Form RC4649, Country by Country Report, will be applicable if you answer “Yes” to the question Do you have to file the country by country report under subsection 233.8 (3) ITA*?

To complete tables 1 and 2 in Part II, “CbC Report Section,” complete a separate copy of Form RC4649 – Part II for each tax jurisdiction, and indicate all constituent entities of the jurisdiction.

You can access Form RC4649 – Part II from Part II, “CbC Report Section” of Form RC4649.

To complete table 3 in Part III, “Additional Information Section,” you have to complete a separate copy of Form RC4649 – Part III for each information or explanation that is judged necessary or that facilitates the comprehension of the information required in Part II, “CbC Report Section,” For each additional piece of information, you can indicate one or more relevant country codes and/or one or more reference codes to Table 1, if applicable.

You can access Form RC4649 – Part III from Part III, “Additional Information Section,” of Form RC4649.

Form RC4649 is transmitted separately from the T2 return. However, in the program, the electronic filing of Form RC4649 has been implemented so that you can transmit both the T2 return and Form RC4649 at the same time.

However, you can transmit the T2 return without Form RC4649, or Form RC4649 without the T2 return.

Consult the Electronic transmission to the CRA topic for more information on how to proceed to transmit this form.

The program defines the status of the check boxes Were all diagnostics related to Form RC4649 corrected in the T2 EFILE diagnostic tab?, Were all diagnostics with the "RC4649" mention and relating to electronic filing corrected in the CCH diagnostic tab? and Form RC4649 applicable, based on the corporation’s information (e.g. whether the corporation’s name, Business Number (BN) and address comply with EFILE requirements) and the data entered in Form RC4649.

If you selected Form RC4649 for electronic filing and one of the previously mentioned check boxes is not selected, make sure to verify the diagnostics to make any required adjustment.

When Form RC4649 is selected for electronic transmission, the required information is complete and the answer to the question Do you have to file the country-by-country report under subsection 233.8 (3) ITA*? is “Yes,” the EFILE status of Form RC4649 will be “Eligible.”

The information on the transmission status of Form RC4649 is also available using the File/Properties command (F11).

The electronic filing date is displayed automatically if the form has been selected for electronic filing.

Note that you can electronically transmit Form RC4649 using a WAC with the program.

Amended Form RC4649

You can also transmit an amended Form RC4649. You must indicate that Form RC4649 is amended by selecting the appropriate check box at the top of the form.

To be able to transmit an amended Form RC4649 for which the value of the EFILE status of “Accepted,” you have to change the value of this status to “Eligible” using the File/Properties (F11) command.

The following instructions are taken from the form.

INSTRUCTIONS

All legislative references on this sheet refer to the Income Tax Act (the Act) unless otherwise stated.

INTRODUCTION

Section 233.8 of the Act requires certain multinational enterprise (MNE) groups to file a country-by-country report (CbCR). This filing requirement is part of a global initiative developed by the Organisation for Economic Co-operation and Development (OECD) to enhance transparency for tax administrations by providing adequate and consistent information among participating jurisdictions with respect to transfer pricing documentation. The CbCR is a prescribed form and is substantially similar to reports that are required to be filed in other jurisdictions.

DEFINITIONS FOR THE PURPOSE OF COUNTRY-BY-COUNTRY REPORTING

Business Entity

A business entity means a person (including a trust but not including a natural person) or a partnership; and a business that is carried on through a permanent establishment if a separate financial statement for the business is prepared for financial reporting, regulatory, tax reporting or internal management control purposes. In summary, a business entity includes a corporation, a trust, a partnership and a business carried on through a permanent establishment (e.g. a branch).

Consolidated Financial Statements

Consolidated financial statements means financial statements in which the assets, liabilities, income, expenses and cash flows of the members of a group are presented as those of a single economic entity and are consistent with generally accepted accounting principles.

Constituent Entity

A constituent entity of an MNE group means a business entity within the MNE group that is included in the consolidated financial statements of the MNE group for financial reporting purposes, or that would be required to be included if equity interests in any of the business entities of the MNE group were traded on a public securities exchange. It also includes any business entity that is excluded from the MNE group’s consolidated financial statements solely for size or materiality reasons.

Country Codes

Country codes are based on the ISO 3166-1 Alpha 2 Standard. You can find a list of the ISO country codes at the following link: ISO Country Codes. Use code “X5” for entities deemed by the reporting MNE or reporting entity not to be resident in any tax jurisdiction for tax purposes.

Use code "XX" to specify a country that is not currently contained in the ISO country list. The "XX" country code should only be used in these specific, exceptional circumstances where there is no adequate ISO country code available.

Due Date

A CbCR, in respect of a reporting fiscal year of the MNE group, must be filed by 12 months after the last day of the reporting fiscal year. In the case where notification of systemic failure has been received by the constituent entity, this deadline can be extended to 30 days after receipt of the notification.

Effective Date

The effective date for filing the CbCR is for fiscal years of MNE groups that begin after 2015.

Excluded MNE Group

An MNE group is exempt from filing a CbCR for a reporting fiscal year in which it qualifies as an “excluded MNE group”. An excluded MNE group for a particular year means an MNE group that has total consolidated group revenue of less than EUR 750 million during the fiscal year immediately preceding the particular fiscal year, as reflected in its consolidated financial statements for the preceding fiscal year.

Fiscal Year

The fiscal year of an MNE group means an annual accounting period for which the ultimate parent entity (defined below) of the MNE group prepares its financial statements.

Multinational Enterprise (MNE) Group

An MNE group is:

- any group of two or more business entities that are required to prepare consolidated financial statements for financial reporting purposes or would be so required if equity interests in any of the business entities were traded on a public securities exchange;

- one of the business entities of the group resides in a particular tax jurisdiction and another business entity resides in a different tax jurisdiction, or one business entity is resident for tax purposes in one jurisdiction and is subject to tax with respect to a business carried on through a permanent establishment in another jurisdiction; and

- it is not an excluded MNE group.

Reporting Fiscal Year

The reporting fiscal year means a fiscal year, if the financial and operational results of the fiscal year are reflected in the CbCR.

Surrogate Parent Entity

A surrogate parent entity of an MNE group means one constituent entity of the MNE group that has been appointed by the MNE group, in substitution for the ultimate parent entity, to file a CbCR on behalf of the MNE group. A surrogate parent entity must file the CbCR on behalf of the ultimate parent entity by the due date of the jurisdiction of tax residence of the surrogate parent entity, and the jurisdiction of residence of the surrogate parent entity must meet the following requirements:

- it must require the filing of the CbCR;

- it must have a qualifying competent authority agreement in effect to which Canada is a party on or before the due date for filing the CbCR in respect of the reporting fiscal year;

- it must not be in a position of systemic failure; and

- it must have been notified by the surrogate parent entity that it is filing as the surrogate parent entity (Note: Refer to Part 1, Section 2 – Role of the Reporting Entity for notification).

Ultimate Parent Entity

An ultimate parent entity of an MNE group means a constituent entity of an MNE group that meets the following conditions:

- It holds directly or indirectly a sufficient interest in one or more other constituent entities of such MNE group so that it is required to prepare consolidated financial statements under accounting principles generally applied in its jurisdiction of residence, or would be so required if its equity interests were traded on a public securities exchange in its jurisdiction of residence; and

- there is no other constituent entity of such MNE group that holds, directly or indirectly, an interest described in (a) above in the first mentioned constituent entity.

Generally, an ultimate parent entity is the constituent entity of the MNE group that is at the top of the ownership chain within the MNE group. If the ultimate parent entity is a partnership, it is deemed to be resident in another jurisdiction if it is resident in that other jurisdiction for tax purposes under the laws of that other jurisdiction. In any other case, it will be resident in the jurisdiction under the laws of which it was organized.

DO YOU HAVE TO FILE THE CBC REPORT?

An MNE group that has total consolidated group revenue of 750 million euros or more in the fiscal year immediately preceding a particular fiscal year, as reflected in its consolidated financial statements for the preceding fiscal year, is required to file a CbCR for fiscal years that begin after 2015.

If the consolidated financial statements are reported in a currency other than the euro, a conversion to euros will have to be made to determine whether the threshold is met. For this calculation use the average exchange rate for the fiscal period as published by the Bank of Canada to convert the consolidated group revenue amount of the MNE group. Annual and monthly average exchange rates can be found at the Bank of Canada website. The selection of a particular exchange rate must be supported with appropriate documentation.

If you are the ultimate parent entity resident for tax purposes in Canada in the reporting fiscal year of such multinational enterprise (MNE) group, you are required to file the CbCR.

If you are a constituent entity (but not the ultimate parent entity) resident for tax purposes in Canada in the reporting fiscal year of such MNE group (where no surrogate parent entity has been appointed by the MNE group to file the CbCR) you are required to file a CbCR if one of the following conditions apply:

- the ultimate parent entity of the MNE group is not obligated to file a Country-by-Country report in its jurisdiction of tax residence;

- the jurisdiction of tax residence of the ultimate parent entity of the MNE group does not have a qualifying competent authority agreement in effect to which Canada is a party on or before the due date for filing the CbCR for the reporting fiscal year; or

- there has been a systemic failure of the jurisdiction of tax residence of the ultimate parent entity and the Minister has notified the constituent entity of the systemic failure.

If there is more than one constituent entity resident for tax purposes in Canada of the MNE group that is required to file a CbCR in respect of a reporting fiscal year, one of those constituent entities can be designated to file the CbCR on behalf of all constituent entities resident for tax purposes in Canada of the MNE group.

A constituent entity described above is not required to file a CbCR if a surrogate parent entity of the MNE group files the CbCR in respect of the reporting fiscal year with the tax authority of its jurisdiction of residence on or before the due date, and the jurisdiction of residence of the surrogate parent entity meets the following requirements:

- requires the filing of CbCRs;

- has a qualifying competent authority agreement in effect to which Canada is a party on or before the due date for filing the CbCR in respect of the reporting fiscal year;

- is not in a position of systemic failure, and

- has been notified by the surrogate parent entity that it is the surrogate parent entity.

If you have been appointed as the surrogate parent entity by an MNE group and are resident for tax purposes in Canada, you are required to file a CbCR on behalf of the ultimate parent entity.

DUE DATE FOR FILING THE CBC REPORT

The CbCR is due no later than 12 months after the last day of the “Reporting Fiscal Year” of the MNE group. If notification of systemic failure has been received by a constituent entity, this deadline can be extended by 30 days after receipt of the notification.

HOW TO COMPLETE THE CBC REPORT

Functional Currency

Certain corporations can elect to file using a functional currency. Report all monetary amounts in Canadian dollars except where an election has been made under paragraph 261(3)(b) of the Act to use a functional currency. If you are reporting in Canadian dollars leave this field blank. If you are reporting in a functional currency, select one of the accepted codes for functional currencies as follows:

AUD – Australian dollar

USD – United States Dollar

GBP – United Kingdom Pound

EUR – Euro

Where the reporting entity’s currency for financial reporting purposes is not Canadian dollars, and they have not elected under paragraph 261(3)(b) of the Act to use a functional currency for the purposes of filing the CbC report, the reporting currency for financial reporting purposes may still be used when filing the CbC report providing that the following conditions are met:

- The reporting entity's reporting currency for financial reporting purposes is a "qualifying currency" as defined in subsection 261(1) of the Income Tax Act.

- The reporting entity discloses in Table 3 – Additional Information that it is reporting in one of the qualifying currencies notwithstanding that no election has been made by the reporting entity pursuant to paragraph 261(3)(b) of the Act. If the amounts in Table 1 required conversion into one of the functional currencies, the conversion rate used should be set out in Table 3.

Amended report

If you are amending a previously filed CbCR check “Yes”, otherwise check “No”. If yes, you must re-complete the whole CbCR including the amendments (i.e. include all information not amended plus all amended information), and re-file the entire amended CbCR. If the initial CbCR was paper filed, then the amended CbCR must be paper filed. If the initial CbCR was electronically filed, then the amended CbCR can also be electronically filed.

Fiscal year concerned

Enter the start and end day of the reporting fiscal year of the MNE group for which you are reporting. The date must be in YYYY-MM-DD to YYYY-MM-DD format. (Reporting fiscal year is defined above.)

PART I – REPORTING ENTITY SECTION

SECTION 1 – Reporting entity identification

Type of reporting entity

Indicate the type of reporting entity by checking one of the following three options:

- Corporation,

- Trust, or

- Partnership.

Identify the reporting entity by entering the name, tax account number (i.e. corporate business number, trust account number, or partnership business number) and address of the reporting entity.

Name of MNE group

Enter the name of the MNE group (i.e. the trade name or operating name).

SECTION 2 – Reporting role

Reporting role of the reporting entity

Indicate the reporting role of the reporting entity by checking one of the three options:

- Ultimate Parent Entity,

- Surrogate Parent Entity, or

- Constituent Entity

If you selected constituent entity and you are reporting on behalf of all constituent entities of the MNE group that are resident for tax purposes in Canada, check “Yes”, otherwise check “No”.

If you checked surrogate parent or constituent entity, you must provide the name of the ultimate parent entity of the MNE group and the country code of the jurisdiction of tax residence of the ultimate parent entity.

SECTION 3 - Certification

This area should be completed by an authorized person or officer who attests to the complete and accurate filing of this CbCR.

PART II – CBC REPORT SECTION

TABLE 1 – Overview of allocation of income, taxes and business activities by tax jurisdictions

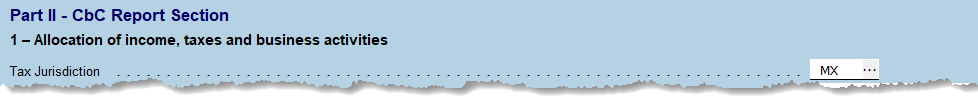

Tax jurisdiction

List all of the tax jurisdictions in which the constituent entities of the MNE group are resident for tax purposes using the country codes based on the ISO 3166-1 Alpha 2 Standard. A tax jurisdiction is defined as a State as well as a non-State jurisdiction which has fiscal autonomy and in respect of which a country code exists. You can find the ISO 3166-1 Alpha 2 Standard country codes at the following website link: ISO Country Codes.

A separate line should be included for all constituent entities in the MNE group deemed by the reporting MNE or reporting entity not to be resident in any tax jurisdiction for tax purposes. Use tax jurisdiction code “X5” for such entities. Where a constituent entity is resident in more than one tax jurisdiction, the applicable tax treaty tie breaker rules should be applied to determine the tax jurisdiction of residence. Where no applicable tax treaty exists, the constituent entity should be reported in the tax jurisdiction of the constituent entity’s place of effective management. The place of effective management should be determined in accordance with the provisions of Article 4 of the OECD Model Tax Convention and its accompanying Commentary. Additional information regarding residency can be provided in the Additional Information section, Table 3.

In the case of a partnership that is the ultimate parent entity of an MNE group , if it is resident for tax purposes under the laws of a specific jurisdiction then it is deemed to be resident for tax purposes in that jurisdiction. In any other case, it will be resident in the jurisdiction under the laws of which it was organized.

Amounts reported

All amounts must be stated in Canadian dollars unless an election has been made to report in a functional currency (refer to “functional currency” described above). Also, all amounts must be stated in one and the same currency. Amounts should be in full units, i.e. without decimals, and any negative values should be identified by entering a “ – “ in front of the amount (e.g. -1000). An entire row must be completed and an amount must be entered in each space provided. Enter “0” if any amount fields on these lines are nil or do not apply to you.

Revenues – Unrelated* party

For the purposes of this form, "Revenues-Unrelated Party" should be read as the aggregate sum of revenues of all the constituent entities of the MNE group listed in Table 2 for each relevant tax jurisdiction, generated from transactions with independent entities.

*Not a reference to subsection 251(2) – "Related Person" of the Act.

Revenues – Related* party

For the purposes of this form, "Revenues-Related Party" should be read as the aggregate sum of revenues generated from transactions between constituent entities listed in Table 2, for each relevant tax jurisdiction. The financial results of all intercompany transactions within the same jurisdiction must be aggregated and not consolidated. Table 3 (Additional Information) of the CbC report can be used to explain levels of domestic intercompany transactions, if required.

*Not a reference to subsection 251(2) – “Related Person” of the Act.

Revenues – Total

Enter the total of the amounts reported for unrelated and related parties.

Profit or Loss before income tax

Enter the sum of the profit or loss before income tax for all of the constituent entities resident for tax purposes in the relevant tax jurisdiction. The profit or loss should include all extraordinary income and expense items.

Income tax paid (on a cash basis)

Enter the total amount of income tax actually paid during the relevant fiscal year by all of the constituent entities resident for tax purposes in the relevant tax jurisdiction. Taxes paid should include cash taxes paid by the constituent entity to the residence tax jurisdiction and to all other tax jurisdictions. Taxes paid should include withholding taxes paid by other entities (associated/related parties and independent/unrelated parties) with respect to payments to the constituent entity. For example, if company A resident in tax jurisdiction A earns interest in tax jurisdiction B, the tax withheld in tax jurisdiction B should be reported by company A.

Income tax accrued – current year

Enter the sum of the accrued current tax expense recorded on taxable profits or losses of the year of reporting of all of the constituent entities resident for tax purposes in the relevant tax jurisdiction. The current tax expense should reflect only operations in the current year and should not include deferred taxes or provisions for uncertain tax liabilities.

Stated capital

Enter the sum of the stated capital of all of the constituent entities resident for tax purposes in the relevant tax jurisdiction. With regard to permanent establishments, the stated capital should be reported by the legal entity of which it is a permanent establishment unless there is a defined capital requirement in the permanent establishment tax jurisdiction for regulatory purposes.

Accumulated earnings

Enter the sum of the total accumulated earnings of all of the constituent entities resident for tax purposes in the relevant tax jurisdiction as of the end of the year. With regard to permanent establishments, accumulated earnings should be reported by the legal entity of which it is a permanent establishment.

Number of employees

Enter the total number of employees on a full-time equivalent (FTE) basis of all of the constituent entities resident for tax purposes in the relevant tax jurisdiction. The number of employees may be reported as of the year-end, on the basis of average employment levels for the year or on any other basis consistently applied across tax jurisdictions and from year to year. For this purpose, independent contractors participating in the ordinary operating activities of the constituent entity must be reported as employees. Reasonable rounding or approximation of the number of employees is permissible, providing that such rounding or approximation does not materially distort the relative distribution of employees across the various tax jurisdictions. Consistent approaches should be applied from year to year and across entities.

Tangible assets other than cash and cash equivalents

Enter the sum of the net book values of tangible assets of all of the constituent entities resident for tax purposes in the relevant tax jurisdiction. With regard to permanent establishments, assets should be reported by reference to the tax jurisdiction in which the permanent establishment is situated. Tangible assets for this purpose do not include cash or cash equivalents, intangibles or financial assets.

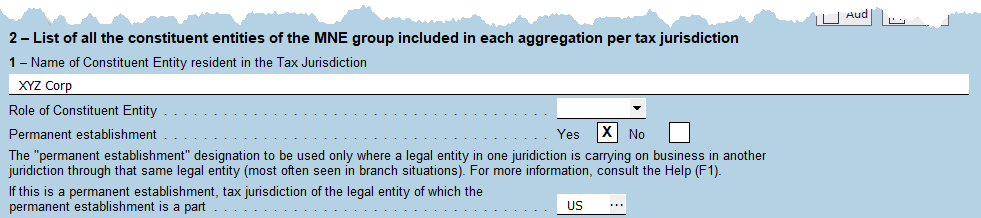

TABLE 2 – List of all the constituent entities of the MNE group included in each aggregation per tax jurisdiction

Tax jurisdiction

State the tax jurisdiction in which the constituent entities of the MNE group are resident for tax purposes using the country codes (based on the ISO 3166-1 Alpha 2 Standard). A tax jurisdiction is defined as a State as well as a non-State jurisdiction which has fiscal autonomy. You can find the ISO 3166-1 Alpha 2 Standard country codes at the following website link: ISO Country Codes.

For additional information on tax jurisdictions, refer to the instructions for Table 1 above. This list of tax jurisdictions should mirror those listed in Table 1.

Name of the constituent entities resident in the tax jurisdiction

List, on a tax jurisdiction-by-tax jurisdiction basis and by legal entity name, all of the constituent entities of the MNE group which are resident for tax purposes in the relevant tax jurisdiction.

Determining if a constituent entity is a permanent establishment

The "-PE" designation is to be used only where a legal entity in one jurisdiction is carrying on business in another jurisdiction through that same legal entity.

This is most often seen in branch situations. With regard to permanent establishments, the permanent establishment should be listed by reference to the tax jurisdiction in which it is situated and not by reference to the tax jurisdiction of residence of the legal entity of which the permanent establishment is a part.

For example, if XYZ Corp, resident in tax jurisdiction A, has a branch in tax jurisdiction B, the branch should be listed on Table 2 as a permanent establishment in tax jurisdiction B. The name of the CE should clearly indicate the legal entity of which the permanent establishment is a part (e.g., XYZ Corp – Tax Jurisdiction A –PE).

Permanent establishment

The term “Permanent establishment” means a fixed place of business through which the business of an enterprise is wholly or partly carried on.

In particular, the term permanent establishment includes:

- a place of management;

- a branch;

- an office;

- a factory;

- a workshop, and

- a mine, an oil or gas well, a quarry or any other place of extraction of natural resources.

Note: The purpose of the permanent establishment designation (shown as “PE” in Table 2 of the Country-by-Country report) is to identify a constituent entity that conducts business activities through a permanent establishment in a particular tax jurisdiction, where the legal entity that it is part of is resident in another tax jurisdiction. A constituent entity may require to be listed multiple times in Table 2 of the Country-by-Country report. In such cases, the constituent entity would be listed once under the legal entity’s tax jurisdiction of residency, and then once for each additional tax jurisdiction in which it operates through a permanent establishment.

Example: (XYZ Corp is a corporation registered in the United States and operating a business through a permanent establishment (“PE”) in Mexico and the United Kingdom):

| Tax jurisdiction | Constituent entity name |

| US | XYZ Corp |

| MX | XYZ Corp - PE - US |

| GB | XYZ Corp - PE - US |

For example, if XYZ Corp, resident in the United States, has a branch in Mexico’s tax jurisdiction, the branch should be listed in subsection 2 - List of all the constituent entities of the MNE group included in each aggregation per tax jurisdiction as a permanent establishment in the Mexican tax jurisdiction indicated in subsection 1 - Allocation of income, taxes and business activities as follows:

Identify the ultimate parent entity and the reporting entity

Identify which constituent entity is the Ultimate Parent Entity and/or the Reporting Entity by indicating the appropriate number code from the list below. There must be one Constituent Entity designated as the Ultimate Parent Entity, and another Constituent Entity designated as the Reporting Entity, or one Constituent Entity designated as both. There cannot be more than one Constituent Entity designated with these roles. For constituent entities that are neither the ultimate parent entity nor the reporting entity, leave this field blank. The valid constituent entity role codes are as follows:

Blank – Neither Ultimate Parent Entity and Reporting Entity (default value)

CBC801 – Ultimate Parent Entity

CBC802 – Reporting Entity

CBC803 – Both Ultimate Parent Entity and Reporting Entity

Name of the city of the address of the constituent entity

Enter the city name of the address of the constituent entity. If the constituent entity is a permanent establishment and has no address, enter the city name of the location of that permanent establishment.

Country code of the country of constituent entity's address

Enter the country code corresponding to the address of the constituent entity.

Tax identification number (TIN) of constituent entities

Enter the tax identification number used by the tax administration of the tax jurisdiction of the constituent entity. When the relevant constituent entity has a TIN that is used by the tax administration in its tax jurisdiction, such TIN is to be mandatorily provided. When a constituent entity does not have a TIN, the value “NOTIN” must be entered. This field must not be left blank.

Country code of the TIN

Enter the country code of the tax jurisdiction that issued the TIN. This country code must be provided when a TIN exists.

Tax jurisdiction of organization or incorporation if different from tax jurisdiction of residence

Enter the country code of the tax jurisdiction under whose laws the constituent entity of the MNE is organized or incorporated if it is different from the tax jurisdiction of residence.

Main business activities

Enter the main business activity(ies) carried out by the constituent entity in the relevant tax jurisdiction by checking one or more of the appropriate boxes. If “Other”, please specify the nature of the activity of the constituent entity in the “Other Information” section provided. More than one business activity can be checked.

PART III – ADDITIONAL INFORMATION SECTION

TABLE 3 – Additional information

Language

When additional information is provided in Table 3, indicate the language in which it is written by checking either “English” or “French”.

Additional Information

Enter further information or explanation that would facilitate the understanding of the compulsory information provided in the CbCR. Each line of additional information can contain up to 4,000 characters.

The Reporting MNE must provide a brief description of the sources of data used in preparing the Country-by-Country report in the Additional Information section.

If a change is made in the source of data used from year to year, the Reporting MNE must explain the reasons for the change and its consequences in the Additional Information section of the template.

If a line of additional information pertains to a specific country or to more than one country, you can enter one or more relevant country codes. If a line of additional information does not pertain to a specific country, leave this blank.

If a line of additional information pertains to summary information provided in Table 1, you can enter one or more 6 character summary reference codes. The summary reference codes are as follows:

- CBC601 – Revenues – Unrelated

- CBC602 – Revenues – Related

- CBC603 – Revenues – Total

- CBC604 – Profit or Loss

- CBC605 – Tax Paid

- CBC606 – Tax Accrued

- CBC607 – Capital

- CBC608 – Earnings

- CBC609 – Number of Employees

- CBC610 – Tangible Assets

If a line of additional information does not pertain to specific summary information provided in Table 1, leave this blank.

Filing this Report

Canadian corporations must file the RC4649 electronically, other than in the limited circumstances where they are subject to the local filing requirement and are filing the CbC report of the UPE under the secondary reporting mechanism. Partnerships and trusts are not able to use electronic filing and must file a CbCR in paper format. Further information on filing a CbCR, including assistance for corporations with electronic filing, is available in Guide RC4651, Guidance on Country-by-Country Reporting in Canada.

If the CbCR is filed in paper format, it must be filed separately from other filings to the CRA. Before filing this CbCR, make a copy of it for your records. Send the original return, amended return, or any other information to:

CbC Reporting & OECD Projects Section

International Tax Division

Canada Building, 18th Floor

344 Slater Street

Ottawa ON K1A 0L5

Penalties for non-filing or late-filing

There are penalties for failing to complete and file this CbCR by the due date.

Voluntary Disclosures

To promote compliance with Canada’s tax laws, we encourage you to voluntarily correct any deficiencies in your past tax affairs. You can make a voluntary disclosure by contacting your tax services office. The addresses and fax numbers are listed on our Web Site at canada.ca/taxes/.

For more information, see Information Circular IC00-1R6, Voluntary Disclosures Program (Income Tax Act).

See Also