Payment threshold and frequency

A corporation must pay instalments if the total tax and the tax on capital it must pay (except for compensation tax of financial institutions), for the current and previous taxation years, exceeds $3,000. However, instalments frequency is reduced for eligible small businesses.

A CCPC is eligible for quarterly instalments payments in Québec if it meets the following conditions:

- when the payment is due, the corporation has a perfect compliance history (compliance with this condition will be determined according to Québec’s legislation);

- the corporation must have income from a business actively carried on during either the current or previous year;

- the corporation and any of its associated corporations, has taxable income for the current or previous taxation year not exceeding $500,000 (compliance with this condition will be determined according to Québec’s legislation);

- the corporation and any of its associated corporations, has paid-up capital for the current or previous taxation year of less than or equal to $10,000,000 (compliance with this condition will be determined according to Québec’s legislation). If the corporation claimed the manufacturing corporation deduction (code 08) on line 393 or 394 of Form CO-1136, Calculation of Paid-Up Capital (Jump Code: 1136), the amount that should be taken into account is the amount of paid-up capital to which this deduction will have been added.

A section entitled “Quarterly instalments calculation” allows you to calculate these instalments. To take advantage of this, the corporation will have to meet the eligibility criteria stated by means of questions at the beginning of this section.

However, note that the corporation can choose to continue making monthly instalments, even if it is eligible for quarterly instalments. To do so, select the check box provided to that effect at the end of the questionnaire.

Furthermore, if you choose method 2 and you want the first two payments to be calculated without taking the applicable threshold into account, answer Yes to the question at the beginning of Section 2, “Combined 1st and 2nd instalment base method.” This situation can occur, for example, when the return is not yet completed, but you are sure that if it was, the threshold would be reached and instalments would be payable.

It is also possible to make payment calculations even if the threshold is not reached by selecting the Select this box if you want the instalments to be calculated without taking the applicable threshold into account check box which appears in the 'Payment method' section.

Apply the current year refund to next year’s instalments

If you want to apply the current year refund against next year’s instalments, enter the refund amount on line 491 of the Corporation Income Tax Return (CO-17) and select the appropriate check box in Form Federal Tax Instalments (Jump Code: IFED).

This way, the program will include the refund amount from the CO-17 return in the Refund transferred to instalments column of Form Québec Tax Instalments, to adjust the calculation of instalments payable in the next year. Note that the program determines the refund amount based on the payments entered in the Instalments paid column of Form Québec Tax Instalments. Therefore, if the corporation has already made some instalment payments for the next year, it must enter these payment amounts in the Instalments paid column in order for the refund amount to be applied to the next instalment payment to make.

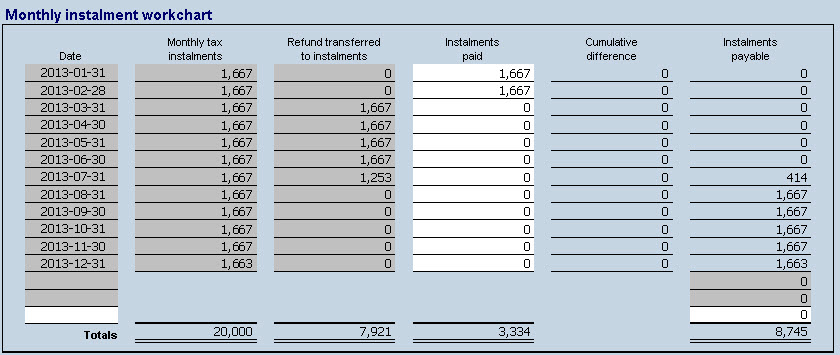

Here is an example demonstrating how the Refund transferred to instalments column works:

The corporation has a $7,921 refund, and the refund amount has been entered on line 491 of the CO-17 return. The corporation has already made a payment of $1,667 for the months of January and February. The refund will be applied to cover the March, April, May and June payments entirely, as well as part of the July payment. Therefore, the corporation will have to pay an amount of $414 for the month of July.

Note: Revenu Québec will first apply the refund against any outstanding balance of the corporation’s account, then any amount owed in any account of the corporation or any related business number accounts. Any excess amount will then be transferred to the corporation’s instalments for the next year. Revenu Québec will transfer the refund only if all the required returns for the corporation’s account or any related account have been filed.

Particular situations

A corporation’s first base instalment corresponds to the tax it paid for its previous taxation year. The second base instalment corresponds to the tax it paid in its second to last taxation year. The first and second instalment bases must be calculated without taking into account the following deductions:

- the deduction for income earned from a major project;

- the deduction for income earned from a large investment project;

- the deduction of an amount pertaining to a subsequent taxation year event. For example a loss carryback (a 2010 loss carried back to 2009) or the unused portion of the foreign tax credit pertaining to a subsequent taxation year.

Amalgamation, winding up, transfer

A corporation resulting from the amalgamation of two or more corporations must calculate its first and second instalment base by adding the first and second base instalment of the corporations it is replacing.

A parent corporation that winds-up a subsidiary of which it holds 90% or more must add the first and second base instalment of this subsidiary to its first and second base instalment for the year of the wind-up.

For the taxation year following the wind-up, the parent corporation must add to its first base instalment the amount resulting from the following calculation:

|

First base instalment of the subsidiary |

X |

Full months before wind-up |

|

|

|

12 |

When a corporation receives all or substantially all of the assets of another corporation with whom it is at non-arm’s length, and section 518 and 529 of the Québec Taxation Act apply to the disposition of one of these assets, it must add to the first and second instalment base of the other corporation. The above mentioned rules relating to the winding up of a subsidiary apply to such situation.

Lines are provided for to calculate the first and second instalment base to allow for an adjustment when there is an amalgamation, a wind-up, a transfer or a rollover. For more information on this topic, refer to section 1027 of the Québec Taxation Act or to section 1027R of the Tax regulations for more details on this topic.

Corporation’s dissolution

Please note that if you have indicated, on line 078 of Form Identification (Jump Code: ID), that this is the final tax return of the corporation as a result of its dissolution, the program will not calculate any instalment payments, because there will be no taxation year after the year of dissolution.

References

For more information, refer to Form CO-1027.

See also

Guide de la déclaration de revenus des sociétés (available in French only)