This form has been designed to allow you to estimate interest on the balance unpaid, the late-filing penalty as well as the interest on the late-filing penalty for the TP1 income tax return.

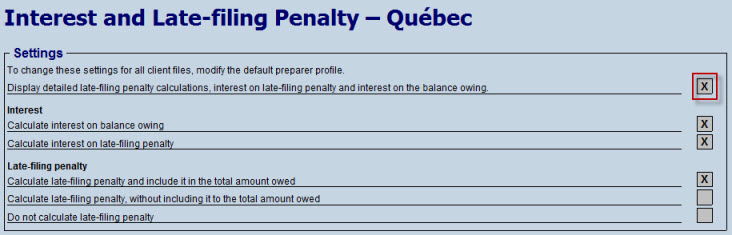

If you want to display on screen and print detailed calculations of the interest on the balance unpaid, the late-filing penalty and the interest on late-filing penalty, select the following box:

Note that all the boxes in the “Settings” section can be modified for all client files from the INTEREST tab of the preparer profile used.

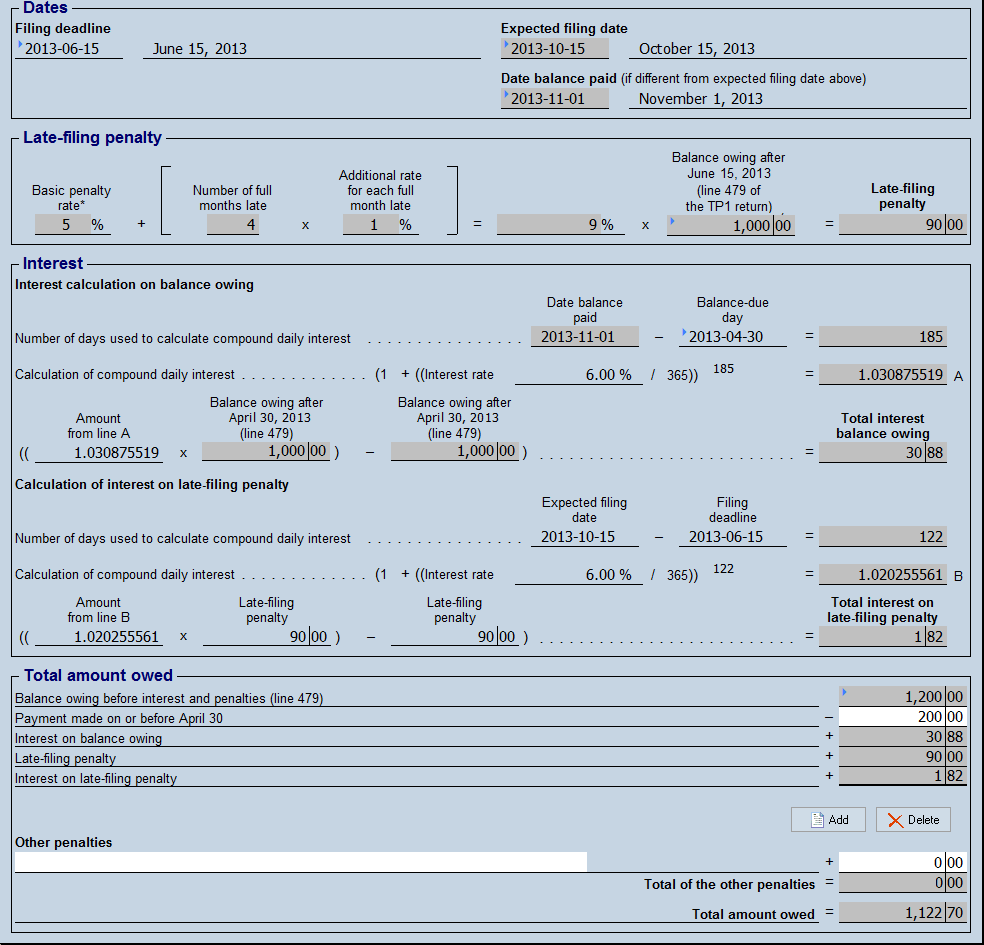

The field “Filing deadline” is used to determine the number of complete months that the return is late for purposes of calculating the late-filing penalty and is also used to determine the number of days that the return is late for purposes of calculating the interest on the late-filing penalty.

The field “Expected filing date” allows you to enter the date on which the return is filed. It is used to enable the calculations for the late-filing penalty, the interest on the late-filing penalty and the interest on the balance unpaid. When a date is entered in this field and the field “Date balance paid (if different from expected filing date above)” is not completed, the program considers that the total payment has been made, i.e., that the payment enclosed with the return takes into account the balance unpaid and the amounts of interest and penalty estimated in this form.

When the taxpayer late filed his return and the total payment of his balance due has been made at a date other than the date entered in the field “Expected filing date,” the field “Date balance paid (if different from expected filing date above)” in the “Dates” section allows you to enter the date on which the balance due has been paid in full. When a date is entered in this field, the program calculates the interest on the balance due until this date.

The field “Balance-due day” is used to determine the number of days that the balance due is late for purposes of calculating the interest on the balance unpaid.

The interest rate prescribed by Revenu Québec may change every three months, on the following dates: January 1, April 1, July 1 and October 1. It is possible to modify the prescribed interest rates for all clients from the INTEREST tab of the preparer profile used.

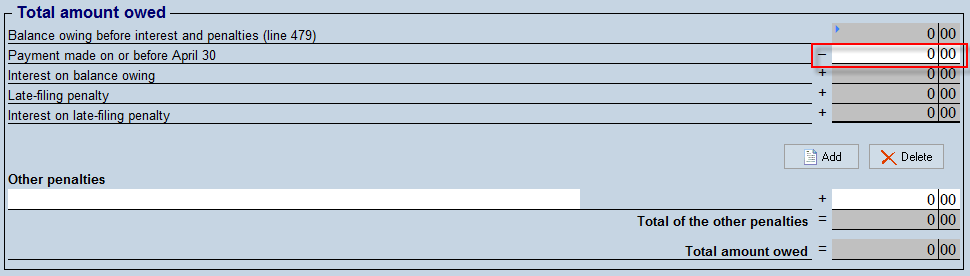

If the taxpayer paid part of his balance due on or before the balance-due day, you can enter the amount of the payment made in the field below in the “Total amount owed” section. The program will then calculate the interest on the balance due, the late-filing penalty and the interest on the late-filing penalty using the difference between the balance due and the payment made.

Example

On October 15, 2013, a self-employed worker files his or her return in which there is a balance owing of $1,200. As a self-employed worker, he or she had until June 15, 2013, to file the return. However, the self-employed worker had to pay the balance owing on or before April 30, 2013. The taxpayer made a first payment of $200 before April 30, 2013, and paid the remaining $1,000 on November 1, 2013. Therefore, the late-filing penalty as well as the interest are calculated on an amount of $1,000.

The late-filing penalty as well as the interest (5% in this case) on this penalty is applicable starting June 16.

As for the interest on the balance owing, it is calculated starting May 1.

See Also