This form only displays if you enter an amount greater than $0 on line 435 of the CO-17, Corporation Income Tax Return (Jump Code: QJ), or CO-17.SP, Information and Income Tax Return for Non-Profit Corporations (Jump Code: QJSP).

The custom question Do you want to complete the remittance slip? has been added to the form.

If you answer “Yes” to the question Do you want to complete the remittance slip? and the amount in the field “Amount remitted” is more than or equal to $2, Form CO-1027.P, Payment of Income Tax, Capital Tax, Registration Fee or Compensation Tax of a Corporation (Jump Code: 1027P) will become applicable. It will then be printed if you are using the “Client,” “EFILE - TED” or “GOVT RSI, Bar Codes - RDA, code à barres” or “Office” print format. You can define the answer to this new question for all of the returns in the preparer profile you are using, at point 2 of the CLIENT LETTER tab.

Note that only the French version of the printed form should be sent to Revenu Québec.

Payments must always be accompanied by a remittance slip.

If a CO-17 or CO-17.SP return, including attached documents, is accompanied by a remittance slip and the payment, all documents should be sent to one of the addresses in the Guide de la déclaration de revenus des sociétés (CO-17.G). When the income tax return is transmitted electronically and only the payment accompanied by the remittance slip must be transmitted to Revenu Québec, all documents must be sent to the address shown on the remittance slip.

However, note that Revenu Québec promotes the payment of income tax through Internet banking.

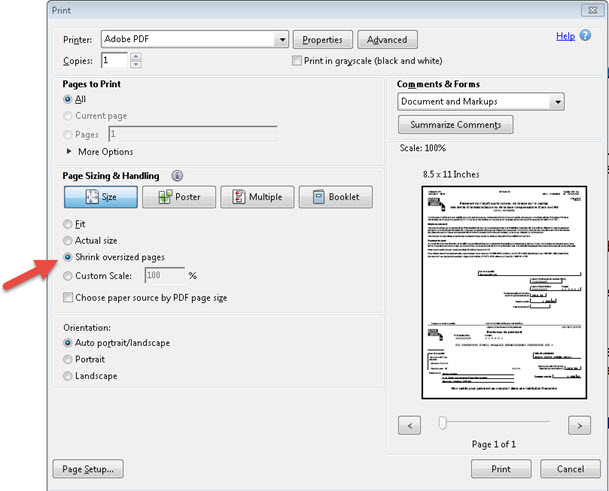

Where the form is to be printed from a PDF document, the option Actual size should be defined in the print settings as required by Revenu Québec.

See Also

Guide de la déclaration de revenus des sociétés (available in French only)