T2203 – Automatic allocation to each jurisdiction

Taxprep is able to automatically make the allocation to the different jurisdictions in Form T2203 based on the net income from different sources (the T5013 slip and the self-employment statements).

There are three types of situations where income will be taken into account for automatic allocation purposes.

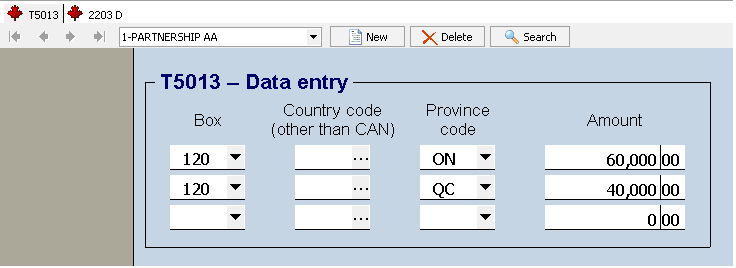

- T5013 slip:

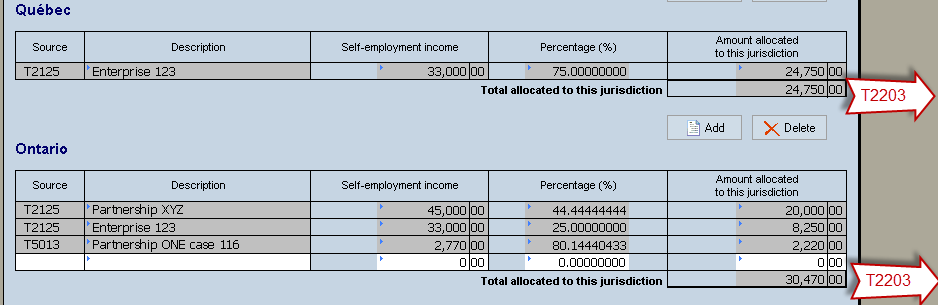

When a T5013 slip contains self-employment income, it will be taken into account for automatic allocation purposes on Form T2203 based on the allocation indicated with the province or country codes. The percentages of allocation for each related province are calculated in the background. These percentages are then updated and displayed in the workchart T2203 Detail, Detail of Net Income per Jurisdiction (Jump Code: 2203 D).

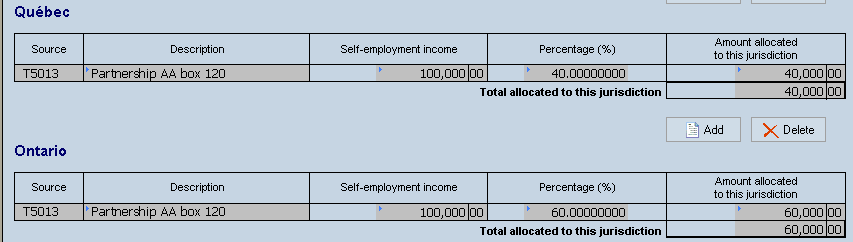

- T5013 slip with income transferred to a self-employment statement to claim partner’s expenses:

In this case, the percentages of allocation are calculated in the background, but, instead of being transferred directly into the workchart T2203 Detail, they are transferred into the “Net income allocation to various jurisdictions” section of the self-employment statement linked to Form T5013. This allows you to allocate the net income to each jurisdiction by taking the partner’s expenses into account.

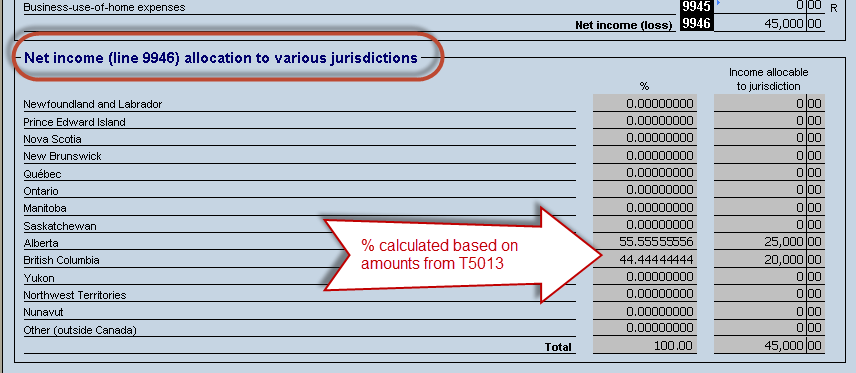

- Self-employment statement (T2125, T2121, T2042, T1163 or T1273) with income from more than one jurisdiction:

Note that the automatic allocation made from the self-employment income statements varies based on the province indicated in the mailing address indicated on the self-employment statement. In addition, it is possible to manually define (i.e., using an override) the percentages of allocation directly in the “Net income allocation to various jurisdictions” section of a self-employment statement. The percentages are then transferred and displayed in the workchart T2203 Detail.

Thereafter, the total amounts calculated for each jurisdiction in the workchart T2203 Detail are transferred into Form T2203.

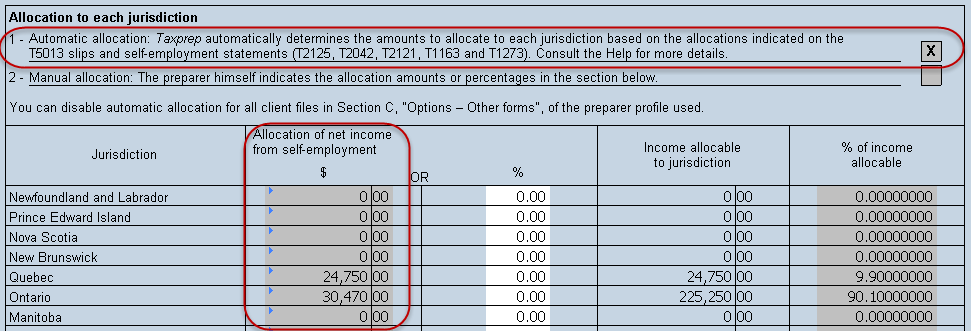

By default, Taxprep will attempt to make an automatic allocation to each jurisdiction. Box 1 will then be selected by the program and the fields in the column Allocation of net income from self-employment will be calculated with the amounts from the workchart T2203 Detail, Detail of Net Income per Jurisdiction (Jump Code: 2203D).

Note that the default behaviour of the program can be modified in your preparer profile if you prefer Taxprep never to make automatic allocations.

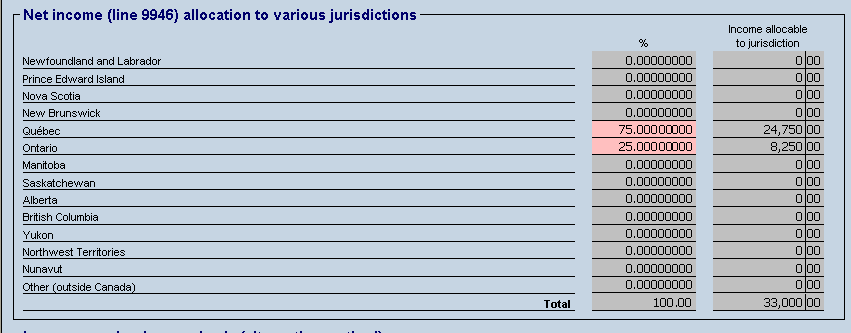

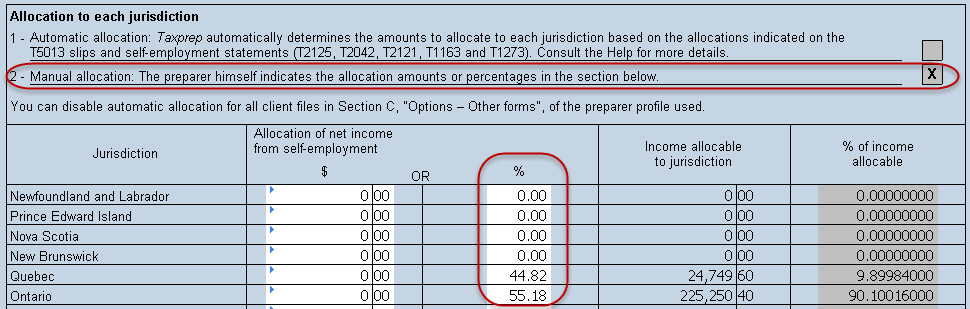

You can manually enter the allocation percentages at any time. As soon as a percentage is entered in the % column, the program automatically selects box 2, which indicates that the allocation is now made manually. The fields in the column Allocation of net income from self-employment are no longer calculated by the program when box 2 is selected.

TP1 returns (Québec):

A similar process is performed for Forms TP-22 and TP-25: Taxprep automatically calculates the amount on line Portion of the income derived from establishments located in Québec. The details of this calculation can be reviewed on the workchart TP22 TP25, Detail of Net Income From Businesses Carried on in Québec (Jump Code: Q22 Q25 D).