Steps for linking a TP-1086.R.23.12 form with a statement of real estate rental properties.

Complete a copy of the Statement of Real Estate Rental Properties (Jump Code: RENTAL) for a given real estate rental property owned by the corporation as a sole owner or as a co-owner.

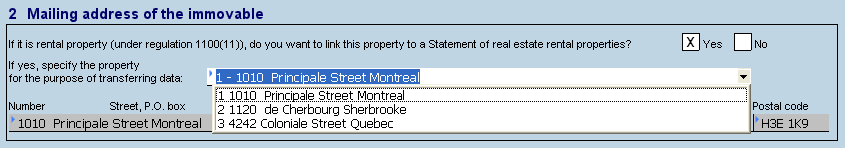

In Form TP-1086.R.23.12, indicate that you want to link this property to a statement of real estate rental properties by answering the relevant question, and then, using the drop-down menu, select the address of the property for which you wish to transfer the information:

The address and the postal code of the property will be updated to Form TP-1086.R.23.12 and an expand cell, located to the right of the expense’s description in the statement of real estate rental properties, will allow you to go from one form to the other.

When rolling forward data, the form will remain linked to a statement of real estate rental properties until you answer “Yes” to the question Was this the final year of your rental operation? in the Statement of Real Estate Rental Properties (Jump Code: RENTAL).

See also

Statement Real Estate Rental Properties (Regulation 1100(11))