The Five-Year Comparative Summary workchart (Jump Code: SUM5) summarizes key tax items from the federal and provincial returns for the current year and provides a comparison with the balances from the past four taxation years

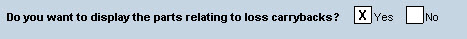

The option presented below allows you to display only the parts that can apply to the filing corporation, based on the provincial or territorial jurisdiction selected in Form Identification (Jump Code: ID).

If you answer “No” to this question, another question will display. This second question allows you to display the parts relating to loss carrybacks at the federal, in Québec and in Alberta that can apply to the filing corporation, based on the provincial or territorial jurisdiction selected in Form Identification.

Because of its overview nature, this workchart provides a meaningful starting point for a detailed review. It may also be useful in client discussions.

You can print and maintain this workchart with your other working papers.

Losses carried back to prior taxation years can be entered in the “Federal information (T2)”, “Québec (CO-17)” and/or “Alberta (AT1)” parts. The taxable income adjusted as a result of loss carrybacks is then calculated automatically for each year.

If, in the prior years, you have claimed loss carrybacks and did not adjust the taxable income entered a little further up the form, you can indicate the amounts claimed in the “Loss carrybacks requested in prior years to reduce taxable income” subsection.

The current-year losses amounts carried back to prior years are calculated with Schedule 4 (Jump Code: 4) as well as Forms CO-1012 (Jump Code: 1012), CO-17S.4 (Jump Code: Q4C) and ATI Schedule 10 (Jump Code: A10).

When rolling forward the client file, the program will add the amounts of the different types of losses carried back to each of the prior years to the amounts of loss carrybacks of the same type requested in each previous year. The accumulation of these amounts will be rolled forward in the previous column of the “Loss carrybacks requested in prior years to reduce taxable income” subsection.

Example: You had entered an amount of $1,000 for 2011 on line Capital losses (50%) of the “Loss carrybacks requested in prior years to reduce taxable income” subsection and, for its 2013 fiscal year end, the corporation has a $500 capital loss, of which you are claiming the carryback to 2011. As a result of the roll forward, an amount of $1,500 will be entered as a loss carryback to the previous year on line Capital losses (50%) of the column related to 2011.

A table similar to the calculation of the adjusted taxable income is available to keep track of the adjusted Part IV tax. The adjusted Part IV tax is calculated by multiplying by 3 for dividends received before January 1, 2016, and 100 / 38 1/3 for dividends received after December 31, 2015.

If, in the prior years, you have claimed loss carrybacks to reduce the taxable dividends subject to Part IV tax and did not adjust the Part IV tax amount indicated further down in the form, you can enter the amounts claimed in the fields of the “Loss carrybacks requested in prior years to reduce taxable dividends subject to Part IV tax” subsection.

The current-year loss amounts carried back to prior years to reduce taxable dividends subject to Part IV tax are calculated with Schedule 4 (Jump Code: 4).

When files are rolled forward to a subsequent year, the appropriate column in the Five-Year Comparative Summary is updated.

Note: The information on the following lines is with reference to Schedule 200, T2 Corporation Income Tax Return.

The “Abatement/Other” line in the “Credits against Part I tax” part, contains the following information:

- Federal tax abatement, line 608

- Investment corporation deduction, line 620

- General tax reduction for CCPCs from amount I on page 5, line 638

- General tax reduction from amount P on page 5, line 639

- Federal logging tax credit from Schedule 21, line 640

- Eligible Canadian bank deduction under section 125.21, line 641

- Federal qualifying environmental trust tax credit, line 648

The “Other” line in the “Federal taxes” part, contains the following information:

- Part IV.1 tax payable from Schedule 43, line 716

- Part VI tax payable from Schedule 38, line 720

- Part VI.1 tax payable from Schedule 43, line 724

- Part VI.2 tax payable from Schedule 67, line 725

- Part XIII.1 tax payable from Schedule 92, line 727

- Part XIV tax payable from Schedule 20, line 728

The “Other” line in the “Refunds/credits” part, contains the following information:

- Federal capital gains refund from Schedule 18, line 788

- Federal qualifying environmental trust tax credit refund, line 792

- Return of fuel charge proceeds to farmers tax credit, from Schedule 63, line 795

- Canadian film or video production tax credit (Form T1131), line 796

- Film or video production services tax credit (Form T1177), line 797

- Canadian journalism labour tax credit from Schedule 58, line 798

- Air quality improvement tax credit from Schedule 65, line 799

- Tax withheld at source, line 800

- Provincial and territorial capital gains refund from Schedule 18, line 808

- Provincial and territorial refundable tax credits from Schedule 5, line 812