The following instructions are taken from the form.

Find out if you have to file a Part XIII.2 tax return

Non-resident investors who hold Canadian property mutual fund investments may have 15% tax withheld on assessable distributions that are paid or credited to them. Both the assessable distributions and the withholding tax will be reported on an NR4 slip, Statement of Amounts Paid or Credited to Non-Residents of Canada. Generally, the withheld 15% tax is considered the final tax obligation to Canada on that income.

A non-resident investor can realize a loss on the disposition of a Canadian property mutual fund investment. The investor can apply this loss against any assessable distributions they receive, up to the amount of the total assessable distributions paid or credited on the investment. To do this, the non-resident investor must file a Part XIII.2 tax return by the due date. The investor can claim a refund of some or all of the tax withheld. In claiming a refund of Part XIII.2 tax paid, the investor can carry back any unused amounts of this type of capital loss for three tax years or carry them forward indefinitely.

As a non-resident of Canada, you can choose to file this return if you want to claim a refund of Part XIII.2 tax, if you realized a Canadian property mutual fund loss during the tax year, or if you have a balance owing.

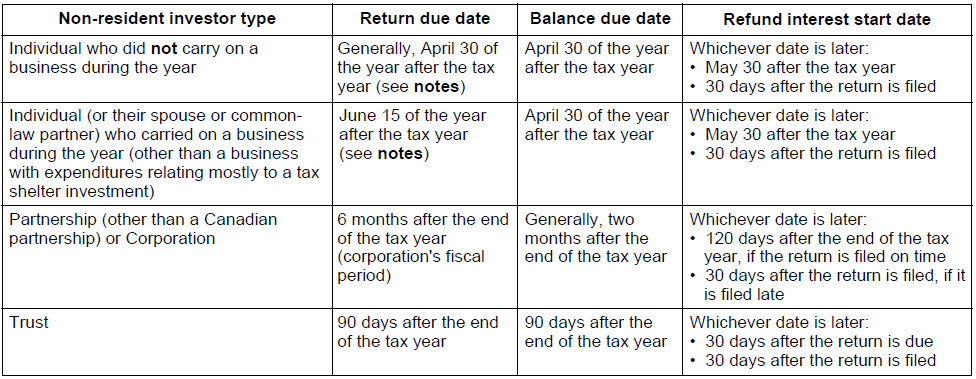

Due dates and refund interest

If you file late

If you file the Part XIII.2 return late, the CRA will not apply any losses to reduce or refund Part XIII.2 tax on the return. If the payer did not withhold the correct amount of non-resident tax, the CRA will issue a non-resident tax assessment to you. If you incurred a loss for the tax year, it will not be recognized and will not be available to offset Part XIII.2 tax in any tax year.

Refund interest

The CRA will pay you compound daily interest on your tax refund for the tax year.

Notes: When a due date falls on a Saturday, Sunday, or public holiday recognized by the CRA, your return is considered on

time if the CRA receives it or if it is postmarked on or before the next business day. For more information, go

to canada.ca/taxes-dates-individuals.

If you are the legal representative of the estate of an individual who died during the year, you must file the return by

April 30 of the year after the tax year or six months after the date of death, whichever is later. For more information,

see Guide T4011, Preparing Returns for Deceased Persons.

For more information

If you need more information after reading this form, go to canada.ca/taxes or call one of the following numbers:

- 1-855-284-5946, from Canada and the United States.

- 613-940-8499, from outside Canada and the United States. The CRA only accepts collect calls made through telephone operators. After your call is accepted by an automated response, you may hear a beep and notice a normal connection delay.

Terms used on this return

Assessable distribution: The part of any amount that the mutual fund paid or credited to a non-resident investor, other than as a specified investment flow-through (SIFT) trust wind-up event, and that is not otherwise subject to tax under Part I or Part XIII of the Income Tax Act.

Canadian property mutual fund investment: A share or unit of a mutual fund that is listed on a designated stock exchange and that has more than 50% of its fair market value attributable to real property in Canada, a Canadian resource property, or a Canadian timber resource property.

Canadian property mutual fund loss: The loss from the disposition of a Canadian property mutual fund investment (as defined above) but only to the extent that the loss is not more than the total of all assessable distributions that were paid or credited on the investment after 2004 while the non-resident owned the investment. A non-resident investor has a loss for a tax year only if they file a return under Part XIII.2 for that year by the filing due date.

SIFT trust wind-up event: A distribution of property to a taxpayer by a particular trust resident in Canada, subject to certain conditions. For more information, go to canada.ca/cra-sift-trust.

Where to mail your return

|

If your country of residence is: |

Send your return and correspondence to: |

|

Denmark |

Winnipeg Tax Centre |

|

All other countries |

Sudbury Tax Centre |

Processing time

The CRA usually processes returns in 8 to 10 weeks.

Witholding a refund

The CRA may keep all or part of a refund for any of the following reasons:

-

to apply against any amount you owe or are about to owe to the CRA

-

to satisfy a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

-

to apply against certain other federal, provincial or territorial debts

If you disagree with the assessment

If you disagree with the assessment or reassessment, contact the CRA for more information. If you still disagree, you can make a formal objection by sending a completed Form T400A, Notice of Objection – Income Tax Act, or a signed letter to:

Chief of Appeals

Appeals Intake Centre

PO Box 2006, Station Main

Newmarket ON L3Y 0E9

CANADA

If you are an individual (other than a trust) filing an objection, the time limit for filing is whichever date is later:

- one year after the due date of the return

- 90 days after the date of the notice of assessment or reassessment

In every other case, you have to file an objection within 90 days after the date of the notice of assessment or reassessment.