Release Notes - CCH iFirm Taxprep T2 2024 v.1.0 (2024.10.37)

New: Introducing Wolters Kluwer Support Platform

As part of our commitment to service, Wolters Kluwer is pleased to announce the launch of our new Support Platform.

Register to our Support Platform to submit, modify and track all your support requests in a single location. A chatbot system and a live chat feature powered by our virtual assistant are also included, with access to over 40,000 articles from our knowledge base. Note that as of December 1, 2023, email support service will be discontinued and replaced by support tickets created from the new platform.

If you need help during the registration process, please consult the following article to get all the information you need: How do I register to the new Support Platform?

Register now to our Support Platform and take advantage of all the benefits it has to offer!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Taxprep is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T2

With CCH iFirm Taxprep T2, have the most comprehensive collection of corporate tax forms available, as well as tools designed to address complex T2 preparation requirements. CCH iFirm Taxprep T2 also provides you with:

- the possibility of attaching supporting documents to electronically transmitted returns;

- GIFI data transfers.

Taxation Years Covered

CCH iFirm Taxprep T2 2024 v.1.0 is designed to process corporate tax returns with taxation years beginning on or after January 1, 2022, and ending on or before October 31, 2024.

Overview - Version 1.0

CCH iFirm Taxprep T2 2024 v.1.0 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

Schedule 56, Part II.2 Tax on Repurchases of Equity

Schedule 56 used to calculate the Part II.2 tax ITA that applies to a corporation resident in Canada (other than a mutual fund corporation) that has redeemed, acquired or cancelled equity listed on a designated stock exchange has been added. For more information, consult the note relating to this subject.

Schedule 572, Ontario Made Manufacturing Investment Tax Credit

Schedule 572 allowing for a 10% refundable tax credit that is available to qualifying corporations that invest in eligible property that becomes available for use after March 22, 2023, has been added. For more information, consult the note relating to this subject.

Schedule 200, T2 Corporation Income Tax Return

Schedule 200 has been updated and now includes changes relating to substantive Canadian-controlled private corporations (CCPCs). For more information, consult the note relating to this subject.

Improve Your Productivity

Federal

Schedule 89, Request for Capital Dividend Account Balance Verification); and

T2054, Election for a Capital Dividend Under Subsection 83(2)

As required by the CRA, Schedule 89 must be electronically transmitted with the capital dividend account (CDA) balance calculated immediately before the date on which the dividend becomes payable. In the situation when the electronic filing status of Schedule 89 and Form T2054 is at “Eligible” at the same time and the answer to the question Is the form completed and ready to be transmitted? in the Instructions when the form is electronically transmitted to the CRA part of Form T2054 is set to Yes, a diagnostic will appear on this question. It will be indicated in this diagnostic to set the answer to the question Is the form completed and ready to be transmitted? to No on Form T2054 and to transmit Schedule 89 electronically. Then, set the answer to the question Is the form completed and ready to be transmitted? to Yes on Form T2054 and transmit it. Please note that the procedure for properly transmitting Schedule 89 and Form T2054 can be found in the Instructions when the form is electronically transmitted to the CRA part of Form 2054.

Québec

Québec refundable tax credit forms

Revenu Québec wishes to receive the refundable tax credit forms when the credit is calculated at $0 (for example, when eligible expenses are reduced in full by an amount of assistance, a benefit or an advantage). Refundable tax credits totalling $0 will be reported on lines 440p to 440y of the CO-17 return.

New Forms

Federal

Schedule 56, Part II.2 Tax on Repurchases of Equity

Schedule 56 is used to calculate the Part II.2 tax ITA that applies to a corporation resident in Canada (other than a mutual fund corporation) that has redeemed, acquired or cancelled equity listed on a designated stock exchange. The transactions must have occurred after December 31, 2023. This additional tax is calculated by multiplying by 2% the net value of the corporation’s repurchases of equity during the year.

However, if the amount C does not reach the minimum threshold of $1 million (prorated based on the number of days in the taxation year if it consists of less than 365 days), the Part II.2 tax will be zero.

Ontario

Schedule 572, Ontario Made Manufacturing Investment Tax Credit

A 10% refundable tax credit is available to qualifying corporations that invest in eligible property that becomes available for use after March 22, 2023, up to a $20,000,000 limit. When the corporation is associated with other qualifying corporations, the $20,000,000 expenditure limit applies to the group and can be shared among its members.

Above Part 1, the custom question Is the filing corporation a qualifying corporation as defined in subsection 97.2(3) of the Taxation Act, 2007 (Ontario)? has been added on screen to determine if the corporation is a qualifying corporation. The answer to this question will be calculated to Yes when the following conditions are met:

-

The corporation is a Canadian-controlled private corporation (CCPC) throughout its taxation year;

-

The corporation is not exempt from Ontario corporate income tax for its taxation year;

-

The corporation carries on business in Ontario in its taxation year through a permanent establishment in Ontario; and

-

The corporation’s taxation year ends after March 22, 2023.

If the corporation is associated with other qualifying corporations, Part 1 – Agreement between associated corporations must be duly completed. The answer to the question on line 050, Were you associated in the tax year with one or more other qualifying corporations?, is Yes when the answer to the question Is the corporation a qualifying corporation as defined in subsection 97.2(3) of the Taxation Act, 2007 (Ontario)? is Yes for the copies of the associated or related corporations of Schedule 9 WORKCHART in the part for Schedule 572. For more information, consult the note relating to Schedule 9 WORKCHART.

In Part 2 – Eligible property acquired in the current tax year, you must enter eligible property as defined in subsection 97.2(17) of the Taxation Act, 2007 (Ontario). The amount of the tax credit is carried over to line 474 of Schedule 5.

Deleted Forms

Québec

-

TP-1029.9, Tax Credit for Taxi Drivers or Taxi Owners

Nova Scotia

-

NS-Capital Tax, Corporation Capital Tax Return

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Corporate Identification and Other Information

The question Must the corporation file the annual return for Ontario corporations under the Ontario Corporation Information Act? has been removed from Part General information.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the answer to this question will not be retained.

In addition, the question Did the corporation meet, at any time during the taxation year, the definition of substantive CCPC under subsection 248(1) ITA? has been added to Part Additional information and corresponds to the new line 290 of the T2 Corporation income tax return.

Finally, following the removal of Form Corporation Capital Tax Return for Nova Scotia, line NS-Capital Tax (for taxation years beginning before November 1, 2021) has been deleted from Part Instalment paid.

Schedule 200, T2 Corporation Income Tax Return*

The following lines have been added:

-

In Part Attachments, line 277, Is the corporation a covered entity that redeemed, acquired or cancelled equity of the corporation in the tax year?, indicates that Schedule 56, Part II.2 Tax on Repurchases of Equity is applicable.

-

In Part Additional information, line 290, Did the corporation meet the definition of substantive CCPC under subsection 248(1) at any time during the tax year?, allows you to indicate that the corporation has met the criteria of a substantive CCPC.

-

In Part Summary of tax and credits, line 705, Part II.2 tax payable from Schedule 56, is equal to amount G from Schedule 56 when this schedule is applicable.

For taxation years ending after April 6, 2022, a private corporation (other than a CCPC) would be a substantive CCPC when, at any time in a tax year:

-

It is controlled, directly or indirectly in any way, by one or more Canadian resident individuals, or

-

It would, if each share of the capital stock of a corporation that is owned by a Canadian resident individual were owned by a particular individual, be controlled by this individual.

Further, a corporation would be considered a substantive CCPC when the corporation would have been a CCPC but for the fact that a non-resident or public corporation has a

right to acquire its shares.

When line 290 indicates Yes, the calculations in parts General tax reduction for Canadian-controlled private corporations and Refundable portion of Part I tax as well as the calculations for line 604, Refundable tax on CCPC's or substantive CCPC's investment income, are activated.

T2 Bar Code Return

The line Part II.2 tax payable (from line 705 of the T2 return) has been added to Part Certification of the form.

Schedule 2, Charitable Donations and Gifts*

Schedule 5, Tax Calculation Supplementary – Corporations

With the addition of Schedule 572, Ontario Made Manufacturing Investment Tax Credit, line 474 is calculated from the amount on line 106 of Schedule 572. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amount entered on line 474 will be retained as an overridden amount.

Schedule 7, Aggregate Investment Income and Income Eligible for the Small Business Deduction

In custom Part 3A, Canadian and foreign investment income and adjusted aggregate investment income calculation, lines under column C, Adjusted aggregate investment income, are no longer calculating for a corporation that is a cooperative corporation, a credit union or an insurance corporation that is deemed not to be a private corporation and eligible for the SBD because these entities are excluded from the definition of adjusted aggregate investment income in subsection 125(7) ITA.

In addition, in order to calculate the aggregate investment income on line 440 and the foreign investment income on line 445 of Schedule 200, Schedule 7 is applicable when the corporation answers Yes on line 290 of Schedule 200.

Schedule 8, Capital Cost Allowance (CCA)*

The calculation for column 13 has been modified to deduct the amount of immediate expensing (IE) (column 12) directly from the cost of acquisitions during the year (column 3). Previously, the result in column 13 was obtained by performing the following operations on the amount from column 3:

-

deduct the cost of designated immediate expensing property (DIEP) (column 4);

-

add the amount of undepreciated capital cost (UCC) of the DIEP (column 11);

-

deduct the amount of IE (column 12).

Similarly, there is no longer an adjustment for the amount of proceeds of disposition of DIEP (column 9) in the calculation of the following columns:

-

column 16, which is used to determine the proceeds of disposition available to reduce the UCC of accelerated investment incentive property (AIIP) and property included in Classes 54 to 56;

-

column 19, used to determine the UCC adjustment amount for property acquired during the year other than AIIP and property included in Classes 54 to 56.

The calculation changes have been applied to the corresponding lines of Schedule 8 WORKCHART, Capital Cost Allowance (CCA) Workchart. Since the changes in this schedule have been applied to the Federal, Québec and Alberta columns, please note that they will also have an impact on the results indicated in the corresponding columns of the following forms:

-

CO-130.A, Capital Cost Allowance, when the corporation has a permanent establishment in Québec;

-

AT1 Schedule 13, Alberta Capital Cost Allowance (CCA), when the corporation has a permanent establishment in Alberta.

Schedule 8 WORKCHART, Capital Cost Allowance (CCA) Workchar

The field Government assistance received or entitled to be received has been added to subsection Acquisition for copies of Schedule 8 WORKCHART relating to a Class 10.1 property. In accordance with subsection 13(7.1) ITA, the amount entered in this field will be deducted from the acquisition cost calculated on line 203 after the application of the cost of acquisition limit for Class 10.1 vehicles.

The limit for capital cost allowance (CCA) increases to $37,000 (before taxes) for Class 10.1 passenger vehicles acquired in the taxation year after December 31, 2023.

In addition, as announced by the Ministère des Finances du Québec in the Information Bulletin 2023-6 published on November 7, 2023, the additional capital cost allowance of 30% is abolished for property acquired after December 31, 2023. Properties acquired before January 1, 2024, that meet all other eligibility criteria still qualify for the additional deduction for the period during which the corporation claims CCA on these properties. If a corporation owned only eligible property in classes 14.1, 43.1, 43.2, 44, 50 or 53 (without having created a separate class for Québec tax return purposes), and a property in the same class is acquired after December 31, 2023, it will be necessary to create a separate class that includes the eligible property currently included in the existing class, in accordance with section 130R194.2 of the Regulation respecting the Taxation Act. For more information on the proposed steps to create a separate class in this situation, please consult the Help topic relating to Schedule 8.

Furthermore, following the addition of codes 3, Clean technology, and 4, Carbon capture, utilization and storage, to the Investment tax credit code drop-down list in Schedule 8 WORKCHART ADD, when the client file is rolled forward, the ITC (prior year) field in the copy of the corresponding class in Schedule 8 WORKCHART for which one of the new credit codes is selected in the Investment tax credit code drop-down list in the copy of Schedule 8 WORKCHART ADD is equal to the amount:

-

of the clean technology ITC entered on line 155 in Part 24 of Schedule 31 when code 3 is selected in the Investment tax credit code drop-down list of a copy of Schedule 8 WORKCHART ADD for a property in this class and an ITC is claimed by the corporation on line 155 in Part 24 of Schedule 31.

-

of the carbon capture, utilization, and storage ITC entered on line 200 in Part 25 of Schedule 31 when code 4 is selected in the Investment tax credit code drop-down list of a copy of Schedule 8 WORKCHART ADD for a property in this class and an ITC is claimed by the corporation on line 200 in Part 25 of Schedule 31.

Schedule 8 WORKCHART ADD, Additions and Dispositions Workchart

As announced by the Ministère des Finances du Québec in the Information Bulletin 2023-6 published on November 7, 2023, the additional capital cost allowance of 30% is abolished for property acquired after December 31, 2023. Accordingly, for property in classes 14.1, 43.1, 43.2, 44, 50 and 53, the question Is the property a property that qualifies for the additional CCA of 30% in Québec? in Part Québec only will be calculated to Yes only if the property was acquired before January 1, 2024.

In addition, the following codes have been added to the Investment tax credit code drop-down list following the addition of the clean technology and the carbon capture, utilization and storage investment tax credits to Parts 24 and 25 of Schedule 31:

-

Code 3 – Clean technology

-

Code 4 – Carbon capture, utilization and storage

Schedule 9 WORKCHART, Related and Associated Corporations Workchart

In Part Schedule 65 – Air quality improvement tax credit, the calculation of taxable capital employed in Canada for the preceding taxation year has been modified. The taxable capital is now displayed in this part regardless of the corporation's association code that connects the corporation with the filing corporation.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, any amount entered by override on this line is retained.

In addition, in order for Part 1 – Agreement between associated corporations of Schedule 572 to be completed and for the expenditure limit of $20,000,000 to be allocated, you must complete the new Part Schedule 572 – Ontario made manufacturing investment tax credit. When the answer to the question Is the corporation a qualifying corporation as defined in subsection 97.2(3) of the Taxation Act, 2007 (Ontario)? for the copies of the associated or related corporations is Yes, a line is generated in the table of Schedule 572. In such cases, complete the line Expenditure limit allocated in the copies of the associated or related corporations. The line Expenditure limit allocated for the filing corporation will thus be calculated based on what has been entered for the associated or related corporations.

Schedule 24, First-time Filer After Incorporation, Amalgation, or Wind-up of a Subsidiary into a Parent*

Schedule 31, Investment Tax Credit - Corporations*

The following parts have been added:

-

Part 24 – Clean technology ITC

-

Part 25 – Carbon capture, utilization and storage ITC

Currently, the CRA’s system does not support the new classes 57 to 60, and the calculations for the two new investment tax credits (ITCs) have not been integrated into Schedule 31 yet. Consequently, you must manually calculate the amount of each ITC and enter it in Parts 24 and 25, if necessary.

Former Parts 24 and 25 have been renumbered 26 and 27.

Schedule 31 will also apply if an amount is entered on lines 155 and/or 200 of Parts 24 and 25.

Schedule 38, Part VI Tax on Capital of Financial Institutions*

Schedule 54, Low Rate Income Pool (LRIP) Calculation

To take into account the modifications to the low rate income pool definition in subsection 89(1) ITA of section 20 in Bill C-59, An Act to implement certain provisions of the fall economic statement tabled in Parliament on November 21, 2023 and certain provisions of the budget tabled in Parliament on March 28, 2023, the following updates have been made:

-

The question Was the corporation a substantive CCPC at any time in its preceding taxation year? has been added under the form’s instructions.

When rolling forward a client file where line 290 of the T2 return indicates Yes, the answer to this question will also indicate Yes.

In cases where the answer to the question is Yes, line 140 is equal to the aggregate investment income for the preceding taxation year, and line 150 is calculated.

-

In Part 3, to consider the modifications made to the calculation of element G as specified in subsection 20(2) of Bill C-59, three new custom lines are used to indicate the lesser of 80% of the aggregate investment income for the preceding taxation year and the portion of the taxable dividends paid in the preceding taxation year that has not reduced the LRIP on line 540.

These modifications apply to taxation years that start after April 6, 2022.

Schedule 63, Return of Fuel Charge Proceeds to Farmers Tax Credit*

For the 2023 year, the provinces of Newfoundland and Labrador (NL), Prince Edward Island (PE), Nova Scotia (NS) and New Brunswick (NB) have been added as designated provinces. The return of fuel charge proceeds to farmers tax credit can be claimed if the farming corporation incurred eligible farming expenses in a designated province. The 2023 payment rate for those provinces is 0.140%. Parts 2 to 5 and the corresponding lines have been added to Parts 10 and 11.

In addition, the 2023 payment rate for the provinces of Ontario (ON), Saskatchewan (SK), Manitoba (MB) and Alberta (AB) is 0.186%. Former Parts 2 to 5 have been renumbered 6 to 9.

In Part 10 (formerly Part 6), lines relating to the 2021 year have been removed and those relating to the 2023 year have been added.

Schedule 65, Air Quality Improvement Tax Credit*

Aggregate Amount of Loans and Amount of Deposits

Following the removal of Form Corporation Capital Tax Return for Nova Scotia, column Outside Nova Scotia has been deleted from Parts Amounts outstanding on loans made by a bank and Amounts on deposit with a bank.

Automobile Expenses – Non-Deductible Interest Expenses and Other Expenses

The monthly limit relating to interest expenses is increasing to $350 for financing contracts beginning after December 31, 2023.

Automobile Expenses – Non-Deductible Leasing Costs and Other Expenses

The limit relating to the acquisition cost of an automobile is increasing to $37,000, and the monthly limit for deductible leasing costs is increasing to $1,050 in respect of leasing contracts beginning after December 31, 2023.

RSI, Electronic Filing and Bar Codes Control Workchart

Following the publication of the Information Bulletin 2023-4 by the Minister of Finance of Québec, the answer to the question Must this return be electronically filed with Revenu Québec? will be calculated to Yes when a corporation which is resident in Canada is filing an initial CO-17 return for a taxation year beginning after 2023 and the corporation is not an insurance corporation, not reporting in functional currency, not exempt from tax under Title I of Book VIII of Part I of the Taxation Act or has not indicated making an application under the Revenu Québec’s voluntary disclosure program for this tax return.

Client Letter Worksheet

Following the removal of Form Corporation Capital Tax Return for Nova Scotia, the NS check box and the field Refund have been deleted from Part Capital tax. The part relating to the deleted form has also been removed from the client letter Filing Instructions.

In addition, following the removal of Form Tax Credit for Taxi Drivers or Taxi Owners, the TP-1029.9 check box has been removed from the CO-17 – Paper format and CO-17 – Internet filing parts. The part relating to the deleted form has also been removed from the client letter Filing Instructions.

Inducement, Inducement Calculation Workchart

Line Ontario apprenticeship training tax credit has been removed from the Tax credits whose amount should be added to income – Ontario part.

Finally, line Alberta agri-processing investment tax credit has been added to the Tax credits whose amount should be added to income – Alberta part.

RC4649, Country-by-Country Report*

The use of the Japanese yen (JPY) as a functional currency when filing Form RC4649 is now allowed.

Scenarios, Tax Scenarios Worksheet

Following the removal of Form Corporation Capital Tax Return for Nova Scotia, line Instalments and refundable credits has been deleted from Part Nova Scotia.

Summary, Corporate Taxpayer Summary

Following the removal of Form Corporation Capital Tax Return for Nova Scotia, field Instalments and refundable credits for Nova Scotia has been deleted from Part Summary of provincial information – provincial income tax payable.

Also, following the addition of the Agri-processing Investment Tax Credit to AT1 Schedule 3, Alberta Other Tax Deductions and Credits, the field Amount available for carry forward – Agri-processing investment tax credit – A3 has been added to the Summary of provincial carryforward amounts part.

T106 Slip*

T106 Summary, Information Return of Non-Arm's Length Transactions with Non-Residents*

The use of the Japanese yen (JPY) as a functional currency when filing Form T106 is now allowed.

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates *

The use of the Japanese yen (JPY) as a functional currency when filing Form T1134 is now allowed.

T1135, Foreign Income Verification Statement*

The use of the Japanese yen (JPY) as a functional currency when filing Form T1135 is now allowed.

AgriStability and AgriInvest – Programs – Alberta*

AgriStability and AgriInvest Programs – Prince Edward Island*

The supplemental form for new participants has been removed because the government no longer uses it to collect historical data. When the Prince Edward Island option is selected on line Province of main farmstead, line Please indicate the filing corporation’s situation and boxes New participant and Participant from last year no longer display. To display the form for participants from the preceding year, you must check the box Do you want to display the supplemental forms? to Yes. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the box New participant has been checked, no data will be retained. If the box Participant from last year has been checked, all the data will be kept, and the box Do you want to display the supplemental forms? will be checked to Yes.

Ontario

Schedule 500, Ontario Corporation Tax Calculation*

Schedule 554, Ontario Computer Animation and Special Effects Tax Credit*

Former Parts 4, Ontario labour expenditures before April 24, 2015, and 5, Assistance before April 24, 2015, have been removed. In addition, lines 600, 610 and 612 have been removed from former Part 8, Tax credit calculation. It is now the total of the amounts entered on line 611 of each copy of the schedule that is carried forward to line 456 of Schedule 5, Supplementary Tax Calculation – Corporation.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, no value related to the removed fields will be retained.

Schedule 556, Ontario Film and Television Tax Credit*

The fields relating to the qualifying labour expenditures (QLE) incurred prior to 2008 have been removed from Parts 6, 7 and 9. The tax credit calculation for a first-time production in Part 7 and the tax credit calculation for an eligible Ontario production other than a first-time production in Part 9 have been adjusted accordingly.When opening a return prepared with a prior version of CCH iFirm Taxprep T2, no value related to the removed fields will be retained.

Québec

CO-771, Calculation of the Income Tax of a Corporation

The custom question If the corporation’s tax year ends after June 30, 2020, and before July 1, 2021, is the corporation making the election to use the number of remunerated hours of the previous taxation year that were used to determine whether it was eligible for the SBD or to establish its SBD rate for its previous taxation year? and the custom line d, related to the calculation of paid hours of the employees of the corporation, have been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the question had been answered and/or if a number of hours had been entered on line d, the values will not be retained.

In addition, lines 195 to 205 in Part 11.2, Additional reduction in the tax rate, and the fields in Part 12.2, Taxation year that includes March 25 and 26, 2021, have been protected. These lines and fields pertain to days in the taxation year that are prior to 2022. It is no longer possible to enter such taxation years in this version of CCH iFirm Taxprep T2.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the values that pertain to protected fields will not be retained.

CO-1029.8.35, Tax Credit for Québec Film Productions

Following the announcement of the 2024-2025 budget tabled on March 12, 2024, the Government of Québec increased the refundable tax credit for Québec film productions by increasing the limit on eligible production costs incurred and directly attributable to relevant film productions. To reflect this change, the custom question If you selected box 10h, was the application for an advance ruling (or the application for a qualification certificate, if the application for an advance ruling was not filed earlier for this production) filed with SODEC after March 12, 2024? has been added to Part 2. It is used to determine the applicable rate for calculating the limit based on the cumulative production costs in Part 4.4.

CO-1029.8.36.DA, Tax Credit for the Development of E-Business

The calculation of line 80, Total income tax for the taxation year concerned, has been modified to take into account deductions related to the tax credit for salaries and wages – IFC and deductions relating to the synergy capital tax credit. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, any amount entered by override on this line is retained.

CO-1029.8.36.II, Tax Credit for Investment and Innovation*

Following the presentation of the Québec economic and financial update and the publication of the Information Bulletin 2023-6 by the Ministère des Finances du Québec on November 7, 2023, the following modifications have been made to the form:

-

The tax credit is extended for an additional five-year period, applicable to specified expenses relating to the acquisition of a specified property before January 1, 2030.

-

In Part 4, the custom question Does the fiscal period of the qualified partnership begin after December 31, 2023? has been added and is used to calculate the portion of the tax credit to include on the custom line Portion of the tax credit relating to the specified expenses incurred after 2023 by the partnerships of which the corporation is a member for their fiscal periods beginning after December 31, 2023 in new Part 7.

-

The descriptions of lines 51 to 54 in Part 5.1, Specified expenses for the year after taking into account the balance of the annual cumulative limit, have been modified to consider the reduction from 48 to 36 months of the period in which the specified expenses incurred in preceding taxation years (or fiscal periods for a partnership or a joint venture) reduce the cumulative limit of $100 million when the taxation year (or the fiscal period for a partnership or a joint venture) begins after December 31, 2023.

-

A column has been added to Part 6 to calculate the tax credit related to specified expenses incurred after December 31, 2023, according to the new rates of 25%, 20% and 15% respectively applicable to low, intermediate, and high economic vitality territory.

-

As the tax credit is now entirely refundable for a taxation year of the corporation (and for a fiscal period of a partnership of which the corporation is a member) that starts after December 31, 2023, Part 7 (lines 101 to 104) has been added to determine the portion of the tax credit that is entirely refundable and the portion that is not.

-

Line 103, Portion of the tax credit that is entirely refundable, has been split into two custom lines, Portion of the tax credit relating to the specified expenses incurred after 2023 by the corporation in a taxation year beginning after December 31, 2023 and Portion of the tax credit relating to the specified expenses incurred after 2023 by the partnerships of which the corporation is a member for their fiscal periods beginning after December 31, 2023, to allow the calculation (or the input, in some cases) of the relevant portion of the tax credit according to the qualifying entity.

-

Line 118 in Part 9.1, Refundable portion of the tax credit that can be deducted from the balance of income tax, and line 130 in Part 9.2.2, Refundable portion of the tax credit that exceeds the balance of income tax, now correspond to the amount of line 104, Portion of the tax credit that is not entirely refundable.

-

In Part 10, Refundable tax credit that can be claimed for the taxation year, line 137a has been added to include the amount from line 103.

-

Modifications have also been made to the notes of the form, notably to the definition of specified expenses as well as to the definition of low economic vitality territory relating to the Argenteuil and Matawinie RCM.

In addition, the following changes have been made to the list of geographic codes on line 14a.1:

-

Code 30090 Courcelles and code 29025 Saint-Évariste-de-Forsyth have been replaced by code 29027 Courcelles-Saint-Évariste.

-

Code 32040 Plessisville (ville) and code 32045 Plessisville (paroisse) have been replaced by code 32043 Plessisville.

-

The name of the municipality previously associated with code 06035, Ristigouche-Partie-Sud-Est, has changed to Ristigouche-Sud-Est.

CO-1029.8.36.IK, Cumulative Limit Allocation Agreement for the Tax Credit for Investment and Innovation*

Following the publication of Information Bulletin 2023-6 by the Minister of Finance of Québec, the cumulative limit of $100 million is now calculated for a four-year period for a taxation year of a qualified corporation that begins after December 31, 2023 (instead of a five-year period for taxation years beginning before January 1, 2024). As a result, the amount of specified expenses and eligible expenses calculated in column C of the table in Part 2 takes into account this new definition.

CO-1029.8.36.SP, Tax Credit for Film Production Services

Following the announcement of the 2024-2025 budget tabled on March 12, 2024, the Government of Québec has increased the basic tax credit rate to 25% and has introduced a cap limiting the cost of service contracts related to computer-aided special effects and animation to 65%. To reflect these changes, the following modifications have been made to the form:

-

The custom box AA, The application for an approval certificate was filed with SODEC after May 31, 2024, or the application was filed with SODEC after March 12, 2024, but before June 1, 2024, and SODEC considers that the work relating to the film production was not sufficiently advanced on March 12, 2024, has been added on screen to Part 2. It is used to determine the tax credit rate on line 161 of Part 10 as well as the multiplication factor on lines 45d and 77.

-

When box AA is selected, box 07b will also be selected.

-

A diagnostic has been added to lines 28 and 100 so that the user can verify the amounts entered on these lines and apply the 65% cap if necessary.

COZ-1179, Logging Operations Return*

Following a request from the Direction générale de la législation of Revenu Québec, the form has been modified to better meet the requirements of section 1184 TA and to calculate the deduction on line 423 of Form CO-17.

Note 13 mentions that if the logging tax payable before the reduction of the excess amount (amount on line 77) exceeds the amount of the deductions under the Taxation Act and the federal Income Tax Act, the excess amount must be used to reduce the logging tax payable for that year, provided the reduction does not reduce the amount deducted for the year in the federal income tax return. If this condition is not met, the excess amount must be claimed as a deduction with respect to the Québec income tax payable for the covered taxation year or a subsequent taxation year.

Previously, the corporation had to determine the excess amount of logging tax payable using only former note 12 (which now corresponds to note 13). Part 5.2 has been added to determine this amount.

Part 5.3 calculates the amount of logging tax payable for the year. The calculation is the same as in the previous version of the form, but the amount on line 78 is calculated from the new Part 5.2. Since line 78 is now calculated, boxes 78a and 78b have been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the value on line 78 will not be retained, as it will be calculated from Part 5.2.

In Part 7, line 88 has been removed because this information is now presented on line 77a of the new Part 5.2.

Part 8 has been added. It is used to calculate the logging tax deduction to be carried to line 423 of Form CO-17 and to determine the amount that cannot be claimed this year but can be carried to a future year. In addition, Part 8.3.2 contains a table showing the amounts from previous years that have been used in a previous year or that may be used in the covered year. This will make it easier to keep track of amounts to be carried.

Finally, the information relating to a taxation year beginning before March 18, 2016, has been removed.

QC L440P-Y, Additional Québec Credits

The following credit code has been removed from the form:

-

006, Tax credit for taxi owners (TP-1029.9)

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount was calculated or entered by override on this line, it will not be retained.

QC Instalment, Québec Tax Instalments

Following Order in Council 90-2023, line Deduction for income earned from a major investment project has been removed from the adjusted income tax payable calculation and the adjusted capital tax payable calculation.

British Colombia

Schedule 429, British Columbia Interactive Digital Media Tax Credit*

Alberta

AT1, Alberta Corporate Income Tax Return*

The use of the Japanese yen (JPY) as a functional currency when filing an AT1 return is now allowed. Thus, box 5, Japan, has been added to the choices on line 041.

The amount of the Agri-processing investment tax credit, which is calculated in AT1 Schedule 3, Alberta Other Tax Deductions and Credits, will be displayed on line 076, Other deductions per AT1 Schedule 3 (AITC, CITC, and APITC). For more information, consult the note relating to this subject.

AT1 Schedule 3, Alberta Other Tax Deductions and Credits*

The non-refundable Agri-processing Investment Tax Credit (APITC) has been added. This tax credit is administered by certificate and is applicable to eligible corporations for expenditures made on or after February 7, 2023.

When a APITC certificate is granted to an eligible corporation, the tax credit amount can be claimed against corporate income taxes owed in Alberta until the value of the credit is used up, for up to 10 years. The maximum amount that can be claimed in the first three years is limited as follows:

-

the lesser of 20% of the APITC amount in the current taxation year or [AT1, page 2, line 068 - (lines 070 + 072) - (Alberta Schedule 3, lines 104 + 204 + 306 + 308 + 310)];

-

the lesser of 30% of the APITC amount in the first preceding taxation year or [AT1, page 2, line 068 - (lines 070 + 072) - (Alberta Schedule 3, lines 104 + 204 + 308 + 310)]; and

-

the lesser of 50% of the APITC amount in the second preceding taxation year or [AT1, page 2, line 068 - (lines 070 + 072) - (Alberta Schedule 3, lines 104 + 204 + 310)].

Any remaining credit amount can be carried forward from the third to the tenth preceding taxation year, but it is limited to the result of [AT1, page 2, line 068 - (lines 070 + 072) - (Alberta Schedule 3, lines 104 + 204)].

For more details about the APITC, visit the Web site https://www.alberta.ca/alberta-agri-processing-investment-tax-credit, section 25.04 of the Alberta Corporate Tax Act and the Agri-processing Investment Tax Credit Regulation.

Alberta Corporate Income Tax – Filing Exemption Checklist*

Following the addition of the Agri-processing investment tax credit (APITC) in AT1 Schedule 3, Alberta Other Tax Deductions and Credits, line 8 has been adjusted. If an APITC is claimed, the box at line 8 will be checked to No. For more information, consult the note relating to this subject.

Saskatchewan

Schedule 411, Saskatchewan Corporation Tax Calculation

In its Bill 157 tabled on March 27, 2024, the Government of Saskatchewan has announced that the lower rate of tax of 1% is extended to June 30, 2025. Therefore, the calculations relating to the number of days in the taxation year for lines 3A and 3B have been modified to reflect this change.

Manitoba

Schedule 385, Manitoba Odour-Control Tax Credit*

Following the update of this schedule, former Parts 1, Eligible expenditures made in the current tax year, 3, Refundable tax credit for agricultural corporations, and 4, Request for carryback of credit, have been removed. Therefore, lines 120, 150 and 161 as well as amount g from Part 2 have been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, no value related to the removed fields will be retained.

Schedule 394, Manitoba Rental Housing Construction Tax Credit*

Former Part 1, Manitoba refundable rental housing construction tax credit, has been removed from the schedule in its recent update. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the values in these fields will not be retained.

Yukon

Schedule 444, Yukon Business Carbon Price Rebate*

The data entered in columns 1 to 5 and 7 of the table in Part 1, Eligible Yukon mining UCC for eligible Yukon mining assets, is now part of the data that is electronically filed with the T2 return as lines 100, 105, 108, 110, 115 and 120 respectively. In addition, the data entered on lines Are you an eligible Yukon mining business taxpayer? (line 050) and Prescribed mining adjustment factor (line 130) of Part 1, Eligible Yukon mining UCC allocated from partnerships (line 150) of Part 2 and Mining business rebate factor (line 175) of Part 3 is also part of the electronic transmission.

Also, the custom question Do you want to transfer the data for all the properties (other than those in classes 41 and 41.2) entered in the table hereunder to the table of Part 4? has been added in Part 1 to allow you to automatically transfer (or not) the properties entered in the table of Part 1 to the table of Part 4. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the answer to this question is Yes.

Finally, the calculation on lines 175 of Part 3 and 500 of Part 6 has been updated to take into account the new mining business rebate factor and the new business rebate factor for a tax year ending after March 31, 2024.

Northwest Territories

Schedule 461, Northwest Territories Corporation Tax Calculation*

Prince Edward Island

Schedule 322, Prince Edward Island Corporation Tax Calculation*

Newfoundland and Labrador

Schedule 307, Newfoundland and Labrador Corporation Tax Calculation

In accordance with the Newfoundland and Labrador budget tabled on March 21, 2024, custom lines 1 and 2 have been added to Part 2 to reflect the reduction of the lower rate of tax from 3% to 2.5% that came into effect on January 1, 2024.

Corrected Calculations

The following problems have been corrected in version 2024 1.0:

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

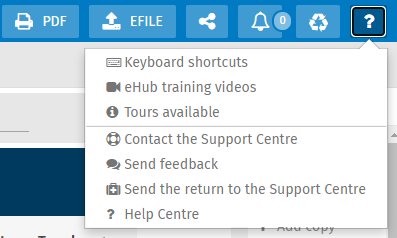

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Taxprep T2 e-Bulletin notifies you each time an updated or new form is made available in a program update.