Release Notes - CCH iFirm Taxprep T2 2021 v.2.0 (2021.40.32)

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T2

With CCH iFirm Tax T2, have the most comprehensive collection of corporate tax forms available, as well as tools designed to address complex T2 preparation requirements. CCH iFirm Tax T2 also provides you with:

- the possibility of attaching supporting documents to electronically transmitted returns;

- GIFI data transfers.

Taxation Years Covered

CCH iFirm Taxprep T2 2021 v.2.0 is designed to process corporate tax returns with taxation years beginning on or after January 1, 2019, and ending on or before May 31, 2022.

Overview - Version 2.0

CCH iFirm Taxprep T2 2021 v.2.0 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

New fields for the electronic signature added to form T183 CORP

Three new fields (electronic signature indicator, signature date, and signature time), the content of which must be transmitted when Form T183 is electronically signed, have been added to the form. For more information, consult the note relating to this subject.

New Forms

The following forms have been added to the program:

- CO-17.CE, Online Commercial Activities of a Corporation

- CO-737.18.CI, Deduction Relating to the Commercialization of Innovations in Québec

- Schedule 444, Yukon Business Carbon Price Rebate

Improve Your Productivity

Preparer Profiles

General Information tab

The option Do not allow e-mail address entry in any of the forms in the return has been added to section Options – Return in the General Information tab of the preparer profile. When this option is selected, a diagnostic will display in the return to prevent you from entering or editing information in the e-mail address fields. This option is set to No by default. Note that when converting the preparer profile, this option selection will be retained. The roll forward for the e-mail address is not impacted by this addition. Therefore, any e-mail address entered will be rolled forward.

Client letter, Filing Instructions for the AgriStability and AgriInvest program forms

Client letter, Worksheet

Client letter, Filing Instructions

To resolve a display problem with date fields in the Filing Instructions for the AgriStability and AgriInvest program forms letter and in the Filing Instructions letter paragraphs, we replaced the second date fields which were protected with new protected fields in the following sections of the Client Letter Worksheet form:

- T2 – Paper format

- T2 – Internet filing

- T106

- T1044

- T1134

- T1135

- CO-17 – Internet filing

- AT1 – Paper format

- AT1 – NET FILE

- British Columbia

- Manitoba

- SCT1

- Capital tax

- AGRI/HAGRI – Agri-stability and Agri-Investment programs

- Other information

In addition, we have also replaced all date fields that were used in the Filing Instructions for the AgriStability and AgriInvest program forms letter and in the Filing instructions letter. Adjust your customized letters, if necessary.

Also, in the Filing instructions letter, a specific paragraph for the electronic signature of Form T183CORP has been added in the Mailing section to electronically file the T2 return.

New Forms

Québec

CO-17.CE, Online Commercial Activities of a Corporation

This new form is for any corporation that, in its taxation year, has income from its online commercial activities. If you are in this situation, answer Yes to the question on line 19a of the CO-17 return and complete this form. The first five lines will be completed using data indicated in federal Schedule 88. If you have more than five Internet sites, you must list them in this form.

CO-737.18.CI, Deduction Relating to the Commercialization of Innovations in Québec

This multiple copy form is for any qualified corporation that, for a taxation year starting after December 31, 2020, claims a deduction in computing its taxable income in respect of the commercialization of a qualified intellectual property asset developed in Québec. With this deduction, the qualified corporation benefits from an effective tax rate of 2% on the qualified portion of its taxable income attributable to that qualified intellectual property asset.

For each qualified intellectual property asset, complete a separate copy of form CO-737.18.CI. To make it easier to find copies in this form, we have added the Description of the qualified intellectual property asset custom field, which will be displayed in the drop-down list on the toolbar above each multiple copy form.

In addition, for each qualified intellectual property asset, complete Part 3.1 on a separate copy for the current taxation year as well as for each of the six previous taxation years in order to be able to calculate the weighted average of percentages of expenditures attributable to Québec of Part 3.2

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount had been entered in the Deduction relating to the commercialization of innovations in Québec field (code 18) of Form QC L265-266, it will be retained as an overridden amount. You will then have to complete Form CO-737.18.CI and delete the overridden amount in the Deduction relating to the commercialization of innovations in Québec field (code 18) of Form QC L265-266 for the deduction calculated in Form CO-737.18.CI to be updated to Form QC L265-266.

For more information on this deduction, consult the help topic of this form as well as sections 737.18.43 and 737.18.44 of the Québec Taxation Act.

Yukon

Schedule 444, Yukon Business Carbon Price Rebate

The Yukon business carbon price rebate is a refundable tax credit that the corporation can claim, under section 16 of the Yukon Income Tax Act (ITA), if the following conditions are met:

- The corporation is an eligible Yukon business taxpayer;

- The corporation used an eligible Yukon asset in the tax year, principally in carrying on an eligible Yukon business; and

- The corporation filed an income tax return for a tax year ending after July 1, 2019.

This refundable tax credit is equal to the amount of the business rebate factor for the financial year in which the tax year ends multiplied by the eligible Yukon undepreciated capital cost (UCC) of the taxpayer as of the end of the tax year. For your information, the business rebate factor for the next financial year is determined on or before November 1 in each financial year by the Yukon minister of Finance under the Yukon Government Carbon Price Rebate Act.

To correctly calculate the Yukon business carbon price rebate under subsection 16(6) of the Yukon ITA, note 5 has been adjusted to take into account the tax measure of subsection 26(5) in part 4 of Yukon bill 33 and the proration of the number of days in the tax year has been added in Part 3 in the following cases:

- When the tax year is shorter than 12 months, while the Yukon business carbon price rebate is multiplied by the number of days in the tax year divided by 365; or

- When the tax year starts before July 1, 2019, while the Yukon business carbon price rebate is multiplied by the number of days in the tax year after June 30, 2019, divided by 365.

In addition, the definition of “eligible Yukon asset” in subsection 16(1) of the Yukon ITA refers to depreciable property of the taxpayer, of a prescribed class, within the meaning of the federal Act, that is prescribed for this purpose. Therefore, notes 1 and 2 have been adjusted to take into account class 56 that was added to federal Bill C-30, which was assented on June 29, 2021.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered on line 699 of Schedule 5, it will be retained as an overridden amount. Then, complete Schedule 444 and delete the overridden amount on line 699 of Schedule 5 for the Yukon Business Carbon Price Rebate calculated in Schedule 444 to be updated in Schedule 5.

Deleted Forms

Alberta

- AT1 Schedule 5, Alberta Royalty Tax deduction

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Corporate Identification and Other Information

Following the addition of line 096, If yes, provide the preparer's name or firm name, in the AT1 return, the equivalent line If yes, provide the preparer’s name or firm name (AT1 line 096), has been added to the Filing information section. This line appears when the corporation has a permanent establishment in Alberta. Data entered on this line comes from the preparer’s profile. If no preparer’s profile is used, data must be entered if the AT1 return is applicable. For more information, consult the note relating to the AT1 return.

Federal

Schedule 200, T2 Corporation Income Tax Return*

In the Taxable income section, line a, Employer deduction for non-qualified securities under an employee stock options agreement, has been renumbered and renamed line 352, Employer deduction for non-qualified securities. This line is now part of the electronic transmission and the bar codes of the T2 return.

Schedule 1, Net Income (Loss) for Income Tax Purposes

As a result of the update of the T2 Guide - Corporate income tax return on June 14, 2021, the guide mentions that once the income has been reported in Schedule 125 you must use Schedule 1 to report income from the COVID-19 programs by clearly indicating which COVID-19 subsidy you received on line 605 with a corresponding “000” entry on line 295. Refer to the T2 Guide - Corporation Income Tax Return for more information.

Since the description is not often the same, we have removed the old fourth row from the column 605 Taxable amounts from COVID-19 programs. You can use the free lines after the third line of the table in the Other additions section to enter the description with the amount of assistance on line 605 Description as well as 0 on line 295 Amount.

In addition, the CRA has updated the specifications for electronic transmission as well as the federal bar codes to allow transmission of 0 to lines 295, 296, 395 and 396. In CCH iFirm Taxprep T2, you must confirm your amount 0, by entering 000 in or overriding 000 in lines 295 Amount and 395 Amount of Schedule 1 so that the information will be transmitted. For lines Total 296 and 396, CCH iFirm Taxprep T2 does it for you.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the data entered in the old fourth line called Taxable amounts from COVID-19 programs of the table in the section Other additions will not be retained.

Schedule 3, Dividends Received, Taxable Dividends Paid, and Part IV Calculation*

Schedule 4, Corporation Loss Continuity and Application*

Schedule 6, Summary of Dispositions of Capital Property*

In Part 9, the input field Portion of the capital gain that is subject to a 100% inclusion rate per 100(1) has been added to enter the portion of the capital gain arising from the disposition of a partnership’s interest attributable to depreciable property or non-capital property. In addition, line 902 has been added to take into account the input amount in computing the total capital gains or losses on line P.

Schedule 7, Aggregate Investment Income and Income Eligible for the Small Business Deduction*

Schedule 8, Capital Cost Allowance (CCA)*

On April 19, 2021, the Department of Finance tabled the annual federal budget announcing the immediate expensing of certain depreciable property. While the underlying policy was proposed in the budget documents, the Department of Finance has not yet drafted any form of legislation supporting that policy. The Canada Revenue Agency (CRA) cannot implement system or form changes to process immediate expensing claims until a bill is tabled in the House of Commons. In addition, any deduction claimed based on the budget announcement will not be processed by the CRA.

The CRA has also informed us that no changes to the program should be made at this time. As a result, the modifications made to version 2021 1.1 to take the deduction for immediate expensing into account in the CCA have been removed, as the calculation for this deduction cannot be made at the date of the program release.

This also involves the removal of fields and lines in the following forms:

- Capital Cost Allowance (CCA) Workchart

- Additions and Dispositions Workchart

- Related and Associated Corporations Workchart

- CO-130.A, Capital Cost Allowance

- AT1 Schedule 13, Alberta Capital Cost Allowance (CCA)

Schedule 16, Patronage Dividend Deduction*

Schedule 17, Credit Union Deductions*

Schedule 54, Low Rate Income Pool (LRIP) Calculation*

The CRA has adjusted the description for line 140 to specify that the election under subsection 89(11) ITA not to be a Canadian-controlled private corporation must be made in a prior tax year in order for the amount of aggregate investment income from the previous year to be included in the calculation of the LRIP. The calculations performed by CCH iFirm Taxprep T2 have been adjusted to take this precision into account.

Schedule 89, Request for Capital Dividend Account Balance Verification*

Following an update of the form, the City and Province fields have been added to Part 1. As a result, the names of the city and province are no longer included in the Address field. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the overridden information in the Address field will not be retained.

In addition, Part 5 has also been added. If the capital dividend account (CDA) balance is to include net proceeds of a life insurance, provide the items listed in Part 5 to the CRA when you make a request for a CDA balance verification. If you are in this situation, a diagnostic will be displayed to prompt you to send the following:

- the name of the insured individual;

- the name of the beneficiary;

- the policy number;

- the adjusted cost base of the policy;

- the total amount received related to the life insurance proceeds (a detailed breakdown of the amount received); and

- a letter from the insurance company indicating whether the life insurance policy was a taxable or non-taxable policy.

With the addition of Part 5, former Part 5 – CDA balance becomes Part 6 – CDA balance.

Schedule 97, Additional Information on Non-Resident Corporations in Canada*

Inducement, Inducement Calculation Workchart

As a result of the update of the T2 Guide - Corporate income tax return on June 14, 2021, the guide mentions reporting a description on Schedule 1, therefore the prior line Canada emergency wage subsidy (CEWS), Canada emergency Rent Subsidy (CERS) and other taxable amounts from related to COVID-19 programs has been withdrawn.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the information entered on this line is reported in the Other amounts section. If the check box in column A and B, where the latter was applicable, had been selected, it will also be selected in the Other amounts section.

T183 CORP, Information Return for Corporations Filing Electronically*

Electronic signature: The CRA will continue to accept an electronic signature on Form T183. The CRA added three new fields (electronic signature indicator, signature date, and signature time), the content of which must be transmitted when Form T183 is electronically signed. Data in those new fields will be electronically transmitted with the T2 return, which is not the case with data in the other fields of the form. You must keep retaining this form and provide it to the CRA upon request.

These fields can be found in the new Electronic Signature section, which was added to the form, on screen only. When the answer to the question Are you planning on using an electronic signature method on Form T183? is Yes, EFILE diagnostics will prompt you to complete these fields to transmit the return.

In addition, the date of signature in Part 3 will no longer be automatically updated. Instead, you will have to manually enter the date of signature in the Electronic signature section. The date that must be transmitted to the CRA is the date of signature and not the date the form was printed. The three new EFILE fields (electronic signature indicator, signature date, and signature time), will be automatically completed by the program once the form is signed using the electronic signature feature of CCH iFirm Portal.

The answer to the question relating to the electronic signature will default to Yes. However, if you elect not to use electronic signatures, the answer to this question can be defaulted to No by clearing the check box Using an electronic signature method on Form T183 in the EFILE tab, in the Canada Revenue Agency section of the preparer profile.

Doing so will prevent EFILE diagnostics related to the electronic signature feature from being displayed and the date of signature in Part 3 will be automatically updated as in prior years.

T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim

The year’s maximum pensionable earnings amount for purposes of the Canada pension plan has been updated for the 2022 calendar year (and is now $64,900). This amount is used to determine the specified employees’ salary or wages in Part 5 when the proxy method is selected to calculate the SR&ED expenditures.

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates

For taxation years starting after December 31, 2020, custom question Are all foreign affiliates dormant? has been added at the beginning of the T1134 – Summary form, under the question Do you want to file Form T1134?.You should answer Yes to this new question when all foreign affiliates of the reporting entity(ies) are dormant, according to the instructions on Form T1134. In this situation, you will have to provide the information regarding these foreign affiliates in subsection D. Dormant foreign affiliates in Section 3 of Part I, and no copy of Form T1134 – Supplement has to be completed. Also note that Form T1134 will have to be paper-filed in this case, because electronic filing is not possible when no copy of Form T1134 – Supplement is completed as per the CRA requirements.

T2054, Election for a Capital Dividend Under Subsection 83(2)*

Following an update of the form, the City and Province fields have been added to Part 1. As a result, the names of the city and province are no longer included in the Address field.When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the overridden information in the Address field will not be retained.

AgriStability and AgriInvest Additional Information and Adjustment Request*

AgriStability and AgriInvest Programs – Ontario*

AgriStability and AgriInvest Programs – Harmonized Provinces* and British Columbia*

AgriStability and AgriInvest Programs – Alberta*

AgriStability and AgriInvest Programs – Saskatchewan*

AgriStability and AgriInvest Programs – Prince Edward Island

The following two supplemental forms have been added:

- 2020 Supplemental Forms (New participants)

- 2020 Supplemental Forms (Participant from 2019)

To access these forms, answer Yes to the question Do you want to display the supplemental forms? located at the top of the Agri/Hagri form. Then select the appropriate box on the line Please indicate the filing corporation’s situation. The selected form will be displayed after Statement A.

Ontario

Schedule 502, Ontario Tax Credit for Manufacturing and Processing*

Schedule 570, Ontario Regional Opportunities Investment Tax Credit*

As a result of an update, the schedule has been entirely renumbered. In addition, lines 110, 225, 325, 330 and 335 have been added to include the amounts of eligible special expenditures and the tax credit based on the special expenditures in the electronic transmission and the T2 Bar codes. Finally, line L.1 in Part 3 has been removed.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the amount on line L.1 is overridden and this amount is less than the amount on line K.1, the amount on line M.2 will be retained as an overridden amount on line 335.

Québec

Note:

For all corporations, the Government of Québec asked us to add a diagnostic to prompt you to attach complete financial statements to their income tax returns, as per Guide IN-417.A. If the corporation holds an interest in a joint venture or a partnership, you must also include the complete financial statements of the joint venture or partnership for each fiscal period that ended in the corporation’s fiscal period.

In addition, note that insurance corporations can now transmit their income tax returns electronically.

CO-17, Corporation Income Tax Return

The box on line 19a will now be selected based on the applicability of Form CO-17.CEWhen opening a return prepared with a prior version of CCH iFirm Taxprep T2, the answer to this question will be retained, using an override, and a diagnostic will prompt you to complete Form CO-17.CE, where applicable.

CO-17S.232, Summary of Dispositions of Capital Property

The field Portion of the capital gain that is subject to a 100% inclusion rate under section 637 TA has been added to transfer the amount entered on the line Portion of the capital gain that is subject to a 100% inclusion rate per 100(1) in Schedule 6. In addition, line ff has been added to take into account the amount in computing the total capital gains or losses on line Q.

CO-130.A, Capital Cost Allowance

The column Immediate expensing amount deducted has been removed. For more information, consult the note related to Schedule 8.

CO-771, Calculation of the Income Tax of a Corporation*

Custom line d, which displays on screen only and relates to the number of paid hours has been added above line 07a. The number of hours on this line is included in the calculation of line 07a.

In addition, if an amount is entered on the line for code 18 of Form QC L265-266, this code will be updated to one of boxes 18ji to 18pi and the amount will be updated to lines 18j to 18p.

Finally, Part 13, which used to be custom, and which displayed on screen only, has now been integrated to Section 12.2 of the official form.

Note that the cells relating to calculations prior to January 1, 2019, in Sections 11.3 and 12.1 are now protected cells. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the overridden values on lines 200, 202 to 204d, 225 to 237 will not be retained.

CO-1029.8.33.6, Tax Credit for an On-the-Job Training Period*

Box The training period started after March 27, 2018, and before March 26, 2021, or after April 30, 2022 and box The training period started after March 25, 2021, and before May 1, 2022, which are located above Section 2, have been respectively renamed The training period started after March 27, 2018, and before March 26, 2021 and The training period started after March 25, 2021, as it is not necessary to know if a training period has started after April 30, 2022. The credit calculation will instead be based on expenditures incurred after April 30, 2022.

CO-1029.8.33.13, Tax Credit for the Reporting of Tips

This form has been updated in order to integrate the various applicable rates for 2022. In addition, because the form no longer supports a 2018 calendar year, the calculation of the rates on lines 60b, 60e and 60h of Section 2.10 have been removed.

CO-1029.8.36.DA, Tax Credit for the Development of E-Business*

The order of lines in Section 2.2.1 has changed. The amount of assistance, benefit or advantage now relates to the qualified salary or wages incurred multiplied by the percentage of qualified salary or wages at the time of the accumulation of credits, minus the portion attributable to qualified activities carried out by the employee and whose ultimate beneficiary is a government entity. In addition, the amount of the portion attributable to qualified activities carried out by the employee and whose ultimate beneficiary is a government entity now relates to the qualified salary or wages incurred multiplied by the percentage of qualified salary or wages that may give rise to more than on tax credit.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered on former lines 21 and/or 21e, it will not be retained. In that situation, a diagnostic will prompt you to re-enter the amounts of lines 21e and 21g.

CO-1029.8.36.DF, Tax Credit for Film Dubbing*

The lines relating to calculations for a taxation year starting before March 28, 2018, have been removed.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount had been entered using an override on line 63, it will be retained on line 66. The data entered on the other removed lines will not be retained.

CO-1029.8.36.EL, Tax Credit for Book Publishing*

CO-1029.8.36.II, Tax Credit for Investment and Innovation*

Part 6 has been restructured and custom lines have been replaced by official lines according to the following matches:

- Lines AA and BB become lines 86 and 87. Line CC becomes the field for the result of the product of the amount on line 86 by the rate on line 87.

- Lines DD and EE become lines 86a and 87a. Line FF becomes the field for the result of the product of the amount on line 86a by the rate on line 87a.

- Lines GG and HH become lines 89 and 90. Line II becomes the field for the result of the product of the amount on line 89 by the rate on line 90.

- Lines JJ and KK become lines 89a and 90a. Line LL becomes the field for the result of the product of the amount on line 89a by the rate on line 90a.

- Lines MM and NN become lines 92 and 93. Line OO becomes the field for the result of the product of the amount on line 92 by the rate on line 93.

- Lines PP and QQ become lines 92a and 93a. Line RR becomes the field for the result of the product of the amount on line 92a by the rate on line 93a.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amounts entered by override on lines 86, 89 and 92 will not be retained.

CO-1029.8.36.PS, Tax Credit to Support Print Media Companies*

The question Is the corporation a registered journalism organization? has been added on screen only in the Identification section. When the answer to the question is Yes and the corporation is exempt from tax, the program recognizes that the corporation qualifies for the tax credit, which is not the case for exempt corporations that are not registered journalism organizations.

CO-1029.8.36.XM, Tax Credit for the Production of Multimedia Events or Environments Presented Outside Québec*

CO-1159.2, Compensation Tax for Financial Institutions*

In the Québec Budget, tabled on March 25, 2021, the Government of Québec announced that the compensation tax for financial institutions would be maintained. In Section 2.5 and Part 6, the number of days in the taxation year was limited to the days before April 1, 2024. Starting now, those two sections will no longer be limited to a date, as the compensation tax for financial institutions is maintained beyond March 31, 2024.

QC L265-266, Deductions from Taxable Income

Code 19, Deduction relating to the value of stock options deemed received by an employee has been added to the form.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered on line 352 (formerly line a) in Schedule 200 and the same amount was entered in the field for code 99 in Form QC L265-266, then the amount entered will not be retained, because it will be calculated in the field for code 19. Where the amount entered on line 352 is different from the amount in the field for code 99, a diagnostic will prompt you to make the required adjustments. The diagnostic will disappear as soon as the amount in the field for code 99 is corrected.

RD-1029.8.6, Tax Credit for University Research or Research Carried Out by a Public Research Centre or a Research Consortium*

TP-1029.9, Tax Credit for Taxi Drivers or Taxi Owners*

As a result of the update of the form, the basic amount of $301 and the 1% rate for the 2021 taxation year have been added for purposes of calculating the tax credit for taxi drivers.

In addition, for the 2022 taxation year, CCH iFirm Taxprep T2 does not calculate the credit on line 28 as the credit has been abolished.

TP-1086.R.23.12, Costs Incurred for Work on an Immovable

Revenu Québec added data from Form TP-1086.R.23.12 to the electronic data filing. To comply with filing requirements, the following changes have been made to the form:

- The copy of the form can only be applicable if the payer is a corporation or a partnership. If the payer is a sole proprietor, a co-owner or a member of a partnership who is not required to file an RL-15 slip, a cooperative or a trust, the copy of the form cannot be applicable. If you are in this situation and you want to print a copy of this form, use the Ctrl+P shortcut keys.

- In Part 2, the address line has been split into three lines, i.e., Number, Street, P.O. box and City, town or municipality. No numerical characters can be entered on the line City, town or municipality. If the answer to the question If it is rental property (under regulation 1100(11)), do you want to link this property to a Statement of real estate rental properties? is Yes, the address will not be updated to Form Statement of Real Estate Rental Properties. However, the postal code will continue being updated. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, while the postal code will be retained, the address will not, and you will have to enter it.

Alberta

AT1, Alberta Corporate Income Tax Return*

Line 095, Was this return prepared by a tax preparer for a fee? and line 096, If yes, provide the preparer's name or firm name have been added at the end of the form. These lines are completed from the information entered in Form Identification if the AT1 return is applicable.

Alberta Consent Form*

The Alberta Consent Form can no longer be used to authorize online access to a representative (TRACS). Previous versions of the form requesting TRACS access will no longer be accepted. The custom question Do you want to authorize online access (TRACS) to an individual? and section 4, Authorize online access (TRACS) to an individual have been removed from the form. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, no value related to the removed lines will be retained.

AT100, Preparing and Filing the Alberta Corporate Income Tax Return*

The check box associated with line 7 has been renamed It is not claiming the Alberta Scientific Research and Experimental Development (SR & ED) Tax Credit. nor is it reporting a recapture of SR & ED. In addition, line 10, It is not claiming the Alberta Innovation Employment Grant (IEG), has been added.

AT1 Schedule 13, Alberta Capital Cost Allowance (CCA)

The column Immediate expensing amount deducted has been removed. For more information, consult the note related to Schedule 8.

AT1 Schedule 18, Alberta Disposition of Capital Property

The field Portion of the capital gain that is subject to a 100% inclusion rate has been added to transfer the amount entered on the line Portion of the capital gain that is subject to a 100% inclusion rate per 100(1) in Schedule 6. In addition, line 099a has been added to take into account the amount in computing the total capital gains or losses on line 099b.

AT1 Schedule 29, Alberta Innovation Employment Grant*

As a result of the update of the schedule, column 265, Enter Taxable Capital for the first preceding year, and line 300, Total Taxable Capital from all associated corporation(s) for the first preceding year, have been added to the Allocation of the Maximum Expenditure Limit table. Data from line 265 can be entered in Schedule 9 WORKCHART in the Alberta AT1 Schedule 29 – Alberta innovation employment grant section. Regardless of whether or not the check box Select this check box if the corporation is associated with one or more corporations that have each claimed an Innovation Employment Grant (IEG) in their taxation year ending in the same calendar year is selected in Schedule 9, if an amount is entered on the line Taxable capital employed in Canada in the last taxation year ending in the preceding calendar year, a line will be automatically created in the Allocation of the Maximum Expenditure Limit table for that associated corporation.

Saskatchewan

Schedule 404, Saskatchewan Manufacturing and Processing Profits Tax Reduction*

As a result of the update of the form, all lines have been renumbered.

Manitoba

Schedule 384, Manitoba Paid Work Experience Tax Credit*

The following parts, which were used to enter or calculate the amounts relating to the carried forward credit, have been removed:

- Part 9, Non-refundable credit available for carryforward;

- Part 10, Non-refundable credit available for carryforward by year of origin;

- Summary and analysis of credit.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if amounts had been entered in the removed parts, they will not be retained.

Schedule 388, Manitoba Film and Video Production Tax Credit)*

Prince Edward Island

Schedule 322, Prince Edward Island Corporation Tax Calculation*

Line 2C has been added to Part 2 to calculate the tax at the lower rate of 1% for the number of days in the tax year after December 31, 2021.

Corrected Calculations

The following problems have been corrected in version 2021 2.0:

Federal

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

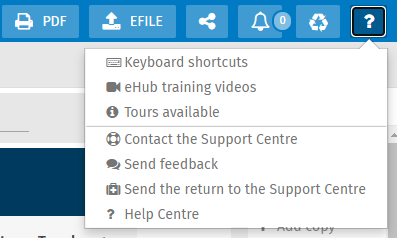

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Tax T2 e-Bulletin notifies you each time an updated or new form is made available in a program update.

How to Reach Us

Technical and Tax support Hours

Monday to Friday: 8:30 a.m. to 8:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com