An increasing number of firms use the CRA’s Represent a Client service as part of the personal income tax return preparation process. This secure service provides online access to tax data of individuals they represent. The AUTHORIZATION form allows you to submit an authorization request to access to your clients’ information before you start preparing their tax return.

Once registration is done and the authorization request is submitted to and accepted by the CRA, you can consult data of your clients online and use the TaxprepConnect download functionality to import their tax data to Taxprep, which will allow you to prepare their returns faster.

The steps to start using this service are as follows:

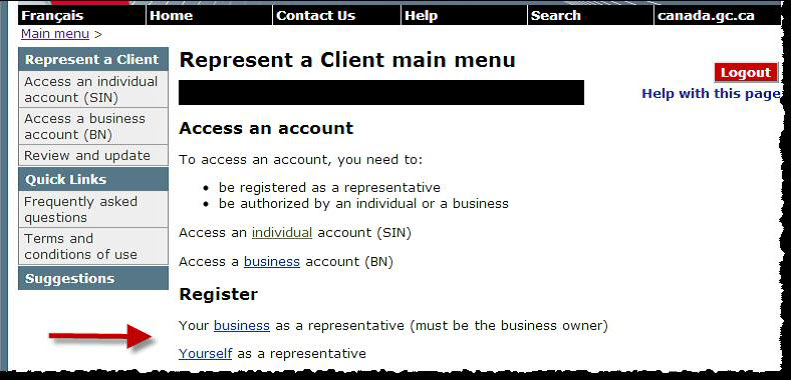

- On the CRA Web site, click Register to create your own user ID and password to use the Represent a client service.

- To confirm your identity, you will need to enter you access code, found on your assessment notice, as well as your postal code.

- The next step consists in creating your security questions and answers.

- You will be able to access the CRA’s Represent a Client service immediately after that step.

- On the CRA Web site, log on to the Represent a Client service using your CRA user ID and password, and register your business (using your business number (BN)), or register as a representative, to obtain a RepID or a GroupID.

- Obtain authorization from your clients.

Notes:

If you want your employees to also have online access to your clients’ information, they will also have to obtain a RepID from the CRA as explained in step 1.

The best practice for a firm to request authorization via the AUTHORIZATION form is to do it based on their BN (or GroupID), instead of a RepID. This way, a new authorization is not required should an employee leave, and it is easy to create groups of employees to control access to clients’ information.

Preparer Profiles – AUTHORIZATION FORMS tab, subsections Electronic filing and Additional options

Taxprep determines if the AUTHORIZATION form is applicable for electronic filing based on information entered in the preparer profile for all of your clients.

In the preparer profile, under the AUTHORIZATION FORMS tab, in the Electronic filing subsection, the following options allow you to determine for which type of clients you want to complete the AUTHORIZATION form:

- transmit for clients for whom you do not have the authorization or whose authorization is expired;

- transmit only for new clients.

The Additional options subsection allows you to manage certain situations separately:

- transmit for authorizations expired on or before.

However, you may make a different choice for a specific client by answering Yes or No to the question Do you want to transmit an Authorization/Cancellation request for this taxpayer? in the AUTHORIZATION form.

Representative information

Enter your RepID or GroupID identification number, or your BN. A RepID is a seven-character alphanumeric code starting with letter G, and a BN is a nine-digit number. You must also indicate the name associated with the identification number used.

Note that the program does not validate these values: it is important that you make sure that they correspond to the information provided or received at the time of your registration as a representative with the CRA, because, if the information entered is incorrect, it could cause the form to be rejected.

Level of authorization:

You can choose the authorization level for the authorization request. This choice will apply to all your clients. However, you may modify your choice directly on the form. If you do not indicate a level of authorization, it will be defaulted to level 1.

Expiry date:

You can enter an expiry date if you want the authorization to end at a specific time.

Rolled forward Data section

The values of the line Consent expiry date rolled forward from previous year and the box This taxpayer already authorized you to access the Represent a Client service and your access is still valid come from the roll forward of information entered last year.

The date on which the Accepted value has been allocated by the program as a result of the acceptance by the CRA of the authorization request will be rolled forward to the field Last electronic filing (prior years) accepted on:.

For the following years, if there is no new electronic transmission of the authorization request, this value will be retained during roll forward. However, if the authorization request is transmitted again, the new acceptance date of the form will be rolled forward.

The box This taxpayer already authorized you to access the Represent a Client service and your access is still valid will be selected during roll forward in the following situation:

- the form has been accepted and transmitted last year;

- the form was not applicable, but the box This taxpayer already authorized you to access the Represent a Client service and your access is still valid was selected last year.

Note that the box will not be selected if the expiry date of the consent is passed at the time the client file is rolled forward.

Electronic filing – Checklist

The purpose of the list of criteria in this section of the form is to make it eligible for electronic filing. Therefore, this list ensures that the form meets the conditions related to electronic transmission required by the CRA. When all criteria are complied with, the boxes will be automatically selected and the status of the electronic filing will be displayed at the end of this section. However, verify the general type diagnostics relating to the AUTHORIZATION form, because the eligibility for electronic filing is directly dependant on those diagnostics.

Representative information

This section must contain only one of the identifier among a RepID with a first name and a last name, a GroupID with a group name or a BN with a business name.

Taxpayer information

The program automatically updates the taxpayer’s social insurance number (SIN) as well as the first and last name to this section.

Authorization information

Enter the authorization expiry date if you want the authorization to end at a specific time.

Cancellation information

To be able to download your client’s tax data using the TaxprepConnect functionality, the same CRA user ID and password must not have more than one valid authorization with the CRA for the same client. For example, this could occur if, throughout the years, a client authorized both your BN and your RepID in two separate authorization requests.

Normally, in a case where you have both a RepID and a BN registered with the Represent a Client service, you should associate your RepID with your business in the Administration section of your Represent a Client account. This way, the client only has one authorization to give, i.e. the one with the BN.

Where your Represent a Client account contains redundant authorizations for the same client, you can delete the extra authorization(s), either in the Web page of you Represent a Client account, or in this section of the form.

You can also complete this section if you know that other representatives still hold a valid authorization that your client no longer wants, or if your corporation changed name (you will have to cancel the authorization held under the old name).

As a result of the deletion of the authorization of a taxpayer, you will no longer be able to access information and services for this taxpayer, either online, or using the traditional means, including by telephone, fax or mail.

Note that the taxpayer can immediately cancel any existing authorization by consulting the Web site https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals/account-individuals.html or calling 1-800-959-7383.

Certification

Enter a signature date and have the signature page signed by your client or his or her legal representative before you proceed with the transmission of the authorization request. Furthermore, the authorization request must be filed no later than six months after the signature date. Therefore, the authorization request will not be eligible if the date of signature has passed six months.

Before filing the authorization request, make sure that your EFILE number and EFILE password are entered in the options and settings (Tools/Options and Settings /Electronic Services /Identification).

IMPORTANT: As required by the CRA, make sure that your client or his or her legal representative signs the signature page before filing it.

- The Eligible value status is determined when all of the eligibility questions under the Electronic Filing – Checklist section are set to Yes. The filing status displays automatically at the end the Electronic Filing – Checklist section and is also accessible through the File/Properties (F11) command.

The Accepted or Accepted with Conditions value status is determined when the transmitted authorization request is accepted by the CRA. Once one of these values is allocated, the data displayed on the form will no longer be modified by the program, to make sure it matches the transmitted data that was accepted by the CRA. The form will no longer be applicable when printing the form.

If the authorization request status was already set to Accepted with conditions, you must not file it again. Consult the EFILE INFO form for more information on the acceptance.

If you have to transmit an authorization request again for which the value of the status is Accepted or Accepted with Conditions, you will have to answer Yes to the question If the form has already been transmitted and accepted this year, do you want to transmit another copy of the form for this taxpayer? under the Electronic Filing – Checklist section. This will allow the program to update the data in the form.

IMPORTANT:

The CRA has put in place a monitoring program for the electronic transmission and will ask to see copies of the signature pages. If you fail to provide these copies, the CRA will remove your name as the authorized representative for the account of the taxpayer concerned. The CRA may also suspend your electronic filing privileges.

The check box The form has been signed has been added to the electronic filing checklist as the signature page must be signed before being transmitted. Therefore, the T1013 form will not be eligible until you confirm that it has been signed.

Do not send a signed copy of the form, unless the CRA requires to see it as a result of verification.