Release Notes - CCH iFirm Taxprep T1 2023 v.4.0 (2024.10.37.01)

New: Introducing Wolters Kluwer Support Platform

As part of our commitment to service, Wolters Kluwer is pleased to announce the launch of our new Support Platform.

Register to our Support Platform to submit, modify and track all your support requests in a single location. A chatbot system and a live chat feature powered by our virtual assistant are also included, with access to over 40,000 articles from our knowledge base. Note that since December 1, 2023, the Support Centre no longer offers an email support service, which has been replaced by our new support ticketing system.

If you need help during the registration process, please consult the following article to get all the information you need: How do I register to the new Support Platform?

Register now to our Support Platform and take advantage of all the benefits it has to offer!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Taxprep is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax-related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About

This version contains the forms released by the Canada Revenue Agency (CRA) and Revenu Québec for the 2023 taxation year.

The modifications made to version 4.0 only relate to tax rates and the addition of extra calculations. The 2024 federal and provincial government tax rates which were known at the time of this release have been integrated to help you forecast your clients’ tax situation for the next taxation year (with the Planner mode).

This version is approved for:

-

Paper filing;

-

EFILE;

-

Electronic filing of Form AUTHORIZATION;

-

Electronic filing of Form T1135;

-

Using the Auto-fill T1 return (AFR) service;

-

Using the Tax Data Download (TDD) service;

-

The ReFILE service;

-

The transmission of returns for taxpayers in multiple-jurisdiction situations;

-

The PAD (Pre-authorized debit);

-

The Express NOA (Notice of Assessment);

-

Printing the 2D bar code on the federal and Québec returns;

-

Electronic filing via NetFile Québec.

Import or convert preparer profiles, custom letters, custom print formats and custom diagnostics

When a new taxation year is added to the application, remember that the prior period Preparer Profile, custom letters, custom print formats and custom diagnostics must be imported or converted.

For more information, please consult the following FAQ: https://support.cch.com/canada/solution/000118906/FAQ-Why-is-my-current-Preparer-Profile-empty-since-the-latest-deployment-of-CCH-iFirm-Tax?language=en

Auto-fill T1 return – 2023 Tax Season

Important dates

Federal

February 5, 2024 – Opening of the Auto-fill T1 return service. The CRA tax data can be downloaded from the RETRIEVE tab.

What's New:

-

New T4FHSA slip is now available for download.

-

Addition of a correspondence preference indicator which specifies whether the taxpayer prefers electronic or paper mail from the CRA.

-

Enhancement of the My Account access indicator, which now specifies whether the taxpayer has limited or full access to My Account.

-

Addition of an indicator when the taxpayer has Canada Emergency Benefits (CEB) debt.

-

Addition of an indicator when the taxpayer has an uncashed cheque from the C

Tax Data Download from Revenu Québec – 2023 Tax Season

Important dates

Québec

February 19, 2024 – Opening of the Tax Data Download service.

The Revenu Québec tax data can be downloaded from the RETRIEVE tab.

What's New:

-

New RL-32 slip (FHSA) is now available for download.

Electronic services prior years’ support

Federal

In addition to the current tax year 2023, the CRA also supports prior-year electronic services as indicated below until January 2025:

|

2022 |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

|

|

T1 EFILE (original returns) |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

|

T1 ReFILE (amended returns) |

✓ | ✓ | ✓ | ||||

|

T1135 |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

|

Auto-fill my return (slips only) |

✓ | ✓ |

✓ |

✓ | ✓ | ✓ | ✓ |

|

Express notice of assessment (Express NOA) |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

* You will have to use the CCH iFirm Taxprep T1 program for the year in question and update your EFILE password to the current year.

Québec

In addition to the current tax year 2023, Revenu Québec also supports prior-year electronic services as indicated below until January 2025:

|

2022 |

2021 |

2020 |

|

|

TP1 Netfile Québec (original returns) |

✓ | ✓ | ✓ |

|

TP1 Netfile Québec (amended returns) |

✓ | ✓ | ✓ |

|

Tax data download |

✓ | ✓ | ✓ |

* You will have to use the CCH iFirm Taxprep T1 program for the year in question and update your EFILE password to the current year.

Modifications Made to Version 4.0

Updated Forms

Federal

2024 federal budget – Capital gains measures

Following the proposals in the 2024 federal budget to increase the capital gains inclusion rate from one-half to two-thirds on the portion of capital gains realized in the year exceeding $250,000 beginning June 25, 2024, as well as the increase in the lifetime capital gains exemption on the disposition of qualified small business corporation shares and qualified farm or fishing property to $1,250,000, also beginning June 25, 2024, the following changes have been made to version 4 of CCH iFirm Taxprep T1 2023 for 2024 planning purposes:

-

Schedule 3: addition of a custom section on screen only to distinguish capital gains realized before June 25, 2024 (period 1) from those realized after June 24, 2024 (period 2).

-

Form T2017: addition of 2023 reserves for the previous year and 2024 reserves for period 1 and period 2.

-

Form T657: addition of two sections with respect to the two new caps on the lifetime capital gains exemption:

Part 3t for the $1,016,836 cap for period 1

Part 3u for the $1,250,000 cap for period 2

These additions enable preparers to carry out planning in line with these new measures. Here are the general steps to follow in this regard:

-

Complete Schedule 3 as usual.

-

Complete Form T2017 as usual.

-

Complete the custom section in Schedule 3 to distinguish period 1 gains from period 2 gains and indicate in the section relating to period 2 the capital losses from other years and the capital gains deduction to be applied against this period's gains.

Diagnostics have also been added to guide the preparer when planning with respect to capital gains.

Please note that these new measures have been implemented based on our understanding of the information contained in the budget documents, as no bill has been tabled at this time. In addition, the calculations have not been adjusted for early-filed returns and do not consider Gains resulting from donations (Form T1170)

AMT 2024, Estimated Alternative Minimum Tax for the 2024 Taxation Year

In the 2024 federal budget, the government has announced changes to the alternative minimum tax. Therefore, adjustments have been made to the form. The calculations are performed in Planner Mode only.

Note that the following components are not considered in the estimate:

-

No amount is carried over on the tax return and no provincial or territorial alternative minimum tax calculation is performed.

-

The calculations do not take into account the amount of the alternative minimum tax carryover that may be claimed in 2024.

-

The calculation of the special foreign tax credit does not take into account the inclusion of the full amount of any applicable capital gain in the calculation of the individual's non-business income from foreign sources.

Capital cost allowance (CCA) – Accelerated rate for new eligible purpose-built rental projects

The 2024 budget proposes an accelerated CCA rate of 10% under class 1 for new eligible purpose-built rental projects for which construction begins on or after Budget Day and before January 1, 2031, and are available for use before January 1, 2036.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

Capital cost allowance (CCA) – Immediate expensing of productivity-enhancing assets

In its April 16, 2024, budget, the federal government is proposing immediate expensing for new additions to classes 44, 46 and 50 if the property is acquired on or after Budget Day and becomes available for use before January 1, 2027. The enhanced deduction would provide a 100% first-year deduction and would be available only for the year in which the property becomes available for use.

Property that becomes available for use after 2026 and before 2028 would continue to benefit from the accelerated investment incentive.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

Capital cost allowance (CCA) – Phasing out of the accelerated investment incentive measure

A phase-out period of the tax measures related to accelerated investment incentive property (AIIPs) is beginning in 2024. The UCC adjustment factor is modified for all CCA classes considered to be AIIPs. The adjustment factor is reduced from 7/3 to 1.5 for classes 43.1, 54 and 56, from 1 to 0.5 for classes 43.2 and 53, and from 1.5 to 7/8 for class 55. For all other classes, the adjustment factor is zero.

The new calculations have not been integrated in this version of the program, but diagnostics requesting changes to certain amounts when these new tax rules are applicable have been added.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

Schedule 6, Canada Workers Benefit – Enhancement of four payments

In its April 16, 2024, budget, the federal government plans to pay the Canada Workers Benefit in four instalments a year instead of three and increase the amounts so that a family can receive up to $2,739 a year as well as an additional amount of $821 for workers with disabilities.

The calculation of the four payments will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

The amounts above have been integrated in the current version of the program but are only available in Planner Mode or for returns that are produced early.

Passenger vehicles – Increase of the capital cost ceiling for passenger vehicles in respect of capital cost allowance and maximum monthly deductible leasing costs purposes

On December 2023, the Department of Finance Canada has announced, through a news release, the ceilings governing the deductibility of automobile costs and the rates used to calculate the value of taxable benefits related to the use of an automobile that will be applicable for the year 2024.

Effective January 1, 2024:

-

the $36,000 ceiling applicable to passenger vehicles (Class 10.1) will increase to $37,000 when such a vehicle is purchased after 2023;

-

the ceiling will increase from $950 to $1,050 a month in respect of eligible deductible leasing costs for leasing contracts entered into after 2023.

-

the maximum allowable interest deduction will be increased to $350 from $300 per month for new automobile loans entered into on or after January 1, 2024.

The new calculations have not been integrated to this version of the program, but diagnostics have been added asking to modify certain amounts when these new tax rules are applicable.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

Adding a second CPP contribution (CPP2)

In Bill C-26 assented to in 2016, the federal government indicates that, starting in 2024, CPP2 contributions will be made in addition to basic CPP contributions and the first additional CPP contributions.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

Launching the Canada Disability Benefit

The 2024 budget announces that the government would begin paying this benefit to eligible low-income, working-age Canadians with disabilities between the ages of 18 and 64 starting in July 2025, since the benefit will come into force in June 2024. The model proposes a maximum benefit amount of $2,400 per year for eligible individuals.

This update will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

Doubling the volunteer firefighter and search and rescue tax credits

The 2024 budget announces the government's intention to increase tax credits from $3,000 to $6,000. This increase will provide these volunteers with up to $450 back on their taxes.

The amounts above have been integrated in the current version of the program but are only available in Planner Mode or for returns that are produced early.

Deduction for tradespeople’s travel expenses

The 2024 federal budget proposes to introduce a single, harmonized deduction for certain travel expenses of tradespeople in the construction industry, with no cap on expenses, retroactive to the 2022 taxation year.

This change will be incorporated into version 1.0 of CCH iFirm Taxprep T1 2024.

Indigenous child and family services settlement

The 2024 federal budget proposes to exclude the income of the trusts established under the First Nations Child and Family Services, Jordan’s Principle, and Trout Class Settlement Agreement from taxation. This measure would apply to the 2024 and subsequent taxation years. The federal government is also committed to ensure that federal social benefits and social assistance benefits for class members would not be negatively impacted by the payments received.

This change will be incorporated into version 1.0 of CCH iFirm Taxprep T1 2024.

Employee ownership trust tax exemption

The 2023 federal budget proposed to exempt the first $10 million in capital gains realized on the sale of a business to an EOT from taxation to facilitate the creation of employee ownership trusts under Bill C-59.

This change will be incorporated into version 1.0 of CCH iFirm Taxprep T1 2024.

Québec

Harmonization with new capital gains measures

Following the announcement made by the Ministère des Finances du Québec on its position to harmonize with the proposals in the 2024 federal budget to increase the capital gains inclusion rate from one-half to two-thirds on the portion of capital gains realized in the year exceeding $250,000 beginning June 25, 2024, as well as the increase in the lifetime capital gains exemption on the disposition of qualified small business corporation shares and qualified farm or fishing property to $1,250,000, also beginning June 25, 2024, the following changes have been made to version 4 of CCH iFirm Taxprep T1 2023 for 2024 planning purposes:

-

Schedule G: addition of a custom section on screen only to distinguish capital gains realized before June 25, 2024 (period 1) from those realized after June 24, 2024 (period 2).

-

Schedule G: addition of 2023 reserves for the previous year and 2024 reserves for period 1 and period 2.

-

Form TP-726.7: addition of two lines to Work Chart 2:

For the $1,016,836 cap for period 1

For the $1,250,000 cap for period 2

These additions enable preparers to carry out planning in line with these new measures. Please see the general steps to follow in the Federal section of the same topic. The preparer will then need to override the information in the custom section of Schedule G and will also need to indicate in the section relating to period 2 the capital losses from other years and the capital gains deduction to be applied against this period's gains.

Diagnostics have also been added to guide the preparer when planning with respect to capital gains.

Please note that these new measures have been implemented based on our understanding of the information contained in the budget documents, as no bill has been tabled at this time. In addition, the calculations have not been adjusted for early-filed returns and do not consider the following components:

-

Capital gains deduction on resource property

-

Gains resulting from donations (Form Q1170)

-

Adjustment of investment expenses versus capital gains (Schedule N)

QAMT 2024, Estimated Alternative Minimum Tax for the 2024 Taxation Year

The purpose of this new grid is to estimate on a summary basis whether the individual is subject to the Québec alternative minimum tax for the 2024 taxation year. Calculations are made in Planner Mode only, based on the information available in Information Bulletin 2023-7 published on December 19, 2023.

As a result of the belated announcement with respect to the harmonization of the measures announced in the 2024 federal budget, these measures are not reflected in the form.

Notes:

-

The calculations take into account the increase in the capital gains inclusion rate following the harmonization decision announced in the 2024 federal budget (Information Bulletin 2024-5).

-

No amount is carried over on the tax return. The calculations do not take into account the amount of the alternative minimum tax carryover that may be claimed in 2024.

-

No adjustment is made with respect to capital losses of other years and business investment losses since these losses are applied at a rate of 50% on the return. The Information Bulletin indicates that this rate will be 50% for AMT purposes.

-

The calculation does not take into account multiple jurisdictions.

Changes made to the Québec Pension Plan

As of January 1, 2024, workers aged 65 and over who are already receiving their retirement pension will be able to stop contributing to the QPP. If a person chooses to stop contributing to the Plan, the contributions made by his or her employer will also cease. On January 1 of each year, workers who turned 72 years old in the previous year will automatically stop contributing to the QPP.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

Capital cost allowance (CCA) – Elimination of the additional deduction of 30% in Québec

As announced by the Ministère des Finances du Québec in Information Bulletin 2023-6 published on November 7, 2023, the additional deduction of 30% for property in classes 14, 14.1, 43.1, 43.2, 44, 50 and 53 that was acquired after December 31, 2023, is abolished. Property acquired before January 1, 2024, that meets all other eligibility criteria may still qualify for the additional deduction for the period during which the taxpayer is claiming CCA on that property.

The new calculations have not been integrated in this version of the program, but diagnostics requesting changes to certain amounts when these new tax rules are applicable have been added.

The new calculations will be integrated in version 1.0 of CCH iFirm Taxprep T1 2024.

New Brunswick

New tax credits for volunteer firefighters and search and rescue volunteers

In its Bill 27, the Government of New Brunswick proposes two non-refundable provincial tax credits: one for volunteer firefighters and the other for search and rescue volunteers.

This change will be incorporated into version 1.0 of CCH iFirm Taxprep T1 2024.

Prince Edward Island

PE428, Prince Edward Island Tax and Credits

The following measures were announced in the 2024 Prince Edward Island budget and have been integrated to the current version of the program, but only in Planner mode or for early-filed returns:

-

The current three personal income tax brackets and surtax have been replaced by a five-bracket system for the 2024 tax year, with lower tax rates for each of the first three brackets. The brackets are divided as follows:

9.65% on taxable income of $32,656 or less;

13.63% on the portion of taxable income exceeding $32,656, but not exceeding $64,313;

16.65% on the portion of taxable income exceeding $64,313, but not exceeding $105,000;

18% on the portion of taxable income exceeding $105,000, but not exceeding $140,000;

18.75% on taxable income exceeding $140,000.

-

The Prince Edward Island non-refundable tax credit rate has decreased to 9.65% for the 2024 taxation year.

Planner mode

The 2024 tax rates which were known at the time of this release have been integrated to help you forecast your clients’ tax situation for the next taxation year (with the Planner mode).

Modifications Made to Version 3.0

Updated Forms

Federal

Payments greater than $10,000 – Mandatory electronic payments

When the income tax balance owing on the T1 return is greater than $10,000, a diagnostic will be displayed to indicate that payments of more than $10,000 to the Receiver General of Canada must now be made electronically, either through a financial institution's online services, the CRA's My Payment service, or through a pre-authorized debit agreement set up on the CRA's My Business Account site.

A diagnostic has also been added for instalment payments, as the same principle applies to instalment payments of more than $10,000.

Revenu Québec has harmonized with this measure. As a result, all tax payments and instalments greater than $10,000 must be made electronically.

This new obligation has been in effect since January 1, 2024. Taxpayers who fail to comply could face penalties.

T101 slip, Statement of Resource Expenses

Addition of box 155, Expenses qualifying for a provincial tax credit – CMETC – Ontario

As a result of provincial Bill 146 (Ontario), the Ontario focused flow-through share tax credit is harmonized with the 2022 amendments to the Income Tax Act relating to flow-through shares. Thus, critical mineral exploration expenses are considered for the Ontario provincial tax credit. Therefore, box 155 has been added to the T101 slip.

T5013 slip, Statement of Partnership Income

Addition of boxes relating to expenses qualifying for a provincial tax credit – CMETC

To enable the exploration of critical minerals, a new 30% critical mineral exploration tax credit (CMETC) has been introduced in 2022. As critical mineral exploration expenses are considered for provincial tax credits, four boxes have been added to the T5013 slip:

-

Box 241, Critical Mineral Exploration Tax Credit – British Columbia;

-

Box 242, Critical Mineral Exploration Tax Credit – Saskatchewan;

-

Box 243, Critical Mineral Exploration Tax Credit – Manitoba;

-

Box 244, Critical Mineral Exploration Tax Credit – Ontario.

Climate Action Incentive Payment

The benefit known as the Climate action incentive payment (CAIP) from 2021 to 2023 was renamed the Canada Carbon Rebate (CCR) in 2024.

This version contains the updated rates for 2024 for all provinces concerned. It should be noted that in Bill C-59, the government announced that as of April 2024, the rural supplement will increase from 10% to 20%. However, this bill has not been sanctioned yet. We will monitor the situation to include the rate update when Bill C-59 is sanctioned.

T1206, Tax on Split Income

Lines 9 and 10 have been added to section Calculation of line 42000 of your return of Form T1206 to reflect Bill C-47.

Lines 78 to 92 of section Tax on split income for multiple jurisdictions, province or territory with an income allocation that is not your province or territory of residence now apply, in addition to the six current provinces and territories, to the Northwest Territories.

As a result, these lines must be completed for each applicable province or territory to which income is allocated in Part 1 of Form T2203 and which is not the province or the territory of residence of the taxpayer. The applicable provinces and territories are British Columbia (BC), Saskatchewan (SK), Newfoundland and Labrador (NL), Prince Edward Island (PE), Manitoba (MB), Yukon (YT) and the Northwest Territories (NT).

Alberta

Alberta Child and Family Benefit

The Alberta child and family benefit rates have been adjusted.

Newfoundland and Labrador

Newfoundland and Labrador Child Benefit

The Newfoundland and Labrador child benefit rates are increasing effective July 1, 2024. The rates have been adjusted to reflect this change.

Corrected Calculations

The following problems have been corrected in version 2023 3.0:

Federal

Electronic Filing

Federal

New:

Starting with the 2023 tax year, the CRA has lifted additional EFILE restrictions to allow the following types of T1 returns to be accepted electronically:

-

Non-residents filing a return under section 116 of the Income Tax Act

-

Deemed residents filing a return for other reasons than staying in Canada for 183 days or more

-

Emigrants

As a result, the CRA has created the EFILE field Residency type. This field can be found in the Residence section of the ID form. It is a mandatory field for all T1 returns that are EFILED and is automatically calculated by the program.

As indicated above, not all non-resident and deemed resident returns can be EFILED this year. Diagnostics have been added or modified to indicate which situations remain EFILE exclusions.

Note that these transmissions will be available in the next version of CCH iFirm Taxprep T1, scheduled to be released in early March.

ReFILE (amended return)

The CRA now allows the transmission of the following ReFILE requests:

-

Returns from newcomers to Canada (immigrants)

Information about EFILE

Federal

Important dates

- February 5, 2024 Opening of the system for electronic transmission of authorization requests.

- February 19, 2024 Opening of the EFILE On-Line transmission system.

- January 24, 2025 The CRA will stop accepting electronically filed T1 returns.

Registration and Renewal On-line

To renew your EFILE privileges for this year’s tax season, you must follow the instructions provided on the "Renewal" page on the CRA Web site at http://www.efile.cra.gc.ca/l-rnwl-eng.html.

To register as a new electronic filer, you must register online by completing the EFILE Registration On-Line form on the CRA Web site at http://www.efile.cra.gc.ca/l-rgstr-eng.html.

You will find more information concerning renewals and new applications at http://www.efile.cra.gc.ca/.

In order to be able to electronically file Form AUTHORIZATION, you must meet the following two criteria:

- Have a valid EFILE number and password; and

- Be a registered representative (online access).

A registered representative is a person who is registered with the CRA’s Represent a Client service. To register with the service, go to http://www.cra.gc.ca/representatives

Québec

Important dates

- February 19, 2024 – Opening of the NetFile Québec system.

- February 19, 2024 – Opening of the Refund Info-line system.

- January 17, 2025 – The NetFile Québec system will shut down.

NetFile Québec

- Tax preparers must register for “My Account for professional representatives” (available in French only), a secure space on RQ’s Web site, if they have not already done so in the past.

Note that renewal is automatic for persons who registered for this space in the past. - Consult the page “À qui s'adresse Mon dossier” (available in French only) to see which profile applies to you and what actions you can perform online on behalf of a business or an individual.

Modifications Made to Version 2.0

Updated Forms

Federal

ID, Identification and Other Client Information

The field Second name has been added for EFILE purposes to the First-time filer section. This optional field is to be used only when a taxpayer files a T1 return for the first time with the CRA. This field is EFILED to the CRA but does not appear anywhere on the T1 return. Even when a second name is provided when filing a return for the first time, the CRA will not ask again for this second name when a taxpayer files his or her T1 returns in subsequent years.

First Home Savings Account (FHSA)

Additions have been made to the program to reflect the measure.

Schedule 15

The question Did the taxpayer open one or more FHSAs in 2023 and did not make any contributions, transfers or withdrawals? is now required.

Accountant’s Summary

A section has been added to present information on the first home savings account (FHSA).

Client letters

Form T1279 has been added as a form to be signed in the client letters.

Climate Action Incentive Payment

Climate action incentive payments for 2024 for all the provinces concerned have not been announced at the time of this version’s release. It should be noted that in Bill C-59, the rural supplement will increase from 10% to 20%. However, the bill has not been sanctioned yet. We will monitor this situation to include the 2024 rate update when Bill C-59 is sanctioned.

T4A, Statement of Pension, Retirement, Annuity & Other Income

Lump-sum payments from a SPP or a money purchase RPP must be reported on line 11500 if a taxpayer is 65 years old or older on December 31 or if the amount was received upon the death of a spouse or a common-law partner. Box 0181 has been added to Form T4A to report the relevant amount.

For Québec residents, box C9 has been added to the Rl-2 slip to report the amount on line 122 of the TP1 income tax return.

T777, Statement of Employment Expenses and T2200, Declaration of Conditions of Employment

The temporary flat rate method that allowed eligible employees, for the 2020 to 2022 taxation years, to deduct $2 for each day worked at home has been abolished for the 2023 taxation year.

As a result, Forms T777S, Statement of Employment for Working at Home Due to COVID-19, and TP-59.S, Expenses Related to Working Remotely Because of the COVID-19 Pandemic, have been removed from the program.

Under certain conditions, eligible employees who worked from home in 2023 will still be able to claim home office expenses by completing Form T777, using the detailed method.

Taxpayers who wish to claim home office expenses for 2023 using the detailed method will need to obtain Form T2200.

In addition, Form T2200S, Declaration of Conditions of Employment for Working at Home Due to COVID-19, has been deleted. Form T2200 will need to be completed to justify employment expenses, without regard to the situation.

T1170, Capital Gains on Gifts of Certain Capital Property

The calculation of the capital gain resulting from the donation of certified ecologically sensitive land now includes a separate section on Form T1170. As a result of this change, the gain subject to the inclusion rate of 50% of a donation of certified ecologically sensitive land is now carried forward to item 4, Real estate, depreciable property and other properties rather than item 5, Bonds, debentures, promissory notes, crypto-assets, and other similar properties, of Schedule 3.

For Québec, the same change has been made to Form Q1170, and the new section is carried forward to section Immovables and depreciable property of Schedule G.

The format of the maturity date in section Bonds and debentures that are publicly traded, and other properties has changed, and the day is now displayed. If an entry was made with version 1 of the program, the date will automatically display the 15th of the month. Review the entries and make any necessary corrections.

T1223, Clergy Residence Deduction

Changes have been made to Form T1223 to allow more than one choice to be entered in questions 1 and 3 of Part B – Conditions of employment. If entries were made for these questions in version 1 of the program, they will be lost and will need to be entered again.

T2043, Return of Fuel Charge Proceeds to Farmers Tax Credit

For the 2023 taxation year, residents of Nova Scotia (NS), Prince Edward Island (PE), Newfoundland and Labrador (NL) and New Brunswick (NB) will be able to claim the Return of fuel charge proceeds to farmers tax credit by completing Form T2043.

For the provinces of NS, PE, NL and NB, the rate of the tax credit is 0.140% of the amount of eligible farming expenses.

For the provinces of Ontario (ON), Manitoba (MB), Saskatchewan (SK) and Alberta (AB), which are already eligible for this credit, the tax credit is increased to 0.186% of the eligible farming expenses.

CCA class 10.1

In Forms CCA class 10.1 and AUTO, section Proceeds of disposition for a passenger vehicle (DIEP in a prior taxation year only) has been added to calculate the proceeds of disposition when disposing of a passenger vehicle that is DIEP.

As a result, the following fields have been added:

-

Proceeds of disposition

-

Cost of the passenger vehicle

-

Original capital cost

-

Government assistance received or repaid

-

Applicable proceeds of disposition

The program will roll forward the new field Original capital cost for the 2022 files that were rolled forward with version 2.0 and subsequent versions. The 2022 files previously rolled forward with version 1.0 will need to be revised in order to make the required changes; the 2022 files can be rolled forward again with version 2.0.

When the disposal date is in the taxation year and the answer to the question Was the property a DIEP in a prior taxation year? is Yes, the fields in section Proceeds of disposition for a passenger vehicle (DIEP in a prior taxation year only) will need to be completed.

The disposition amount will correspond to the amount calculated on line Applicable proceeds of disposition when it exceeds the UCC available used to calculate the recapture of a passenger vehicle that is DIEP. In other cases, the proceeds of disposition will be equal to zero.

Québec

Schedule B, Tax Relief Measures

The Basic Income Program (BIP) came into effect on January 1, 2023. This program is intended for people who, for at least 66 months out of the last 72, have had severe employment constraints and have been recipients of the Social Solidarity Program or similar government measures.

Individual BIP recipients receiving a monthly adjustment for a person without a spouse will be deemed not to ordinarily live with any other person. As a result, the claimant may receive the amount for a person living alone if the conditions are met.

The monthly adjustment for a person without a spouse is shown in box Q1 of the RL-5 slip.

Schedule P, Tax Credits Respecting the Work Premium

The adapted work premium may be claimed by an individual if he or she or his or her spouse has received benefits under the Basic Income Program.

T4A, Statement of Pension, Retirement, Annuity & Other Income

Box RY, One-time payment for older seniors, has been removed from the Québec column.

Modifications Made to Version 1.0

Forms, Schedules, and Workcharts Added to the Program

Federal

First Home Savings Account (FHSA)

In Budget 2022, the government proposed the introduction of the First Home Savings Account (FHSA). This new registered plan, available since April 1, 2023, allows future first-time home buyers to save a total of $40,000 tax free, up to an annual contribution limit of $8,000. Like a Registered Retirement Savings Plan (RRSP), contributions are tax deductible, and withdrawals for first-time homebuyers, including investment income, are tax free, as is the case with a Tax-Free Savings Account (TFSA).

For more information on the FHSA, visit: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account.html.

For Québec residents, the Québec government has announced the harmonization of the measure in Information Bulletin 2022-4 dated June 9, 2022.

This new measure is reflected in the program as follows:

New T4FHSA slip

The new T4FHSA slip is issued to an individual who has opened a FHSA when a transaction with an impact on his or her tax return has been carried out during the year.

For Québec residents, the new RL-32 slip is issued.

New lines - Income Tax and Benefit Return

While a withdrawal from a FHSA is not included in your income if it is a qualifying withdrawal, a designated amount or an amount otherwise included in your income, the amount withdrawn from a FHSA is taxable in all other cases. In addition, contributions made during the year may be deducted.

As a result, the T1 general return introduces three new lines:

-

Line 12905, First home savings account (FHSA) income;

-

Line 12906, FHSA income – other;

-

Line 20805, FHSA deduction.

For Québec residents, the following additions have been made:

-

Code 19 has been added to Line 154, Other income;

-

Line 215, FHSA deduction, has been added to the TP1 income tax return;

-

Code 13 has been added to Line 250, Other deductions.

New custom Form 12905/12906

The new custom Form 12905/12906 shows details of income included on lines 12905 and 12906.

New Schedule 15

The new Schedule 15 must be completed if:

-

a FHSA has been opened during the year;

-

contributions have been made to the FHSA;

-

a transfer from a Registered Retirement Savings Plan (RRSP) to a FHSA has been made;

-

a designation of FHSA amounts has been made;

-

a qualifying withdrawal from a FHSA has been made.

This schedule is also used to calculate the FHSA deduction available for the year and the unused FHSA contribution that can be carried forward to future years.

Addition of two custom sections

Two custom sections have been added to the bottom of Schedule 15 to track the taxpayer's FHSA:

-

FHSA information;

-

Calculation of an excess FHSA amount.

Form CFSUM

A FHSA section has been added to carry forward balances available on Schedule 15.

Client letters

Client letters have been updated to include FHSA information.

Planner mode

In order for calculations to take into account the amount of deferred contributions and unused FHSA contributions that may be deducted in future years, custom lines have been added to Schedule 15.

Schedule 12, Multigenerational Home Renovation Tax Credit (MHRTC)

The Multigenerational Home Renovation Tax Credit (MHRTC) is a new refundable tax credit that can be claimed on the 2023 tax return by completing the new Schedule 12.

This new tax credit is intended for families wishing to create a secondary unit so that a senior or a disabled person can live close to a relative.

This secondary unit must accommodate a relative that is 65 years of age or older or a relative that is 18 to 64 years of age that qualifies for the disability tax credit. This may be a grandparent, a parent, a child, a grandchild, a brother or a sister, an aunt or an uncle, or a niece or a nephew.

The tax credit is 15% of the lesser of qualifying expenditures and $50,000, up to a maximum credit of $7,500 per qualifying renovation.

T4 Slip Summary

Box 45, Employer-offered dental benefits, has been added to the T4 Slip Summary to indicate the employee's dental insurance status.

For 2023, box 45 might be empty in certain situations.

Box 45 is shown for information purposes only; it does not affect any calculations on the return.

For more information: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/completing-filing-information-returns/t4-information-employers/t4-slip.html.

AMT 2024, Estimated alternative minimum tax for the 2024 taxation year

The purpose of this new workchart is to estimate on a summary basis whether the individual is subject to the federal alternative minimum tax for the 2024 taxation year. The calculations are performed in Planner Mode only, with respect to the measures that were introduced in the 2023 federal budget.

Notes:

-

No amount is carried over on the tax return and no provincial or territorial alternative minimum tax calculation is performed.

-

The calculations do not take into account the amount of the alternative minimum tax carryover that may be claimed in 2024.

-

The capital gains amount does not include the adjustments that are normally made on lines 22 to 27 of Form T691.

-

No adjustment is made with respect to capital losses of other years and business investment losses since these losses are applied at a rate of 50% in the return. The 2023 budget provides that this rate will also be 50% for AMT purposes.

-

The calculations do not take into account the investment tax credit, the recapture of the investment tax credit and the federal surtax on business income earned outside Canada.

Québec

TP-1029.61.MD, Expenses Included in Rent at a Private Seniors’ Residence – Tax Credit for Home-Support Services for Seniors

This new form contains the worksheet with respect to expenses included in the rent for a private seniors' residence, which was previously included in Part 1 of Schedule J.

The form is used to calculate the cost of home-support services for the individual who lived in a private seniors' residence, in the same way as in previous years. However, a second table has been added for cases of involuntary separation (when the taxpayer and the spouse both live in the residence, but separately), to detail the expenses included in the spouse's rent.

The amounts on lines 22 and 23 of Form TP-1029.61.MD are carried over to the same line numbers of Schedule J.

For more information, refer to the section on Schedule J and the Help of Form TP-1029.61.MD.

British Columbia

T1356, British Columbia clean buildings tax credit

A new temporary tax credit, the British Columbia clean buildings tax credit, has been introduced for individuals undertaking qualifying retrofits that improve the energy efficiency of eligible commercial and residential buildings with four or more units in British Columbia. The tax credit is equal to 5% of eligible expenses. The retrofit must be completed before April 1, 2026, and be certified by the British Columbia Ministry of Finance to qualify. The credit amounts are then reported on form BC479.

Saskatchewan

T1279, Saskatchewan Mineral Exploration Tax Credit

This credit was previously calculated in Form SK428. The CRA has added Form T1279 to calculate the credit or carry it back to previous years. The tax credit rate is increased to 30% for 2023 and subsequent taxation years.

Updated Forms

Federal

Client Information (interview)

The field The Québec TP1 return is applicable was added to section Other information. This field can be used when creating custom filters or diagnostics if needed.

Schedule 3, Capital gains (or losses)

In its 2022 budget, the federal government introduced a new rule concerning property flipping. New subsection 12(12) of the Act provides that profits from property flipping of residential or rental property (defined in new subsection 12(13)) held for less than 365 consecutive days prior to the resale will be subject to full taxation. Accordingly, profits from property flipping are considered to be fully taxable business income and are not eligible for the 50% capital gains inclusion rate or the principal residence exemption. In addition, new subsection 12(14) provides that a taxpayer’s business loss with respect to property flipping is deemed to be nil.

Two lines have been added to Schedule 3 to indicate whether the taxpayer has disposed of a property to which this new rule applies and whether the disposition can reasonably be considered to have occurred because of or in contemplation of one of the life events to which the rule does not apply.

For more information on property flipping and the life events that are excluded from the rule, see the information on Schedule 3 and in the help section therein.

T2125, Residential and rental property flipping

Starting in 2023, profits or losses resulting from a flipped residential or rental property owned for less than 365 consecutive days prior to it being resold are now deemed to be business income and must be reported on Form T2125.

A check box has been added to Form T2125 to indicate that a flipped property has been reported. When this box is selected and the flipped property generates a loss, this loss will be deemed to be nil (the amount on line 9946 of Form T2125 will be equal to zero).

Schedule 6, Canada Workers Benefit

Effective July 2023, all taxpayers who claimed the Canada Workers Benefit (CWB) on line 45300 of their 2022 tax return (by filing Schedule 6) have received the Advanced Canada Workers Benefit (ACWB).

Taxpayers who received the ACWB in 2023 will receive a RC210 slip. The ACWB amounts entered on the RC210 slip will be carried forward to a new section (Step 4), which has been added to Schedule 6.

The ACWB amount received by the taxpayer and to be carried forward to line 41500 of the T1 return will not exceed the Canada Workers Benefit (CWB) amount calculated in Schedule 6. The calculation of the CWB amount to be carried forward to line 41500 of the T1 return is performed in the new section in Schedule 6.

In addition, box 11 has been added to the RC210 slip. This new box is used to indicate the portion of the disability supplement that is included in ACWB payments separately.

Since the CRA now automatically pays ACWB amounts to all qualifying taxpayers, the amounts of the ACWB payments that the taxpayer will receive will be calculated in a section that has been added to the RC210 slip. A paragraph has also been added to the letters to indicate the ACWB payment amounts to which the taxpayer is entitled.

T4A, Statement of Pension, Retirement, Annuity and Other Income

Addition of box 15, Payer-offered dental benefits

In the 2023 budget, the government clarifies the implementation of the Canadian Dental Care Plan. The plan will cover dental care for uninsured Canadians with an annual family income under $90,000, while those with a family income under $70,000 will not have to pay a co-payment.

As a result, box 15, Payer-Offered dental benefits, has been added to the T4A slip to indicate whether the individual has access to dental coverage and, if so, whether it also covers the spouse and dependent children.

Modification to box 201, Repayment of COVID-19 financial assistance

Prior to 2023, the amount reimbursed for federal benefits related to COVID-19 was to be reported on line 23210, while the amount reimbursed for provincial and territorial benefits related to COVID-19 was to be reported on line 23200.

In 2023, with the elimination of line 23210, the reimbursed amount of federal benefits related to COVID-19 will also be included on line 23200.

This measure is reflected in the program as follows:

-

Box 201 is no longer duplicated;

-

Box 201 is carried over completely to line 23200;

-

Line 23210 is deleted.

Worksheet for the return

Following technical interpretation 2018-0753471E5 published on October 6, 2023, by the CRA, the calculations of the worksheet for line 45200 – Refundable medical expense supplement has been modified so that the adjusted family net income no longer includes the income from a spouse or common-law partner who died during the year.

T657, Calculation of Capital Gains Deduction

If you disposed of qualified farm or fishing property (QFFP) or qualified small business corporation shares (QSBCS) you may be eligible for the lifetime capital gains exemption (LCGE). Because you only include one half of a capital gain in your income, your cumulative capital gains deduction is one half of the LCGE.

The total of your capital gains deductions on gains arising from dispositions in 2023 of qualifying capital property has increased to $485,595 (i.e., one half of the LCGE increased by indexation to $971,190 for 2023).

For dispositions of QFFP after April 20, 2015, the LCGE is increased to $1,000,000. This additional deduction does not apply to dispositions of QSBCS:

-

The limit on gains arising from dispositions in 2022 of qualifying capital property is $456,815 (one half of an LCGE of $913,630)

-

The limit on gains arising from dispositions in 2021 of qualifying capital property is $446,109 (one half of an LCGE of $892,218)

-

The limit on gains arising from dispositions in 2020 of qualifying capital property is $441,692 (one half of an LCGE of $883,384)

-

The limit on gains arising from dispositions in 2019 of qualifying capital property is $433,456 (one half of an LCGE of $866,912)

-

The limit on gains arising from dispositions in 2018 of qualifying capital property is $424,126 (one half of an LCGE of $848,252)

-

The limit on gains arising from dispositions in 2017 of qualifying capital property is 417,858 (one half of an LCGE of $835,716)

-

The limit on gains arising from dispositions in 2016 of qualifying capital property is $412,088 (one half of an LCGE of $824,176)

-

The limit on gains arising from dispositions in 2015 of qualifying capital property is $406,800 (one half of an LCGE of $813,600)

-

The limit on gains arising from dispositions in 2014 of qualifying capital property is $400,000 (one half of an LCGE of $800,000)

-

The limit on gains arising from the dispositions of qualifying capital property after 2008 and before 2014 is $375,000 (one half of an LCGE of $750,000).

TP-80, Business or Professional Income and Expenses

Line 122, Work in progress at the beginning of the fiscal period, has been removed from section Income and expenses of Form TP-80.

Until 2022, all expenses related to telecommunications, electricity, heating and water had to be reported on line 238 of the form.

Starting in 2023, line 238 will be used to report telecommunication expenses only. Electricity, heating and water expenses will be reported on the new line 239 of Form TP-80.

Passenger vehicles – Increase of the capital cost ceiling for passenger vehicles in respect of capital cost allowance and maximum monthly deductible leasing costs purposes

Effective January 1, 2023:

-

the $59,000 ceiling applicable to zero-emission passenger vehicles (Class 54) will increase to $61,000 when such a vehicle is purchased after 2022;

-

the $34,000 ceiling applicable to passenger vehicles (Class 10.1) will increase to $36,000 when such a vehicle is purchased after 2022;

-

the ceiling will increase from $900 to $950 a month in respect of eligible deductible leasing costs for leasing contracts entered into after 2022.

The following forms have been updated to reflect the new rates, effective January 1, 2023, for vehicle acquisitions or leases:

-

Forms Partner, AUTO and CCA 10.1 of Forms T2125, TP-80, T2042, Q2042, T2121, Q2121, T776, TP-128, T1163, T1273, as well as Forms T777 AUTO and T777 CCA.

Québec

Schedule C, Tax Credit for Childcare Expenses

Line 20, If you are entering expenses paid to a camp or boarding school, check box 20, has been removed from Schedule C.

Schedule J, Tax Credit for Home-Support Services for Seniors

Part 1, which is used to calculate the cost of home-support services for an individual who has lived in a private seniors' residence, is now on the new form Expenses Included in Rent at a Private Seniors’ Residence. The fields 22 and 23 of Form TP-1029.61.MD will be carried over to the corresponding fields of Schedule J.

Schedule L, Business Income

Line 30, Montant des commissions qui proviennent d’une entreprise et que vous avez reçues après avoir cessé son exploitation, has been added to Schedule L.

For a self-employed person, the QPIP and QPP calculations are based on the taxpayer's business income for the year; the non-eligible commission income on line 30 therefore avoids increasing the income eligible for QPIP contributions (section A of Schedule R) and QPP contributions (workchart 445).

Client letters - Transmission of Form TP-726.20.2

Form TP-726.20.2 is required and must be mailed when an additional capital gains exemption on certain resource properties is claimed. Client letters have been updated to reflect this requirement.

RL-1 slip

Addition of an option to box RM, Self-employed commissions, of the RL-1 slip

The calculations of the Québec Parental Insurance Plan (QPIP) and the Québec Pension Plan (QPP) for a self-employed person are based on the taxpayer's business income for the year while the business was operating. Thus, commissions received when the business is no longer actively operated should not be included in the calculation of contributions. Section A of Schedule R, used for calculating QPIP contributions, and Workchart 445, used for calculating QPP contributions, are both based on the amount on line 27 of Schedule L. Entering non-eligible commission income on line 30 avoids increasing the income eligible for contributions.

An option has been added to box RM of the RL-1 slip to allow the amount to be carried forward to line 30 of Schedule L.

TP-1.D, Income Tax Return

Revenu Québec has added boxes 10, 10.1 and 10.2 to the TP-1.D return. Boxes 10 and 10.1 allow the taxpayer to register for notifications sent by text message or e-mail, while box 10. 2 is a consent indicator to receive online correspondence only. These boxes can be selected in section Registration for online correspondence from Revenu Québec that has been added to Form ID, Identification and Other Client Information.

Please note that consent to receive notices of assessment and other documents in My Account (box 10.2) and notifications sent by text message or e-mail are not linked. It is possible to accept one and refuse the other. To opt out of notifications, the taxpayer must call Revenu Québec directly.

Client letters have been updated to reflect these additions. The content displayed in these letters will be based on the choice made in box 10, 10.1 or 10.2.

British Columbia

BC479, British Columbia Credits

A new section has been created on form BC479 to report the British Columbia clean buildings tax credits on the new form T1356. For more information, see the section of form T1356.

A new refundable tax credit, the British Columbia renter's tax credit, has been introduced for eligible individuals who rent and occupy a unit in British Columbia for at least six months in a calendar year. The credit is income-based: households with an adjusted income up to $60,000 will receive $400 and households with an adjusted income between $60,000 and $80,000 will receive a gradually reduced credit.

BC Family Benefit

Since July 1, 2023, an additional annual supplement of up to $500 will be provided to single-parent families.

Manitoba

MB428, Manitoba Tax

The basic personal amount has been increased to $15,000.

Yukon

Schedule 14, Yukon Government Carbon Price Rebate

The Yukon Government Carbon Price Rebate now includes the Yukon mining business carbon price rebate. This rebate can be claimed by a business using eligible Yukon mining assets. Part 2 of the schedule is now presented in table format. The first table calculates the Yukon mining business carbon price rebate, and the second calculates the Yukon general business carbon price rebate.

Northwest Territories

Cost-of-Living Offset

In 2023, changes have been made to the Cost-of-Living Offset (COLO) to reduce the carbon tax burden on residents living in different regions. Therefore, residents living in higher heating fuel use areas will receive higher COLO payments. The regional COLO has two parts:

-

The baseline COLO amount to help offset direct and indirect effects of carbon tax, excluding carbon tax on heating fuel;

-

An additional COLO amount based on zones (Zone A, Zone B and Zone C) to help offset the effect of the carbon tax on heating fuel costs.

In the program, the calculations consider the additional amount for Zone A residents. Zone B and Zone C residents will receive a higher additional amount.

Nunavut

Nunavut Carbon Credit

In Budget 2023, the Government of Nunavut announced the introduction of the new Nunavut carbon credit. It is a non-taxable amount paid to individuals and families to help offset the cost of the carbon tax. This amount is combined with the quarterly payment of the federal GST/HST credit.

New Brunswick

NB428, New Brunswick Tax and Credits

The government of New Brunswick has made changes to its tax brackets. There are now four tax brackets instead of five, divided as follows:

-

9.40% on taxable income of $47,715 or less;

-

14% on the portion of taxable income exceeding $47,715, but not exceeding $95,431;

-

16% on the portion of taxable income exceeding $95,431, but not exceeding $176,756;

-

19.50% on taxable income exceeding $176,756.

Benefit, Climate action incentive payment

Following the Government of New Brunswick's request, the federal pollution pricing fuel charge has been replacing the province's own fuel charge since July 1, 2023. New Brunswick will continue to apply its own provincially-administered fuel charge for industrial emitters.

Residents of New Brunswick will receive two CAI payments in 2023-2024: a double payment in October 2023 to return the projected proceeds from the July to September 2023 and the October to December 2023 periods, as well as a single payment in January 2024 to return the projected proceeds from January to March 2024. In April 2024, New Brunswick residents will receive the first of four regular quarterly payments for 2024-2025.

Newfoundland and Labrador

NL479, Newfoundland and Labrador Credits

The physical activity tax credit rate has been increased from 8.7% to 17.4%. The maximum amount that can now be claimed per family for this credit is $348.

Forms Removed

Federal

-

T1B, Request to Deduct Federal COVID-19 Benefits Repayment in a Prior Year

-

T2039, Air Quality Improvement Tax Credit

-

T2203 Schedule ON(S11) MJ, Ontario tuition and education amount

Québec

-

TP1 Line 462, Senior's activity tax credit

Ontario

-

Schedule ON(S12), Ontario seniors’ home safety tax credit

-

ON63052, Ontario staycation tax credit

Saskatchewan

-

Schedule SK(S12), Saskatchewan home renovation tax credit

Where to Find Help

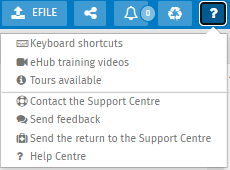

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the help resources, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Taxprep T1 e-Bulletin notifies you each time an updated or new form is made available in a program update.