The following information is taken from pages 3 to 6 of the form.

Column A – Property class number

Depreciable property must be grouped in classes. Use a separate line for each class. Where property in the same class was acquired for the purpose of earning income from more than one business, a separate class must be created for each such business.

Note that a separate class must also be created for a property in Class 43.1, 43.2, 50 or 53 acquired after December 3, 2018, or for a property that qualifies as eligible intellectual property and allows the corporation to benefit from the additional deduction for the amortization of certain assets (30% rate). For more information, see the instructions for line 250 in the Corporation Income Tax Return Guide (CO-17.G).

Column B – UCC at the beginning of the taxation year

Enter, for each class the undepreciated capital cost (UCC) displayed in the last column of the CCA table on the copy of form CO-130.A completed for the previous taxation year.

Column C – Cost of acquisitions during the taxation year

For each class of property, enter the capital cost of depreciable property acquired during the taxation year and available for use. Also enter the cost of property acquired in previous taxation years that was available for use only during the current taxation year (such property was excluded in previous taxation years because it was not available for use).

The capital cost of a property is generally the total cost incurred by the corporation to acquire the property and includes the following costs:

- legal or accounting fees, engineering fees and other costs incurred to acquire the property;

- site preparation costs, delivery or installation costs, test costs and other costs incurred to bring the property into service;

- in the case of property that the corporation manufactures for its own use, the costs incurred for materials and labour and overhead reasonably attributable to the property (but no amount should be included as a gain that could have been realized if the property had been sold).

You must deduct from the capital cost of the property the amount of any assistance received, any input tax credit (ITC) allowed and any input tax refund (ITR) claimed in the taxation year. You must add to the capital cost of the property the amount of any assistance, ITCs and ITRs already deducted but refunded (or deemed refunded) by the corporation in the taxation year.

Note that there are other rules that reduce the capital cost of certain property.

Column C.1 – Capital cost of AIIPs acquired in the taxation year (amount included in the amount in column C)

If property, included in a particular class, and described in column C do not include property related to the accelerated investment incentive (AIIP), enter 0. Otherwise, for each class, enter the portion of the amount in column C that relates to the acquisition of the AIIP. To be considered as an AIIP, a property must meet, among other things, the following conditions:

- it was acquired after November 20, 2018;

- it became available for use during the taxation year and before 2028.

Note that, in this form, property in new classes 54 and 55 is considered to be AIIP.

For more information, see section 8.3 of the CO-17.G guide.

Column D – Adjustments

Enter, for each class, the total of all adjustments that have to be considered in the calculation of the UCC.

To calculate this amount, you must, among other things,

- add all the amounts, each of which represents assistance that meets the following conditions:

- it relates to a depreciable property in the class;

- it was repaid by the corporation, pursuant to an obligation to repay that assistance, after the corporation had disposed of the property;

- it would have been included in the calculation of the capital cost of the property under section 101 of the Taxation Act if the refund had been made before the property was disposed of.

- subtract all amounts, each of which represents assistance that meets the following conditions:

- it relates to depreciable property of the class or was paid to enable the acquisition of such property;

- the corporation received it or was entitled to receive it before the time it claims capital cost allowance and after the property was disposed of;

- it would have been included, under section 101 of the Taxation Act, in the amount of assistance that the corporation received or was entitled to receive in respect of the property if it had been received before the property was disposed of.

Important: Negative amounts in column D must be preceded by a minus (–) sign.

Column E – Proceeds of the disposition made during the taxation year

Determine the net proceeds of disposition for each property disposed of. The net proceeds correspond to either the capital cost of the property disposed of or the proceeds of disposition minus any expenses incurred for the disposition, whichever is less. Enter the total net proceeds of the disposition of property for each class.

Column F – UCC after acquisitions and dispositions

For each class, add, the amount in column B, C and D and deduct the amount on column E.

If the result is negative, or if it is positive and there is no property of the same class left at the end of the taxation year, enter 0 on the corresponding line of column K and follow the instructions in the section entitled "Recapture of CCA and terminal loss."

Column F.1 – Proceeds of disposition available to reduce the UCC of AIIP acquired

If the property included in a particular class and described in column C does not include an AIIP, enter 0. Otherwise, do the following calculation for each class: amount in column E minus the amount in column C, from which you will have subtracted the amount in column C.1.

Certain adjustments must also be made to the result. This means that you have to, among other things

- subtract all amounts, each of which represents assistance that meets the following conditions:

- it relates to a depreciable property of the class;

- it was repaid by the corporation, pursuant to an obligation to repay that assistance, after the corporation had disposed of the property;

- it would have been included in the calculation of the capital cost of the property under section 101 of the Taxation Act if the refund had been made before the property was disposed of.

- add all the amounts, each of which represents assistance that meets the following conditions:

- it relates to depreciable property of the class or was paid to enable the acquisition of such property;

- the corporation received it or was entitled to receive it before the time it claims capital cost allowance and after the property was disposed of;

- it would have been included, under section 101 of the Taxation Act, in the amount of assistance that the corporation received or was entitled to receive in respect of the property if it had been received before the property was disposed of.

Important: If the amount in column F.1 is negative, enter 0.

Column F.2 – Net capital cost additions of AIIP acquired during the year

If the property included in a particular class and described in column C does not include an AIIP, enter 0. Otherwise, perform the following calculation for each class: amount in column C.1 minus the amount in column F.1.

Column F.3 – UCC adjustment for AIIP acquired during the taxation year

If the property included in a particular class and described in column C does not include an AIIP, enter 0. Otherwise, perform the following calculation for each class: amount in column F.2 multiplied by the variable determined using the following table.

|

Classes |

Variable applicable according to the date the property became available for use |

||

|

Before 2024 |

In 2024 or 2025 |

In 2026 or 2027 |

|

|

14.1 (eligible intellectual property) |

19 |

9 |

0 |

|

43.1 or 54 |

7/3 |

1.5 |

5/6 |

|

43.2 |

1 |

0.5 |

0 |

|

44 (eligible intellectual property) |

3 |

1 |

0 |

|

50 (property used mainly in Quebec and acquired after December 3, 2018) |

9/11 |

0 |

0 |

|

53 |

1 |

0.5 |

0 |

|

55 |

1.5 |

7/8 |

3/8 |

|

14.1 or 44 (other than an eligible intellectual property), 50 (other than used mainly in Quebec or that was acquired between November 21 and December 3, 2018) or other class (except classes 12, 13, 14 and 15) |

0.5 |

0 |

0 |

|

12, 13, 14 and 15 |

0 |

0 |

0 |

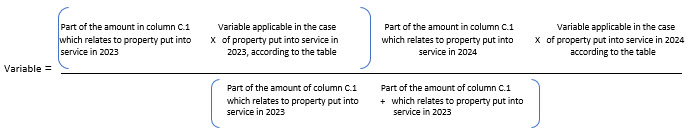

If the corporation's taxation year begins in 2023 and ends in 2024, the applicable variable will be the result of the following calculation:

If the corporation's taxation year begins in 2025 and ends in 2026, you must perform the same calculation, but substitute 2023 for 2025 and 2024 for 2026.

For more information, see section 8.3 of the CO-17.G guide.

Column G – UCC adjustment for non-AIIP acquired during the taxation year

Some property are not subject to the half-year rule. This is the case, among others, for property in classes 13, 14, 15, 23, 24, 27, 29, 34 and 52 and for certain property in classes 10 and 12.

For property subject to the accelerated investment incentive, the half-year rule is suspended until the end of 2027 (see section 8.3 of the CO-17.G guide).

If the half-year rule does not apply to a class, enter 0 in column G. Otherwise, perform the following calculation for each class: 50% multiplied by the amount in column C, from which you will have subtracted the amounts in columns C.1 and E.

Certain adjustments must also be made to the result. This means that you have to, among other things

- subtract all amounts, each of which represents assistance that meets the following conditions:

- it relates to a depreciable property of the class;

- it was repaid by the corporation, pursuant to an obligation to repay that assistance, after the corporation had disposed of the property;

- it would have been included in the calculation of the capital cost of the property under section 101 of the Taxation Act if the refund had been made before the property was disposed of.

- add all the amounts, each of which represents assistance that meets the following conditions:

- it relates to depreciable property of the class or was paid to enable the acquisition of such property;

- the corporation received it or was entitled to receive it before the time it claims capital cost allowance and after the property was disposed of;

- it would have been included, under section 101 of the Taxation Act, in the amount of assistance that the corporation received or was entitled to receive in respect of the property if it had been received before the property was disposed of.

Column H – Base amount available for the CCA calculation

For each class, add the amount in columns F and F.3 and deduct the amount in column G.

Column I – Rate

Enter the CCA rate applicable for each class. To know this rate, Consult the section "CCA rate, by class of property.” For classes which use the straight-line depreciation method, leave column I blank.

Column J – Capital cost allowance

Multiply, for each class, the amount in column H by the rate in column I. The result is the maximum allowable capital cost allowance.

Generally, where a corporation's taxation year is less than 12 months, the maximum amount allowable must be multiplied by the number of days in the taxation year, and the result divided by 365.

Note that an investment incentive is provided for Class 13, 14 and 15 assets acquired after November 20, 2018 and put into service before 2028. This incentive allows the corporation to increase the amount of maximum allowable amortization deduction. For more information, refer to part 8.3 of the CO-17.G guide.

Enter the total of column J on line 107 of form CO-17.A.1, Revenu net fiscal. (CO-17.A.1).

If an amount in column F is negative, it is a recapture of capital cost allowance (CCA). You must enter 0 on the corresponding line in column K; then add all the negative amounts in column F and enter the result on line 55 of form CO-17.A.1. This amount must be added to the corporation’s income.

If an amount in column F is positive and there is no more property of the same class at the end of the taxation year, it is a terminal loss. You must enter 0 on the corresponding line in column K; then add all the positive amounts in column F and enter the result on line 119 of form CO-17.A.1. This amount must be deducted from the corporation’s income.

There can be no recapture of CCA nor can there be a terminal loss for class 10.1 property.

Special cases

For explanations of the particulars concerning to certain classes of property, refer to line 250 of the Guide de la déclaration de revenus des sociétés (CO-17.G) (available in French only).

The following table shows the CCA rate for each class of property.

|

Class |

Rate |

Class |

Rate |

Class |

Rate |

|

1 |

4% |

17 |

8% |

41 |

25% |

|

2 |

6% |

18 |

60% |

42 |

12% |

|

3 |

5% |

22 |

50% |

43 |

30% |

|

4 |

6% |

23 |

100% |

43.1 |

30% |

|

5 |

10% |

25 |

100% |

43.2 |

50% |

|

6 |

10% |

26 |

5% |

44 |

25% |

|

7 |

15% |

28 |

30% |

46 |

30% |

|

8 |

20% |

29 |

50% |

50 |

55% |

|

8.1 |

33 1/3% |

30 |

40% |

53 |

50% |

|

9 |

25% |

31 |

5% |

54 |

30% |

|

10 |

30% |

32 |

10% |

55 |

40% |

|

10.1 |

30% |

33 |

15% |

||

|

11 |

35% |

35 |

7% |

||

|

12 |

100% |

37 |

15% |

||

|

14.1 |

5% |

38 |

30% |

||

|

16 |

40% |

39 |

25% |

The straight-line depreciation method is used with the following classes of property: 13, 14, 15 and 29. The CCA rate for class 36 property is 0%.

See Also

Schedule 8, Capital Cost Allowance (CCA)

IN-191, Capital Cost Allowance in Respect of Property Acquired After November 20, 2018