Release Notes CCH iFirm Taxprep T3 2023 v.3.0 (2023.20.35.01)

Our Support Centres are Going Digital: Emails are Now Our First Priority

As part of our transformation to digital support centres, we are pleased to announce that email inquiries will now be given first priority. This digital shift will allow us to process your requests even faster, and better meet your needs.

From now on, use emails instead of telephone to contact Customer Service and the Support Centre by including your account number and the name of your product in the subject line as well as detailed information in your email (form/line/diagnostic number, print screens, etc.) to get accelerated service!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About CCH iFirm Taxprep

Welcome to CCH iFirm Taxprep, the first cloud-based professional tax software in Canada.

CCH iFirm Taxprep runs in your Web browser, with nothing to install on your desktop. Therefore, all updates will be automatically deployed during tax season.

Please note that CCH iFirm Tax is only supported on the Google Chrome and the Microsoft Edge (based on Chromium) Web browsers.

CCH iFirm Taxprep is bilingual and provides you with:

- Most robust tax calculations of the industry, imported from the Taxprep software programs;

- Comprehensive diagnostics with audit trail of user reviewed diagnostics;

- Ability to navigate through cells with data entered in the year;

- Ability to add review marks and comments;

- Intuitive user interface;

- and many more other features.

If you want to learn about the new non-tax related features delivered with this new CCH iFirm Taxprep version, consult the Technical Release Notes.

About CCH iFirm Taxprep T3

With CCH iFirm Taxprep T3, you have the most comprehensive collection of trust tax forms as well as tools designed to help you comply with requirements relating to the preparation of tax returns for trusts. CCH iFirm Taxprep T3 allows you to import data relating to beneficiaries in CSV format to speed-up data entry and reduce related input errors.

About

We are pleased to provide you with CCH iFirm Taxprep T3 2023 v.3.0. This version covers taxation years ending between January 1, 2022, and December 31, 2023, inclusive.

The rates applicable to the 2023 taxation year are those known as of February 24, 2023. Any changes resulting from subsequent federal, provincial and territorial announcements will be integrated into future updates of the program.

You can view the applicable rates by accessing the Table of Values Used in the Return found in the program.

Electronic Filing

Government requirements

At the federal level and in Québec, any filer filing more than 50 slips or RL slips of a same type must file the data electronically by Internet. Below that threshold, paper filing is accepted.

CCH iFirm Taxprep T3 will generate a diagnostic prompting you to use EFILE as soon as you prepare more than 50 slips or RL slips.

Budget 2021 announced that the threshold for mandatory electronic filing of income tax information returns for a calendar year would be lowered from 50 to 5 information returns.

The legislation for this measure was not finalized at the time of publication. For the latest information about the penalty for not filing information returns over the Internet, go to Penalty for failure to file information returns over the Internet.

Important dates for Internet transmission

The CRA has been accepting electronic transmissions of T3 and NR4 slips since January 9, 2023. Revenu Québec has been accepting transmission of RL-16 slips since November 2022.

Please note that you can no longer use the CRA’s Filing by Internet file transfer (XML) service to electronically transmit a T3, T3M or T3S return, as this type of transmission has not been supported by the CRA since December 23, 2021. However, you can still use the CRA’s Filing by Internet file transfer (XML) for Forms T1061, T2000, T3D, T3GR, T3P and T3RI.

The CRA has been offering electronic filing of T3 Trust Income Tax and Information Return, as well as the T3M and T3S returns through T3 EFILE since March 2, 2022. The CRA will accept the EFILING of T3 returns for the tax years 2022 and 2023 as of February 20, 2023, and the system will close next year on January 26, 2024. For more information on this matter, please see the Federal – T3 EFILE article.

Rolling Forward Files

CCH iFirm Taxprep T3 2023 allows you to roll forward client files saved with Taxprep for Trusts (with the .321 or .322 extension), Cantax FormMaster (with the .T21 or .T22 extension) and version 2022.1 of ProFile (with the.21R extension).

The taxation year after a roll forward cannot end after December 31, 2023. If needed, it will be shortened so as to correspond to the period covered by this version.

Addition for the October 6, 2023, release

Trust Identification and Other Information

The Additional information for roll forward subsection has been added to the Tax year information section of the Identification form. This new section allows the next year-end to be entered if the next tax year is shortened. Therefore, this year-end will be used when rolling forward the file. The file will then be rolled forward to the version of CCH iFirm Tax T3 that supports this year-end.

Version 3.0 Content

Form Added to the Program

T2043, Return of Fuel Charge Proceeds to Farmers Tax Credit

In 2021, the Government of Canada introduced a refundable tax credit, i.e., the Return of Fuel Charge Proceeds to Farmers Tax Credit. This credit is intended to return a portion of the fuel charge proceeds from the federal carbon pollution pricing system directly to farming businesses in provinces that do not currently meet the federal stringency requirements.

These designated provinces are Ontario, Manitoba, Saskatchewan and Alberta. Eligible farming businesses include self-employed farmers, partnerships and partners in farming partnerships that actively engage in either the management or the daily activities related to the earning of income from farming and that incur total farming expenses of $25,000 or more, which are all or partially allocated to designated provinces.

As a result, Form T2043 has been added to the program to calculate the return of fuel charge proceeds to farmers tax credit. In addition, Form T2043 WS has been added to facilitate the calculations in the various parts of Form 2043. The worksheets will be automatically linked to T2042 statements. Form T2043 cumulates all T2043 WS worksheets. Note that this refundable tax credit is claimed on line 920 of the T3 return.

The credit is considered government assistance received during the year and is taxable. It should be included in the return of the taxation year in which it was claimed, not in the year in which it is received. This refundable tax credit is automatically included in income on line 9600 of Form T2042.

In addition, if the trust is a member of a partnership, the credit will be prorated in Form T2043 and considered as part of the partner’s income. The amounts of the credits received by the partner will be found in box 237 of the T5013 slip and/or in a letter provided by the partnership. These amounts should be entered in Part 5, Total return of fuel charge proceeds to farmers tax credit.

Modifications and additions

AUT-01, Authorize a Representative for Offline Access; and

AUT-01X, Cancel Authorization for a Representative

New boxes have been added to Step 1, Account information, to enter another CRA identifier and type if you identified a non-resident account number. In addition, if you are making a request for a non-resident account, the forms will now have to be sent to the Sudbury Tax Centre regardless of the province of residence or the language used to file the forms.

Client Letter Workshee; and

TX19, Asking for a Clearance Certificate

The Client Letter Worksheet has been enhanced to include an additional section showing the different mailing addresses for Form TX19. Customer letters have been modified to take into account the area code entered in Form TX19. It is still possible to exclude a mailing address from the client letters, and this choice can now be made for all tax returns, using a new line to that end in the Client Letter tab of the tax preparer’s profile.

T3-DD, Direct Deposit Request for T3

The list of banking institution numbers has been updated and several changes have been made. If a withdrawn code has been entered in box 351 of the form, it will be deleted. In all circumstances, it is advisable to validate the banking information before filing this form.

T776, Statement of Real Estate Rentals

T2042, Statement of Farming Activities

T2125, Statement of Business or Professional Activities

Area A – Calculation of capital cost allowance (CCA) claim has been updated in the Statement of Business forms. While the columns of the CCA charts and the relevant instructions have been added and can be printed, they do not contain any new calculations, as they are used exclusively for immediate expensing, which doesn't apply to trusts.

TP-646.R, Request for an Adjustment to a Trust Income Tax Return

Following an update to the form, the trust account number and a third option with respect to the filing of Form MR-69, Authorization to Communicate Information or Power of Attorney, have been added to section 1, Information about the trust.

Version 2.0 Content

Modifications and additions

Trust Identification and Other Information

Trust codes 308 to 310, 312 and 902 have been temporarily removed as per the 2022 update of the T4013 Trust Guide. As a result, we have added “do not use” to the end of these codes.

TP-1129.53, Income Tax Return for Environmental Trusts

The form was updated and now contains a fourth section in which you can enter the identity of the settlors, trustees, beneficiaries and persons who can exert control over the trustee’s decisions. Take note that Revenu Québec does not require the completion of this additional section for tax years ending before December 31, 2023.

NAICS codes

The CRA has released an update to the NAICS. The codes have been converted in the program when applicable. Please verify that the NAICS codes on the various forms and returns are still accurate.

Version 1.0 Content

Modifications and additions

ID, Trust Identification and Other Information

A validation message has been added to the Federal Account Number field. If an incorrect trust account number is entered, a pop-up message will prompt you to enter a valid one.

Donations, Summary of charitable donations; and

QC Donations, Summary of charitable donations

A separate table has been added to track ecological gifts made after February 10, 2014 that can be carried over for a period of 10 years.

LM-58.1.2, Application for a Trust Identification Number

The temporary exemption which allowed new trusts to omit the identification number from the Trust Income Tax Return (TP-646) and the RL-16 slips is no longer in effect. As a result, Form LM-58.1.2, which allows for the application of an identification number, has been added to the program.

RL-16 slip, Trust Income

The temporary exemption which allowed new trusts to omit the identification number from the RL-16 slips is no longer in effect. As a result, the option provided for this purpose on the Identification form has been removed. The identification number must therefore be obtained prior to the production of the RL-16 slips. If the trust has a federal account number, it must be included on the RL-16 slips. However, you do not have to enter the trust’s federal account number if it has not yet been assigned. Note that these numbers will be hidden on copy 2 of the slip, as required by Revenu Québec.

In its Guide to Filing the RL-16 Slip, Revenu Québec has provided clarification regarding the consolidated RL-16 slips. A consolidated RL-16 can be issued when the income of several trusts can be combined on one slip for a single beneficiary. Since a CCH iFirm Taxprep T3 file must be created for each trust, this cannot be done with our program. Therefore, we have removed the question Is this a consolidated RL-16 slip?.

T3, Trust Income Tax and Information Return

As a result of an update, several refundable tax credits have been added to Step 5, Summary of tax and credits.

T3 APP, Application for Trust Account Number

Step 5, Representative contact information, has been removed from the form. Therefore, if you want to authorize a representative, please complete Form AUT-01, Authorize a Representative for Offline Access.

T3BC, British Columbia Tax; and

T3BCMJ, Provincial Tax (Multiple Jurisdictions) – British Columbia Tax

The line British Columbia T3M tax credit has been added to these forms.

T3RCA, Retirement Arrangement Part XI.3 Tax Return

CCH iFirm Taxprep T3 now supports the electronic filing of Form T3RCA. Diagnostics were also added to assist with the EFILE process.

Reminder: CCH iFirm Taxprep T3 cannot EFILE more than one return at the same time, may it be Forms T3, T3M, T3RCA or T3S.

T3NB, New Brunswick Tax; and

T3NBMJ, Provincial (Multiple Jurisdictions) – New Brunswick Tax

On November 1, 2022, the Government of New Brunswick announced the removal of one tax bracket for the 2023 and subsequent taxation years. Therefore, the tax brackets for graduated rate estates (GRE) and qualifying disability trusts (QDT) will be the following:

|

Tax brackets |

Rates |

|

$47,715 or less |

9.4% |

|

More than $47,715, but not more than $95,431 |

14% |

|

More than $95,431, but not more than $176,756 |

16% |

|

More than $176,756 |

19.5% |

T3SK, Saskatchewan Tax; and

T3SKMJ, Provincial Tax (Multiple Jurisdictions) – Saskatchewan Tax

The line Saskatchewan T3M tax credit has been added to these forms.

T183 Trust, Information Return for the Electronic Filing of a Trust Return

The Representative Identifier (Rep ID) cell has been added in Part C, Electronic Filer Identification.

The CRA has indicated that the RepID entered on Form T183 should be the same that you or your firm provided during the registration or the renewal process for the EFILE number shown on this form, regardless of who is preparing or transmitting the return. This field is optional on Form T183 for 2022 tax returns and can be left blank. If a RepID is entered, it will be transmitted electronically with the return. However, the CRA has indicated that the RepID will not be used to track the accuracy of tax returns; it is simply an additional mechanism for the CRA to ensure that the users of EFILE services have been suitably screened.

At the CRA’s request, this field is partially masked when the form is printed.

T1229, Statement of Resource Expenses and Depletion Allowance;

T101, Statement of Resource Expenses; and

T5013, Statement of Partnership Income

On December 15, 2022, Bill C-32 received Royal Assent. This bill includes a new 30% critical mineral exploration tax credit for specified mineral exploration expenses incurred in Canada that are renounced to flow-through share investors. As a result, lines Critical mineral exploration tax credit (CMETC) and Portion subject to an interest-free period – CMETC have been added to the T101 and T5013 slips. The information that is entered on these lines will be transferred to the new Critical mineral exploration tax Credit (CMETC) column of Part I in Form T1229 as well as in line Portion subject to an interest-free period. The CMETC column has also been added to the chart in Part IV.

TP-80, Business or Professional Income and Expenses

If you are an accountant, a dentist, a lawyer, a notary, a physician, a veterinarian or a chiropractor, the value of the work in progress at the end of the year must be included in your income for the year. If you had elected, for the federal income tax return, to exclude the value of the work in progress at the end of the year from your income and the election was still valid during the last tax year that started before March 22, 2017, a transitional measure stating that the full value of this work would be included in your income for the year as of the fifth tax year beginning after March 21, 2017, was applicable. This transitional measure is no longer in effect. Moreover, for the tax years ending in 2022 and the following tax years, the entire value of the work in progress at the end of the fiscal period must be included in your income.

Slips, Federal Slips Summary; and

QSlips, Summary of RL-slips – Québec

These forms, which are now available, are verification tools that allow you to quickly review the amounts entered in the federal slips and RL-slips to make sure they were correctly entered.

EFILE Information

Form EFILE Information is now available on the screen. In this form, you will find the information of all the most recent transmissions, namely:

-

T3RET, T3M, T3S and T3RCA returns;

-

Slips and RL slips;

-

Specialized returns.

If the transmission of the returns or supporting documents is rejected, we will display the error codes in this form.

Notice to reader removed

As a result of the coming into force of the new Canadian Standard on Related Services (CSRS) 4200, Compilation Engagements, published by the Auditing and Assurance Standards Board, the software introduces changes to the Notice to Reader.

CSRS 4200 addresses compilation engagements, also referred to as “Notice to Reader” in practice and contains new conducting and reporting requirements. Therefore, to align with key changes, including scope and reporting standards, the Notice to Reader is taken from the software.

The removal of the Notice to Reader is showcased in the following locations in the software:

-

removal of the Notice to Reader letter (Federal and Québec)

-

removal of options in Preparer profile section related to Notice to Reader and disclaimers

-

changes in Form ID, Letter C, and Self-employment income statements.

The following is retained:

-

the Custom mention option in preparer profile

-

the Engagement letter.

Where to Find Help

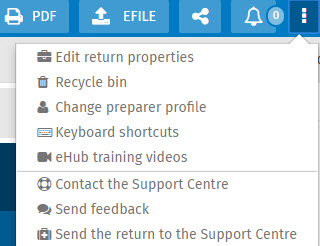

This version provides the following help resources:

- List of available keyboard shortcuts;

- eHub training videos.

To access the Help or to submit a suggestion or idea regarding the product, click the following icon in the top right portion of the screen:

How to Reach Us

Technical and Tax support

Toll Free: 1-800-268-4522

E-mail:csupport@wolterskluwer.com