Release Notes CCH iFirm Taxprep T3 2020 v.3.0 (2020.20.28.01)

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T3

With CCH iFirm Taxprep T3, you have the most comprehensive collection of trust tax forms as well as tools designed to help you comply with requirements relating to the preparation of tax returns for trusts. CCH iFirm Taxprep T3 allows you to import data relating to beneficiaries in CSV format to speed-up data entry and reduce related input errors.

About

We are pleased to provide you with the third version of CCH iFirm Taxprep T3 2020. This version covers taxation years ending between January 1, 2019, and December 31, 2020, inclusive.

The rates applicable to the 2020 taxation year are those known as of June 11, 2020. Any changes resulting from subsequent federal, provincial and territorial announcements will be integrated into future updates of the program.

You can view the applicable rates by accessing the Table of Values Used in the Return found in the program.

Electronic Filing

Government requirements

At the federal level and in Québec, any filer filing more than 50 slips or RL slips of a same type must file the data electronically by Internet. Below that threshold, paper filing is accepted.

CCH iFirm Taxprep T3 will generate a diagnostic prompting you to use EFILE as soon as you prepare more than 50 slips or RL slips.

Important dates for Internet transmission

The CRA has been accepting electronic transmissions of T3 and NR4 slips and T3 returns since January 6, 2020. Revenu Québec has been accepting transmission of RL-16 slips since November 5, 2019.

Rolling Forward Files

CCH iFirm Taxprep T3 2020 allows you to roll forward client files saved with Taxprep for Trusts (with the .318 or .319 extension), Cantax FormMaster (with the .T18 or .T19 extension) and version 2019.1 of ProFile (with the.18R extension).

The taxation year after a roll forward cannot end after December 31, 2020. If needed, it will be shortened so as to correspond to the period covered by this version.

Version 3.0 Content

Modifications and additions

Electronic Signature

As part of the measures taken by the governments because of the COVID-19 pandemic, in CCH iFirm Taxprep T3, the digital signature functionality was added on additional forms. Because the needs relating to electronic signature are constantly evolving, we were proactive and added several forms to facilitate the electronic signature in the future. For more information on the complete list of forms that can be electronically signed, consult the article Electronic Signature – Supported Forms.

T3, Trust Income Tax and Information Return and TP-646, Trust Income Tax Return

The Canada Revenue Agency and Revenu Québec announced a series of flexibility measures to help taxpayers in the wake of the coronavirus (COVID-19). Therefore:

- The deadline for filing the income tax returns of trusts (T3RET and TP-646) whose taxation year ends on December 31, 2019, was postponed to May 1, 2020;

-

The deadline for filing the income tax return of trusts (T3RET and TP-646) that would otherwise have a filing due date on March 31, in April or May 2020, is now June 1, 2020;

-

The deadline for filing the federal income tax return of trusts (T3RET) that would otherwise have a filing due date in June, July or August 2020, is now September 1, 2020;

-

The deadline for filing the Québec income tax return of a trust (TP-646) whose taxation year ended on a date that falls within the period from March 2 to May 31, 2020, is now September 1, 2020;

- The balances and instalments of trusts payable on or after Mars 18, 2020, and before September 1, 2020, will have to be paid no later than September 1, 2020;

- The balances and instalments of trusts (TP-646) payable on March 17, 2020, and before September 1, 2020, must be paid no later than September 1, 2020;

- The June 15, 2020, instalment payment date has been modified for September 1, 2020;

- The interest and late-filing penalty will apply to amounts payable after September 1, 2020.

As a result, the filing deadlines and balances owing for these returns have been modified in forms Identification, LW, Interest, Instalments, QC Instalments and the Client Letter.

Note: Part XII.2 tax payable is not covered under the flexibility measures relating to COVID 19, which allow for the payments of balances owing to be postponed to September 1, 2020. Therefore, the amount of Part XII.2 tax payable indicated on line 83 of the T3 return must be paid no later than the filing deadline for the return.

Schedule 1, Disposition of Capital Property

The acquisition date format in column 1 has been changed from YY-MM to YYYY-MM in all sections of the form. As a result, if you completed the form with a prior version of the program, any year between “21” and “99” will be considered to be in the 20th century (between 1921 and 1999) and a year between “00” and “20” will be considered to be in the 21st century (between 2000 and 2020). We recommend that you review the acquisition dates before filing the form.

LM-15, Voluntary Disclosure

As a result of an update, Form LM-15 underwent many changes. The form was for the most part redesigned, i.e. sections were renumbered, modified or deleted while others were added. For example, Section 3, Conditions for benefitting from the program, which is entirely new. Therefore, we strongly suggest that you review the entire form before submitting it.

Client letter, Worksheet

Trusts that reside in Hamilton and surrounding areas as well as Kitchener-Waterloo and surrounding areas in Ontario should now be mailing their returns to the following address: Winnipeg Tax Centre, T3 Trust Returns Program, P.O. Box 14003, Station Main, Winnipeg MB R3C 0N8. If you doubt that the trust’s residence is located in the surrounding areas of one of these cities, mail the return to the Winnipeg Tax Centre. Note that a diagnostic prompting you to select a tax centre when the trust resides in Ontario was added to the LW form.

In addition, trusts that reside in Laval, Montréal and Sherbrooke and in surrounding areas of these three cities in Québec must now send their returns to the Winnipeg Tax Centre as well.

MR-69, Authorization to Communicate Information or Power of Attorney

As a result of discussions with Revenu Québec, field 1b, Social Insurance Number (SIN), has been added to enter a deceased person’s social insurance number. Note that the SIN can only be used to complete Form MR-69 for a testamentary trust that has no account number. If this is the case, fields 2a, Last name and 2b, First name should be completed. Fields 1b, 2a and 2b are now updated from the deceased information in the Type of trust section of the Identification form.

Income and Deductions, Other Income and Deductions

In its June 16, 2019, Notice of Ways and Means Motion to amend the Income Tax Act the Department of Finance of Canada announced the addition of paragraph 110(1)(e), which permits a deduction for computing a taxpayer’s taxable income if certain conditions are met.

To that end, a line has been added to the Other deductions for computing taxable income (line 54) section of Form Income and Deductions to include the new deduction under paragraph 110(1)(e) ITA.

Rates Federal-Provincial, Table of Rates and Values Used in the Return

In its March 19, 2020 Budget, the Government of Manitoba announced that the Provincial Sales Tax (PST) rate would be decreased from 7% to 6% and that this measure would be effective on July 1, 2020. To file forms that contain Manitoba PST calculations before July 1, 2020, enter 7% on the line Manitoba, in the Sales tax section of the form, using an override.

T3BC, British Columbia Tax

T3BCMJ, Provincial Tax (Multiple Jurisdictions) – British Columbia Tax

A 7th column has been added to the table in Forms T3BC and T3BCMJ, on screen only, to present the new $220,000 top tax bracket for the 2020 and subsequent taxation years.

Version 2.0 Content

Modifications and additions

AUT-01, Authorize a Representative for Access by Phone and Mail

AUT-01X, Cancel Authorization for a Representative

Significant changes have been made to the authorization process for representatives with the CRA. The CRA has not been accepting requests to authorize or cancel a representative using the T1013 or NR95 forms since February 10, 2020, as these forms were removed. They have been replaced by Form AUT-01, which allows you to communicate with the CRA by telephone or in writing, and Form AUT-01X, which allows you to cancel an authorization. If you completed an authorization or a cancellation request using one of the removed forms in a prior version of the program, only a portion of the information will be transferred to the new AUT-01 and AUT-01X forms. Therefore, we strongly recommend that you review the content of these forms before filing them.

In addition, in the AUTHORIZATION FORMS tab of the preparer profile, the NR95 – Authorizing or cancelling a representative for a non-resident tax account section has been deleted and the T1013 – Authorizing or cancelling a representative section has been renamed AUT-01 – Authorize a Representative for Access by Phone and Mail. The level of authorization drop-down list has been replaced by the Type of access check boxes. You must now choose between a representative that is an individual or a firm by selecting the check boxes provided for this purpose.

RC199, Voluntary Disclosures Program (VDP) Application

At the time of the update of this form, Part E – For disclosures identifying shares of non-resident corporations (other than foreign affiliates) was removed from Section 6.

DONATIONS, Summary of Charitable Donations

We added a new option to indicate that the gift was made after the 36-month period but within 60 months after the date of death by a former GRE that continues to meet all of the requirements of a GRE except for the 36-month time limit.

T3BC, British Columbia Tax

T3BCMJ, Provincial Tax (Multiple Jurisdictions) - British Columbia Tax

In its February 18, 2020 Budget, the Government of British Columbia announced the addition of a new top tax bracket for the 2020 and subsequent taxation years. Therefore, taxable income greater than $220,000 from Graduated Rate Estates (GRE) and Qualifying Disability Trusts (QDT) will be taxed at a rate of 20.5%. As for the tax rate for trusts other than GRE and QDT, it has been increased from 16.5% to 20.5%. In addition, the credit rate for donations over $200 has also been adjusted to 20.5%

Version 1.0 Content

Modifications and additions

T1013, Authorizing or Cancelling a Representative

NR95, Authorizing or Cancelling a Representative for a Non-Resident Tax Account

Important changes to the CRA authorization process for representatives

Commencing in mid-February, the CRA will no longer accept requests to authorize or cancel a representative using the T1013 or NR95 forms as the CRA will eliminate these forms.

From that date on, the CRA will make available on its Web site the new combined Form AUT-01 that only grants off-line access. This new form will group three authorization forms, i.e. Forms T1013, RC59 and NR95. Therefore, if you want to file a hard copy of the combined Form AUT-01, you need to get the new printable version of the form from the CRA and complete it manually or wait for the next version of Taxprep for Trusts. Note that this new printable version of Form AUT-01 can only be used to ask for off-line access that will grant the right to contact the CRA by phone, mail or in person. No online access can be granted through this printable version.

T3 slip, Statement of Trust Income Allocations and Designations

Before 2018, the tax on split income (TOSI) only applied to individuals under the age of 18. Under the new rules that came into effect in 2018, the tax on split income now applies to individuals age 18 or older.

In general terms, these rules can apply to dividends, interest or capital gains received either directly or indirectly through a partnership or a trust (other than a mutual fund trust). The rules may vary depending on whether the individual is under the age of 18, between 18 and 24 or more than 24. For more information on this topic, consult the Help of the T3 slip.

Although the CRA has not added any boxes to the T3 slip to indicate income subject to the tax on split income, custom boxes have been added to enter the income split amount when preparing slips. If you use the Print Slips command, this information is printed in the “Footnotes – Notes” box.

Schedule 8, Investment Income, Carrying Charges, and Gross-up Amount of Dividends Retained by the Trust

Schedule 11, Federal Income Tax

T3MB, Manitoba Tax

T3NB, New-Brunswick Tax

T3NL, Newfoundland and Labrador Tax

T3NT, Northwest Territories Tax

T3ON, Ontario Tax

T3YT, Yukon Tax

Following our recent communications with the CRA, the gross-up rate for dividends other than eligible dividends will now be based on the taxation year-end date instead of the date on which the dividend was received. As a result, for a trust whose fiscal year end is in 2019, the gross-up rate for dividend used will be 15%, even if the dividend was received in 2018.

T776, Capital Cost Allowance

T2042, Capital Cost Allowance

T2125, Capital Cost Allowance

The amount on line Additional CCA of 30% calculated on acquisitions of the current fiscal year claimable in the next fiscal year in the “Classes 14, 14.1, 43.1, 43.2, 44, 50 and 53 only” section of the following forms is now calculated:

- T776 Area A, CCA Other than classes 10.1 and 13;

- T2042 Area A, CCA Other than Classes 10.1 and 13; and

- T2125 Area A, CCA Other than Classes 10.1 and 13.

RL-16 slip, Trust income

The amount on lines A-2, A-3, A-4, E-1, F-1, G-1, G-3 and H-3 is now calculated. When opening a client file prepared with a prior version of CCH iFirm Taxprep T3, if an amount had been entered on any of these lines, it will be retained as an override.

In addition, boxes C11, Actual amount of eligible dividends – after 2017 and before March 28, 2018, C12, Actual amount of eligible dividends after March 27, 2018 and before 2019, C21, Actual amount of ordinary dividends – after 2017 and before March 28, 2018, and C22, Actual amount of ordinary dividends – after March 27, 2018 and before 2019, have been deleted. Boxes K-1, Split income – Foreign income tax on business income, and L-1, Split income – Foreign income tax on non-business income have been added.

Schedule B, Investment Income, Gross-Up of Dividends Not Designated and Adjustment of Investment Expenses

Line 327c, Portion of the amount on line 326 that corresponds to the gross-up of dividends received or deemed received in 2019, multiplied by the applicable rate for each column, has been added to Section 2, “Amount of the gross-up of dividends not designated and dividend tax credit” of this form.

TP-646.F-V, Schedule F – Income Tax payable by a Specified Trust for a Specified Immovable

Columns 3.1, 5.1 and 5.2 have been added to the Capital cost allowance table to calculate the capital cost allowance for accelerated investment incentive property (AIIP) acquired after November 20, 2018, and which became available for use during the tax year. For more information, consult the Help of the form.

TP-128.F-V, Income Earned by a Trust from the Rental of Immovable Property

Columns 3.1, 5.1 and 5.2 have been added to the Capital cost allowance table to calculate the capital cost allowance for accelerated investment incentive property (AIIP) acquired after November 20, 2018, and which became available for use during the tax year. For more information, consult the Help of the form.

TP-768.1, Recovery Tax – Qualified Disability Trust

Schedule H has been replaced with Form TP 768.1. The calculation performed on this form for the recovery tax of a qualified disability trust is the same as the calculation that was performed on Schedule H.

TP-772, Foreign Tax Credit

At the time of the update of this form, lines 30.1, 50.1, 60.1 and 80.1 have been added to enter the portion of the amounts on lines 30, 50, 60 and 80, respectively, attributable to foreign income tax paid on split non-business income. Line 91, Enter the amount from line 75 of form TP-766.3.4-V if you entered an amount on line 30.1 or 60.1 of this form, had also been add to the form.

MR-69, Authorization to Communicate Information or Power of Attorney

As per Revenu Québec requirements, the 2D bar code is no longer generated when some minimal validations are not met. The corresponding diagnostics have been reclassified in the “Bar code” group. A diagnostic has also been added to advise the preparer that the bar code will not be generated when printing the form as long as the adjustments are not made. Please note that the absence of a 2D bar code may cause processing delays from Revenu Québec.

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

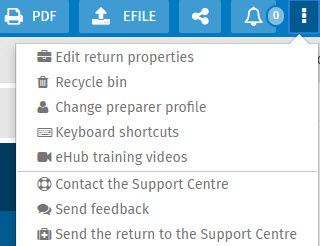

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

How to Reach Us

Technical and Tax support Hours

Monday to Friday: 8:30 a.m. to 8:00 p.m. (EST)

Toll Free: 1-800-268-4522

E-mail:csupport@wolterskluwer.com