Release Notes - CCH iFirm Cantax T2 2022 v.1.2 (2022.20.33.03)

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Cantax

Welcome to CCH iFirm Cantax, the first cloud-based professional tax software in Canada.

CCH iFirm Cantax runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Cantax is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Cantax version, consult the Technical Release Notes.

About CCH iFirm Cantax T2

With CCH iFirm Cantax T2, you have the most comprehensive collection of corporate tax forms available, as well as tools designed to address complex T2 preparation requirements. CCH iFirm Cantax T2 also provides you with:

- the possibility of attaching supporting documents to electronically transmitted returns;

- GIFI data transfers.

Taxation Years Covered

CCH iFirm Cantax T2 2022 v.1.2 is designed to process corporate tax returns with taxation years beginning on or after January 1, 2020, and ending on or before October 31, 2022.

Overview - Version 1.2

CCH iFirm Cantax T2 2022 v.1.2 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

Update of Schedule 8

We have added to this version the latest official update of Schedule 8, in which the CRA integrated the modifications related to immediate expensing. For more information, consult the note relating to this subject.

New form TP-130.EN

Form TP-130.EN, Agreement Respecting the Immediate Expensing Limit, has been added to this version. For more information, consult the note relating to this subject.

New Forms

Québec

TP-130.EN, Agreement Respecting the Immediate Expensing Limit

This form is used to allocate the $1.5 million immediate expensing limit among the associated eligible persons or partnerships. The limit allocated to the filing corporation will be used to establish capital cost allowance for immediate expensing property.

The information relating to associated corporations in Parts 2 and 3 is completed with the data entered on the corresponding lines in Schedule 9 WORKCHART, while the information relating to associated persons or partnerships in Parts 2 and 3 is completed with the data entered on the corresponding lines in Section 1 of Schedule 8. The information in columns B and C of Part 2 and in columns C and D of Part 3 for associated persons or partnerships must be manually entered, as this information is located in input cells. When rolling forward a client file, the data in the input cells will be retained.

The form becomes applicable when Parts 2 and 3 are completed correctly, the corporation has a permanent establishment in Québec and the corporation is eligible for immediate expensing on the federal income tax return.

In addition, in the instructions at the top of the form, Revenu Québec asks that the federal immediate expense limit agreement be attached to the Corporation Income Tax Return. Therefore, for corporations that have a permanent establishment in Québec, Schedule 8 will also be printed with the Québec corporate income tax return.

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Schedule 8, Capital Cost Allowance (CCA)*

Part 1, Agreement between associated eligible persons or partnerships (EPOPs), has been added to indicate the percentage of the immediate expensing limit assigned under the agreement to each corporation, individual and partnership of an associated group. The Add and Delete buttons at the top of the table allow you to manage the lines for associated individuals and partnerships. To add an associated eligible corporation, use Schedule 9 WORKCHART. The new question at line 105, Are you associated in the tax year with one or more EPOPs with which you have entered into an agreement under subsection 1104(3.3) of the Regulations? will be set to Yes when at least one line other than the line of the filing corporation contains data.

The CCA calculation table is now in Part 2 and the following lines and columns have been added for the immediate expensing calculation:

- Line 232, Cost of acquisitions from column 3 that are designated immediate expensing property (DIEP)

- Line 234, Proceeds of dispositions of the DIEP

- Line 236, UCC of the DIEP

- Lien 238, Immediate expensing

- Column 13, Cost of acquisitions on remainder of Class

- Column 15, Remaining UCC

In addition, line 225, previously named Cost of acquisitions from column 3 that are accelerated investment incentive properties (AIIP) or zero-emission vehicle (ZEV) has been renamed Cost of acquisitions from column 13 that are accelerated investment incentive properties (AIIP) or properties included in Classes 54 to 56. All other existing columns have been renumbered.

New lines 105 to 125 in Part 1 and lines 232 to 238 in Part 2 are now part of the Internet filing and the T2 barcodes.

Note that in cases where the corporation is associated with other persons or partnerships for the allocation of the immediate expensing limit and that it has filed its T2 return before the Schedule 8 version that includes immediate expensing was published, it will have to submit a copy of Schedule 8 with Part 1, Agreement between associated eligible persons or partnerships (EPOPs), duly completed.

Schedule 8 WORKCHART, Capital Cost Allowance (CCA) Workchart

The calculation of the line Maximum allowable CCA has been modified in the following situations to conform with the Income Tax Regulations (ITR) now in effect:

- CCA class 14: the undepreciated capital cost of properties that is taken into consideration in the calculation of the CCA is now reduced by the immediate expensing amount related to these properties, according to subsection 1100(0.2) and paragraph 1100(1)(c) ITR.

- Shortened taxation years: the immediate expensing amount is included in the allowable CCA amount before the latter amount is prorated for a year with less than 12 months, according to subsection 1100(3) ITR.

Schedule 9 WORKCHART, Related and Associated Corporations Workchart

The Québec CO-130.AD – Capital cost allowance for immediate expensing property section has been renamed Québec TP-130.EN - Agreement respecting the immediate expensing limit. Several fields have been added to complete Form TP-130.EN, Agreement Respecting the Immediate Expensing Limit. The Immediate expensing limit and Percentage of the allocated limit for the calendar year covered fields are calculated based on the data in the Schedule 8 – Capital cost allowance (CCA) section, whereas the Title or position of authorized representative and Date of signature of authorized representative fields of the copy for the filing corporation are calculated based on the data in Form Identification, Corporate Identification and Other Information. The two fields for the copies of the associated corporations are calculated based on the data in the Québec CO-17 – Corporation income tax return section. For more information, consult the note relating to this subject.

Schedule 63, Return of Fuel Charge Proceeds to Farmers Tax Credit*

Line 1A has been renumbered 080 and no longer refers to line 9898 of Schedule 125. In addition, this line is now an input line. You must indicate the total farming expenses that represent the amounts deducted in calculating net income from farming for income tax purposes. Since line 080 is an input line, the program will prompt a diagnostic to complete this line if the corporation has a permanent establishment in a designated province (Ontario, Manitoba, Saskatchewan and Alberta), its taxation year ends after December 31, 2020, and farm expenses are entered in the GIFI. When opening a return prepared with a prior version of CCH iFirm Cantax T2, only overridden data that was entered on line 1A will be kept on line 080.

T183 CORP, Information Return for Corporations Filing Electronically

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if a time entered on line 932, Electronic signature time (HHMMSS), includes a character other than a number, this time will not be retained.

Québec

CO-17.SP, Information and Income Tax Return for Non-Profit Corporations

It is now possible to file an amended return electronically. For more information on the different ways to file an amended return, consult the Question used to specify whether there is an adjustment request concerning a Québec tax return section in the Corporate Identification and Other Information topic.

CO-130.AD, Capital Cost Allowance for Designated Immediate Expensing Property*

This form is now an official Revenu Québec form.

CO-156.TR, Additional Deduction for Transportation Costs of Small and Medium-Sized Manufacturing Businesses

In its Information Bulletin 2022-4, published on June 9, 2022, the Québec government has announced a consequential amendment to the additional deduction for transportation costs incurred by remote small and medium-sized businesses to reflect the harmonization with the federal tax legislation with respect to the widening of the range over which the business limit is reduced based on the combined taxable capital employed in Canada that was announced in the April 7, 2022, budget.

For this reason, we have made changes to section 5 Additional deduction for transportation costs of small and medium-sized manufacturing businesses, on screen only, to include this new measure. When the taxation year starts after April 6, 2022, the amount of line 73 will be $40 million instead of $5 million, and lines 71 to 78 will be calculated if the paid-up capital is greater than $10 million, but less than $50 million.

CO-156.TZ, Additional Deduction for Transportation Costs of Small and Medium-Sized Businesses Located in a Special Remote Area

In its Information Bulletin 2022-4, published on June 9, 2022, the Québec government has announced a consequential amendment to the additional deduction for transportation costs incurred by remote small and medium-sized businesses to reflect the harmonization with the federal tax legislation with respect to the widening of the range over which the business limit is reduced based on the combined taxable capital employed in Canada that was announced in the April 7, 2022, budget.

For this reason, we have made changes to section 2 Additional deduction for transportation costs of small and medium-sized businesses located in a special remote area, on screen only, to include this new measure. When the taxation year starts after April 6, 2022, the amount of line 16 will be $40 million instead of $5 million, and lines 13 to 20 will be calculated if the paid-up capital is greater than $10 million, but less than $50 million.

CO-771, Calculation of the Income Tax of a Corporation

In its Information Bulletin 2022-4, published on June 9, 2022, the Québec government has announced that it is harmonizing with the federal government's tax measure with respect to the widening of the range over which the business limit is reduced based on the taxable capital employed in Canada that was announced in the April 7, 2022, budget.

For this reason, we have made changes to subsection 8.1 Business limit used to determine the SBD, on screen only, to include this new measure. When the taxation year starts after April 6, 2022, the amount of line 84b will be $40 million instead of $5 million, and lines 84 to 95 will be calculated if the paid-up capital is greater than $10 million, but less than $50 million.

Corrected Calculations

The following problems have been corrected in version 2022 1.2:

Federal

- Schedule 8 WORKCHART and AUTO LEASE – Automobile expense deduction limits for acquisitions and leases entered into after 2021 are incorrect

- Schedule 8 – The amount eligible for immediate expensing is incorrect for a taxation year with a number of days between 357 and 364

- Schedule 63 – The description of line 1A and the amount calculated on this line are incorrect

- Schedule 8 WORKCHART – The cost of acquisitions of DIEP in columns Québec and Alberta is incorrect if property acquired previously in Schedule 8 WORKCHART ADD and current-year additions are entered in Schedule 8 WORKCHART

- Schedule 8 – The amount eligible for immediate expensing for Québec and Alberta is incorrect for a short taxation year when the amount allocated to the corporation is $1,500,000

- Schedule 8 WORKCHART – The amount calculated on line “Cost of acquisitions that are AIIP and ZEV (other than DIEP)” may be incorrect when Schedule 8 WORKCHART ADD includes property that is both AIIP and DIEP

Overview - Version 1.0

CCH iFirm Cantax T2 2022 v.1.0 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

Calculations related to the immediate expensing measure

Government authorities have confirmed to us that they accept returns where the immediate expensing measure has been applied. We have therefore integrated the calculations related to this. However, the CRA and the Alberta government have informed us that adjustment requests for a return to take into account the immediate expensing measure will be processed only when the bill confirming this measure receives Royal Assent. For more information, consult the note relating to this subject.

Automobile deduction limits

The calculations related to the automobile deduction limits applicable to the 2022 taxation years have been integrated, but only for Québec returns. The automobile deduction limits applicable to the 2022 taxation years will be applied by the CRA and the Alberta government only when a bill confirming this measure will be tabled. For more information, consult the note relating to this subject.

Update of Form T106 Summary and T106 Slip

The most recent versions of Form T106 Summary and T106 Slip have been added to CCH iFirm Cantax T2. These versions must be completed when the corporation taxation year begins after 2021. For more information, consult the note relating to this subject.

New Forms

Fédéral

Schedule 20, Part XIV – Additional Tax on Non-Resident Corporations

This schedule must be completed if the corporation is a non-resident corporation that earned income from a business carried on in Canada. Because it is difficult to determine every situation where a corporation is subjected to Part XIV tax, the custom question Is the corporation subject to part XIV tax - Additional Tax on Non-Resident Corporations? has been added to the top of the schedule. This schedule becomes applicable once you click the Yes button.

Schedule 59, Information Return for Non-Qualified Securities

Use this schedule if the filing corporation is an employer to report, as required under subsection 110(1.9), that a security to be issued or sold under an employee security option agreement between your employee and a qualifying person is a non-qualified security. You must file this schedule on or before the filing due date for the tax year of the particular qualifying person (which may be a person other than the employer) that includes the day on which the agreement is entered into.

Above the Non-qualified securities reporting section, the custom question which is on the screen only, Do you have to file the information return for non-qualified securities under subsection 110(1.9) ITA?, has been added, and when you answer Yes to this question, the schedule will be applicable; it will be filed with the T2 return and box 274 of Schedule 200 will be checked. For corporations that have a permanent establishment in Quebec, Schedule 59 will also be printed in the Québec corporation income tax return. If you must file this schedule before the filing due date of the filing corporation, answer No and print the schedule by using Ctrl+ Shift + p shortcut keys. For corporations that have a permanent establishment in Québec, you must print a copy for the Canada Revenue Agency and a copy for Revenu Québec. When you answer No, this schedule will not be filed with the T2 return, but box 274 of Schedule 200 will still be activated.

The custom question, Do you want to roll forward the data in column 1?, has also been added. When you answer Yes to this question, the names of the employees will be kept on the following year’s tax return.

Schedule 63, Return of Fuel Charge Proceeds to Farmers Tax Credit

To claim this refundable tax credit for a taxation year ending in 2021 or 2022, you must use this schedule if the corporation operates a farming business in one of the following designated provinces: Ontario, Manitoba, Saskatchewan or Alberta. To benefit from this tax credit, the total of farming expenses minus mandatory inventory adjustments, optional inventory adjustments and non-arm's length transactions must be equal or superior to $25,000 in Part 1. You must make sure that the amounts calculated on lines 1B, Mandatory inventory adjustments, and 1C, Optional inventory adjustments, are solely related to section 28 of the Income Tax Act. Please override these lines if necessary.

In the case of a corporation that has a permanent establishment in more than one jurisdiction, the total of eligible farming expenses of line 100 will be allocated to each designated province based on the relevant proportion under which taxable income is allocated under Part IV of the Income Tax Regulations, in part 2 to 5. Then, in part 6, eligible farming expenses allocated to the designated province(s) will be multiplied by the payment rate for the calendar year. The payment rate for the 2021 calendar year is 0.147%, and the payment rate for the 2022 calendar year is 0.173%. In a taxation year that straddles the 2021 and 2022 calendar years, a calculation will be done for the 2021 year and another for the 2022 year, relative to the number of days in the taxation year in each calendar year. Afterwards, the amount of line 395, Return of fuel charge proceeds to farmers tax credit for all designated provinces, will be carried to line 495, Total return of fuel charge proceeds to farmers tax credit, of Part 7. If there is an amount on line 495, the schedule will be applicable and that amount will be carried to line 795, Return of fuel charge proceeds to farmers tax credit, of Schedule 200. In addition, when Schedule 63 is applicable, box 273 of Schedule 200 will be activated.

When the corporation is a member of a partnership, enter the amount of box 237 from each T5013 slip to lines 400 to 430, according to the province.

RC4649, Country-by-Country Report

This form must be completed when a multinational enterprise (MNE) group of which the ultimate parent entity resides in Canada for income tax purposes earned a total consolidated group revenue of 750 million euros or more in the fiscal year immediately preceding a particular fiscal year.

These enterprises will have twelve months after the last day of their taxation year to file this form.

Custom question Do you have to file the country-by-country report under subsection 233.8(3) ITA? has been added at the top of the form. If the answer to this question is Yes, the form will become applicable.

To complete tables 1 and 2 of Part II, complete a separate copy of Form RC4649 Part 2 for each tax jurisdiction, and indicate all constituent entities of the jurisdiction. You can access Form RC4649 Part 2 from Part II of Form RC4649.

To complete table 3 of Part III, complete a separate copy of Form RC4649 Part 3 for any information or explanation that is deemed necessary or that facilitates comprehension of the information required in Part II. For each piece of additional information, you can indicate the country code(s) as well as reference code(s) relating to table 1, where applicable. You can access Form RC4649 Part 3 from Part III of Form RC4649.

To prevent Form RC4649 from being mailed to the CRA after it is electronically filed, a watermark indicating that the form is a duplicate will print on the form after it is successfully EFILED.

Transmission of Form RC4649

When Form RC4649 should be filed for a client and you want to file it electronically, answer Yes to the question Do you want to select this form for electronic filing? in the Electronic filing section of this client’s Form RC4649.

To file Form RC4649, select EFILE returns from the EFILE drop-down menu. As you can transmit Forms RC4649 and returns together, make sure to select the returns and the forms that you want to file before the transmission. Note that you can EFILE Form RC4649 with a Web access code (WAC).

Québec

Capital cost allowance for immediate expensing property

Following discussions with Revenu Québec, with respect to their treatment of immediate expensing, this custom form has been added to allow you to enter the designated immediate expensing property (Part 2) and to calculate the amount that is deducted for immediate expensing (Part 3) for a taxation year.

When, for a CCA class entered in Schedule 8 WORKCHART, a property is entered in Schedule 8 WORKCHART ADD where the answer to the question Is the property a designated immediate expensing property (DIEP)? is Yes, a line is automatically created in Part 2. Otherwise, when an amount is entered directly on line Cost of additions for designated immediate expensing property (DIEP) included in the amount on line 203, a line will also be created with the CCA class number in column D and the capital cost in column E, and you will need to complete the other columns for that line and/or create other lines using the Add button if more than one property is included in the capital cost.

The table in Part 3 will fill with the data entered in the corresponding lines in Schedule 8 WORKCHART when there is an amount on the line Cost of additions for designated immediate expensing property (DIEP) included in the amount on line 203 under column Québec.

The form becomes applicable when there is an amount under column E, Capital cost, in the table of Part 2. In accordance with our discussions with Revenu Québec, the form is printed when applicable.

Nova Scotia

Schedule 351, Additional Certificate Numbers for the Nova Scotia Capital Investment Tax Credit

This form is used to enter the additional certificate numbers for the Nova Scotia capital investment tax credit.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if a certificate number had been entered on line 841 of Schedule 5, this number will be retained on the first line of column 100 in Schedule 351, and the amount of the tax credit entered on line 568 of Schedule 5 will be retained on the first line of column 200 in Schedule 351. If no certificate number had been indicated on line 841 of Schedule 5, the amount of the tax credit entered on line 568 of Schedule 5 will be retained as an overridden amount. You will then have to complete Schedule 351 and cancel the override on line 568 of Schedule 5 in order for the credit calculated in Schedule 351 to update to Schedule 5.

Deleted Forms

New Brunswick

- Schedule 365, Additional Certificate Numbers for the New Brunswick Film Tax Credit

Nova Scotia

- Schedule 345, Additional Certificate Numbers for the Nova Scotia Film Industry Tax Credit

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Note:

The Auditing and Assurance Standards Board (AASB) has issued a new Canadian Standard on Related Services (CSRS) 4200, Compilation Engagements. Under CSRS 4200, the use of disclaimers on any schedule of the tax return may no longer be appropriate, and a notice to reader is no longer considered an appropriate form of communication. Diagnostics have been added to inform you of this situation when you choose to use the disclaimers or the Notice to Reader letter template. These two elements will be removed from the next version of the program, which is scheduled to be released at the end of November 2022.

Update of the NAICS list of codes for 2022

Note that the list of NAICS codes underwent certain changes for 2022. This list is used in Form Identification, Corporate Identification and Other Information, in the data entry screen of the T106 slip, in Form T106 Summary, Information Return of Non-arm’s Length Transactions with Non-Residents and in Form T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates.

For details on these changes, consult the help topics related to the forms and slips concerned. When opening a return prepared with a prior version of CCH iFirm Cantax T2 or when rolling forward client files, the codes that were entered, but that have since been removed from the list will be replaced by an equivalent code or will not be retained.

Corporate Identification and Other Information

Part Direct deposit request has been removed because it will not be possible to file this request with a T2 effective May 16, 2022. For information on how to enrol for direct deposit, go to canada.ca/cra-direct-deposit.

Schedule 200, T2 Corporation Income Tax Return*

Lines 273 to 275 have been added under Part Attachments to indicate that Schedules 63, 59 and 65 respectively are filed with the T2 return. Also, under Part Summary of tax and credits, lines 795, Return of fuel charge proceeds to farmers tax credit, and 799, Air quality improvement tax credit, have been added. However, note that at the time of the program’s release, the CRA had not published Schedule 65 that is used to calculate the air quality improvement tax credit.

Finally, Part Direct deposit request as well as lines 910, 914 and 918 have been removed because it will not be possible to file this request with a T2 return after May 16, 2022. For information on how to enrol for direct deposit, go to canada.ca/cra-direct-deposit.

Schedule 4, Corporation Loss Continuity and Application*

Schedule 5, Tax Calculation Supplementary – Corporations*

The following lines have been removed from the schedule:

- line 565, Nova Scotia film industry tax credit;

- line 836, Certificate number (from Schedule 345);

- line 595, New Brunswick film tax credit; and

- line 850, Certificate number (from Schedule 365).

The custom British Columbia political contribution – senate nominee elections tax credit field has also been removed because this tax credit was announced in the British Columbia Bill 17 in 2013 which did not receive Royal Assent.

In addition, the amount on line 568 is now calculated based on the amount on line 300 from the new Schedule 351. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount was entered on line 568 of Schedule 5 and no certificate number was indicated on line 841, the amount on line 568 will be retained as an overridden amount. You will then have to complete Schedule 351 and cancel the override on line 568 of Schedule 5 in order for the credit calculated in Schedule 351 to update to Schedule 5.

Schedule 6, Summary of Dispositions of Capital Property*

Schedule 7, Aggregate Investment Income and Income Eligible for the Small Business Deduction*

Schedule 8, Capital Cost Allowance (CCA)

Following the announcement of the federal and provincial government authorities concerning the acceptance of returns that are considering the immediate expensing measure, the following custom elements have been added on screen only:

- The Immediate expensing column at the end of the Capital cost allowance table.

- The custom question Is the corporation a CCPC eligible for the immediate expensing measure for the current taxation year?. The answer to this question must be Yes for the program to perform the calculations related to the immediate expensing measure.

- The custom table Allocating the immediate expensing limit among associated eligible persons and partnerships. This table allows you to allocate the limit between the eligible corporations, individuals, and partnerships that are part of an associated group. Note that the Add and Delete buttons allow you to manage the lines for associated individuals and partnerships. To add an associated eligible corporation, use Schedule 9 WORKCHART.

- The line Amount eligible for immediate expensing in the current taxation year, which is used to calculate the prorated allocated limit for a taxation year shorter than 365 days.

- Allocation scenario tables for federal Schedule 8, Québec’s Form CO-130.A and Alberta’s AT1 Schedule 13.

Note that the CRA will update Schedule 8 in the coming months to include the immediate expensing calculations. Until then, the amount claimed for immediate expensing has been added to line 217.

Also note that the CRA has informed us that adjustment requests for returns to take into account the immediate expensing measure will be processed only when Bill C-19 receives Royal Assent.

Schedule 8 WORKCHART, Capital Cost Allowance (CCA) Workchart

Following the announcement of the federal and provincial government authorities concerning the acceptance of returns that are considering the immediate expensing measure, the calculations for this measure have been integrated and the following lines have been added:

- Adjustments relating to DIEP included on line 205

- Cost of additions for designated immediate expensing property (DIEP) included in the amount on line 203

- Proceeds of disposition of DIEP included on line 207

- DIEP UCC

- Immediate expensing

- Cost of acquisitions for property other than DIEP

- Cost of acquisitions that are AIIP and ZEV (other than DIEP)

- Remaining UCC

Also, the questions Is the property a designated immediate expensing property (DIEP) for the taxation year?, Was the property a DIEP in a prior taxation year? as well as the line Proceeds of disposition (Immediate expensing property (IEP) only) have been added to Part CCA class 10.1.

The question Is one of the properties acquired in the taxation year a designated immediate expensing property (DIEP)? has been added to CCA class 14.

A property must be designated as a DIEP no later than the day of the twelfth month after the corporation’s filing due date for the taxation year to which the designation relates. The amount entered on line Immediate expensing has been added to both lines Maximum allowable CCA and line 217, CCA claimed.

Finally, the Department of Finance Canada announced on December 23, 2021, that the CCA ceiling for passenger vehicles is increasing from $30,000 to $34,000 (before taxes), and the ceiling for zero-emission passenger vehicles is increasing from $55,000 to $59,000 in respect of vehicles acquired after December 31, 2021. However, the CRA informed us that these increased ceilings would only be considered once a bill confirming this increase is tabled. At the date of publication of the program, a bill had still not been tabled.

For Québec income tax purposes, Revenu Québec has confirmed that both ceilings are officially increasing to $34,000 and $59,000 respectively for vehicles acquired after December 31, 2021. The amount of $34,000 will therefore be used in the calculations of the Québec column for CCA class 10.1 when the acquisition date entered is after December 31, 2021.

Schedule 8 WORKCHART ADD, Additions and Dispositions Workchart

The question Is the property a designated immediate expensing property (DIEP)? has been added. When the answer to this question is Yes, the adjusted capital cost is added to the line Cost of additions for designated immediate expensing property (DIEP) included in the amount on line 203 in Schedule 8 WORKCHART.

For the calculations of the original capital cost of zero-emission passenger vehicles in a CCA class 54 in Part Information relating to zero-emission vehicles, specific lines for Québec and Alberta have been added. The amount of $59,000 will be used in the calculations of the line Original capital cost for Québec line when the acquisition date entered is after December 31, 2021. This amount will then be taken into consideration in the calculation of the Adjusted capital cost before partial dispositions – Québec line in Part Addition.

Schedule 9 WORKCHART, Related and Associated Corporations Workchart

To complete the custom table Allocating the immediate expensing limit among associated eligible persons and partnerships for associated corporations in Schedule 8, the Schedule 8 – Capital cost allowance (CCA) section has been added and contains the following fields:

- The question Is the corporation a CCPC that can benefit from the immediate expensing measure?. When the answer to this question is Yes, a line is created in the custom table of Schedule 8.

- The line Immediate expensing limit indicates the maximum limit amount for the corporation.

- The line Limit allocated indicates the limit amount allocated to the corporation. This amount can be entered either in Schedule 9 WORKCHART or in the Limit allocated – Federal Schedule 8 column in the custom table of Schedule 8.

In addition, the Québec CO-130.AD – Capital cost allowance for immediate expensing property and Alberta AT1 Schedule 13 – Capital cost allowance (CCA) sections have been added. The amount indicated in the field Limit allocated is equal to the corresponding field in the Schedule 8 – Capital cost allowance (CCA) section.

Schedule 31, Investment Tax Credit - Corporations*

Schedule 58, Canadian Journalism Labour Tax Credit*

Schedule 89, Request for Capital Dividend Account Balance Verification*

Schedule 91, Information Concerning Claims for Treaty-Based Exemptions*

Schedule 97, Additional Information on Non-Resident Corporations in Canada*

Schedule 141, Notes Checklist*

In Part 1, the line 111 Were financial statements prepared? has been added.

In Part 2, the option Other has been added to line 198.

Additionally, Part 5 – Information on the person who prepared the information return has been added. Line 110 has been moved to this new part.

Automobile Expenses – Non-Deductible Leasing Costs and Other Expenses

The Department of Finance Canada announced on December 23, 2021, that the limit relating to the acquisition cost of an automobile will increase from $30,000 to $34,000 and that the limit for monthly deductible leasing costs will increase from $800 to $900 in respect of leasing contracts beginning after December 31, 2021. However, the Canada Revenue Agency informed us that these two new limits would only be considered once a bill confirming these increases is tabled. At the date of publication of the program, a bill had still not been tabled.

For Québec income tax purposes, Revenu Québec has confirmed that both limits are officially increasing to $34,000 and $900 respectively for leasing contracts beginning after December 31, 2021. To correctly calculate the amount of non-allowable expenses related to automobile leasing on line 37 of Form CO-17.A.1, Net Income for Income Tax Purposes, specific Québec lines have been added to calculate deductible and non-deductible leasing costs using the increased limits when the acquisition date entered is after December 31, 2021.

RSI, Electronic Filing and Bar Codes Control Workchart

Following the proposed modifications to subsection 205.1(2) of the Income Tax Regulations, the answer to the question Must this return be electronically filed with the CRA in pursuance of subsection 150.1(2.1) ITA? will be calculated to Yes when a Canadian corporation is filing an initial T2 return for a taxation year starting after 2021 and the corporation is not an insurance corporation, not reporting in functional currency, not exempt from tax under section 149 ITA, or has not indicated making an application under the Canada Revenue Agency’s (CRA) Voluntary Disclosures Program for this tax return.

Also note that, starting with the 2022 calendar year, a person (or a partnership) is deemed to be a tax preparer for a calendar year if, in the year, it accepts consideration to prepare more than five returns of income (instead of the previous ten) of corporations, more than five returns of income (instead of the previous ten) of individuals, or more than five returns of income of estates or trusts. However, for the 2022 calendar year, the CRA will not assess the penalty when the tax preparer exceeds the five returns threshold without surpassing the old threshold of ten returns as well as without considering the returns of income of estates or trusts that are paper filed.

Client Letter, Filing Instructions

The new proposed subsection 160.5(2) ITA makes it mandatory for an income tax payment or instalment remittances over $10,000 to be made by electronic means, either through a financial institution, the CRA’s My Payment service, with a pre-authorized debit agreement set up through the CRA’s My Business Account service or via wire transfer.

The paragraphs under the Payment section for a T2 return have been modified accordingly.

T106 Slip*

T106 Summary, Information Return of Non-Arm's Length Transactions with Non-Residents*

A new version of Form T106 for taxation years starting after 2021 has been integrated into the program and only displays when the taxation year covered by the return starts after 2021. For taxation years starting prior to 2022, the previous version of the form must be used.

In the version of the form that applies for taxation years starting after 2021, new fields have been added in the T106 Slip:

- The field Taxpayer Identification Number (TIN) has been added at the beginning of Part II;

- In Part IV, a line has been added to indicate the information regarding an investment in the reporting entity by the non-resident;

- At the end of Part IV, new fields allow you to indicate if a Pertinent Loan or Indebtedness (PLOI) election was made and, if applicable, the amount of deemed interest related to the election.

In addition, for taxation years starting after 2021, when a reporting person’s total amount of transactions with a non-resident during the taxation year is below $100,000, it is not required to report these transactions in Part III of the T106 Slip. For taxation years starting prior to 2022, the threshold remains at $25,000.

Finally, it is no longer possible to enter a negative value in all the fields of Parts IV, V and IV of the T106 Slip. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if a negative value was entered in one of these parts, it will not be retained. The ending balances calculated in Parts IV and VI will also be recalculated to disregard negative values, which will affect the amounts rolled forward as beginning balances.

T106L, List of non-residents

Following the update of Form T106, a new column has been added to the table in order to display the amount of investment in the reporting entity by the non-resident. Note that this new column only applies for taxation years starting after 2021.

T217, Election or Revocation of an Election to use the Mark-to-Market Method*

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates*

EFILE Information

New custom sections have been added to the form (which is available for printing only in the EFILE copy print format or in a custom print format), i.e., T106 – Docs, T1134 – Docs and T1135 – Docs. In these new sections you will find key information with respect to electronic transmission of supporting documents accompanying the T106, T1134 and T1135 returns, as well as the information required to amend supporting documents for EFILE purposes in case of a reject. For more information, consult the note on the transmission of supporting documents in the May 30, 2022 section of the CCH iFirm Cantax Technical Release Notes.

AgriStability and AgriInvest – Programs – Ontario*

AgriStability and AgriInvest – Programs – Prince Edward Island*

The following changes have been made to Form Statement A, Statement of Farming Activities for Corporations:

- In the Participant Identification section, the SIN # field has been removed.

- In the Production (Crop) Insurance (PI) Information section, the fields What name is listed on your Production (Crop) Insurance Agreement? and If you have been previously enrolled under another Name or PI#, please indicate Name or PI# have been added.

- In the Shareholder Information section, the Social Insurance Number field has been removed.

- In the Partnership Information section, the Social Insurance Number field has been removed.

Ontario

Schedule 502, Ontario Tax Credit for Manufacturing and Processing*

Fields 1A and 1C become lines 030 and 040 that are now part of the lines in the electronic data transmission or in the bar codes transmitted to the CRA.

Schedule 564, Ontario Book Publishing Tax Credit*

Schedule 568, Ontario Business-Research Institute Tax Credit*

Québec

Note:

In version 2021 2.0, as specified in Guide IN-417.A, the Government of Québec had asked us to add a diagnostic to prompt you to attach complete financial statements to the income tax returns of all corporations. Revenu Québec has decided to remove the reference asking you to attach the financial statements and the notes relating to the financial statements from Guide IN-417.A. Following the update of this guide and at the request of Revenu Québec, we removed this diagnostic from the program.

CO-17.R, Request for an Adjustment to a Corporation Income Tax Return or to an Information and Income Tax Return for Non-Profit Corporations

Revenu Québec recommends attaching Form CO-17.R to amended returns. In this regard, the Print this form box has been added to the form to indicate whether you wish to attach this form to the amended return. A diagnostic has been added in case more than one form is selected to be printed with a return that is already in progress.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, if Form CO-17.R has been completed, the Print this form box will be checked.

CO-737.18.CI, Deduction Relating to the Commercialization of Innovations in Québec*

As a result of the update of the form, lines 57a and 57b in section 3.1.4 have been removed.

CO-1029.8.36.II, Tax Credit for Investment and Innovation

The following modifications have been made to the geographical codes of line 14a.1:

- The municipality name associated with code 78047, which was Saint-Faustin-Lac-Carré, is now Mont-Blanc.

- Code 82010 associated with the municipality Notre-Dame-de-la-Salette is now code 80087.

- The municipality name associated with code 14045, which was Saint-Germain, is now Saint-Germain-de-Kamouraska.

- Code 4020 associated with the municipality Mont-Alexandre is now code 02902.

- Every code that had four digits now have five digits because the digit 0 has been added to the beginning of the codes.

FM-220.3, Property Tax Refund for Forest Producers*

For a taxation year ending after December 31, 2021, the reimbursement of property taxes for forest producers will be allowed regardless of whether eligible forest development expenses are less than the property taxes of a unit, and the reimbursement of property taxes will no longer be calculated unit per unit. The reimbursement will now be equal to the lesser amount between eligible development expenses for the year and the total of the amount of property taxes paid for all property assessment units of the owner. For this purpose, Part 3.1 must be used for a taxation year ending before January 1, 2022, and Part 3.2 must be used for a taxation year ending after December 31, 2021.

In addition, for a taxation year ending after December 31, 2021, the eligible development expenses incurred in the year cannot be carried forward if the amount of such expenses is less than the amount of property taxes paid during the same period. Consequently, the Summary and analysis for the development work expenses carried forward table has been adjusted.

When opening a return prepared with a prior version of CCH iFirm Cantax T2, for a taxation year ending after December 31, 2021:

- If the Property taxes line(s) have been overridden, the addition of those lines will be retained by an override at line 44;

- Finally, if line 40 has been overridden, the data will be retained by an override on line 46.

Alberta

AT1, Alberta Corporate Income Tax Return*

Line 064, Deduct: Royalty Tax Deduction (Schedule 5, line 021), has been removed.

AT1 Schedule 12, Alberta Income/Loss Reconciliation*

Line 092, Income exempt under ITA paragraph 149(1)(t), has been removed.

Saskatchewan

Schedule 411, Saskatchewan Corporation Tax Calculation*

The subsection relating to the additional deduction for credit unions has been removed. This subsection applied to taxation years that had days before the year 2020. It is no longer possible to enter such taxation years in this version of CCH iFirm Cantax T2.

Manitoba

Schedule 384, Manitoba Paid Work Experience Tax Credit*

Schedule 387, Manitoba Small Business Venture Capital Tax Credit*

Schedule 389, Manitoba Book Publishing Tax Credit*

Yukon

Schedule 444, Yukon Business Carbon Price Rebate*

The calculation of line 500 of Part 3 as well as the note 6 have been updated, for a tax year ending after March 31, 2022, to take into account the new business rebate factor of $39.62 for each $1000 of eligible Yukon undepreciated capital cost (UCC).

In addition, class 56 has been added to paragraph 5(c) of the Carbon Price Rebate General Regulation and applies to taxation years ending after 2021. When this class is selected at line 200, the prescribed inclusion rate at line 205 is 500%.

Nunavut

Schedule 481, Nunavut Corporation Tax Calculation*

The lines relating to the number of days in the taxation year before July 1, 2019, have been removed from the schedule. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount was entered on one of those lines, it will not be retained.

Prince Edward Island

Schedule 321, Prince Edward Island Corporate Investment Tax Credit*

Schedule 322, Prince Edward Island Corporation Tax Calculation*

Line 2 relating to the number of days in the taxation year before January 1, 2020, has been removed from the schedule. When opening a return prepared with a prior version of CCH iFirm Cantax T2, if an amount was entered on this line, it will not be retained.

Corrected Calculations

The following problems have been corrected in version 2022 1.0:

Québec

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

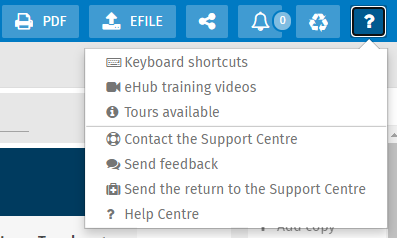

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Cantax T2 e-Bulletin notifies you each time an updated or new form is made available in a program update.

How to Reach Us

Technical and Tax support Hours

Monday to Friday: 8:30 a.m. to 8:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com