The T106 is a separate return, filed separately from the Federal T2 Schedule 200.

Multiple Non-residents

If the corporation does business with more than one non-resident you will require more than one T106.

If you want to create more than one Form T106, click New. You can also click Delete to remove an existing copy of the T106.

Note: When a T106 slip is an “Unmodified,” “Amended” or “Cancelled” type slip, it is no longer possible to delete that slip.

Return and slip type (for electronic filing purposes)

The four codes to use are the following:

- 1 New

- 2 Unmodified

- 3 Amended

- 4 Cancelled

- When a T106 is initially filed, the program displays New for the summary and each individual slip.

- When a T106 form is amended, the program displays Unmodified for any summary or slip that has not been modified.

- If the summary or any of the slips has been modified, the program displays Amended for each summary or slip that has been amended.

- Only a slip can be cancelled, and not a summary. If a slip is cancelled, the answer to the question Do you want to cancel this slip? must be “Yes,” and the program displays Cancelled.

Electronic Filing

Form T106 contains Form T106 Summary (Jump Code: 106S) as well as T106 slips (Jump Code: 106) and is transmitted separately from the T2 return. However, electronic filing of Form T106 has been implemented in the program so that you can transmit both the T2 return and Form T106 at the same time.

However, you can transmit the T2 return without Form T106, or Form T106 without the T2 return.

The program defines the status of the check boxes Were all diagnostics related to Form T106 corrected in the T2 EFILE diagnostic tab?, Were all diagnostics with the "T106" mention and relating to electronic filing corrected in the CCH diagnostic tab? and Form T106 applicable, based on the corporation’s information (e.g. depending on whether the corporation’s name, Business Number (BN) and address comply with EFILE requirements) and the data entered in Form T106.

If you selected Form T106 for electronic filing and one of the above-mentioned check boxes is not selected, make sure to verify the diagnostics before making any required adjustment.

When Form T106 is selected for electronic transmission, the required information is complete and the total of all Box I amounts in the T106 slips exceeds CAN$1,000,000, the EFILE status of Form T106 will be “Eligible.”

The information on the transmission status of Form T106 is also available using the File/Properties command (F11).

The electronic filing date is displayed automatically if the form has been selected for electronic filing.

Note that you cannot electronically transmit Form T106 using a WAC with the program. An EFILE number must be used.

Amended Form T106

You can also transmit an amended Form T106. In that case, indicate that Form T106 is amended by selecting the appropriate check box at the top of the form.

To be able to transmit an amended Form T106 for which the value of the EFILE status is “Accepted,” you have to change the value of this status to “Eligible” using the File/Properties (F11) command.

T106 – Docs

You do not need to file an amended return to transmit documents when the T106 electronic filing status is Accepted because there is no time limit constraint to transmit documents with the T106 – Docs service.

The following instructions are taken from the form.

Purpose

The T106 Summary and Slips are annual information returns used to report non-arm’s length transactions between reporting persons or partnerships and non-residents under section 233.1 of the Income Tax Act. The T106 Summary and Slips are prescribed forms.

Definitions

Under section 233.1 of the Income Tax Act:

A "reporting person" for a taxation year means a person (corporation, trust or individual) who, at any time in the year,

- is resident in Canada; or

- is non-resident and carries on business (other than a business carried on as a member of a partnership) in Canada.

A "reporting partnership" for a fiscal period means a partnership

- a member of which is resident in Canada in the period; or

- that carries on business in Canada in the period.

A "reportable transaction" means

- in the case of

- a reporting person for a taxation year who is not resident in Canada at any time in the year, or

- a reporting partnership for a fiscal period no member of which is resident in Canada in the period,

- in any other case, a transaction or series of transactions that relate in any manner whatever to a business carried on by a reporting person (other than a business carried on by a reporting person as a member of a partnership) or partnership in a taxation year or fiscal period.

a transaction or a series of transactions that relate in any manner whatever to a business carried on in Canada by the reporting person or partnership in the year or period or a preceding taxation year or period; and

The terms arm’s length and non-arm’s length are discussed in Interpretation Bulletin IT 419, Meaning of Arm’s Length. Refer also to sections 251 and 252 of the Income Tax Act.

Who has to file

Areporting person has to file T106 documentation for a tax year in respect of reportable transactions in which the reporting person and the non-arm’s length non-resident person (or partnership of which that non-resident person is a member) participated in the period. The reporting person has to file the T106 documentation if the amount of the total reportable transactions for all the non-residents combined is more than CAN $1,000,000 (i.e., the total of all Box I amounts is more than CAN $1,000,000).

Areporting partnership has to file T106 documentation for a fiscal period in respect of reportable transactions in which the reporting partnership and the non-arm’s length non-resident person (or partnership of which the non-resident person is a member) participated in the period. The reporting partnership has to file the T106 documentation if the amount of the total reportable transactions for all the non-residents is more than CAN $1,000,000 (i.e., the total of all Box I amounts is more than CAN $1,000,000). File T106 documentation for the partnership only and not for each partner.

Where a reporting person or partnership’s total amount of the transactions with a particular non-resident during the taxation year is below $25,000, there is no need to report these transactions in Part III of the T106 Slip. Please see the notice on the CRA Web page, Form T106, Information Return of Non-Arm's Length Transactions with Non-Residents - De Minimis Policy for additional information.

Branches

A Canadian branch of a foreign-based corporation or a foreign-based branch of a Canadian corporation does not have to file T106 documentation for notional transactions. However, non-arm’s length transactions between a branch and a non-arm’s length party have to be reported in the reporting person’s/partnership’s T106.

When to file

T106 documentation has to be filed on or before the following dates:

Corporations – six months after the end of the tax year.

Partnerships – the due date is the same as the due date for filing a partnership information return under section 229 of the Income Tax Regulations. If no partnership information return has to be filed, the reporting partnership’s due date is the day by which the partnership information return would be required to be filed if section 229 did apply to the reporting partnership.

Trusts - 90 days after the end of the tax year.

Individuals - April 30 after the end of each calendar year. For individuals who are self-employed, or individuals whose spouse is self-employed, the filing due date is extended, as with their T1 individual income tax returns, to June 15 after the end of the calendar year.

For short tax years/fiscal period ends, T106 documentation is due at the same time as the filing due date of the T1, T2, and T3 income tax returns or the T5013 information return. For short tax years/fiscal periods which together do not exceed 12 months, one set of T106 documentation is enough if information for the tax years/fiscal periods is detailed in a letter that must accompany the T106 documentation.

What to file

Each reporting person or partnership has to file one T106 Summary, as well as a separate T106 Slip for each non-resident. The information reported in the T106 is filed in respect of the corporation, partnership, trust or individual and not by sub-division, cost centre or individual partner.

Where to file

T106 documentation has to be mailed to the Winnipeg Taxation Centre, Data Assessment & Evaluation Programs, Validation & Verification Section, Foreign Reporting Returns, 66 Stapon Road, Winnipeg MB R3C 3M2. T106 documentation has to be filed separately from the income tax return. Do not attach T106 documentation to your income tax return.

Penalties

Late Filing – A late filing penalty, or multiple late filing penalties for more than one T106 Slip may be assessed under subsection 162(7) of the Income Tax Act where T106 documentation is filed after the due date. The penalty is equal to the greater of $100 and $25 per day, as long as the failure to file continues, to a maximum of 100 days.

Failure to file – A failure to file penalty may be assessed under subsection 162(10) of the Income Tax Act where reporting persons or partnerships knowingly, or under circumstances amounting to gross negligence, fail to file or fail to comply with a request by the Canada Revenue Agency (CRA) for T106 documentation. The minimum penalty is $500 per month, to a maximum of $12,000 for each failure to comply. Where the CRA has served a demand to file T106 documentation, the minimum penalty is $1,000 per month, to a maximum of $24,000 for each failure to comply.

False statement or omission – A false statement or omissions penalty may be assessed under subsection 163(2.4) of the Income Tax Act where information provided on the T106 Summary or Slip is incomplete or incorrect. The penalty is $24,000.

Transfer Pricing Methodologies (TPM)

Use the codes listed below to reflect the main transfer pricing methodology.

|

1 |

Comparable Uncontrolled Price |

|

2 |

Cost-Plus |

|

3 |

Resale |

|

4 |

Profit Split |

|

5 |

Transactional Net Margin |

|

6 |

Qualifying Cost Contribution Arrangement |

|

7 |

Other |

You can find more information on transfer pricing methods in Information Circular 87-2, International Transfer Pricing. The circular is available at our tax services offices and on the Internet at: canada.ca/taxes.

T106 Slip - Instructions

If an election has been made under paragraph 261(3)(b) of the Income Tax Act to report in a functional currency, state all monetary amounts in that functional currency, otherwise state all monetary amounts in Canadian dollars (no cents).

Part II – Non-resident information

Q.1 and Q.2. Enter the name and address of the non-resident. For the list of country codes, see the CRA publication, T4061 – NR4 – Non-Resident Tax Withholding, Remitting and Reporting guide, Appendix A – Country Codes.

Q.3. State the type of relationship that exists between the reporting person/partnership and the non-resident. The Canada Revenue Agency needs the relevant financial statements (in English or French) of the non-resident if the non-resident is controlled by the reporting person or partnership and is resident in a non-treaty country. Canada has income tax conventions (treaties) with more than 60 countries. These include the United States, the United Kingdom, France, Japan, and Australia. For information about the countries with which Canada has concluded an income tax treaty, contact your tax services office or consult the Internet at: https://www.canada.ca.

Q.4. State the main business activities for the transactions reported in Part III by entering the appropriate North American Industrial Classification System (NAICS) codes.

Tip: To facilitate the selection of the appropriate code, you can display a search box by clicking the ellipsis points of the data entry cell or by using the Alt+Down arrow shortcut.

The current NAICS codes can be found at the Statistics Canada internet site, https://www23.statcan.gc.ca/imdb/p3VD.pl?Function=getVD&TVD=1369825. You can

enter more than one code.

Q.5. State the main countries for the transactions reported in Part III by entering the appropriate country code. You can enter more than one code. For the list of country codes, see the information provided under Q1. and Q2. above.

Q.6. Enter yes or no to the question. In general, subsection 247(4) of the Income Tax Act relates to the requirement to maintain and make available contemporaneous transfer pricing documentation. You can find more information on contemporaneous documentation requirements in Information Circular 87-2, International Transfer Pricing. The circular is available at our tax services offices and on the Internet at: canada.ca/taxes.

Part III – Transactions between reporting person/partnership and non-resident

Enter (to the nearest Canadian dollar/functional currency unit if applicable) the monetary consideration derived or incurred for the transactions in Part III. Only record in Part III those amounts that apply to the non-resident described in Part II. Report gross amounts in the two columns.

The “Sold to non-resident” and “Revenue from non-resident” refers to gross sales and revenue received from non-arm’s length transactions with non-residents. For example, this includes transactions related to exports from Canada and services provided to the non-resident.

The “Purchased from non-resident” and “Expenditure to non-resident” refers to gross purchases and expenditures made relating to non-arm’s length transactions with non-residents. For example, this includes transactions related to imports into Canada and services provided by the non-resident.

For the banking industries, the line for “Stock in trade/raw materials” must be used to report bonds, debentures, loans, mortgage transactions. The normal interest income and expense on loans and advances with the non-arm's length non-resident(s) must be reported in the Financial section.

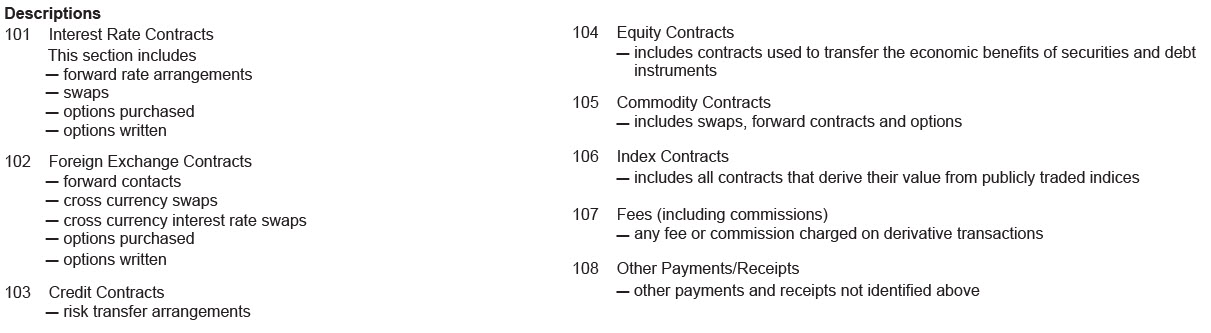

Part V – Derivatives

The column for Notional Amounts applies to swap transactions. The terms used in this section are described below:

|

Descriptions |

|||

|

101 |

Interest Rate Contracts |

104 |

Equity Contracts |

|

|

This section includes |

|

- includes contracts used to transfer economic benefits of securities and debt instruments |

|

|

- forward rate arrangements |

|

|

|

|

- swaps |

105 |

Commodity Contracts |

|

|

- options purchased |

|

- includes swaps, forward contracts and options |

|

|

- options written |

|

|

|

|

|

106 |

Index Contracts |

|

102 |

Foreign Exchange Contracts |

|

- includes all contracts that derive their value from publicly traded indices |

|

|

- forward contracts |

|

|

|

|

- cross currency swaps |

107 |

Fees |

|

|

- cross currency interest rate swaps |

|

- any fee or commission charged on derivative transactions |

|

|

- options purchased |

|

|

|

|

- options written |

108 |

Other Payments / Receipts |

|

|

|

|

- other payments and reciepts not identified above |

|

103 |

Credit Contracts |

|

|

|

|

- risk transfer arrangements |

|

|

Do you need more information?

For general enquiries, contact the Business Enquiries section of your tax services office. For detailed information about completing the form, contact the International Audit Division of your tax services office. The address and telephone number of the tax services office are listed under 'the Canada Revenue Agency' in the Government of Canada section of your telephone book and on the Internet canada.ca/taxes.

T106 Summary

Instructions

If an election has been made under paragraph 261(3)(b) of the Income Tax Act to report in a functional currency, state all monetary amounts in that functional currency, otherwise state all monetary amounts in Canadian dollars (no cents). The codes for the functional currencies are as follows:

AUD – for Australian dollar

USD – for U.S. dollar

GBP – for U.K. pound

EUR – for Euro

Amended returns

If this is an amended return, tick (√).

You must re-complete the entire T106 package including the amendments (i.e. include all information not amended plus all amended information), and re-file this entire amended T106 package. If the initial T106 was paper filed, then the amended T106 must be paper filed. If the initial T106 was electronically filed, then the amended T106 can be electronically filed or paper filed.

Section 1 – Reporting person/partnership

identification

For partnership code, tick (√):

- If end partners are individuals or trusts.

- If end partners are corporations.

- If end partners are a combination of 1 and 2 mentioned above.

An end partner is the final recipient (corporation, trust or individual) that receives an allocation of income from the partnership after the income has flowed through the various levels of a tiered partnership.

For individual code, tick (√):

- If the individual or the individual's spouse is self-employed.

- If the individual or the individual's spouse is not self-employed.

Section 2 – Summary information

Q.1. Enter the applicable tax year/fiscal period.

Q.2. State if this is the first time that a T106 has been filed. If "no," enter the last tax year/fiscal period end for which T106 documentation was filed.

Q.5. Enter the gross revenue of the reporting person/partnership. Do not enter the net income or taxable income. When reporting non-arm's length transactions between a related party and a branch, enter the gross income attributable to the branch.

Q.6. State the main business activities of the reporting person/partnership by entering the appropriate North American Industrial Classification System (NAICS) code(s). The list of current NAICS codes can be found at the Statistics Canada internet site, https://www23.statcan.gc.ca/imdb/p3VD.pl?Function=getVD&TVD=1369825. Main business activity means any business segment which accounts for more than 10% of the gross revenue of the reporting person/partnership or the non-resident.

Certification

An authorized officer, person, or representative has to sign this form when it is completed. The certification declaration on this form applies to the T106 Summary and Slips.

Purpose

The T106 Summary and Slips are annual information returns used to report non-arm's length transactions between reporting persons or partnerships and non-residents under section 233.1 of the Income Tax Act (Act). The T106 Summary and Slips are prescribed forms.

For greater certainty, where any reporting person or partnership and any non-arm's length non-resident person or partnership are participants in a transaction or series of transactions and as a result, any amount referred to in Parts III, IV, V or VI is arranged with, paid to or received from, an arm's length entity, these amounts must be reported.

Definitions

Under section 233.1 of the Act :

A "reporting person" for a taxation year means a person (corporation, trust or individual) who, at any time in the year,

- is resident in Canada; or

- is non-resident and carries on business (other than a business carried on as a member of a partnership) in Canada.

A "reporting partnership" for a fiscal period means a partnership

- a member of which is resident in Canada in the period; or

- that carries on business in Canada in the period.

A "reportable transaction" means

- in the case of

- a reporting person for a taxation year who is not resident in Canada at any time in the year, or

- a reporting partnership for a fiscal period no member of which is resident in Canada in the period,

a transaction or a series of transactions that relate in any manner whatever to a business carried on in Canada by the reporting person or partnership in the year or period or a preceding taxation year or period; and

- in any other case, a transaction or series of transactions that relate in any manner whatever to a business carried on by a reporting person (other than a business carried on by a reporting person as a member of a partnership) or partnership in a taxation year or fiscal period.

The terms arm's length and non-arm's length are discussed in Income Tax Folio S1-F5-C1, Related Persons Dealings at Arm's Length. Refer also to sections 251 and 252 of the Act.

Who has to file a T106 information return

A reporting person has to file a T106 information return for a tax year in respect of reportable transactions in which the reporting person and the non-arm's length non-resident person (or partnership of which that non-resident person is a member) participated in the period. The reporting person has to file the a T106 information return if the amount of the total reportable transactions for all the non-residents combined is more than CAN $1,000,000 (i.e., the total of all Box I amounts is more than CAN $1,000,000).

A reporting partnership has to file a T106 information return for a fiscal period in respect of reportable transactions in which the reporting partnership and the non-arm's length non-resident person (or partnership of which the non-resident person is a member) participated in the period. The reporting partnership has to file the a T106 information return if the amount of the total reportable transactions for all the non-residents is more than CAN $1,000,000 (i.e., the total of all Box I amounts is more than CAN $1,000,000). File a T106 information return for the partnership only and not for each partner.

Where a reporting person or partnership's total amount of the transactions with a particular non-resident during the taxation year is below CAN $100,000 there is no need to report these transactions in Part III of the T106 Slip. Please see the notice at canada.ca/cra-de-minimis-policy-t106 for additional information. The revised threshold of CAN $100,000, for reporting transactions in Part III, applies only to tax years or fiscal periods that begin in 2022 and later years/periods.

Branches

A Canadian branch of a foreign-based corporation or a foreign-based branch of a Canadian corporation does not have to file a T106 information return for notional transactions. For the purposes of the Act, the corporation and its branches are considered to be the same person. However, non-arm's length transactions between a branch and a non-arm's length party have to be reported in the reporting person's/partnership's T106 information return.

When to file

T106 information returns have to be filed on or before the following dates:

Corporations – six months after the end of the tax year.

Partnerships – the due date is the same as the due date for filing a partnership information return under section 229 of the Income Tax Regulations. If no partnership information return has to be filed, the reporting partnership's due date is the day by which the partnership information return would be required to be filed if section 229 did apply to the reporting partnership.

Trusts – 90 days after the end of the tax year.

Individuals – April 30 after the end of each calendar year. For individuals who are self-employed, or individuals whose spouse is self-employed, the filing due date is extended, as with their T1 individual income tax returns, to June 15 after the end of the calendar year.

For short tax years/fiscal periods, the T106 information return is due at the same time as the filing due date of the T1, T2, and T3 income tax returns or the T5013 information return. For short tax years/fiscal periods which together do not exceed 12 months, one set of T106 Summary and Slips is enough if the information for the tax years/fiscal periods is detailed in a letter that must accompany the T106 information return.

What to file

Each reporting person or partnership has to file one T106 Summary, as well as a separate T106 Slip for each non-resident. The information reported in the T106 information return is filed in respect of the corporation, partnership, trust or individual and not by sub-division, cost centre or individual partner.

Where to file

Partnerships can EFILE and NETFILE T106 information returns electronically for the 2017 and later fiscal periods. Corporations can EFILE T106 information return electronically for the 2015 and later tax years. Corporations and partnerships can attach supporting documentation such as financial statements related to EFILED foreign reporting returns, via the tax preparation software with the electronic Submit documents service. Individuals and trusts have to paper file the T106 information return. T106 information returns have to be filed separately from the income tax return. Do not attach a T106 information return to your income tax return. For the most up to date information about who can EFILE a T106 information return, see the "What's new" information on the T106 page at canada.ca/revenue-agency/services/forms-publications/forms/t106. T106 information returns can also be mailed to the Winnipeg Taxation Centre, Data Assessment & Evaluation Programs, Validation & Verification Section, Foreign Reporting Returns, 66 Stapon Road, Winnipeg MB R3C 3M2.

Penalties

Late Filing – A late filing penalty, or multiple late filing penalties for more than one T106 Slip may be assessed under subsection 162(7) of the Act where a T106 information return is filed after the due date. The penalty is equal to the greater of CAN $100 and CAN $25 per day, as long as the failure to file continues, to a maximum of 100 days.

Failure to file – A failure to file penalty may be assessed under subsection 162(10) of the Act where reporting persons or partnerships knowingly or under circumstances amounting to gross negligence, fail to file or fail to comply with a request by the CRA for a T106 information return. The minimum penalty is CAN $500 per month, to a maximum of CAN $12,000 for each failure to comply. Where the CRA has served a demand to file a T106 information return, the minimum penalty is CAN $1,000 per month, to a maximum of CAN $24,000 for each failure to comply.

False statement or omission – A false statement or omission penalty may be assessed under subsection 163(2.4) of the Act where information provided on the T106 Summary or Slip is incomplete or incorrect. The penalty is CAN $24,000.

Transfer Pricing Methods (TPM)

Use the codes listed below to reflect the main TPM.

|

1 |

Comparable Uncontrolled Price |

|

2 |

Cost-Plus |

|

3 |

Resale |

|

4 |

Profit Split |

|

5 |

Transactional Net Margin |

|

6 |

Qualifying Cost Contribution Arrangement |

|

7 |

Other |

You can find more information on TPMs at: canada.ca/cra-transfer-pricing.

Privacy Notice

Personal information is collected under the authority of the Income Tax Act and is used for the administration and enforcement of the Act, including assessments, audits, enforcement actions, collections, and appeals. The information collected may be shared and/or verified with federal, provincial, territorial, or foreign government institutions to the extent authorized by law. Incomplete or inaccurate information may result in interest payable, penalties or other actions.

The social insurance number is collected for income tax purposes under section 237 of the Income Tax Act and is used for identification purposes.

Under the Privacy Act, individuals have a right of protection, access to and correction of their personal information, or to file a complaint with the Privacy Commissioner of Canada regarding the handling of their personal information. Refer to Personal Information Bank CRA PPU 035 at canada.ca/cra-information-about-programs. More information about requesting access to information can be found at canada.ca/atip.

T106 Slip – Instructions

If an election has been made under paragraph 261(3)(b) of the Income Tax Act (Act) to report in a functional currency, state all monetary amounts in that functional currency, otherwise state all monetary amounts in Canadian dollars. Round all monetary amounts to the nearest Canadian dollar or functional currency unit, if applicable. Only certain corporations can elect to report in a functional currency. See the CRA publication Income Tax Folio S5-F4-C1, Income Tax Reporting Currency at: canada.ca/cra-income-tax-reporting-currency.

Part II – Non-resident information

Q.1., Q.2. and Q.3. Enter the name, TIN and address of the non-resident. For the list of country codes, go to canada.ca/cra-country-codes.

Q.4. State the type of relationship that exists between the reporting person/partnership and the non-resident. The CRA needs the relevant financial statements (in English or French) of the non-resident if the non-resident is controlled by the reporting person or partnership and is resident in a non-treaty country. Canada has income tax conventions (treaties) with more than 90 countries. These include the United States, the United Kingdom, France, Japan, and Australia. For information about the countries with which Canada has concluded an income tax treaty, go to canada.ca/en/department-finance/programs/tax-policy/tax-treaties.

Q.5. State the main business activities for the transactions reported in Part III by entering the appropriate NAICS codes. The current NAICS codes can be found at https://www23.statcan.gc.ca/imdb/p3VD.pl?Function=getVD&TVD=1369825. You can enter more than one code.

Q.6. State the main countries for the transactions reported in Part III by entering the appropriate country code. You can enter more than one code. For the list of country codes, see the information provided under Q1., Q2. and Q3. above.

Q.7. Enter yes or no to the question. In general, subsection 247(4) of the Act relates to the requirement to maintain and make available to the Minister contemporaneous transfer pricing documentation. You can find more information on contemporaneous documentation at canada.ca/cra-transfer-pricing by going to the "Documentation Requirements" section and clicking on the "contemporaneous documentation" link.

Part III – Transactions between reporting person/partnership and non-resident

Enter the amount (rounded to the nearest Canadian dollar or functional currency unit, if applicable) for the transactions in Part III. Only record in Part III those amounts that apply to the non-resident described in Part II. Report gross amounts in the two columns.

The "Sold to non-resident" and "Revenue from non-resident" refers to gross sales and revenue received from non-arm's length transactions with non-residents. For example, this includes transactions related to exports from Canada and services provided to the non-resident.

The "Purchased from non-resident" and "Expenditure to non-resident" refers to gross purchases and expenditures made relating to non-arm's length transactions with non-residents. For example, this includes transactions related to imports into Canada and services provided by the non-resident.

For the banking industries, the line for "Stock in trade/raw materials" must be used to report bonds, debentures, loans, mortgage transactions. The normal interest income and expense on loans and advances with the non-arm's length non-resident(s) must be reported in the Financial section.

Part IV – Indebtedness, investments and similar amounts

Subsection 15(2) of the Act can apply to a non-resident shareholder of a Canadian resident corporation, in which case, the debt is treated as a deemed dividend subject to non-resident withholding tax. Where a corporation resident in Canada (CRIC) is controlled by a non-resident corporation, subsection 212.3(2) of the Act contains similar rules (the foreign affiliate dumping rules) to deem certain amounts owing by a foreign affiliate of the CRIC to be a dividend paid to the non-resident shareholder.

The election to treat the debts as a PLOI, is a choice the non-resident shareholder and the CRIC can make to avoid the deemed dividend treatment and the withholding tax liability that would otherwise result. You can find more information on PLOI, at canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/corporation-payments/understanding-interest.html#Ins.

State whether a PLOI election was made and if so, provide the deemed interest amount included as taxable income for the tax year or fiscal period.

Part V – Derivatives

The column for "Notional Amount" applies to swap transactions. The terms used in this section are described below:

Do you need more information?

If you need more information, go to canada.ca/taxes or call 1-800-959-5525 for enquiries. For detailed information about completing the form, contact your tax services office (TSO). TSO contact information can be found at canada.ca/cra-tso-contact-information.

T106 Summary Form – Instructions

If an election has been made under paragraph 261(3)(b) of the Income Tax Act to report in a functional currency, state all monetary amounts in that functional currency, otherwise state all monetary amounts in Canadian dollars. Round all monetary amounts to the nearest Canadian dollar or functional currency unit, if applicable. Only certain corporations can elect to report in a functional currency. See the Canada Revenue Agency (CRA) publication Income Tax Folio S5-F4-C1, Income Tax Reporting Currency, at: canada.ca/cra-income-tax-reporting-currency. The codes for the functional currencies accepted at the time of publication are as follows:

AUD – for Australian dollar

USD – for U.S. dollar

GBP – for U.K. pound

EUR – for Euro

JPY – for Japanese Yen

Amended returns

If this is an amended return, tick the box on the top of the T106 Summary form.

You must re-complete the entire T106 information return package including the amendments (i.e. include all information not amended plus all amended information), and re-file this entire amended T106 information return package. If the initial T106 information return was paper filed, then the amended T106 information return must be paper filed. If the initial T106 information return was electronically filed, then the amended T106 information return can be electronically filed or paper filed.

Section 1 – Reporting person/partnership identification

For partnership code, tick:

1 - If the end partners are individuals or trusts.

2 - If the end partners are corporations.

3 - If the end partners are a combination of 1 and 2 mentioned above.

An end partner is the final recipient (corporation, trust or individual) that receives an allocation of income from the partnership after the income has flowed through the various levels of a tiered partnership.

For individual code, tick:

1 - If either the individual or the individual's spouse is self-employed.

2 - If neither the individual nor the individual's spouse is self-employed.

Section 2 – Summary information

Q.1. Enter the applicable tax year/fiscal period.

Q.2. State if this is the first time that a T106 information return has been filed. If "no," enter the last tax year-end/fiscal period end for which a T106 information return was filed.

Q.5. Enter the gross revenue of the reporting person/partnership. Do not enter the net income or taxable income. When reporting transactions between a non-arm's length party and a branch, enter the gross income attributable to the branch.

Q.6. State the main business activities of the reporting person/partnership by entering the appropriate NAICS code(s). The list of current NAICS codes can be found at https://www23.statcan.gc.ca/imdb/p3VD.pl?Function=getVD&TVD=1369825. Main business activity means any business segment that accounts for more than 10% of the gross revenue of the reporting person/partnership or the non-resident.

Certification

An authorized officer, person, or representative has to sign this form when it is completed. The certification declaration on this form applies to the T106 Summary and Slips.

Sorting names of non-residents

Form T106L is a list of all the copies in the T106 multiple copy form.

When you click the ![]() button, the names of the non-residents

with whom the corporation dealt with will appear in alphabetical order

both on screen and when printing. Names beginning with numeric characters

will appear at the top of the list, in ascending order. When adding new

copies of the T106 Slip you will

have to repeat the process in order for all the names to be sorted.

button, the names of the non-residents

with whom the corporation dealt with will appear in alphabetical order

both on screen and when printing. Names beginning with numeric characters

will appear at the top of the list, in ascending order. When adding new

copies of the T106 Slip you will

have to repeat the process in order for all the names to be sorted.

The sort will be retained when rolling forward the client file.

Note: As soon as an electronic transmission of Form T106 is accepted, the Sort button is no longer accessible.

See also

T2 Corporation – Income Tax Guide

International tax and non-resident enquiries

North American Industrial Classification System Codes

NAICS codes 2022 – Addition and Removal of Codes