Québec – Payments made for eyeglass frames

Transportation and travel expenses

Expenses for medical services not available in your area – line 378 (Québec)

Methods for determining the travelling expenses

Rate applicable based on where the move begins

Eligible medical expenses for which a limit could be applied because of the disability amount

Eligible amount of medical expenses for other dependants – line 33199

Québec prescription drug insurance plan premium

General Rules – Federal

The following information is automatically updated to the medical expenses workchart by the program:

- Employee-paid premiums for private health services plans (T4, box 85, T4A, box 135)

- Premiums paid under the Prescription Drug Insurance Plan for the previous taxation year (for Québec residents only)

Note: Expenses incurred for purely cosmetic purposes, including any related services and other expenses, such as travel expenses, are not eligible for the medical expense tax credit. Both surgical and non-surgical procedures aimed purely at enhancing one's appearance are ineligible. However, the expense is eligible if it is necessary for medical or reconstructive purposes, for example, a surgery to address a deformity related to a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease.

To consult the list of eligible medical expenses, go to https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/lines-330-331-eligible-medical-expenses-you-claim-on-your-tax-return.html.

For more information on eligible medical expenses, see Income Tax Folio S1–F1–C1, Medical Expense Tax Credit.

General Rules – Québec

The following information is automatically updated to the medical expenses workchart by the program:

- Employee-paid premiums for private health services plans (RL-1 and RL-2, box 235);

- Premiums paid under the Prescription Drug Insurance Plan for the previous taxation year;

- Private health services plan (RL-1, box J); and

- Value of the coverage received by the individual under a private health services plan (RL-22, box B).

To consult the list of eligible medical expenses, go to https://www.revenuquebec.ca/en/online-services/forms-and-publications/current-details/in-130-v/.

Québec – Payments made for eyeglass frames

Expenses incurred for:

- eyeglasses frames are limited to $200 per person per reference period used (12 consecutive months);

- services provided for purely esthetic purposes are no longer deductible.

In certain particular situations, the amounts displayed in the Québec medical expenses workchart can be overridden.

Impact of the tax credit for home-support services for seniors (Québec) on medical expenses claimed in Québec

Expenses used to calculate the tax credit for home-support services for seniors (TCHSS) cannot be included in the calculation of the tax credit for Québec medical expenses, while at the federal level, these expenses give entitlement to the tax credit for medical expenses.

|

Example: A taxpayer paid $17,500 to a care and nursing home. From this amount, expenses of $5,200 are eligible for the tax credit for home-support services for seniors. Calculation of medical expenses claimable federally:

Calculation of medical expenses to claim in Québec:

|

Expenses for medical services not provided in an area

Transportation and travel expenses

The following expenses are eligible:

|

Distance |

Federal |

Québec |

|

|

|

Medical services not provided in an area |

Other medical expenses |

Medical services not provided in an area (TP1 return, line 378) |

|

At least 40 km (one way) |

|

|

|

|

At least 80 km (one way) |

|

|

|

|

At least 200 km (one way) |

|

|

|

Federal

- At least 40 km (one way): If the taxpayer had to travel to obtain medical treatment that was not available in his or her area (within 40 kilometres of his or her place of residence), he or she may claim the travel expenses amount. In this situation, public transit expenses paid (for example, for travel by taxi, bus or train) can be included in medical expenses. When public transit is not easily accessible, the taxpayer can claim vehicle use expenses.

-

If the taxpayer is claiming travel expenses incurred to get medical treatment, you can calculate these expenses using the detailed method or the simplified method.

If you use the detailed method to calculate vehicle use expenses, the taxpayer has to keep all receipts and records for the travel expenses incurred in the 12-month period. When this method is used, you have to take into account the total number of kilometres that the taxpayer drove during that period, as well as the number of kilometres he or she drove specifically for travel giving rise to the medical expenses credit. The amount claimed for travel expenses must correspond to the vehicle expenses attributable to the kilometres driven for medical reasons. For example, if the taxpayer drove a total of 10,000 kilometres during the 12-month period and, of this total, 1,000 kilometres have been driven for medical reasons, the taxpayer can claim 10% of his or her total vehicle expenses for travel expenses.

If you use the simplified method to calculate vehicle expenses, you have to keep track of the number of kilometres that the taxpayer drove to obtain medical care in the 12-month period and multiply the number of kilometres by the rate set for each province or territory. -

At least 80 km (one way): If the taxpayer had to travel more than 80 kilometres to obtain medical treatment, in addition to travel costs, he or she may be able to claim his or her meals and lodging expenses. If you use the detailed method to calculate meal expenses, the taxpayer has to keep his or her receipts. If you use the simplified method, you can claim a flat amount of $23 a meal, to a maximum of $69 per day, per person, without receipts. The taxpayer should keep the receipts for lodging expenses to be able to provide them upon request by the tax authorities.

The taxpayer can also claim travel expenses for a person that accompanies him or her, if a medical practitioner certifies in writing that the taxpayer was unable to travel without assistance.

Québec

A taxpayer can include in his or her medical expenses the following transportation and travel expenses incurred for himself or herself, for his or her spouse or for a dependant (hereinafter “the person”):

-

transportation expenses incurred by the person travelling by ambulance to or from a public hospital or licensed private hospital;

-

at least 40 km (one way): transportation expenses incurred by the person using a transport business or an amount considered reasonable for the use of the person’s own vehicle where the transport service was not immediately available and where the distance driven to obtain medical services not available in the person’s locality is at least 40 kilometres;

-

at least 80 km (one way): travel expenses incurred by the person, if the distance to drive to obtain medical services not available in the person’s locality is at least 80 kilometres;

-

transportation or travel expenses incurred by an individual accompanying the person requiring care, if, according to the written certification by a practitioner, this person is incapable of travelling alone.

Expenses for medical services not available in your area - line 378 (Québec)

A taxpayer may claim an amount for certain expenses paid to obtain medical services that were not available in his or her area. The following expenses are eligible:

-

travel and lodging expenses paid in the current year to obtain, in Québec, medical services that were not available at least 200 kilometres, one way of the locality in which the taxpayer lives;

-

moving expenses paid in the current year to move to within 80 kilometres of a health establishment in Québec, where the health establishment is located 200 kilometres or more from the locality in which the taxpayer formerly lived (one way).

If the taxpayer can deduct these expenses as moving expenses, or if they entitle the taxpayer to the travel deduction (deduction for residents of designated remote areas), it may be more advantageous to deduct those expenses on the lines of his or her return that correspond to these deductions.

To be eligible for this credit and to be able to enter those expenses on line 378, the taxpayer must have paid the medical expenses for himself or herself, for his or her spouse or for any other person who depended on the taxpayer during the year in which the expenses were incurred, and he or she must enclose with his or her return Form Expenses for Medical Services Not Available in Your Area (TP-752.0.13.1) as well as his or her receipts. Taxprep automatically updates these expenses to a copy of this form.

Moving Expenses

For purpose s of this form, the moving expenses correspond to reasonable moving expenses, other than those claimed on line 21900 (and/or lines 228 and 378 in the Québec return) of up to $2,000, incurred to move to a more accessible dwelling, to enable a person, the person’s spouse or a dependant to gain access to or to be mobile or functional within the dwelling, where the person concerned lacks normal physical development or has a severe and prolonged mobility impairment.

Methods for Determining the Travelling Expenses

Taxpayers can choose between two methods, one simplified and the other detailed, to calculate his or her travel expenses.

If the taxpayer chooses the detailed method to calculate his or her vehicle use expenses, he or she must keep his or her receipts and keep a record of the expenses he or she incurred.

To determine the applicable rates for the simplified method, go to https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-255-northern-residents-deductions/meal-vehicle-rates-used-calculate-travel-expenses.html or call the Tax Information Phone Service (TIPS) at 1-800-267-6999.

Cost of care or cost of attendant care

- Eligible medical expenses for which a choice must be made between the claim as medical expenses and the claim for the disability amount

The types of expenses that can be claimed in this section are the following:

- Remuneration paid for full-time attendant care in a nursing home under paragraph 118.2(2)(b) (Form T2201 required);

- Remuneration paid for full-time attendant care in a self-contained domestic establishment (like the individual's house) under paragraph 118.2(2)(c) (Form T2201 or certification required);

- Cost of full-time care in a nursing home under paragraph 118.2(2)(d) (Form T2201 or certification required);

The program optimizes the claim by determining which is more advantageous for the taxpayer and the spouse: claiming these expenses as medical expenses, or claiming the disability amount. During the optimization by the program, the following two amounts are compared:

- tax payable (line 43500 of the T1 return) minus the refundable supplement for medical expenses (line 45200 of the T1 return) when these expenses are claimed;

- tax payable (line 43500 of the T1 return) when the disability amount is claimed.

If the program determines that it is more advantageous to claim these expenses for the patient, the check box Claim the expenses paid instead of the disability amount will be selected, and the program will cancel the disability amount in the T1 Jacket and Form 428, where applicable, of the patient (either the taxpayer, the spouse or a dependant whose return is connected) or in the FAM form for a dependant whose return is not connected.

If the program determines that it is more advantageous to claim the disability amount for the patient, the check box Claim the disability amount instead of the expenses paid will be selected, and the program will not claim these expenses in the MED form.

The optimization is done for all patients for whom these expenses have been incurred, and you can modify the optimization using an override in subsection “Summary.”

Diagnostics have been added to inform you of the optimization made by the program.

Note that the following amounts are not taken into account in the optimization of these expenses:

- Canada caregiver amount for infirm children under 18 years of age (line 30500);

- Tax reduction in Forms BC428, NB428, NL428, NS428, ON428 and PE428.

Diagnostics have been added to advise you when the optimization of these expenses is not optimal and to verify the results.

Note: No optimization is made for a patient who is the spouse and whose return is not coupled. A diagnostic has been added to advise you that no optimization is made for this patient.

The only types of costs that can be claimed in this section are the following:

- Remuneration paid for part-time attendant care in a nursing home under paragraph 118.2(2)b.1) (Form T2201 required);

- Remuneration paid for full-time attendant care that was not claimed under paragraph 118.2(2)b), 118.2(2)c) or 118.2(2)d) (Form T2201 required) (Note)

This salary must have been paid to a person who was not at the time the taxpayer's spouse or under 18 years of age, and the individual who received the care must have either been someone with a severe and prolonged mental or physical impairment.

Note: Where these costs are eligible under more than one paragraph and where the individual is eligible for the disability tax credit, it becomes important to determine which of the claims is more advantageous for the individual.

Both the disability amount and these expenses can be claimed provided these expenses do not exceed $10,000 (or $20,000 for a deceased person). Note that the Ontario limit is $14,911 (or $29,823 for a deceased person).

The program optimizes the claim by determining whether it is more advantageous for the taxpayer and the spouse (where applicable) to claim these expenses as medical expenses (taking the limit into account) as well as the disability amount or claim the total amount of these expenses paid instead of the disability amount. During optimization, the program compares the following two amounts:

- tax payable (line 43500 of the T1 return) minus the refundable supplement for medical expenses (line 45200 of the T1 return) when these expenses limit and the disability amount are claimed;

- tax payable (line 43500 of the T1 return) when the total of these expenses are claimed.

If the program determines that it is more advantageous to claim these expenses limit and the disability amount, the check box Claim the expenses paid (taking the limit into account) as well as the disability amount will be selected, and the program will limit these expenses to $10,000 in the MED form.

If the program determines that it is more advantageous to claim the total of these expenses, the check box Claim the expenses paid instead of the disability amount will be selected, and the program will cancel the disability amount in the T1 Jacket and Form 428, where applicable, of the patient (either the taxpayer, the spouse or a dependant whose return is connected) or in the FAM form for a dependant whose return is not connected.

The optimization is done for all patients for whom these expenses have been incurred, and you can modify the optimization using an override in subsection “Summary.”

Diagnostics have been added to inform you of the optimization done by the program.

Note that the following amounts could not be taken into account in the optimization of these expenses:

- Canada caregiver amount for infirm children under 18 years of age (line 30500);

- Tax reduction in Forms BC428, NB428, NL428, NS428, ON428 and PE428.

Diagnostics have been added to advise you when the optimization of these expenses is not optimal and you have to verify the results.

Note: No optimization is made for a patient who is the spouse and whose return is not coupled. A diagnostic has been added to advise you that no optimization is made for this patient.

Here is a table from Guide RC4065, Medical Expenses, which details the types of expenses and whether the disability amount can be claimed or not. Note that the same rules apply for Québec.

|

Type of expense |

Certification required |

Can you claim the disability amount? |

|---|---|---|

|

1 - Fees paid for full-time care in a nursing home under paragraph 118.2(2)d) |

Form T2201 or a medical practitioner must certify in writing that the person is, and in the foreseeable future will continue to be, dependent on others for his or her personal needs and care because of a lack of normal mental capacity. |

You can claim the disability amount, if eligible, or these expenses, but not both. |

|

2 - Salaries and wages for attendant care provided in Canada. This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages under paragraph 118.2(2)b.1) |

Form T2201 |

You can claim the disability amount and up to $10,000 for these expenses ($20,000 if the person died in the year). |

|

3 - Salaries and wages for one full-time attendant outside of a self-contained domestic establishment under paragraph 118.2(2)b) |

Form T2201 |

You can claim the disability amount or these expenses, but not both. |

|

4 - Full-time attendant at home under paragraph 118.2(2)c) |

Form T2201 or a medical practitioner must certify in writing that the person is, and is likely to be for a long continuous period of indefinite duration, dependent on others for his or her personal needs and care because of an impairment in physical or mental functions and needs a full-time attendant. |

You can claim the disability amount, if eligible, or these expenses, but not both. |

|

5 - Salaries and wages for care in a group home in Canada under paragraph 118.2(2)b.2) |

Form T2201 |

You can claim the disability amount and these expenses. |

|

6 - Care, or training and care, at a school, institution, or other place (such as a detoxification clinic) under paragraph 118.2(2)e) |

Form T2201 or an appropriately qualified person must certify in writing that because of a mental or physical impairment, the person needs the equipment, facilities, or personnel specially provided by that place for persons with the same type of

impairments. |

You can claim the disability amount, if eligible, and these expenses. |

Eligible amount of medical expenses for other dependants – line 33199

You can calculate the medical expenses paid by you or your spouse or common-law partner for one or several of the following persons, when they are your dependants, on line 33199:

- your children or grand-children ages 18 years old or more (or those of your spouse or common-law partner);

- your parents, grand-parents, brothers, sisters, uncles, aunts, nephews or nieces that resided in Canada at one time in the year (or those of your spouse or common-law partner).

These medical expenses have to be paid in the same 12-month period determined on line 33099.

How to determine medical expenses paid by you or your spouse or common-law partner on line 33199 in Taxprep?

- First, enter the name of the dependant in the family profile (Jump Code: FAM).

- Then, if this person is a dependant eligible for the purpose of line 33199, you may select him or her in the Name of patient drop-down list in Form MED, Medical Expenses Worksheet – Federal (Jump Code: MED).

- Finally, if you or your spouse or common-law partner paid medical expenses for this dependant, select his or her name in the Name of patient drop-down list, enter any other required information as well as the amount paid. This amount will be updated to line 33199.

Note: The medical expenses that were paid by the dependant have to be entered in his or her return and claimed on line 33099. The medical expenses entered in the dependant’s return included in the family data file are never carried over to the taxpayer’s return, because they must be entered in the return of the person who paid them.

Québec Prescription Drug Insurance Plan Premium

For the purpose of the Québec income tax return, the contribution paid to the Québec prescription drug insurance plan is, deemed paid on December 31. In order for the Québec prescription drug insurance plan contribution to be included in medical expenses in Québec for the current year, the medical expenses must cover a 12-month period that includes December 31 of the current year.

For the purpose of the federal income tax return, the Québec prescription drug insurance plan premium paid for the preceding year will only be deductible on the current federal tax return.

Optimization

Keeping certain factors in mind, the program optimizes the medical expenses, in other words, it calculates the optimal use of the medical expenses and the refundable medical expenses supplement by the taxpayer or the spouse.

As only expenses exceeding 3% of net income are deductible, there is an advantage in having the person with the lowest income claim the medical expenses. However, when the couple’s income is low, there is an advantage in having the person whose working income is greater than the base income claim the medical expenses, as that person will also be eligible for a refundable supplement.

Consideration must also be given to the possibility that the person who is eligible to claim the most medical expenses does not need the deduction to reduce tax payable. In some circumstances, due to the refundable supplement, the deduction should still be claimed by that person, while in others, it is more advantageous to ignore the refundable supplement and to claim the medical expenses in the spouse’s return.

To optimize the medical expenses, there must have been a spouse on December 31 (or the spouse must have passed away during the year) and the taxpayer’s and spouse’s returns must be prepared jointly.

The optimization is not applicable if the taxpayer or the spouse:

- arrived or left Canada during the year;

- is a non-resident;

- separated or divorced in the year;

- is in pre-bankruptcy or the return is filed by a trustee.

Several diagnostics have been added to explain the scope of the optimization.

You may, however, modify, in the medical expenses worksheet, the choice made by the program by selecting, using an override, the check box You wish to claim medical expenses. Also, if you want to have the spouses share the expenses, you must override the amount entered on line Medical expenses (line 33099) and/or line Medical expenses for other dependants (line 33199).

The program does not take into account the provincial tax in its optimization calculation (only the federal tax is considered) and does not optimize the deduction for medical expenses for the Québec tax return. However, several diagnostics were added to help you decide concerning the sharing of the deduction by the taxpayer and the spouse.

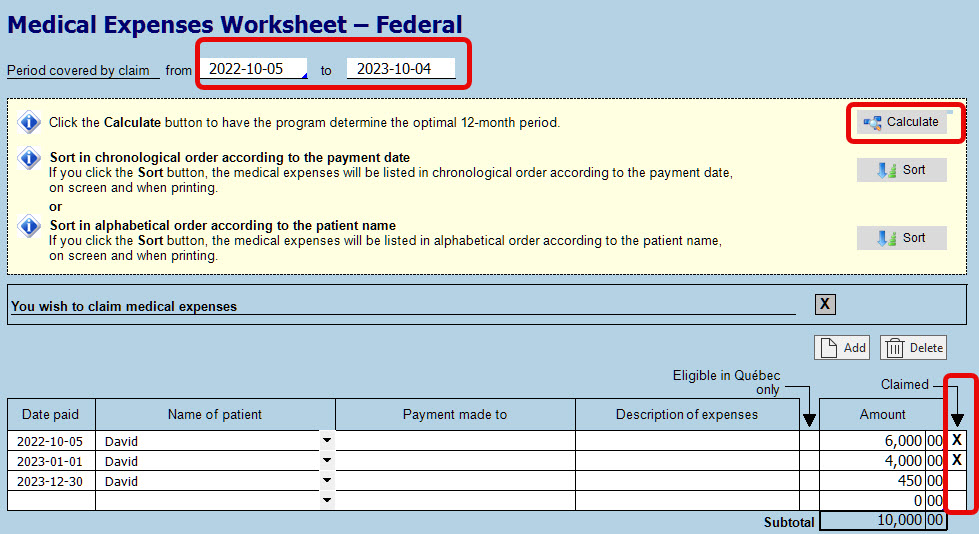

Optimization of the 12-month period

When prior year medical expenses are listed in the medical expenses worksheet, the program allows you to determine the most advantageous 12-month period ending in the current year. To do so, click the Calculate button at the top of the form. The program will modify the dates in the “Period covered by claim” section to find the optimal 12-month period.

The program will clear the box in the Claimed column for each expense that has not been incurred in the period covered. However, note that you still have the ability to manually select or clear the box for each expense.

The medical expenses entered in the medical expenses worksheet whose payment date is included in the current or preceding year and for which the box of the Claimed column is not selected will be rolled forward the following year to retain a history of the expenses paid but not claimed in the last two years. This information can be useful when preparing the return of a deceased person.

See Also

Federal Income Tax and Benefit Guide - Lines 33099 and 33199