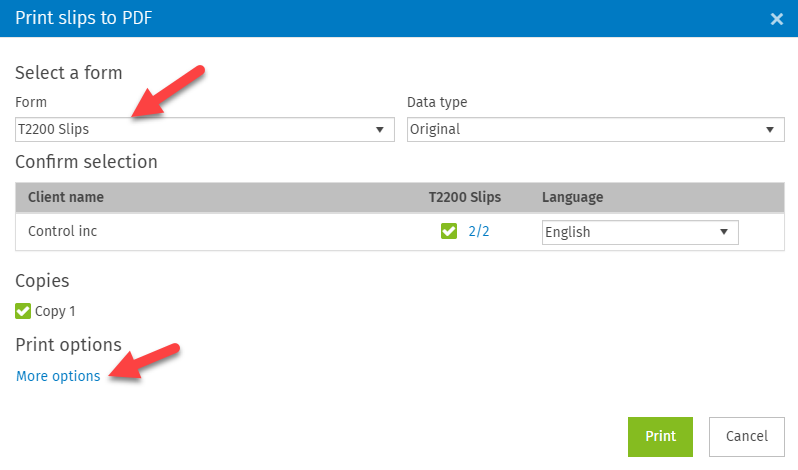

Ability to import slips from T3 and Forms into a T1 return

The Import slips from T3 and TF feature allows you to import slips generated in CCH iFirm Taxprep T3 and/or in CCH iFirm Taxprep Forms directly into the T1 return, saving preparation time.

When the slip is produced (either printed or transmitted electronically) in CCH iFirm Taxprep T3 or in CCH iFirm Taxprep Forms, it automatically becomes available for download and import in the T1 return for the corresponding taxpayer.

-

In the T1 return, open the Retrieve tab.

-

Click Import slips from T3 and TF.

-

Click Download; all available slips for that taxpayer will be listed.

-

Select the copy of the slip for which data should be imported in the return.

-

Click Import selected items.

The following slips and RL slips are supported for import:

Import from CCH iFirm Taxprep T3 to CCH iFirm Taxprep T1

-

T3/RL-16

Import from CCH iFirm Taxprep Forms to CCH iFirm Taxprep T1

-

T4/RL-1

-

T4A/RL-1/RL-2

-

T5/RL-3

-

T5013/RL-15

-

T2200

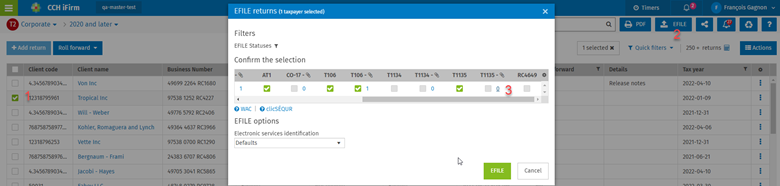

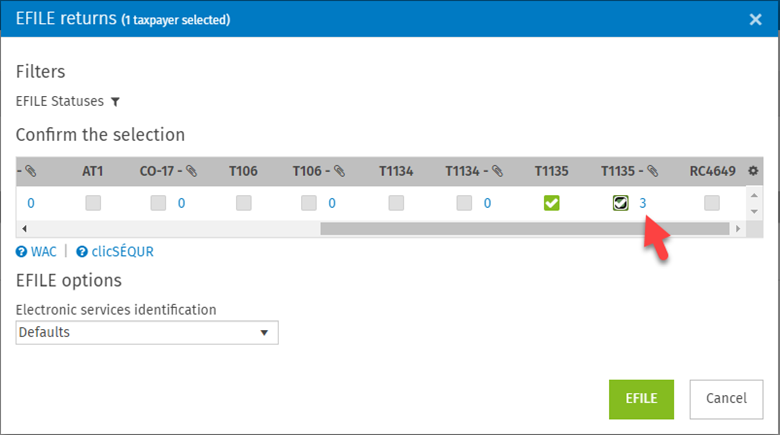

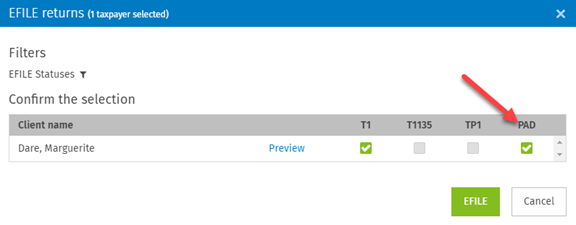

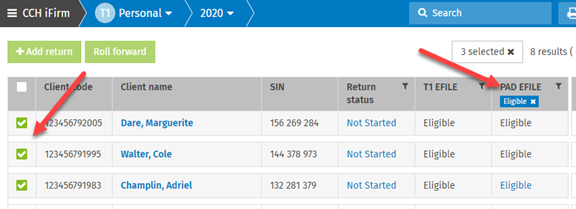

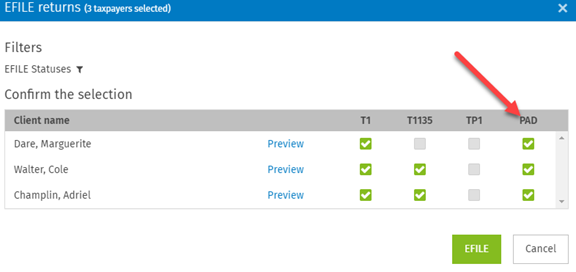

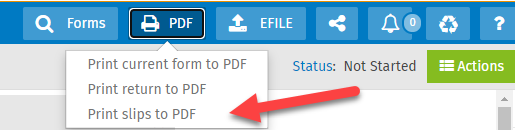

CCH iFirm Taxprep T3 and CCH iFirm Taxprep Forms support EFILE in bulk

CCH iFirm Taxprep T3 and CCH iFirm Taxprep Forms now allow returns, forms and slips to be EFILED in bulk from the return manager.

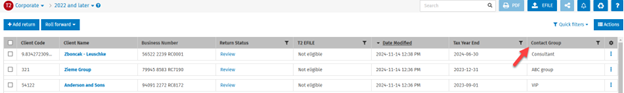

The contact group information is displayed in the return manager

The Contact Group column can be displayed in the CCH iFirm Taxprep return manager, allowing you to view the contact group of the tax documents. It is possible to filter on that column and identify any returns linked with a contact group.

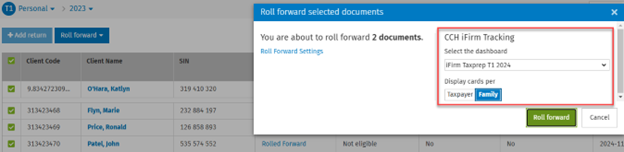

Ability to create CCH iFirm Tracking cards when rolling forward a tax return

CCH iFirm Tracking cards can now be created when rolling forward a tax return.

Note: The CCH iFirm Tracking section will be available in the Roll forward selected documents modal only if you have a CCH iFirm Tracking license and the Tracking – Access to Tracking security role.

December 6, 2024 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

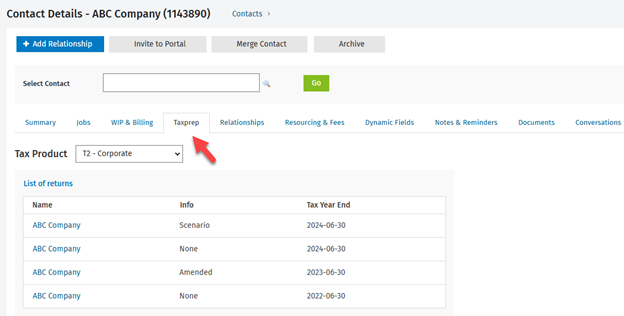

Open a tax return directly from the contact

The Taxprep tab has been added to the Contact Details page, allowing you to open a taxpayer’s tax returns. By clicking the name of the taxpayer, the return will open in a separate tab.

For more information about this integration, see the Core & Contacts section of the December 6, 2024 CCH iFirm release notes.

Access to the taxpayer’s portal in one click

From an open tax return, the Portal icon will display in the breadcrumb. By clicking it, the taxpayer’s portal will open in a separate tab.

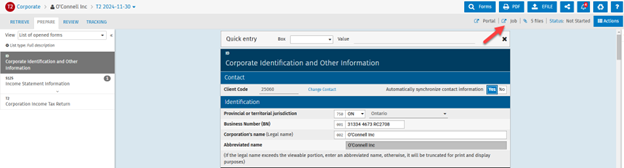

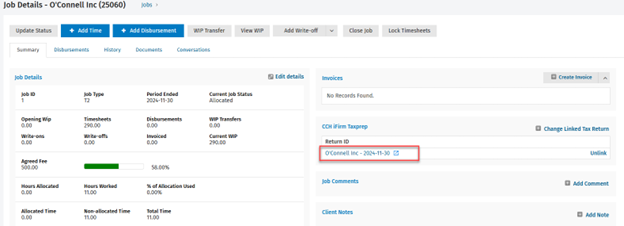

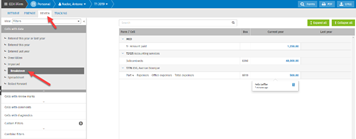

CCH iFirm Jobs & Billing is now integrated with CCH iFirm Taxprep

From an open tax return, the Job icon will display in the breadcrumb. By clicking it, the taxpayer’s job will open in a separate tab. Similarly, from a job, a CCH iFirm Taxprep return can also be opened by clicking the tax return link. For more information on how to create the link from a job to a tax return, see the Jobs & Billing section of the December 6, 2024 CCH iFirm release notes.

ESC key now closes the form and brings you to the form that was last opened

The ESC key behaviour has been improved. When closing a form by using the ESC key, the active form will close, and you will be taken to the form that was last accessed.

CCH iFirm Taxprep T3 and CCH iFirm Taxprep Forms support EFILE in bulk

CCH iFirm Taxprep T3 and CCH iFirm Taxprep Forms now allow returns, forms and slips to be EFILED in bulk from the return manager.

Return manager improvements

Ability to resize columns

All columns in the return manager can now be resized by placing the cursor on the right side of the column name and then dragging the cursor to adjust the width of the column.

New column used to identify the taxpayer type

The Taxpayer Type column has been added to the T1 return manager, allowing you to identify the taxpayer type: Main, Spouse or Dependant. It is also now possible to filter on this column.

Return count

The return count is now displayed at the bottom-right side of the screen in the return manager. To display the number of returns in the return manager, click Show number of returns.

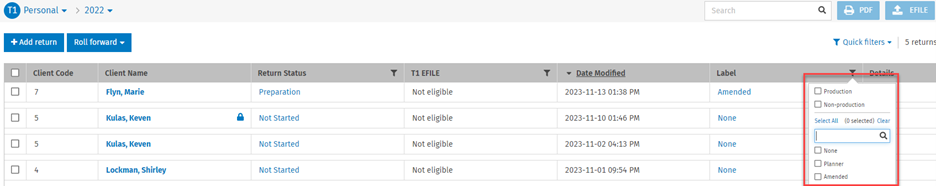

PDF naming convention improvements

Additional syntax available to customize PDF naming conventions:

-

Label (Pro only)

-

Details

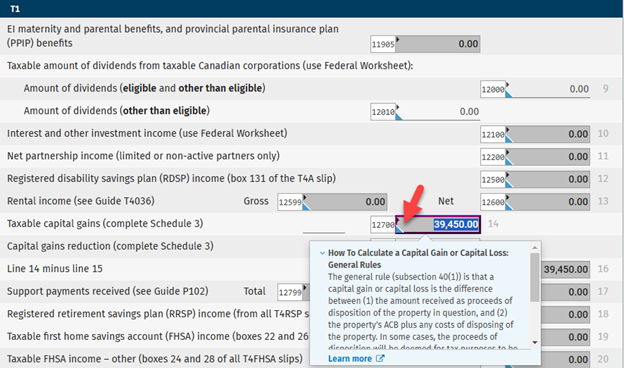

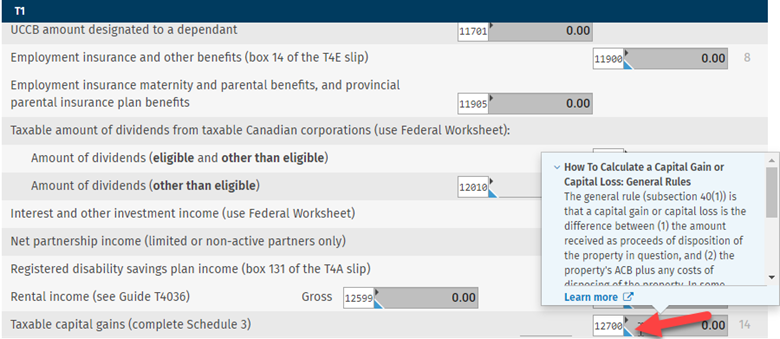

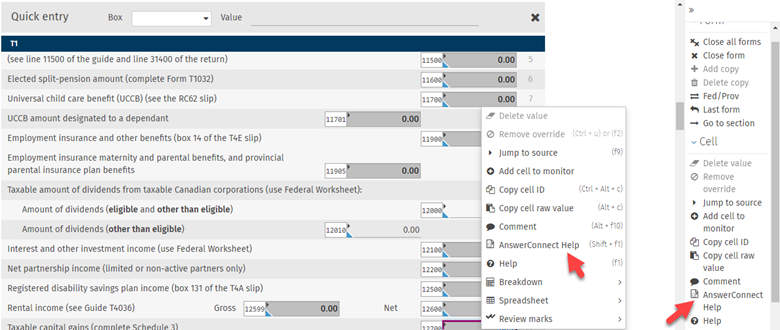

Integration with CCH AnswerConnect now allows access to topics from a cell or a form

In addition to accessing a CCH AnswerConnect topic from a cell, it is now possible to open a relevant CCH AnswerConnect topic related to a tax form. To do that, open the right pane and click the AnswerConnect Help option under the Form section.

The behaviour to view or open a CCH AnswerConnect topic from a cell has not changed. All cells with a blue triangle icon are integrated with CCH AnswerConnect.

You can quickly identify these links to CCH AnswerConnect by looking for the blue triangle icon located in the left corner of the form field. A preview of the content will appear when you hover over the link:

If you want to see the entire topic in CCH AnswerConnect, you can use one of the following methods:

-

Click Learn more from the preview;

-

Use the Shift + F1 shortcut from the field;

-

Use the contextual menu (right-click) from the field;

-

Use the right pane link.

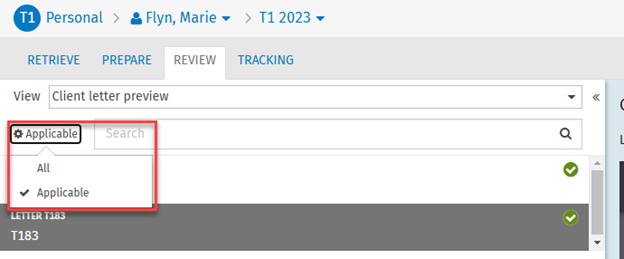

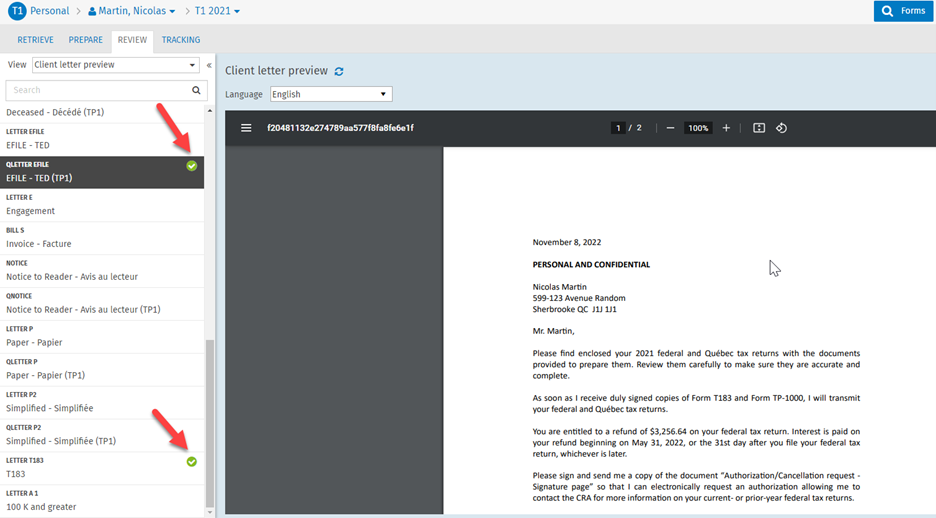

Ability to display only applicable letters inside a return

From the Review tab > Client letter preview, it is now possible to display only the applicable letters by clicking the gear icon and selecting Applicable:

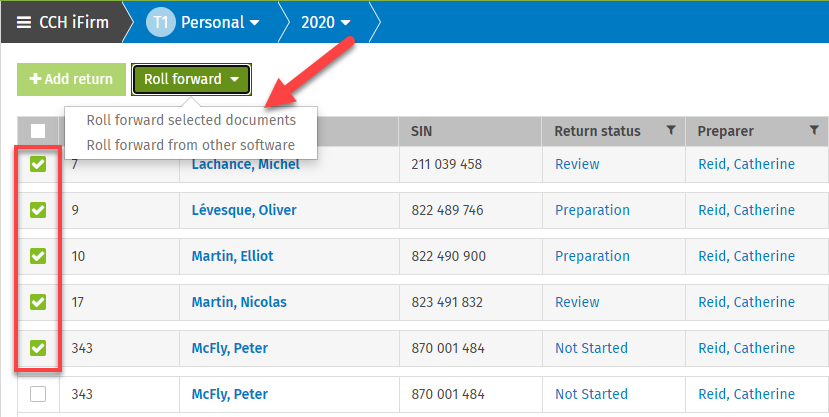

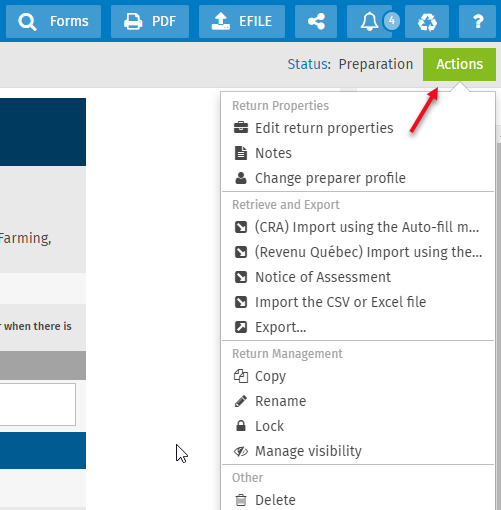

Ability to roll forward from an open tax return

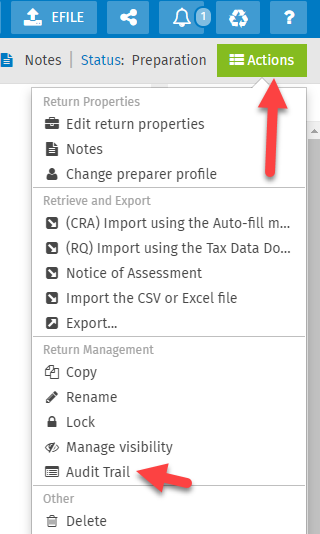

In addition to rolling forward a tax return from the return manager, it is now possible to roll forward a tax return directly from an open tax return. To do this, click Actions > Roll forward. Once the tax return is rolled forward, a notification will be displayed.

Support of additional metadata when importing a Taxprep on-premise file

When importing a Taxprep on-premise file into CCH iFirm Taxprep, the following additional metadata is retained:

-

Return’s notes (F11)

-

Cells’ comments (attached notes)

-

Predefined return statuses. Please see the Import Taxprep Files help topic to view the list of supported return statuses.

-

Lock of the return

CCH iFirm Taxprep Advanced and Pro Only

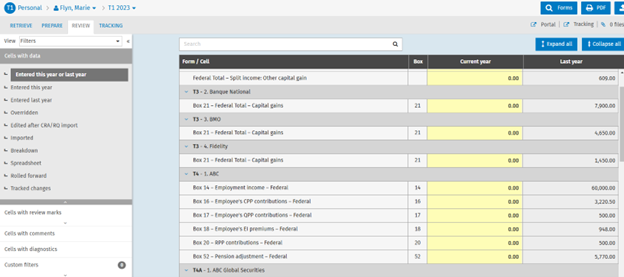

Last year’s input fields are highlighted in yellow, including in the Review tab

When a tax return is rolled forward to a subsequent tax year, all fields that had a value in the previous year and are empty in the current year are highlighted in yellow. The Review tab now behaves the same way as a form, and these fields are also highlighted in yellow:

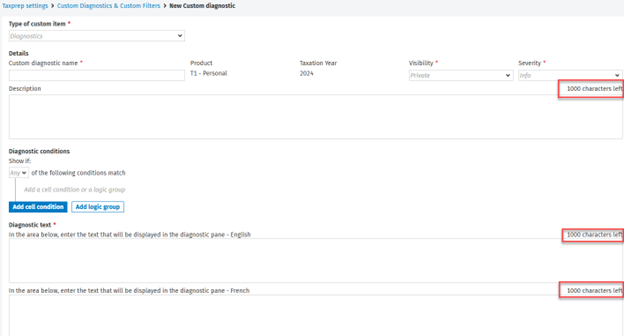

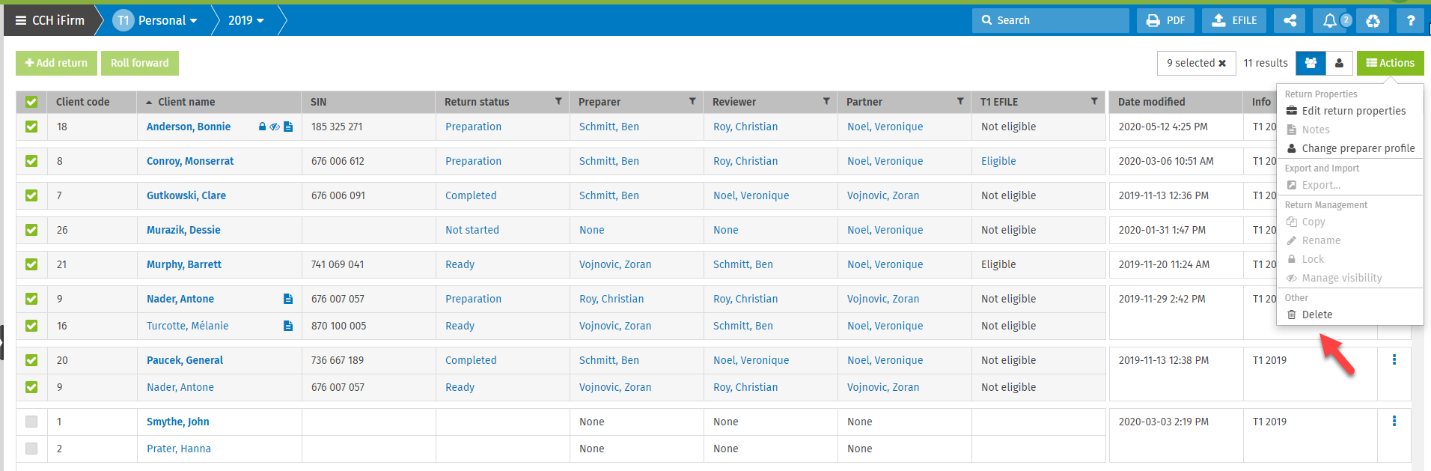

Custom diagnostic and custom filter descriptions

Description fields for custom diagnostics and custom filters now support up to 1,000 characters.

CCH iFirm Taxprep Pro Only

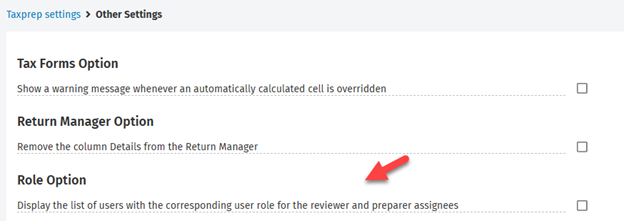

Ability to filter the list of preparers and reviewers when selecting assignees for a tax return

The option Display the list of users with the corresponding user role for the reviewer and preparer assignees has been added to Settings > Taxprep > Other Settings. This option allows you to display the list of users that only have the preparer or reviewer role when you select assignees for a tax return.

Note: To configure roles and assign them to your users, click Settings > Users > Manage Roles.

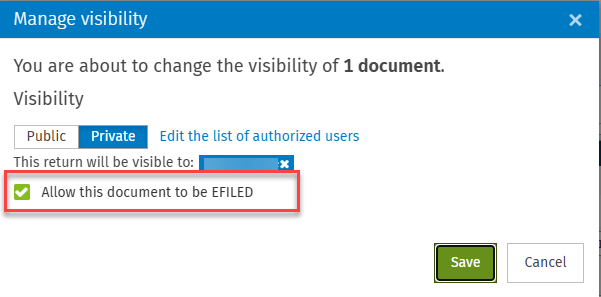

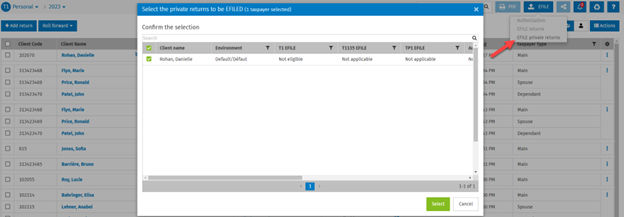

Manage visibility feature improvements

When the Manage visibility feature is used to produce a personal or a private return, another user can EFILE the return without having access to its content. This new option is helpful when a user is preparing a personal return but doesn’t have the rights to EFILE the return.

The Manage visibility modal now includes the option Allow this document to be EFILED. When selected, any user in your firm with the Tax – Returns – Manage visibility – EFILE security role can EFILE private returns from the return manager without being able to open them or view their content.

The following security roles are required to EFILE private returns:

-

Tax – T1 – Returns – EFILE

-

Tax – T2 – Returns – EFILE

-

Tax – Returns – Manage visibility – EFILE

Users with the required security roles are now able to EFILE private returns from EFILE > EFILE private returns:

Changes to the partner assignee are now restricted under a specific security role

The following security role is required to modify a partner assignee inside an existing CCH iFirm Taxprep return: Tax – Returns – Edit all cells of the contact.

Web API additional endpoints

-

Get list of return manager customer filters

This endpoint retrieves the list of all return manager custom filters and custom diagnostics that are available for a given product and year.

-

Publish to Portal

These endpoints publish a batch of documents or slips by printing them to PDF, then publishing them to the corresponding portal. For more details, see the Publish Endpoints help topic.

-

Set label

This endpoint assigns a label to a document or a batch of documents for the product specified in the URL of the endpoint. For more details, see the Labels Endpoint help topic.

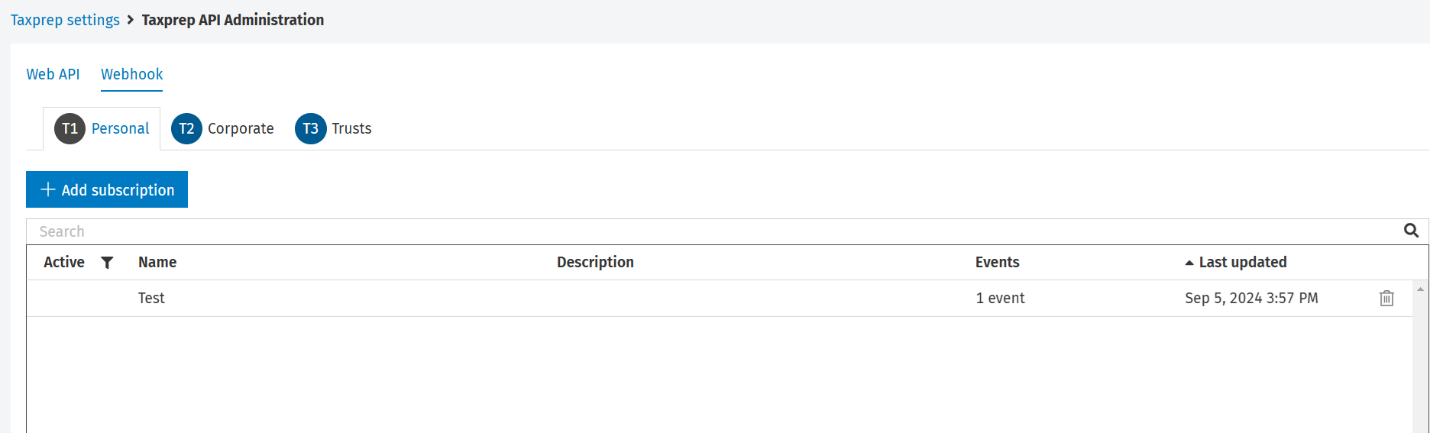

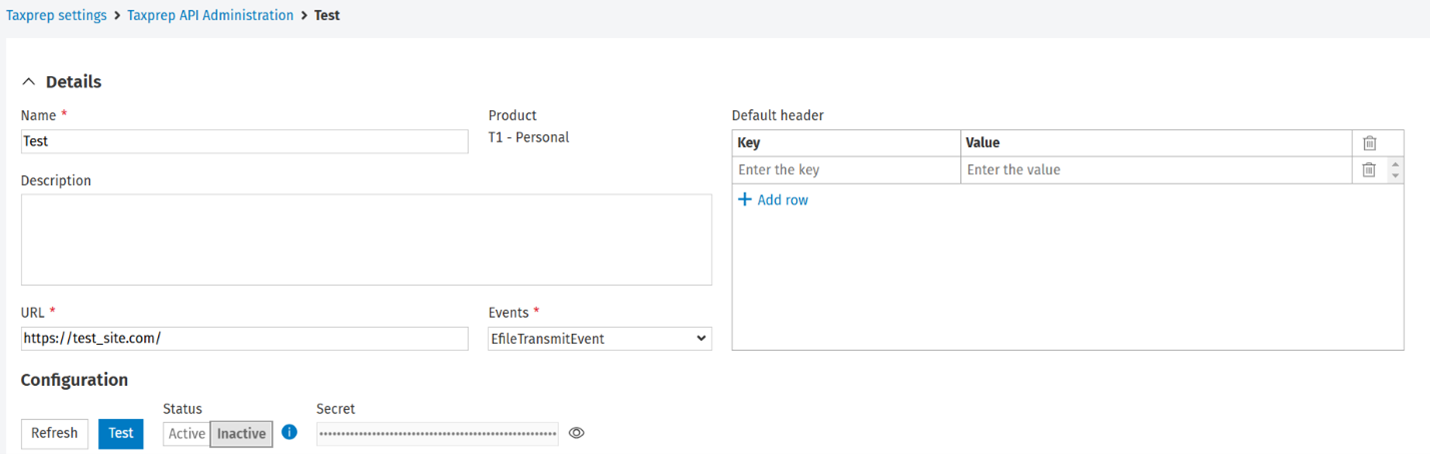

Webhook-based notifications for main electronic transmissions

Webhook-based notifications for status changes (acceptance or rejection) of the following main electronic transmissions are now included in the existing CCH iFirm Taxprep Web API offering: T1 (federal), TP1 (Québec), T2 (federal), AT1 (Alberta), CO-17 (Québec) and T3 RET (federal).

In order to enable webhook-based notifications from Settings > Taxprep > Taxprep API Administration, a new subscription should be created:

Within a subscription, a destination URL linked to a web application to be notified of EFILE status changes should be provided. The authentication is based on a secret key generated by a CCH iFirm administrator per subscription and can be used to validate webhook notifications at the destination URL.

Note that in order to activate a subscription, a successful webhook event should be sent to the configured destination web application.

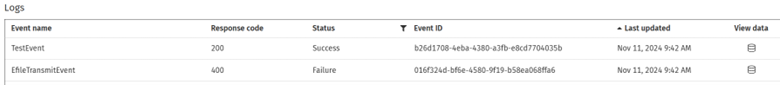

A recently sent webhook notification event and its corresponding status are available in the Logs section for every active subscription:

For more information, including the properties received when an event is triggered, see the About CCH iFirm Taxprep Webhook help topic.

July 23, 2024 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

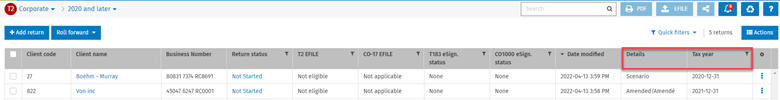

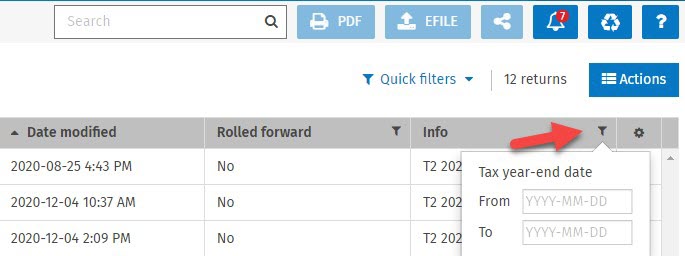

T2, T3 and TF most recent returns are grouped into a single return manager entry

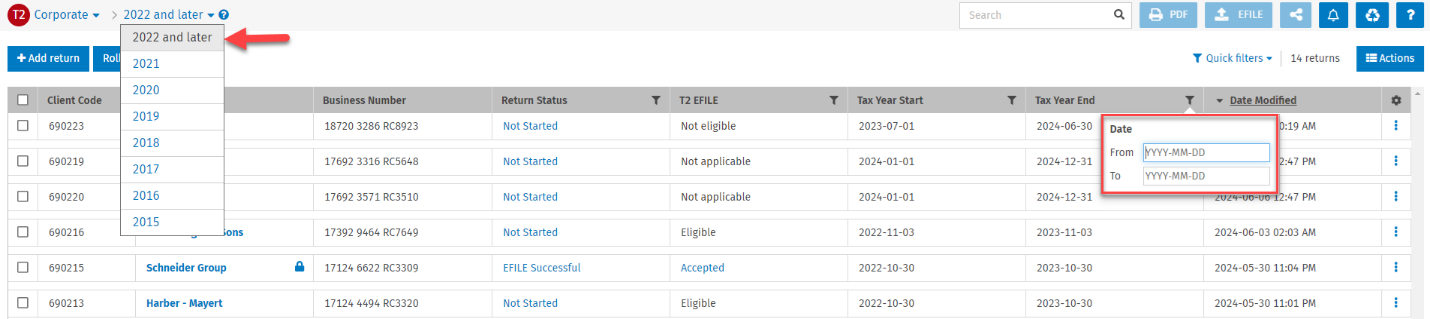

T2 return manager:

The return manager groups the 2022 and following tax years into a single entry. The returns are displayed based on the tax year start date.

The years included in the most recent return manager will be updated once per year.

In addition, the Tax Year column has been separated in two columns:

-

Tax Year Start

-

Tax Year End

These two columns allow you to view the tax year start and end dates of a return and filter returns based on that information.

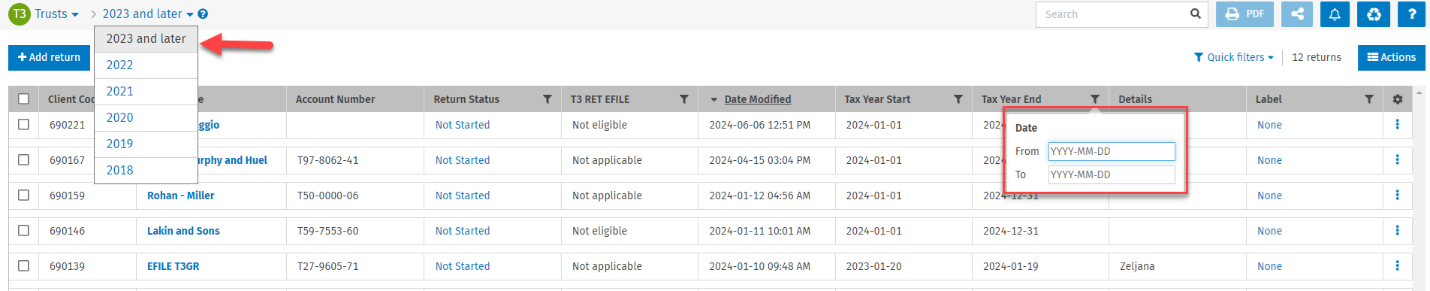

T3 and TF (Forms) return manager:

The return manager groups the 2023 and following tax years into a single entry. The returns are displayed based on the tax year end date.

The years included in the most recent return manager will be updated once per year.

In addition, the Tax Year column has been separated in two columns:

-

Tax Year Start

-

Tax Year End

These two columns allow you to view the tax year start and end dates of a return and filter returns based on that information.

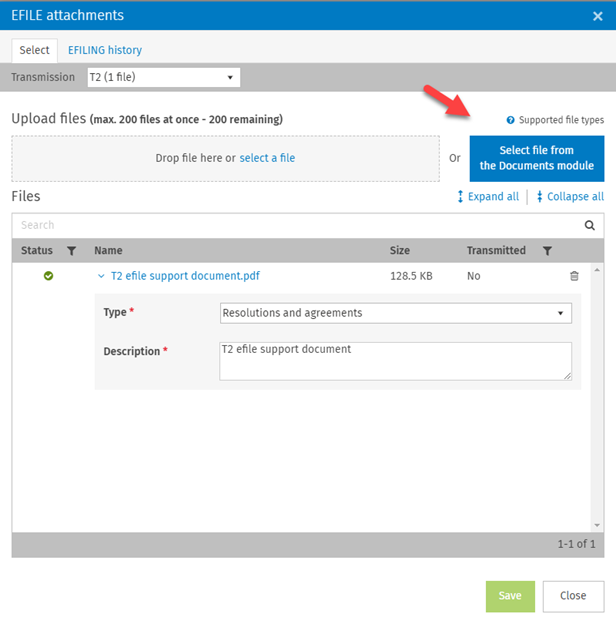

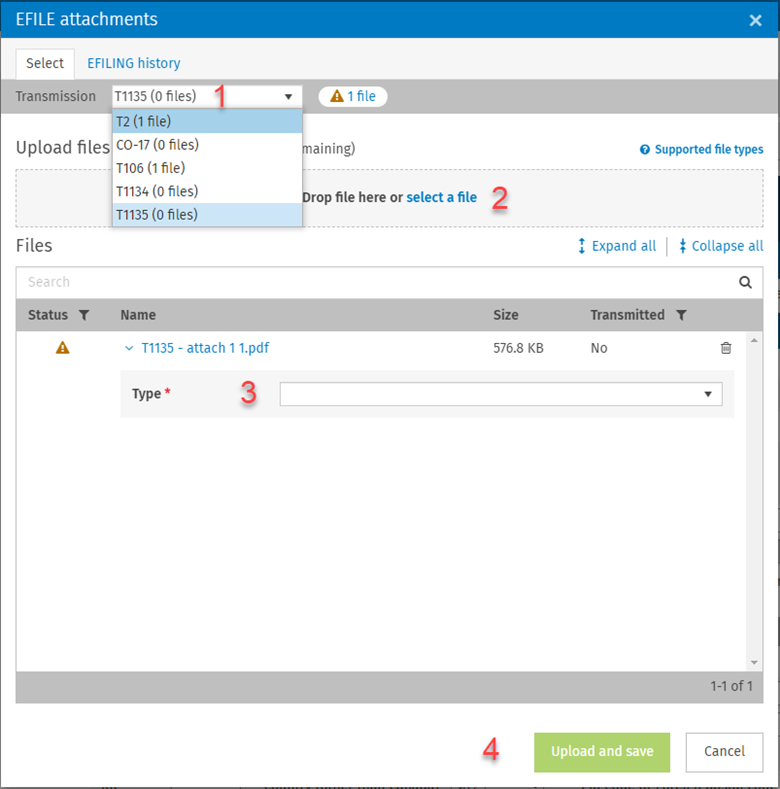

Ability to attach EFILE support documents from the CCH iFirm Documents module

EFILE support documents can be attached directly from the CCH iFirm Documents module.

June 7, 2024 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

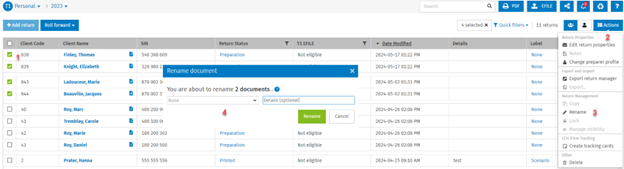

Ability to apply labels and details in bulk

Label and details can be applied or modified in bulk:

-

Select the returns for which the label and/or the details should be applied or modified.

-

Click the Actions button.

-

Click Rename.

-

Select the label and/or add details.

May 17, 2024 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

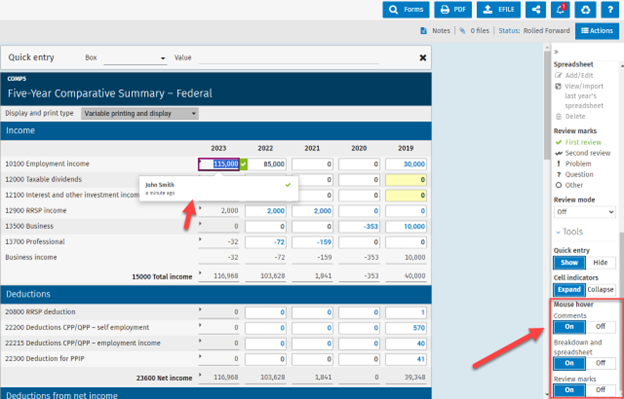

Hide information displaying on mouse hover

The cell metadata on mouse hover can now be enabled or disabled based on user preferences.

The section Mouse hover has been added to the right pane, allowing you to enable or disable the mouse hover for the following cell metadata:

-

Comments

-

Breakdowns and spreadsheet

-

Review marks

By default, the mouse hover will be enabled, and when hovering over a cell, information related to the added metadata will be displayed.

To disable the mouse hover, select Off for the metadata for which you do not want to see information on mouse hover:

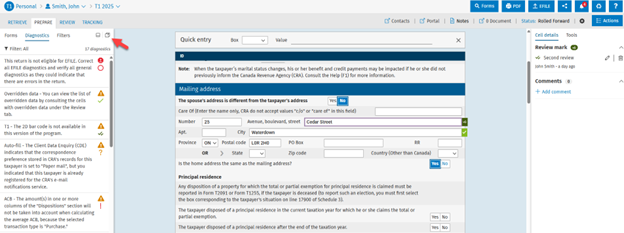

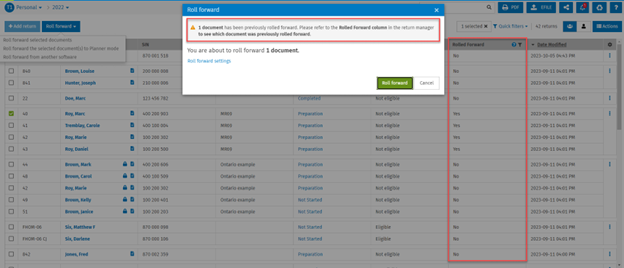

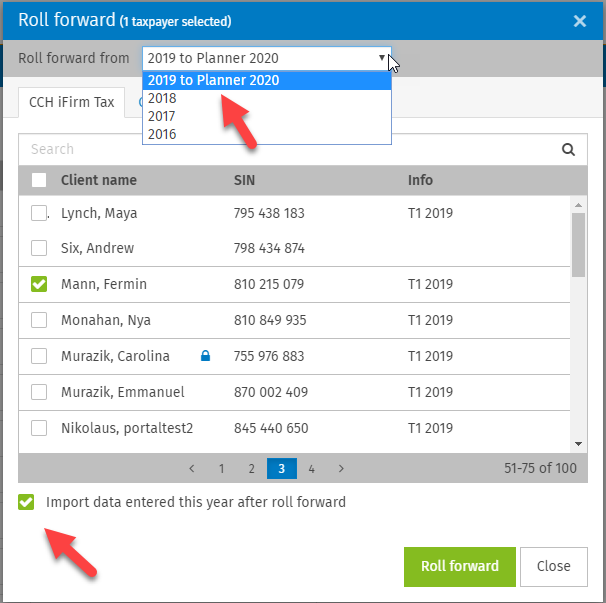

Warning message advising you that a tax return has already been rolled forward

In addition to the existing Rolled forward column that indicates if the tax return has been rolled forward to the subsequent year, a warning message has been added to advise you that the selected tax return(s) have already been rolled forward:

1 document has been previously rolled forward. Please refer to the Rolled Forward column in the return manager to see which document was previously rolled forward.

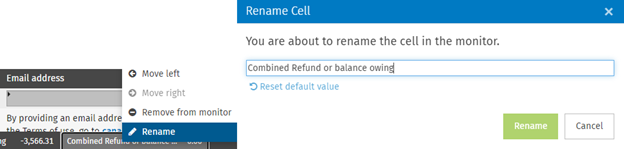

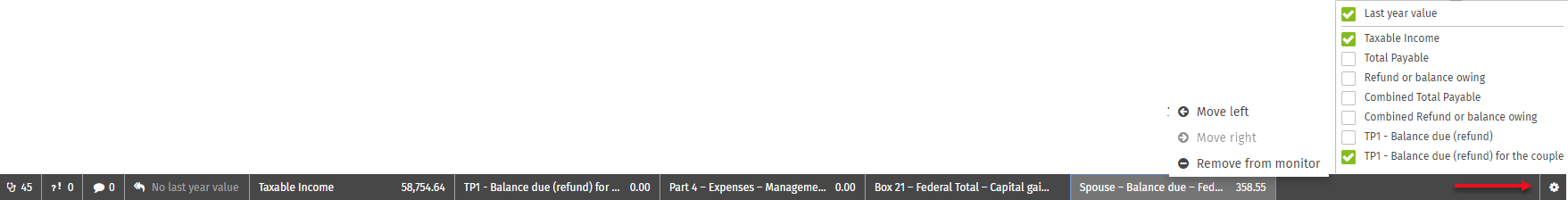

Customize the name of cells in the monitor

You can now customize the name of cells present in the monitor’s status bar.

To change the name of a cell in the monitor, right-click the cell that you want to modify and click Rename. Enter the new desired name and confirm the change.

Reset default value allows you to revert to the default description of the cell.

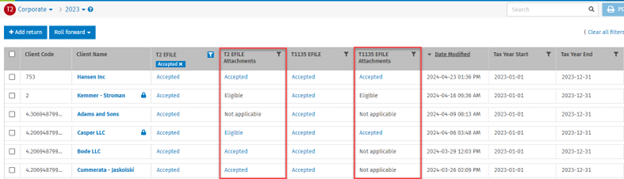

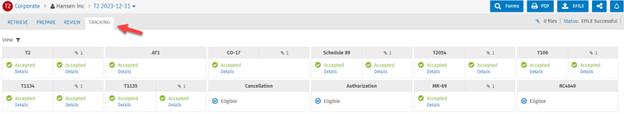

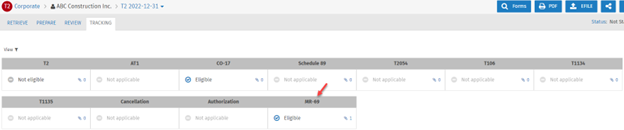

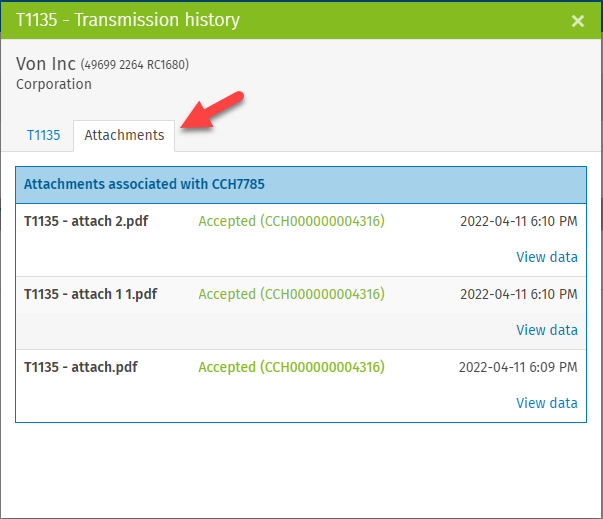

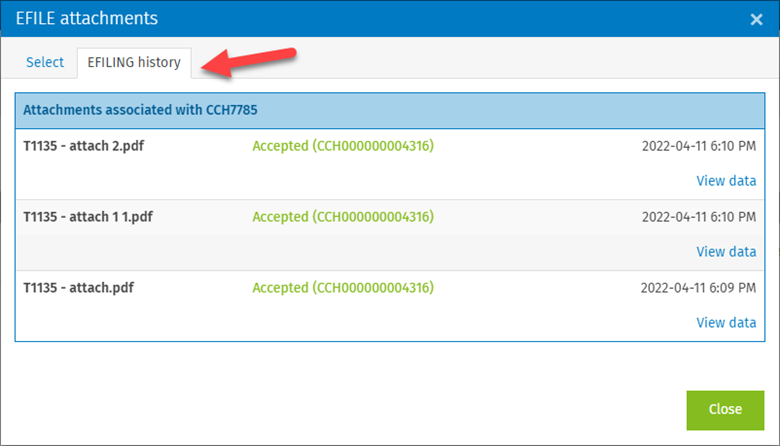

EFILE attachments status is presented in distinct columns

In the return manager and the Tracking tab of an open tax return, the EFILE attachments status is presented separately from the main electronic transmission. For example, in the return manager, the T2 EFILE and T2 EFILE Attachments columns show the EFILE status of both transmissions separately. By having separate columns, it is now possible to filter the returns based on the EFILE attachments status and access from the return manager the EFILE attachment transmission history by clicking the linked EFILE status.

In the Tracking tab of an open tax document, all supported EFILE attachments are presented in the different columns, allowing you to see their EFILE statuses.

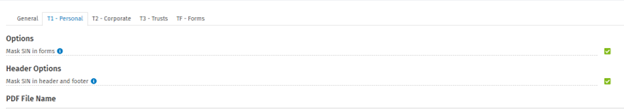

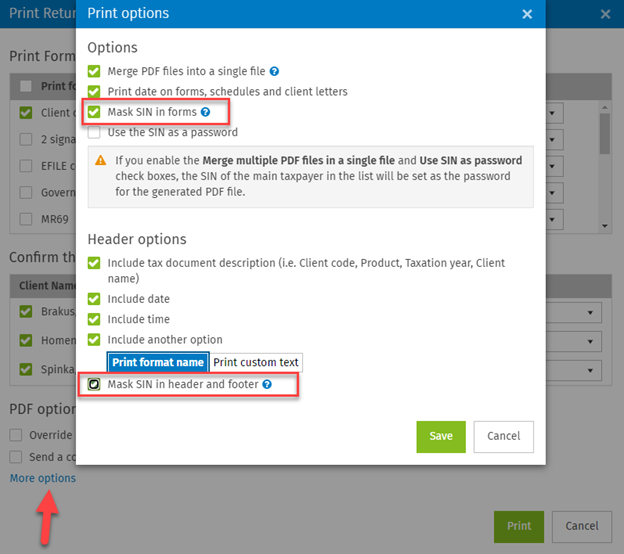

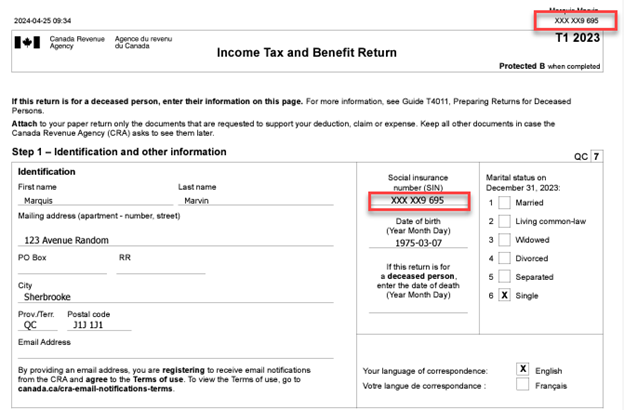

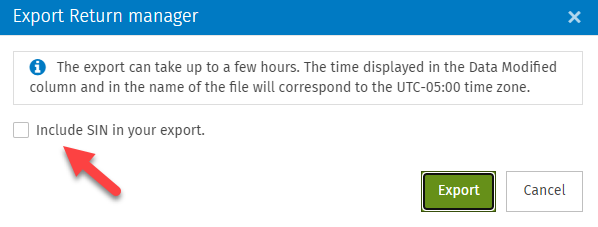

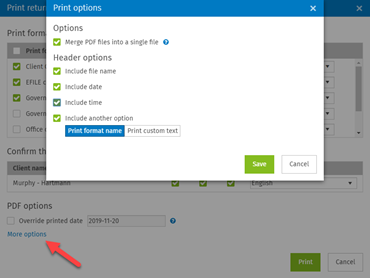

PDF customization improvements

Ability to partially mask the social insurance number when printing T1 forms

In Settings > Taxprep > Customize PDF File > T1 – Personal, two options have been added, allowing you to mask the first five digits of the social insurance number (SIN) when printing a T1 return or a T1 form:

-

Mask SIN in forms

-

Mask SIN in header and footer

Note that these options are not selected by default.

The options can be modified when printing or publishing a return or a form by clicking the More options link.

Note that due to CRA and Revenu Québec restrictions, the SIN cannot be masked on all forms. Please click here for more information.

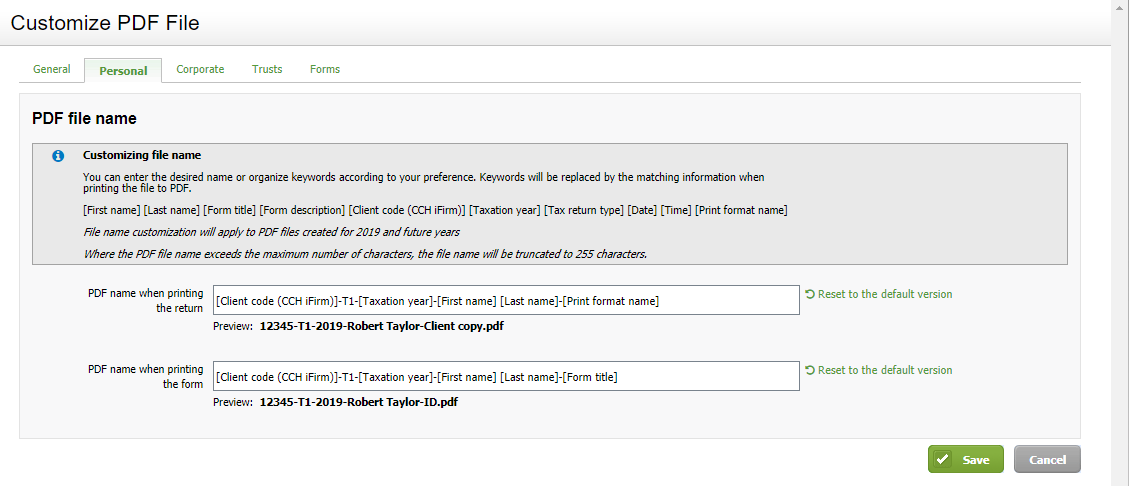

Customizing PDF naming conventions for notices of assessment

In addition to customizing PDF names when printing a return or a form, it is now possible to customize PDF names when printing T1 or T2 notices of assessment from Settings > Taxprep > Customize PDF File > T1 – Personal or T2 – Corporate.

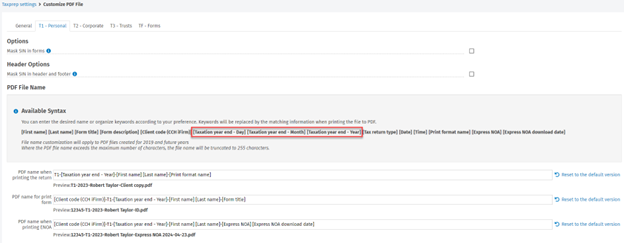

Additional syntax available to customize PDF naming conventions

The Taxation year syntax has been divided in three different parameters, providing more flexibility for the customization of PDF naming conventions:

-

Taxation year end – Day

-

Taxation year end – Month

-

Taxation year end – Year

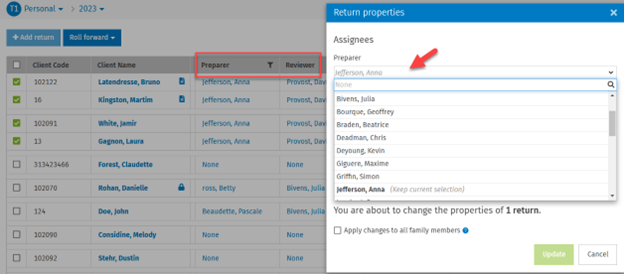

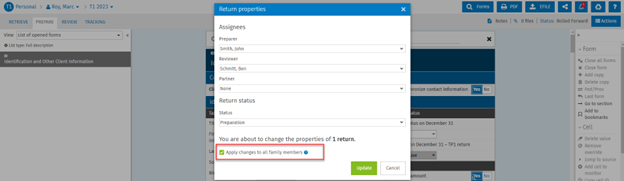

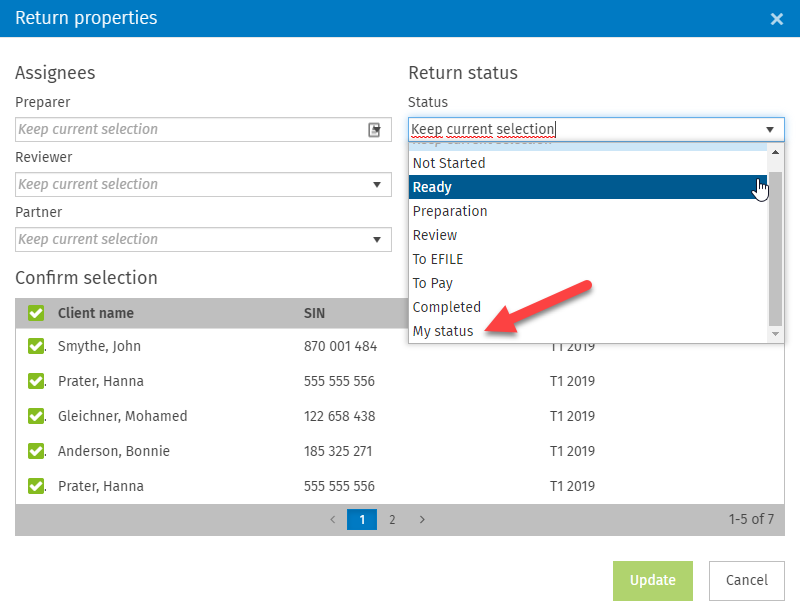

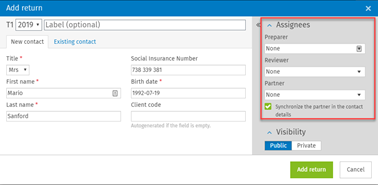

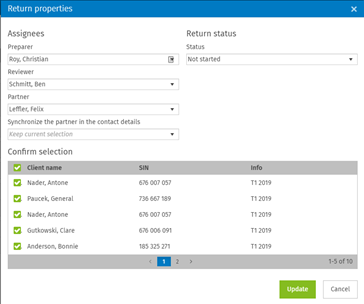

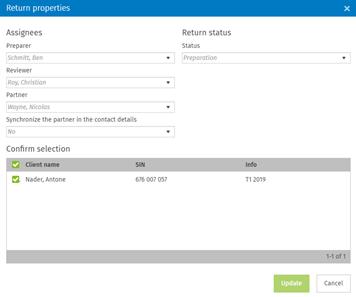

Ability to apply assignees and return statuses to all family members simultaneously

Note: The ability to apply assignees to all family members simultaneously is only available with the Pro package.

When working in a return, a user can modify the assignees and the return status for all family members simultaneously. The option Apply changes to all family members has been added to the Return properties modal, allowing to apply the changes for assignees and the return status for all family members simultaneously.

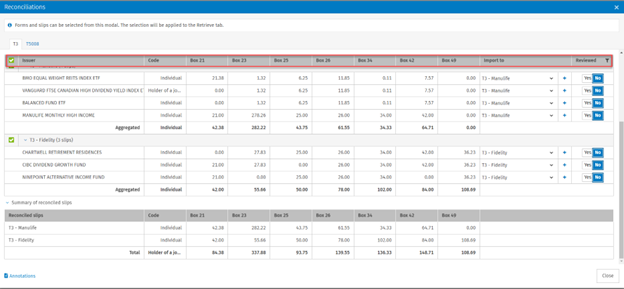

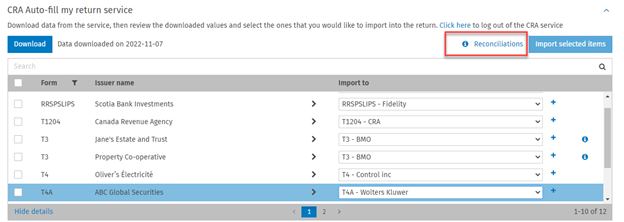

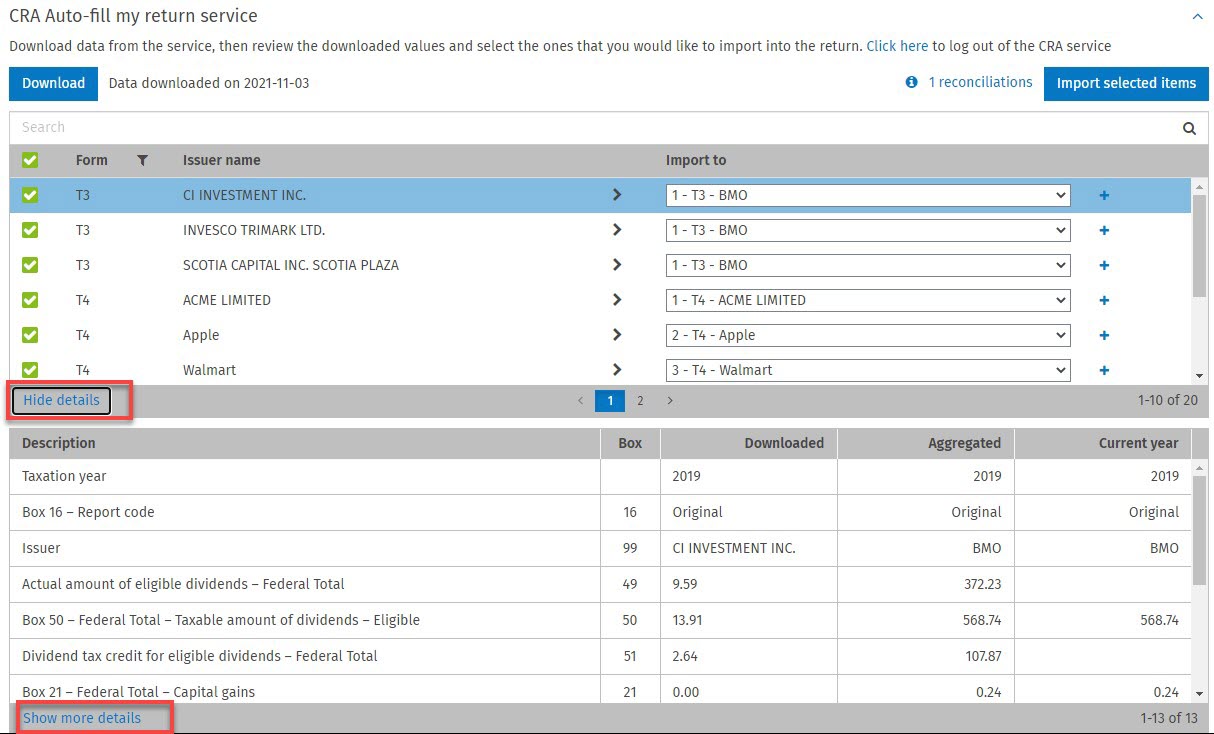

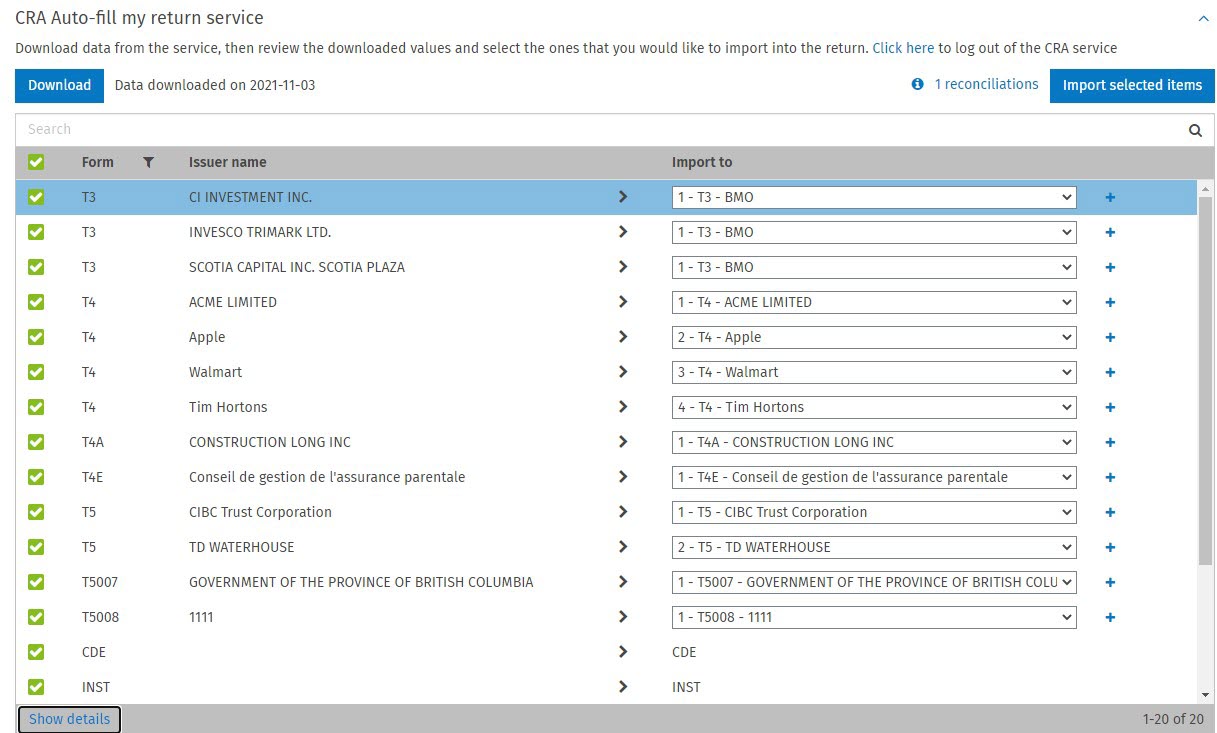

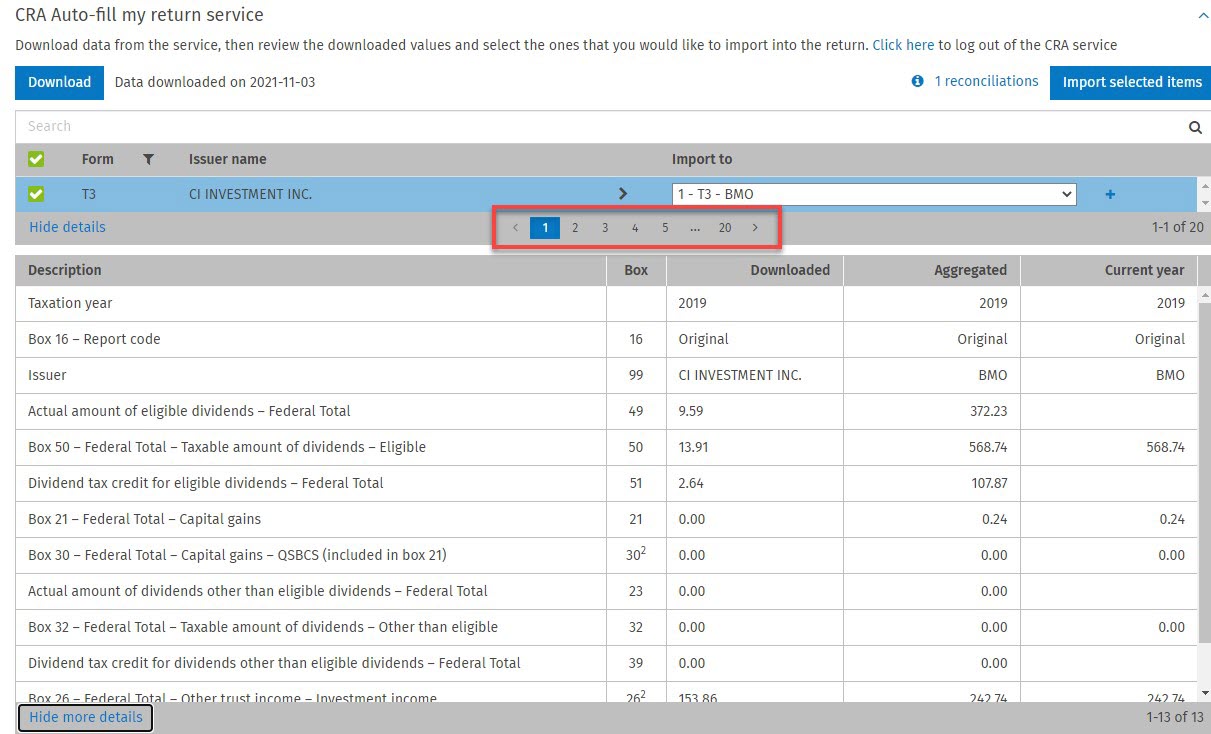

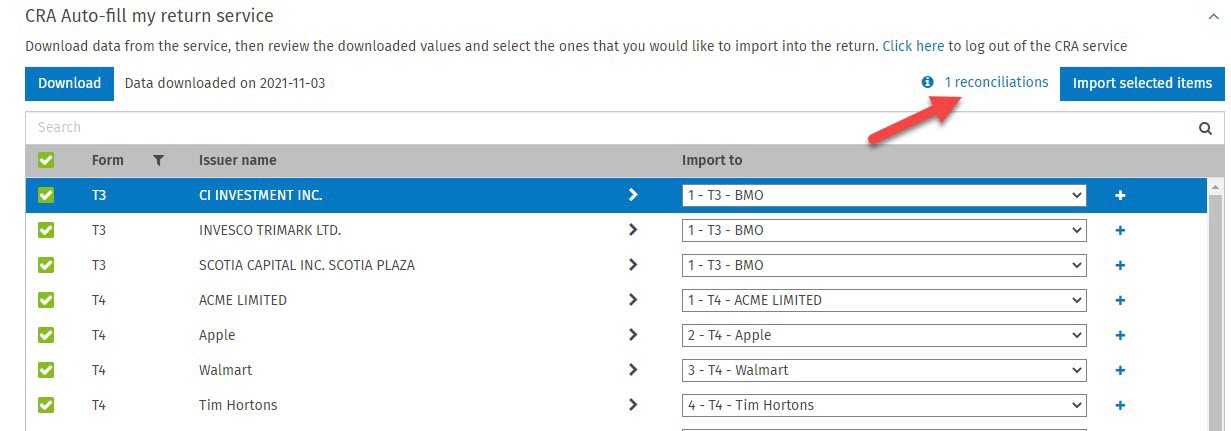

The header in the Auto-fill-my return reconciliations modal is always visible

The header in the Auto-fill my return reconciliations modal is now always visible when you scroll down in the dialog box, allowing you to see the name of each column:

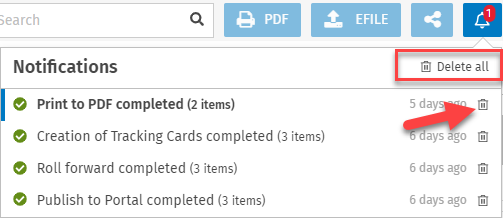

Ability to delete notifications

The notifications that appear in the notification centre can now be deleted. You can choose to delete all notifications by clicking Delete all or individual notifications by clicking the Delete icon at the top right of each notification.

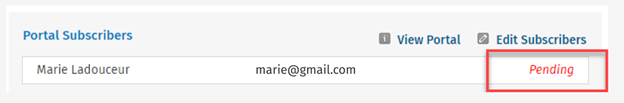

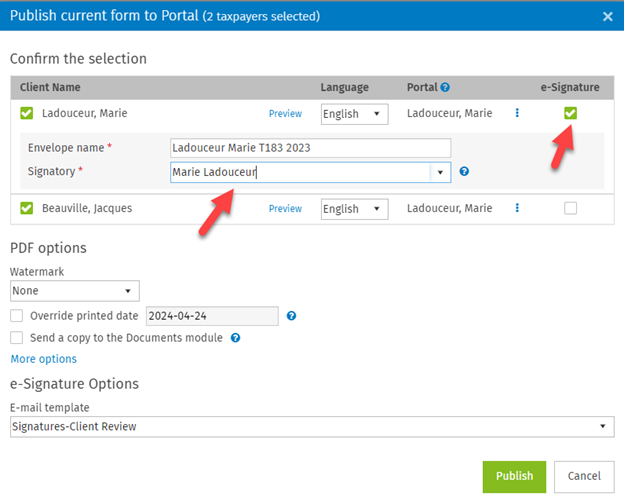

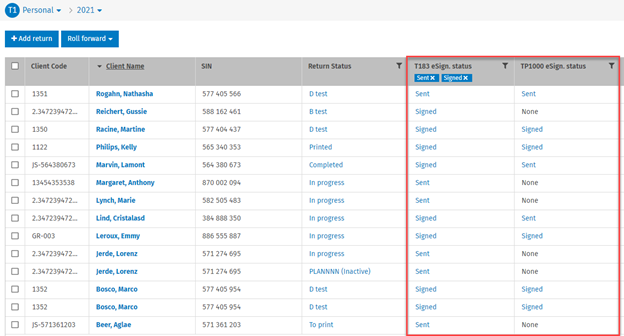

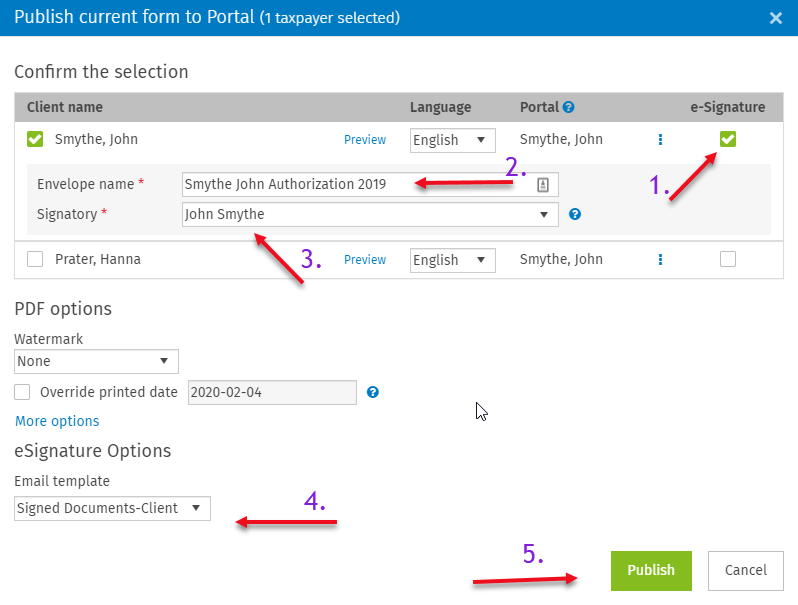

The digital signature can be published even when the state of the portal invitation is Pending

The forms can be published for digital signature even when your client has not accepted the CCH iFirm Portal invitation yet.

CCH iFirm Taxprep Advanced and Pro Only

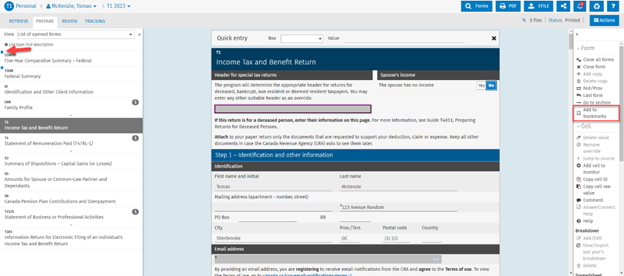

Ability to bookmark forms for all products

You can now bookmark forms for all products. These forms will open automatically when creating or opening a return and will always be displayed on top of the list of forms.

To add a form to your bookmarks, click Add to bookmarks in the right panel of the return.

A ribbon will be added to the top left corner of the bookmarked forms’ names.

When a form is added to the bookmarks, the button in the right panel will change to Remove from bookmarks.

You can remove forms from the bookmarks by clicking Remove from bookmarks.

CCH iFirm Taxprep Pro Only

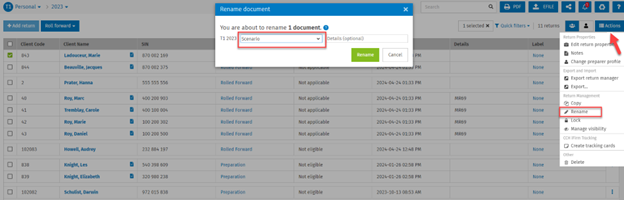

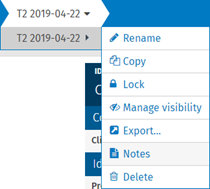

Label feature improvements and modifications

Label moved to Rename document dialog box

The label has been moved from the Return properties modal to the Rename document dialog box in order to be identical to the Details feature. The label can be applied to a tax document from the Actions > Rename dialog box.

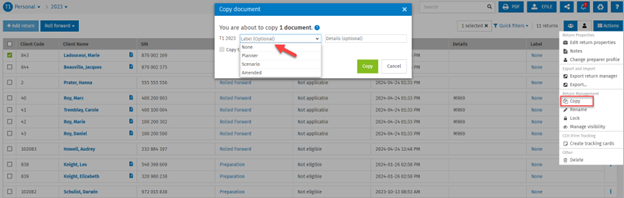

Labels available when creating a copy of a return:

When creating a copy of a return, the label can be applied from the Copy document modal.

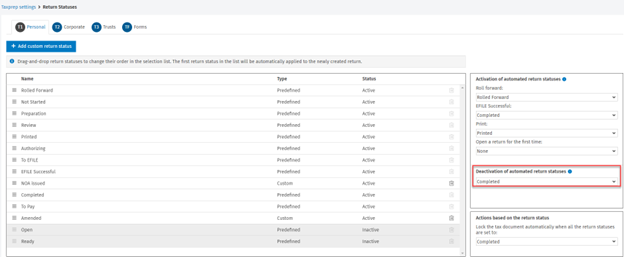

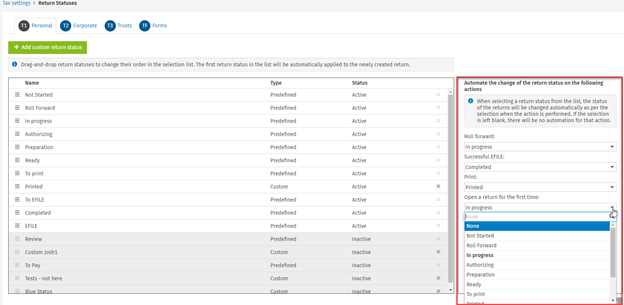

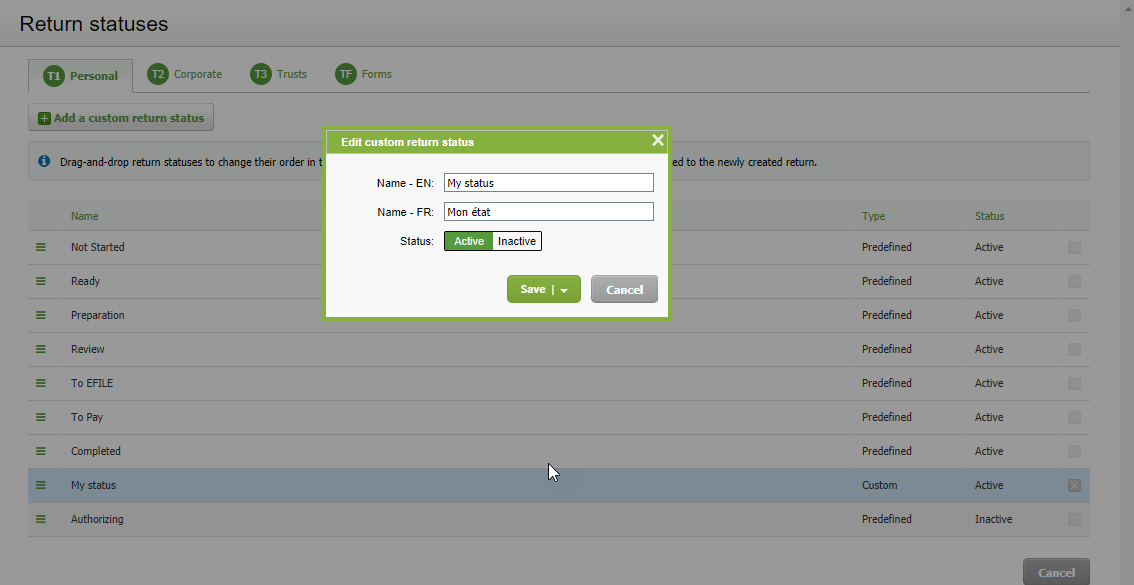

Ability to deactivate automated return statuses when the return reaches a specific preparation step

The Activation of automated return statuses feature allows you to automate the change of the tax return statuses based on four different tax return actions.

The new Deactivation of automated return statuses option provides you with more flexibility by allowing you to deactivate automated return statuses when the return reaches a certain preparation step.

For example, if the automation of the return statuses is set in the following manner:

-

When the return is rolled forward, the return status will change to Rolled Forward.

-

When the return is printed, the return status will change to Printed.

-

When the return is successfully transmitted (EFILE), the return status will change to Completed.

-

The deactivation of automated return statuses is set to Completed.

In the example above, if a user decides to print a return when the return status is Completed, the return status will remain to Completed.

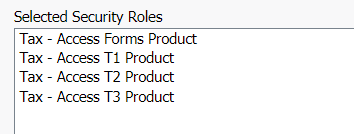

New tax security roles

The following security roles have been added or modified to manage user rights:

EFILE

The Tax – Product – Returns – EFILE, Access transmission history security role has been split in different security roles.

Tax – T1 – Returns – EFILE

Tax – T2 – Returns – EFILE

Tax – T3 – Returns – EFILE

Tax – TF – Returns – EFILE

With these security roles, users can EFILE returns.

Tax – T1 – Returns – Access transmission history

Tax – T2 – Returns – Access transmission history

Tax – T3 – Returns – Access transmission history

Tax – TF – Returns – Access transmission history

With these security roles, users can consult the transmission history specific to each product.

Note: The user to whom the Tax – Product – Returns – EFILE, Access transmission history security role had been assigned will be assigned these two security roles by default.

Add and copy a return

The Tax – Returns – Add and copy security role has been split in two different security roles:

Tax – Returns – Add

With this security role, users can create a tax return.

Tax – Returns – Copy

With this security role, users can copy a tax return.

Note: The user to whom the Tax – Returns – Add and copy security role had been assigned will be assigned these two security roles by default.

Import data using T1/T2 Auto-fill service

Two tax security roles have been added to the Import data using T1/T2 Auto-fill service feature:

Tax – T1 – Returns – Import CRA/RQ Data

Tax – T2 – Returns – Import CRA Data

With these security roles, users can import into a T1 or T2 tax return the data that was downloaded using the CRA’s Auto-fill my return service and Revenu Québec’s Tax Data Download service.

Note that the Tax – T1 – Returns – Import CRA/RQ Data and Tax – T2 – Returns – Import CRA Data security roles will not be assigned by default to any users’ specific security profiles but will be assigned to predefined and custom security profiles.

Web API additional endpoints

-

Delete documents endpoint (POST)

The Delete documents endpoint is now available, allowing you to delete documents and move them to the recycle bin. See the list of endpoints in our Help Centre. -

Couple and Uncouple endpoints (POST)

The Couple and Uncouple endpoints are now available, allowing you to add a spouse or a dependent to a tax return or to uncouple a spouse or a dependent from a tax return. See the list of endpoints in our Hep Centre Centre. -

Get data by using predefined filters from the Review tab (POST)

This endpoint retrieves the value of one or more cells from the document according to the chosen review filter. The filter categories that are supported are Cells with data, Cells with review marks and Cells with comments. See the list of endpoints in our Help Centre.

December 15, 2023 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

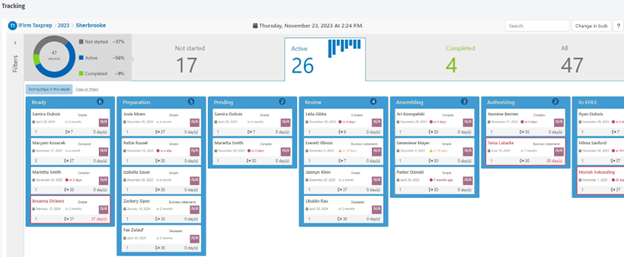

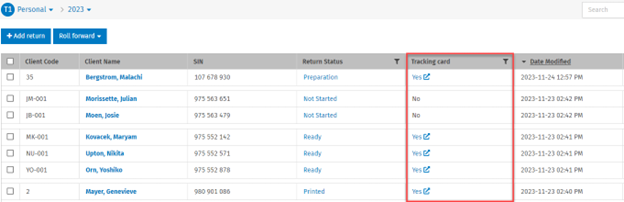

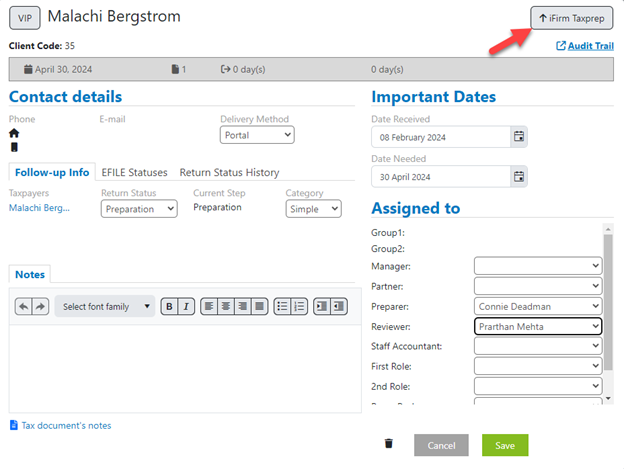

CCH iFirm Tracking now integrated with CCH iFirm Taxprep T1

CCH iFirm Tracking is now integrated with CCH iFirm Taxprep T1 and allows you to analyze your T1 tax season in real time, from anywhere and anytime, and manage your workload more efficiently by creating cards for any T1 tax return.

-

Know in real time if you are on track to complete outstanding returns by their due dates.

-

See visual alerts that let you know when returns remain in a given stage for longer than a set number of days.

-

View the history of all changes made to the Tracking card for any return.

-

Identify over-assigned and under-assigned employees and make changes to balance workloads and reduce bottlenecks.

-

Determine return categories for each return and set complexity levels for each of these categories.

-

Customize CCH iFirm Tracking based on your own workflow by creating every step of your tax preparation process.

For more information about CCH iFirm Tracking, please click here.

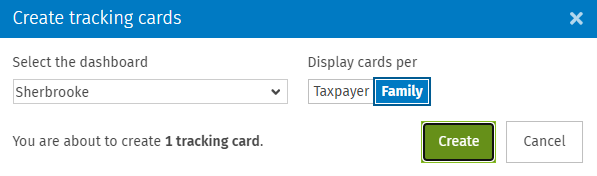

Here are the steps to create a CCH iFirm Tracking card and link it to a tax return:

-

Click the Actions button, followed by Create tracking cards.

-

If you have more than one dashboard, select the dashboard into which the card will be created. Select whether to create a card per taxpayer or per family. If the Family option is chosen, all family members will be included on a single card.

-

Click Create.

When the card(s) have been created, you will be advised from the notification centre.

Note: When a new tax document is created, CCH iFirm Tracking cards can be created at the same time or can be created in bulk from the return manager (up to 100 cards at a time).

Once the tax document is linked with a CCH iFirm Tracking card, the applicable content in the CCH iFirm Tracking card will always be synced with the tax document. For example, if the return status is changed in the card, the tax document in CCH iFirm Taxprep will be updated automatically. Similarly, if the return status is changed in the tax document, the CCH iFirm Tracking card will be updated with the same status.

In the return manager, the new Tracking card column will display Yes if the tax document has a CCH iFirm Tracking card created for it. Click Yes to open the CCH iFirm Tracking card in a separate tab.

From an open tax document, the Tracking icon will display in the breadcrumb, and by clicking it, the CCH iFirm Tracking card for the taxpayer will open in a separate tab.

Similarly, a user can open the taxpayer’s tax document by clicking the iFirm Taxprep button on the CCH iFirm Tracking card.

T4FHSA and RL-32 slips (first home savings account) – Internet file transfer (XML) service transmission

T4FHSA and RL-32 slips (first home savings account) can be electronically uploaded on the federal and provincial websites by using the Filing by Internet file transfer (XML) service. For more information, consult the CCH iFirm Taxprep Forms release note.

December 8, 2023 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

Automatic numbering of slips

Each slip is automatically numbered to better differentiate each slip copy.

Cells added to the monitor are used for subsequent tax years

Any cell added to the monitor will be in effect for subsequent years. As a result, there will be no need to manually add custom fields when the new tax year’s version is released.

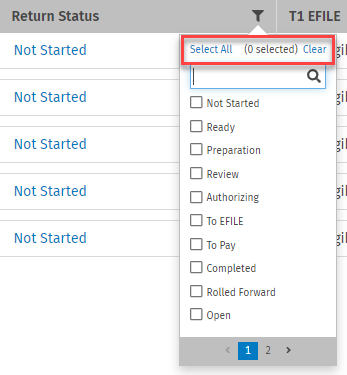

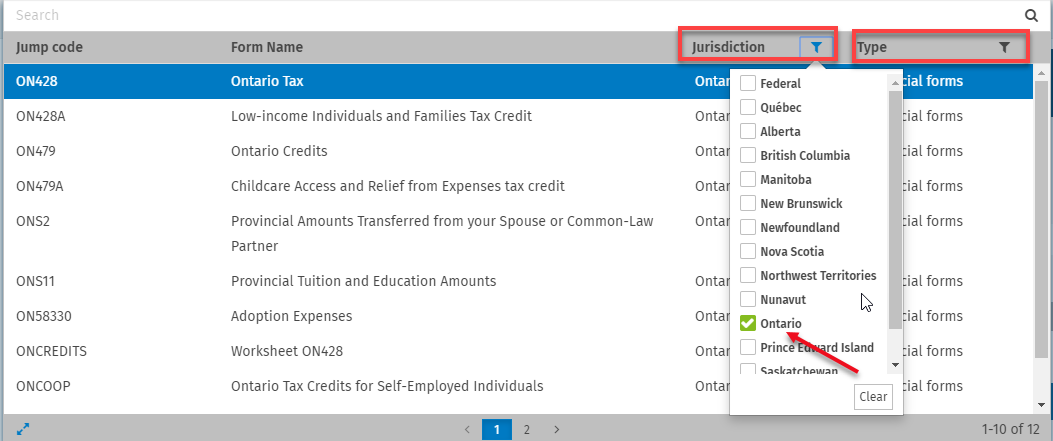

Ability to Select All or Clear a return manager filter

The Filters modal in the return manager contains a new option to Select all or Clear selections in the filters.

Note: This option is not available for the Preparer, Reviewer and Partner roles.

CCH iFirm Taxprep Advanced and Pro Only

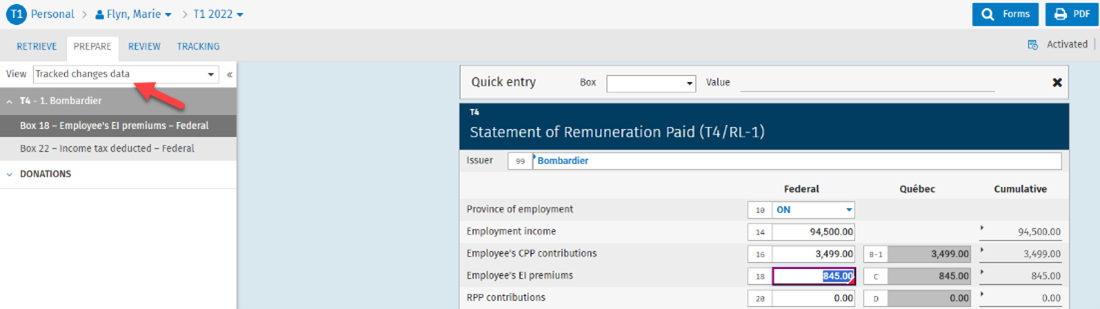

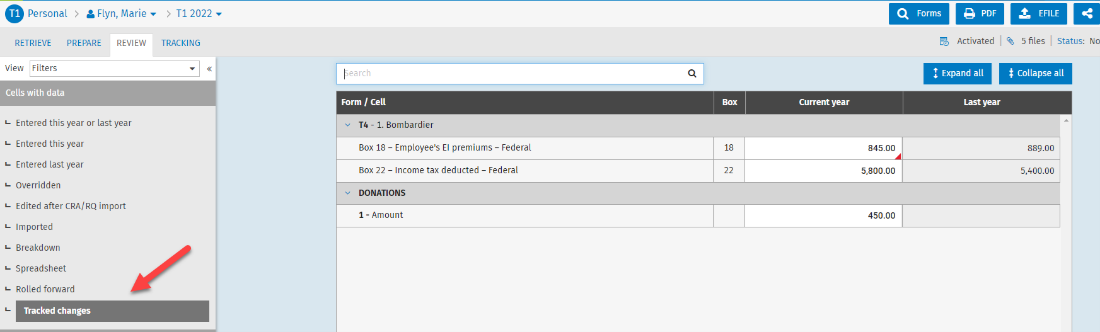

Activate the Track changes feature and identify modified tax data

The Track changes feature allows you to identify a tax value that was modified since Track changes was activated.

To activate Track changes, click the Actions button, followed by Activate Track changes. Once the Track changes feature is activated, any value that is modified in a tax field will be listed in the Tracked changes filter, which is available from the Prepare and Review tabs.

Prepare tab:

Review tab:

Once Track changes is activated, the icon will appear in the breadcrumb.

To stop tracking changes, click the icon in the breadcrumb and deactivate it. Alternatively, from the Actions button, click Deactivate Track changes.

When the Track changes feature is deactivated, the list of modified data will be deleted from the Tracked changes filter.

The following security role is required to activate or deactivate the Track changes feature: Tax – Returns - Activate and Deactivate track changes.

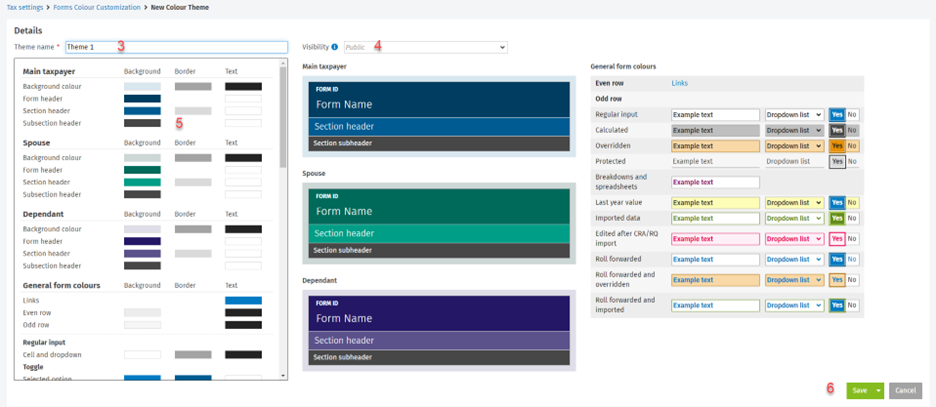

Customize the colours of the tax forms’ components

Customize your tax forms’ colours by creating custom colour themes. Each user can select a preferred theme.

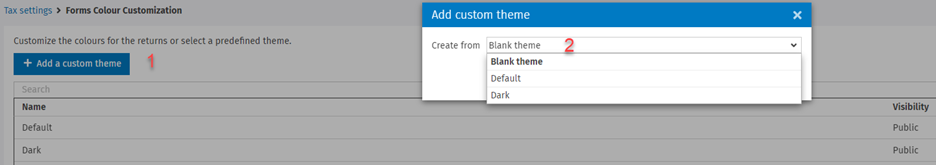

Here are the steps to create custom colour themes:

-

From Settings/Taxprep/Forms Colour Customization, click Add a custom theme.

-

Create the theme from a blank template or from an existing template (predefined or custom).

-

Specify the theme name.

-

Specify the visibility type: Public (visible to all users) or Private (visible to the user who creates it).

-

Change the colours of any of the available components.

-

Click Save.

-

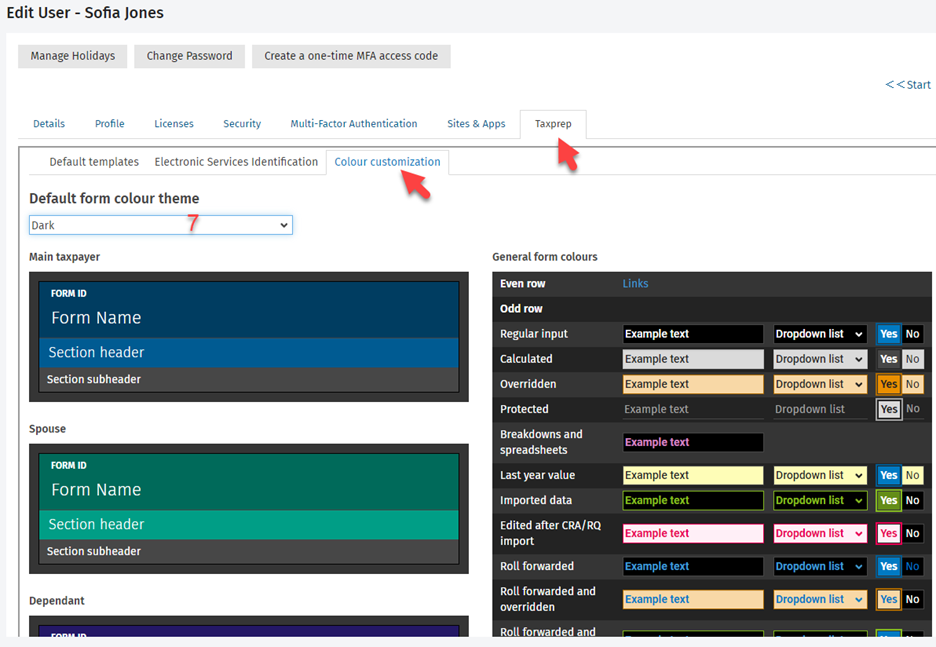

From Settings/Users/Name of the user/Taxprep/Colour Customization, select the desired colour theme and save it.

Two predefined colour templates exist: Default and Dark.

When the user opens a tax document, the selected theme will be applied to the tax forms’ colours.

The following security role is required to create custom themes: Tax – Settings - Forms colour customization.

T2 linked return can be opened even if a user doesn’t have access to all linked returns

When a T2 return is linked to other associated returns (as part of the Import and link corporations feature), a user will be able to open a T2 return even if he or she doesn’t have contact access to all linked returns.

CCH iFirm Taxprep Pro Only

Custom labels allow standardization of the additional details added to a tax document

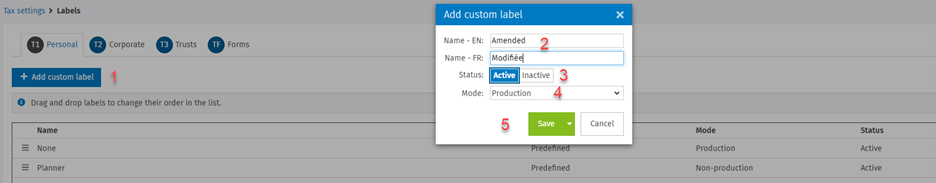

In addition to the Details column that allows you to add additional information to a tax document, the new Label column facilitates the standardization of the list of categories that can be added to a tax document. Here are the steps to create custom labels:

-

From Settings/Taxprep/Labels, create the labels per product by clicking Add custom label.

-

Enter the name of the label.

-

Indicate the status. If the status is Inactive, it will not be possible to apply the label to the tax document.

-

Select the mode. Please see the next note for more details about the mode.

-

Click Save.

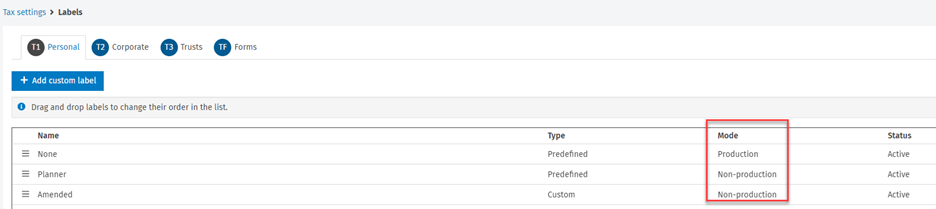

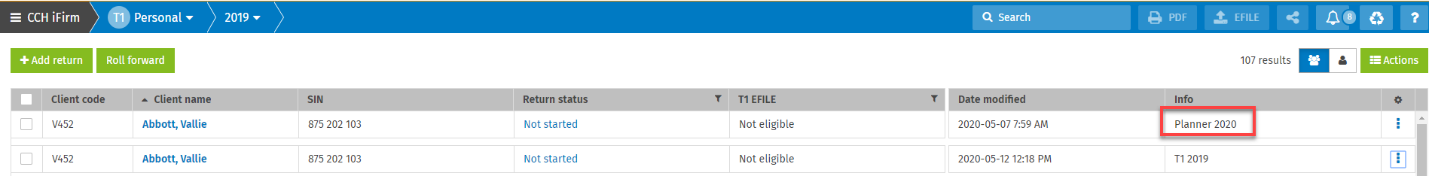

Two predefined labels exist for each product, and these predefined labels can be renamed but cannot be made inactive. For T1, the None and Planner predefined labels are provided, while for the other tax products (T2, T3 and Forms), the predefined labels are None and Scenario.

By default, the None predefined label is applied to all tax documents except T1 planner files, where the Planner label will be applied.

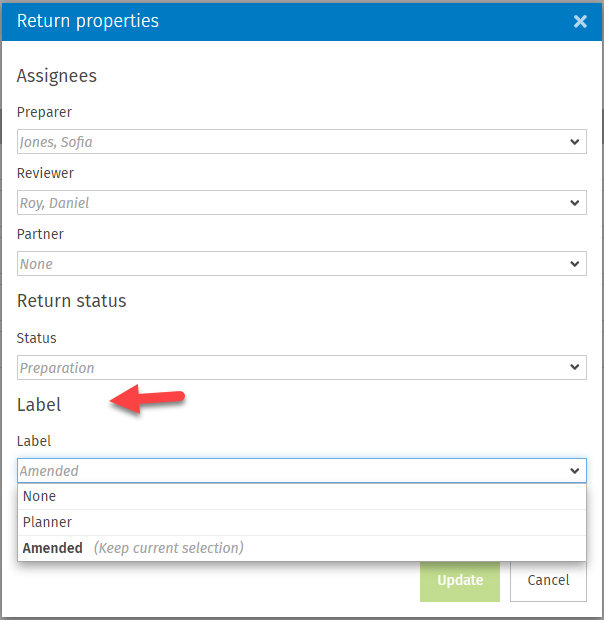

The labels created from the Settings view can be applied to a tax document from the Actions/Edit Return properties modal:

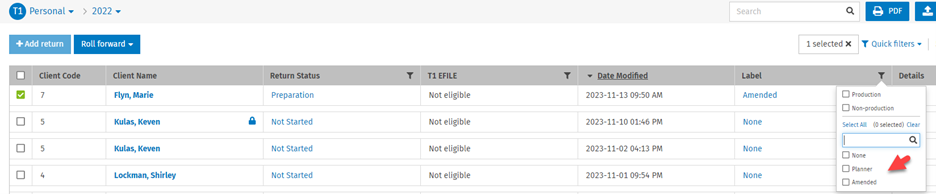

The Label column in the return manager indicates which labels are applied to a return and allows you to filter the returns based on these labels:

The Remove the column Details from the return manager option has been added in Settings/Taxprep/Other Settings, allowing you to hide the Details column for all users. This will force users to use the standardized labels to identify the type of tax document.

Note that even if the Details column is hidden, users will still be able to add a note to any tax document to provide additional information when needed.

The following security roles are required to add, edit or delete labels:

Tax – Settings – Labels – Add, Edit

Tax – Settings – Labels – Delete

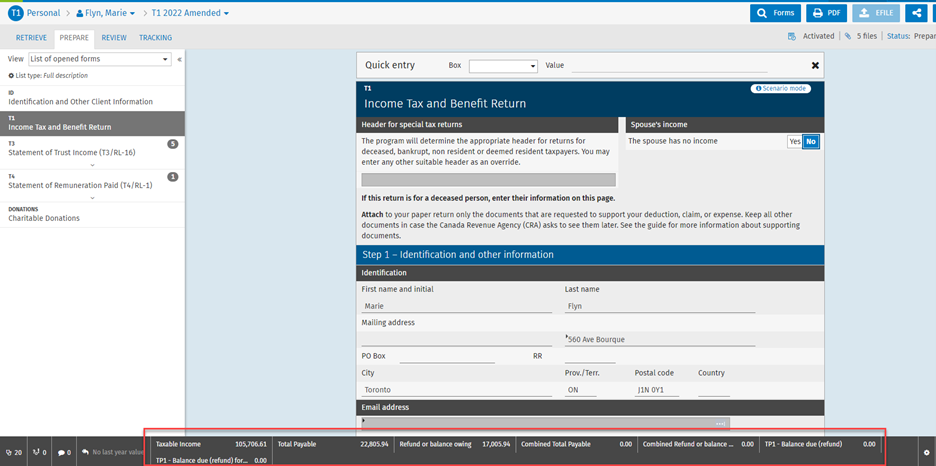

Scenario mode blocks users from production actions in a tax document

Scenario mode can be applied to any tax document created for scenario/planning purposes and will prevent accidentally filing the wrong return to government authorities. Scenario mode can be applied by using labels.

Predefined or custom labels have two modes:

-

Production

-

Non-production

For any custom label, you can decide which mode should be selected.

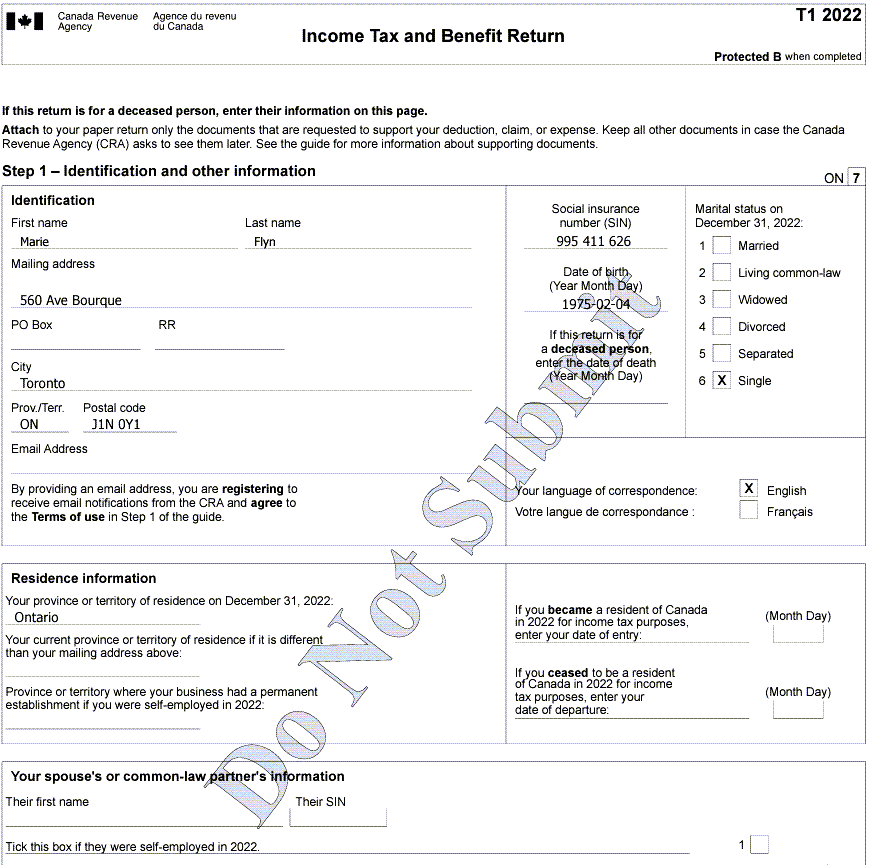

If a label applied to a tax document has a Non-production mode, the tax document will be in Scenario mode and the following will apply:

-

The Scenario mode tag will appear on screen, in the header of any form.

-

The EFILE button will be disabled for that tax document.

-

Any print output will have a Do not submit watermark.

From the return manager, you can filter the tax returns based on the labels or the production type:

Note: The Planner label will be added and the EFILE button will be disabled by default on a T1 tax document that is rolled forward to Planner mode, while the printout will contain the Planner watermark.

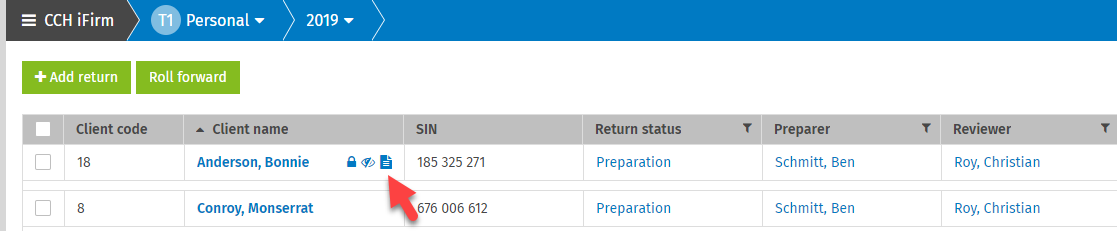

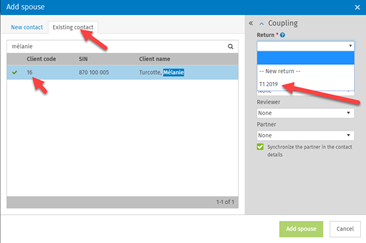

New security roles to manage visibility of SIN or Account Number columns in the return manager

The following security roles were added to allow you to manage the rights to view the SIN column in T1 or the Account Number column in Forms:

Tax – T1 – Return Manager – View SIN column

Tax – TF – Return Manager – View Account Number Column

Without these two security roles, the user will not be able to view the SIN column in T1 or the Account Number column in Forms in the following sections of the application:

-

T1 and/or Forms return manager

-

Existing Contact tab in the Add return modal

-

Roll Forward report from the notification centre

-

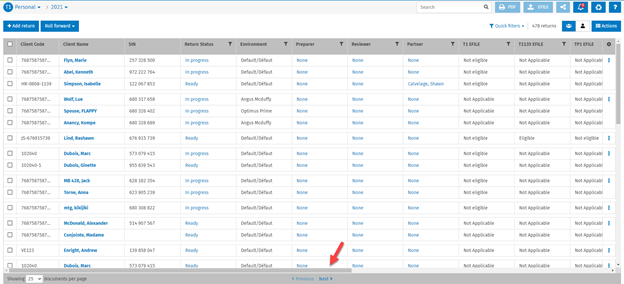

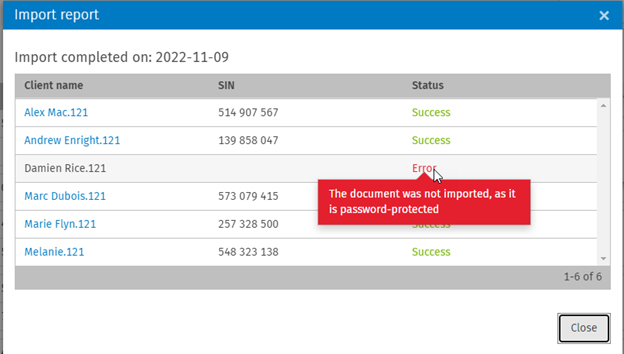

Import report from the notification centre

-

The Select a return modal is accessible in the Import bankruptcy or the Import Statements options from the Retrieve tab (T1 only)

October 6, 2023 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

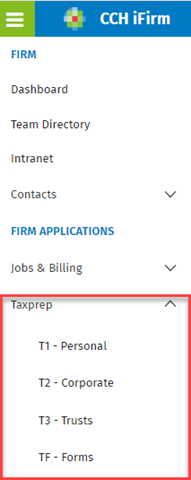

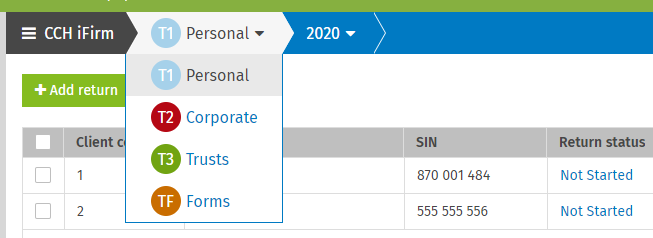

New label for the Tax module

To standardize with other module names, we have changed the label of the Tax module. The left pane in CCH iFirm now displays Taxprep at the first level and under Taxprep, the following products are listed:

T1 - Personal

T2 - Corporate

T3 - Trust

TF - Forms

June 2, 2023 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

Ability to electronically transmit Schedule 89, Request for Capital Dividend Account Balance Verification

The electronic transmission of Schedule 89 is now available.

Schedule 89 is transmitted separately from the T2 return and from Form T2054. However, the electronic transmission of this schedule has been implemented in the program so that the T2 return and Schedule 89 can be transmitted at the same time.

Section Electronic filing has also been added in Schedule 89. The electronic status will be displayed at the end of this section. When the status is Eligible, you can transmit Schedule 89.

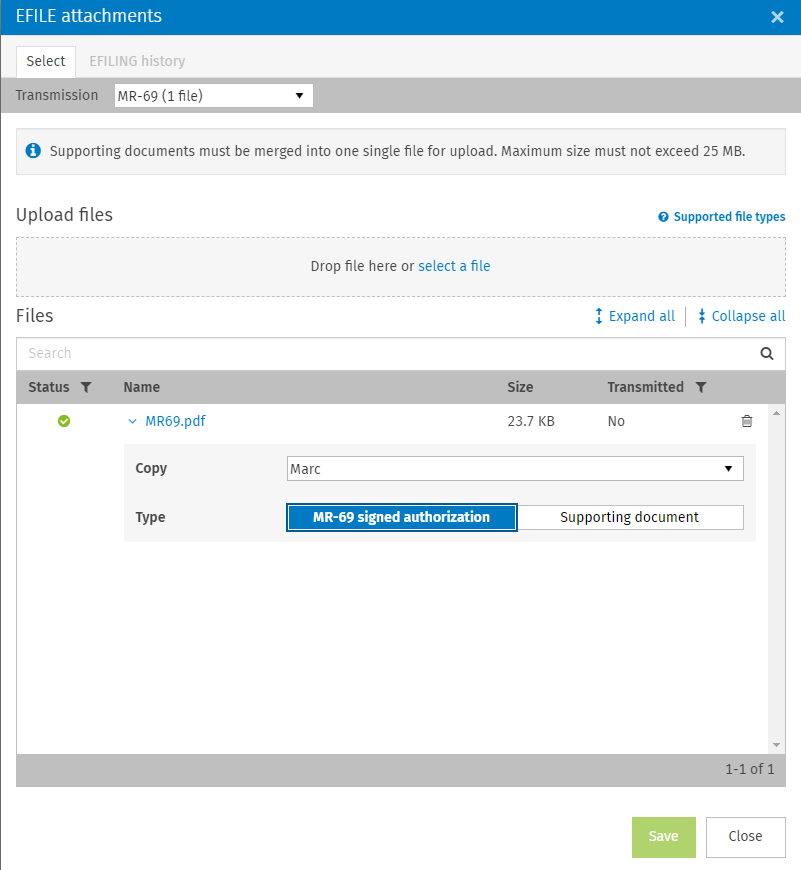

It is possible to attach supporting documents to Schedule 89 and to EFILE them. To attach supporting documents for EFILING purposes, click the Actions button, select EFILE attachments, and follow the instructions indicated in the EFILE attachments modal.

Ability to electronically transmit Form T2054, Election for a Capital Dividend Under Subsection 83(2)

The electronic filing of Form T2054 is now available.

Form T2054 is transmitted separately from the T2 return and from Schedule 89. However, the electronic transmission of this form has been implemented in the program so that the T2 return and Form T2054 (as well as Schedule 89, if applicable) can be transmitted at the same time.

Section Form T2054 filing methods has been added at the top of the form, allowing you to select the form for electronic filing.

It is possible to attach supporting documents to Form T2054 and to EFILE them. To attach supporting documents for EFILING purposes, click the Actions button, select EFILE attachments, and follow the instructions indicated in the EFILE attachments modal.

Note that the administrator’s resolution must always be attached to support Form T2054. You can attach it electronically within 24 hours of the form being accepted.

If you have never filed Form T2054 or Schedule 89 before, or if you disagree with either the amount shown in your CDA balance on the My Business Account website or with your recently received CDA balance from the Canada Revenue Agency, you should transmit Schedule 89 at the same time you transmit Form T2054.

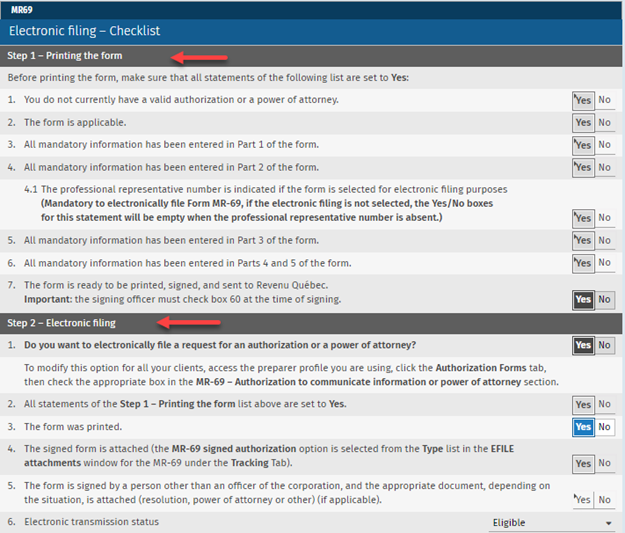

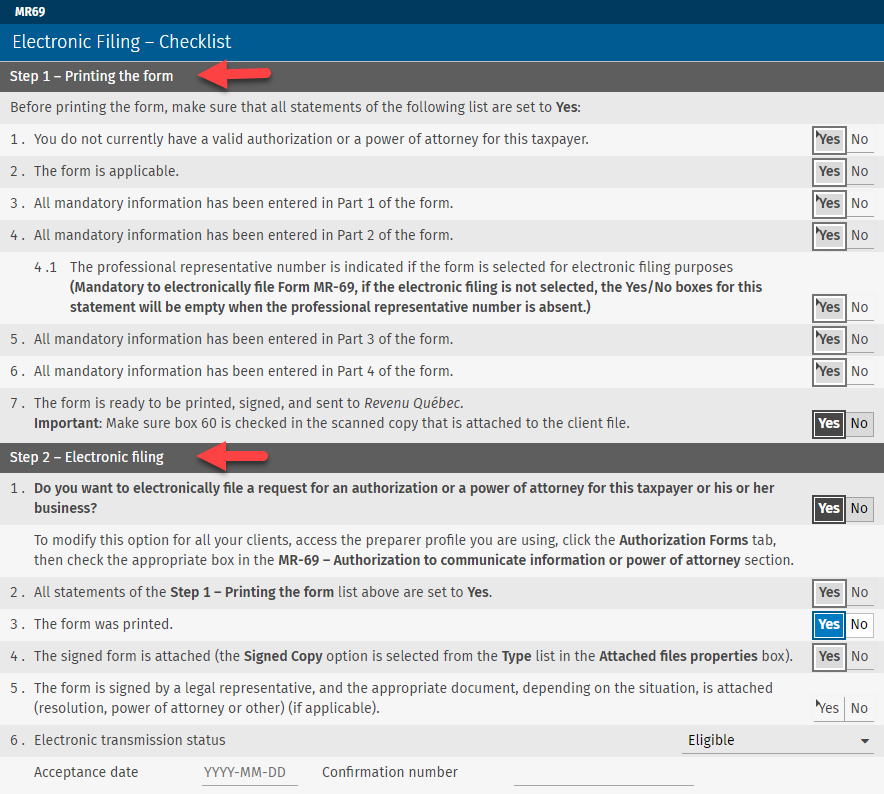

Ability to electronically transmit T2 MR-69

The electronic transmission of Form T2 MR-69 is now available.

A 2-step checklist has been added to the form to help you prepare and electronically transmit an MR-69 form. By providing answers to all statements in the checklist, you are making sure that the mandate is compliant and meets the requirements of Revenu Québec. This will prevent you from being prompted by an error code at the time of transmission.

The first step helps you complete the form correctly before printing it, so that the printed copy meets the requirements of Revenu Québec and contains a 2D bar code when the copy is signed by the taxpayer or representative. Revenu Québec requires Form MR-69 in French to be valid.

The second step covers the requirements that should be complied with to be able to electronically transmit the mandate and the attached document(s).

The electronic status will be displayed at the end of the checklist. When the status is Eligible, you can transmit the MR-69 form and attached documents.

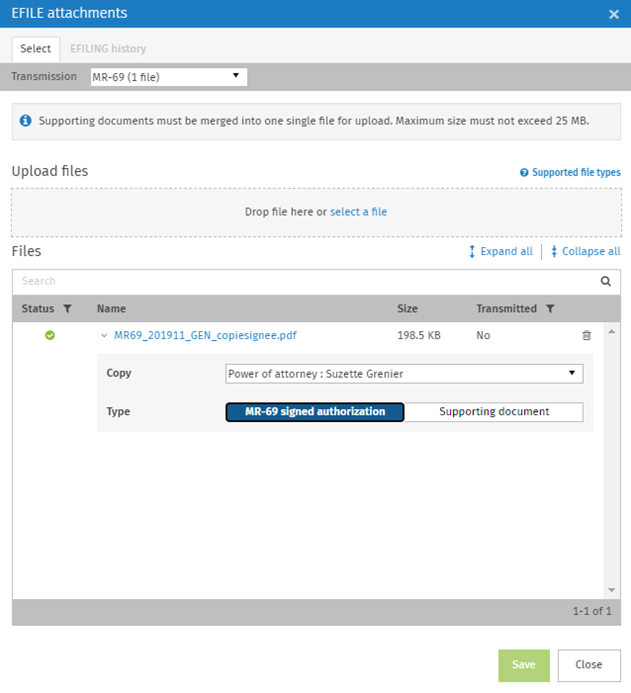

Revenu Québec requires that a PDF document of all four pages of the signed Form MR-69 be transmitted along with the authorization request. It is possible to attach supporting documents as well. To attach the PDF document for EFILING purposes, click the Actions button, select EFILE attachments, and follow the instructions indicated in the EFILE attachments modal.

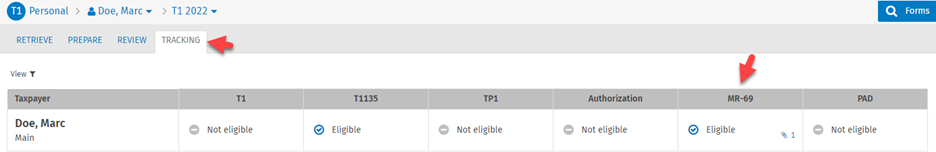

As any other EFILE transmissions, MR-69 EFILE details can be viewed from the TRACKING view.

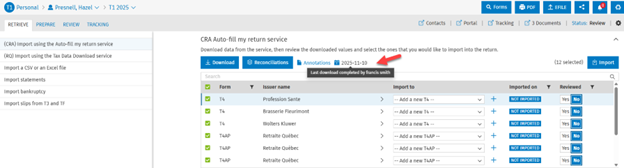

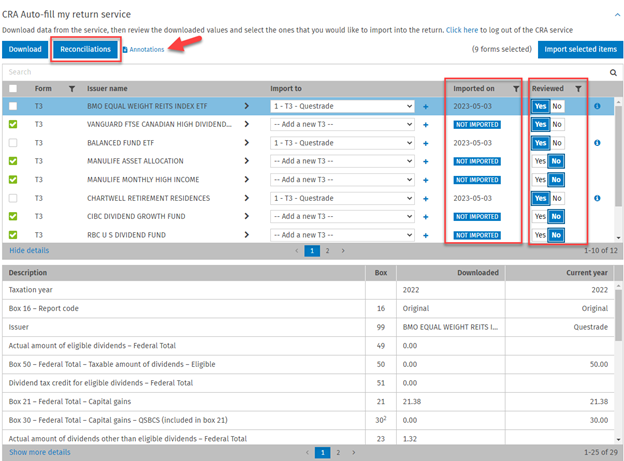

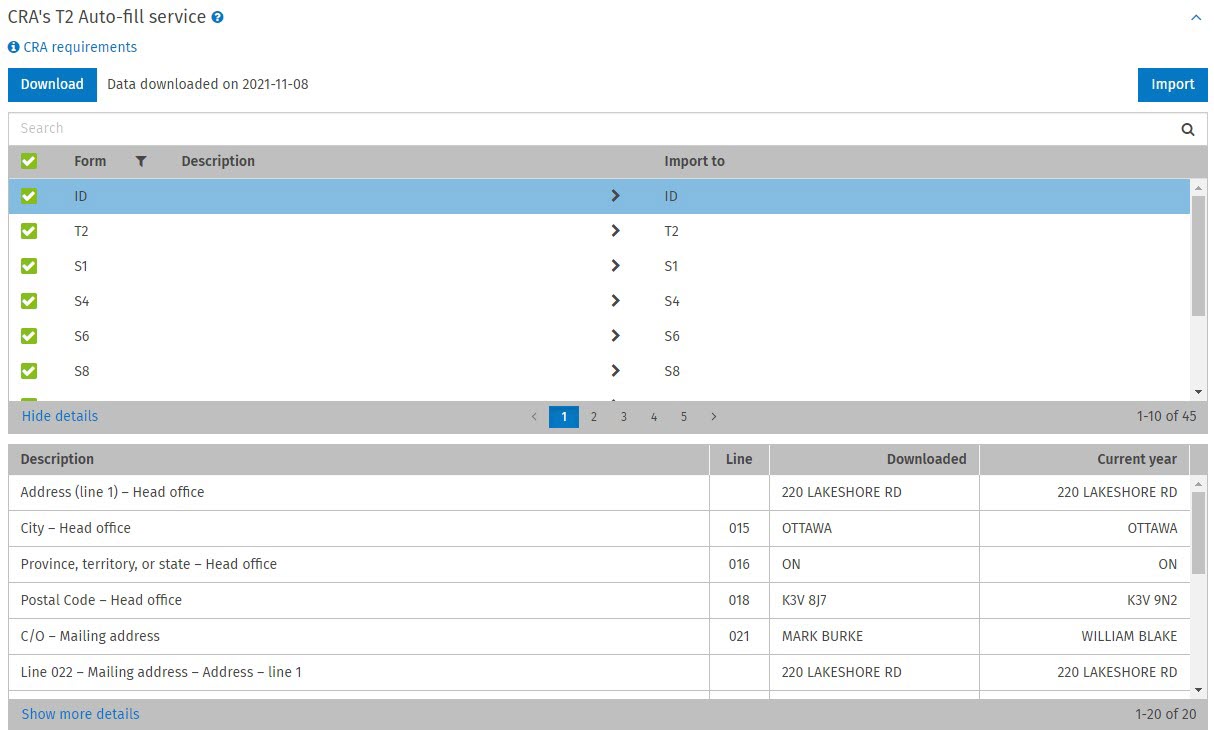

T1 and T2 Auto-fill (AFR) enhancements

Several enhancements have been made to the Auto-fill return feature:

Retrieve tab

-

The Annotations modal has been added to allow you to leave comments related to AFR.

-

The column Imported on indicates the date on which data was imported into the tax return, where applicable. The forms and slips already imported into the return will not be selected by default for another import. You can use this column to filter the results based on whether the forms and slips have been imported.

-

The column Reviewed allows you to track whether the downloaded data in the forms has been reviewed. You can filter this column to display only forms and slips that have been reviewed or not reviewed.

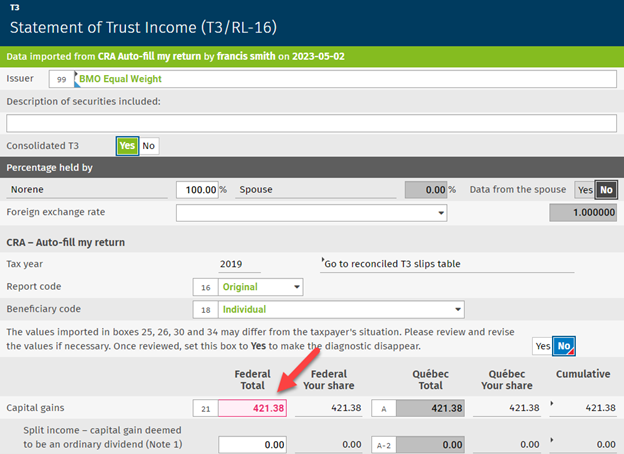

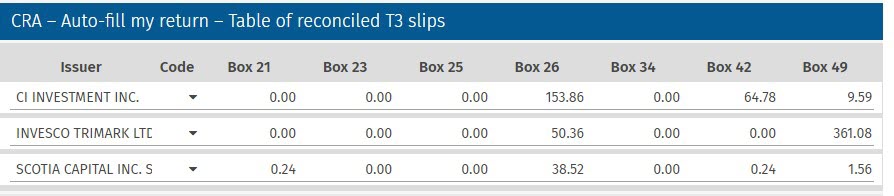

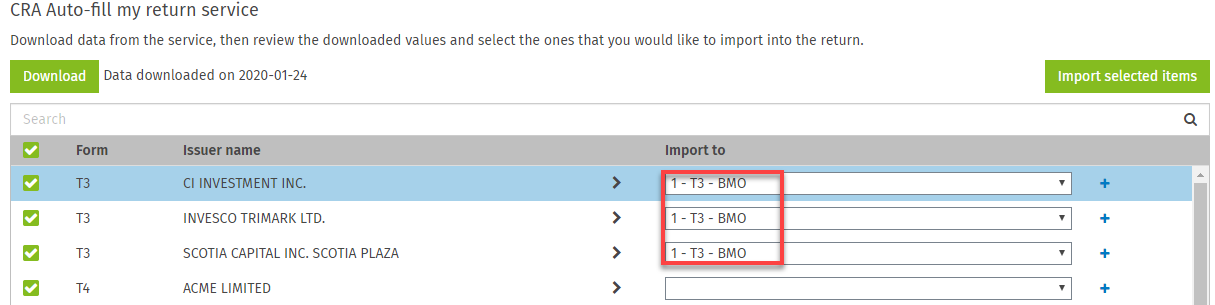

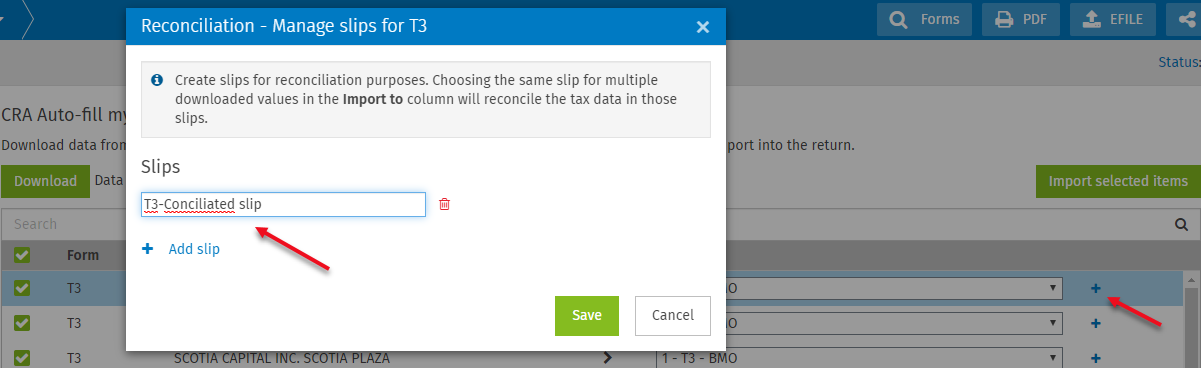

Reconciliations modal for T3, T5008 and RL-16 slips

-

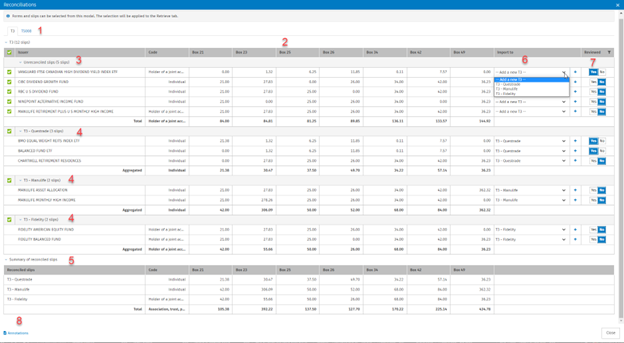

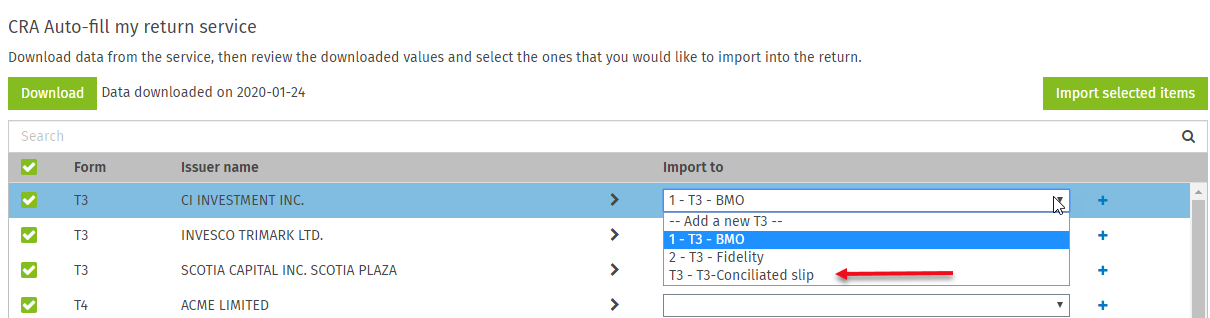

Separate tabs have been created for each type of reconciliation (i.e., T3, T5008 and RL-16 slips). (See #1 in the image below.) The RL-16 tab can be found in section Import using the Tax data download service.

-

The number of columns displaying the values reported on the downloaded slips has been expanded to facilitate reconciliation. (See #2 in the image below.)

-

Different sections have been created:

Section Unreconciled slips lists all the downloaded slips that have not been reconciled yet. (See #3 in the image below.)

A separate section has been created for each consolidated slip. Each component of the downloaded slip is displayed, along with the consolidated totals for each column, which facilitates reconciling with the slip received by the taxpayer. When a section of a consolidated slip is selected, each component of the downloaded slip under that section will be selected for import to the return. (See #4 in the image below.)

Summary of reconciled slips. (See #5 in the image below.)

-

The column Import to allows you to easily select or modify the appropriate consolidated slip for each downloaded slip. (See #6 in the image below.) This selection can also be made in the main Auto Fill My Return screen.

-

The column Reviewed has been added to track whether the slips have been reviewed. This column can be filtered. (See #7 in the image below.)

-

The Annotations modal has been added to allow you to leave any comments related to the reconciliation of slips. (See #8 in the image below.)

Forms

-

If a user changes data that has been imported from AFR, the display colour of the field value will change from green to pink, and the field’s background will be pink.

Review tab

-

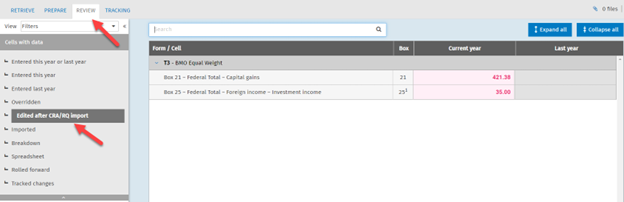

The filter Edited after CRA/RQ import has been added in the Review tab. This filter will identify any value imported from AFR that has been changed by a user.

Customize the order of the columns in the return manager

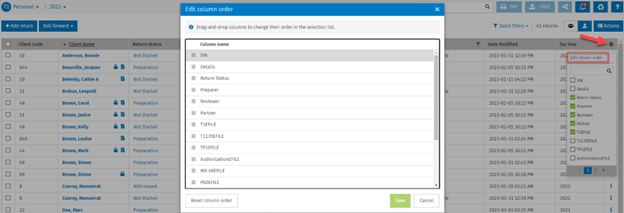

The order of the columns in the return manager can be customized per user, per product and per year. Click the gear button and:

-

Click Edit column order.

-

Reorder the columns with the drag-and-drop function.

-

Save the changes.

If a custom filter is applied, every custom column that is associated with that filter can be reordered as a block.

The button Reset column order allows you to reset the order of the columns to the predefined or initial order.

Note: The Client Code and Client Name columns cannot be reordered.

Addition of a review mark

A fifth review mark called Other has been added. The shortcut for this review mark is Ctrl+5. When applied to any field, the field will be surrounded by a red rectangle.

The following existing review marks can be applied to any tax field:

-

First review (Ctrl +1)

-

Second review (Ctrl +2)

-

Problem (Ctrl + 3)

-

Question (Ctrl + 4)

-

Other (Ctrl+5)

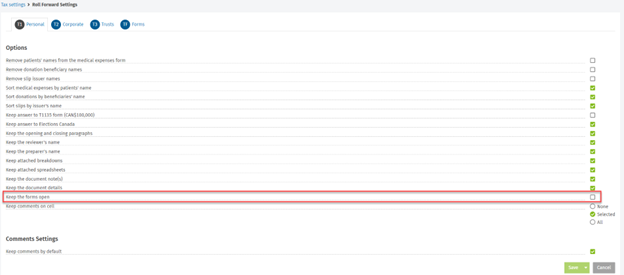

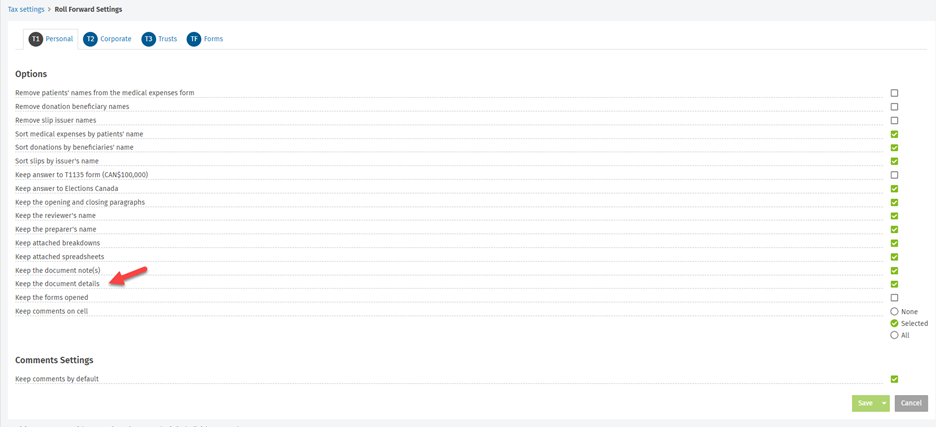

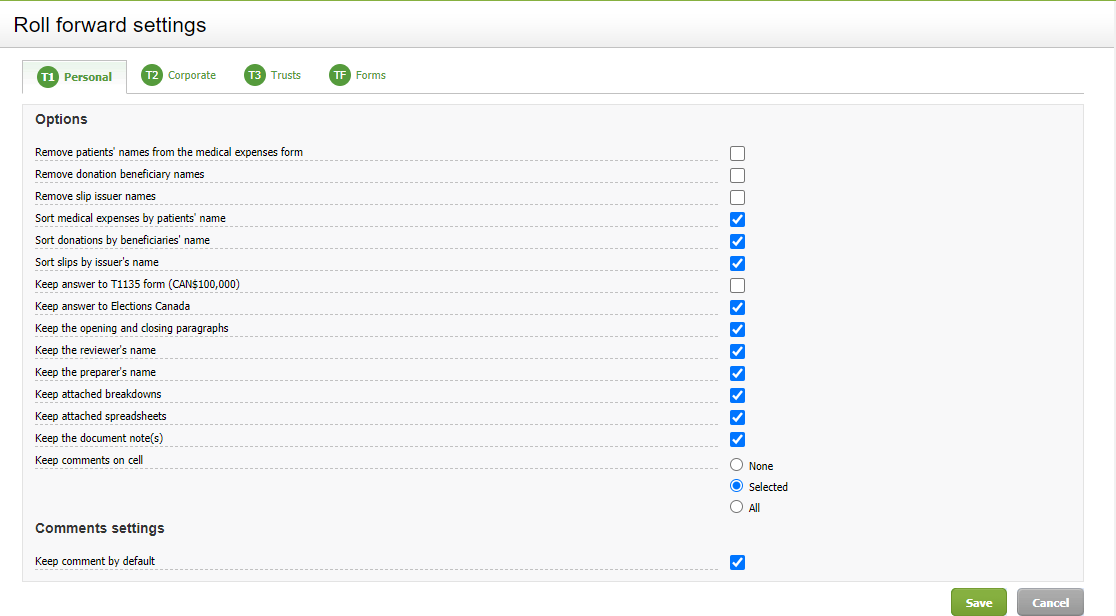

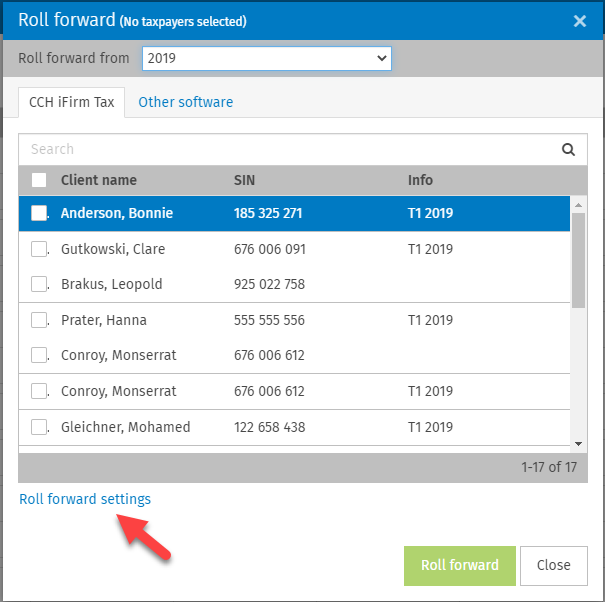

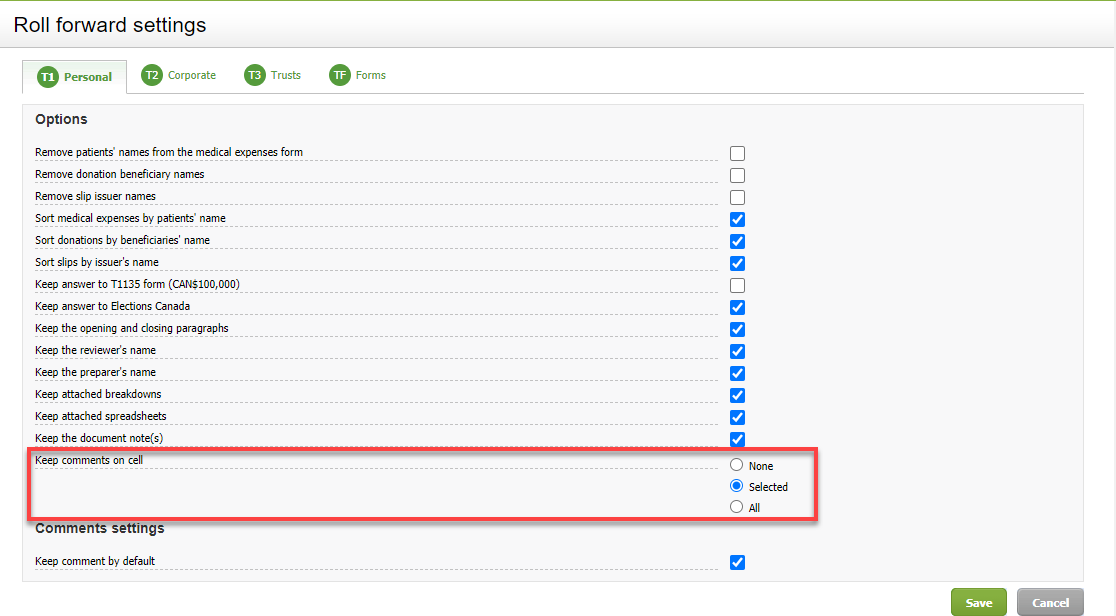

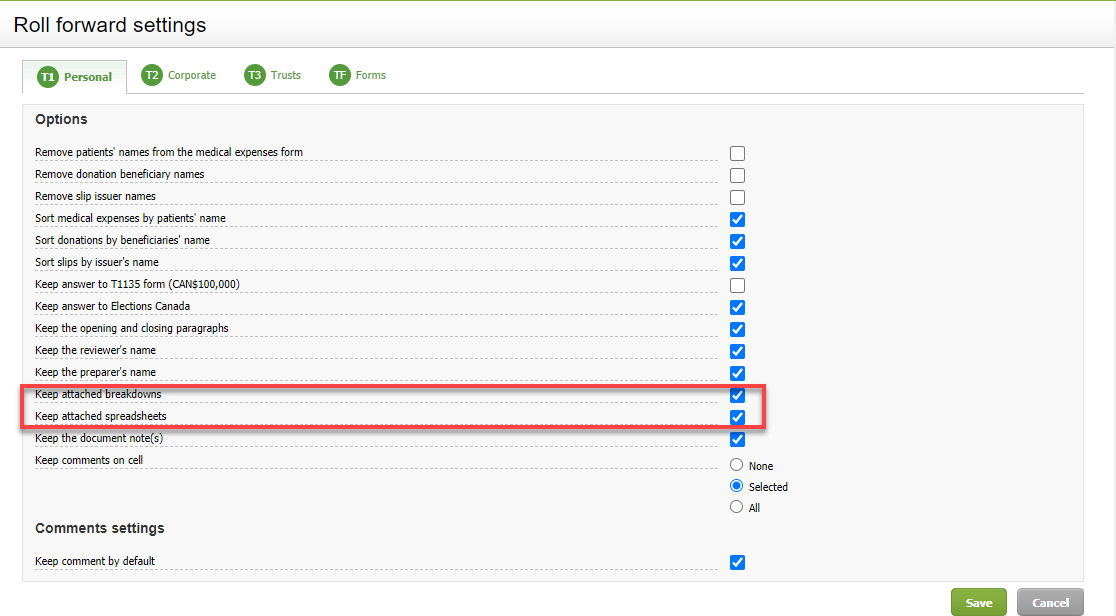

New roll forward option to retain last year’s open forms in Prepare tab

The option Keep the forms open has been added to the Roll Forward Settings, allowing you to decide if the opened forms need to be rolled forward to the subsequent taxation period. By default, Keep the forms open is not selected. It can be modified through Settings/Taxprep/Roll Forward Settings to be applied to all tax returns during the roll forward process or it can be modified from the Roll forward modal by clicking Roll forward setting.

If this new roll forward option is selected, all forms that were opened in the Prepare tab will remain open after the roll forward, and you will not need to reopen them in the current tax return.

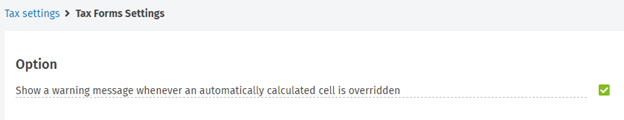

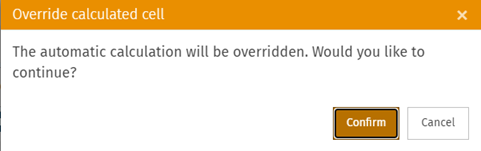

Set a warning message for a user who overrides a calculated cell

From Settings/Taxprep/Tax Forms Settings, select Show a warning message whenever an automatically calculated cell is overridden.

If this option is selected, the following warning message will appear when a user overrides a calculated cell.

By default, this new option is not selected.

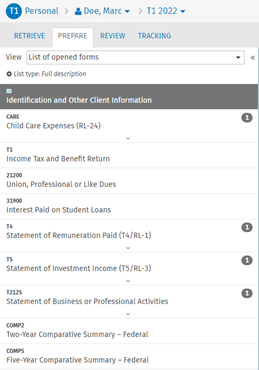

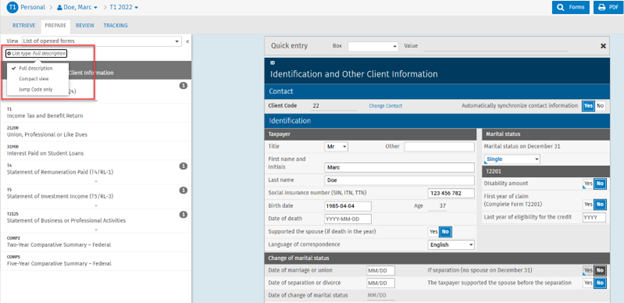

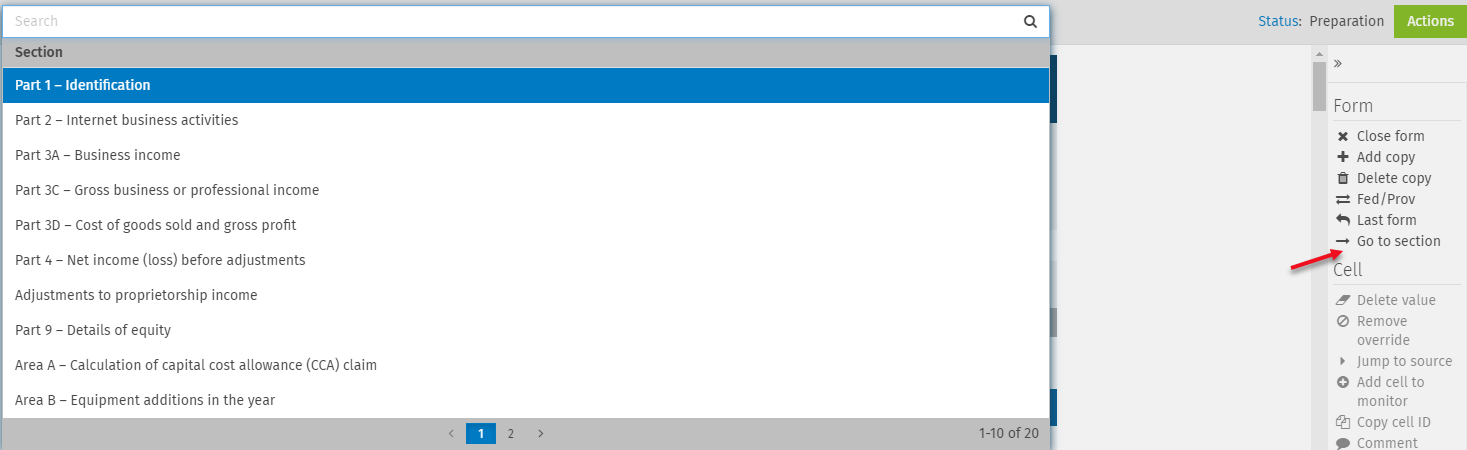

Choose between three different display options in the list of open and applicable forms of the Prepare tab

There are now three different display options for open and applicable forms in the Prepare tab:

-

Full description

-

Compact view

-

Jump Code only

To select the desired view, click List type:...

CCH iFirm Taxprep Pro Only

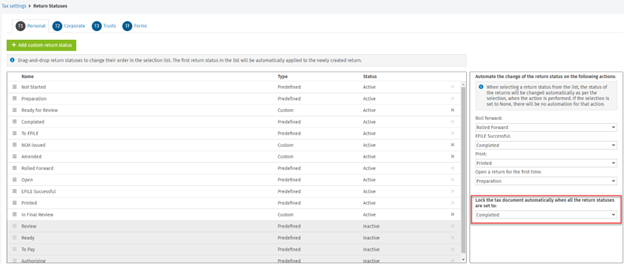

Automatically lock tax documents based on the return status

To automatically lock a tax document, go to Settings/Taxprep/Return Statuses and specify the return status that will trigger the automatic lock action for a return. Note that for the T1 application, the return status must be specified for every tax return for the family (e.g., Completed) in order for the tax document to be automatically locked.

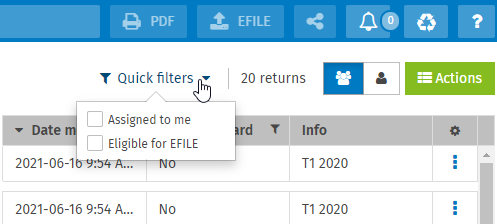

A new security role that manages the application of custom filters from the return manager

The following security role has been added to manage users’ rights with respect to applying the custom filters from the return manager:

-

Tax – Return Manager – Custom Filters – Apply

Users with this security role can select and apply custom filters from the Quick filters drop-down menu of the return manager to filter the list of returns based on the conditions defined in the selected custom filter. Without this security role, users can’t see the Custom Filters section from the Quick filters view in the return manager.

Note that the Tax – Return Manager – Custom Filters – Apply security role will not be assigned by default to any users’ security profiles. You will need to assign this security role to any user that should be allowed to apply the available custom filters from the return manager.

There are now four available security roles relating to the Custom filter feature:

-

Tax – Return Manager – Custom Filters – Apply

-

Tax – Settings – Public Custom Diagnostics and Custom Filters – Add, Edit

-

Tax – Settings – Public Custom Diagnostics and Custom Filters – Delete

-

Tax – Settings – Public Custom Diagnostics and Custom Filters – Roll Forward

Web API additional endpoints

-

Return Assignees endpoint

The Return Assignees endpoint is now available, allowing you to apply or update the assignee(s) of the returns (preparer, reviewer or partner). See the list of endpoints in our Help system.

-

Recycle bin endpoint

The Recycle bin endpoint is now available, allowing you to obtain a list of all tax documents that have been deleted and are in the recycle bin. See the list of endpoints in our Help system.

January 27, 2023 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

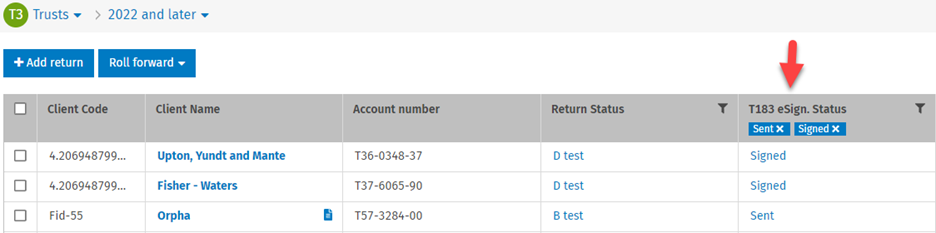

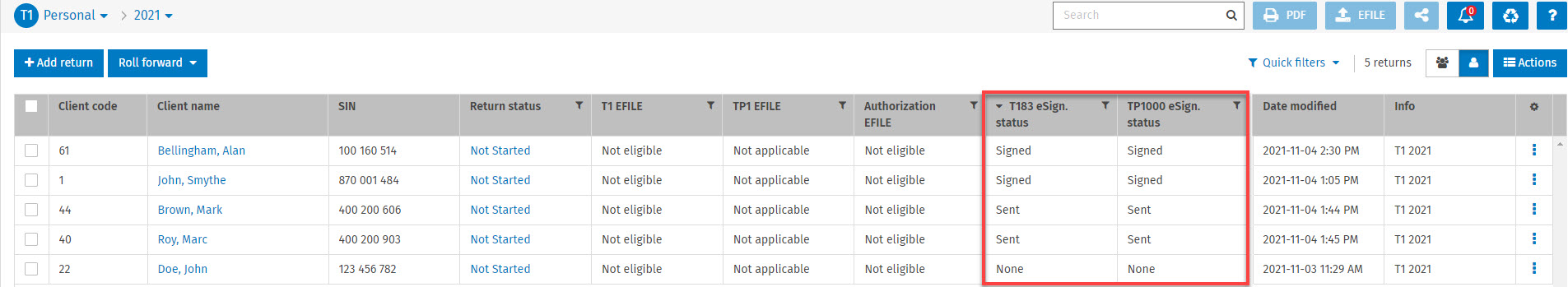

Digital signature feature – A T183 column added to the T3 return manager, allowing an easy way to monitor digital signature status

To streamline your signature process, a T183 column has been added to the T3 return manager, allowing you to easily keep track of the digital signature status of Form T183. This column already exists in T1 and T2 return managers.

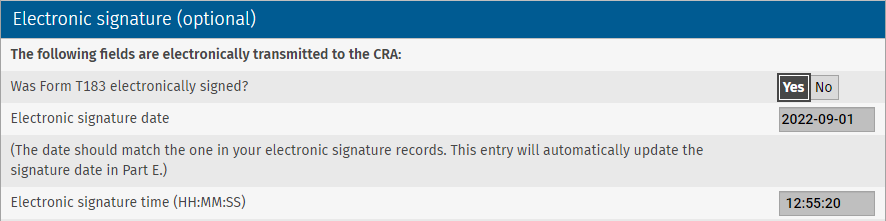

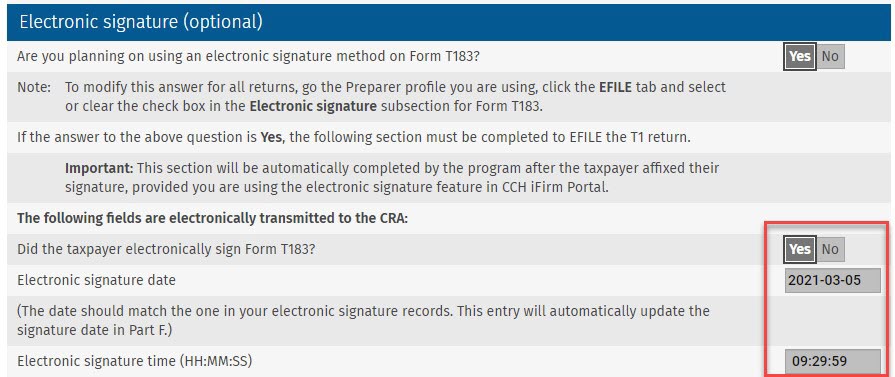

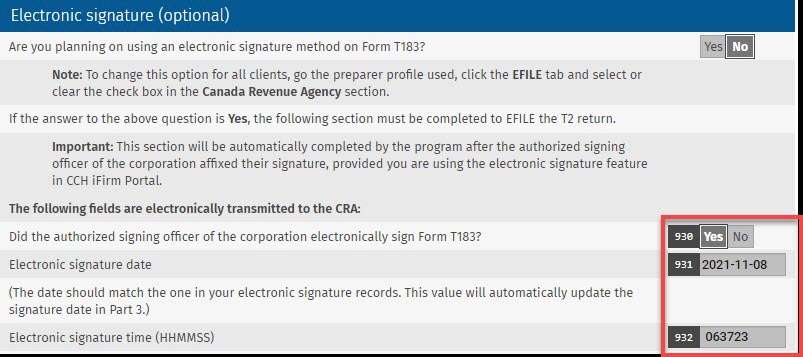

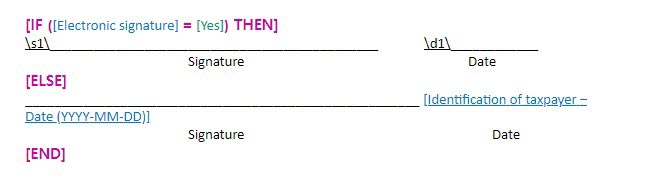

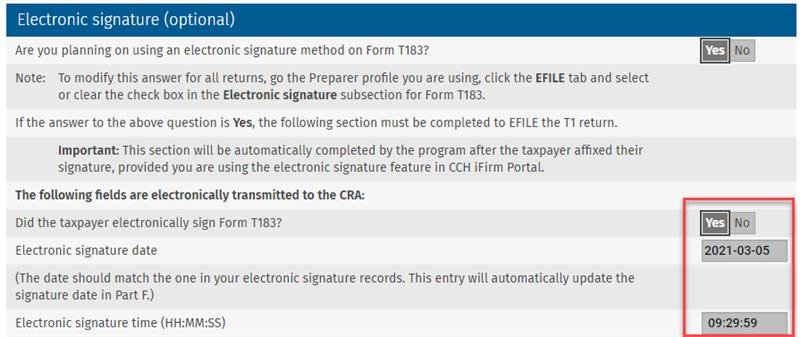

T183 – Digital signature time stamp automatically updated in the T3 product

If you are using the electronic signature feature in CCH iFirm Portal, the fields in the Electronic signature section of Form T183 of a T3 return are now automatically completed. The T183 Electronic signature section is automatically updated with the time stamp for T1, T2 and T3 products.

Electronic filing of T3RCA returns

As soon as the CRA transmission services will open in February, it will be possible to transmit a Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return (Jump Code: T3RCA) using the EFILE service.

CCH iFirm Taxprep Advanced and Pro Only

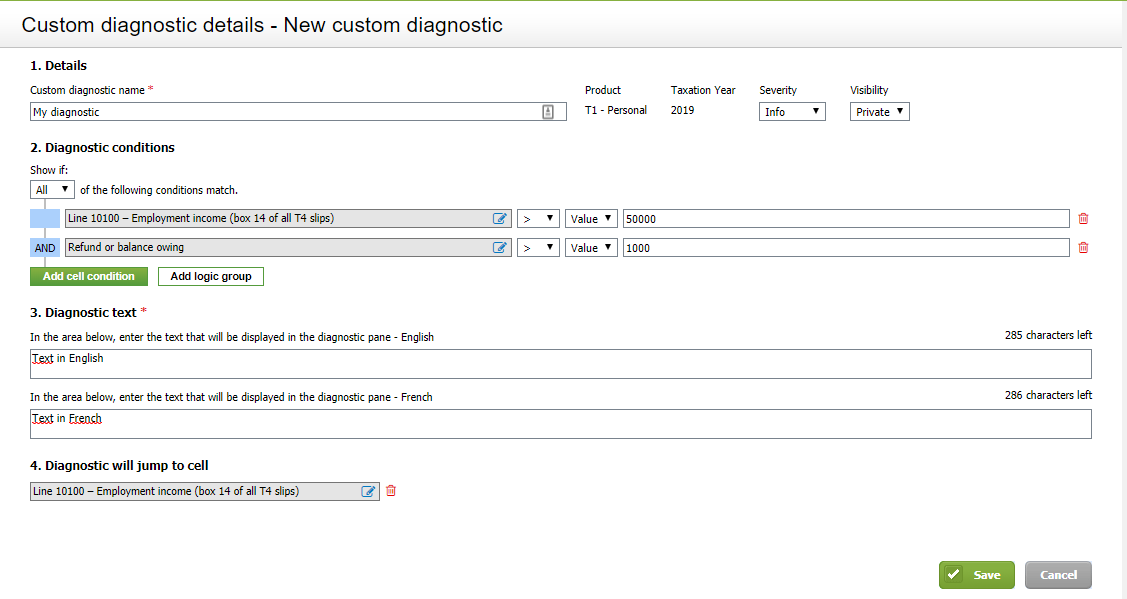

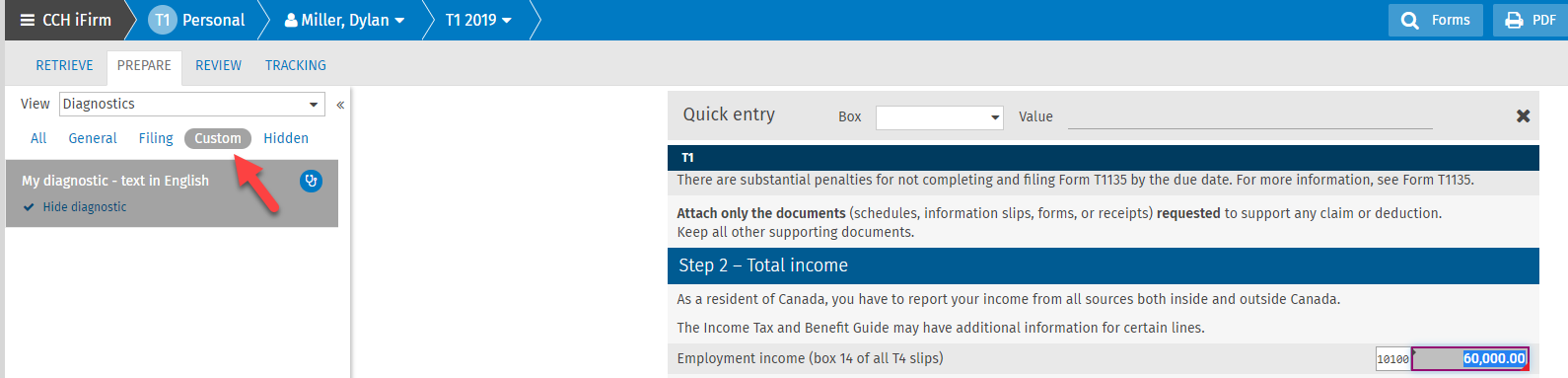

Custom filters feature allows you to search for the tax returns based on user-defined specific conditions

In addition to custom diagnostics, now it is possible to also create the custom filters that will allow you to search for the taxpayers from the return manager based on user-defined specific conditions, for example, search for any taxpayer having the rental income or search for the 71-year-old taxpayers.

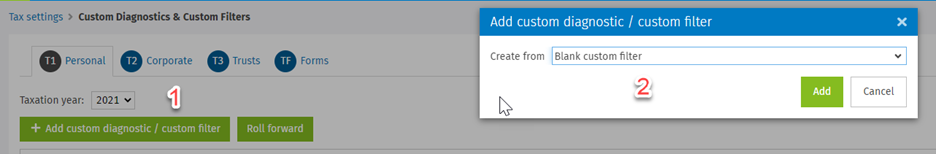

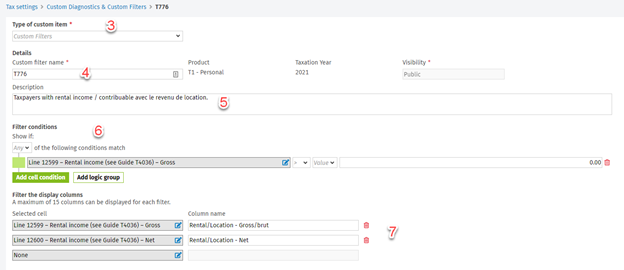

The custom filters can be created for each tax product (T1, T2, T3 and Forms). Once you have navigated to Settings/Taxprep/Custom Diagnostics & Custom filters, only a few easy steps are required to create custom filters or custom diagnostics and custom filters together:

-

Click Add custom diagnostic / custom filter.

-

Select a blank custom filter or an existing custom filter in the Create from drop-down list.

-

The Type of custom item drop down selection will depend on what you chose in Step 2. In the example below, Custom Filters will be selected, but it can be modified for Diagnostics or Custom diagnostics and filters.

-

Enter the custom filter name.

-

Enter the custom filter description.

-

Enter the custom filter conditions

-

Select the cells that will be displayed in the return manager as columns. Column name description can be modified, allowing you to enter your own description.

Note: The steps can be slightly different if you create a custom diagnostic and a filter together. In this case, additional fields need to be completed such as the Diagnostic text field.

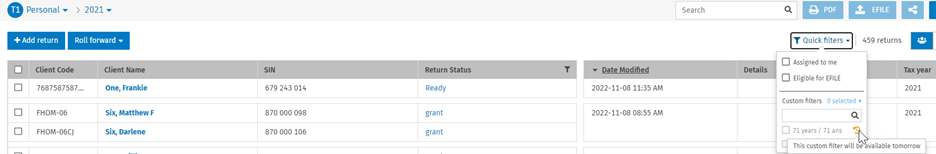

The custom filters that you have created will be available in the return manager under the Quick filters menu. Once the custom filter is created, it will take up to one day to be available for use. The filter that is not available yet will be disabled and a hover message will indicate: This custom filter will be available tomorrow.

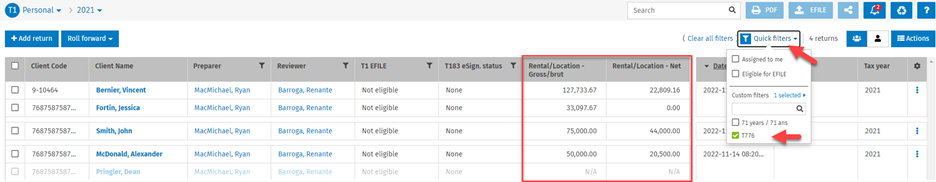

To apply a custom filter, click Quick Filters from the return manager and select the desired custom filter. The applicable tax returns will be displayed in the list, including the columns that you set to be displayed with the custom filter (Step 7). The columns displayed in the return manager can be hidden if you click the gear button.

If the Group list by family view is used for T1, family member tax returns that are not applicable for a particular filter will be displayed in the list, but the mention N/A will be displayed, and the information for the family members that are not applicable will be in light blue.

To display only applicable tax returns for a filter, it is recommended to use the Do not group list view:

The following security roles have been added to manage users’ rights for the Custom filters feature:

-

Tax – Settings – Public Custom Diagnostics and Custom Filters – Add, Edit

-

Tax – Settings – Public Custom Diagnostics and Custom Filters – Delete

-

Tax – Settings – Public Custom Diagnostics and Custom Filters – Roll Forward

December 16, 2022 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

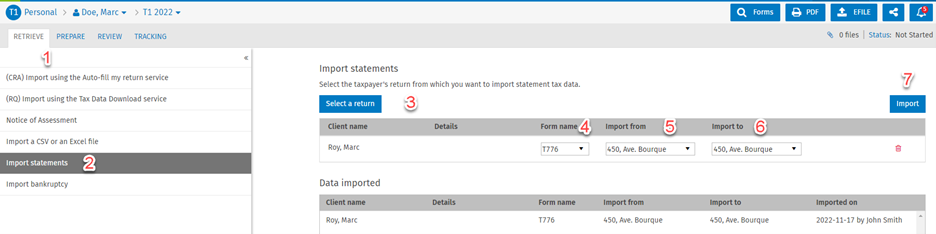

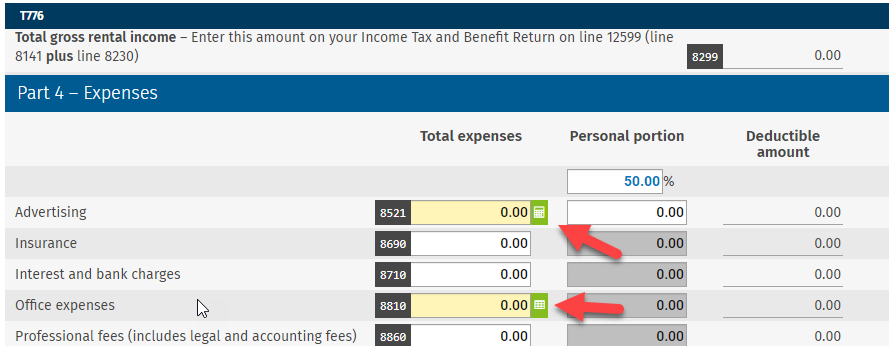

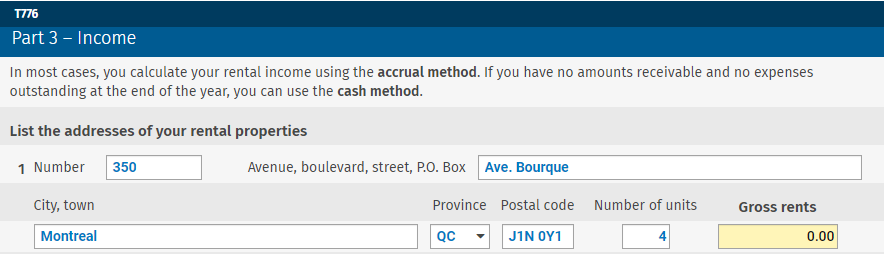

Import Statements of Self-Employed Individuals

Import tax data from the return of a taxpayer who is a self-employed individual into the return of his or her partner (a partner must not be the spouse, when the spouse’s return is being completed at the same time).

The data that can be imported is found in the following forms:

-

T776, Statement of Real Estate Rentals

-

T1163, Statement A - AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Individuals

-

T1273, Statement A - Harmonized AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Individuals

-

T2042, Statement of Farming Activities

-

T2121, Statement of Fishing Activities

-

T2125, Statement of Business or Professional Activities

To import data from the statement of a self-employed individual into the partner’s return, proceed as follows:

-

Click the RETRIEVE tab.

-

Select Import statements section.

-

Select from which return you want to import data.

-

Select from which statement you want to import data using the Form name column.

-

Select from which copy of the statement you want to import data using the Import from column.

-

Select to which copy of the selected statement you want to import data using the Import to column.

-

Click the Import button.

The Data imported section under the RETRIEVE tab will display the history of all statements’ imports.

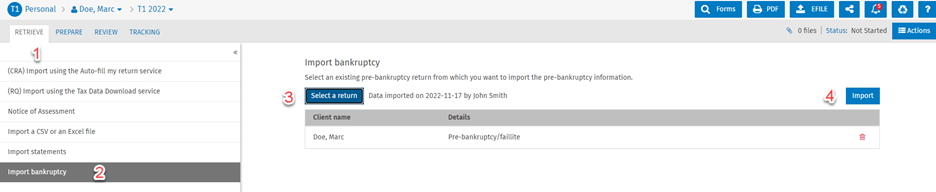

Import Bankruptcy Data

Import pertinent tax data from a taxpayer’s pre-bankruptcy return into the post-bankruptcy return.

The imported data is inserted in the appropriate forms as well as in Form Bankruptcy Information of the current return.

In order to import data from the pre-bankruptcy return into the post-bankruptcy return, proceed as follows:

-

Click the RETRIEVE tab.

-

Select the Import bankruptcy section.

-

Select the return from which you want to import data.

-

Click the Import button.

Note that you cannot import bankruptcy data from the spouse or dependant's return. You must be in the main taxpayer's return to import the bankruptcy.

Ability to electronically transmit T1 MR-69

The electronic transmission of T1 MR-69 form is now available.

A 2-step checklist has been added to the form to help you prepare and electronically transmit an MR-69 form. By providing answers to all statements in the checklist, you are making sure that the mandate is compliant and meets the requirements of Revenu Québec. This will prevent you from being prompted by an error code at the time of transmission.

The first step helps you complete the form correctly before printing it, so that the printed copy meets the requirements of Revenu Québec and contains a 2D bar code when the copy is signed by the taxpayer or representative.

The second step covers the requirements that should be complied with to be able to electronically transmit the mandate and the attached document(s).

The electronic status will be displayed at the end of the checklist. When the status is Eligible, you can transmit the MR-69 form and attached documents.

Revenu Québec requires that a PDF document of all three pages of the signed Form MR-69 be transmitted along with the authorization request. It is possible to attach supporting documents as well. To attach the PDF document for EFILING purposes, click the Actions button, select EFILE attachments, and follow the instructions indicated in the EFILE attachments modal.

As any other EFILE transmissions, MR-69 EFILE details can be viewed from the TRACKING view:

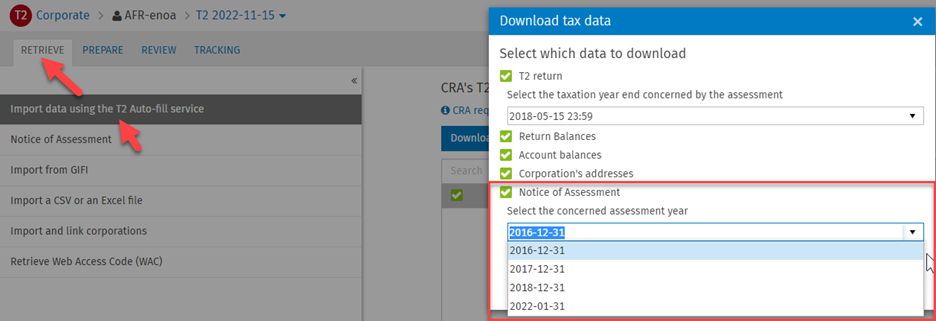

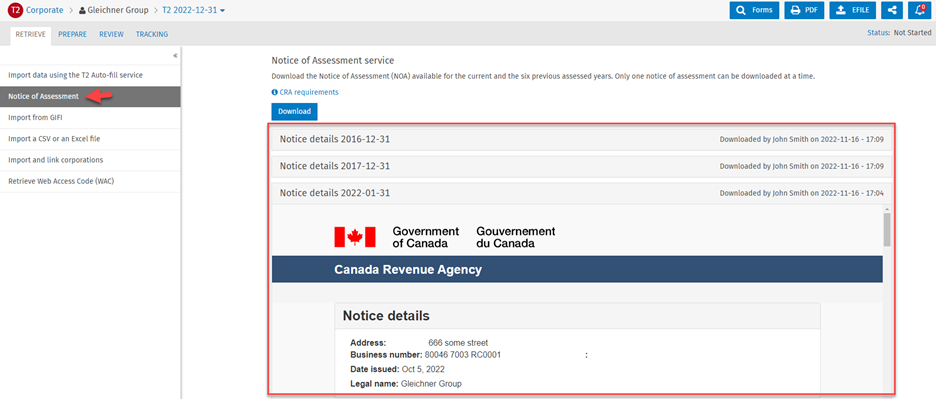

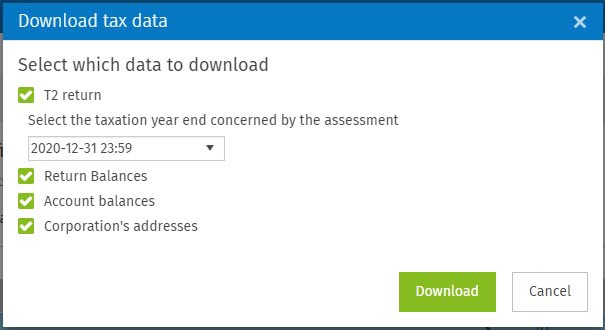

Download the T2 Notice of Assessment from the CRA ‘‘T2 Auto-fill’’ service

It is now possible to download a corporation's notice of assessment. The notice of assessment can be downloaded from the RETRIEVE tab in the following section:

-

Import data using the T2 Auto-fill service. In this case, the notice of assessment can be downloaded along with the other data available for download. However, to view the downloaded notice of assessment, you must go to the Notice of Assessment section.

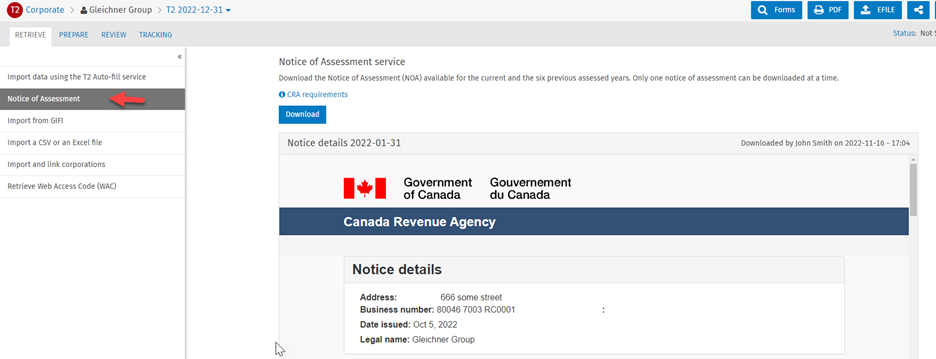

-

Notice of Assessment

Please note that following the transmission of a current year tax return, it may take a minimum of three days before the notice of assessment is available for download. In addition, it is possible to download the current year notice of assessment, as well as the previous six taxation years. Downloaded notices of assessment can be viewed from the Notice of Assessment section.

Click on the header of each notice of assessment to collapse or expand it.

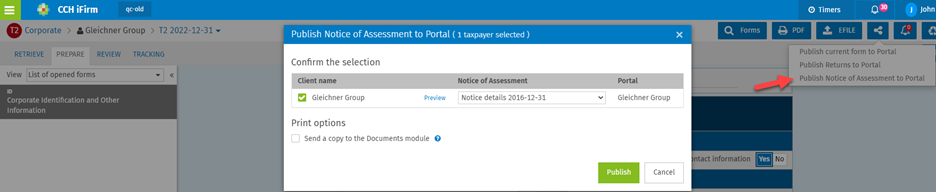

The downloaded notice of assessment can be published or printed:

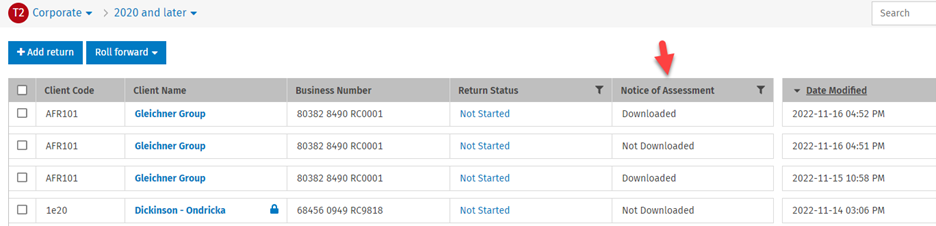

Finally, the Notice of Assessment column has been added to the return manager, allowing you to identify the returns for which the notice of assessment has been uploaded.

December 2, 2022 Release

CCH iFirm Taxprep Essentials, Advanced and Pro

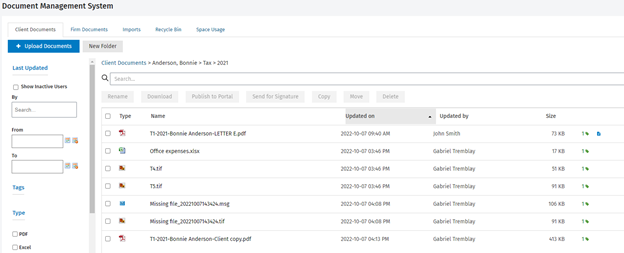

CCH iFirm Documents now integrated with CCH iFirm Taxprep

CCH iFirm Documents and CCH iFirm Taxprep now offer integration, allowing users to access and store tax-related documents in CCH iFirm Documents directly from the CCH iFirm Taxprep interface.

-

A new Tax folder will now be visible under each contact in CCH iFirm Documents.

-

In the Tax folder, year folders will be created automatically.

-

Any document stored in the proper year folder will now be visible and accessible from the corresponding tax returns.

From a tax return, the tax-related documents added in the CCH iFirm Documents module can be viewed from the breadcrumb by clicking on the paper clip icon: