Payment threshold and frequency

A corporation must pay quarterly instalments if its total tax payable for its current year or its first instalment base exceeds $2,000 unless it is exempt from paying instalments for the year.

A corporation is exempt from paying instalments if it meets one of the following requirements:

- it is a CCPC, it claims the Alberta Small Business Deduction and its taxable income for the current year is equal to or lower than $500,000; or

- it is a CCPC, it claims the Alberta Small Business Deduction and its taxable income for the previous year is equal to or lower than $500,000.

Apply the current year refund to next year’s instalments

If you want to apply the current year refund against next year’s instalments, select code 2 on line 092 of the Alberta Corporate Income Tax Return (AT1) and select the appropriate check box in Form Alberta Tax Instalments (Jump Code: IAB).

This way, the program will include the refund amount from the AT1 return in the Refund transferred to instalments column of Form Alberta Tax Instalments to adjust the calculation of instalments payable in the next year. Note that the program determines the refund amount based on the payments entered in the Instalments paid column of Form Alberta Tax Instalments. Therefore, if the corporation has already made some instalment payments for the next year, it must enter these payment amounts in the Instalments paid column in order for the refund amount to be applied to the next instalment amount to make.

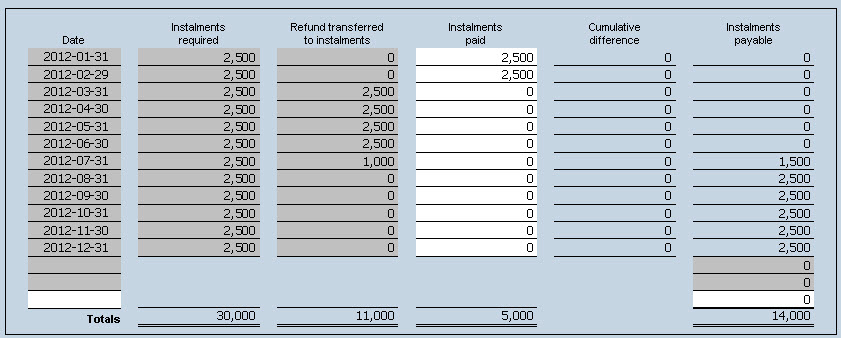

Here is an example demonstrating how the Refund transferred to instalments column works:

The corporation has an $11,000 refund and code 2 has been selected on line 092 of the AT1 return. The corporation has already made a $2,500 payment for the months of January and February. The refund will be applied to cover the payments for March, April, May and June entirely, as well as part of the July payment. Therefore, the corporation will have to pay an amount of $1,500 for the month of July.

Note: The Alberta government will first apply the refund against any outstanding balance of the corporation’s account, then any amount owed in any account of the corporation or any related business number accounts. Any excess amount will then be transferred to the corporation’s instalments for the next year The Alberta government will transfer the refund only if all the required returns for the corporation’s account or any related account have been filed.

Particular situations

Lines were added to calculate the first and second instalment base to allow for an adjustment when amalgamating, winding up, transferring or rolling over. For more information on this topic, refer to section 5301 of the Income Tax Regulations.

Corporation’s dissolution

Please note that if you have indicated, on line 078 of Form Identification (Jump Code: ID), that this is the final tax return of the corporation as a result of its dissolution, the program will not calculate any instalment payments, because there will be no taxation year after the year of dissolution.

References

For more information, refer to the Information Circular CT-3.

Guide to Completion of the Alberta Corporate Income Tax Return - Part 1