FIN 542S - Logging Tax Return of Income

Complete and file this return if the corporation had income from the sale of British Columbia logs, standing timber, timber rights or the export of logs.

Do NOT use this return if the corporation processed logs into primary or secondary forest products (lumber, shakes, shingles, poles, pulp, paper, etc.).

FIN 542P – Logging Tax Return of Income for Processors

Complete and file this return if the corporation processed logs into primary or secondary forest products (lumber, shakes, shingles, poles, pulp, paper etc.). Processors must also include on this form any additional income from the sale of British Columbia logs, standing timber, timber rights or the export of logs.

If the corporation processed logs into primary or secondary forest products answer “Yes” to the question Did the corporation process logs into primary or secondary forest products in the taxation year covered by this form? located in the form header. Otherwise, answer “No” to this question. The answer to this question will determine which form should be completed.

Each individual or corporation that engages in logging operations on private or crown land in British Columbia is responsible for filing an annual logging tax return with the British Columbia Ministry of finance. Logging operations include the following:

- the sale of logs or standing timber;

- the sale of the right to cut standing timber;

- the sale of primary and secondary forest products produced from logs such as lumber, pulp and paper, shakes, etc.; and

- the export of logs.

Logging tax returns must be filed within six months after the end of the taxation year in which logging operations occurred. A copy of the taxpayer’s federal income tax return and financial statements must be submitted with the logging tax return.

If the logging operations cease, the taxpayer should notify the Commissioner of Income Tax in writing.

The taxpayer will no longer be required to file a logging tax return unless he or she resumes logging operations.

Logging income is calculated in accordance with Division B of the federal Income Tax Act and is generally gross revenue from logging operations less any related operating expenses.

Where logs are manufactured into primary and secondary forest products, a processing allowance may be deducted. The processing allowance is calculated as 8% of the original cost of assets used to produce primary and secondary forest products. The allowance may not exceed 65% nor be less than 35% of the net processing income (calculated as total income from all sources less income from the sale of logs or standing timber and non-logging income).

For each taxation year, a taxpayer must pay a tax equal to the lesser of:

- 10% of the taxpayer’s income from logging operations in British Columbia; or

- 150% of the credit that would be allowable under section 127(1) of the federal Act, as if the tax referred to in paragraph (a) was paid.

For the purpose of the Logging Tax Act, the allowable logging tax deduction under section 127(1) of the federal Act means the logging tax deduction that would be allowable before any deduction is made for investment tax credits or political contribution credits under the federal Act.

The amount of logging tax paid is usually fully deductible as a credit from income taxes if claimed within three years of filing the taxpayer’s federal income tax return.

If you process logs cut from standing timber outside British Columbia you may be able to deduct an amount for the non-British Columbia net processing income.

The non-British Columbia processing income is calculated as: A x (B ÷ C)

Where:

A is the net processing income (the amount on line 150);

B is the volume of logs acquired or cut outside of British Columbia; and

C is the total volume of logs acquired or cut.

The program included this calculation in the on screen form. When you print the form, if there is a calculation on line 155, this calculation will be attached as a schedule to the form. This calculation must be enclosed with the return as requested by the British Columbia government.

Under the Logging Tax Act, a taxpayer is required to pay logging tax instalments based on the lesser of the previous year’s tax or the current year’s estimated tax. One-half of this instalment base is due by the end of the taxation year and one quarter is due by the end of the third month following the year end. The remaining tax payable is due with the logging tax return six months after the taxation year end.

Instalment payments are not required for taxpayers whose instalment base is less than $2,000. Taxpayers who are not required to make instalments must remit the entire balance of tax owing on or before the logging tax return’s due date, i.e., six months after the taxation year end.

The $2000 limit on instalments is not addressed in the legislation. It is an administrative policy that was developed in the interest of taxpayers’ fairness and to mirror the Canada Revenue Agency's instalment rule.

To authorize a representative, use Form FIN 146, Authorization or Cancellation of a Representative (Jump Code: FIN146)

Further Information

If you have any questions, concerns or comments, please contact the provincial Income Taxation Branch, by telephone at 250-953-3082 (Victoria) or 1-877-387-3332 (toll-free) or e-mail at ITBTaxQuestions@gov.bc.ca.

You can also find information on the Web site at http://www2.gov.bc.ca/gov/content/taxes/income-taxes.

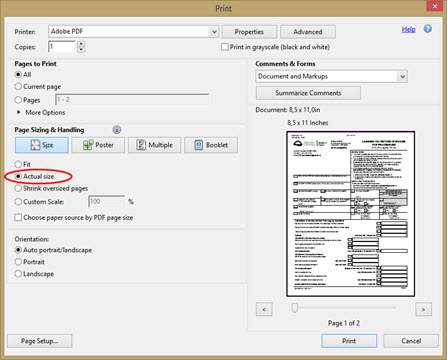

Printing from a PDF document

Where the form is to be printed from a PDF document, the option Actual size should be defined in the print settings as required by the British Columbia government.

See Also

Instructions for Form Logging Tax Return of Income (FIN 542S)

Instructions for Form Logging Tax Return of Income for Processors (FIN 542P)