Payment threshold and frequency

Calculation methods for Saskatchewan monthly instalment vary based on the type of corporation. The methods will be different based on whether or not the corporation is a “resource Corporation” that must pay a “Corporation Capital Tax Resource Surcharge.”

Corporations must pay monthly instalments when the instalment payments exceed $400 a month.

Apply the current year refund against next year’s instalments

If you want to apply the current year refund against next year’s instalments, you must select the Apply to subsequent year check box in the Corporation Capital Tax Return (Jump Code: SJ), then select the appropriate check box in Form Saskatchewan Tax Instalments (Jump Code: ISK).

This way, the program will include the refund amount from the Corporation Capital Tax Return or Corporation Capital Tax Return – Financial institution, as the case may be, in the Refund transferred to instalments column of Form Saskatchewan Tax Instalments to adjust the calculation of instalments payable in the next year. Note that the software determines the refund amount based on the payments entered in the Instalments paid column of Form Saskatchewan Tax Instalments. Therefore, if the corporation has already made some instalment payments for the next year, it must enter these payment amounts in the Instalments paid column in order for the refund amount to be applied to the next instalment payment to make.

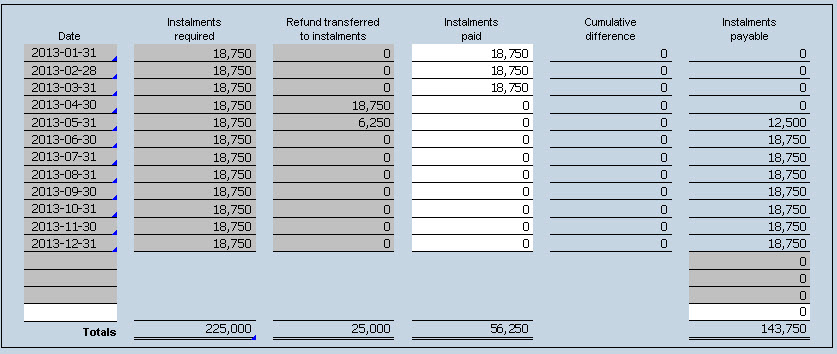

Here is an example demonstrating how the Refund transferred to instalments column works:

The corporation has a $25,000 refund and the Apply to subsequent year check box has been selected in the Corporation Capital Tax Return. The corporation made an $18,750 payment for the months of January, February and March. The refund will be applied to cover the April payment entirely, as well as part of the May payment. Therefore, the corporation will have to pay $12,500 for the month of May.

Note: The Saskatchewan government will first apply the refund against any outstanding balance of the corporation’s account, then any amount owed in any account of the corporation or any related business number accounts. Any excess amount will then be transferred to the corporation’s instalments for the next year. The Saskatchewan government will transfer the refund only if all the required returns for the corporation’s account or any related account have been filed.

Particular situations

According to information received from Saskatchewan Finance, a newly formed corporation as a result of amalgamation will be considered as a new corporation with regard to Saskatchewan instalments. The corporation will be required to remit equal monthly instalments based on an amount representing 75% of its tax payable for its first taxation year. The same applies if all or substantially all of the assets of a corporation are transferred to a corporation with whom it is at a non-arm’s length and this transfer results in the creation of a new corporation. However, the parent corporation’s instalments are not affected by the winding up of a subsidiary.

Corporation’s dissolution

Please note that if you have indicated, on line 078 of Form Identification (Jump Code: ID), that this is the final tax return of the corporation as a result of its dissolution, the program will not calculate any instalment payments, because there will be no taxation year after the year of dissolution.

References

For more information, refer to the Information Bulletin CT-4.