Release Notes - CCH iFirm Taxprep T2 2024 v.2.0 (2024.40.38)

Register to the Wolters Kluwer Support Platform

Register to our support platform to submit, modify and track all your support requests in a single location. A chatbot system and a live chat feature powered by our virtual assistant are also included, with access to over 40,000 articles from our knowledge base. Note that since December 1, 2023, the Support Centre no longer offers an email support service, which has been replaced by our new support ticketing system.

If you need help during the registration process, please consult the following article to get all the information you need: How do I register to the new Support Platform?

For more details about the web ticketing system and best practices, watch the following “How to” videos:

Register now to our Support Platform and take advantage of all the benefits it has to offer!

To consult our customer service schedule and learn more about how to contact us, please visit our corporate Web site.

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Taxprep is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T2

With CCH iFirm Taxprep T2, have the most comprehensive collection of corporate tax forms available, as well as tools designed to address complex T2 preparation requirements. CCH iFirm Taxprep T2 also provides you with:

- the possibility of attaching supporting documents to electronically transmitted returns;

- GIFI data transfers.

Taxation Years Covered

CCH iFirm Taxprep T2 2024 v.2.0 is designed to process corporate tax returns with taxation years beginning on or after January 1, 2022, and ending on or before May 31, 2025.

Overview - Version 2.0

CCH iFirm Taxprep T2 2024 v.2.0 includes several technical and tax changes. Here is a summary of the main topics addressed in this document.

Capital gains inclusion rate modifications

The modifications to the capital gains inclusion rate have not been implemented in this version of CCH iFirm Taxprep T2. When the CRA made us aware that none of its schedules would be updated at this time to take these modifications into account, we were not in a position to make adjustments to this version before its release. We are planning to release a version at the beginning of 2025 that will implement the modifications even if no updated official CRA schedule is available.

Schedule 75, Clean Technology Investment Tax Credit

Schedule 75, used to calculate the clean technology investment tax credit for corporations that have acquired clean technology property after March 27, 2023, has been added to the program. For more information, consult the note relating to this subject.

Schedule 150, Net Income (loss) for Income Tax Purposes for Insurance Companies; and

Schedule 151, Investment Revenue From Designated Insurance Property for Insurance Companies

These schedules have been added to the program to calculate the net income (loss) for income tax purposes for insurance companies. For more information, consult the note relating to this subject.

Improve Your Productivity

Federal

T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim

In subsection Print only of Part 2 – Project information, the text of the checkbox has been corrected as follows: Set this option to "Yes" if you do not want to print the description of the project in Section B (lines 242, 244 and 246).

New Forms

Federal

Schedule 75, Clean Technology Investment Tax Credit

Schedule 75 is used to calculate the clean technology investment tax credit (ITC). This refundable tax credit is available to a corporation resident in Canada (including a taxable Canadian corporation that is a member of a partnership) that has acquired eligible property after March 27, 2023, and before January 1, 2035.

In Part 1, Clean technology ITC calculation, you must manually enter all the information in columns 100 to 135, column 155 and line 160 to calculate the clean technology ITC for each asset. However, if code 3, Clean technology (Schedule 75), is selected in the Investment tax credit code drop-down list on a copy of Schedule 8 WORKCHART ADD, the values in the Class, Description, Acquisition date and Adjusted capital cost fields in the Information relating to the property – CCA other than classes 10.1, 13 and 14 and Addition sections of this copy will then be transferred to columns 100, 105, 115 and 125 of a new row in Part 1 of Schedule 75.

The regular clean technology ITC rate can be as high as 30% of the capital cost of eligible assets that are acquired and become available after March 27, 2023, and before January 1, 2034.

You must elect to meet the labour requirements for wage requirements and apprenticeship requirements in order to benefit from the regular credit rate (percentage determined on line 145 of Part 1) for each of the designated work sites in column 155 of Part 1. If you meet the labour requirements, you must complete Part 3, Attestation and election to meet labour requirements. However, if you choose not to meet the labour requirements, the percentage determined on line 145 of Part 1 will be reduced by 10 percentage points (reduced tax credit rate) for clean technology goods prepared or installed after November 27, 2023, and you will not need to complete Part 4. For more details on labour requirements, see section 127.46 ITA.

Note that you cannot claim the clean technology ITC if you are claiming the carbon capture, utilization, and storage ITC on line 200 in Part 24 of Schedule 31 for a particular asset.

In Part 2, Recapture of clean technology ITC, you must enter the amount(s) of clean technology ITCs you have already received and are required to recapture in a taxation year for clean technology property you have acquired in the year or in any of the previous 10 calendar years when:

-

the clean technology property is converted to a non-clean technology use;

-

the clean technology property has been exported from Canada; or

-

the clean technology property has been disposed of.

In addition, this schedule applies when the corporation is resident in Canada and at least one of the following conditions is met:

-

a value is calculated on line 165 of Part 1;

-

a value is calculated on line 245 of Part 2; or

-

a value is calculated on line 430 of Part 4.

For more details on the clean technology ITC, please consult the help and section 127.45 ITA.

Schedule 150, Net Income (loss) for Income Tax Purposes for Insurance Companies

Insurance companies and fraternal benefit societies carrying on an insurance business in Canada are required to complete Schedule 150 in order to reconcile the regulatory statement of profit with net income for income tax purposes. This requirement arises from IFRS 17 – Insurance contracts, which came into effect on January 1, 2023.

When the schedule is applicable, the net income or loss after extraordinary items from line 110 is entered as amount A2 in Schedule 1. The net income or loss based on GIFI data is therefore not entered as amount A1, even when the transfer of GIFI data is activated in the form Corporate Identification and Other Information. A note to this effect has been added to this form, as well as below question 4 of section B. Options – Return in the Preparer Profiles.

For more information, refer to the help topic of this schedule as well as section 138 of the Income Tax Act and IFRS 17 – Insurance contracts.

Schedule 151, Investment Revenue From Designated Insurance Property for Insurance Companies

All resident companies and fraternal benefit societies who operate a life insurance business in Canada and in a country other than Canada, and all non-resident companies operating an insurance business in Canada need to complete Schedule 151. This requirement arises from IFRS 17 – Insurance contracts, which came into effect on January 1, 2023.

Above Part 1 – Total reserve liabilities and Canadian reserve liabilities – Regulations 2400(1) and 8600, the custom question Has the corporation made the election under subparagraph 2400(1)(b)(i) of the definition of “attributed surplus” of the Income Tax Regulations? has been added on screen only to perform calculations in Part 4 – Mean Canadian investment fund – Regulations 2400 and 2412 – Non-resident insurer and in Part 5 – Designation tests – Regulations 2400(1), 2401(2) and 2401(4) of this schedule. When rolling forward a file, the answer to this question will be retained.

In Part 6 – Minimum revenue test – Regulation 2411, box Method 1 or box Method 2 must be selected to determine the method used to calculate the total minimum required investment revenue. When rolling forward a file, the choice of method will be retained. In addition, if the amount on line 850 is positive, it will be transferred to line 439 of Part 5 in Schedule 150. However, if the amount is negative, the absolute value of the amount will be transferred to the Current tax year excess amount column of the custom table Summary and analysis of cumulative excess account.

Québec

CO-737.18.17.CH, Deduction for Income from a Large Investment Project – Alternative Calculation Method*

A corporation claiming the deduction for income from one or more large investment projects that it is carrying out directly and which has made an irrevocable election to use the alternative calculation method for one of them must complete the new multicopy Form CO-737.18.17.CH for all its projects, including projects carried out through a partnership of which it is a member, whether or not the partnership has made the election. However, where the corporation has not made the election and is a member of a partnership that has made the election, the corporation must continue to complete and file Form CO-737.18.17.

The alternative calculation method eliminates the need to keep separate books and allows the corporation (or partnership) to benefit from tax assistance for all its activities, starting with the taxation year that begins after the date on which the election is made. The custom part Alternative calculation method election, which appears only on the first copy of the form, is used to indicate that the corporation has made the election and to enter the date on which the election is made. In addition, the question Is this the first taxation year to which the election applies? is calculated to Yes and the dates in the fields Start date and End date for the first taxation year indicate the dates of the current taxation year when the date entered in the field Date on which the election is made is included in the first preceding year in the History of taxation years table of Schedule 4N and the start date of the current taxation year is after the date of the election. The program then assumes that the election applies to all large investment projects carried out by the corporation (or any partnership of which it is a member).

Thus, when the custom questions Has the corporation irrevocably elected to use the alternative calculation method for one or more of its large investment projects? and Is this the first taxation year to which the election applies? both indicate Yes, you can click the Retrieve button to create a copy of Form CO-737.18.17.CH (including copies of Form CO-737.18.17.CH PROJECT) for each applicable copy of Form CO-737.18.17 and transfer all relevant data and amounts from the copies of Form CO-737.18.17 to the corresponding copies of Form CO-737.18.17.CH that have been created.

The data entered in the fields in the custom part Alternative calculation method election are retained when the file is rolled forward.

Complete parts 2, 3, 4.1.3, 4.2, 4.3, 5.1, 8 and 9, where applicable, on a separate copy of Form CO-737.18.17.CH PROJECT for each large investment project carried out by the corporation or by a partnership of which the corporation is a member. Parts 5.2, Maximum tax holiday, 6, Deduction limit for the taxation year, and 7, Deduction for income from a large investment project, should be completed only on the first copy of Form CO-737.18.17.CH.

For more information about form CO-737.18.17.CH, please consult the help topic on Forms CO-737.18.17 and CO-737.18.17.CH.

Updated Forms

* Note that form titles followed by an asterisk (*) have been updated according to the most recent version issued by the applicable tax authority.

Federal

Schedule 200, T2 Corporation Income Tax Return*

Line 278, Is the corporation subject to the excessive interest and financing expenses limitation (EIFEL) rules contained primarily in sections 18.2 and 18.21, or is it a party to any election under the EIFEL rules?, has been added to section Attachments.

In addition, line 580, Total labour requirements addition to tax, has been added to section Part I Tax. The amount calculated on this line corresponds to the total of additions to tax to meet labour requirements for investment tax credits. Custom lines aa, ab, ac and ad have been added to the screen, each representing one of these credits: the carbon capture, utilization, and storage ITC; the clean technology ITC; the clean hydrogen ITC and the clean energy ITC. The amount ab relates to the clean technology ITC and is equal to the amount on line 430 of Schedule 75. Lines aa, ac and ad are input fields.

Schedule 1, Net Income (Loss) for Income Tax Purposes*

Line 250 has been added to indicate the hybrid mismatch amount under subsection 18.4(4) ITA or subsection 12.7(3) ITA to be added to the income. Similarly, line 350 has been added to allow for the deduction of the adjustment for the hybrid mismatch amount under paragraph 20(1)(yy) ITA.

Moreover, with the addition of Schedule 150, Net Income (loss) for Income Tax Purposes for Insurance Companies, lines A1 and A2 have been added to this schedule.

-

Line A1 is calculated from the values entered in the GIFI when the corporation has activated the box to transfer the GIFI data and Schedule 150 is not applicable. Otherwise, the line is an input field;

-

Line A2 corresponds to the amount on line 110 of Schedule 150.

Amount A is now the sum of amounts A1 and A2.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amount on line A is retained and entered on line A1.

Schedule 5, Tax Calculation Supplementary – Corporations*

Line 329, Manitoba rental housing construction incentive tax credit, has been added to Part 2, Manitoba tax payable, tax credits, and rebates.

Schedule 8, Capital Cost Allowance (CCA)*

The calculation for the following columns has been revised to include elements from columns 6 and 7 that are related to designated immediate expensing property (DIEP):

-

column 16, which is used to determine the proceeds of disposition available to reduce the UCC of accelerated investment incentive property (AIIP) and property included in Classes 54 to 56;

-

column 19, used to determine the UCC adjustment amount for property acquired during the year other than AIIP and property included in Classes 54 to 56.

In addition, the amount calculated in column 11 is now limited to the amount calculated in column 10.

The calculation changes have been applied to the corresponding lines of Schedule 8 WORKCHART. Since the changes in this schedule have been applied to the Federal, Québec and Alberta columns, please note that they will also have an impact on the results indicated in the corresponding columns of the following forms:

-

CO-130.A, when the corporation has a permanent establishment in Québec;

-

AT1 Schedule 13, when the corporation has a permanent establishment in Alberta.

Schedule 8 WORKCHART, Capital Cost Allowance (CCA) Workchart

As they are now supported by the CRA’s system, the following CCA classes are now available in the program:

-

Class 57 (8%): Equipment in a CCUS project – CO2 capture, transport or storage;

-

Class 58 (20%): Equipment in a CCUS project – Use of CO2 in industrial production;

-

Class 59 (100%): Intangible property acquired for determining the existence of a geological formation to store captured carbon;

-

Class 60 (30%): Intangible property acquired to prepare a well to store captured carbon.

Note that since class 59 already benefits from a 100% CCA rate, the program does not automatically calculate an immediate expensing amount for property in this class that is designated immediate expensing property acquired before 2024.

Moreover, following the addition of codes 5, Clean hydrogen, and 6, Clean technology manufacturing ITC, to the Investment tax credit code drop-down list in Schedule 8 WORKCHART ADD, when rolling forward a return, the amount entered in the ITC (prior year) field in the copy of the corresponding class in Schedule 8 WORKCHART for which one of the new credit codes is selected in the Investment tax credit code drop-down list in the copy of Schedule 8 WORKCHART ADD will be equal to the amount:

-

of the clean hydrogen ITC entered on line 140 in Part 24 of Schedule 31 when code 5, Clean hydrogen, is selected in the Investment tax credit code drop-down list in a copy of Schedule 8 WORKCHART ADD for a property in this class and an ITC is claimed by the corporation on line 140 in Part 24 of Schedule 31.

-

of the clean technology manufacturing ITC entered on line 170 in Part 24 of Schedule 31 when code 6, Clean technology manufacturing, is selected in the Investment tax credit code drop-down list in a copy of Schedule 8 WORKCHART ADD for a property in this class and an ITC is claimed by the corporation on line 170 in Part 24 of Schedule 31.

Furthermore, following the addition of Schedule 75, when rolling forward a return, the amount entered in the ITC (prior year) field in the copy of the corresponding category in Schedule 8 WORKCHART for which code 3, Clean technology (Schedule 75), is selected in the Investment tax credit code drop-down list in a copy of Schedule 8 WORKCHART ADD will be equal to the amount in column 150 in Part 1 of Schedule 75 of the category corresponding to that in Schedule 8 WORKCHART. However, if a category is present more than once in Part 1 of Schedule 75, the amount entered in the ITC (prior year) field in the copy of the corresponding category from Schedule 8 WORKCHART will be equal to the sum of the amounts in column 150 in Part 1 of Schedule 75 for which we have the corresponding category.

Schedule 8 WORKCHART ADD, Additions and Dispositions Workchart

The following codes have been added to the Investment tax credit code drop-down list following the addition of the clean hydrogen and the clean technology manufacturing investment tax credits to Part 24 of Schedule 31:

-

Code 5 – Clean hydrogen

-

Code 6 – Clean technology manufacturing

Schedule 9 WORKCHART, Related and Associated Corporations Workchart

In the Alberta AT1 Schedule 29 – Alberta innovation employment grant section, modifications have been made following the update of Alberta Schedule 29. The option Select this check box if the corporation is associated with one or more corporations that have each claimed an Innovation Employment Grant (IEG) in their taxation year ending in the same calendar year has been replaced by the question Is the corporation a “qualified corporation” as defined under paragraph 26.95(1)(g) of the Alberta Corporate Tax Act?. When the answer to this question is Yes, the expenditure limit is calculated and line 268 must be completed. Furthermore, following the addition of columns 245, 267 and 268 to the Allocation of the Maximum Expenditure Limit table of Alberta Schedule 29, the equivalent lines have been added to this section.

Schedule 31, Investment Tax Credit – Corporations*

Former Part 24, Clean technology ITC, has been renamed Clean economy ITCs. Line 200 for the carbon capture, utilization and storage ITC has been moved to Part 24; consequently, former Part 25, Carbon capture, utilization and storage ITC, has been removed.

The following lines have been added to Part 24:

-

Line 140, Clean hydrogen ITC

-

Line 170, Clean technology manufacturing ITC

The calculations for the two new investment tax credits (ITCs) have not been integrated into Schedule 31 yet. Consequently, you must manually calculate the amount of each ITC and enter it on lines 140 and 170 of Part 24, if necessary.

Furthermore, following the addition of Schedule 75, line 155 of Part 24 is now calculated from line 165 of Part 1 in Schedule 75.

Former Parts 26 and 27 have been renumbered 25 and 26.

Finally, Schedule 31 is applicable when an amount is entered on lines 140 and/or 170 of Part 24.

Schedule 53, General Rate Income Pool (GRIP) Calculation

The calculation of line 100, GRIP at the end of the previous tax year, has been modified. When this is the first year after an amalgamation and the return is prepared by rolling forward the return of one of the predecessor corporations, the amount on line 100 will be zero.

Diagnostics have been added to Part Eligibility for the various additions to prompt the user to answer all sub-questions if the corporation was formed as a result of an amalgamation or if it wound up a subsidiary in the previous taxation year and to ensure that Parts 3 and 4 have been completed when required.

Schedule 54, Low Rate Income Pool (LRIP) Calculation*

The calculation of line 100, LRIP at the end of the immediately previous tax year, has been modified. When this is the first year after an amalgamation and the return is prepared by rolling forward the return of one of the predecessor corporations, the amount on line 100 will be zero.

Diagnostics have been added to Part Eligibility for the various additions to prompt the user to answer all sub-questions if the corporation was formed as a result of an amalgamation or if it wound up a subsidiary in the previous taxation year and to ensure that Parts 5 and 6 have been completed when required.

Schedule 56, Part II.2 Tax on Repurchases of Equity*

Line 205 no longer accepts negative values.When opening a return prepared with a prior version of CCH iFirm Taxprep T2, any negative amount entered by override on this line will not be retained.

Schedule 58, Canadian Journalism Labour Tax Credit*

In accordance with the economic update presented in November 2023, the salary and wages limit is raised from $55,000 to $85,000 as of January 1, 2023, and the tax credit rate is increased from 25% to 35% for expenses incurred after 2022 and before 2027. As a result, the following changes have been made to Part 3 of the form:

-

Above the table, amounts A and B calculate the proportion of days before 2023 and after 2022 that are in the taxation year in which the organization is a qualifying journalism organization.

-

The calculation in column 5 has been modified to allow proration based on amount A.

-

Former column 8 becomes the new column 11, and the calculation has been adjusted to reflect the addition of columns.

-

Columns 8, 9 and 10 have been added to calculate the eligible labour expenditure based on the number of days in the taxation year after 2022.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, an amount entered as an override in column 8 is retained as an overridden value in column 11.

Schedule 63, Return of Fuel Charge Proceeds to Farmers Tax Credit*

Client Letter Worksheet

Following the change to the initial deadline to submit the Statement A form without a late filing penalty for the AgriStability program participants of Manitoba, New Brunswick, Nova Scotia, Newfoundland and Labrador, Yukon and Northwest Territories, the line AgriStability filing deadline for MB, NB, NS, NL, YK and NT has been added to section AGRI/HAGRI – AgriStability and AgriInvest programs. In addition, the first line has been renamed Filing deadline (general) and now displays the filing deadline for the AgriInvest program participants as well as the AgriStability participants from other provinces. For more information, consult the note relating to this subject.

Instalment, Federal Tax Instalments

Line Total labour requirements addition to tax has been added to section Instalment base calculation. For the first instalment base method, the amount in this field is equal to the amount on line 580 of Schedule 200, while it is an input field for the estimated tax method.

Inducement, Inducement Calculation Workchart

The roll forward calculations for lines Tax credit for multimedia titles and Tax credit for corporations specialized in the production of multimedia titles in Part Tax credits whose amount should be added to income – Québec have been modified to take into account the carry forward deductions related to these tax credits.

In addition, line Manitoba refundable rental housing construction incentive tax credit has been added to Part Tax credits whose amount should be added to income – Manitoba.

Line Tax credit for the integration of information technologies has been removed from section Tax credits whose amounts should be added to income – Québec.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount had been entered on this removed credit line, it will not be retained.

Finally, line Alberta film and television tax credit has been added to Part Tax credits whose amount should be added to income – Alberta.

Summary, Corporate Taxpayer Summary

Following the update of Forms CO-1029.8.36.TM and CO-1029.8.36.PM, lines Tax credit for multimedia titles – CO-1029.8.36.TM and Tax credit for corporations specialized in the production of multimedia titles – CO-1029.8.36.PM have been added to Part Summary of provincial carryforward amounts to allow tracking of the deferrable amounts of deductions related to these tax credits.

T183 CORP, Information Return for Corporations Filing Electronically*

Line 705 from the T2 return is now displayed in Part 2, Declaration of the form. In addition, the signature time has been added to Part 3, Certification and authorization.

T661, Scientific Research and Experimental Development (SR&ED) Expenditures Claim

Following the update of Alberta Schedule 29, the calculations of lines 429d and 513d have been modified.

In addition, the year’s maximum pensionable earnings amount for purposes of the Canada pension plan has been updated for the 2025 calendar year (and is now $71,300). This amount is used to determine the specified employees’ salary or wages in Part 5 when the proxy method is selected to calculate the SR&ED expenditures.

T2183, Information Return for Electronic Filing of Special Elections*

AgriStability and AgriInvest Additional Information and Adjustment Request*

AgriStability and AgriInvest Programs – Harmonized provinces* and British Columbia*

Line Cellphone number has been removed from subsections Participant identification and Contact person information.

As of the 2024 program year, the initial deadline to file the Statement A form without a late filing penalty is June 30, 2025, for the AgriStability program participants of Manitoba, Nova Scotia, New Brunswick, Newfoundland and Labrador, Northwest Territories and Yukon. The date of September 30, 2025, remains unchanged for the AgriStability program participants in British Columbia and the AgriInvest program participants in the harmonized provinces and British Columbia.

AgriStability and AgriInvest Programs – Ontario*

In the new participant form, the line Annual gross farming income has been removed from Section B: Farming activities and the lines Primary commodity sold in 2024, No. of productive units sold in 2024 and Unit type have been added to it.

AgriStability and AgriInvest Programs – Alberta*

AgriStability and AgriInvest Programs – Saskatchewan*

AgriStability and AgriInvest Programs – Prince Edward Island

In Part Schedule 2c of the supplemental form, the columns Average Weight of the tax year ending inventory are now input columns. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, only the overridden amounts will be retained.

Ontario

Schedule 572, Ontario Made Manufacturing Investment Tax Credit*

Following a discussion with the CRA, the applicability of Schedule 572 has been modified. Previously, the schedule could be applicable when an allocation of the expenditure limit was made in column 110 and the amount on line 106, Ontario made manufacturing investment tax credit, was equal to 0. The CRA has confirmed that in such a situation, Schedule 572 is not to be filed. For the schedule to be filed, the qualifying corporation must have an amount calculated on line 106.

Québec

Use of the pound sign in certain forms

The lines and fields listed in the following forms no longer support the pound sign (#):

-

CO-17 and CO-17.SP: line 200, Name of director of the corporation

-

CO-17 and CO-17.SP: line 200, Title or position

-

CO-17.CE: line 11, Websites

-

CO-1029.8.33.6: line 17b, Organization code or number of the permit issued by the Ministère de l’Éducation or the Ministère de l’Enseignement supérieur

-

CO-1029.8.33.6: line 17f, Education program – Number

-

CO-1029.8.33.13: line 01e, File (of the corporation or partnership, as applicable)

-

CO-1029.8.35: line 09, Number of the ruling or qualification certificate

-

CO-1029.8.36.5): line 05f, Number of the certificate issued by the Minister

-

CO-1029.8.36.5: line 07d, Certificate number

-

CO-1029.8.36.7: line 07a, Certificate number

-

CO-1029.8.36.DF: line 05c, SODEC certificate number

-

CO-1029.8.36.EL: line 05b, Number of the favourable advance ruling or qualification certificate

-

CO-1029.8.36.FO: line 09a, Organization code or MEES permit number

-

CO-1029.8.36.FO: line 09e, Number of the particular training

-

CO-1029.8.36.SM: lines 06a and 06b, Number of either the favourable advance ruling given or the qualification certificate issued for each eligibility period

-

CO-1029.8.36.SP: line 05c, Number of the favourable advance ruling given

-

CO-1029.8.36.SP: line 05d, Number of the qualification certificate issued (where applicable)

-

CO-1029.8.36.SP: line 05f, Number of the approval certificate issued

-

CO-1029.8.36.PS: line 07a, Number of certificate

-

CO-1029.8.36.TM: line 07, Number of the qualification certificate issued by Investissement Québec (file number)

-

CO-1029.8.36.TM, line 09ld, Number of certificate

-

TP-1086.R.23.12: Part 2 Address of the immovable, Street number

-

TP-1086.R.23.12: Part 2 Address of the immovable, Street name or PO Box

-

TP-1086.R.23.12: Part 3 Information on the person or businesses that carried out the work, Name (first and last name for an individual)

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if a pound sign has been entered into one of these fields, the value will not be retained.

In addition, if a pound sign is present in the fields listed below, a diagnostic will be displayed to prompt you to make the necessary corrections:

-

CO-17: Preparer – Name

-

CO-17: Preparer – Address

Registration Fees

The registration fees on line 441b on CO-17, Corporation Income Tax Return and CO-17.SP, Information and Income Tax Return for Non-Profit Corporation will be indexed on January 1, 2025. The amount for cooperatives will increase from $46 to $47, the amount for non-profit legal persons (incorporated association), a syndicate of co-ownership and fraternal benefit societies, from $39 to $40, and the amount for corporations, mutual insurance corporations and other entities, from $101 to $104.

CO-17, Corporation Income Tax Return)*

The question on line 19b has been modified. You must attach Form TP-21.4.39, Déclaration relative aux cryptoactifs, when the corporation has received, held or disposed of (sold, transferred, exchanged, gave, etc.) one of more crypto-assets. When the answer to question 19b is Yes and there are no attachments with the CO-17 return, the return will not be eligible for electronic transmission. We expect to implement the new form in version 2025 v.1.0 of the program.

CO-17.A.1, Net Income for Income Tax Purposes

Following the addition of line 250 to Schedule 1, line 80h is now exclusively used to indicate the hybrid mismatch amount under subsection 18.4(4) ITA or subsection 12.7(3) ITA to be added to the income. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if a description or value was indicated on line 80h, it will be retained on the first line that does not contain any data among lines 80i to 80k. If these lines all contain data, the data on line 80h will be added to the data on line 80k. Please verify the accuracy of the data retained.

Furthermore, following the addition of line 350 to Schedule 1, line 150g is now exclusively used to indicate the adjustment for the hybrid mismatch amount under paragraph 20(1)(yy) ITA. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if a description or value was indicated on line 150g, it will be retained on the first line that does not contain any data among lines 150h to 150k. If these lines all contain data, the data on line 150g will be added to the data on line 150k. Please verify the accuracy of the data retained.

CO-17.SP, Information and Income Tax Return for Non-Profit Corporations*

CO-156.TR, Additional Deduction for Transportation Costs of Small and Medium-Sized Manufacturing Businesses*

CO-156.TZ, Additional Deduction for Transportation Costs of Small and Medium-Sized Businesses Located in a Special Remote Area*

CO-737.18.17, Deduction for Income from a Large Investment Project*

CO-1029.8.33.13, Tax Credit for the Reporting of Tips*

To take into account the new measures with respect to the second additional QPP contributions, you must complete if necessary the new part 2.3.2, Second additional contribution (2024 calendar year onward), for the 2024 and subsequent calendar years that are covered on line 07. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the calendar year covered on line 07 was 2024, verify if adjustments are required in parts 2.3.1 and 2.3.2.

In addition, part 2.10, Contribution to the health services fund for the 2018 calendar year, has been removed.

Finally, the various applicable rates for 2025 have been integrated into the form.

CO-1029.8.33.CS, Tax Credit for the Retention of Persons With a Severely Limited Capacity for Employment

A box for the year 2025 has been added to line 6.

CO-1029.8.33.TE, Tax Credit to Foster the Retention of Experienced Workers*

In accordance with the 2024-2025 budget tabled on March 12, 2024, the tax credit is abolished for contributions relating partially or fully to salaries, wages or other remuneration attributable to a date subsequent to March 12, 2024.

CO-1029.8.35, Tax Credit for Québec Film Productions*

Boxes 10e, 10f and 10h have been removed from Part 2, Information about the property. Question AA has also been removed, as it was only relevant when box 10f was selected.

Boxes 10i, The application for an advance ruling or a qualification certificate was filed with SODEC before March 13, 2024, and 10j, The application for an advance ruling or a qualification certificate was filed with SODEC after March 12, 2024, have been added to Part 2. These new boxes replace the custom question BB that had been added to the previous version of the program. This question has therefore been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if the answer to question BB is Yes, box 10j will be selected, and if, conversely, the answer to this question is No, box 10i will then be selected.

Finally, lines 93 and 94 have been removed from section 4.4, as the temporary 2% increase is no longer applicable since January 1, 2017.

CO-1029.8.36.DA, Tax Credit for the Development of E-Business*

Following the announcement of the 2024-2025 budget tabled on March 12, 2024, the Government of Québec has modified the calculation of the tax credit for the development of e-business.

First of all, the definition of eligible salary has been modified. Thus, for taxation years beginning after 2024, the $83,333 limit applicable to eligible salary or wages is removed and is being replaced by an exclusion threshold based on the basic personal amount. As a result, former sections 2.2.2 and 2.2.3 form new section 2.3, and this new section applies only to taxation years beginning before 2025. In addition, new section 2.4 is used to calculate the new exclusion threshold per eligible employee and applies to taxation years beginning after 2024. Since the basic personal amount for 2025 was unknown when the version was released, enter the amount, as required, in the cell provided for that purpose below line 35a of the form.

Then, the rate for the refundable tax credit and the deduction respecting the tax credit on lines 68 and 101 respectively now vary according to the calendar year in which the taxation year began. These rates are presented in notes 13 and 17 of the form.

CO-1029.8.36.II, Tax Credit for Investment and Innovation

The following changes have been made to the list of geographic codes that can be found on lines 14a.1, 14a.2 and 14a.3 of Part 2, Information about the specified property:

-

Code 11020 Saint-Guy and code 13060 Lac-des-Aigles have been replaced by code 13062 Lac-des-Aigles.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if codes 11020 Saint-Guy or 13060 Lac-des-Aigles had been entered, they will be replaced by code 13062 Lac-des-Aigles.

CO-1029.8.36.PM, Tax Credit for Corporations Specialized in the Production of Multimedia Titles*

Several changes have been made to the form in accordance with the budget tabled by the Government of Québec in March 2024.

Firstly, the calculation of the eligible labour expense has been modified. For each eligible employee, an exclusion threshold based on the basic personal amount must now be calculated to determine the eligible salary. The current $100,000 annual limit on eligible labour has been removed, along with the election concerning employees to whom the annual limit does not apply. Thus, Part 2, Employees to whom the annual limit on qualified salary or wages does not apply, section 3.3, Qualified salary or wages for a taxation year beginning before January 1, 2025, and section 3.4, Reduction of qualified salary or wages that may give rise to more than one tax credit for a taxation year beginning before January 1, 2025, are only calculated for taxation years beginning before 2025. The new section 3.5, Qualified salary or wages for a taxation year beginning after December 31, 2024, applies to taxation years beyond 2024. Since the basic personal amount for 2025 was unknown when the version was released, enter the amount, as required, in the cell provided for that purpose below line 49a of the form.

Secondly, the updated form takes into account the addition of a non-refundable portion of the tax credit. Therefore, Part 7, Deduction respecting the tax credit for corporations specialized in the production of multimedia titles (non-refundable portion of the tax credit), has been added to the form. Amounts calculated on lines 96 and 108 will be reported on one of the lines 421b to 421f of the CO-17 return.

Finally, custom question CC has been added to Part 1 of the form to allow the user to specify the type of multimedia title. The rate on line 65, Tax credit rate, is based on the answer to question CC and the start date of the taxation year. As a result, the checkboxes on this line have been removed.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the box selected on line 65 determines the box to select for question CC. If the 37.50% box is selected, the facts certified by the qualification certificate are those in box 1, whereas if the 30.00% box is selected, the facts in box 2 are certified by the certificate. Finally, if the 26.25% box is selected, the certificate specifies none of the circumstances in boxes 1 and 2.

CO-1029.8.36.SP, Tax Credit for Film Production Services*

Boxes 06a, 06b, 07a and 07b have been removed from Part 2, Information about the film production, and lines 15 to 32 have been removed from Part 3, Labour costs.

Boxes 07c and 07d have been added to Part 2. These new boxes replace box AA that had been added to the previous version of the program to take into account the measures announced in the March 2024 budget. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if box AA was selected, box 07d will also be selected. Conversely, if box AA was not selected, but 07b was, box 07c will be selected.

Lines 27a to 27h have been added to Part 3. These lines apply the 65% rule for contracts relating to computer-aided special effects and animation. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the value entered on line 29 will be retained on line 27f.

CO-1029.8.36.TM, Tax Credit for Multimedia Titles*

Several changes have been made to the form in accordance with the budget tabled by the Government of Québec in March 2024.

Firstly, the calculation of the eligible labour expense has been modified. For each eligible employee, an exclusion threshold based on the basic personal amount must now be calculated to determine the eligible salary. The current $100,000 annual limit on eligible labour has been removed, along with the election concerning employees to whom the annual limit does not apply. Thus, Part 3, Employees to whom the annual limit on qualified salary or wages does not apply, section 4.3, Qualified salary or wages for a taxation year beginning before January 1, 2025, and section 4.4, Reduction of qualified salary or wages that may give rise to more than one tax credit for a taxation year beginning before January 1, 2025, apply only to taxation years beginning before 2025. The new section 4.5, Qualified salary or wages for a taxation year beginning after December 31, 2024, applies to taxation years beyond 2024. Since the basic personal amount for 2025 was unknown when the version was released, enter the amount, as required, in the cell provided for that purpose below line 49a of the form.

Secondly, the updated form takes into account the addition of a non-refundable portion of the tax credit. Therefore, Part 8, Deduction respecting the tax credit for multimedia titles (non-refundable portion of the tax credit), has been added to the form. Amounts calculated on lines 96 and 108 will be reported on one of the lines 421b to 421f of the CO-17 return. Note that Part 8 is cumulative for all multimedia titles indicated in the form.

Finally, custom question CC has been added to Part 2 of the form to allow the user to specify the type of multimedia. The rate on line 65, Tax credit rate, is based on the answer to question CC and the start date of the taxation year. As a result, checkboxes on this line have been removed.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the box selected on line 65 defines the multimedia type for question CC. If the 37.50% box is selected, the title is a multimedia title available in French, whereas if the 30.00% box is selected, the title is a multimedia title that is not available in French. Finally, if the 26.25% box is selected, the title is another title.

CO-1175.4, Life Insurance Corporation*

The update of this form includes the modification of the calculation of the taxable capital of a corporation resident in Canada and of the amount determined for the year in respect of the capital of the corporation’s foreign insurance subsidiaries for a taxation year beginning after December 31, 2022 (see sections 1175.8 and 1175.10 TA). Therefore, sections 2.1 and 2.2 have been renumbered 2.1.1 and 2.2.1. They are used to calculate the taxable capital of a corporation resident in Canada and the amount determined for the year in respect of the capital of the corporation’s foreign insurance subsidiaries for a taxation year beginning before January 1, 2023.

Sections 2.1.2 and 2.2.2 have been added and are used to calculate the taxable capital of a corporation resident in Canada and the amount determined for the year in respect of the capital of the corporation’s foreign insurance subsidiaries for a taxation year beginning after December 31, 2022. As a result, the amount resulting from the calculation on line 38 of section 2.3 is now equal to the corporation’s capital on line 16 if the taxation year begins before January 1, 2023, or is equal to the corporation’s capital on line 19m if the taxation year begins after December 31, 2022.

Likewise, the amount resulting from the calculation on line 39 of section 2.3 is now equal to the amount determined for the year in respect of the capital of the corporation’s foreign insurance subsidiaries on line 37 if the taxation year begins before January 1, 2023, or is equal to the amount determined for the year in respect of the capital of the corporation’s foreign insurance subsidiaries on line 37v if the taxation year begins after December 31, 2022.

A diagnostic will appear on line 6 and/or line 20 to advise you not to complete sections 2.1.1 and 2.2.1 if the corporation's taxation year begins after December 31, 2022. In this situation, you must transfer the data entered on lines 11 and 14 of section 2.1.1 to lines 18 and 19k of section 2.1.2, then delete the data concerned from section 2.1.1, as applicable.

In addition, if the corporation has one or more foreign insurance subsidiaries, you must transfer the data entered on lines 20 to 25, 28 and 32 to 34 of section 2.2.1 to lines 37a to 37c, 37f, 37n and 37q to 37s of section 2.2.2. Delete the data concerned from section 2.2.1, as applicable.

Line 31 has been removed from section 2.2.

Finally, lines 93 and 94 as well as note 13 have been removed from Part 6 because the deduction for a major investment project is no longer applicable as of January 1, 2021 (see repealed section 1175.4 TA).

Q1 L70A, Taxable Tax Credits; and

Q1 L140A, Non-Taxable Tax Credits

Credit code 099, Tax credit relating to information technologies, has been removed from both forms.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount had been entered on code line 099 of these forms, it will not be retained.

QC L421B-421F, Deduction in the Tax Calculation

The following codes have been added to the form:

-

315, Deduction relating to the tax credit for multimedia titles – current year

-

316, Deduction relating to the tax credit for multimedia titles – previous year

-

317, Deduction relating to the tax credit for multimedia titles – subsequent year

-

318, Deduction relating to the tax credit for corporations specialized in the production of multimedia titles – current year

-

319, Deduction relating to the tax credit for corporations specialized in the production of multimedia titles – previous year

-

320, Deduction relating to the tax credit for corporations specialized in the production of multimedia titles – subsequent year

QC L440P-Y, Additional Québec Credits

Credit code 099, Tax credit for the integration of information technologies (CO-1029.8.36.TI), has been removed from the form, as this credit can only be claimed for a taxation year ending before 2021.

When opening a return prepared with a prior version of CCH iFirm Taxprep T2, if an amount had been entered on code line 099, it will not be retained.

British Colombia

Schedule 421, British Columbia Mining Exploration Tax Credit*

Schedule 422 (T1196), British Columbia Film and Television Tax Credit*

Animated productions that start principal photography after May 31, 2024, are not eligible for the regional tax credit (calculated in Part 10) or the distant location regional tax credit (calculated in Part 11). Therefore, lines 10D and 11D are no longer calculated when principal photography begins after this date.

In addition, lines 13A and 13B have been removed from Part 13. The tax credit calculation on line 13B has been moved to line 760. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amount entered by override on line 13B is retained as an overridden value on line 760.

Schedule 423 (T1197), British Columbia Production Services Tax Credit*

Animated productions that start key animation after May 31, 2024, are not eligible for the regional production services tax credit (calculated in Part 7), nor the distant location production services tax credit (calculated in Part 8). A diagnostic has been added to worksheets 2 and 4 to inform the user that the key animation start date is after May 31, 2024.

In addition, lines 6A and 6B have been removed from Part 6. The tax credit calculation on line 6B has been moved to line 800. Similarly, lines 9A and 9B have been removed from Part 9. The tax credit on line 9B has been moved to line 805. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the amount entered by override on line 6B is retained as an overridden value on line 800, and the amount entered by override on line 9B is retained as an overridden value on line 805.

Schedule 428, British Columbia Training Tax Credit*

Schedule 430, British Columbia Shipbuilding and Ship Repair Industry Tax Credit*

Alberta

AT1, Alberta Corporate Income Tax Return*

The electronic filing exemption for a corporation whose gross revenue does not exceed $1 million no longer applies to taxation years beginning after 2024.

On line 030, Special Corporation Status, options 6, Insurance Corporation, and 7, Non-resident Corporation, have been added. Option 6 is selected when the answer to the question Is this an insurance corporation? of the ID form is Yes, while option 7 is selected when the answer to the question on line 080 of the ID form is No.

Finally, line 115, Alberta Film and Television Tax Credit (FTTC), has been added to the form. If an amount for this credit had been entered on line 087, it must be removed and entered on line 115.

AT1 Schedule 12, Alberta Income/Loss Reconciliation*

Lines 010, 011, 012 and 013 related to the eligible capital property have been removed. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, the values related to the removed lines will not be retained.

AT1 Schedule 29, Alberta Innovation Employment Grant*

Bill 4, which received Royal Assent on December 7, 2023, is introducing changes on how the 12% portion of the tax credit is calculated when the corporation is associated with one or more corporations for innovation employment grant (IEG) purposes (box 100 set to Yes). Thus, the definition of the base amount, which was determined by calculating the average eligible expenditures for the two preceding taxation years, no longer applies and the definition of the allowed amount has been added.

The changes are reflected in the schedule as follows:

-

Line 112 is now only used to calculate the 12% portion of the tax credit when the corporation is not associated with one or more corporations for IEG purposes (box 100 set to No).

-

Section Associated – Base amount and lines 120 to 124 have been removed.

-

The following columns and lines have been added to the Allocation of the Maximum Expenditure Limit table and to the Alberta AT1 Schedule 29 – Alberta innovation employment grant section of Schedule 9 WORKCHART:

235, Current Taxation Year End

245, Current year’s eligible expenditures. For the filing corporation, the amount on this line is equal to the amount on line 031. When rolling forward a return, the amounts on lines 245 will be transferred to lines 250, Eligible expenditures for the first preceding year. The amount on line 275 corresponds to the total of column 245.

267, Individual corporation maximum allowed amount Line 245 - [(line 250 + line 260) / 2]. The amount on this line can be negative, but in such a case, do not complete line 268. The amount on line 310 corresponds to the total of column 267.

268, Allocated allowed amount to each corporation. This line must be completed manually and is for qualified corporations only. The amount must not exceed the lesser of the amount from line 267, the allocated expenditure limit from line 240 and the amount according to paragraph 26.971(3)(a) of the ACTA. The amount on line 320 corresponds to the total of column 268. The amount allocated to the filing corporation is reported to line 325, then line 125 calculates the lesser between the amounts of lines 108 and 325 and multiplies it by 12%.

In addition, a corporation no longer has to be considered a qualified corporation to have incurred eligible expenditures. For example, if the filing corporation claiming the IEG is associated with a corporation in Saskatchewan that carries on scientific research and experimental development in Alberta during the taxation year, the expenditures incurred by the associated corporation must be entered in the Allocation of the Maximum Expenditure Limit table and lines 220, 235, 245, 250, 260, 265 and 267 must be completed. In such a case, leave line 268 of the associated corporation blank since it is not a qualified corporation.

The modifications from Bill 4 are effective as of January 1, 2021. When opening a return prepared with a prior version of CCH iFirm Taxprep T2, please revise the data entered in the Allocation of the Maximum Expenditure Limit table.

For more information on the allowed amount, consult section 26.971 of the Alberta Corporate Tax Act and the Guide to Claiming the Alberta Innovation Employment Grant.

Saskatchewan

Schedule 411, Saskatchewan Corporation Tax Calculation)

Following a discussion with the CRA, the calculation of line 1B has been modified for situations where the corporation has specified corporate income calculated in Schedule 7 and the other CCPC assigns a portion of its business limit to the filing corporation. When calculating line 1B, the business limit assigned to the corporation must be increased by the ratio of the Saskatchewan business limit to the federal business limit.

Yukon

Schedule 444, Yukon Business Carbon Price Rebate*

The calculations have been updated to reflect legislative changes concerning a taxation year ending after 2023. As a result, an eligible mining business taxpayer must only enter its eligible Yukon mining assets in the table of Part 1 and must not enter them in the table of Part 4. Therefore, the custom question Do you want to transfer the data for all the properties (other than those in classes 41 and 41.2) entered in the table hereunder to the table of Part 4? is now calculated to Yes only when the taxation year of the corporation ends before 2024.

In addition, in Part 6, former lines F and G have been renamed custom lines e1, Eligible Yukon UCC, and e2, Total eligible Yukon mining UCC and former line H has been renamed line F, Total eligible Yukon UCC. Line I becomes line G. Line e2 is now calculated only when the taxation year of the corporation ends before 2024.

Corrected Calculations

The following problems have been corrected in version 2024 2.0:

Where to Find Help

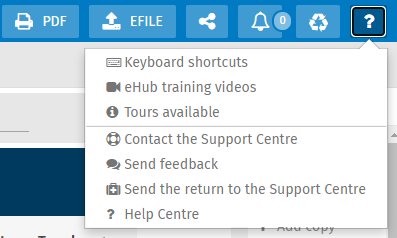

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

Note that the CCH iFirm Taxprep T2 e-Bulletin notifies you each time an updated or new form is made available in a program update.