Release Notes - CCH iFirm Taxprep T2 2022 v.2.2 (2022.40.34.04)

Our Support Centres are Going Digital: Emails are Now Our First Priority

As part of our transformation to digital support centres, we are pleased to announce that email inquiries will now be given first priority. This digital shift will allow us to process your requests even faster, and better meet your needs.

From now on, use emails instead of telephone to contact Customer Service and the Support Centre by including your account number and the name of your product in the subject line as well as detailed information in your email (form/line/diagnostic number, print screens, etc.) to get accelerated service!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Tax is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T2

With CCH iFirm Tax T2, have the most comprehensive collection of corporate tax forms available, as well as tools designed to address complex T2 preparation requirements. CCH iFirm Tax T2 also provides you with:

- the possibility of attaching supporting documents to electronically transmitted returns;

- GIFI data transfers.

Taxation Years Covered

CCH iFirm Taxprep T2 2022 v.2.2 is designed to process corporate tax returns with taxation years beginning on or after January 1, 2020, and ending on or before May 31, 2023.

Overview - Version 2.2

CCH iFirm Taxprep T2 2022 v.2.2 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

Schedule 67, Canada Recovery Dividend

This new schedule has been added to calculate the Part VI.2 tax of the ITA that applies to each corporation that was a bank or life insurer group member at any time in the 2021 taxation year. For more information, consult the note relating to this subject.

Schedule 68, Additional Tax on Banks and Life Insurers

This new schedule has been added to calculate the additional tax of 1.5% that applies to a corporation that is a bank or life insurer group member. For more information, consult the note relating to this subject.

Schedule 200, T2 Corporation Income Tax Return

Schedule 200 has been updated to take into account the new calculation for the business limit reduction related to the taxable capital for taxation years starting after April 6, 2022. For more information, consult the note relating to this subject.

Improve Your Productivity

Québec

CO-1029.8.33.6, Tax Credit for an On-the-Job Training Period

As per section 1029.8.33.7.2 of the TA, for a training period beginning before March 26, 2021, the expenditures incurred before March 26, 2021, or after March 25, 2021, qualify for the same credit rate. Therefore, in the Eligible expenses part of all copies of Form 10298336 PARTS 2 to 7, on screen only, the text of the previous custom box Expenditures incurred before March 26, 2021, for a training period beginning before that date or expenditures incurred after April 30, 2022 has been replaced by Expenditures incurred for a training period beginning before March 26, 2021, or expenditures incurred after April 30, 2022.

New Forms

Federal

Schedule 67, Canada Recovery Dividend

Schedule 67 is used to calculate the Part VI.2 tax of the ITA that applies to each corporation that was a bank or life insurer group member at any time in the 2021 taxation year under subsection 191.5(1) of the ITA. This temporary additional tax is calculated as 15% of the corporation’s 2020 and 2021 average taxable income that is in excess of $1 billion allocated among the members of a bank or life insurer group. The Part VI.2 tax is calculated on the T2 return filed for the last taxation year ending in 2022 and is payable in five equal instalments, the first of which is payable in that last 2022 taxation year and the others in the four subsequent taxation years.

Above Part 1, on screen only, the custom question Was the filing corporation a bank or life insurer group member at any time during a 2021 tax year? has been added and the answer is calculated to Yes when, in the first copy of Schedule 9 WORKCHART, Related and Associated Corporations Workchart, the answer to the custom question Is the filing corporation a) a bank, b) a life insurance corporation that carries on business in Canada, c) or any financial institution (as defined in subsection 190(1)) at some time during a 2021 taxation year that was related to another bank or life insurer group member at the end of a 2021 taxation year? is Yes in the new section Schedule 67 – Canada recovery dividend. The schedule is applicable when the answer to the custom question on the schedule is Yes, the end of the filing corporation's taxation year is in 2022 and there is an amount entered on line 230 of Part 2.

In the table in Part 1, the information on lines 100, 105 and 110 is updated from the information in Schedule 9 WORKCHART when, in the new section in Schedule 67 – Canada recovery dividend, the answer to the question indicating that the filing corporation or the associated or related corporations are members of the related group is Yes. For more information, consult the Help and the note relating to Schedule 9 WORKCHART.

For a corporation that was a bank or life insurer group member at any time during the 2021 taxation year but was no longer in the last filing corporation year ending in 2022, use the Add button to add an input line and enter the relevant information manually.

In Part 3, the custom field For tax years 2023 and subsequent, enter the amount from line 230 of Part 2 determined for your latest 2022 tax year has been added, on screen only, to calculate the instalments payable for years subsequent to the last taxation year ending in 2022. Note that no amount should be entered in this field when the end of the taxation year ends in 2022. The amount in this field is retained when rolling forward a file.

If an amalgamation or a wind-up of a subsidiary occurs after the last taxation year ending in 2022, use the custom fields Part VI.2 tax payable transferred on an amalgamation or the wind-up of a subsidiary to enter the Part VI.2 tax instalments payable by the predecessor corporations or the wound-up subsidiaries in order to correctly calculate the amounts on lines 310 to 340 for 2023 and subsequent taxation years. In addition, the values entered in these custom fields are retained when rolling forward a file.

Schedule 68, Additional Tax on Banks and Life Insurers

For a taxation year that ends after April 7, 2022, a corporation that is a bank or life insurer group member, as defined in subsection 123.6(1) of the ITA, must add an additional tax of 1.5% of its taxable income to its Part I tax payable. An income deduction of $100,000,000 is allowed, and if the corporation is related to another bank or life insurer group member, this deduction can be allocated among the members. If the taxation year includes April 7, 2022, the additional tax is prorated for the number of days in the taxation year that ends after April 7, 2022.

Above Part 1, the custom question Is the corporation a bank or life insurer group member under 123.6 of the ITA? has been added to the screen to determine if the corporation must pay an additional tax. The answer to this question is calculated to Yes when:

-

In Form Corporate Identification and Other Information, the answer to the questions Is this a bank? or If it is an insurance corporation, does it carry on life insurance business? is Yes; or

-

The answer to the question Is the corporation a financial institution under section 190(1) ITA? of Schedule 38, Part VI Tax on Capital of Financial Institutions is Yes and the answer to the new question Is the corporation a bank or life insurer group member under section 123.6 of the ITA? is Yes in section Schedule 68 – Additional tax on banks and life insurers of Schedule 9 WORKCHART, Related and Associated Corporations Workchart of the copies of the associated or related corporations.

If the corporation is related to another bank or life insurer group member, Part 1 – Agreement must be duly completed. The answer to the question on line 010, Is this corporation related to another bank or life insurer group member?, is Yes when the answer to the question Is the corporation a bank or life insurer group member under 123.6 of the ITA? is Yes in the new section of Schedule 68 for the copies of the associated or related corporations of Schedule 9 WORKCHART. For more information, consult the note relating to Schedule 9 WORKCHART.

In Part 2 – Calculation of the Additional Tax on Banks and Life Insurers, when the answer to line 010 is Yes, line 275, Income deduction, is calculated from the amount that is indicated on the first line of column 120, Allocation of the income deduction. If the answer to line 010 is No, line 275 displays $100,000,000 if the corporation’s taxation year covers at least 51 weeks. If the taxation year of the corporation is shorter than 51 weeks, the following calculation is done: $100,000,000 X (the number of days in the taxation year/365).

Finally, the amount on line 300, Additional Tax on Banks and Life Insurers, is carried over to line 565 of Schedule 200, T2 Corporation Income Tax Return.

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Schedule 200, T2 Corporation Income Tax Return*

Line 276 has been added in Part Attachements to indicate that Schedule 68 is filed with the return.

Under Part Small business deduction, the taxable capital business limit reduction calculation has been modified to consider the upper threshold of $50 million (instead of the previous $15 million) in taxable capital, for taxation years starting after April 6, 2022.

In Part Part I tax, line 565 has been added to include the additional tax on banks and life insurers calculated on Schedule 68.

Finally, under subpart Federal tax in Part Summary of tax and credits, line 725 been added to take into account the Part VI.2 tax payable calculated on Schedule 67.

Schedule 8 WORKCHART, Capital Cost Allowance (CCA) Workchart

The Department of Finance Canada announced on December 16, 2022, that, in respect of vehicles acquired after December 31, 2022, the ceiling for capital cost allowances (CCA) will increase from $34,000 to $36,000 (before taxes) for Class 10.1 passenger vehicles and from $59,000 to $61,000 (before taxes) for Class 54 zero-emission passenger vehicles. However, the CRA informed us that these increased ceilings would only be considered once a bill confirming this increase is tabled. At the date of publication of the program, a bill had still not been tabled. The calculations done for Alberta will be adjusted at the same time as the ones on the federal return.

For Québec income tax purposes, Revenu Québec has confirmed that both ceilings are officially increasing to $36,000 and $61,000 respectively for vehicles acquired after December 31, 2022. The amount of $36,000 will therefore be used in the calculations of the Québec column for CCA class 10.1 when the acquisition date entered is after December 31, 2022.

Schedule 9 WORKCHART, Related and Associated Corporations Workchart

The section Schedule 67 – Canada recovery dividend has been added and includes the following new fields:

-

The following questions:

In the first copy (for the filing corporation), the question Is the filing corporation a) a bank, b) a life insurance corporation that carries on business in Canada, c) or any financial institution (as defined in subsection 190(1)) at some time during a 2021 taxation year that was related to another bank or life insurer group member at the end of a 2021 taxation year?,

In other copies (for related and associated corporations), the question Is the corporation a) a bank, b) a life insurance corporation that carries on business in Canada, c) or any financial institution (as defined in subsection 190(1)) at some time during a 2021 taxation year and that was related to the filing corporation at the end of a 2021 taxation year?

-

The line Income deduction allocated to the corporation.

The answer to the question in the first copy is calculated to Yes when the taxation year end is 2022 and if:

-

In Form Corporate Identification and Other Information, the answer to one of the questions Is this a bank? or If it is an insurance corporation, does it carry on life insurance business? is Yes; or

-

In Schedule 38, Part VI Tax on Capital of Financial Institutions, the answer to the question Is the corporation a financial institution under section 190(1) ITA? is Yes and, in the new section Schedule 67 – Canada recovery dividend, the answer to the question Is the corporation a) a bank, b) a life insurance corporation that carries on business in Canada, c) or any financial institution (as defined in subsection 190(1)) at some time during a 2021 taxation year and that was related to the filing corporation at the end of a 2021 taxation year? in one of the copies of related and associated corporations is Yes.

In addition, in order to complete Part 1 – Agreement of Schedule 68, Additional Tax on Banks and Life Insurers and to allocate the income deduction of $100,000,000, you must complete the section Schedule 68 – Additional tax on banks and life insurers of Schedule 9 WORKCHART. When the answer to the question Is the corporation a bank or life insurer group member under 123.6 of the ITA? for the copies of the associated or related corporations is Yes, a line is generated on the table of Schedule 68. In such cases, complete the line Allocation of the income deduction for the copies of the associated or related corporations. The line Allocation of the income deduction for the filling corporation will thus be calculated based on what has been entered for the associated or related corporations.

Schedule 38, Part VI Tax on Capital of Financial Institutions*

Following the addition of Schedule 67 for the calculation of Part VI.2 tax payable, lines 845 and 888, Part VI.2 tax credit from the current year, have been added, respectively in Parts 6 and 7, to deduct the amount of Part VI.2 tax payable in the current taxation year from the Part VI tax payable.

Also, line 885, Surtax credit applied from previous years, has been removed.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amount on line 885 will not be retained.

Automobile Expenses – Non-Deductible Leasing Costs and Other Expenses

The Department of Finance Canada announced on December 16, 2022, that the limit relating to the acquisition cost of an automobile will increase from $34,000 to $36,000 and that the limit for monthly deductible leasing costs will increase from $900 to $950 in respect of leasing contracts beginning after December 31, 2022. However, the Canada Revenue Agency informed us that these two new limits would only be considered once a bill confirming these increases is tabled. At the date of publication of the program, a bill had still not been tabled. The calculations done for Alberta will be adjusted at the same time as the ones on the federal return.

For Québec income tax purposes, Revenu Québec has confirmed that both limits are officially increasing to $36,000 and $950 respectively for leasing contracts beginning after December 31, 2022. To correctly calculate the amount of non-allowable expenses related to automobile leasing on line 37 of Form CO-17.A.1, Net Income for Income Tax Purposes, specific Québec lines have been added to calculate deductible and non-deductible leasing costs using the increased limits when the acquisition date entered is after December 31, 2022.

Ontario

Schedule 500, Ontario Corporation Tax Calculation

For taxation years starting after April 6, 2022, the denominator used in the calculation of amount 2E is equal to $90,000 to consider the upper threshold of $50 million (instead of the previous $15 million) in taxable capital.

Alberta

AT1 Schedule 1, Alberta Small Business Deduction

For taxation years starting after April 6, 2022, the denominator used in the calculation of the lines (c) Under the Part Area B – Determination of the Value for Line 015 is equal to $90,000 to consider the upper threshold of $50 million (instead of the previous $15 million) in taxable capital.

New Brunswick

Schedule 366, New Brunswick Corporation Tax Calculation*

The calculation of the business limit reduction based on the taxable capital employed in Canada is performed with a reduction factor of $90,000 to consider the upper threshold of $50 million (instead of the previous $15 million) in taxable capital for taxation years starting after April 6, 2022, on lines 1G and 1H.

Overview - Version 2.0

CCH iFirm Taxprep T2 2022 v.2.0 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

Notice of assessment download via the T2 Auto-fill service

It is now possible to download the notice of assessment of a corporation in CCH iFirm Taxprep T2 via the CRA’s T2 Auto-fill service.

Update of Schedules 89 and T2054

Several sections have been added to schedules 89 and T2054. You must now use these versions of the forms when electing for a capital dividend under subsection 83(2) of the Income Tax Act. For more information, consult the note relating to schedule 89 and the note relating to schedule T2054.

New Forms

The following forms have been added to the program:

-

Schedule 65, Air Quality Improvement Tax Credit

-

Schedule 352, Nova Scotia Financial Institutions Capital Tax

-

Schedule 353, Nova Scotia Financial Institutions Capital Tax – Agreement Among Related Corporations

Improve Your Productivity

Preparer profiles

EFILE tab

Check boxes Using an electronic signature method on Form T106, Using an electronic signature method on Form T1134 and Using an electronic signature method on Form T1135 have been added to the Tax Preparer’s Profile.

New Forms

Federal

EFILE Information

The form EFILE information is now available on the screen. In this form, you will find the information of all the most recent transmissions.

Schedule 65, Air Quality Improvement Tax Credit

A Canadian-controlled private corporation (CCPC), or a cooperative that is eligible for the Small Business Deduction (SBD), whose taxable capital used to calculate the business limit reduction is less than $15 million can claim the air quality improvement tax credit for expenditures incurred after August 31, 2021, and before January 1, 2023, in a taxation year that ends after 2021. Any expenditures incurred after August 31, 2021, and before the start date of the first taxation year ending after 2021 are to be included in that taxation year.

Part 3, Agreement between affiliated eligible entities includes a custom question Is the corporation affiliated with other eligible entities that have claimed the tax credit in the qualifying period? that determines the applicability of the section. When applicable, the information in the table relating to the filing corporation and any affiliated eligible corporations are calculated from the data entered in Schedule 9 WORKCHART, notably the new part for Schedule 65. The Add and Delete buttons may be used to manage the lines relating to affiliated eligible individuals and partnerships.

Upon rolling forward a return with a taxation year ending before December 31, 2022, the following data are retained:

-

In the table of Part 2, the information in column 1, Name and address of the qualifying location and the amount in column 5, Total qualifying expenditures for which a credit was claimed in prior tax years, which correspond to the amount in column 10, Cumulative qualifying expenditures of the corporation

-

In the table of Part 3, when the answer to the custom question is Yes,

the percentage in column 3, Percentage assigned under the agreement, is retained and,

for the line created using the Add button, the information in column 1, Name of eligible entity, 2B, Social insurance number of the individual and 2C, Account number of the partnership, is retained.

Nova Scotia

Schedule 352, Nova Scotia Financial Institutions Capital Tax

Financial institutions with a permanent establishment in Nova Scotia are liable to pay tax on their taxable capital employed in the province. Schedule 352 must be used for taxation years starting after October 31, 2021.

The following custom lines have been added on the screen only at the top of the schedule:

-

Is the corporation a bank?;

-

Is the corporation a trust or a loan company? and

-

For a trust company or a loan company, is its registered office in the province?

The first two questions are calculated from data entered in the Form Identification, Corporate Identification and Other Information and you must manually answer the third question if the answer to the second question is Yes. These questions are used to determine the amount of the basic capital deduction on line A.

The basic capital deduction for a tax year is equal to:

-

$5 million, if the total amount of the capital of the financial institution and its related financial institutions is $10 million or less;

-

$30 million, for a financial institution that is a trust company or a loan company with its registered office in Nova Scotia;

-

the deduction is NIL in all other circumstances.

If the corporation is a member of a related group, Schedule 353 must be completed to allocate the basic capital deduction.

Since line 120, Capital deduction claimed for the year is made of the two elements, lines A, Basic capital deduction and B, Investments in related financial institutions in the same year have been added. Line A is calculated, and line B is an input line.

The amount on line 150, Nova Scotia financial institutions capital tax is carried to line 222 of Schedule 5.

Schedule 353, Nova Scotia Financial Institutions Capital Tax – Agreement Among Related Corporations

This schedule must be used by financial corporations with a taxation year beginning after October 31, 2021, that are liable to pay the Nova Scotia financial institutions capital tax and that must allocate the basic capital deduction among the members of the related group. The amount of the basic capital deduction of the filing corporation is carried to line A, Basic capital deduction of Schedule 352. To the right of column 400, a custom column Capital for the year has been added to determine the amount of the basic capital tax. Data used to complete this schedule comes from Schedule 9, Related and Associated Corporations Workchart.

Deleted Forms

Québec

-

CO-17.B.2, Amount to Be Included in the Income of a Corporation That Is a Member of a Multi-Tier Partnership

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Removal of the Notice to reader

As a result of the coming into force of the new Canadian Standard on Related Services (CSRS) 4200, Compilation Engagements, published by the Auditing and Assurance Standards Board, the program is introducing changes to the Notice to Reader.

CSRS 4200 addresses compilation engagements, also referred to as the Notice to Reader in practice, and contains new conducting and reporting requirements. Therefore, to align with key changes, including scope and reporting standards, the Notice to Reader is removed from the program.

The removal of the Notice to Reader is reflected in the following locations in the program:

-

Removal of the Notice to Reader letter;

-

Removal of the options related to the Notice to Reader and the disclaimers in the Preparer profile section;

-

Changes in Letter C;

With respect to the default sentence in the Customized note section of the preparer profile, we recommend that you manually remove it if you were using it. If you were using your own text, we recommend checking whether the text is still appropriate in light of the changes that have been made to the Canadian Standard on Related Services (CSRS) 4200.

Schedule 200, T2 Corporation Income Tax Return

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the answer entered on line 275, Is the corporation claiming an air quality improvement tax credit?, and the amount on line 799, Air quality improvement tax credit from Schedule 65, are retained as overridden data.

Schedule 3, Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation*

The following columns have been added to Part 1 to correctly calculate the amount on line 2E of Part 2:

-

Custom column H.1, Total eligible dividends paid by the connected payer corporation (line 465 in Schedule 3 for the tax year in column D); and

-

Custom column I.2, Additional non-eligible dividend refund of the connected payer corporation from its ERDTOH (amount II from T2 return for the tax year in column D).

Note 5 explains the calculations performed in column L. You will have to complete the new columns H.1 and I.2 in Part 1 to correctly calculate column L.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount has been entered using an override on line 2E of Part 2, cancel the override.

Schedule 5, Tax Calculation Supplementary — Corporations*

The following lines have been added:

- line 506, Newfoundland and Labrador non-refundable green technology tax credit;

- line 508, Newfoundland and Labrador non-refundable manufacturing and processing investment tax credit;

- line 523, Newfoundland and Labrador refundable manufacturing and processing investment tax credit;

- line 526, Newfoundland and Labrador refundable green technology tax credit;

- line 222, Nova Scotia financial institutions capital tax (from Schedule 352);

- line 324, Manitoba data processing investment tax credits (from Schedule 392); and

- line 685, British Columbia clean buildings tax credit.

Schedule 8, Capital Cost Allowance (CCA)

To meet CRA’s specifications, the percentages entered or calculated on line 120 in the table of Part 1 now indicate three decimals instead of four. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the value on these lines will be truncated from four decimals to three.

The list of type of asset codes used for line 301 to indicate the taxation year’s acquisitions in the Classes 43.1 and 43.2 only table has been updated. The descriptions and definitions of codes 01, 02, 06, 08, 09, 12, 13, 16, 17, 18, 20, 21 and 22 have been updated. The following codes have been added:

-

25- Pumped hydroelectric energy storage

-

26- Solid biofuel production system

-

27- Equipment used to produce hydrogen by electrolysis of water

-

28- Hydrogen refuelling equipment

-

29- Air-source heat pump system

Schedule 9 WORKCHART, Related and Associated Corporations Workchart

The percentages entered or calculated on the line Percentage assigned in Part Schedule 8 – Capital cost allowance (CCA) and on the line Percentage of the allocated limit for the calendar year covered in Part Québec TP-130.EN – Agreement respecting the immediate expensing limit now indicate three decimals instead of four. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the value on these lines will be truncated from four decimals to three.

In addition, to fill out Schedule 353 and its allocation of basic capital deduction for related corporations table, the section Schedule 353 – Nova Scotia financial institutions capital tax – Agreement among related corporations has been added. When the checkbox The corporation is a financial institution is activated, a line will be created in the table of Schedule 353. The line Allocation of basic capital deduction for the year is used to complete column 400 of the table in Schedule 353. Finally, the line Capital for the year has been added to complete the custom column in the table on Schedule 353.

Also, following the removal of Section 2, Adjusted aggregate investment income, from Form CO-771.1.3.AJ, Adjusted Business Limit, the Québec CO-771.1.3.AJ – Adjusted business limit section has been removed.

Finally, new section Schedule 65 – Air quality improvement tax credit has been added with the question Is the corporation an eligible corporation that claims the tax credit during the qualifying period? and lines Taxable capital employed in Canada for the preceding taxation year, Total ventilation expense and Percentage assigned under the agreement. For the filing corporation, the question indicates Yes when the corporation is a Canadian-Controlled Private Corporation (CCPC), or a cooperative that is eligible for the Small Business Deduction (SBD), whose taxable capital used to calculate the business limit reduction is less than $15 million and that claims the tax credit in the current taxation year or claimed it in a prior taxation year. The current taxation year must include days in 2022.

When the question indicates Yes, a line is created in the table of Part 3 in Schedule 65 with the relevant information, including the percentage on the line Percentage assigned under the agreement.

Upon rolling forward a return with a taxation year ending before December 31, 2022, the answer entered to the question in the copies for associated and related corporations as well as the percentage for copies of all corporations entered in Schedule 9 WORKCHART are retained.

Schedule 13, Continuity Of Reserves*

Schedule 27, Calculation of Canadian Manufacturing and Processing Profits Deduction*

Parts 14 to 17 have been added to calculate the deduction for profits generated by zero-emission technology manufacturing (ZETM). This deduction applies to ZETM profits generated in a taxation year that starts after 2021 and before 2032.

The new line 9K has also been added to Part 9. Line 9K is calculated when a corporation claims manufacturing and processing profits deduction for other eligible activities, either Canadian manufacturing and processing or for electrical energy for sale or producing steam for sale. In cases where the corporation claims only the ZETM deduction, the amount on line 350 will automatically update line 626 of the T2 Return.

The same principle also applies to the manufacturing and processing profits deduction for generating electrical energy for sale or producing steam for sale calculated on line 13L.

Schedule 31, Investment Tax Credit – Corporations*

The parts below have been removed:

-

Part 22 – Eligible child care spaces expenditures

-

Part 23 – Current-year credit – ITC from child care spaces expenditures

-

Part 25 – Request for carryback of credit from child care space expenditures

Part 2 is now Part 2A, Determination of a qualifying corporation. Line 390 has been moved to this section.

Part 2B, Determination of an excluded corporation – SR&ED, has been added. Line 650 has been moved to this new section.

In addition, line 242 was removed from Part 5.

Lines concerning the calculation of the SR&ED expenditure limit for tax years ending before March 19, 2019, were removed from Part 10.

As a result of an update, the schedule has been entirely renumbered.

Schedule 53, General Rate Income Pool (GRIP) Calculation*

Schedule 89, Request for Capital Dividend Account Balance Verification*

As a result of updates to the schedule, the following changes have been made:

-

Part 2 – CDA components (except for eligible capital property) is now made of two sections: Part 2A – CDA components (except for eligible capital property) – Summary lines for predecessor corporations (for amounts after July 13, 1990) and Part 2B – CDA components (except for eligible capital property) – Detail lines for filing corporation. If you have information that relates to the amalgamations or wind-ups after July 13, 1990, in Part 2B, it should be moved to Part 2A.

-

Since Part 3 – CDA components – Eligible capital property (ECP) must only display amounts related to the filing corporation, and for the amounts reported therein to be considered in the calculation, custom lines Eligible capital property for tax years ending before January 1, 2018 (predecessor corporations) and Eligible capital property for tax years ending before January 1, 2018 (filing corporation – Part 3) have been added to Part 7 – CDA balance. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amount entered on line 6B.1 of the former Part 6 is retained on line Eligible capital property for tax years ending before January 1, 2018 (filing corporation – Part 3).

-

Part 5 – Additional information – Capital dividends received from a Trust has been added.

-

The previous Part 5 – Additional information – Life insurance has been replaced with Part 6 – Additional information – Life insurance, and this section contains details relating to life insurance. The requirement to provide a letter from the insurance company stating whether the life insurance policy was a taxable or a non-taxable policy is maintained.

Please note that the new Part 5, Additional Information - Capital Dividends Received from a Trust, and the changes to the life insurance section (new Part 6) have also been incorporated into the new version of Form T2054.

As a result, when completing these sections of Schedule 89, the information is automatically transferred to the corresponding sections of Form T2054.

Furthermore, the line's numbers have been added to the form to reflect the official CRA schedule. Note that the data from the schedule is not part of the data sent in the electronic transmission. You still have to print and mail the schedule.

AUTHORIZATION, Representative authorization request

Effective October 2022, the CRA is using a two-step verification process to authorize a representative that electronically transmits a request through the program. Once the authorization request is received by the CRA, the corporation has ten (10) business days to confirm the authorization request by accessing the CRA’s My Business Account service. If the 10-day period expires, the request will be cancelled, and the representative will need to submit a new authorization request.

RSI, Electronic Filing and Bar Codes Control Workchart

Following the publication of legislative proposals by the federal government on August 9, 2022, the question Must this return be electronically filed with the CRA in pursuance of subsection 150.1(2.1) ITA? Indicates Yes when a corporation has a gross revenue greater than $1 million for a taxation year starting before 2024 instead of 2022.

Client Letter Worksheet

Following the publication of legislative proposals by the federal government on August 9, 2022, payments greater than $10,000 made to the Receiver General must be made through electronic means when the payment is made after 2023 instead of 2021.

Inducement, Inducement Calculation Workchart

The following line has been added to the Tax credits whose amount should be added to income – Manitoba section:

-

Manitoba data processing centre investment tax credit

The following line has been added to the Tax credits whose amount should be added to income – British Columbia section:

-

British Columbia clean buildings tax credit

The following line has been added to the Tax credits whose amount should be added to income – Québec section:

-

Tax credit for production of biofuel in Québec

The following lines have been added to the Tax credits whose amount should reduce the capital cost of property – Newfoundland and Labrador section:

-

Newfoundland and Labrador green technology tax credit

-

Newfoundland and Labrador manufacturing and processing investment tax credit

Corporate Taxpayer Summary

In the Other provinces subsection of the Summary – taxable capital section, the column Capital used to calculate the Nova Scotia basic capital deduction on financial institutions (Schedule 353) has been added. The total of this column is used to determine the basic capital deduction which is used in Schedules 352 and 353.

In addition, the column Taxable capital used to calculate line 120 in Schedule 65 has been added to the table Federal under the Part Summary – taxable capital.

Data Download with the CRA’s T2 Auto-fill Service

The fields Date the dividend becomes payable, Includes information up to (hour(s) and minute(s)), Deduct: Dividend payable on, Subtotal, Deduct: Amount subject to Part III tax, Deduct: Amount identified as an election pursuant to ss. 184(3) of the ITA and Capital dividend account balance as of proceed date have been removed from the Capital dividend account (CDA) section.

T106 Summary, Information Return of Non-arm’s Length Transactions with Non-Residents

If the return is being efiled, the CRA has requested that the mention “FOR ELECTRONIC SIGNATURE ONLY – DO NOT SEND BY MAIL TO CRA” be added when the form is sent to obtain an electronic signature. For this reason, the new question Are you planning on using an electronic signature method on Form T106? has been added in the Electronic Filing section.

T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim*

The year’s maximum pensionable earnings amount for purposes of the Canada pension plan has been updated for the 2023 calendar year (and is now $66,600). This amount is used to determine the specified employees’ salary or wages in Part 5 when the proxy method is selected to calculate the SR&ED expenditures.

T1134, Information Return Relating to Controlled and Not-Controlled Foreign Affiliates

If the return is being efiled, the CRA has requested that the mention “FOR ELECTRONIC SIGNATURE ONLY – DO NOT SEND BY MAIL TO CRA” be added when the form is sent to obtain an electronic signature. For this reason, the new question Are you planning on using an electronic signature method on Form T1134? has been added in the Electronic Filing section.

T1135, Foreign Income Verification Statement*

If the return is being efiled, the CRA has requested that the mention “FOR ELECTRONIC SIGNATURE ONLY – DO NOT SEND BY MAIL TO CRA” be added when the form is sent to obtain an electronic signature. For this reason, the new question Are you planning on using an electronic signature method on Form T11135? has been added in the Electronic Filing section.

T1145, Agreement to Allocate Assistance for SR&ED Between Persons Not Dealing at Arm's Length*

T1146, Agreement to Transfer Qualified Expenditures Incurred in Respect of SR&ED Contracts Between Persons Not Dealing at Arm's Length*

T1263, Third-Party Payments for Scientific Research and Experimental Development (SR&ED)*

T2054, Election for a Capital Dividend Under Subsection 83(2)*

The following additions have been made:

-

the name of the firm in Part 1

-

the question Has there been an acquisition of control since the date of the last election? in Part 2

-

The following parts:

Part 4 – Capital dividends distributed to the corporation from a trust

Part 5 – Capital gain or loss during the current tax year

Part 6 – Shareholder information

Part 7 – Additional information – Life insurance

It should be noted that the newly added parts 4, 5 and 7 are automatically updated when the following schedules are completed:

-

Part 4: Schedule 89 (Part 5)

-

Part 5: schedule 6 (Parts 1 to 7)

-

Part 7: Schedule 89

Since the amounts in Schedule 6 are carried over to Part 5, a custom checkbox has been added to remove the deemed gains under paragraph 40(3.1)(a) ITA and the deemed losses under subsection 40(3.12) ITA from the calculation and the printout.

Furthermore, the line's numbers have been added to the form to reflect the official CRA schedule. Note that the data from the schedule is not part of the data sent in the electronic transmission. You still have to print and mail the schedule.

AgriStability and AgriInvest Additional Information and Adjustment Request*

AgriStability and AgriInvest Programs – Ontario*

AgriStability and AgriInvest Programs – Harmonized Provinces* and British Columbia*

AgriStability and AgriInvest Programs – Saskatchewan*

AgriStability and AgriInvest – Programs – Alberta*

Ontario

Schedule 570, Ontario Regional Opportunities Investment Tax Credit*

Québec

TED-CO-17

The limit of numeric characters for the transmission of returns authorized by the Québec government is raised from 12 to 13.

CO-17, Corporation Income Tax Return*

The text on line 32, Nature of the corporation’s activities, has been replaced by Corporation's sector activity. Enter the NAICS code.

Above lines 206 to 208, a Sort button has been added to allow you to sort shareholders by the largest to the least significant percentage of voting shares held.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the nature of the corporation’s activities has been entered by overriding line 32, the value is not retained.

In addition, when rolling forward a return, if the nature of the corporation’s activities was entered by overriding line 32, the value is not retained.

Note that the following special tax code 102 Production of biofuel in Québec can now be selected on lines 425ai and 425bi.

CO-17.A.1, Net Income for Income Tax Purposes*

As a result of the form being updated, the following lines have been removed from the Current Year and Prior Year columns, as they are no longer applicable.

Section 2.1 Amount to be added

- Line 28 Eligible capital expenditures according to the financial statements

- Line 57 Reserve from the previous year, related to a partnership’s qualifying transitional income

Section 2.2 Amount to be deducted

- Line 110 Deduction with respect to incorporeal capital property

- Line 127 Additional deduction for trucks and tractors designed for hauling freight

- Line 128 Reserve for the year, related to a partnership’s qualifying transitional income

In addition, line 54a Amounts related to the adjusted stub period accrual or to a new member of a partnership (form CO-17.B) has been added.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if values were entered on lines 28 and 57 in section 2.1 Amount to be added, the amounts will be kept on the first available line between lines 80h and 80k. If values were entered on lines 110, 127 and 128 of section 2.2 Amounts to be deducted, the amounts will be kept on the first available line between lines 150g and 150k.

CO-17.B, Adjustment of Income from One or More Partnerships*

The form has been restructured to consider only the amount inclusion from the adjusted stub period accrual, the income inclusion for a new corporate member of a partnership and the income shortfall adjustment and additional amount. As line 30B, Corporation’s share of the partnership’s income or losses has been removed, form CO-17.B does not calculate the income or loss for the current taxation year from partnerships of which the corporation is a member.

The form now displays the amount to include in respect of each partnership for which form CO-17.B.1, Amount to Be Included in the Income of a Corporation That Is a Member of a Partnership) is completed according to the character of the income and not globally:

-

Part 3 accounts for active business income (or loss)

-

Part 4 accounts for property income (or loss)

-

Part 5 accounts for other income (or other loss)

-

Part 8 accounts for the taxable capital gain (or allowable capital losses)

The income shortfall adjustment amount and the additional amount are grouped in Part 6. The total amount on lines 21, 23, 25 and 38 from Parts 3 to 6 are then added up in Part 7 and the amount on line 45 is updated to the new line 54a in form CO-17.A.1, Net Income for Income Tax Purposes. The taxable capital gains on the custom line AA and the allowable capital losses on custom line BB are respectively updated to lines Taxable capital gains under sections 217.18 to 217.34 TA and Allowable capital losses under sections 217.18 to 217.34 TA in form CO-17S.232, Summary of Dispositions of Capital Property.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the amount on line 31B differs from the amount entered on line 129, Income or loss for tax purposes – partnerships in the federal Schedule 1, Net Income (Loss) for Income Tax Purposes, the amount on line 31B, to which is added the amount on line 132, Income or loss for tax purposes – joint ventures in Schedule 1, is retained on line 54 as an overridden amount.

CO-17.B.1, Amount to Be Included in the Income of a Corporation That is a Member of a Partnership*

Following the removal of form CO-17.B.2, Amount to Be Included in the Income of a Corporation That is a Member of a Multi-Tier Partnership) because the calculations were now identical to those in form CO-17.B.1, the form has been renamed Amount to Be Included in the Income of a Corporation That is a Member of a Partnership and is now used to determine an amount to include in the income of a corporation related to a single-tier or multi-tier partnership.

In Part 2, on lines 11 and 12, the start date and end date of the fiscal period of the partnership to be entered are the start and end date of the fiscal period that starts in the corporation’s taxation year and that ends after.

Former Parts 3, Eligible alignment income, 6, Qualifying transitional income (QTI), 7, Adjusted QTI and 8, Transitional reserve, as well as all custom parts related to these parts, have been removed because the information contained therein was outdated. Lines in the remaining Parts 3, Adjusted stub period accrual (ASPA) and 4, Amount to be included in the income of a corporation that is a new member of a partnership have been rearranged to better display the allocation of the amounts according to the character of the income: active business income (or losses), property income (or losses), other income (or other losses) and taxable capital gains (or allowable capital losses). Part 5, Income shortfall adjustment, correspond to the Part 9 of the previous version of the form.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2:

-

a copy of form CO-17.B.1 is created for each existing copy of form CO-17.B.2 and all data from Parts, 4.1.3 and 4.2, as well as parts 5 and 9 are retained respectively on the corresponding lines of Parts 3, 4, and 5 in form CO-17.B.1

-

one year will be added to the start date and end date on lines 07 and 08 in Part 2.

CO-17.R, Request for an Adjustment to a Corporation Income Tax Return or to an Information and Income Tax Return for Non-Profit Corporations*

CO-17.SP, Information and Income Tax Return for Non-Profit Corporations*

The extension concerning the telephone number of the corporation has been added to Section 1 of the form. The extension number comes from the Extension field in the Certification section of Form Identification.

Furthermore, the text on line 32, Describe the corporation’s activities, has been replaced by Corporation’s sector of activities. Enter the NAICS code. The information related to this line comes from line 32 of Form CO-17.

CO-130.A, Capital Cost Allowance*

The amount deducted in regard to the immediate expensing (amount in column G of Part 3 of Form CO-130.AD) is subtracted from columns C.1 and F.

CO-737.18.CI, Deduction Relating to the Commercialization of Innovations in Québec*

Section Information about the qualified intellectual property Assets has been added to the form.

The following lines were also added:

-

Line 06 Protected invention

-

Line 06a Protected plant variety

-

Line 06b Protected software

-

Line 07 Identification number

-

Line 08 Describe the qualified intellectual property asset

CO-771, Calculation of the Income Tax of a Corporation*

Line 05a, The corporation is a Canadian-controlled private corporation (CCPC) throughout its taxation year; it or a partnership of which it is a member carries on manufacturing sector activities; 1 and the corporation’s taxation year begins before January 1, 2017, has been removed.

The change with respect to the broadening of the range within which the business limit is reduced based on the paid-up capital, which appeared on screen only, is now integrated to subsection 8.1, Business limit used to determine the SBD, of the official form.

Additionally, former subsection 11.1, Proportion of manufacturing and processing activities (taxation year beginning before January 1, 2017), has been removed.

CO-771.1.3, Associated Corporations' Agreement Respecting the Allocation of the Business Limit *

CO-771.1.3.AJ, Adjusted Business Limit*

Section 2, Adjusted aggregate investment income, has been removed. This section was used for the calculation of the amount on line 28. Henceforth, the amount on line 28 is now calculated from the amount on line 417 of Schedule 200. In addition, former sections 3 and 4 have been renumbered 2 and 3.

CO-771.2.1.2, Income of a Corporation That Is a Member or Designated Member of a Partnership From an Eligible Business Carried On in Canada by the Corporation

Following the update of forms CO-17.B, Adjustment of Income from One or More Partnerships and CO-17.B.1, Amount to Be Included in the Income of a Corporation That Is a Member of a Partnership, the description of lines 12b, 12c, 14b and 14c have been modified on screen only. Also, it is not possible to enter an amount on lines 12a and 14a anymore.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, amounts entered on lines 12a and 14b will not be retained.

CO-1029.8.33.6, Tax Credit for an On-the-Job Training Period*

The box The training period started after March 27, 2018, and before March 26, 2021, and the box The training period started after March 25, 2021, located above section 2, have been renamed respectively Expenditures incurred before March 26, 2021, for a training period beginning before that date or expenditures incurred after April 30, 2022, and Expenditures incurred in the period from March 26, 2021, to April 30, 2022, for a training period beginning after March 25, 2021, to incorporate the calculation of the tax credit based on expenditures that were incurred after April 30, 2022.

When the date of May 1, 2022, is between the start and end date of the training period, the boxes Expenditures incurred before March 26, 2021, for a training period beginning before that date or expenditures incurred after April 30, 2022, and Expenditures incurred in the period from March 26, 2021, to April 30, 2022, for a training period beginning after March 25, 2021, will be in input. In this situation, if you activate the Expenditures incurred in the period from March 26, 2021, to April 30, 2022, for a training period beginning after March 25, 2021 box, a button will appear on the screen so that you can make a copy of sections 2 and 3 of this form for expenditures incurred after April 30, 2022.

Lines 18f and 18g have been added to indicate the number of training period weeks included in the amount of the line 18e for which expenditures were incurred either before May 1, 2022, or after April 30, 2022.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the end date of the training period on line 18d ends before May 1, 2022, the number of weeks entered at line 18e is entered on line 18f. Conversely, if the training period start date is after April 30, 2022, the number of weeks is entered on line 18g. In other cases, the number of weeks entered on line 18e is kept as an overriden number of weeks on line 18e, and a diagnostic then prompts you to indicate the correct number of weeks on lines 18f and 18g. As well, if a number of weeks is entered on line 56 or 74, this number is not retained

CO-1029.8.33.13, Tax Credit for the Reporting of Tips

This form has been updated in order to integrate the various applicable rates for 2023.

CO-1029.8.33.CS, Tax Credit for the Retention of Persons with a Severely Limited Capacity for Employment*

In its Information Bulletin 2022-4, published on June 9, 2022, the Québec government has announced changes to the definition of “qualified corporation” and “qualified partnership” to remove the paid-up capital and compensated hours requirements for taxation years or fiscal periods ending after December 30, 2022. For these taxation years and/or fiscal periods, the following questions will not be considered in the tax credit calculation:

-

Is the paid-up capital determined for the corporation’s preceding taxation year, including that of members of an associated group, less than $15 million?

-

Does the number of remunerated hours of the corporation’s employees, calculated for the taxation year, exceed 5,000 or is the corporation a corporation in the primary or manufacturing sector?

-

Is the paid-up capital that would be allocated to the partnership for the preceding year less than $15 million?

-

Does the number of remunerated hours of the partnership’s employees, calculated for the fiscal year, exceed 5000, or is the partnership a corporation in the primary or manufacturing sector?

CO-1029.8.33.TE, Tax Credit to Foster The Retention Of Experienced Workers*

In its Information Bulletin 2022-4, published on June 9, 2022, the Québec government has announced changes to the definition of “qualified corporation” and “qualified partnership” to remove the paid-up capital and compensated hours requirements for taxation years or fiscal periods ending after December 30, 2022. For these taxation years and/or fiscal periods, the following questions will not be considered in the tax credit calculation:

-

Is the paid-up capital determined for the corporation’s preceding taxation year, including that of members of an associated group, less than $15 million?

-

Does the number of remunerated hours of the corporation’s employees, calculated for the taxation year, exceed 5,000 or is the corporation a corporation in the primary or manufacturing sector?

-

Is the paid-up capital that would be allocated to the partnership for the preceding year less than $15 million?

-

Does the number of remunerated hours of the partnership’s employees, calculated for the fiscal year, exceed 5000, or is the partnership a corporation in the primary or manufacturing sector?

In addition, we adjusted the calculation of line 06, Calendar year. If December 31 is not in the corporation's tax year, line 06 will be blank.

CO-1029.8.33.TF, Agreement Concerning the Tax Credit to Foster the Retention of Experienced Workers*

CO-1029.8.36.II, Tax Credit for Investment and Innovation*

Following the announcement of the March 2022 budget, the Ministère des Finances du Québec will temporarily improve the tax credit relating to investment and innovation for one year, until December 31, 2023. Therefore, the periods for which the specified incurred expenses qualify have been modified for the following choices.

- After March 10, 2020, but before March 26, 2021

- After March 25, 2021, but before January 1, 2024

- After December 31, 2023

CO-1029.8.36.PM, Tax Credit for Corporations Specialized in the Production of Multimedia Titles*

CO-1029.8.36.TM, Tax Credit for Multimedia Titles*

QC L265-266, Deductions from Taxable Income

Code 01, International financial centre (IFC) as well as code 07, Income earned from a major investment project, have been removed, as these deductions can no longer be claimed.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the data entered on lines 01 and 07 will not be retained.

QC L440P-Y, Additional Québec Credits

Q1 L70A, Taxable Tax Credits and

Q1 L140A, Non-Taxable Tax Credits

In its 2022–2023 Budget tabled on March 22, 2022, the Québec Government announced the introduction of a new refundable tax credit for production of biofuel.

Therefore, the tax credit code 111, Tax credit for production of biofuel in Québec, has been added in the three forms.

TP-130.EN, Immediate Expensing Limit Agreement*

The percentages entered or calculated in column Percentage of limit assigned for the calendar year concerned of the table under Part 2 now indicate three decimals instead of four. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the value on these lines will be truncated from four decimals to three.

British Colombia

Schedule 423, British Colombia Production Services Tax Credit*

Schedule 427, British Columbia Corporation Tax Calculation*

Schedule 428, British Columbia Training Tax Credit*

Schedule 430, British Columbia Shipbuilding and Ship Repair Industry Tax Credit*

Alberta

AT1, Alberta Corporate Income Tax Return*

Alternate addressees are no longer accepted by the Alberta Taxation Revenue Administration (TRA). Consequently, the alternate addresses at lines 018 to 024 have been removed from the return. All address changes should be made via TACS or contacting the Alberta TRA. In addition, line 027, Fax number, has been removed.

The Alberta TRA confirmed to us that in the case of a floating year-end, that the question on line 038, Has the taxation year-end changed since the last return was filed?, must be answered with No. In the form Identification, Corporate Identification and Other Information, when the answer is Yes to the question, Is the tax year a full year with a floating year-end?, the calculation of line 038 has now been modified to show the answer No.

AT1 Schedule 10, Alberta Loss Carry-Back Application*

The address lines 058 to 068 have been removed from the schedule. In addition, line 056, Fax Number, has been removed.

Alberta Schedule 29 Listing, Listing of Innovation Employment Grant Projects Claimed in Alberta

As a result of changes to the examples in the Guide to Claiming the Alberta Innovation Employment Grant, the calculation on line 135 has been changed. The amount calculated on this line no longer includes the Alberta innovation employment grant calculated on line 513d2 of Schedule T661.

Saskatchewan

Schedule 411, Saskatchewan Corporation Tax Calculation

As a result of the tabling of Bill 89 on November 2, 2022, which announced the extension of the lower tax rate at 0% until July 1, 2023, line 3B of Part 3 has been modified to calculate the number of days in the tax year after June 30, 2023, and before July 1, 2024.

Manitoba

Schedule 387, Manitoba Small Business Venture Capital Tax Credit*

Schedule 388, Manitoba Film and Video Production Tax Credit*

The CRA removed the terms “taxable Canadian” from fields 511 and 512.

Nova Scotia

Nova Scotia Financial Corporation Capital Tax Return

For a taxation year starting after October 31, 2021, the form will no longer be applicable. For any financial institution that has a permanent establishment in Nova Scotia and whose taxation year begins after October 31, 2021, the capital tax is now administered by the federal government. You must use new Schedules 352 and 353. For more information, consult the note relating to this subject.

Corrected Calculations

The following problem has been corrected in version 2022 2.0:

Saskatchewan

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

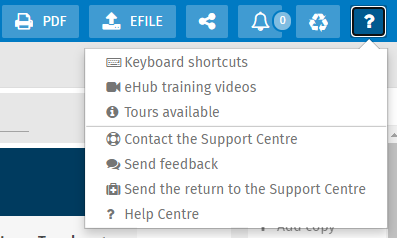

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Tax T2 e-Bulletin notifies you each time an updated or new form is made available in a program update.

How to Reach Us

Technical and Tax support Hours

Monday to Friday: 8:30 a.m. to 8:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail: csupport@wolterskluwer.com