Release Notes CCH iFirm Taxprep T3 2021 v.3.0 (2021.20.31)

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that the product is only supported with the Google Chrome browser.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T3

With CCH iFirm Taxprep T3, you have the most comprehensive collection of trust tax forms as well as tools designed to help you comply with requirements relating to the preparation of tax returns for trusts. CCH iFirm Taxprep T3 allows you to import data relating to beneficiaries in CSV format to speed-up data entry and reduce related input errors.

About

We are pleased to provide you with the third version of CCH iFirm Taxprep T3 2021. This version covers taxation years ending between January 1, 2020, and December 31, 2021, inclusive.

The rates applicable to the 2021 taxation year are those known as of March 3, 2021. Any changes resulting from subsequent federal, provincial and territorial announcements will be integrated into future updates of the program.

You can view the applicable rates by accessing the Table of Values Used in the Return found in the program.

Electronic Filing

Government requirements

At the federal level and in Québec, any filer filing more than 50 slips or RL slips of a same type must file the data electronically by Internet. Below that threshold, paper filing is accepted.

CCH iFirm Taxprep T3 will generate a diagnostic prompting you to use EFILE as soon as you prepare more than 50 slips or RL slips.

Important dates for Internet transmission

The CRA has been accepting electronic transmissions of T3 and NR4 slips and T3 returns since January 11, 2021. Revenu Québec has been accepting transmission of RL-16 slips since November 9, 2020.

Rolling Forward Files

CCH iFirm Taxprep T3 2021 allows you to roll forward client files saved with Taxprep for Trusts (with the .319 or .320 extension), Cantax FormMaster (with the .T19 or .T20 extension) and version 2020.1 of ProFile (with the.19R extension).

The taxation year after a roll forward cannot end after December 31, 2021. If needed, it will be shortened so as to correspond to the period covered by this version.

Version 3.0 Content

Modifications and additions

User-defined cells for reporting purposes

Fields have been added to the User-defined cells for reporting purposes section in the General information tab of the preparer profile. Data in these new fields is updated to the corresponding section of Form Identification. This is information is for the sole purpose of following up on your returns; it is not required to calculate the income tax return and will not be EFILED.

T2042, Statement of Farming Activities

T2125, Statement of Business or Professional Activities

Q2042, Statement of Farming Activities

Line 9, Electricity for zero-emission vehicles, has been added to Chart A.

T3NB, New Brunswick Tax

T3NBMJ, Provincial Tax (Multiple Jurisdictions) – New Brunswick Tax

On May 11, 2021, the Government of New Brunswick announced that the provincial personal income tax rate on the first tax bracket would be decreased from 9.68% to 9.4% starting on January 1, 2021. Therefore, the taxation rate of the first bracket, the rate of the first donations amount and the income tax on the base amount for the second to fifth bracket have been updated in the 2021 table of Form Rates federal-provincial.

Version 2.0 Content

Modifications and additions

T3MJ – T3 Provincial and territorial taxes – Multiple jurisdictions

Forms relating to provincial and territorial taxes for multiple jurisdictions situations has been updated for all provinces and territories.

Version 1.0 Content

Modifications and additions

E-Signature

The E-signature functionality was added to forms that can be electronically signed in CCH iFirm Taxprep T3. For the complete list of forms that can be electronically signed, consult the article Digital Signature – Supported Forms.

Preparer profile

The option Do not allow e-mail address entry in any of the forms in the return has been added to Section B. Options – Returns in the PROFILE tab of the preparer profile. When this option is selected, a diagnostic will display in the return to prevent you from entering or editing information in the e-mail address fields. This option is set to No by default. Note that when converting the preparer profile, this option selection will be retained. The roll forward for the e-mail address is not impacted by this addition. Therefore, any e-mail address entered will be rolled forward.

Schedule A, Taxable Capital Gains and Designated Net Taxable Capital Gains

A table has been added to Part 1 of the form to enter the gain or loss realized on disposition of virtual currency transactions.

To enter dispositions of virtual currency transactions giving rise to a capital gain or loss, select the box Virtual currency transactions (Québec only) in subsection Bonds, debentures, promissory notes, and other similar properties in Schedule 1. Data will then be transferred to the correct section of Schedule A. You must also enter the number of units and the method of disposition in subsection Bonds, debentures, promissory notes, and other similar properties in Schedule 1.

T3 Slip, Statement of Trust Income Allocations and Designations

In previous versions of the program, the jump code for the T3 slip was T3S. This jump code was changed to T3Slip following the addition of Form T3S, Supplementary Unemployment Benefit Plan Income Tax Return in the program.

T1134, Information Return Relating to Controlled and Not-Controlled Foreign Affiliates

The Canada Revenue Agency (CRA) published a new version of Form T1134, which must be used for taxation years starting after 2020. Therefore, the previous version of the form must be used for T1134 forms prepared for taxation years starting prior to 2021.

Note that only the previous version of Form T1134 will be available in version 2021.1.0 of CCH iFirm Taxprep T3. To that end, a note has been added at the top of the form when the taxation year is starting in 2021. The new version of the form will be integrated in a future version of CCH iFirm Taxprep T3.

T776, Capital Cost Allowance

T2042, Capital Cost Allowance

T2125, Capital Cost Allowance

The new CCA class 56 has been added for properties acquired after March 1, 2020, and available for use before 2028, that are zero-emission automotive equipment and vehicles that currently do not benefit from the accelerated rate provided by classes 54 and 55. Like these two CCA classes, class 56 benefits from a temporary enhanced first-year CCA rate of 100% for eligible property available for use before 2023.

T3 APP, Application for Trust Account Number

As result of an update, Form T3APP underwent a significant number of changes. For example, the Trust Information section has been revamped and some of the information it contained has been moved to three new sections, i.e. Step 2 – Primary trustee contact information, Step 3 – Address and Step 4 – Mailing address. In addition, this form now allows you to request an authorization for a representative at the same time as an application for an account number. To do so, complete the new Section Step 5 – Representative contact information of Form T3APP instead of completing Form AUT-01.

If you completed this form using a prior version of CCH iFirm Taxprep T3, we strongly suggest that you review the entire form before submitting it.

T3BC, British Colombia Tax

As result of an update, Form T3BC underwent a significant number of changes. First, the Graduated Rate Estate (GRE) or Qualified Disability Trusts (QDT) and Trust other than GRE and QDT subsections have been added to the Step 2 – Donations and gifts tax credit section. An additional row has been added for SITPs and FAPHs to calculate the tax credit for donation. This allows for donations qualifying for a 16.8% credit to be presented separately as they are not eligible for the 20.5% tax credit. Second, lines 27, Total British Colombia political contributions, and 28, Allowable political contribution tax credit, and the corresponding table have been deleted as this credit has been withdrawn. As a result of these changes, several lines of the form have been renumbered.

If you completed this form using a prior version of CCH iFirm Taxprep T3, we strongly suggest that you review the entire form before submitting it.

TP-653, Deemed Sale Applicable to Certain Trusts

A table has been added to Part 3 of the form to enter the gain or loss realized on disposition of virtual currency transactions.

To enter dispositions of virtual currency transactions giving rise to a capital gain or loss, select the box Virtual currency transactions (Québec only) in subsection Bonds, debentures, promissory notes, and other similar securities of Form T1055. Data will then be transferred to the correct section of Form TP-653. You must also enter the name of the virtual currency and the number of units in subsection Bonds, debentures, promissory notes, and other similar securities of Form T1055.

TP-750, Income Tax Payable by a Trust Resident in Québec That Carries On a Business in Canada, Outside Québec, or by a Trust Resident in Canada, Outside Québec, That Carries On a Business in Québec

As a result of the update of the form, line 20, Dividend tax credit in Section 2, Trust resident in Québec that carries on a business in Canada, outside Québec, has been moved and renumbered 26.1. Therefore, the percentage of business carried on in Québec is no longer applied to this credit when calculating the Québec income tax payable. In addition, line 40, Dividend tax credit in Section 3, Trust resident in Canada, outside Québec that carries on a business in Québec, has been deleted.

Forms added to the program

- T3D, Income Tax Return for Deferred Profit Sharing Plan (DPSP) or Revoked DPSP

- T3GR, Group Income Tax and Information Return for RRSP, RRIF,RESP, or RDSP Trust

- T3GRWS, Worksheet for Part XI.1 Tax on Non-Qualified Property of an RRSP and RRIF, or RESP Trust

- T3S, Supplementary Unemployment Benefit Plan Income Tax Return

- T1061, Canadian Amateur Athlete Trust Group Information Return

- T2000, Calculation of tax on agreements to acquire shares

Where to Find Help

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

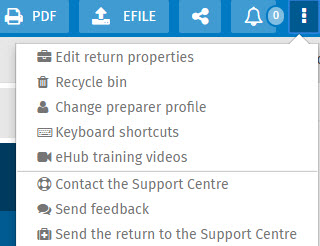

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

How to Reach Us

Technical and Tax support

Toll Free: 1-800-268-4522

E-mail:csupport@wolterskluwer.com