Refundable tax credits

The refundable tax credits can be estimated and deducted when calculating instalments. The program estimates the refundable provincial tax credits using the same credit amounts as the current year credits. Taking these tax credits into account reduces the amount of instalments that will have to be paid in the upcoming year.

Important: If you know that in the upcoming year the corporation will not be eligible for those refundable tax credits or that one or more of these credits will be lower for the current year, revise the refundable provincial tax credit amounts that are used in the calculation of instalments using an override. Please note that if you omit to make these adjustments, and thus, allow for too great a reduction of the instalments using these refundable tax credits, the corporation may have to pay interest and/or penalties to the CRA.

If you have to make changes for a province or territory other than Alberta or Québec, make the required modifications on the line Provincial/territorial refundable tax credits other than Alberta, Québec and Ontario and/or on the line Ontario refundable tax credits located under the title “Estimated current year credits.”

Payment threshold and frequency

A separate threshold is examined to determine whether the corporation is required to pay instalments with respect to its tax payable according to parts I, VI, VI.1 and XIII.1 and whether it is required to pay instalments with respect to its provincial or territorial tax.

If you choose method 2 and you want the first two payments to be calculated without taking the applicable threshold into account, answer Yes to the question at the beginning of Section 2, “Combined 1st and 2nd instalment base method.” This situation can occur, for example, when the return is not yet completed, but you are sure that if it was, the threshold would be reached and instalments would be payable.

It is also possible to make payment calculations even if the threshold is not reached by selecting the Select this box if you want the instalments to be calculated without taking the applicable threshold into account check box which appears in the 'Payment method' section.

The corporate income tax instalment threshold is $3,000. An eligible CCPC may pay its income tax via quarterly instalments.

A CPCC is eligible if it meets the following conditions:

- when the payment is due, the corporation has a perfect compliance history;

- an amount has been deducted in accordance with section 125 ITA in the calculation of the corporation’s tax payable for the current or previous taxation year;

- the corporation, and any of its associated corporations, has taxable income for the current or previous taxation year not exceeding $500,000;

- the corporation, and any of its associated corporations, has taxable capital employed in Canada for the current or previous taxation year not exceeding $10,000,000.

Note: For purposes of quarterly instalments eligibility, a perfect compliance history means that, throughout the preceding 12 months, a corporation has remitted, as and when required, all amounts with respect to income tax, GST/HST, Canada Pension Plan contributions and Employment Insurance premiums, and filed all tax returns as and when required.

A section entitled “Quarterly instalments calculation” allows you to calculate these instalments. To be able to pay quarterly instalments, the corporation will have to meet the eligibility criteria stated by means of questions at the beginning of this section.

However, note that the corporation can choose to continue making monthly instalments, even if it is eligible for quarterly instalments. To make this choice, select the check box provided to that effect at the end of the questionnaire.

If the corporation opts to pay income tax via quarterly instalments, you must ensure at all times that the corporation meets the criteria required to qualify as a small Canadian-controlled private corporation as defined in subsection 157(1.2) ITA.

When the corporation no longer meets the requirements to opt for quarterly instalments at a particular time during the taxation year, a return to monthly instalment payments at the end of the month following the particular time is determined under subsection 157(1.5) ITA.

Apply the current year refund against next year’s instalments

If you want to apply the current year refund against next year’s instalments, select code 2 on line 894 of the T2 return and select the appropriate check box in Form Federal Tax Instalments (Jump Code: IFED).

This way, the program will include the refund amount from the T2 return in the Refund transferred to instalments column of Form Federal Tax Instalments to adjust the calculation of instalments payable in the next year. Note that the program determines the refund amount based on the payments entered in the Instalments paid column of Form Federal Tax Instalments. Therefore, if the corporation has already made some instalment payments for the next year, it must enter these payment amounts in the Instalments paid column in order for the refund amount to be applied to the next instalment payment to make.

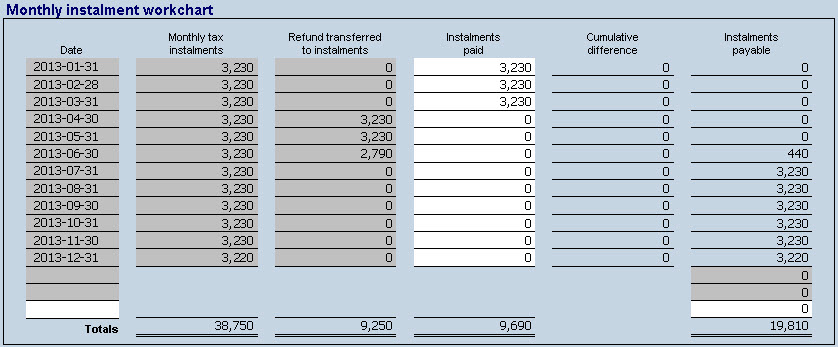

Here is an example demonstrating how the Refund transferred to instalments column works:

The corporation has a $9,250 refund, and code 2 has been selected in the Corporation Income Tax Return (T2). The corporation has already made a $3,230 payment for the months of January, February and March. The refund will be applied to cover the April and May payments entirely, as well as part of the June payment. Therefore, the corporation will have to pay an amount of $440 for the month of June.

Note: The CRA will first apply the refund against any outstanding balance of the corporation’s account, then any amount owed in any account of the corporation or any related business number accounts. Then the CRA will transfer the excess amount to the corporation’s instalments for the next year. The CRA will transfer the refund only if all the required returns for the corporation’s account or any related account have been filed.

Particular situations

Lines are provided in Section 2 to allow for an adjustment when there is an amalgamation, a wind-up, a transfer or a rollover. For more information on this topic, refer to section 5301 of the Income Tax Regulations.

Corporation’s dissolution

Please note that if you have indicated, on line 078 of Form Identification (Jump Code: ID), that this is the final tax return of the corporation as a result of its dissolution, the program will not calculate any instalment payments, because there will be no taxation year after the year of dissolution.

References

For more details, refer to the Corporation Instalment Guide.

See also