This help topic relates to all forms associated with the foreign tax credit calculation, the deduction under subsection 20(11) and the deduction under subsection 20(12). The following topics are addressed:

- Entering foreign income and foreign taxes

- Calculating the foreign tax credit and deductions under subsections 20(11) and 20(12)

- Registered pension plan deduction (RC267, RC268 and RC269)

- Information summary (FIT, FTC SUM, QC FIT and QC FTC SUM)

- List of countries and exchange rates

- Transfer from the Foreign form into Form T1135

- Updating the data from the Foreign form to the return

Entering foreign income and foreign taxes

Foreign income reported on a slip or a form

To correctly calculate the foreign tax credit and the deductions under subsections 20(11) and 20(12), the program will need to know both the foreign income and the related foreign taxes. You may enter them in a number of different slips or forms.

Input can be made in a slip (T3, T5, T4PS, T5008, T5013, RC267, RC268 or RC269) or in a form (T776, Schedule 3, Foreign or T2209 C).

Slips and forms (T3, T5, T4PS, T5008, T5013, RC267, RC268, RC269, T776 and Schedule 3)

In the appropriate data entry screen, depending on the type of income, first indicate the foreign country using the search box. Then, enter the foreign income and taxes on the applicable lines. The foreign income and taxes entered on the slips are automatically updated to Form T2209 C of the country concerned.

Taxprep transfers income to Form T2209 C, whether or not tax amounts are associated to this income. The same applies for income tax: you do not have to enter income in order for the income tax associated to this income to be transferred to Form T2209 C.

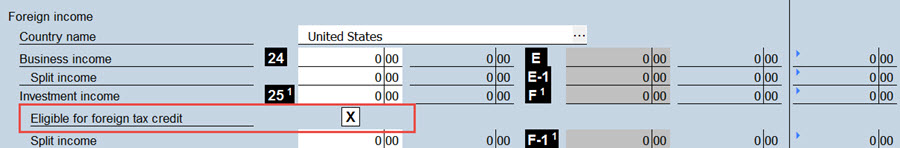

The check box Eligible for foreign tax credit allows you to identify foreign income that is not eligible for the foreign tax credit, in particular, other interest income from US sources. These amounts will not be updated to Form T2209 C, particularly U.S. interest income, unless the taxpayer is a U.S. citizen filing a U.S. income tax return.

When this check box is unselected, these amounts are not transferred to Form T2209 C. If you want to transfer these amounts to Form T2209 C, do not unselect this check box. However, in that case, ensure that the treaty rate indicated in the T2209 C for any U.S. interest income is 0%.

Foreign form

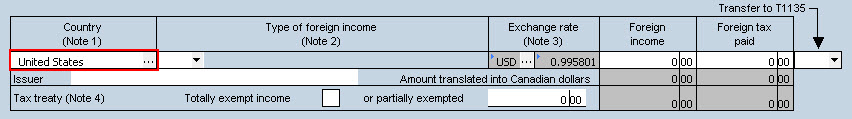

In order for foreign income to be taken into account correctly when calculating the foreign tax credit, select a country using the search box.

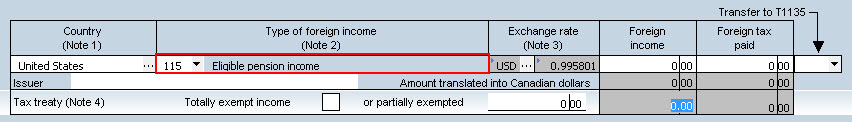

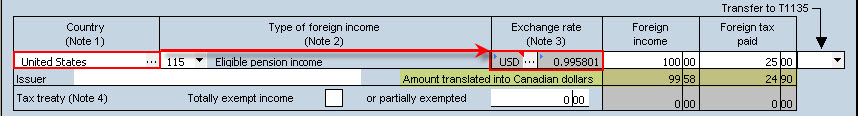

In order for foreign income and taxes to be updated to the correct area of the return, select a type of foreign income using the drop-down list.

The Foreign form allows you to translate the foreign income and taxes into Canadian dollars. The program automatically displays the foreign currency and the average annual exchange rate based on the country that was selected. However, you may choose another currency or rate using an override.

If the foreign income and taxes entered have already been translated into Canadian dollars, no exchange rate should be selected. Instead, you should enter the value “1” using an override in the exchange rate box.

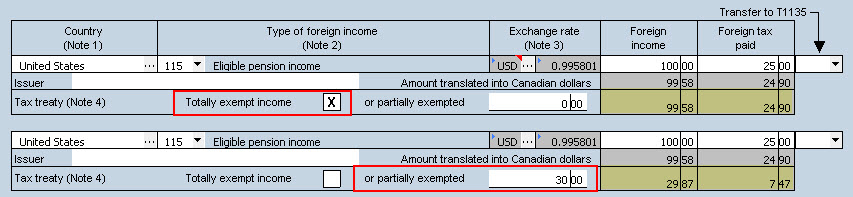

Foreign income can be exempt under a tax treaty with the foreign country concerned. If all foreign income is exempt, select the box Totally exempt income. When this box is selected, a deduction corresponding to 100% of the income is claimed on line 25600 of the tax return. If only a portion of the foreign income is exempt, the exempt portion should be entered in the field provided. When a portion of the income is deemed to be exempt, a deduction is claimed on line 25600 of the tax return.

For more details on where the income entered on the Foreign form is updated to, consult the subsection “Updating the data from the Foreign form to the return.”

You may transfer information from the Foreign form to Form T1135. For more information on this topic, consult the subsection “Transfer to Form T1135.”

Foreign income not entered on a slip or a form

You may enter any other foreign income or tax that cannot be entered in the forms listed above in the copy of Form T2209 C for the applicable country. You only have to use the input section and create the number of lines you need:

If the foreign income earned by the taxpayer is not already included on a slip or a form, you must first enter it on the appropriate form. For example, Form T2125, in the case of professional income. Then, enter the taxable amount in the appropriate section of Form T2209 C for the applicable country. If no copy of Form T2209 C exists for that country, you can create a new copy, then select the appropriate country in the field “Country or countries for which you are making this claim.”

Calculating the foreign tax credit and deductions under subsections 20(11) and 20(12)

When the taxpayer earns foreign income, the program calculates, the foreign tax credit and/or deduction (subsections 20(11) and/or 20(12) of the ITA) if applicable. Form T2209 C shows, on a per-country basis, the detailed calculation of this credit, the deduction under subsection 20(11) and/or the deduction under subsection 20(12).

Form T2209 shows the summary of the foreign tax credit calculation. The program generates the values on this form using data from Form T2209 C, Federal Foreign Tax Credits (Jump Code: 2209C). The program creates a single copy of Form T2209. If the taxpayer is eligible for the federal foreign tax credit for tax paid to more than one country, Form T2209 displays the word “Multiple” in field “Country or countries for which you are making this claim”.

Note for returns of provinces other than Québec: The payment of foreign tax can also give rise to a provincial or territorial credit. Form T2036 shows the calculation of the provincial or territorial foreign tax credit. The program generates the values on this form using data from Form T2209 C, Federal Foreign Tax Credits (Jump Code: 2209C). A copy of Form T2036 is created for each foreign country. The provincial or territorial foreign tax credit is updated to the appropriate provincial or territorial form (Form 428), depending on the province of residence, and reduces the amount of provincial tax payable by the taxpayer.

Note for Québec returns: The foreign data entered in the various slips and forms is updated to Form TP-772. As at the federal level, a separate copy of Form TP-772 will be created for each foreign country. The foreign tax deduction is calculated on line 250 of the TP1 return (deductions under subsections 146 and 146.1), while the foreign tax credit is calculated on line 409 of Schedule E. The duly completed Form TP-772 must be attached to the tax return if the taxpayer claims a foreign tax credit on line 409 of Schedule E.

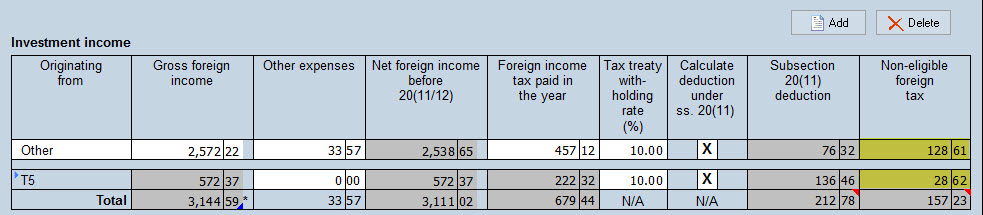

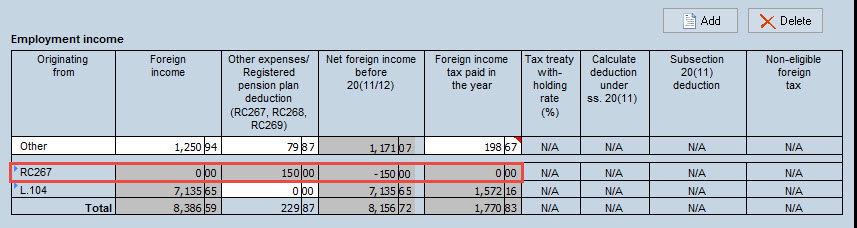

Shown below are explanations of the tables in Form T2209 C and the Form TP-772 for Québec returns.

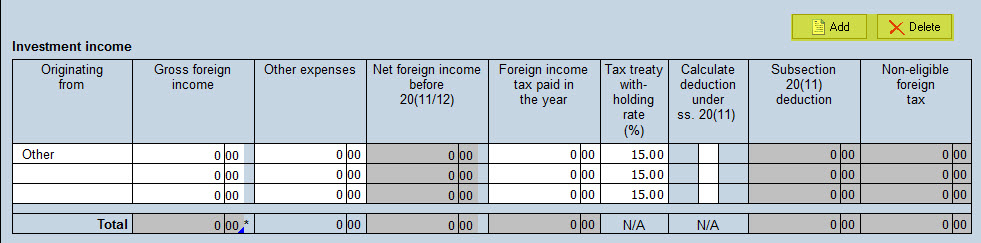

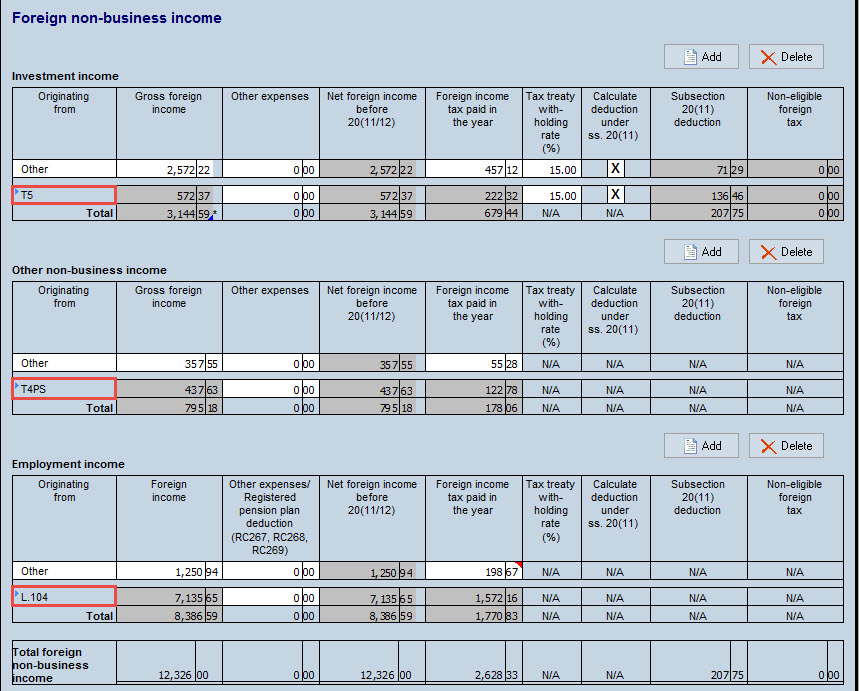

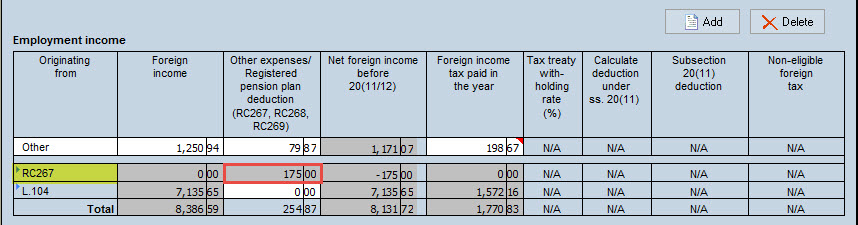

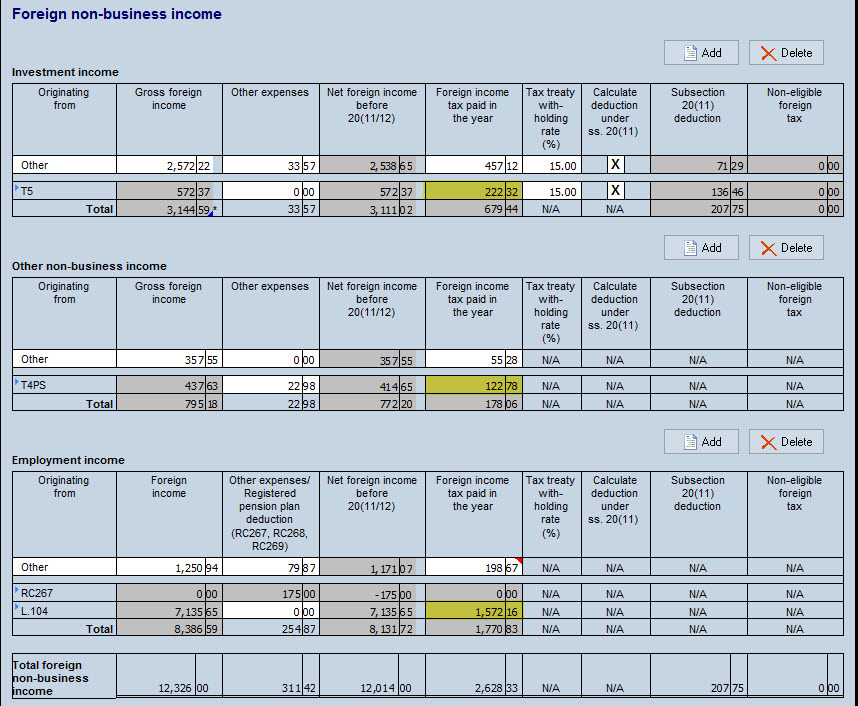

Foreign non-business income

Column “Originating from”

The income amounts are listed according to their origin (T3, T4PS, T5, T5008, T5013, RC267, RC268, RC269, T776, Schedule 3 and Foreign). In the Originates from column, Taxprep indicates where the data comes from by identifying the slip or form of origin. The expand on this column allows you to access the related slip or form directly.

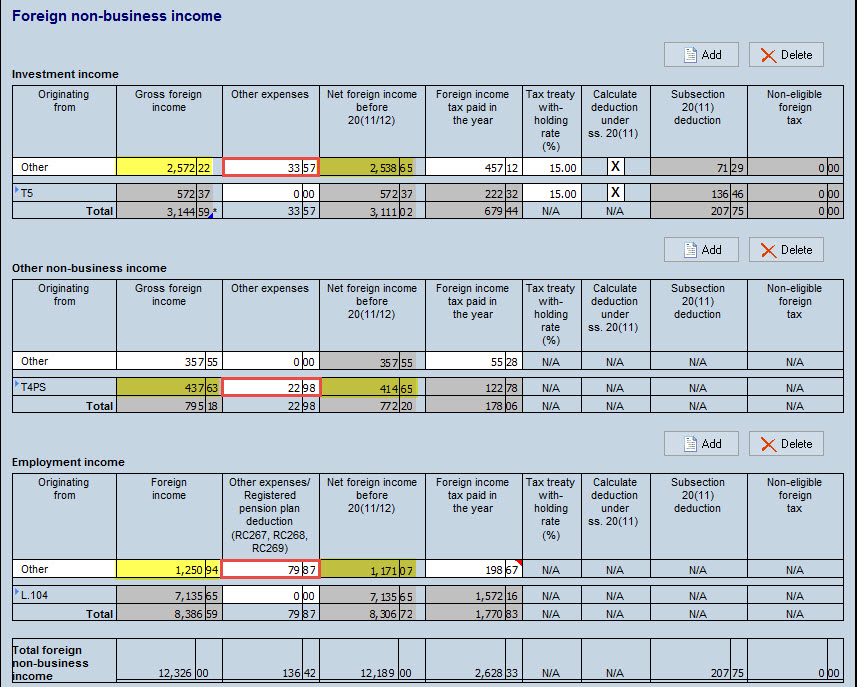

Columns “Gross foreign income” and “Net foreign income before 20(11/12)”

The table shows the gross foreign income and the net foreign income before deductions under subsections 20(11) and 20(12).

To calculate the net foreign income, enter any “other expenses” related to the income in the Other expenses or Other expenses/Registered pension plan deduction (RC267, RC268, RC269) column, based on the type of foreign income. However, where carrying charges have been entered in box 2112, “Carrying charges on interest and dividend income from foreign sources” of the T5013 slip, they are updated to this column.

When a registered pension plan deduction is entered in Form RC267, RC268 or RC269, it is automatically updated to this column. For more information on this topic, consult the “Registered pension plan deduction (RC267, RC268, and RC269)” subsection.

Column “Foreign income tax paid in the year”

The foreign income tax paid in the year is updated from the appropriate slips and forms.

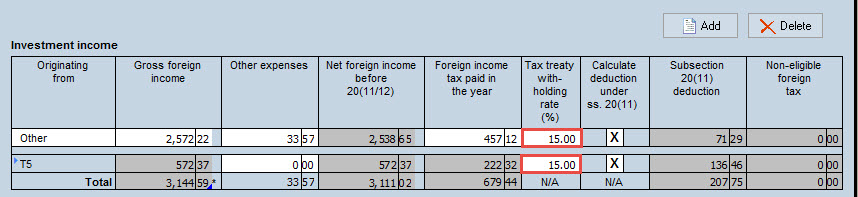

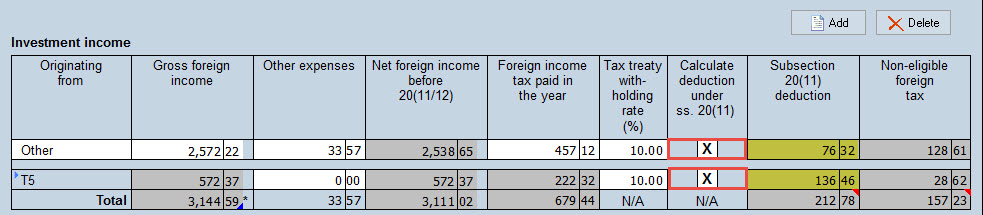

Column “Tax treaty withholding rate (%)”

In the Tax treaty withholding rate (%) column, Taxprep applies a 15% rate by default. However, if this rate is not the rate prescribed by the tax treaty between Canada and the foreign country concerned, you have to modify this rate in order for the calculations to be correct. Keep the default value if the foreign country is not the signatory of a tax treaty with Canada.

For more information on tax treaties signed with Canada, consult the Department of Finance Web site at: www.fin.gc.ca/treaties-conventions/in_force--eng.asp.

Column “Calculate deduction under ss. 20(11)” and “Subsection 20(11) deduction”

The calculation of the deduction under subsection 20(11) is made if the income originates from a country that does not have any tax treaty with Canada, or from a country whose tax treaty with Canada provides for a rate higher than 15%. The foreign tax paid in excess of 15% of the net foreign income can give rise to a deduction in calculating taxable income. This deduction is also available for US citizens who reside in Canada who can be subject to US income tax proportionally higher than 15%.

To trigger or to cancel the calculation of the deduction under subsection 20(11), you can use the check boxes for the Calculate deduction under ss. 20(11) column. This election can be made for each income amount. Taxprep automatically selects the check box for a given income amount when the country of origin for the income is other than the United States and no input has been made in the Tax treaty withholding rate (%) column for this income or an input has been made in this column for this income, but with a rate in excess of 15% as per a tax treaty. In addition, note that the program never selects the check box for income from the United States.

This deduction is only allowed for foreign tax related to dividend, interest or royalty income.

Column “Non-eligible foreign tax”

Non-eligible foreign tax is calculated when the withholding rate under the tax treaty is less than 15%. The spread between the foreign tax credit rate and the withholding rate under the tax treaty is applied to the gross foreign investment income to determine the non-eligible foreign tax.

Deduction under subsection 20(12)

The deduction under subsection 20(12) allows the taxpayer to deduct the foreign tax paid on non-business income (dividend, interest, royalty or rental income) from income. The taxpayer may choose to deduct only a portion of the foreign tax paid under subsection 20(12), or to not deduct any amount under this paragraph. The non-deducted portion of this amount can be used in the foreign tax credit calculation.

The program automatically determines whether it would be more advantageous to claim the deduction under subsection 20(12) or to claim the foreign tax credit. The deduction amount under subsection 20(12) can be modified at any time by overriding the appropriate box.

Note for Québec returns: The program does not automatically calculate the deduction for foreign tax under subsection 20(12). You can claim this deduction by entering the deduction amount on the line Subsection 20(12) deduction (Québec returns only). A diagnostic will display to advise you of situations where such deduction might be advantageous for the taxpayer. In the preparer’s profile, you can choose to disable this diagnostic when the amount is less than a certain threshold.

Foreign tax credit (subsection 126(1))

Income may be subject to tax both in the taxpayer’s country of residence and in the country where the income is earned. The foreign tax credit mechanism is set up to avoid double taxation.

In a nutshell, the credit will be equal to the lesser of the foreign tax paid and the Canadian tax otherwise calculated on the foreign income. Note that foreign tax paid on foreign non-business income that exceeds the credit amount cannot be carried over.

Foreign business income

Under subsection 126(2), the foreign tax credit can also be claimed with regards to foreign business income.

You can enter income tax paid and carried forward from the preceding year in the copy of Form T2209 C for the appropriate country. Taxprep will take into account the tax paid and carried forward for purposes of calculating the foreign tax in Form T2209 C.

Note for Québec residents: 55% of the business income tax paid to a foreign country must be included on line 431, Non-business income tax paid to a foreign country, and the net foreign business income must be included on line 433, Net foreign non-business income, of Form T2209.

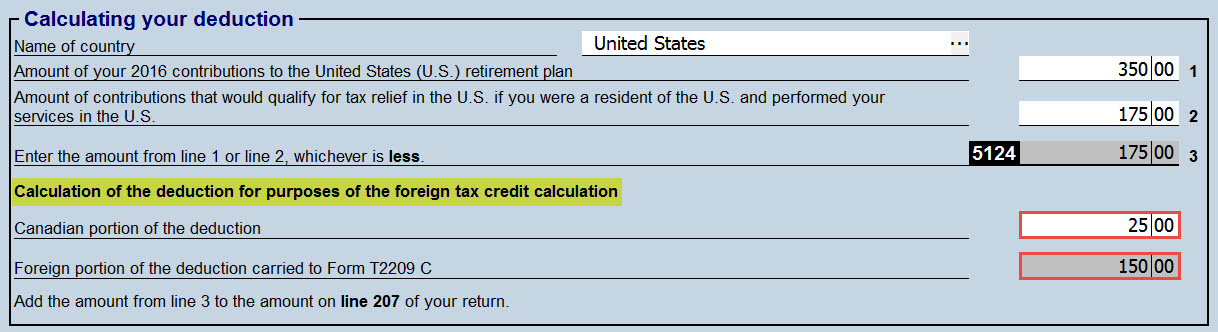

Registered pension plan deduction (RC267, RC268 and RC269)

You can enter, in Forms RC267, RC268 and RC269, the Canadian portion of the deduction that should not be taken into account in the foreign tax credit calculation. To do so, enter the amount on the line to that effect in Form RC267, RC268 or RC269, as applicable.

This way, Taxprep will automatically transfer to Form T2209 C the registered pension plan deduction that should be taken into account in the foreign tax credit calculation.

The adjustments can also be made in Form T2209 C, using overrides.

Information summary (FIT, FTC SUM, QC FIT, and QC FTC SUM)

FIT and QC FIT (for Québec returns only)

These forms list, per country, the net foreign income and foreign income tax paid according to their origin (for example, T3 slip, T5 slip, Schedule 3, etc.) and based on the types of income (for example, other non-business income). Data in this form originates from the corresponding copy of Form T2209 C. By default, only the sections showing a total will print. However, if the box Print all sections of the form is selected, all sections of the form will print.

FTC SUM and QC FTC SUM (for Québec returns only)

These forms list, per country and globally, the net foreign income and income tax based on the type of income (for example, other non-business income). Data in this form originates from the corresponding copy of Form T2209 C.

In addition, it is possible to view the deductions under subsections 20(11) and 20(12) as well as the foreign tax credit, per country and globally, in the “Tax credit and deductions summary” section of Forms FTC SUM and QC FTC SUM (for Québec returns only).

List of countries and exchange rates

The countries in the search box are those indicated in the guide NR4 – Non-Resident Tax Withholding, Remitting, and Reporting. You can choose “Unknown” or “Other” when the country is not indicated or is not known. To consult the country list, go to Form Rates, Foreign Exchange Rates Worksheet (Jump Code: RATES).

It is possible to define a default country for slips and forms (T3, T4PS, T5, T5008, RC267, RC268, RC269, T776 and Foreign) by choosing the desired country in the preparer’s profile in the “Options – Other forms” section.

The exchange rates listed in the Rates form are those from the Bank of Canada (www.bankofcanada.ca). In the event where the Bank of Canada does not provide the exchange rate for a currency in particular, Taxprep displays 1.000000.

If you need to use a country that is not included in the search box, you can add it by entering the country name, the country code, the country currency, the currency code, as well as the exchange rate. The country added will automatically be included in the search box for slips (T3, T4PS, T5, T5008 and T5013) and forms (RC267, RC268, RC269, Schedule 3, T776, Foreign and T2209 C). You can add a maximum of ten countries in Form Rates, Foreign Exchange Rates Worksheet (Jump Code: RATES).

If the exchange rate listed is not the one you want to use, you can modify that rate using an override. If you modify an exchange rate using an override in the Rates form, the new exchange rate will be used everywhere in the client file where the related country is selected.

Note: When coupling two existing client files, Taxprep retains only the list of additional countries entered for the taxpayer.

Transfer from the Foreign form into Form T1135

A transfer of data from the Foreign Income Summary into Form T1135 can be made when the income is generated from specified foreign property.

This transfer is possible only when the type of income selected is 13000, Other foreign income, or 12100, Investments- Section II – Interest, other investment income, and income from foreign sources.

Note that no data is transferred if Part A, “Simplified reporting method,” has been completed in Form T1135.

In order for Taxprep to transfer the data, select the appropriate section of Form T1135 from the Transfer to T1135 drop-down list.

Based on the section of Form T1135 selected for the transfer, the transferred data is the issuer, the country code and the income (loss).

For more information, consult the Help for Form T1135.

Updating the data from the Foreign form to the return

Income amounts are grouped by type in the second section of the form.

Based on the choice made using the drop-down list in the column Type of foreign income, the foreign income entered in the Foreign form is updated to the following locations in the tax return:

Line 10400, Other employment income

- Foreign income entered as type “10400 – Foreign employment income” is updated to the workchart for line 10400.

- The country name and the issuer’s name indicated with respect to the line 10400 foreign income will be shown in the workchart for line 10400.

Line 11500, Other pensions or superannuation

- Foreign income that has been identified income to be reported on line 11500 will be updated to the workchart for line 11500.

- When the type of income selected is “11500 – Eligible pension income” or “11500 – Other Lump-sum/Other pension not eligible for the pension income amount,” the country name as well as the issuer’s name will be shown in the workchart for line 11500.

- The calculation of eligible pension income on line 31400 will be adjusted automatically based on the type of line 11500 foreign pension income selected. This will also affect the amount of pension income that can be split with the spouse on Form T1032.

Line 13000, Other income

- Foreign income that has been identified as income to be reported on line 13000 will be updated to the workchart for line 13000.

- When the type of income selected is “13000 – Other foreign income,” the country name as well as the issuer’s name will be shown in the workchart for line 13000.

Line 25600, Additional deductions

- Foreign income deemed to be non-taxable, all or in part, is updated to the workchart for line 25600.

- For this type of income, the country name as well as the issuer’s name will be shown in the workchart for line 25600.

- For U.S. Social Security benefits, it is not necessary to indicate the non-taxable portion of the benefit. Based on the choice made at the Type of foreign income column, the program calculates a 15% or 50% deduction on line 25600 of the tax return.

- If you select 11500 – U.S. Social Security benefits (after December 31, 1995), a 15% deduction of the taxable amount will be claimed on line 25600 of the tax return.

- If you select 11500 – U.S. Social Security benefits (before January 1, 1996), a 50% deduction of the taxable amount will be claimed on line 25600 of the tax return.

Worksheet Investments - Statement of Investment Income, Carrying Charges, and Interest Expenses, Section II, “Interest, other investment income, and income from foreign sources ”

- Foreign income that has been identified as income to be reported on the Investment worksheet will be updated to Section II of the Investment worksheet.

- The country name as well as the issuer’s name will be shown in Section II of the Investment worksheet.

Form T2209 C

- Based on the country selected in the Foreign form, foreign income and taxes are taken into account in the calculation of the federal and provincial foreign tax credits (Forms T2209 and T2036).