Release Notes - CCH iFirm Taxprep T2 2023 v.2.0 (2023.40.36)

New: Introducing Wolters Kluwer Support Platform

As part of our commitment to service, Wolters Kluwer is pleased to announce the launch of our new Support Platform.

Register to our Support Platform to submit, modify and track all your support requests in a single location. A chat feature powered by our virtual assistant is also included, with access to over 40,000 articles from our knowledge base to ensure your inquiries are addressed promptly. Note that as of December 1, 2023, email support service will be discontinued and replaced by support tickets created from the new platform.

If you need help during the registration process, please consult the following article to get all the information you need: How do I register to the new Support Platform?

Register now to our Support Platform and take advantage of all the benefits it has to offer!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Taxprep is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T2

With CCH iFirm Taxprep T2, have the most comprehensive collection of corporate tax forms available, as well as tools designed to address complex T2 preparation requirements. CCH iFirm Taxprep T2 also provides you with:

- the possibility of attaching supporting documents to electronically transmitted returns;

- GIFI data transfers.

Taxation Years Covered

CCH iFirm Taxprep T2 2023 v.2.0 is designed to process corporate tax returns with taxation years beginning on or after January 1, 2021, and ending on or before May 31, 2024.

Overview - Version 2.0

CCH iFirm Taxprep T2 2023 v.2.0 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

Additional letters added

Five new additional letters have been added, now giving you access to a total of 10 customizable letters. For more information, consult the note relating to this subject.

New Form CO-737.18.17, Deduction for Income from a Large Investment Project

This new multiple copy form is intended for any corporation that, for a taxation year, can claim a tax holiday on income from eligible activities relating to one or more large investment projects that it or a partnership of which it is a member is carrying out. For more information, consult the note relating to this subject.

Schedule 89 and Schedule T2054

A number of improvements have been made to these schedules to help you complete them and comply with CRA requirements. For more information, consult the note relating to the improvements and the note relating to the update of the forms.

Improve Your Productivity

Additional letters added

Five new Additional letters have been added, giving you access to a total of 10 customizable letters. Therefore, templates for Additional letters 6 to 10 have been added to allow you to customize the content of these five new letters. The print options have been added to the Client Letter tab of the Preparer Profiles and the Client Letter Worksheet. To make these letters applicable, select the box(es) corresponding to your needs.

Additional letters added

Five new Additional letters have been added, giving you access to a total of 10 customizable letters:

-

Client letter – Additional client letter 6

-

Client letter – Additional client letter 7

-

Client letter – Additional client letter 8

-

Client letter – Additional client letter 9

-

Client letter – Additional client letter 10

Templates for Additional letters 6 to 10 have been added to allow you to customize the content of these five new letters. The print options have been added to the Client Letter tab of the Preparer Profiles and the Client letter Worksheet. To make these letters applicable, select the box(es) corresponding to your needs.

Federal

Schedule 38, Part VI Tax on Capital of Financial Institutions; and

Schedule 39, Agreement Among Related Financial Institutions – Part VI Tax

Schedules 38 and 39 are also applicable in the following situations: when the amount on line 831, Gross Part VI tax (line 825 or amount 5B, whichever applies), of Schedule 38 is equal to zero, and when the filing corporation that is a financial institution at any time during the tax year was related to another financial institution at the end of the year and an amount appears on line 450, Allocation of capital deduction, of Schedule 39.

In addition, according to CRA requirements, Schedule 38 is also applicable when the filing corporation is a financial institution at any time during the tax year and there is a current-year unused Part I tax credit at line 870.

Schedule 42, Calculation of Unused Part I Tax Credit

According to CRA requirements, this schedule is also applicable when the filing corporation is a financial institution at any time during the tax year and there is a current-year unused Part I tax credit at line 600.

Schedule 89, Request for Capital Dividend Account Balance Verification; and

T2054, Election for a Capital Dividend Under Subsection 83(2)

It is now possible to enter amounts with two decimals in Schedule 89 and in the T2054 form.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the values entered in the amount fields will be retained in both forms.

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates

The custom question Will Form T1134 be filed by another representative reporting entity for the related group? has been added, on screen only, at the top of the T1134 Summary Form, under the question Do you want to file Form T1134?. The default answer to this question is set to No. You must answer Yes to the new question when the corporation is part of a related group and is not filing Form T1134. In this situation, box 271 Did the corporation have any foreign affiliates in the tax year? of the T2 return will be set to Yes and the form will not be applicable.

New Forms

Québec

CO-737.18.17, Deduction for Income from a Large Investment Project

As a result of the 2023-2024 Québec budget tabled on March 21, 2023, and effective as of that date, the tax holiday relating to the carrying out of a large investment project (former TH-LIP) is eliminated.

In this context, no new application for the issuance of an initial certificate relating to a large investment project will be accepted by the Minister of Finance with respect to the application of the former TH-LIP. However, this elimination will not affect the eligibility for the former TH-LIP of corporations that already hold an initial certificate with respect to a project, nor that of partnerships and corporations that are members thereof that already hold such a certificate or that have already applied for the issuance of an initial certificate. These corporations and partnerships will continue to benefit from the tax holiday until the end of the exemption period for the project, in accordance with the rules currently applicable.

This multiple copy form is intended for any corporation that, for a taxation year, can claim a tax holiday on income from eligible activities relating to one or more large investment projects that it or a partnership of which it is a member is carrying out. The 15-year tax holiday may not exceed 15% of the total qualified capital investments relating to the project.

The holiday consists of a deduction when calculating the corporation's taxable income for the taxation year. The deduction is based on the corporation's separate business income, which is earned from eligible activities relating to the corporation's large investment project, or that of the partnership of which the corporation is a member.

To claim the deduction, a corporation or a partnership must have obtained an initial certificate issued by the Minister of Finance before March 21, 2023.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount is entered in the field Income from a large investment project (code 12) of Form Deductions from Taxable Income, it will be retained as an overridden amount. You will then need to complete Form CO-737.18.17 and delete the overridden amount in the field Income from large investment project (code 12) of Form QC L265/266 so that the deduction entered in Form CO-737.18.17 is updated in Form QC L265/266.

For more information on this deduction, refer to the help topic of this form as well as sections 737.18.17.1 to 737.18.17.13 of the Québec Taxation Act.

Deleted Forms

Québec

-

CO-737.SI, Deduction for Innovative Manufacturing Corporations

Alberta

-

AT1 Schedule 9, Alberta Scientific Research & Experimental Development (SR&ED) Tax Credit

-

AT1 Schedule 9 Listing, Listing of SR & ED Projects Claimed

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

T2 Bar Code Return

Part VI.2 tax payable (line 725 of the T2 return) has been added to the form.

Corporate Identification and Other Information

The question Does the corporation carry on logging operations, or is it a member of one or more partnerships that carry on logging operations? has been added to the General information section. If the answer to this question is Yes, the program:

-

will display a diagnostic to verify if you are required to complete Form COZ-1179 when the corporation has a permanent establishment in Québec and Form COZ-1179 is not applicable; or

-

will display a diagnostic to verify if you are required to complete Form FIN 542 when the corporation has a permanent establishment in British Columbia and Form FIN 542 is not applicable.

The program retains the answer to this question during roll forward.

Schedule 2, Charitable Donations and Gifts*

Following the announcement of the 2023 budget of British Columbia, the British Columbia farmers’ food donation tax credit has been extended until December 31, 2026.

Schedule 5, Tax Calculation Supplementary – Corporations*

The following lines have been added to this schedule:

-

Line 524, Newfoundland and Labrador all-spend film and video production tax credit

-

Line 842, Certificate number

-

Line 474, Ontario made manufacturing investment tax credit (from Schedule 572)

Schedule 8 WORKCHART, Capital Cost Allowance (CCA) Workchart

To correctly calculate the UCC adjustment for AIIP and property included in Classes 54 to 56 (ZEP) according to the factor of the relevant period when the property became available for use during the taxation year, the line Cost of additions that are AIIP or ZEV included in the amount on line 203 has been split into multiple Cost of additions included on line 203 that are AIIP or ZEP lines:

-

For CCA classes other than 10.1, 13 and 14, there are now three lines: Available for use before 2024, Available for use in 2024 and 2025, and Available for use in 2026 and 2027;

-

For CCA Class 13, there are now two lines: Available for use before 2024 and Available for use after 2023 and before 2028.

These lines will calculate according to the acquisition date entered for each property recorded in the custom form Additions and Dispositions Workchart, when used, or according to the taxation year’s start and end dates. In the second situation, when the taxation year overlaps two periods, a diagnostic will prompt you to enter the correct amount on one of the two relevant lines, and the second line will calculate as the difference between the amount entered on line Additions (property subject to subsection 1100(2) ITR) and the amount entered by override on the first line.

For CCA Classes 10.1 and 14, the UCC adjustment factor will be determined according to the Acquisition date entered.

Note that the immediate expensing measure ends on December 31, 2023. Any property that becomes available for use in the taxation year after 2023 is no longer eligible.

In the Québec column, for CCA classes other than 10.1, 13 and 14 that may include property that qualify for the accelerated depreciation special rules, the line Capital cost of property qualified for the accelerated depreciation special rules in Québec included in the amount on line 203 has also been split into three lines: Capital cost included on line 203 of property qualified for the accelerated depreciation special rules in Québec: Available for use before 2024, Available for use in 2024 and 2025 and Available for use in 2026 and 2027.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, an amount entered as an override on line Cost of additions that are AIIP or ZEV included in the amount on line 203 is retained, either on line Cost of additions included on line 203 that are AIIP or ZEP – Available for use before 2024 when the taxation year starts before 2024, or on line Cost of additions included on line 203 that are AIIP or ZEP – Available for use in 2024 and 2025 when the taxation year starts after 2023. The same principle applies to the new lines for CCA classes including property qualified for the accelerated depreciation special rules in Québec under the Québec column.

Furthermore, in Part Information relating to class 14.1, line If the election under subparagraph 13(38)(d)(iv) ITA is made for one property in the class, enter the capital gain or the amount to include in income has been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, any amount entered on this line is not retained.

Finally, the Part Additional capital cost allowance (CCA) for Québec, for the calculations of the additional CCA of 35% and 60% for property included in CCA classes 50 and 53 acquired before December 4, 2018, has been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, any amount entered on the lines in this part is not retained.

Schedule 9 WORKCHART, Related and Associated Corporations Workchart

Part Québec CO-737.SI – Deduction for innovative manufacturing corporations has been removed from the schedule, as Form CO-737.SI has been deleted. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered in this section, it will not be retained.

In addition, following the removal of Alberta Schedule 9) and Alberta Form A9 Listing from the program, Part Alberta AT1 Schedule 9 – Alberta scientific research & experimental development (SR&ED) tax credit have been removed.

Schedule 12, Resource-Related Deductions

A custom field has been added under lines 346, Accelerated Canadian development expenses (ACDE) incurred during the tax year (included in current-year expenses), and 446, Accelerated Canadian oil and gas property expenses (ACOGPE) incurred during the tax year (included in current-year expenses), to enter the amount of the expenses that have been incurred in the taxation year before 2024 and calculate the applicable average rate for the deduction in a taxation year that straddles January 1, 2024.

Schedule 35, Taxable Capital Employed in Canada – Large Insurance Corporations*

Lines 107 to 109 and 207 to 210 have been added to Part 1 to reflect the modifications that were made to paragraphs 183.3(3)(b), (c) and (d) ITA, which are applicable to taxation years beginning after December 31, 2022.

In the official update of Schedule 35, column 7, Deferred tax debit balance, in Table 2 as well as lines 121, 201, 221, 223, 343 and 344 in Part 1 have been removed. However, since we are still covering taxation years beginning before January 1, 2023, column 7 will only appear when the taxation year begins before January 1, 2023. Lines 121, 201, 221, 223, 343 and 344 have been retained on this schedule, as they are useful for calculating capital for the year on lines 190, 290 and 390, as were formerly read paragraphs 181.3(3)(b), (c) and (d) ITA.

In addition, in the official update of this schedule, former columns 5, 6, 8 and 9 have been renumbered from 7 to 10, and the following columns have been added to Table 2 to reflect the modifications that were made to subsection 8605(1) of the Income Tax Regulations, which are applicable to taxation years beginning after December 31, 2022:

-

Column 5, 90% of the end of year net CSM; and

-

Column 6, Policyholders’ Liabilities.

Schedule 38, Part VI Tax on Capital of Financial Institutions*

Lines 151 to 171 have been added to Part 1 to reflect the modifications that were made to paragraph 190.13(b) ITA, which are applicable to taxation years beginning after December 31, 2022, if the corporation is a life insurance corporation that was resident of Canada at any time in the year.

In the official update of this schedule, column 7, Deferred tax debit balance, in Table 2 has been removed. However, since we are still covering taxation years beginning before January 1, 2023, column 7 will only appear when the taxation year begins before January 1, 2023.

In addition, in the official update of this schedule, former columns 5, 6, 8 and 9 have been renumbered from 7 to 10, and the following columns have been added to Table 2 to reflect the modifications that were made to subsection 8605(1) of the Income Tax Regulations, which are applicable to taxation years beginning after December 31, 2022:

-

Column 5, 90% of net CSM; and

-

Column 6, Policyholders’ Liabilities.

When the corporation is a life insurance corporation that was resident of Canada at any time in the year and its taxation year begins before January 1, 2023, you must complete lines 102 to 106, as well as lines 121 and 122 to calculate the capital of the year on line 190, as was formerly read paragraph 190.13(b) ITA.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the corporation is a life insurance corporation that was resident of Canada at any time in the year and its taxation year begins after December 31, 2022:

-

If an amount was entered as a substituted value on lines 102 to 106 and 122, these values will be retained as substituted values on new lines 151 to 153, 156, 157 and 165.

-

If an amount was entered as a substituted value on lines 101 and 121, these values will not be retained as substituted values, as they are not applied in the calculation of the capital for the year on line 171.

Schedule 65, Air Quality Improvement Tax Credit*

The question on line 120 has been reworded to comply with the definition of “qualifying corporation”. Thus, a corporation with taxable capital equal to or greater than $15 million does not qualify for the credit.

Schedule 89, Request for Capital Dividend Account Balance Verification; and

T2054, Election for a Capital Dividend Under Subsection 83(2)

In response to the CRA's request, a custom question has been added to confirm that the business number on line 001 of part 1 is the one of the corporation listed on line 002. This question will be mandatory for all electronic filling.

Also, according to CRA requirements, when the answer on lines 004 and 005 of Schedule 89 is equal to No, the schedule must not be transmitted electronically. Therefore, Schedule 89 electronic filing status will be Not eligible in this case and you must answer No to the question Is Schedule 89 ready to be transmitted or retransmitted?. Note that Schedule 89 is still applicable in this situation but will only be printed for your records and those of your client.

In addition, for Form T2054 only, the custom question Has Form T2054 been paper filed? has been added to the Electronic Filing section. You must answer this question in order for the program to be able to correctly calculate the electronic filing status of Form T2054. When the answer to this question is No, the electronic filing status of Form T2054 will be at Eligible.

Schedule 141, General Index of Financial Information (GIFI) – Additional Information*

AUTO LEASE, Automobile Expenses – Non-Deductible Leasing Costs and Other Expenses

Subsection Calculations for Québec has been removed from the form. This subsection is no longer needed to calculate the amount on line 37 of Form CO-17.A.1, Net Income for Income Tax Purposes, as the Canada Revenue Agency and Revenu Québec now use the same limits regarding non-deductible leasing costs. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amount indicated in this subsection will not be retained.

Client Letter Worksheet

Following the removal of Alberta Form A9 Listing from the program, the A9 LISTING check box has been removed from the AT1 – Paper format and AT1 – NET FILE sections.

In addition, the question Do you want to use the extended balance-due day (COVID-19)? and the field Extended balance-due day have been removed from sections T2 – Paper format and T2 – Internet filing.

Similarly, the question Do you want to use separate balance-due days for income tax and for tax on capital and compensation tax (COVID-19)? as well as the fields in subsection COVID-19 – Deferred balance-due day have been removed from section CO-17 – Internet filing.

Finally, the client letter Filing Instructions has been updated to reflect these changes.

Inducement

Line Portion of the Alberta scientific research & development (SR & ED) tax credit that relates to the prescribed proxy amount (PPA) and portion of the Alberta investment tax credit that relates to contributions made to SR&ED farming organizations has been removed from the Alberta section of the form.

Instalment, Federal Tax Instalments

The question Do you want to calculate the tax instalments according to the extended payment date (COVID-19)? has been removed from the form.

Client letter, Filing Instructions

According to Revenu Québec requirements, if Form COZ-1179 is applicable, it must be transmitted to Revenu Québec, either through "My Account for businesses" or by mail, along with any required documents, if applicable, to the following address: 3800, rue de Marly, Québec (Québec) G1X 4A5.

Therefore, a paragraph has been added to the client letter to reflect this Revenu Québec requirement.

Interest, Interest and Late-filing Penalty

The question Do you want to calculate the interest on the balance unpaid for income tax separately from the tax on capital and compensation tax (COVID-19)? as well as the fields related to these calculations have been removed from the Québec section of the form.

Representative Authorization Request; and

Request to Cancel Authorization for a Representative

The CRA has updated the list of program identifiers that are accepted for the electronic transmission of the forms. The program identifier SL – Softwood lumber products export charge has been removed and the following four identifiers have been added:

-

LT Luxury Tax

-

RR Registered charities

-

RU Underused Housing Tax

-

ZA Canada Emergency Rent Subsidy, Tourism and Hospitality Recovery Program – Rent, Hardest-Hit Business Recovery Program – Rent

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, when the code SL is inputted as a program identifier, it is not retained.

RSI, Electronic Filing and Bar Codes Control Workchart

Following the modifications to subsection 205.1(2) of the Income Tax Regulations, the answer to the question Must this return be electronically filed with the CRA in pursuance of subsection 150.1(2.1) ITA? will be calculated to Yes when a Canadian corporation is filing an initial T2 return for a taxation year starting after 2023 and the corporation is not an insurance corporation, not reporting in functional currency, not exempt from tax under section 149 ITA or has not indicated making an application under the CRA’s Voluntary Disclosures Program for this tax return.

Also note that, starting with the 2024 calendar year, a person (or a partnership) is deemed, under subsection 150.1(2.2) ITA, to be a tax preparer for a calendar year if, in the year, it accepts consideration to prepare more than five returns of income (instead of the previous ten) of corporations, more than five returns of income (instead of the previous ten) of individuals, or more than five returns of income of estates or trusts. Penalties may be applied when the tax preparer exceeds the five-return threshold. Furthermore, following the publication of Information Bulletin 2023-4 by the Minister of Finance of Québec, this modification also applies, for the purpose of filing CO-17 returns in Québec, to the definition of “tax preparer” in section 37.1.4 of the Tax Administration Act, except for the reference relating to the returns of income of estates or trusts.

Summary, Corporate Taxpayer Summary

Following the update of Form CO-1029.8.36.EM, line Non-refundable tax credit for resources – CO-1029.8.36.EM has been removed from section Summary of provincial carryforward amounts.

In addition, subsection Québec in section Summary – taxable capital has been modified to remove the column Paid-up capital used to determine the applicability of Form CO-737.SI.When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered in this column, it will not be retained.

T183, Information Return for Corporations Filing Electronically*

Line 770 from the T2 return is now displayed in Part 2 of the form.

T217, Election or Revocation of an Election to use the Mark-to-Market Method*

T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim

Following the removal of Alberta Schedule 9 from the program, line 429d1, Alberta SR&ED tax credit, excluding the portion of the prescribed proxy amount, and line 513d1, Alberta SR&ED tax credit, have been removed from the form.

In addition, the year’s maximum pensionable earnings amount for purposes of the Canada pension plan has been updated for the 2024 calendar year (and is now $68,500). This amount is used to determine the specified employees’ salary or wages in Part 5 when the proxy method is selected to calculate the SR&ED expenditures.

T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim, Part 2 – Project Information

Following the removal of Alberta Schedule 9 and Alberta Form A9 Listing from the program, the custom check box Select this check box if a part or all of the SR&ED expenditures for this project were incurred in Alberta before January 1, 2020 has been removed from the form.

T1044, Non-Profit Organization (NPO) Information Return*

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates*

It is no longer possible to enter a value greater than 100% in column Reporting entity's (-ies') participating percentage for the year in the table under point (iii) in Section 3 of Part III. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if a percentage greater than 100% was entered in this column, it will not be retained.

T1263, Third-Party Payments for Scientific Research and Experimental Development (SR&ED)

Following the removal of Alberta Schedule 9 and Alberta Form A9 Listing from the program, the custom check box Select this check box if a part or all of the SR&ED expenditures of the third party were incurred in Alberta before January 1, 2020 has been removed from the form.

T2183, Information Return for Electronic Filing of Special Elections*

AgriStability and AgriInvest Programs – Harmonized Provinces* and British Columbia*

Line Cellphone number has been added to subsections Participant identification and Contact person information.

As of the 2023 program year, when the corporation farms in the Northwest Territories, it can participate in the AgriStability or the AgriInvest program, or both. In addition, this territory is now part of the harmonized provinces. When you select Northwest Territories on line Province of main farmstead at the top of the form, the harmonized version of Statement A will be displayed.

AgriStability and AgriInvest Programs – Ontario*

AgriStability and AgriInvest – Programs – Alberta*

At the top of the AgriStability Supplementary Form, the lines Subscription and Year have been removed. In addition, the section AgriStability Form Prepared by has been renamed to You may provide the name of the Form Preparer, and the lines Street \ Mailing, Town / City, Provinces, Postal Code, Fax and Email have been removed.

AgriStability and AgriInvest Programs – Saskatchewan*

The units displayed in section 9 have been modified. Here are the changes:

|

Code |

Old text |

New text |

|

104 |

Number of cows that calved |

Number of females that have birthed |

|

123 |

Number of sows that farrowed |

Number of females that have birthed |

|

145 |

Number of sows that farrowed |

Number of females that have birthed |

|

105 |

Number of animals fed |

Number of opening or purchased animals fed |

|

106 |

Number of animals fed |

Number of opening or purchased animals fed |

|

125 |

Number of animals fed |

Number of opening or purchased animals fed |

|

124 |

Number of animals fed |

Number of opening or purchased animals fed |

|

141 |

Number of animal fed days |

Number of animal feed days |

|

142 |

Number of animal fed days |

Number of animal feed days |

AgriStability and AgriInvest Additional Information and Adjustment Request*

Ontario

Schedule 500, Ontario Corporation Tax Calculation*

The business limit reduction calculation in Part 2 is now performed on two lines. Line 2E is used for taxation years starting before April 7, 2022, and line 2F is used for taxation years starting after April 6, 2022.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, amounts entered using an override in the fields of line 2E are carried over to the fields of line 2F for taxation years starting after April 6, 2022.

Québec

Registration Fees

The registration fees on line 441b on CO-17, Corporation Income Tax Return and CO-17.SP, Information and Income Tax Return for Non-Profit Corporations will be indexed on January 1, 2024. The amount for cooperatives will increase from $45 to $46, the amount for non-profit legal persons (incorporated association), a syndicate of co-ownership and fraternal benefit societies, from $38 to $39, and the amount for corporations, mutual insurance corporations and other entities, from $98 to $101.

CO-17, Corporation Income Tax Return*

In section 2, Information about the corporation, line 28b, If you checked Yes, enter the amount of the income tax withheld at source, has been removed. In section 5, Balance due or refund, the custom line Amount of withholding tax has been replaced by the new line 440b, Income tax withheld at source, for corporations that have had tax withheld at source (non-resident corporations). Henceforth, the calculation of line 440, Instalments made (form CO-1027.VE), includes only the amounts entered on Form Instalments Made and Balance Paid by a Corporation, since the income tax withheld at source must be entered on line 440b. Also, the new line 440b should be completed if you answered Yes at box 28a, Did the corporation receive a payment from which income tax was withheld? When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered on the custom line Amount of withholding tax, it will be transferred to the new line 440b.

To harmonize with federal legislation, Revenu Québec has stated that the use of the Japanese yen as a functional currency when filing CO-17 returns is now allowed. In section 2, the Japanese yen has been added to the list of currencies that can be entered on line 40a, If you checked Yes, enter the currency code.

Please note that the code for the deduction relating to the completion of a large investment project (code 20) in the calculation of taxable income can now be entered on lines 265 and 266 via the custom form Deductions from Taxable Income.

Following the publication of Information Bulletin 2023-4 by the Minister of Finance of Québec, any payment for income tax or for an instalment remittance over $10,000 made after December 31, 2023, must be made by electronic means through a financial institution or with a pre-authorized debit agreement.

CO-17.A.1, Net Income for Income Tax Purposes

The deductions associated with codes 04, Additional capital cost allowance of 35% in respect of property that is computer equipment or that is used in manufacturing or processing activities, and 05, Additional capital cost allowance of 60% in respect of property that is computer equipment or that is used in manufacturing or processing activities, are no longer calculated in this version. Lines 129a, 129b and 129c show the deductions calculated for codes 01, 03 and 06 respectively.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, codes 04 and 05 and the amounts associated with these codes are not retained for lines 129a to 129k in the Current year and the Prior year columns.

CO-400, Resource Deduction

Custom fields have been added under lines 47, Accelerated COGPE incurred in the taxation year, and 100, Accelerated CDE incurred in the taxation year, to enter the amount of the expenses that have been incurred in the taxation year before 2024 and calculate the applicable average rate for the deduction, respectively on lines 73 and 137, in a taxation year that straddles January 1, 2024.

CO-771, Calculation of the Income Tax of a Corporation*

The custom line a1 relating to the calculation of the number of hours paid to company employees before June 30, 2020, has been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered on this line, it will not be retained.

CO-771.2.1.2, Income of a Corporation That Is a Member or Designated Member of a Partnership From an Eligible Business Carried On in Canada by the Corporation*

In section 3.1, Income (or loss) from the partnership, without taking into account the business limit, the description of lines 12b, 12c, 14b and 14c has been updated so that changes made on the screen in the prior version of the program are reflected when the form is printed.

Similarly, lines 12a, Reserve from the previous year related to a partnership's qualifying transitional income, and 14a, Reserve for the year related to a partnership’s qualifying transitional income if the corporation is a member of the partnership, have been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, amounts entered on lines 12a and 14b will not be retained.

CO-1029.8.33.13, Tax Credit for the Reporting of Tips

This form has been updated in order to integrate the various applicable rates for 2024.

CO-1029.8.33.CS, Tax Credit for the Retention of Persons With a Severely Limited Capacity for Employment*

The year 2020 has been removed from box 6, and a new box for 2024 has been added.

CO-1029.8.36.EL, Tax Credit for Book Publishing*

Box a, The application for an advance ruling or for a qualification certificate was filed with SODEC before March 22, 2023, and box b, The application for an advance ruling or for a qualification certificate was filed with SODEC after March 21, 2023, of Part 2, Information about the work or groups of works, have been replaced by boxes 8a and 8b respectively.

CO-1029.8.36.EM, Tax Credit Relating to Resources*

Check boxes 05n, The qualified corporation did not incur any eligible mining exploration expenses in the Near North or Far North after March 17, 2016, or it incurred such expenses and is completing the copy of Form CO-1029.8.36.EM for the aggregate of the eligible expenses incurred before March 18, 2016, and 05o, The corporation incurred eligible mining exploration expenses in the Near North or Far North after March 17, 2016, and is completing this copy of Form CO-1029.8.36.EM for the aggregate of the eligible expenses incurred after that date, as well as Part 2, have been removed. In addition, Parts 2 to 9, which were previously in Form CO-1029.8.36.EM PARTS 2 to 9, have been added to Form CO-1029.8.36.EM and renamed Parts 2 to 8.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if amounts are entered in Parts 2 to 9 and check box 05o is selected, the amounts entered in Parts 2 to 8 will be retained.

Part 11 relating to the temporary increase from a previous year has been removed, as it is no longer applicable.

CO-1029.8.36.II, Tax Credit for Investment and Innovation*

CO-1029.8.36.IN, Tax Credit for Investment

The custom check boxes related to the date of eligible expenses have been removed.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the value of this field is not retained, and the form calculations are performed solely based on the criteria related to eligible expenses incurred after 2019.

CO-1029.8.36.XM, Tax Credit for the Production of Multimedia Events or Environments Presented Outside Québec*

Box 17, box 18 and the custom box Limit based on the cumulative production costs: select the box if an advance ruling or a qualification certificate application was filed with the SODEC after March 21, 2023, have been replaced by boxes 18a and 18b in section 2, Information about the qualified production. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the information will be transferred to the new box 18b if you had selected the custom box and box 18. If you had selected the custom box only, the information will also be transferred to box 18b. If you had not selected the custom box, but had selected box 17 or 18, the information will be transferred to the new box 18a. In all other cases, you must specify when the application was submitted to the SODEC.

If box 18a is selected, the applicable rate for the limit will be 50% in section 4.3, Limit based on the cumulative production costs. If box 18b is selected, the applicable rate will be 60%.

Lines 173 to 180 have been removed from section 5, Tax credit, since this part applied to advance ruling or qualification certificate applications that were filed with the SODEC before March 28, 2018.When opening a return prepared with a prior version of CCH iFirm Taxprep T2, amounts entered on lines 173 to 180 will not be retained.

FM-220.3, Property Tax Refund for Forest Producers*

Q1 L70A, Taxable Tax Credits and Q1 L140A, Non-Taxable Tax Credits

The following credit code have been removed from both forms

-

069, Temporary increase in the tax credit relating to mineral resources (for expenses incurred after June 12, 2003)

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount had been entered on one of these code lines, it will not be retained.

QC Instalment, Québec Tax Instalments

The question Do you want to calculate the tax instalment payments according to the extended payment date (COVID-19)? has been removed from the form following its update.

QC L265-266, Deductions from Taxable Income

Code 20, Deduction relating to the completion of a large investment project, has been added to the form.

In addition, line 17, Deduction for innovative manufacturing corporation, has been removed from the form, as Form CO-737.SI has been deleted. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was calculated or entered by override on this line, it will not be retained.

QC L440P-Y, Additional Québec Credits

The following credit code has been removed from the form:

-

069, Temporary increase in the tax credit relating to resources (CO-1029.8.36.EM)

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if there was an amount on the line for this code, it will not be retained.

TP-1086.R.23.12, Costs Incurred for Work on an Immovable*

In Part 1 of the form, the corporation filing the CO-17 return cannot be a sole proprietor, a co-owner or a member of a partnership that is not required to file an RL-15 slip, a cooperative or a trust. For this reason, the fields indicating that the payer is a sole proprietor, a co-owner or a member of a partnership that is not required to file an RL-15 slip, a cooperative or a trust have been removed from Part 1.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, data entered in these fields will not be retained.

In addition, in Part 2, the Province field has been added.

In Part 3, the Identification number field has been added on screen only and must be completed if the business carrying out the work doesn’t have a QST registration number.

British Colombia

Schedule 425 (T666), British Columbia Scientific Research and Experimental Development Tax Credit*

Line 360, Total capital BC qualified expenditures in the tax year before 2014, has been removed.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered on this line, it will not be retained.

Schedule 429, British Columbia Interactive Digital Media Tax Credit*

The credit can now be claimed for eligible salary and wages incurred before September 1, 2028. Line 345, Was the corporation at any time in the tax year an eligible business corporation registered under Part 2 of the Small Business Venture Capital Act, and the tax year ends before February 22, 2017?, has been removed from the form, as the taxation year to which it referred to is no longer supported by this version.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was entered on this line, it will not be retained.

Alberta

AB Instalment, Alberta Tax Instalments

The question Do you want to calculate the tax instalments according to the extended payment date (COVID-19)? has been removed from the form.

AT1, Alberta Corporate Income Tax Return*

The Alberta Investor Tax Credit and the Capital Investment Tax Credit, calculated in Schedule 3 Alberta Other Tax Deductions and Credits, are now displayed on line 076 Other deductions per ATI Schedule 3 (AITC and CITC). The form no longer offers the option to manually input a deduction or a credit in the Basic Alberta Tax Payable section.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amount entered by override on line 76a is retained as an overridden value on line 076.

In addition, currently, it is not possible to select the Japanese yen as a functional currency on line 041 of the AT1 return. If you wish to file the AT1 return using the Japanese yen, file a letter with the Alberta Tax and Revenue Administration stating that the AT1 return is filed using the Japanese yen as a functional currency.

Following the removal of Alberta Schedule 9 from the program, line 081 has been removed from the form and the calculation of line 088 has been modified to reflect this change.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was calculated or entered using an override on line 081, it will not be retained.

AT1 Schedule 2, Alberta Income Allocation Factor*

AT1 Schedule 4, Alberta Foreign Investment Income Tax Credit*

AT1 Schedule 12, Alberta Income/Loss Reconciliation*

AT1 Schedule 15, Alberta Resource Related Deductions

Two custom fields have been added to the custom lines Deduction in respect of the accelerated Canadian development expense (ACDE) in Area D and Deduction in respect of the accelerated Canadian oil and gas property expense (ACOGPE) in Area E to enter the amount of the expenses that have been incurred in the taxation year before 2024 and after 2023 and calculate the applicable average rate for the deduction in a taxation year that straddles January 1, 2024.

AT1 Schedule 16, Alberta Scientific Research Expenditures*

AT1 Schedule 21, Alberta Calculation of Current Year Loss and Continuity of Losses*

Alberta Consent Form*

In the Certification section, lines E-mail Address and Fax Number will be input lines when the answer to the question on line 957, Is the contact person the same as the authorized signing officer?, of Form Corporate Identification and Other Information is No. When the answer to the question on line 957 is Yes, these lines will be calculated from the data in Form Identification. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the answer to the question on line 957 is No, the overridden data on lines E-mail Address and Fax Number will be retained. If the data was not overridden, you must enter it manually.

Alberta Corporate Income Tax – Filing Exemption Checklist

Following the withdrawal of Alberta Schedule 9 from the program, line 7 has been removed from the form.

Nova Scotia

Schedule 341, Nova Scotia Corporate Tax Reduction for New Small Businesses*

The line relating to the number of days in the tax year before April 1, 2020, as well as line Nova Scotia corporate tax reduction for new small businesses (previously line E) have been removed from Part Nova Scotia corporate tax reduction for new small businesses. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, no value related to the removed lines will be retained.

Yukon

Schedule 444, Yukon Business Carbon Price Rebate*

With the exception of assets in CCA Classes 41 and 41.2, assets entered in the table of Part 1, Eligible Yukon mining UCC for eligible Yukon mining assets, should now also be entered in the table of Part 4, Eligible Yukon UCC for eligible Yukon asset. To this end, other than for assets in CCA Classes 41 and 41.2, a line is now automatically created in the table of Part 4 for each asset entered in the table of Part 1, and the data in columns 1, 3, 4 and 5 of Part 4 is calculated and corresponds to the data entered in columns 1, 3, 4 and 5 of Part 1.

Also, line Eligible Yukon UCC from amount A not related to classes 41 and 41.2 of Part 6 has been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, an amount entered on this line is not retained.

Newfoundland and Labrador

Schedule 306, Newfoundland and Labrador Capital Tax on Financial Institutions – Agreement Among Related Corporations

The schedule is now applicable when the amount on line 410 is greater than zero and there is at least one related corporation, whether or not there is capital tax calculated on Schedule 305, Newfoundland and Labrador Capital Tax on Financial Institutions.

Corrected Calculations

The following problems have been corrected in version 2023 2.0:

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

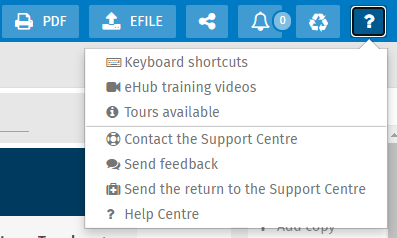

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Taxprep T2 e-Bulletin notifies you each time an updated or new form is made available in a program update.

How to Reach Us

Support Ticket

https://support.cch.com/oss/canada

Technical and Tax support Hours

Monday to Friday: 8:30 a.m. to 8:00 p.m. (EST)

Toll Free: 1-800-268-4522