Schedule 9 - Related and Associated Corporations Workchart

![]() How

to complete Schedule 9, Related and Associated Corporations Workchart

How

to complete Schedule 9, Related and Associated Corporations Workchart

You can access Schedule 9 Workchart, Related and Associated Corporations Workchart by double-clicking or by right-clicking on the line Go to Form 9 Workchart in any related or associated corporation’s schedule or by pressing F9 when this line is selected.

List of subjects:

Québec CO-771.1.3.AJ - Adjusted business limit

Québec CO-1029.8.36.IN – Tax credit for investment

Québec CO-1137.E – Agreement respecting the $1 million deduction

Manitoba MCT1 - Corporation capital tax return

Manitoba – Credit unions and caisses populaires tax return

Saskatchewan SCT1 - Corporation capital tax return

Associated corporation's taxation year ending after the taxation year of the reporting corporation for a same calendar year

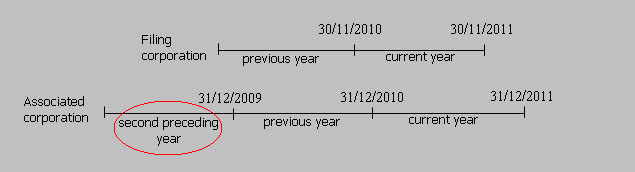

When the associated corporation’s taxation year is ending after the taxation year of the reporting corporation for a same calendar year, the amount that must be taken into account for the associated corporation is the amount with respect to its latest taxation year ending during the taxation year of the reporting corporation. If the taxation year of the reporting corporation that must be taken into account is the previous taxation year, the taxation year to take into account for the associated corporation will be the second prior taxation year.

Based on the taxation year end of the associated corporation, the calculation will take into account the amounts posted for the current taxation year, the previous taxation year or, if applicable, the second preceding taxation year.

|

Example: In the situation below, the associated corporation's taxation year is ending after the taxation year of the reporting corporation for a same calendar year. For the associated corporation, the amount to take into account for the previous taxation year is that of the second previous taxation year.

|

This applies to the following lines of Schedule 9 WORKCHART, listed based on their respective sections:

- “General information – Related and associated corporations”

Taxable capital employed in Canada

- “Schedule 511 – Corporate minimum tax – Total assets and revenue for associated corporations”

Total assets

Total revenue

- “Québec CO-17 – Corporation income tax return”

Paid-up capital of prior taxation year

- "Québec CO-1029.8.36.II – Tax credit for investment and innovation"

Gross revenue of the corporation for the preceding taxation year

When rolling forward the return, the amount entered for the current taxation year will be carried over to the line in respect of the previous taxation year and, if applicable, the amount entered for the prior taxation year will be carried forward to the line relating to the second prior year.

“General information” section

The “General information” section contains essential information on the related or associated corporation, such as the name, the account number, the relationship code and, for the associated corporation, the association code as well as the taxation year covered.

In order for certain calculations to be performed correctly, you must select the appropriate check box.

- The corporation is a cooperative or a credit union

eligible for the small business deduction (SBD).

This box is used to indicate whether the associated corporation is a cooperative or a credit union that must be considered to be a CPCC for the allocation of the business limit for purposes of the SDB. For more information, refer to subsection 136(1) and 137(7) ITA.

In addition, for taxation years that start after 2018, when this box is selected, the cooperative’s or credit union’s passive investment income is not taken into account in the business limit reduction calculation for the group of associated corporations. - Is the corporation an insurance corporation deemed not to be a private corporation under section 141.1 ITA?

For taxation years that start after 2018, this question is used to indicate whether the associated corporation is an insurance corporation, other than a life insurance corporation, that is a private corporation covered by subsection 141.1 ITA. When the answer to this question is “Yes,” the insurance corporation’s passive investment income is not taken into account in the business limit reduction calculation for the group of associated corporations. - Is the corporation covered by sections 21.20.7 to 21.20.9 QTA (it is not associated with the filing corporation for purposes of the Québec tax return)?

When you answer “Yes” to this question, the corporation is not considered to be associated with the filing corporation for purposes of the Québec tax return. As a result, it is not taken into account in the calculations involving all the corporations associated with the filing corporation, and the information relating to this corporation is not displayed in the tables of the Québec forms showing the associated corporations. However, the corporation is still considered to be associated with the filing corporation for the federal and for all other provincial calculations. - If you answered “Yes” to the previous question, is the corporation related to the filing corporation?

When you answer “Yes” to this question, the information relating to this corporation is displayed in Form CO-17S.9 (Jump Code: Q9), and the code indicated in the Relationship code column of this form is “4” to reflect the fact that this corporation is related but not associated with the reporting corporation for purposes of the Québec tax return.

The option shown below allows you to display only the sections that apply to the filing corporation according to the provincial or territorial jurisdiction selected in the Identification form.

![]()

Québec CO-156.EN – Agreement concerning regional ceilings respecting the additional Deduction for transportation costs of small and medium-sized manufacturing businesses

To determine if the corporation qualifies for the additional deduction for transportation costs of remote manufacturing SMEs, you must select the check box Is the corporation a manufacturing corporation that has an applicable regional cap? to indicate that the associated corporation is a manufacturing SMEs that has a regional cap in copy 2 and following of Schedule 9 WORKCHART.

Associated corporations’ paid-up capital of the prior taxation year

The associated corporations’ paid-up capital of the prior taxation year calculated by the program in Sections “Québec CO-737.SI – Deduction for innovative manufacturing corporations”, “Québec CO-771.1.3 –Agreement between associated corporations respecting the business limit”, “Québec CO-1029.8.33CS – Tax Credit for SMBs that employ persons with a severely limited capacity for employment”, “Québec CO-1029.8.33.TE – Tax Credit for Small and Medium-Sized Businesses to Foster the Retention of Experienced Workers”, “Québec CO-1029.8.36.IN –Tax credit for investment” and “Québec CO-1137.E – Agreement respecting the $1 million deduction” corresponds to the paid-up capital entered in Section “Québec CO-17 – Corporation income tax return.” Since the associated corporations’ paid-up capital of the prior taxation year that should be taken into account is not necessarily the same on all forms, override the paid-up capital amount in the appropriate sections based on the information provided in the Guide d'aide au calcul du capital versé, if applicable.

CO-771.1.3.AJ – Adjusted Business Limit

For taxation years starting after 2018, the corporation’s business limit is reduced by the greater between the taxable capital reduction and the adjusted aggregate investment income (AAII) reduction. When an associated corporation is not a related corporation, nor a corporation for which the association code “5” is selected and has a positive AAII according to the amounts entered or rolled forward under the title Data related to the last taxation year ending in the previous calendar year, a copy of Part 2 in Form CO 771.1.3.AJ is created, the end date of the preceding fiscal period is updated to line 09 and the amounts are updated to lines 11, 12, 14 to 18, 21 and 23 for the associated corporations. For more information in respect of the adjusted aggregate investment income calculation, consult the Help topic for Form CO-771.

In a taxation year beginning in 2019, these lines will be calculated from amounts 2A to 2L and line 741 in Part 2 of Schedule 7, Aggregate Investment Income and Income Eligible for the Small Business Deduction, when line 744 has a positive amount.

Otherwise, when rolling forward a client file with a taxation year starting in the previous calendar year, the amounts on lines 705 to 741 in Part 2 of Schedule 7, will be updated to the corresponding lines in Section CO-771.1.3.AJ in Schedule 9 WORKCHART of the filing corporation’s copy.

The line Adjusted aggregate investment income for taxation years ending the previous calendar year has been moved from Part “CO-771.1.3 - Associated corporation’s agreement respecting the allocation of the business limit” to Part “CO-771.1.3.AJ – Adjusted business limit.” The amount on this line represents the total of the amounts on line 24 in the copies of Part 2 of Form CO-771.1.3.AJ in which the name of the corporation corresponds to the name of the corporation entered at the top of Schedule 9 WORKCHART.

Manitoba MCT1 - Corporation capital tax return

Capital deduction allocation

This subsection is used to allocate the capital deduction among corporations that are members of an associated group of corporations for a calendar year.

The capital deduction applies for taxation years ending before May 1, 2017.

Data entered in this sub section will be posted to the “Capital Deduction Allocation” section of Form MCT 1, Corporation Capital Tax Return (Jump Code: MJ).

Exemption for small financial institutions

To determine if the corporation qualifies for the exemption for small financial institutions, enter the paid up capital of the associated corporations in the field “Paid up capital” and you must select the check box Is the corporation a bank, trust or loan corporation? to indicate that the associated corporation is a financial institution in copy 2 and following of Schedule 9 WORKCHART. Please note that the exemption for small financial institutions applies when the difference between the total paid up capital of all members of an associated group of corporations that are banks, trust or loan corporations and the $10,000,000 deduction is less than $4,000,000,000.

Manitoba – Credit unions and caisses populaires tax return

The Credit Unions and Caisses Populaires Tax Return is used to enter the $400,000 deduction allocation between caisses populaires and credit unions associated for a taxation year ending after December 31, 2010.

Data entered in this section will be posted to Section A of the Credit Unions and Caisses Populaires Tax Return (Jump Code: MB-CREDIT UNIONS).

Saskatchewan SCT1 - Corporation capital tax return

Gross assets and salaries of associated corporations

You can use this subsection to enter the gross assets and the salaries of the associated corporations.

If the corporation is a resource corporation, the gross assets of the associated corporations and filing corporation is use to determine if the filing corporation will have to pay the resource surcharge. The salaries are used to calculate the additional exemption to the paid-up capital.

Taxable paid-up capital and salaries of associated corporations - Financial institutions

You can use this subsection to enter the taxable paid-up capital and the salaries of associated corporations.

The taxable paid-up capital of associated corporations is used to determine if the filing corporation is a "small financial institution". The salaries are used to calculate the additional exemption to the paid-up capital.

The data entered in these subsections of the Workchart for Related and Associated Corporations will automatically be posted in schedule SCT1 – Corporation Capital Tax Return (Jump Code: SJ).

See also